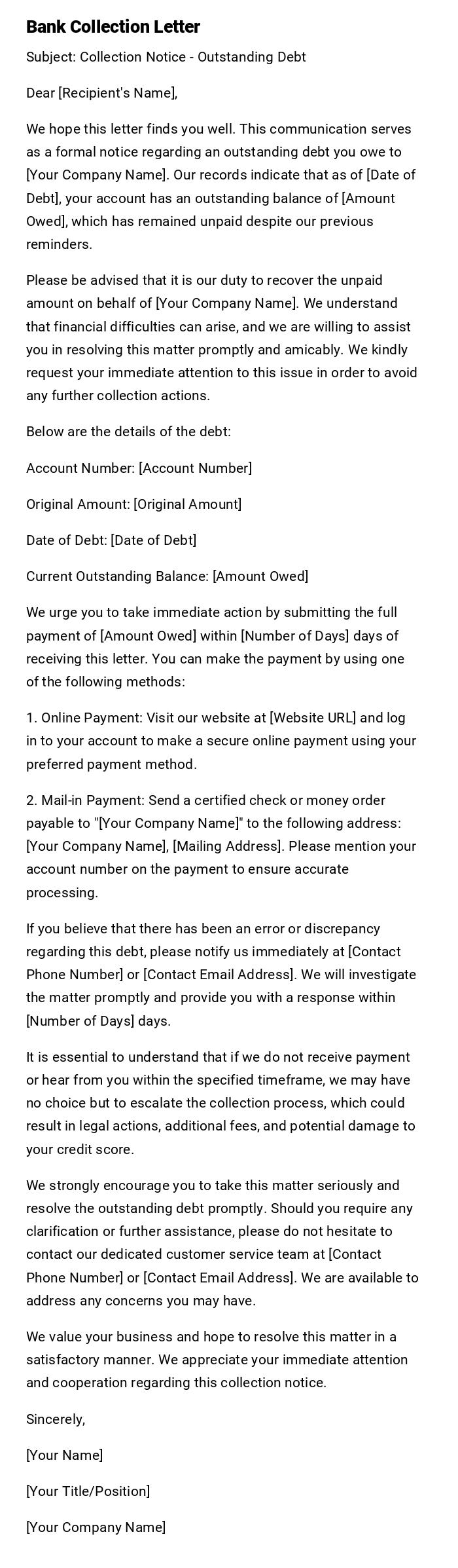

Bank Collection Letter

Subject: Collection Notice - Outstanding Debt

Dear [Recipient's Name],

We hope this letter finds you well. This communication serves as a formal notice regarding an outstanding debt you owe to [Your Company Name]. Our records indicate that as of [Date of Debt], your account has an outstanding balance of [Amount Owed], which has remained unpaid despite our previous reminders.

Please be advised that it is our duty to recover the unpaid amount on behalf of [Your Company Name]. We understand that financial difficulties can arise, and we are willing to assist you in resolving this matter promptly and amicably. We kindly request your immediate attention to this issue in order to avoid any further collection actions.

Below are the details of the debt:

Account Number: [Account Number]

Original Amount: [Original Amount]

Date of Debt: [Date of Debt]

Current Outstanding Balance: [Amount Owed]

We urge you to take immediate action by submitting the full payment of [Amount Owed] within [Number of Days] days of receiving this letter. You can make the payment by using one of the following methods:

1. Online Payment: Visit our website at [Website URL] and log in to your account to make a secure online payment using your preferred payment method.

2. Mail-in Payment: Send a certified check or money order payable to "[Your Company Name]" to the following address: [Your Company Name], [Mailing Address]. Please mention your account number on the payment to ensure accurate processing.

If you believe that there has been an error or discrepancy regarding this debt, please notify us immediately at [Contact Phone Number] or [Contact Email Address]. We will investigate the matter promptly and provide you with a response within [Number of Days] days.

It is essential to understand that if we do not receive payment or hear from you within the specified timeframe, we may have no choice but to escalate the collection process, which could result in legal actions, additional fees, and potential damage to your credit score.

