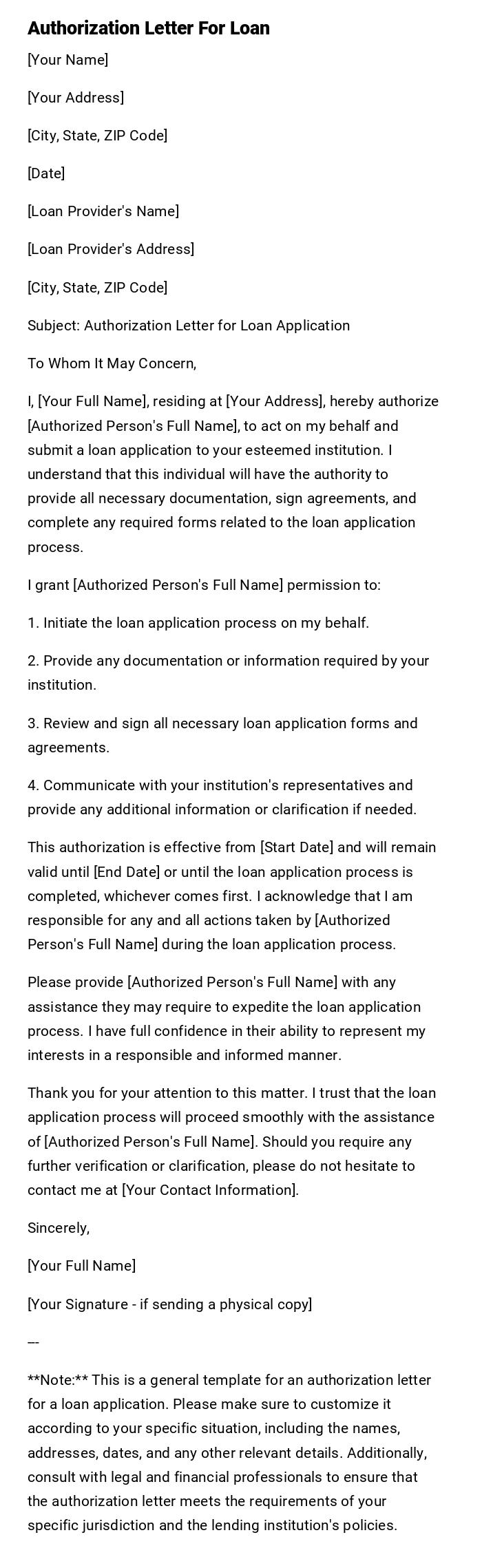

Authorization Letter For Loan

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Loan Provider's Name]

[Loan Provider's Address]

[City, State, ZIP Code]

Subject: Authorization Letter for Loan Application

To Whom It May Concern,

I, [Your Full Name], residing at [Your Address], hereby authorize [Authorized Person's Full Name], to act on my behalf and submit a loan application to your esteemed institution. I understand that this individual will have the authority to provide all necessary documentation, sign agreements, and complete any required forms related to the loan application process.

I grant [Authorized Person's Full Name] permission to:

1. Initiate the loan application process on my behalf.

2. Provide any documentation or information required by your institution.

3. Review and sign all necessary loan application forms and agreements.

4. Communicate with your institution's representatives and provide any additional information or clarification if needed.

This authorization is effective from [Start Date] and will remain valid until [End Date] or until the loan application process is completed, whichever comes first. I acknowledge that I am responsible for any and all actions taken by [Authorized Person's Full Name] during the loan application process.

Please provide [Authorized Person's Full Name] with any assistance they may require to expedite the loan application process. I have full confidence in their ability to represent my interests in a responsible and informed manner.

Thank you for your attention to this matter. I trust that the loan application process will proceed smoothly with the assistance of [Authorized Person's Full Name]. Should you require any further verification or clarification, please do not hesitate to contact me at [Your Contact Information].

Sincerely,

[Your Full Name]

[Your Signature - if sending a physical copy]

---

**Note:** This is a general template for an authorization letter for a loan application. Please make sure to customize it according to your specific situation, including the names, addresses, dates, and any other relevant details. Additionally, consult with legal and financial professionals to ensure that the authorization letter meets the requirements of your specific jurisdiction and the lending institution's policies.

