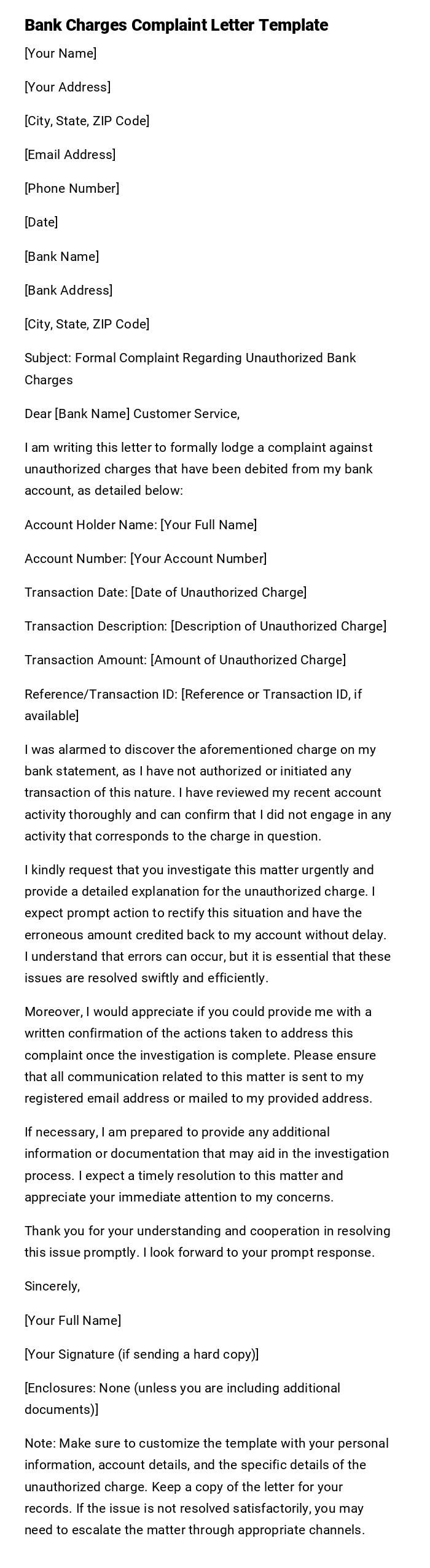

Bank Charges Complaint Letter Template

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Formal Complaint Regarding Unauthorized Bank Charges

Dear [Bank Name] Customer Service,

I am writing this letter to formally lodge a complaint against unauthorized charges that have been debited from my bank account, as detailed below:

Account Holder Name: [Your Full Name]

Account Number: [Your Account Number]

Transaction Date: [Date of Unauthorized Charge]

Transaction Description: [Description of Unauthorized Charge]

Transaction Amount: [Amount of Unauthorized Charge]

Reference/Transaction ID: [Reference or Transaction ID, if available]

I was alarmed to discover the aforementioned charge on my bank statement, as I have not authorized or initiated any transaction of this nature. I have reviewed my recent account activity thoroughly and can confirm that I did not engage in any activity that corresponds to the charge in question.

I kindly request that you investigate this matter urgently and provide a detailed explanation for the unauthorized charge. I expect prompt action to rectify this situation and have the erroneous amount credited back to my account without delay. I understand that errors can occur, but it is essential that these issues are resolved swiftly and efficiently.

Moreover, I would appreciate if you could provide me with a written confirmation of the actions taken to address this complaint once the investigation is complete. Please ensure that all communication related to this matter is sent to my registered email address or mailed to my provided address.

If necessary, I am prepared to provide any additional information or documentation that may aid in the investigation process. I expect a timely resolution to this matter and appreciate your immediate attention to my concerns.

Thank you for your understanding and cooperation in resolving this issue promptly. I look forward to your prompt response.

Sincerely,

[Your Full Name]

[Your Signature (if sending a hard copy)]

[Enclosures: None (unless you are including additional documents)]

Note: Make sure to customize the template with your personal information, account details, and the specific details of the unauthorized charge. Keep a copy of the letter for your records. If the issue is not resolved satisfactorily, you may need to escalate the matter through appropriate channels.

