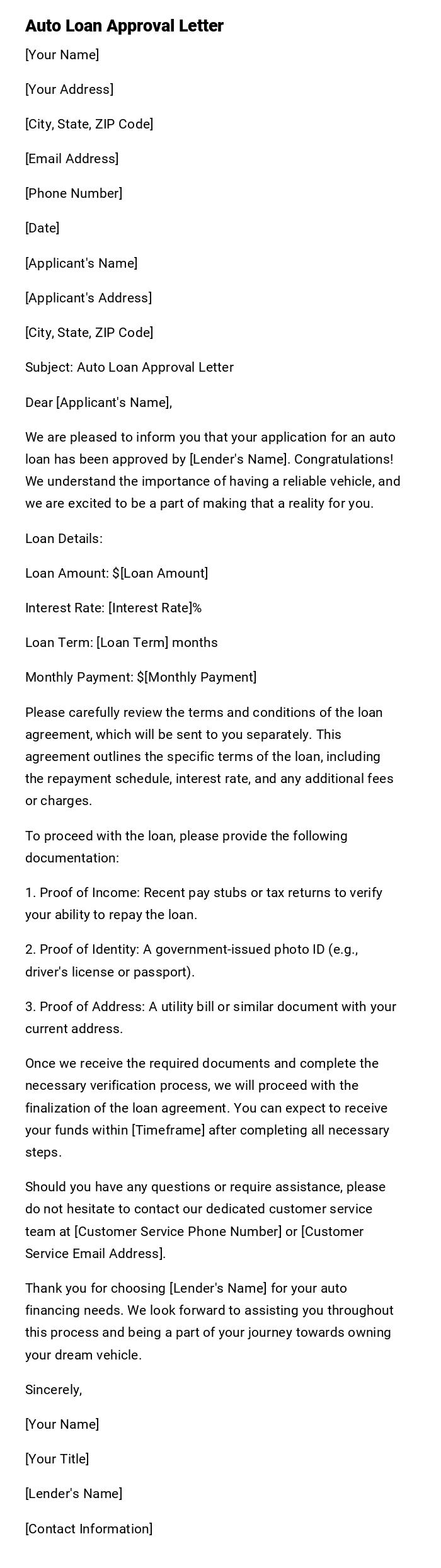

Auto Loan Approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Applicant's Name]

[Applicant's Address]

[City, State, ZIP Code]

Subject: Auto Loan Approval Letter

Dear [Applicant's Name],

We are pleased to inform you that your application for an auto loan has been approved by [Lender's Name]. Congratulations! We understand the importance of having a reliable vehicle, and we are excited to be a part of making that a reality for you.

Loan Details:

Loan Amount: $[Loan Amount]

Interest Rate: [Interest Rate]%

Loan Term: [Loan Term] months

Monthly Payment: $[Monthly Payment]

Please carefully review the terms and conditions of the loan agreement, which will be sent to you separately. This agreement outlines the specific terms of the loan, including the repayment schedule, interest rate, and any additional fees or charges.

To proceed with the loan, please provide the following documentation:

1. Proof of Income: Recent pay stubs or tax returns to verify your ability to repay the loan.

2. Proof of Identity: A government-issued photo ID (e.g., driver's license or passport).

3. Proof of Address: A utility bill or similar document with your current address.

Once we receive the required documents and complete the necessary verification process, we will proceed with the finalization of the loan agreement. You can expect to receive your funds within [Timeframe] after completing all necessary steps.

Should you have any questions or require assistance, please do not hesitate to contact our dedicated customer service team at [Customer Service Phone Number] or [Customer Service Email Address].

Thank you for choosing [Lender's Name] for your auto financing needs. We look forward to assisting you throughout this process and being a part of your journey towards owning your dream vehicle.