We strongly encourage you to take this matter seriously and resolve the outstanding debt promptly. Should you require any clarification or further assistance, please do not hesitate to contact our dedicated customer service team at [Contact Phone Number] or [Contact Email Address]. We are available to address any concerns you may have.

We value your business and hope to resolve this matter in a satisfactory manner. We appreciate your immediate attention and cooperation regarding this collection notice.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company Name]

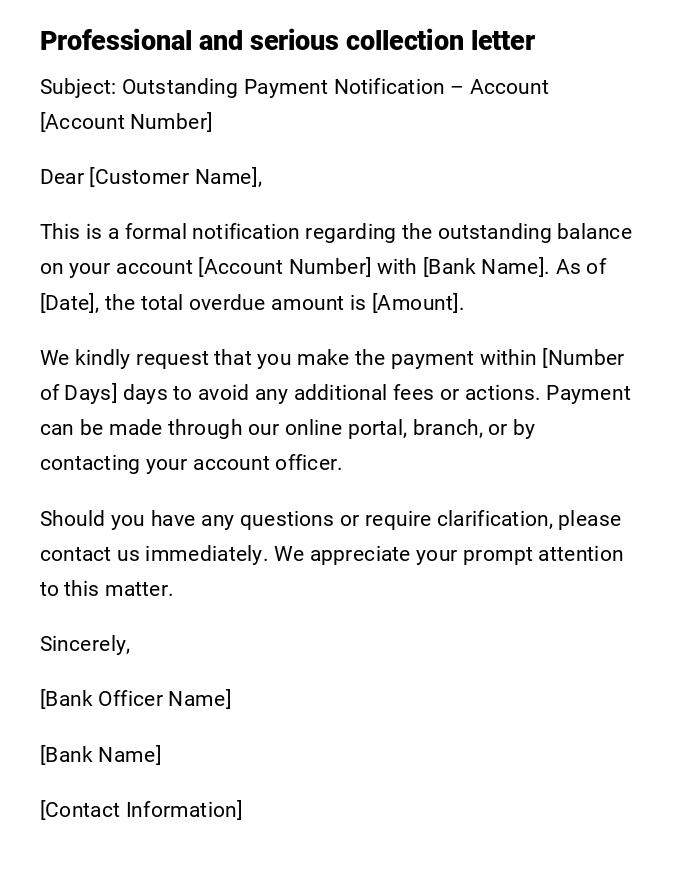

Formal Bank Collection Letter

Subject: Outstanding Payment Notification – Account [Account Number]

Dear [Customer Name],

This is a formal notification regarding the outstanding balance on your account [Account Number] with [Bank Name]. As of [Date], the total overdue amount is [Amount].

We kindly request that you make the payment within [Number of Days] days to avoid any additional fees or actions. Payment can be made through our online portal, branch, or by contacting your account officer.

Should you have any questions or require clarification, please contact us immediately. We appreciate your prompt attention to this matter.

Sincerely,

[Bank Officer Name]

[Bank Name]

[Contact Information]