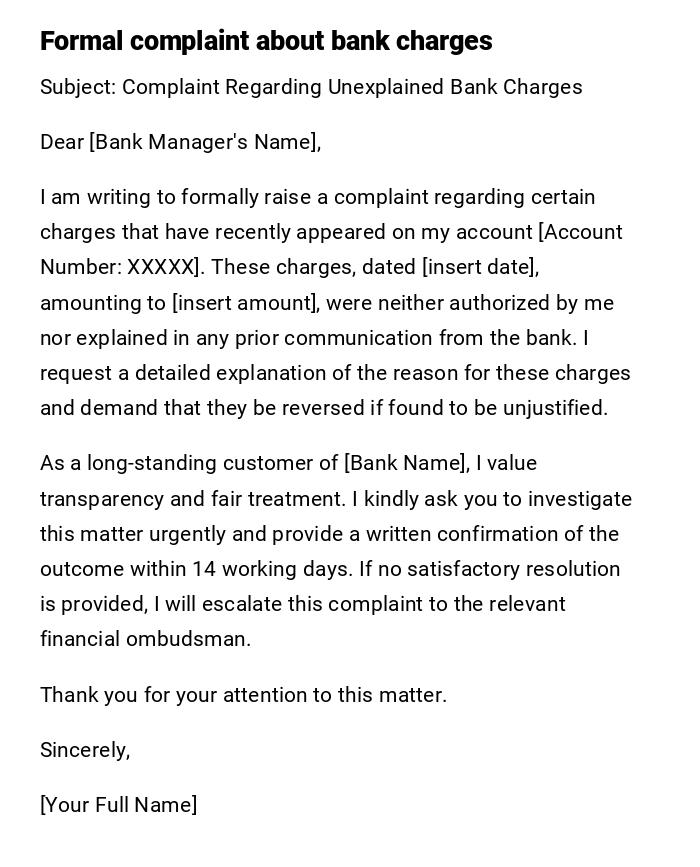

Formal Complaint Letter About Unexplained Bank Charges

Subject: Complaint Regarding Unexplained Bank Charges

Dear [Bank Manager's Name],

I am writing to formally raise a complaint regarding certain charges that have recently appeared on my account [Account Number: XXXXX]. These charges, dated [insert date], amounting to [insert amount], were neither authorized by me nor explained in any prior communication from the bank. I request a detailed explanation of the reason for these charges and demand that they be reversed if found to be unjustified.

As a long-standing customer of [Bank Name], I value transparency and fair treatment. I kindly ask you to investigate this matter urgently and provide a written confirmation of the outcome within 14 working days. If no satisfactory resolution is provided, I will escalate this complaint to the relevant financial ombudsman.

Thank you for your attention to this matter.

Sincerely,

[Your Full Name]