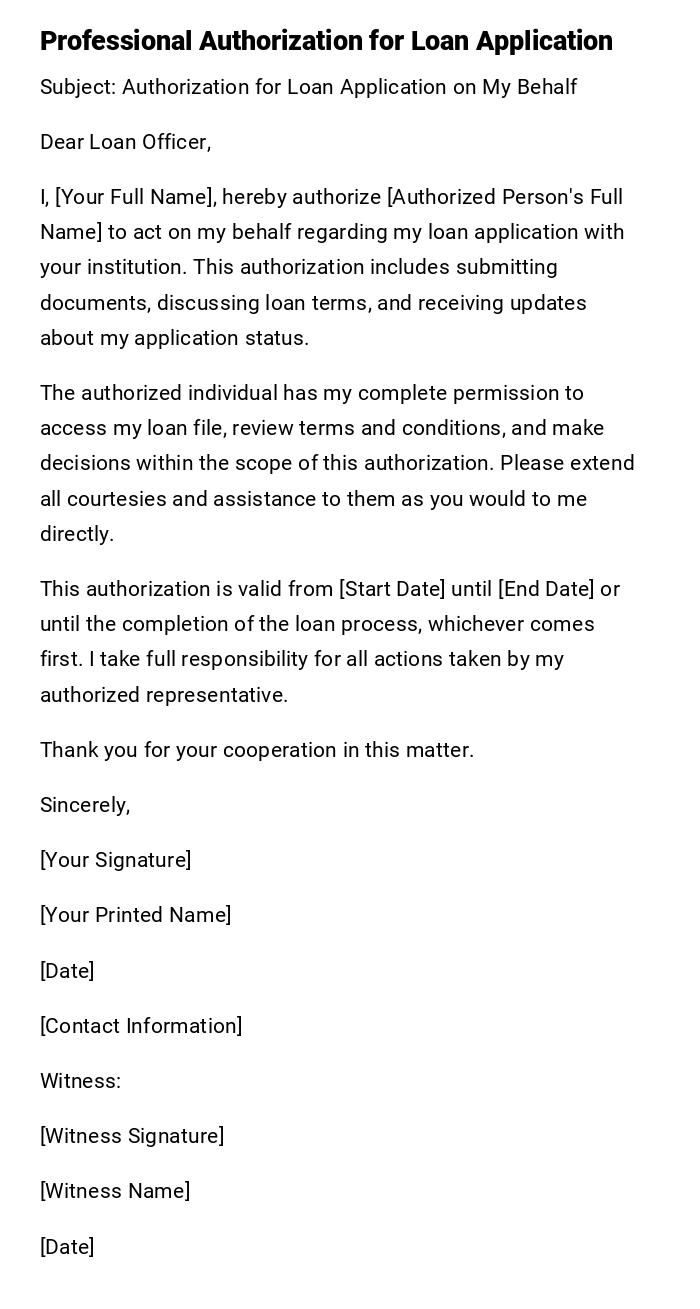

Loan Application Authorization Letter

Subject: Authorization for Loan Application on My Behalf

Dear Loan Officer,

I, [Your Full Name], hereby authorize [Authorized Person's Full Name] to act on my behalf regarding my loan application with your institution. This authorization includes submitting documents, discussing loan terms, and receiving updates about my application status.

The authorized individual has my complete permission to access my loan file, review terms and conditions, and make decisions within the scope of this authorization. Please extend all courtesies and assistance to them as you would to me directly.

This authorization is valid from [Start Date] until [End Date] or until the completion of the loan process, whichever comes first. I take full responsibility for all actions taken by my authorized representative.

Thank you for your cooperation in this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

[Date]

[Contact Information]

Witness:

[Witness Signature]

[Witness Name]

[Date]