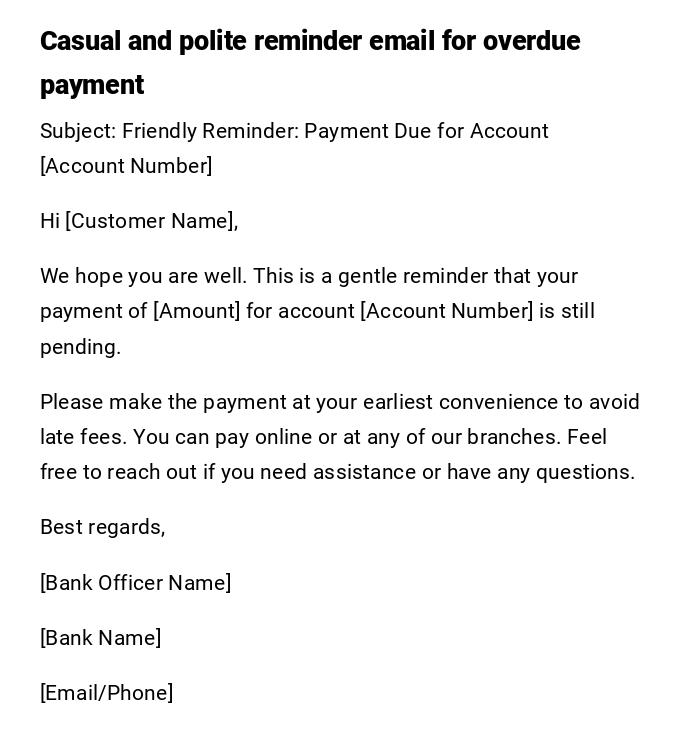

Friendly Reminder Collection Email

Subject: Friendly Reminder: Payment Due for Account [Account Number]

Hi [Customer Name],

We hope you are well. This is a gentle reminder that your payment of [Amount] for account [Account Number] is still pending.

Please make the payment at your earliest convenience to avoid late fees. You can pay online or at any of our branches. Feel free to reach out if you need assistance or have any questions.

Best regards,

[Bank Officer Name]

[Bank Name]

[Email/Phone]

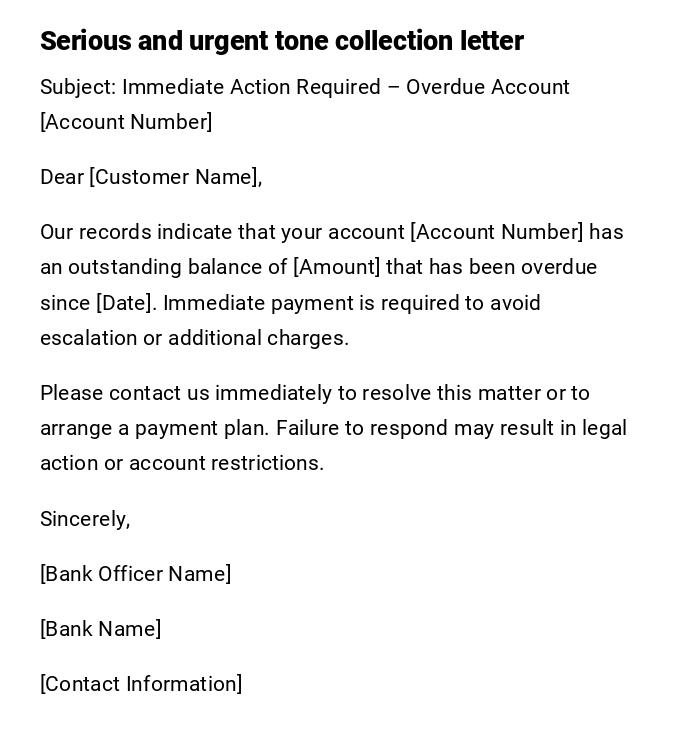

Urgent Bank Collection Letter

Subject: Immediate Action Required – Overdue Account [Account Number]

Dear [Customer Name],

Our records indicate that your account [Account Number] has an outstanding balance of [Amount] that has been overdue since [Date]. Immediate payment is required to avoid escalation or additional charges.

Please contact us immediately to resolve this matter or to arrange a payment plan. Failure to respond may result in legal action or account restrictions.

Sincerely,

[Bank Officer Name]

[Bank Name]

[Contact Information]

Final Notice Collection Letter

Subject: Final Notice – Account [Account Number] Payment Due

Dear [Customer Name],

This letter serves as the final notice regarding the overdue payment of [Amount] for your account [Account Number]. Payment has not been received despite previous reminders.

You are requested to remit the full amount within [Number of Days] to prevent further action. If payment has already been made, please disregard this notice. Otherwise, contact us immediately to avoid escalation.

Sincerely,

[Bank Officer Name]

[Bank Name]

[Contact Information]

Collection Letter with Payment Plan Offer

Subject: Payment Arrangement for Account [Account Number]

Dear [Customer Name],

We noticed that your account [Account Number] currently has an overdue balance of [Amount]. We understand that financial difficulties can arise and are willing to offer a structured payment plan to help you clear your balance.

Please contact us by [Date] to discuss and arrange a suitable schedule. Timely communication will help prevent additional fees or account restrictions.