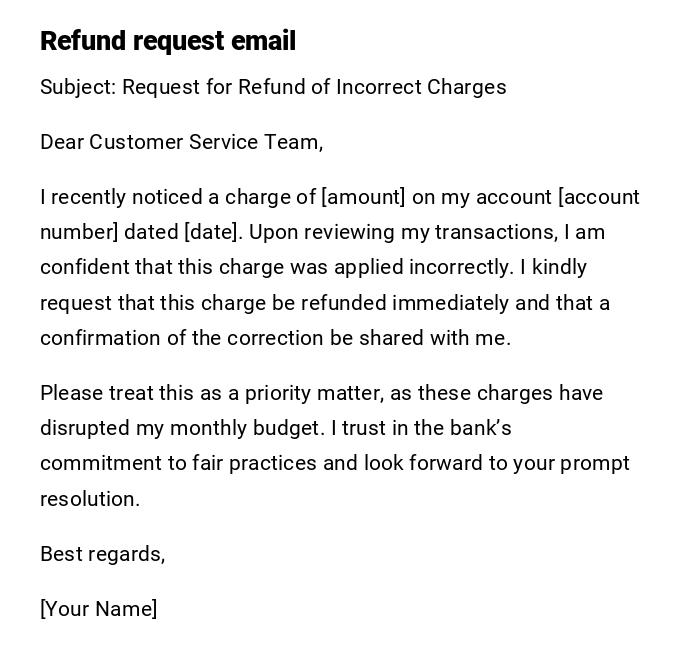

Email Requesting Refund of Incorrect Bank Charges

Subject: Request for Refund of Incorrect Charges

Dear Customer Service Team,

I recently noticed a charge of [amount] on my account [account number] dated [date]. Upon reviewing my transactions, I am confident that this charge was applied incorrectly. I kindly request that this charge be refunded immediately and that a confirmation of the correction be shared with me.

Please treat this as a priority matter, as these charges have disrupted my monthly budget. I trust in the bank’s commitment to fair practices and look forward to your prompt resolution.

Best regards,

[Your Name]

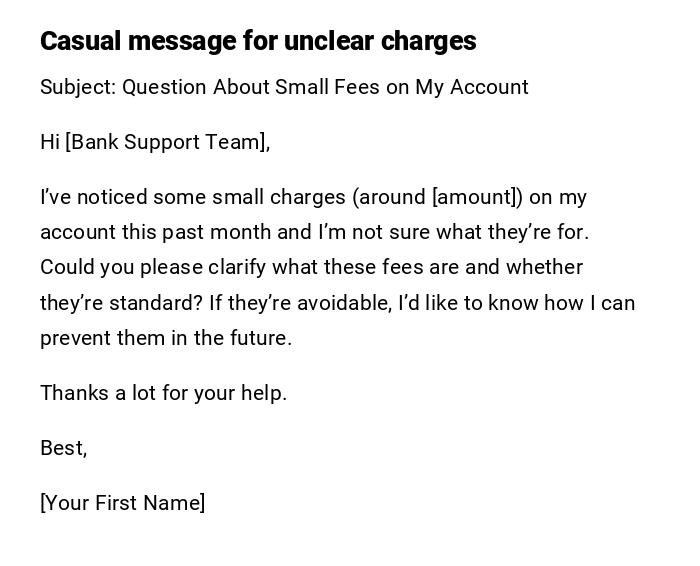

Casual Message to Bank Regarding Small Unclear Fees

Subject: Question About Small Fees on My Account

Hi [Bank Support Team],

I’ve noticed some small charges (around [amount]) on my account this past month and I’m not sure what they’re for. Could you please clarify what these fees are and whether they’re standard? If they’re avoidable, I’d like to know how I can prevent them in the future.

Thanks a lot for your help.

Best,

[Your First Name]