Sincerely,

[Your Name]

[Your Title]

[Lender's Name]

[Contact Information]

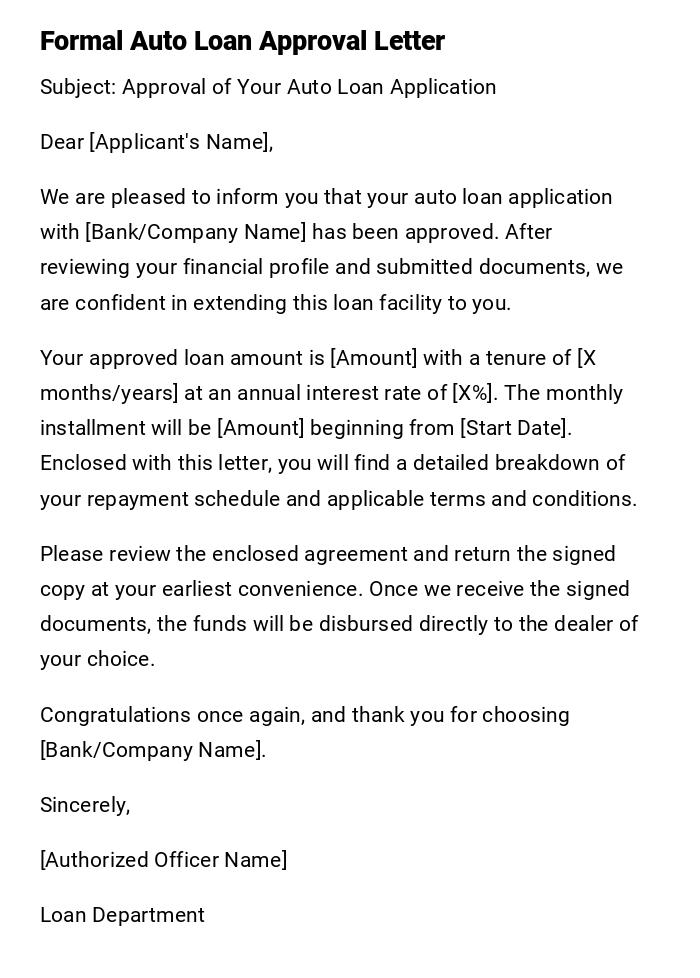

Formal Auto Loan Approval Letter

Subject: Approval of Your Auto Loan Application

Dear [Applicant's Name],

We are pleased to inform you that your auto loan application with [Bank/Company Name] has been approved. After reviewing your financial profile and submitted documents, we are confident in extending this loan facility to you.

Your approved loan amount is [Amount] with a tenure of [X months/years] at an annual interest rate of [X%]. The monthly installment will be [Amount] beginning from [Start Date]. Enclosed with this letter, you will find a detailed breakdown of your repayment schedule and applicable terms and conditions.

Please review the enclosed agreement and return the signed copy at your earliest convenience. Once we receive the signed documents, the funds will be disbursed directly to the dealer of your choice.

Congratulations once again, and thank you for choosing [Bank/Company Name].

Sincerely,

[Authorized Officer Name]