Sincerely,

[Bank Officer Name]

[Bank Name]

[Contact Information]

Polite Collection Letter for Minor Overdue Amount

Subject: Payment Reminder for Account [Account Number]

Dear [Customer Name],

This is a reminder that a small balance of [Amount] remains outstanding on your account [Account Number].

We kindly request that you clear this amount at your earliest convenience. Please contact our customer service if you have already made the payment or require assistance.

Thank you for your cooperation.

[Bank Officer Name]

[Bank Name]

International Customer Collection Letter

Subject: Payment Request for Account [Account Number]

Dear [Customer Name],

Our records indicate that your account [Account Number] has an outstanding balance of [Amount] due since [Date]. This letter is intended for international customers to ensure timely settlement.

Please arrange payment via wire transfer or online banking at your earliest convenience. Contact our international accounts department if you require assistance or confirmation of payment methods.

Sincerely,

[Bank Officer Name]

[Bank Name]

[Contact Information]

What is a Bank Collection Letter and Why It Is Sent

A Bank Collection Letter is a formal communication sent to customers with overdue payments.

Its purposes include:

- Informing customers of outstanding balances

- Requesting timely payment

- Preventing escalation to legal or administrative action

- Offering solutions like payment plans when appropriate

Who Should Send a Bank Collection Letter

- Bank officers or account managers

- Collections department staff

- Branch managers in smaller institutions

- Customer service representatives authorized to communicate about overdue accounts

Whom Should Receive a Bank Collection Letter

- Individual account holders with overdue payments

- Business clients with outstanding invoices

- International customers with overdue account balances

- Joint account holders or authorized signatories when applicable

When to Send a Bank Collection Letter

- After a payment has become overdue

- Following initial friendly reminders

- Prior to potential account restrictions or legal actions

- To offer structured repayment options before escalation

How to Write and Send a Bank Collection Letter

- Start with a clear subject indicating overdue payment

- Address the customer politely and formally

- Specify the overdue amount and account details

- Provide a deadline for payment

- Offer payment options or contact details for assistance

- Close professionally with a formal signature

- Choose email for quick notice or printed letter for formal/legal matters

Requirements and Prerequisites Before Sending

- Confirm the overdue amount and account details

- Review previous reminders and communications

- Prepare payment instructions or plans if offering arrangements

- Ensure proper authorization to communicate about accounts

- Collect contact information for follow-up if needed

Formatting Guidelines

- Length: One page is usually sufficient

- Tone: Professional and polite, firm for urgent or final notices

- Style: Clear, concise, and respectful

- Mode: Email for prompt notice, letter for formal/legal purposes

- Attachments: Include invoices, statements, or payment instructions if necessary

After Sending the Bank Collection Letter

- Confirm receipt if possible, especially for large or international accounts

- Track response and payments received

- Follow up with additional reminders if necessary

- Escalate to account restrictions or legal actions if deadlines are not met

- Document all communications for compliance and record-keeping

Common Mistakes to Avoid

- Sending letters without verifying overdue amounts

- Using overly harsh or threatening language initially

- Forgetting to include payment instructions or deadlines

- Ignoring prior communications and history of the account

- Not maintaining proper documentation for legal compliance

Tricks and Tips for Effective Collection Letters

- Start with a polite reminder and escalate tone gradually

- Clearly mention amounts, dates, and account numbers

- Offer payment solutions to increase the likelihood of collection

- Keep records of all correspondence

- Personalize letters for high-value accounts or long-term customers

Elements and Structure of a Bank Collection Letter

- Subject indicating overdue payment

- Greeting addressing the customer

- Statement of overdue amount and account details

- Reminder of payment deadline

- Payment options and contact details

- Optional: Offer for payment plan

- Closing with professional signature and bank information

- Attachments if applicable

Compare and Contrast Bank Collection Letters with Other Notices

- Compared to friendly reminders: Collection letters are more formal and direct

- Compared to legal notices: Collection letters are less severe but escalate if unpaid

- Alternative methods: Emails, phone calls, text notifications, or portal alerts

- Choosing the format depends on urgency, amount, and account history

Download Word Doc

Download Word Doc

Download PDF

Download PDF