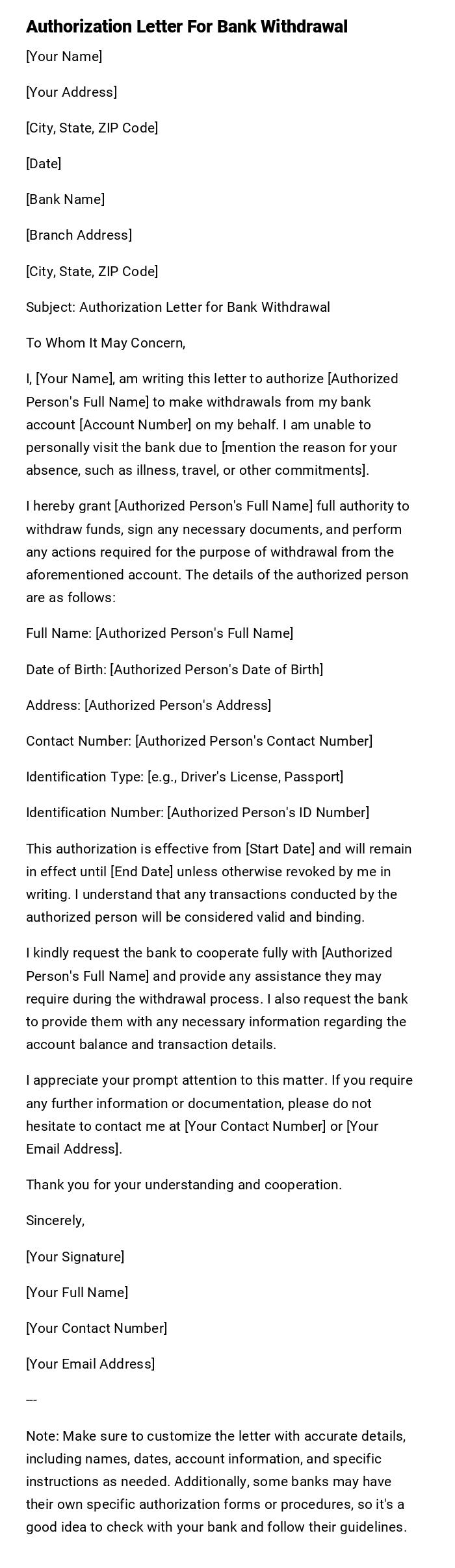

Authorization Letter For Bank Withdrawal

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Bank Name]

[Branch Address]

[City, State, ZIP Code]

Subject: Authorization Letter for Bank Withdrawal

To Whom It May Concern,

I, [Your Name], am writing this letter to authorize [Authorized Person's Full Name] to make withdrawals from my bank account [Account Number] on my behalf. I am unable to personally visit the bank due to [mention the reason for your absence, such as illness, travel, or other commitments].

I hereby grant [Authorized Person's Full Name] full authority to withdraw funds, sign any necessary documents, and perform any actions required for the purpose of withdrawal from the aforementioned account. The details of the authorized person are as follows:

Full Name: [Authorized Person's Full Name]

Date of Birth: [Authorized Person's Date of Birth]

Address: [Authorized Person's Address]

Contact Number: [Authorized Person's Contact Number]

Identification Type: [e.g., Driver's License, Passport]

Identification Number: [Authorized Person's ID Number]

This authorization is effective from [Start Date] and will remain in effect until [End Date] unless otherwise revoked by me in writing. I understand that any transactions conducted by the authorized person will be considered valid and binding.

I kindly request the bank to cooperate fully with [Authorized Person's Full Name] and provide any assistance they may require during the withdrawal process. I also request the bank to provide them with any necessary information regarding the account balance and transaction details.

I appreciate your prompt attention to this matter. If you require any further information or documentation, please do not hesitate to contact me at [Your Contact Number] or [Your Email Address].

Thank you for your understanding and cooperation.