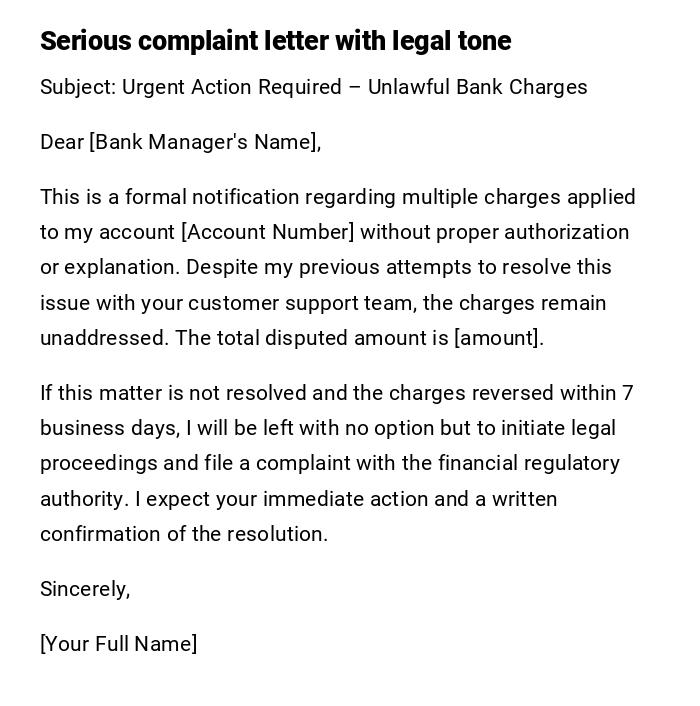

Serious Complaint Letter Threatening Legal Action

Subject: Urgent Action Required – Unlawful Bank Charges

Dear [Bank Manager's Name],

This is a formal notification regarding multiple charges applied to my account [Account Number] without proper authorization or explanation. Despite my previous attempts to resolve this issue with your customer support team, the charges remain unaddressed. The total disputed amount is [amount].

If this matter is not resolved and the charges reversed within 7 business days, I will be left with no option but to initiate legal proceedings and file a complaint with the financial regulatory authority. I expect your immediate action and a written confirmation of the resolution.

Sincerely,

[Your Full Name]

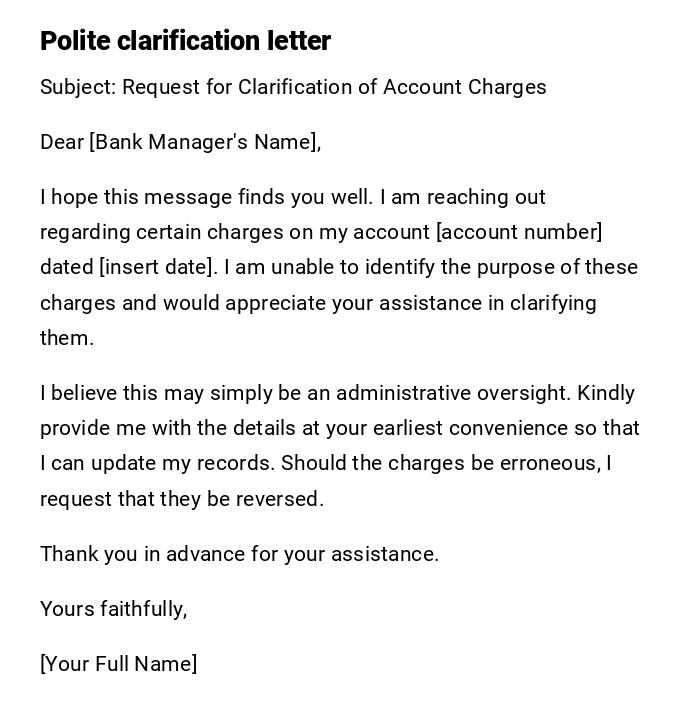

Polite Letter Requesting Clarification Before Escalation

Subject: Request for Clarification of Account Charges

Dear [Bank Manager's Name],

I hope this message finds you well. I am reaching out regarding certain charges on my account [account number] dated [insert date]. I am unable to identify the purpose of these charges and would appreciate your assistance in clarifying them.

I believe this may simply be an administrative oversight. Kindly provide me with the details at your earliest convenience so that I can update my records. Should the charges be erroneous, I request that they be reversed.

Thank you in advance for your assistance.

Yours faithfully,

[Your Full Name]

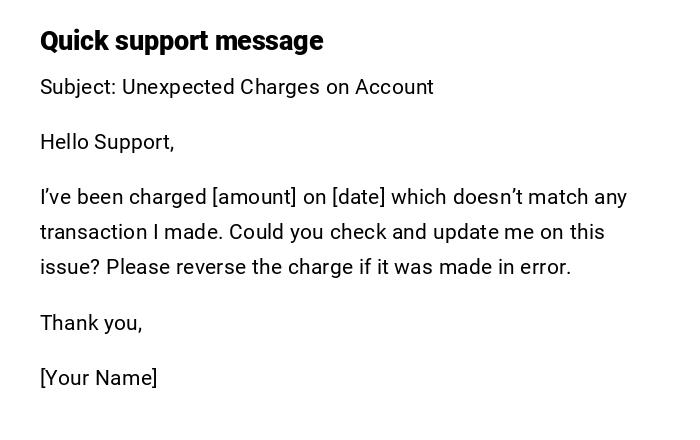

Quick Message to Mobile Banking Support

Subject: Unexpected Charges on Account

Hello Support,

I’ve been charged [amount] on [date] which doesn’t match any transaction I made. Could you check and update me on this issue? Please reverse the charge if it was made in error.