Loan Department

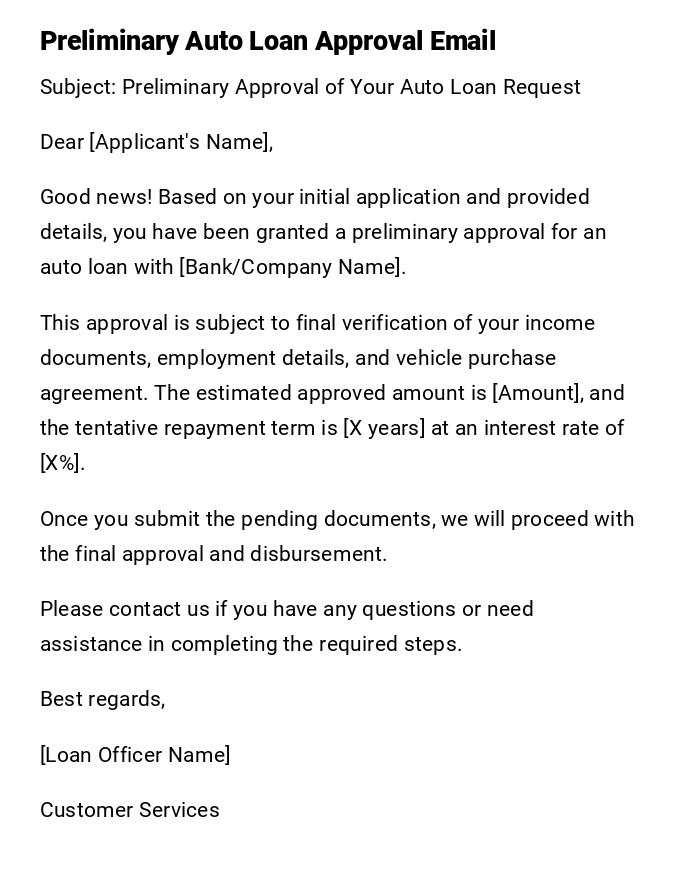

Preliminary Auto Loan Approval Email

Subject: Preliminary Approval of Your Auto Loan Request

Dear [Applicant's Name],

Good news! Based on your initial application and provided details, you have been granted a preliminary approval for an auto loan with [Bank/Company Name].

This approval is subject to final verification of your income documents, employment details, and vehicle purchase agreement. The estimated approved amount is [Amount], and the tentative repayment term is [X years] at an interest rate of [X%].

Once you submit the pending documents, we will proceed with the final approval and disbursement.

Please contact us if you have any questions or need assistance in completing the required steps.

Best regards,

[Loan Officer Name]

Customer Services

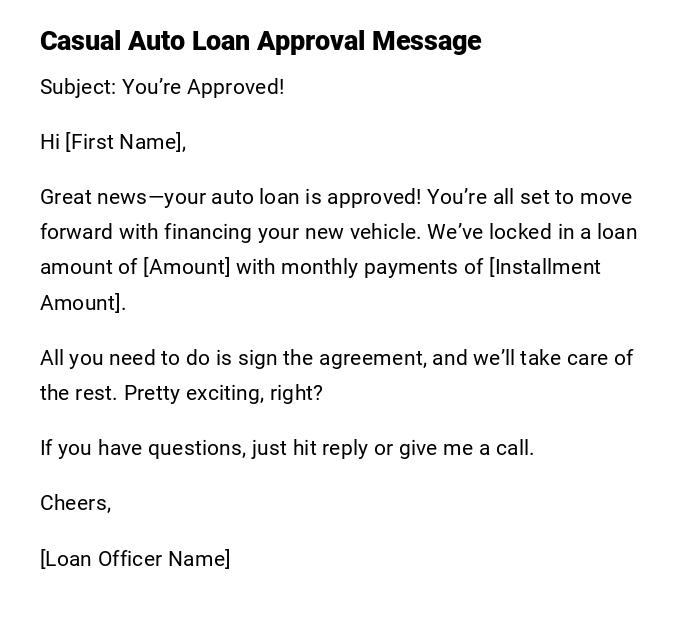

Casual Auto Loan Approval Message

Subject: You’re Approved!

Hi [First Name],

Great news—your auto loan is approved! You’re all set to move forward with financing your new vehicle. We’ve locked in a loan amount of [Amount] with monthly payments of [Installment Amount].

All you need to do is sign the agreement, and we’ll take care of the rest. Pretty exciting, right?

If you have questions, just hit reply or give me a call.

Cheers,

[Loan Officer Name]