Sincerely,

[Your Signature]

[Your Full Name]

[Your Contact Number]

[Your Email Address]

---

Note: Make sure to customize the letter with accurate details, including names, dates, account information, and specific instructions as needed. Additionally, some banks may have their own specific authorization forms or procedures, so it's a good idea to check with your bank and follow their guidelines.

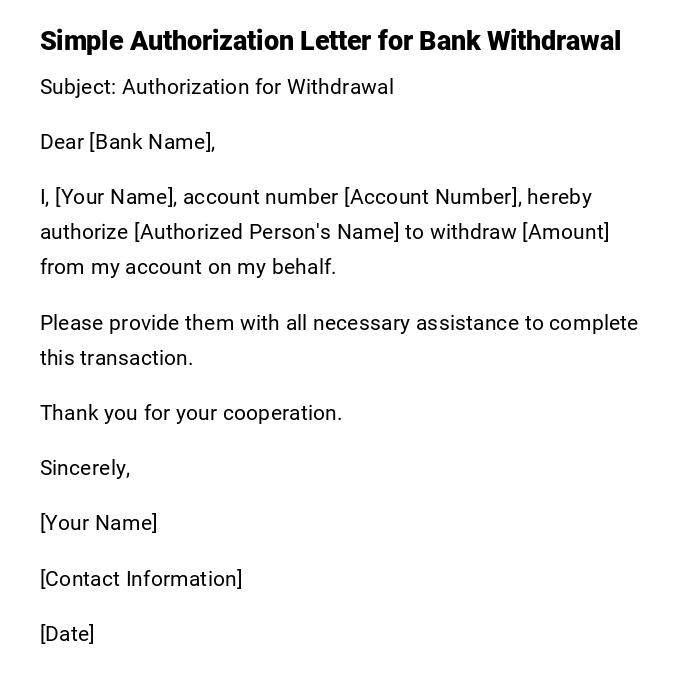

Simple Authorization Letter for Bank Withdrawal

Subject: Authorization for Withdrawal

Dear [Bank Name],

I, [Your Name], account number [Account Number], hereby authorize [Authorized Person's Name] to withdraw [Amount] from my account on my behalf.

Please provide them with all necessary assistance to complete this transaction.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Contact Information]

[Date]

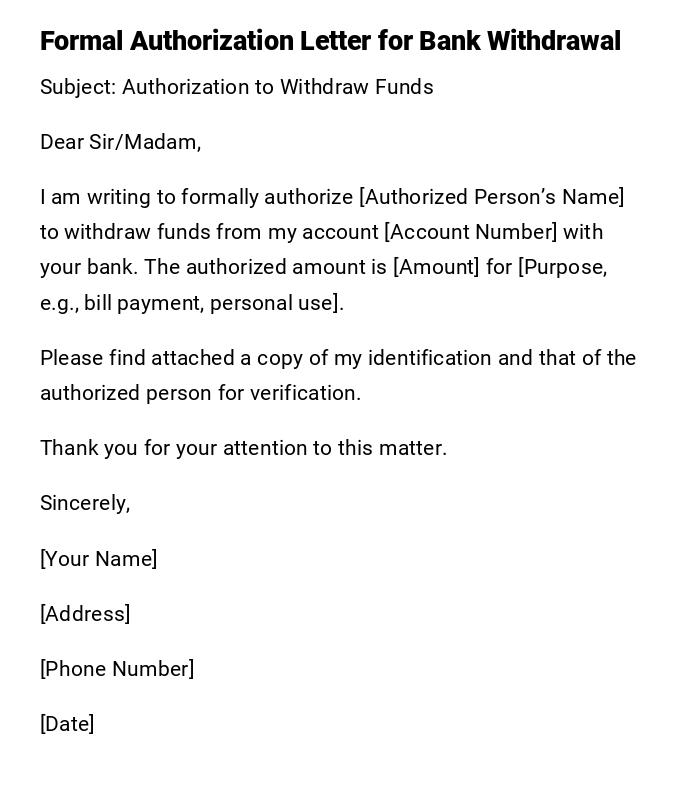

Formal Authorization Letter for Bank Withdrawal

Subject: Authorization to Withdraw Funds

Dear Sir/Madam,

I am writing to formally authorize [Authorized Person’s Name] to withdraw funds from my account [Account Number] with your bank. The authorized amount is [Amount] for [Purpose, e.g., bill payment, personal use].