Thank you,

[Your Name]

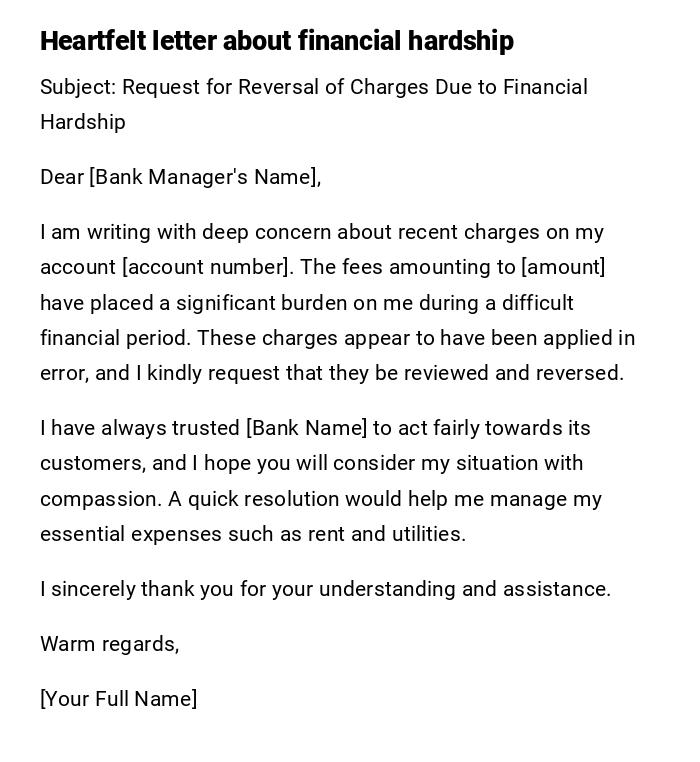

Heartfelt Letter Expressing Financial Hardship Due to Bank Charges

Subject: Request for Reversal of Charges Due to Financial Hardship

Dear [Bank Manager's Name],

I am writing with deep concern about recent charges on my account [account number]. The fees amounting to [amount] have placed a significant burden on me during a difficult financial period. These charges appear to have been applied in error, and I kindly request that they be reviewed and reversed.

I have always trusted [Bank Name] to act fairly towards its customers, and I hope you will consider my situation with compassion. A quick resolution would help me manage my essential expenses such as rent and utilities.

I sincerely thank you for your understanding and assistance.

Warm regards,

[Your Full Name]

Official Letter to Banking Ombudsman After Bank Refusal

Subject: Complaint Against [Bank Name] Regarding Unjustified Charges

Dear Banking Ombudsman,

I am submitting this formal complaint regarding [Bank Name]. Despite multiple attempts to resolve the matter directly, the bank has refused to refund charges of [amount] applied to my account [account number] without justification.

I request your intervention to investigate this case and ensure that my funds are returned. Enclosed with this letter are copies of my correspondence with the bank as evidence of my efforts to resolve this issue.

I appreciate your prompt assistance in protecting my consumer rights.

Yours sincerely,

[Your Full Name]

Funny but Serious Email About Repeated Small Charges

Subject: Are These Tiny Charges Playing Hide and Seek?

Hi [Bank Team],

I’ve spotted a few tiny charges on my account recently that don’t seem to match any of my spending. While the amounts are small, they keep popping up like sneaky little gremlins, and I’d like to know what’s causing them. Could you please explain or, better yet, reverse them if they’re mistakes?