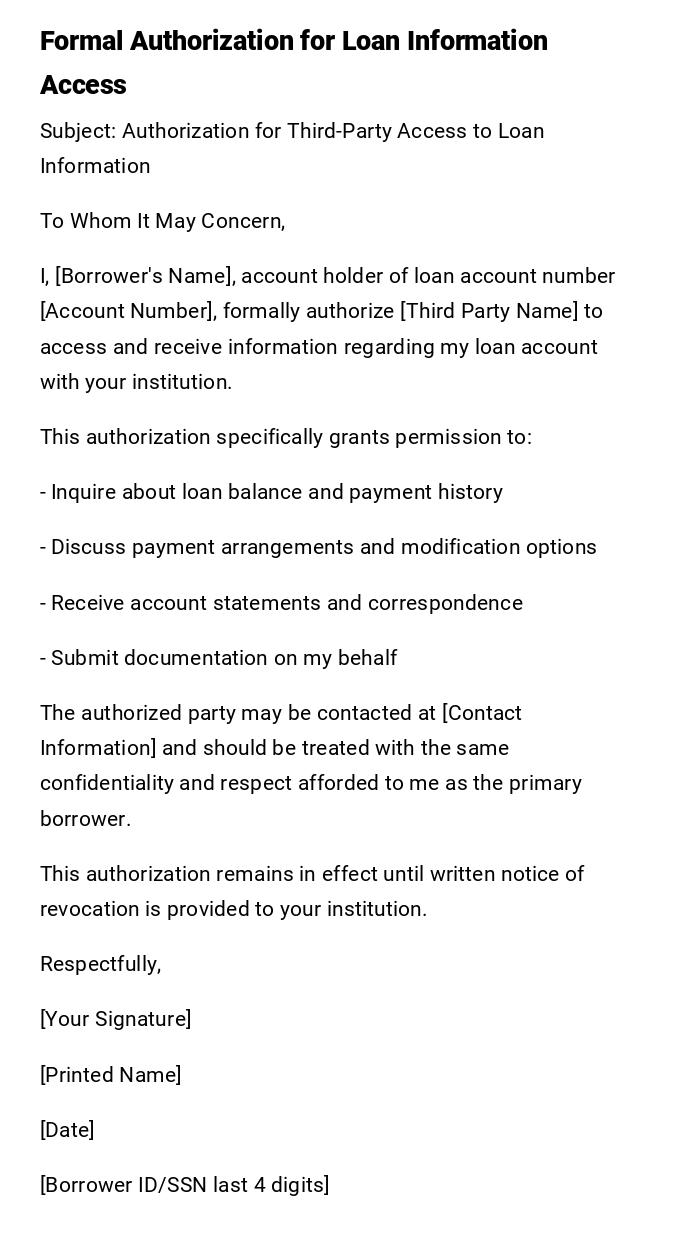

Third-Party Information Access Letter

Subject: Authorization for Third-Party Access to Loan Information

To Whom It May Concern,

I, [Borrower's Name], account holder of loan account number [Account Number], formally authorize [Third Party Name] to access and receive information regarding my loan account with your institution.

This authorization specifically grants permission to:

- Inquire about loan balance and payment history

- Discuss payment arrangements and modification options

- Receive account statements and correspondence

- Submit documentation on my behalf

The authorized party may be contacted at [Contact Information] and should be treated with the same confidentiality and respect afforded to me as the primary borrower.

This authorization remains in effect until written notice of revocation is provided to your institution.

Respectfully,

[Your Signature]

[Printed Name]

[Date]

[Borrower ID/SSN last 4 digits]

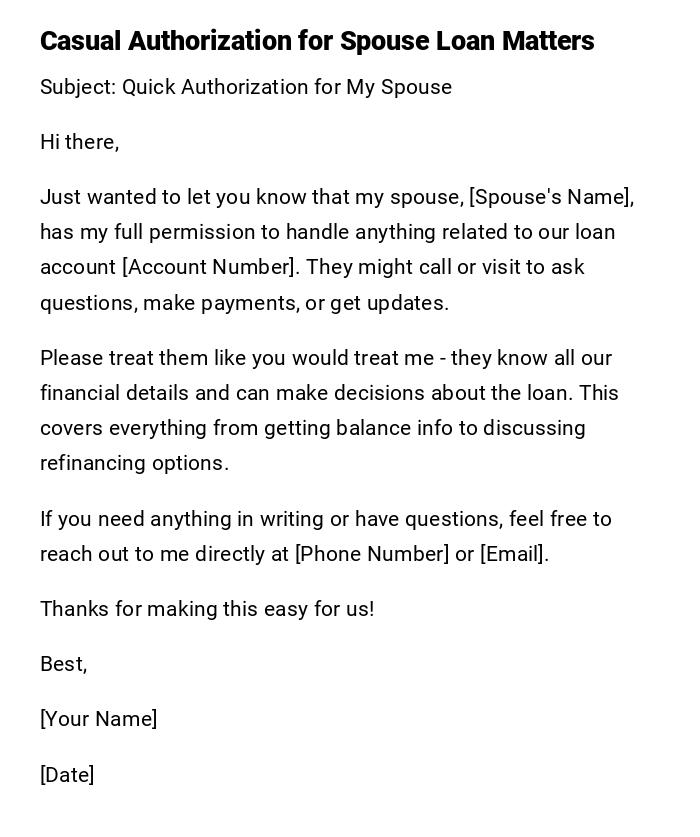

Spouse Loan Authorization Message

Subject: Quick Authorization for My Spouse

Hi there,

Just wanted to let you know that my spouse, [Spouse's Name], has my full permission to handle anything related to our loan account [Account Number]. They might call or visit to ask questions, make payments, or get updates.

Please treat them like you would treat me - they know all our financial details and can make decisions about the loan. This covers everything from getting balance info to discussing refinancing options.

If you need anything in writing or have questions, feel free to reach out to me directly at [Phone Number] or [Email].

Thanks for making this easy for us!