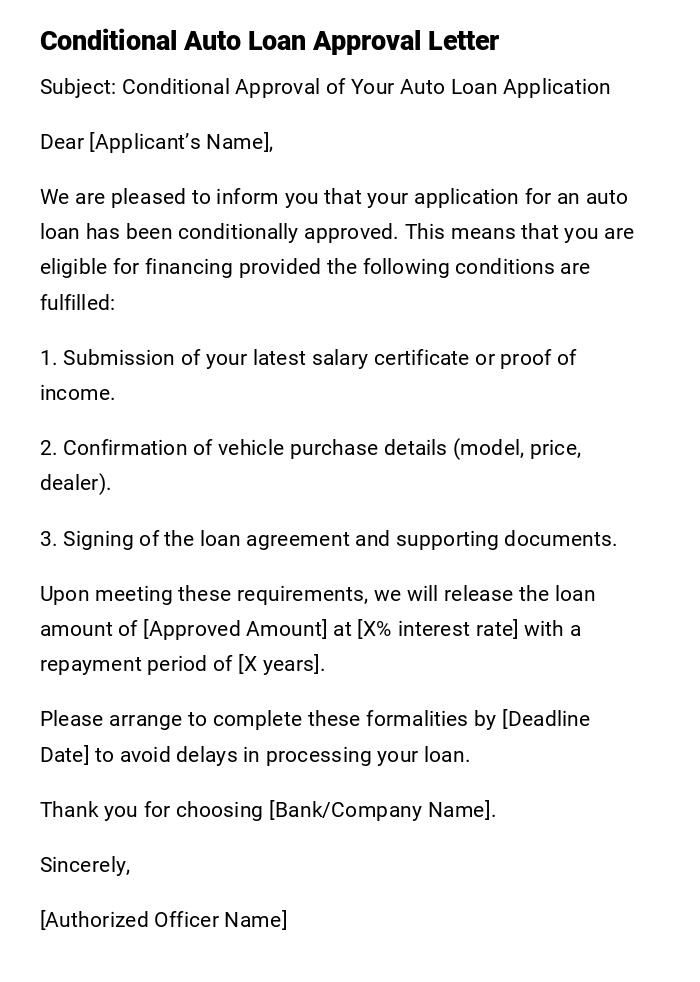

Conditional Auto Loan Approval Letter

Subject: Conditional Approval of Your Auto Loan Application

Dear [Applicant’s Name],

We are pleased to inform you that your application for an auto loan has been conditionally approved. This means that you are eligible for financing provided the following conditions are fulfilled:

1. Submission of your latest salary certificate or proof of income.

2. Confirmation of vehicle purchase details (model, price, dealer).

3. Signing of the loan agreement and supporting documents.

Upon meeting these requirements, we will release the loan amount of [Approved Amount] at [X% interest rate] with a repayment period of [X years].

Please arrange to complete these formalities by [Deadline Date] to avoid delays in processing your loan.

Thank you for choosing [Bank/Company Name].

Sincerely,

[Authorized Officer Name]

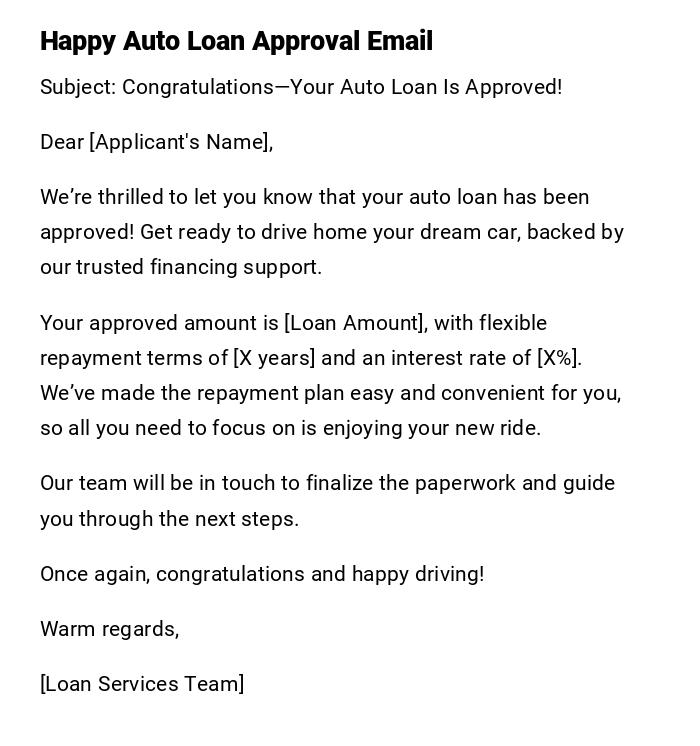

Happy Auto Loan Approval Email

Subject: Congratulations—Your Auto Loan Is Approved!