I’m hoping this can be sorted quickly, so I can get back to trusting that my account is safe and transparent.

Thanks in advance,

[Your Name]

What is a bank charges complaint letter and why do you need it?

A bank charges complaint letter is written to challenge or request clarification about fees applied to a customer’s account.

Its purpose is to ensure transparency, request refunds for incorrect or unfair charges, and hold the bank accountable for clear communication.

This letter helps protect the customer’s financial rights and ensures they are not unfairly burdened with unexplained or erroneous costs.

Who should send a bank charges complaint letter?

- Any bank customer who notices unexpected or unexplained charges.

- Business owners managing corporate accounts.

- Students or individuals on low-income plans who may face hardship due to extra fees.

- Legal representatives acting on behalf of a client or family member.

To whom should the complaint be addressed?

- Customer service or support department for routine issues.

- The branch manager for formal written letters.

- Senior management or grievance cell for escalated complaints.

- Banking Ombudsman or financial regulators if the bank fails to resolve the issue.

- In some cases, consumer protection agencies may also receive the letter.

When should you send a bank charges complaint letter?

- Immediately after spotting an unexplained fee on your statement.

- When repeated charges occur without notice.

- After failed attempts to get clarification through phone or online chat.

- Before escalating to the ombudsman or legal authorities.

- When charges cause financial hardship and need urgent reversal.

How do you write and send the letter effectively?

- Start with a clear subject line indicating it is a complaint.

- Mention account number and dates of disputed charges.

- State whether you want a refund, clarification, or both.

- Keep the tone respectful but firm.

- Choose the right medium: email for speed, printed letter for official escalation.

- Keep copies of all communication for records.

What are the requirements and prerequisites before sending?

- Review your bank statement carefully.

- Double-check whether the charge could be standard (e.g., service fees).

- Gather evidence such as receipts, screenshots, or transaction records.

- Ensure your complaint is based on valid grounds, not misunderstanding.

- Know your bank’s complaint policy and timelines.

Formatting guidelines for a bank charges complaint letter

- Keep the letter concise: usually 1 page.

- Use a professional and polite tone, unless escalation is necessary.

- Include specifics: dates, amounts, and transaction references.

- Avoid emotional or vague statements.

- End with a clear request (refund, reversal, or explanation).

- Always include your full name and contact details.

What should you do after sending the letter?

- Wait for the bank’s official response, usually within 7–14 days.

- Follow up with a phone call if no reply is received.

- Keep records of all replies and acknowledgments.

- Escalate to higher authorities or the ombudsman if unresolved.

- Monitor your account closely for recurring charges.

Pros and cons of sending a bank charges complaint letter

Pros:

- Protects you from unfair or unauthorized charges.

- Ensures transparency and accountability.

- May result in refunds or adjustments.

Cons:

- Can be time-consuming to pursue.

- May require escalation if the bank is unresponsive.

- Resolution is not always guaranteed.

Tricks and tips for making your complaint stronger

- Be precise: list amounts and dates.

- Use a calm but assertive tone.

- Attach supporting documents.

- Give a specific timeline for resolution.

- Use escalation wisely: don’t threaten immediately unless necessary.

- Keep communication professional, even if frustrated.

Common mistakes to avoid when complaining about bank charges

- Sending vague complaints without evidence.

- Using an aggressive or rude tone that discourages cooperation.

- Forgetting to mention account number or charge details.

- Not keeping a record of your communication.

- Ignoring the bank’s complaint process and jumping straight to threats.

Elements and structure of a proper bank charges complaint letter

- Subject line: clear and direct.

- Greeting: address the right person or department.

- Introduction: explain why you’re writing.

- Details: account number, date, and amount of charges.

- Request: refund, reversal, or explanation.

- Closing: polite but firm, with your contact info.

- Attachments: statements, receipts, or correspondence evidence.

Download Word Doc

Download Word Doc

Download PDF

Download PDF