Best,

[Your Name]

[Date]

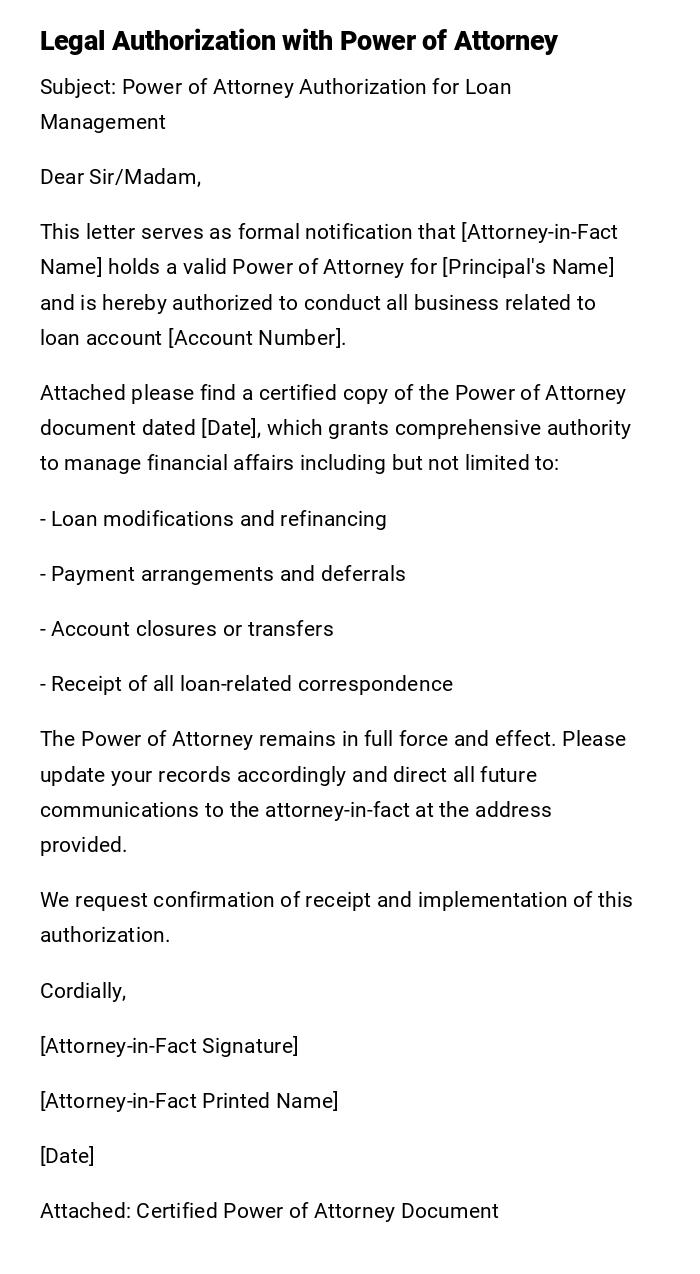

Power of Attorney Loan Authorization

Subject: Power of Attorney Authorization for Loan Management

Dear Sir/Madam,

This letter serves as formal notification that [Attorney-in-Fact Name] holds a valid Power of Attorney for [Principal's Name] and is hereby authorized to conduct all business related to loan account [Account Number].

Attached please find a certified copy of the Power of Attorney document dated [Date], which grants comprehensive authority to manage financial affairs including but not limited to:

- Loan modifications and refinancing

- Payment arrangements and deferrals

- Account closures or transfers

- Receipt of all loan-related correspondence

The Power of Attorney remains in full force and effect. Please update your records accordingly and direct all future communications to the attorney-in-fact at the address provided.

We request confirmation of receipt and implementation of this authorization.

Cordially,

[Attorney-in-Fact Signature]

[Attorney-in-Fact Printed Name]

[Date]