Please find attached a copy of my identification and that of the authorized person for verification.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Address]

[Phone Number]

[Date]

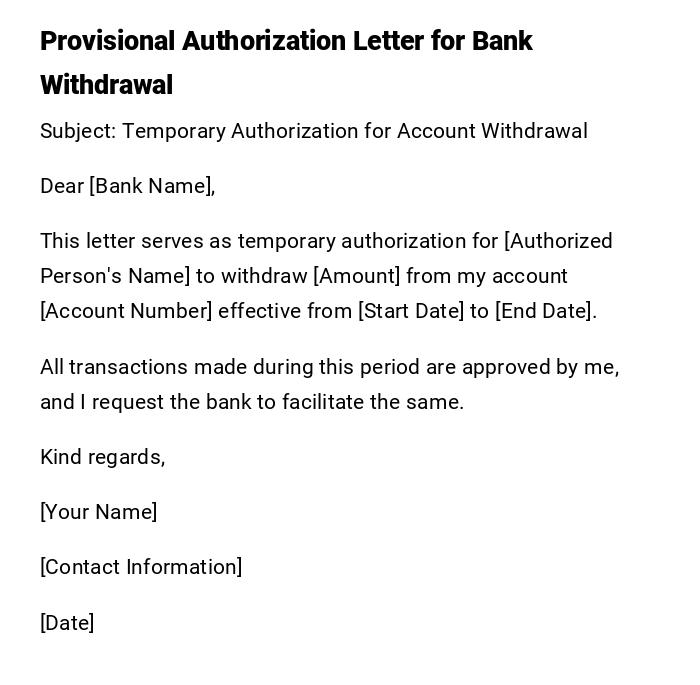

Provisional Authorization Letter for Bank Withdrawal

Subject: Temporary Authorization for Account Withdrawal

Dear [Bank Name],

This letter serves as temporary authorization for [Authorized Person's Name] to withdraw [Amount] from my account [Account Number] effective from [Start Date] to [End Date].

All transactions made during this period are approved by me, and I request the bank to facilitate the same.

Kind regards,

[Your Name]

[Contact Information]

[Date]

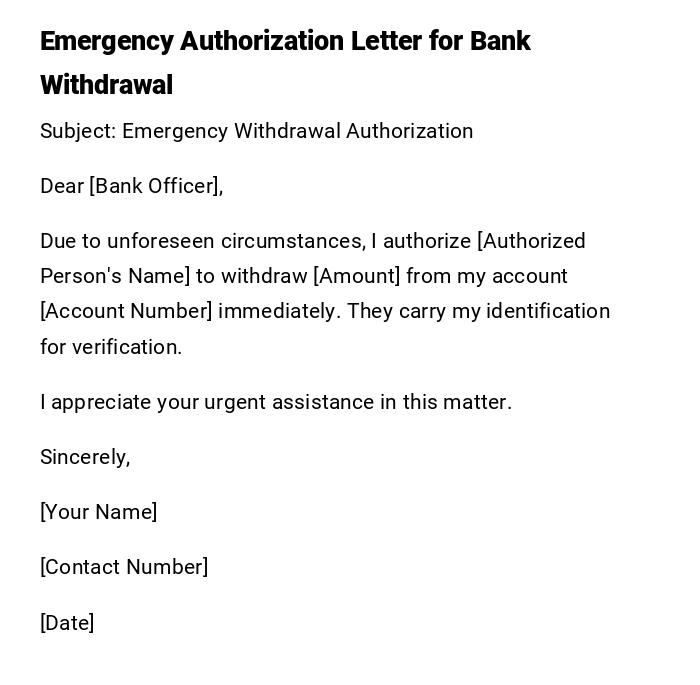

Emergency Authorization Letter for Bank Withdrawal

Subject: Emergency Withdrawal Authorization

Dear [Bank Officer],

Due to unforeseen circumstances, I authorize [Authorized Person's Name] to withdraw [Amount] from my account [Account Number] immediately. They carry my identification for verification.