Dear [Applicant's Name],

We’re thrilled to let you know that your auto loan has been approved! Get ready to drive home your dream car, backed by our trusted financing support.

Your approved amount is [Loan Amount], with flexible repayment terms of [X years] and an interest rate of [X%]. We’ve made the repayment plan easy and convenient for you, so all you need to focus on is enjoying your new ride.

Our team will be in touch to finalize the paperwork and guide you through the next steps.

Once again, congratulations and happy driving!

Warm regards,

[Loan Services Team]

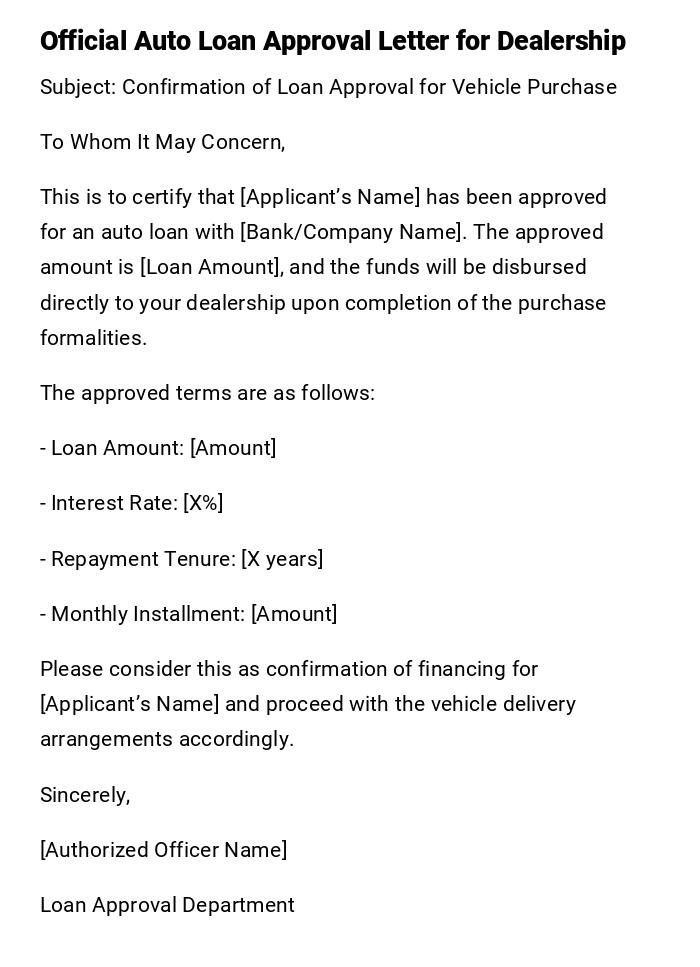

Official Auto Loan Approval Letter for Dealership

Subject: Confirmation of Loan Approval for Vehicle Purchase

To Whom It May Concern,

This is to certify that [Applicant’s Name] has been approved for an auto loan with [Bank/Company Name]. The approved amount is [Loan Amount], and the funds will be disbursed directly to your dealership upon completion of the purchase formalities.

The approved terms are as follows:

- Loan Amount: [Amount]

- Interest Rate: [X%]

- Repayment Tenure: [X years]

- Monthly Installment: [Amount]

Please consider this as confirmation of financing for [Applicant’s Name] and proceed with the vehicle delivery arrangements accordingly.

Sincerely,

[Authorized Officer Name]

Loan Approval Department

Quick Auto Loan Approval Message

Subject: Auto Loan Approved

Dear [Applicant’s Name],

We are glad to inform you that your auto loan application has been approved. The approved loan amount is [Amount], with a repayment term of [X years] at [X% interest rate].

Kindly review the agreement attached and sign to proceed with disbursement.

Thank you for choosing us.

Regards,

[Loan Officer Name]

Provisional Auto Loan Approval Letter

Subject: Provisional Approval of Auto Loan Application

Dear [Applicant’s Name],

We are pleased to grant you a provisional approval for your auto loan request. This provisional sanction covers an amount of [Loan Amount], subject to verification of your submitted documents and compliance with our internal policies.