Attached: Certified Power of Attorney Document

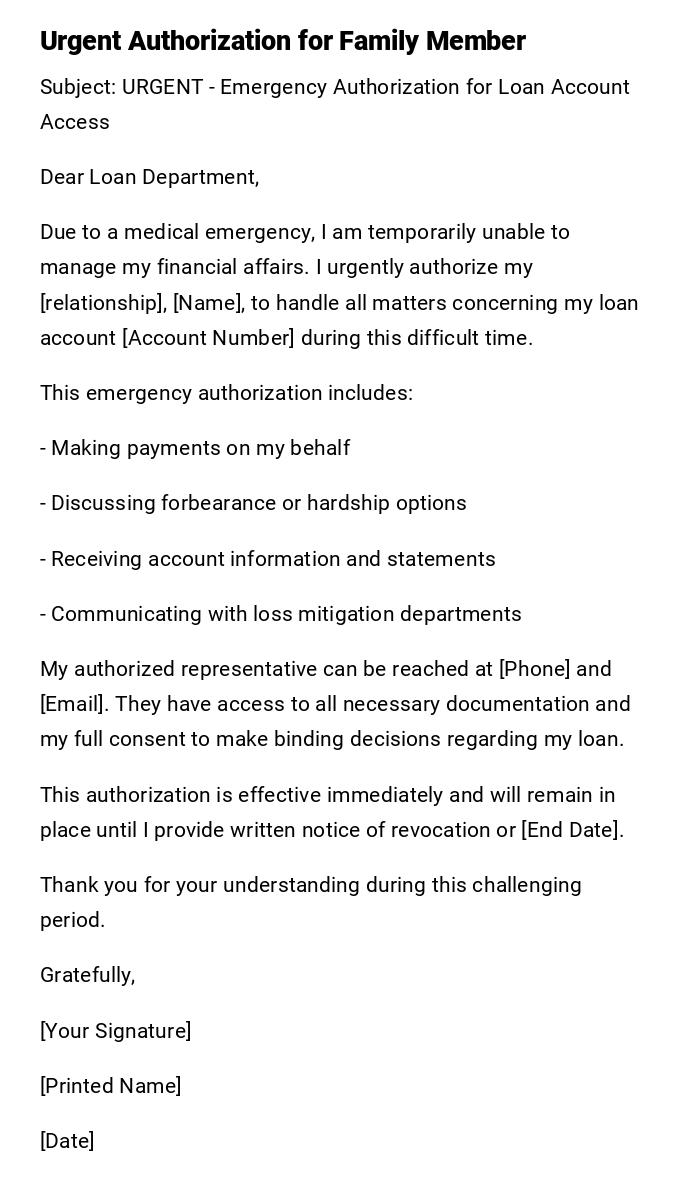

Emergency Loan Authorization Letter

Subject: URGENT - Emergency Authorization for Loan Account Access

Dear Loan Department,

Due to a medical emergency, I am temporarily unable to manage my financial affairs. I urgently authorize my [relationship], [Name], to handle all matters concerning my loan account [Account Number] during this difficult time.

This emergency authorization includes:

- Making payments on my behalf

- Discussing forbearance or hardship options

- Receiving account information and statements

- Communicating with loss mitigation departments

My authorized representative can be reached at [Phone] and [Email]. They have access to all necessary documentation and my full consent to make binding decisions regarding my loan.

This authorization is effective immediately and will remain in place until I provide written notice of revocation or [End Date].

Thank you for your understanding during this challenging period.

Gratefully,

[Your Signature]

[Printed Name]

[Date]