I appreciate your urgent assistance in this matter.

Sincerely,

[Your Name]

[Contact Number]

[Date]

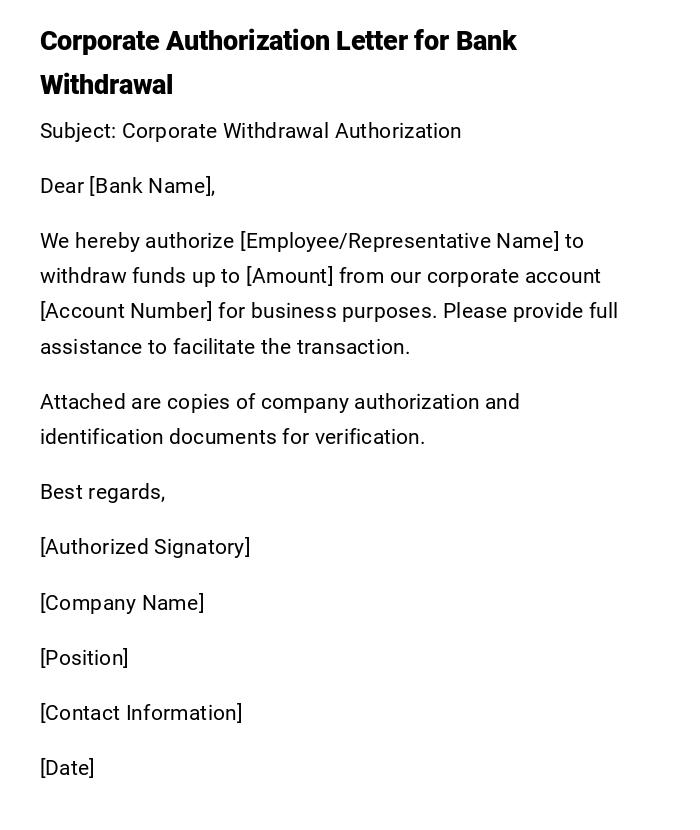

Corporate Authorization Letter for Bank Withdrawal

Subject: Corporate Withdrawal Authorization

Dear [Bank Name],

We hereby authorize [Employee/Representative Name] to withdraw funds up to [Amount] from our corporate account [Account Number] for business purposes. Please provide full assistance to facilitate the transaction.

Attached are copies of company authorization and identification documents for verification.

Best regards,

[Authorized Signatory]

[Company Name]

[Position]

[Contact Information]

[Date]