Please provide the following within [X days]:

- Proof of income/employment

- Vehicle quotation or purchase agreement

- Identification documents

On successful verification, we will issue a final approval and proceed with fund disbursement.

We look forward to assisting you in purchasing your new vehicle.

Sincerely,

[Loan Department]

What is an auto loan approval letter and why is it important?

An auto loan approval letter is a formal communication sent by a bank, credit union, or financing company to confirm that a customer’s loan request for purchasing a vehicle has been accepted.

It serves as proof of financing, which helps the buyer negotiate confidently with car dealerships.

This letter is also important for outlining loan terms such as approved amount, interest rate, tenure, and repayment conditions.

Who issues an auto loan approval letter?

- Banks and financial institutions

- Credit unions

- Auto financing companies

- Sometimes car dealerships (through partner lenders)

The letter is always issued by an authorized loan officer or approval department representative.

To whom should an auto loan approval letter be addressed?

- The applicant (borrower) who applied for financing

- A car dealership (when funds are disbursed directly to them)

- Sometimes both, when official proof is needed for the dealership and the buyer simultaneously

- In certain cases, co-signers or guarantors may also receive a copy

When is an auto loan approval letter sent?

- After the applicant’s financial profile has been reviewed and accepted

- Once preliminary approval is granted, pending documentation

- At the final approval stage before loan disbursement

- When dealerships request financing confirmation for a buyer

- In provisional or conditional cases where documents are still required

How to write and send an auto loan approval letter?

- Begin with a clear subject line confirming approval.

- Address the recipient formally or casually depending on tone.

- State the approved loan amount, tenure, interest rate, and repayment plan.

- Mention any conditions (if provisional/conditional).

- Close with next steps such as signing agreements or contacting the dealership.

- Send by email for quick communication, or by printed letter if official documentation is required.

Requirements and prerequisites before issuing an approval letter

- Applicant must submit identity proof, income proof, and employment details.

- Credit score and history are evaluated.

- Vehicle quotation or purchase order is required.

- Internal verification and underwriting must be completed.

- In conditional cases, pending documents should be clearly listed.

Formatting guidelines for auto loan approval letters

- Length: Usually 1–2 pages or a concise email.

- Tone: Professional, clear, and confident (can be casual for informal notices).

- Style: Use straightforward wording with numbers highlighted.

- Mode: Email for fast communication; printed letter for official confirmation.

- Etiquette: Congratulate the borrower and provide clear next steps.

After sending an auto loan approval letter—what to do next?

- Await signed loan agreements from the borrower.

- Ensure dealership is informed if disbursement is direct.

- Provide repayment schedule and clarify due dates.

- Follow up within a few days if there is no response from the borrower.

- Maintain customer support availability for clarifications.

Pros and cons of sending an auto loan approval letter

Pros:

- Builds trust between lender and borrower

- Gives borrower confidence when negotiating with dealerships

- Serves as written proof of financing terms

Cons:

- May cause confusion if conditions are not clearly stated

- Requires prompt follow-up to avoid delays in disbursement

- Could lock the lender into terms before final verification if not worded carefully

Common mistakes to avoid in auto loan approval letters

- Not specifying whether the approval is final or conditional

- Forgetting to mention repayment terms or interest rate

- Using overly complex financial jargon that confuses the borrower

- Sending the letter without verifying all applicant details

- Omitting clear instructions for the next steps

Key elements and structure of an auto loan approval letter

- Subject line clearly stating “Loan Approved”

- Greeting and applicant’s name

- Approved loan amount and details

- Interest rate, tenure, and repayment plan

- Conditions (if any)

- Instructions for next steps

- Closing and contact details for support

Tricks and tips for writing better auto loan approval letters

- Always congratulate the borrower—it builds goodwill.

- Keep numbers easy to read (bullet points or tables if possible).

- If the approval is conditional, highlight conditions in bold or a list.

- Use a friendly tone in emails but a formal tone in printed letters.

- End with clear contact information to encourage communication.

Download Word Doc

Download Word Doc

Download PDF

Download PDF