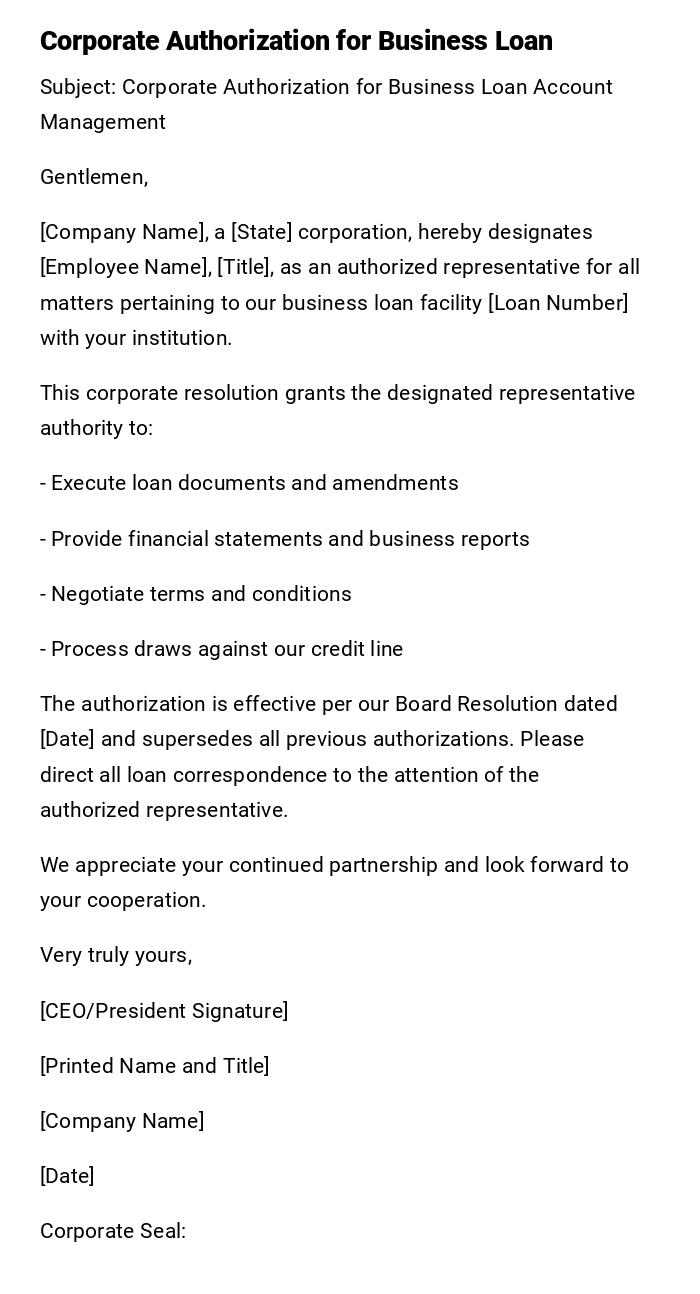

Business Loan Authorization Letter

Subject: Corporate Authorization for Business Loan Account Management

Gentlemen,

[Company Name], a [State] corporation, hereby designates [Employee Name], [Title], as an authorized representative for all matters pertaining to our business loan facility [Loan Number] with your institution.

This corporate resolution grants the designated representative authority to:

- Execute loan documents and amendments

- Provide financial statements and business reports

- Negotiate terms and conditions

- Process draws against our credit line

The authorization is effective per our Board Resolution dated [Date] and supersedes all previous authorizations. Please direct all loan correspondence to the attention of the authorized representative.

We appreciate your continued partnership and look forward to your cooperation.

Very truly yours,

[CEO/President Signature]

[Printed Name and Title]

[Company Name]

[Date]

Corporate Seal:

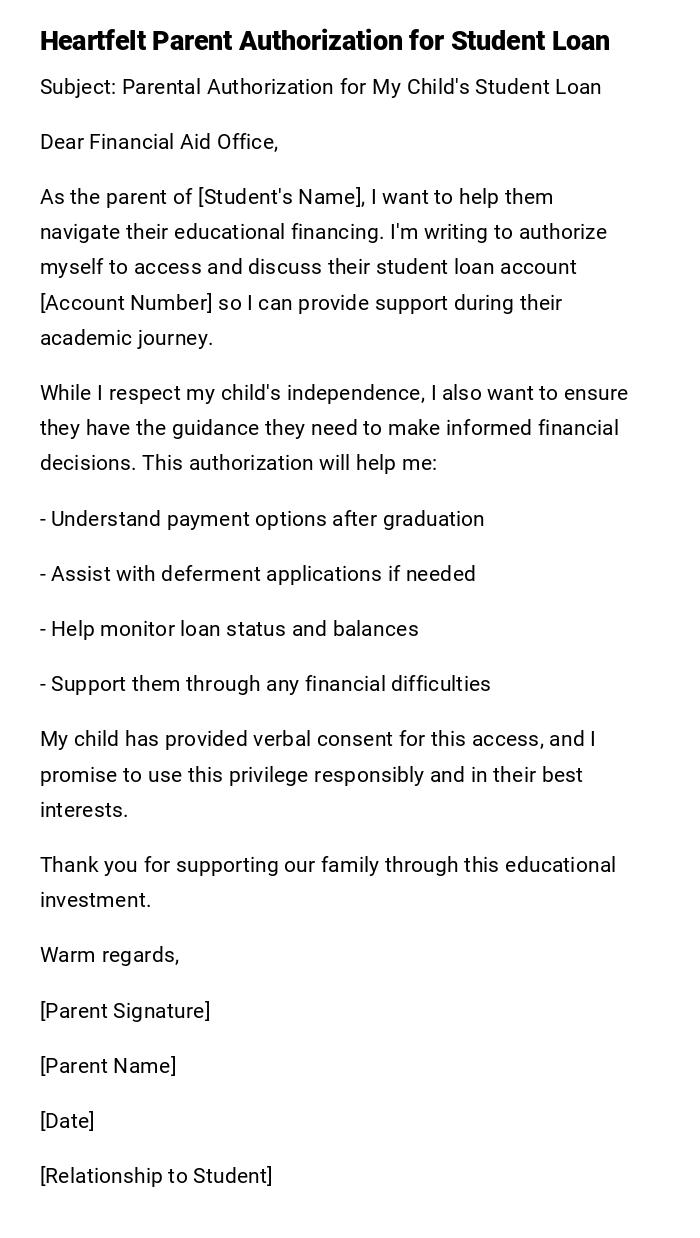

Student Loan Parental Authorization

Subject: Parental Authorization for My Child's Student Loan

Dear Financial Aid Office,

As the parent of [Student's Name], I want to help them navigate their educational financing. I'm writing to authorize myself to access and discuss their student loan account [Account Number] so I can provide support during their academic journey.