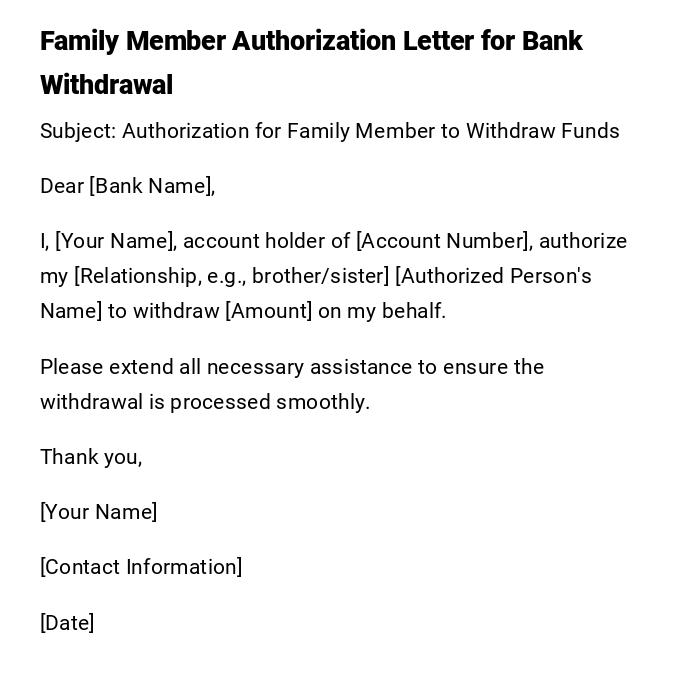

Family Member Authorization Letter for Bank Withdrawal

Subject: Authorization for Family Member to Withdraw Funds

Dear [Bank Name],

I, [Your Name], account holder of [Account Number], authorize my [Relationship, e.g., brother/sister] [Authorized Person's Name] to withdraw [Amount] on my behalf.

Please extend all necessary assistance to ensure the withdrawal is processed smoothly.

Thank you,

[Your Name]

[Contact Information]

[Date]

What is an Authorization Letter for Bank Withdrawal and Why It Is Important

- A formal letter granting someone else permission to withdraw funds from your bank account.

- Ensures clarity and legal backing for the bank to process the transaction.

- Protects the account holder from unauthorized withdrawals.

Who Should Write an Authorization Letter for Bank Withdrawal

- Account holders who are unable to personally withdraw funds.

- Individuals granting authority to trusted persons, family members, or corporate representatives.

- Persons needing temporary or emergency access for authorized individuals.

Whom the Letter Should Be Addressed To

- Bank manager or officer handling the account.

- Specific branch staff if the transaction is branch-specific.

- Any authorized personnel as defined by the bank for verification purposes.

When to Use an Authorization Letter for Bank Withdrawal

- When the account holder is unavailable due to travel, illness, or other commitments.

- In corporate contexts for designated representatives to access company accounts.

- For emergency withdrawals where immediate action is required by a trusted person.

Requirements and Prerequisites Before Writing

- Complete account details: account number, branch, and holder information.

- Full identification of the authorized person (ID copy, relationship proof).

- Specify withdrawal amount and purpose to avoid confusion.

- Understand bank policies on third-party withdrawals.

Formatting and Tone Guidelines

- Tone: Formal and precise; professional for corporate or bank purposes.

- Length: One page or short email (100–200 words).

- Include subject, recipient, clear authorization statement, and signature.

- Attach necessary ID and verification documents.

- Include date and contact information for follow-up.

After Sending / Follow-Up Steps

- Confirm that the bank has received and acknowledged the letter.

- Ensure the authorized person carries proper identification and a copy of the letter.

- Track the withdrawal transaction and request confirmation or receipt.

- Keep a copy of the authorization letter for personal records.

Common Mistakes to Avoid

- Leaving account or withdrawal details incomplete.

- Not specifying authorized person's identity or providing insufficient verification.

- Using informal language or failing to sign the letter.

- Forgetting to attach ID documents or company authorizations.

Tricks and Tips for Effective Authorization Letters

- Clearly state withdrawal amount and purpose to prevent disputes.

- Keep language precise and concise.

- Use professional formatting and proper salutation.

- Attach photocopies of IDs for both account holder and authorized person.

- Specify validity period for temporary authorizations.

Elements and Structure of an Authorization Letter for Bank Withdrawal

- Subject Line: Clearly indicate purpose (e.g., Authorization for Bank Withdrawal).

- Salutation: Direct to bank officer/manager.

- Introduction: State account holder details and relationship with authorized person.

- Authorization Statement: Explicit permission to withdraw funds.

- Details: Withdrawal amount, account number, purpose, and validity.

- Attachments: IDs or corporate authorization documents.

- Closing: Signature, date, and contact information.

FAQ About Authorization Letters for Bank Withdrawal

- Q: Can someone withdraw without this letter?

A: No, banks generally require written authorization and valid ID. - Q: Can it be emailed?

A: Depends on bank policy; some accept scanned copies for pre-authorization. - Q: Is attestation needed?

A: For corporate accounts or high-value transactions, notarization may be required. - Q: How long is it valid?

A: Validity should be specified in the letter, especially for temporary authorizations.

Download Word Doc

Download Word Doc

Download PDF

Download PDF