While I respect my child's independence, I also want to ensure they have the guidance they need to make informed financial decisions. This authorization will help me:

- Understand payment options after graduation

- Assist with deferment applications if needed

- Help monitor loan status and balances

- Support them through any financial difficulties

My child has provided verbal consent for this access, and I promise to use this privilege responsibly and in their best interests.

Thank you for supporting our family through this educational investment.

Warm regards,

[Parent Signature]

[Parent Name]

[Date]

[Relationship to Student]

Attorney Loan Authorization Letter

Subject: Legal Representation Authorization for Loan Account

Dear Loan Servicing Department,

Please be advised that [Law Firm Name] has been retained to represent [Client Name] in all matters related to loan account [Account Number]. I, [Attorney Name], am authorized to act as legal counsel and primary contact for this account.

This legal authorization encompasses:

- Review of all loan documentation and payment history

- Negotiation of loss mitigation alternatives

- Communication regarding legal proceedings

- Settlement discussions and document execution

All future correspondence should be directed to our office at [Address]. Please cease direct contact with our client and coordinate all matters through our legal representation.

We request immediate acknowledgment of this authorization and provision of the complete loan file for our review.

Respectfully submitted,

[Attorney Signature]

[Attorney Name]

[Bar Number]

[Law Firm]

[Date]

What is an Authorization Letter for Loan and Why Do You Need One

An authorization letter for loan is a formal document that grants permission to a third party to act on your behalf regarding loan-related matters. This legal instrument serves as a bridge between you and your chosen representative, allowing them to access information, make inquiries, and sometimes make decisions about your loan account.

The primary purposes include:

- Convenience: When you cannot personally handle loan matters due to travel, work, or other commitments

- Emergency situations: Medical emergencies, hospitalization, or unexpected circumstances that prevent direct communication

- Professional assistance: Engaging attorneys, financial advisors, or accountants to manage complex loan situations

- Family support: Allowing spouses, adult children, or trusted family members to assist with loan management

- Business operations: Designating employees or partners to handle corporate loan facilities

Who Should Send Authorization Letters for Loans

The authorization letter must always be sent by the primary borrower or account holder. This includes:

- Individual borrowers: Personal loan holders, mortgage borrowers, auto loan customers

- Business owners: CEOs, presidents, or designated corporate officers for business loans

- Co-borrowers: Either party on a joint loan can authorize third-party access

- Parents: For student loans where parental involvement is permitted

- Legal guardians: For minors or individuals under legal guardianship

- Trustees: For loans held in trust accounts

- Executors: For estate-related loan matters (with proper documentation)

The sender must have legal authority over the loan account and must provide proper identification verification.

When You Need to Send Loan Authorization Letters

Several scenarios trigger the need for these authorization letters:

- Medical emergencies: Hospitalization, surgery, or extended medical treatment

- Travel obligations: Extended business trips, military deployment, or international travel

- Legal proceedings: Divorce settlements, bankruptcy proceedings, or foreclosure defense

- Professional consultation: Hiring attorneys, CPAs, or financial advisors

- Family assistance: Elderly borrowers needing adult children's help

- Business transitions: Change in corporate structure or personnel

- Loan modifications: Complex restructuring requiring professional assistance

- Hardship situations: Job loss, disability, or other financial crises

- Estate planning: Preparing for incapacity or death

- Educational support: Parents helping college-age children with student loans

Requirements and Prerequisites Before Writing the Letter

Before drafting your authorization letter, ensure you have:

- Complete loan information: Account numbers, loan servicer contact details, current balance

- Authorized person's details: Full legal name, address, phone number, email

- Identification documents: Both yours and the authorized person's ID copies

- Scope definition: Clear understanding of what actions you're authorizing

- Time limitations: Specific start and end dates for the authorization

- Legal capacity: Confirmation that you have the right to authorize access

- Witness availability: Some lenders require witness signatures

- Notarization: Check if your lender requires notarized authorization letters

- Power of attorney: If applicable, ensure POA documents are current and valid

- Corporate resolutions: For business loans, board resolutions may be required

How to Write and Send Your Authorization Letter

The process involves several critical steps:

Planning phase:

- Identify specific needs and scope of authorization

- Choose the most trustworthy and capable representative

- Gather all necessary documentation and information

- Contact your lender to understand their specific requirements

Writing process:

- Use clear, formal language avoiding ambiguity

- Include all required identification information

- Specify exact powers and limitations

- Set clear time boundaries for the authorization

- Include contact information for all parties

Review and finalization:

- Proofread for accuracy and completeness

- Verify all names, numbers, and dates

- Ensure signatures are legible and dated

- Obtain witness signatures if required

Sending methods:

- Certified mail for important legal documents

- Email for urgent situations (if accepted by lender)

- In-person delivery with receipt confirmation

- Fax with follow-up confirmation call

Formatting Guidelines and Best Practices

Length and structure:

- Keep letters concise but comprehensive (typically 1-2 pages)

- Use standard business letter format with clear paragraphs

- Include proper headers with date and addresses

- Maintain professional tone throughout

Essential elements:

- Clear subject line identifying the purpose

- Formal greeting addressing appropriate personnel

- Specific account identification numbers

- Complete names and contact information

- Detailed scope of authorization

- Effective dates and duration

- Professional closing with signatures

Style preferences:

- Use formal, respectful language for legal matters

- Professional tone for business-related authorizations

- Slightly casual approach for family member authorizations

- Urgent tone for emergency situations while maintaining respect

Documentation standards:

- Original signatures in blue or black ink

- Legible printing of all names

- Current dates on all signatures

- Witness information when required

- Notarization if mandated by lender

After Sending Your Authorization Letter

Immediate follow-up actions:

- Contact the lender to confirm receipt within 2-3 business days

- Verify that the authorization has been processed and recorded

- Obtain written confirmation of the authorization setup

- Provide your authorized representative with confirmation details

Ongoing responsibilities:

- Monitor the authorized person's activities regularly

- Maintain communication with both the lender and your representative

- Keep copies of all correspondence and documentation

- Review account statements for any unauthorized activities

Documentation maintenance:

- File all original documents in a secure location

- Provide copies to your authorized representative

- Keep digital backups of important authorizations

- Update emergency contacts with current information

Revocation process:

- Understand how to cancel authorization if needed

- Provide written notice to lender for any changes

- Inform your authorized representative of any modifications

- Obtain confirmation of revocation or changes

Common Mistakes to Avoid

Documentation errors:

- Incomplete or inaccurate account information

- Misspelled names or incorrect contact details

- Missing signatures or improper witness information

- Failure to include required identification numbers

- Using outdated forms or templates

Scope-related mistakes:

- Granting too broad or unlimited authority

- Failing to specify time limitations

- Not defining clear boundaries of authorization

- Overlooking specific tasks or permissions needed

- Creating conflicting authorizations for the same account

Process failures:

- Not following up to confirm receipt and processing

- Failing to notify the authorized person of their responsibilities

- Not maintaining copies of important documents

- Forgetting to revoke expired or unnecessary authorizations

- Not updating authorization when circumstances change

Security oversights:

- Choosing unreliable or untrustworthy representatives

- Not monitoring authorized person's activities

- Failing to protect sensitive account information

- Not implementing proper safeguards or limitations

- Ignoring red flags or suspicious account activity

Pros and Cons of Loan Authorization Letters

Advantages:

- Provides flexibility when you cannot handle matters personally

- Enables professional assistance for complex loan issues

- Facilitates family support during difficult times

- Streamlines business loan management processes

- Offers peace of mind during emergencies or travel

- Allows specialized expertise to address loan problems

- Maintains continuity of loan management during transitions

Disadvantages:

- Potential for misuse or abuse of granted authority

- Risk of miscommunication between parties

- Possible liability for authorized person's actions

- Additional complexity in loan account management

- Privacy concerns regarding sensitive financial information

- Potential confusion or conflicts with lender policies

- Need for ongoing monitoring and oversight

Risk mitigation strategies:

- Choose representatives with proven reliability and competence

- Implement clear scope limitations and time boundaries

- Maintain regular communication and oversight

- Use written documentation for all important decisions

- Establish clear revocation procedures and timelines

Tips and Best Practices for Success

Selection strategies:

- Choose representatives with relevant experience or expertise

- Prioritize trustworthiness and reliability over convenience

- Consider professional qualifications for complex matters

- Ensure the person has time and availability to act promptly

- Verify they understand the responsibility and commitment involved

Communication excellence:

- Establish regular check-in schedules with your representative

- Create clear channels for urgent communication

- Document all important conversations and decisions

- Maintain open dialogue with your loan servicer

- Keep all parties informed of any changes or developments

Documentation mastery:

- Keep detailed records of all authorization-related activities

- Maintain organized files with easy access to important documents

- Create backup copies stored in secure locations

- Use clear labeling and dating systems for all paperwork

- Regularly review and update documentation as needed

Security measures:

- Limit authorization scope to only necessary functions

- Implement regular monitoring of account activity

- Establish clear reporting requirements for your representative

- Use time limitations to minimize exposure risks

- Create accountability measures and oversight procedures

Download Word Doc

Download Word Doc

Download PDF

Download PDF