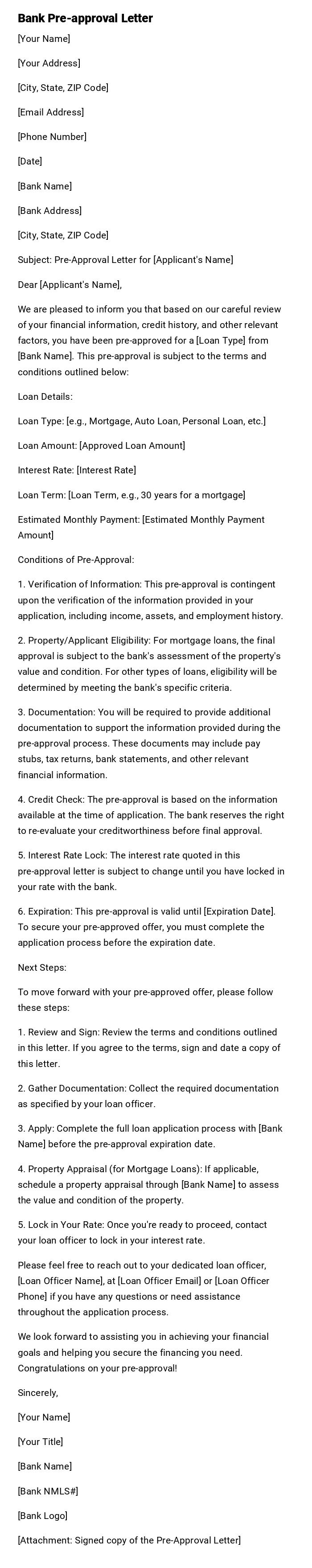

Bank Pre-approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Pre-Approval Letter for [Applicant's Name]

Dear [Applicant's Name],

We are pleased to inform you that based on our careful review of your financial information, credit history, and other relevant factors, you have been pre-approved for a [Loan Type] from [Bank Name]. This pre-approval is subject to the terms and conditions outlined below:

Loan Details:

Loan Type: [e.g., Mortgage, Auto Loan, Personal Loan, etc.]

Loan Amount: [Approved Loan Amount]

Interest Rate: [Interest Rate]

Loan Term: [Loan Term, e.g., 30 years for a mortgage]

Estimated Monthly Payment: [Estimated Monthly Payment Amount]

Conditions of Pre-Approval:

1. Verification of Information: This pre-approval is contingent upon the verification of the information provided in your application, including income, assets, and employment history.

2. Property/Applicant Eligibility: For mortgage loans, the final approval is subject to the bank's assessment of the property's value and condition. For other types of loans, eligibility will be determined by meeting the bank's specific criteria.

3. Documentation: You will be required to provide additional documentation to support the information provided during the pre-approval process. These documents may include pay stubs, tax returns, bank statements, and other relevant financial information.

4. Credit Check: The pre-approval is based on the information available at the time of application. The bank reserves the right to re-evaluate your creditworthiness before final approval.

5. Interest Rate Lock: The interest rate quoted in this pre-approval letter is subject to change until you have locked in your rate with the bank.

6. Expiration: This pre-approval is valid until [Expiration Date]. To secure your pre-approved offer, you must complete the application process before the expiration date.

Next Steps:

To move forward with your pre-approved offer, please follow these steps:

1. Review and Sign: Review the terms and conditions outlined in this letter. If you agree to the terms, sign and date a copy of this letter.

2. Gather Documentation: Collect the required documentation as specified by your loan officer.

3. Apply: Complete the full loan application process with [Bank Name] before the pre-approval expiration date.

4. Property Appraisal (for Mortgage Loans): If applicable, schedule a property appraisal through [Bank Name] to assess the value and condition of the property.

5. Lock in Your Rate: Once you're ready to proceed, contact your loan officer to lock in your interest rate.

Please feel free to reach out to your dedicated loan officer, [Loan Officer Name], at [Loan Officer Email] or [Loan Officer Phone] if you have any questions or need assistance throughout the application process.

We look forward to assisting you in achieving your financial goals and helping you secure the financing you need. Congratulations on your pre-approval!

Sincerely,

[Your Name]

[Your Title]

[Bank Name]

[Bank NMLS#]

[Bank Logo]

[Attachment: Signed copy of the Pre-Approval Letter]

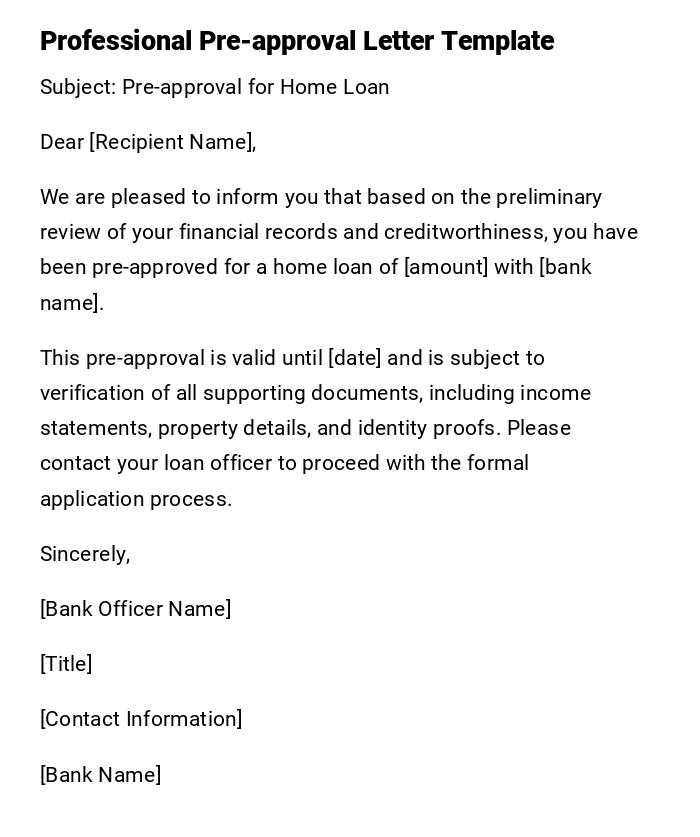

Standard Bank Pre-approval Letter for Home Loan

Subject: Pre-approval for Home Loan

Dear [Recipient Name],

We are pleased to inform you that based on the preliminary review of your financial records and creditworthiness, you have been pre-approved for a home loan of [amount] with [bank name].

This pre-approval is valid until [date] and is subject to verification of all supporting documents, including income statements, property details, and identity proofs. Please contact your loan officer to proceed with the formal application process.

Sincerely,

[Bank Officer Name]

[Title]

[Contact Information]

[Bank Name]

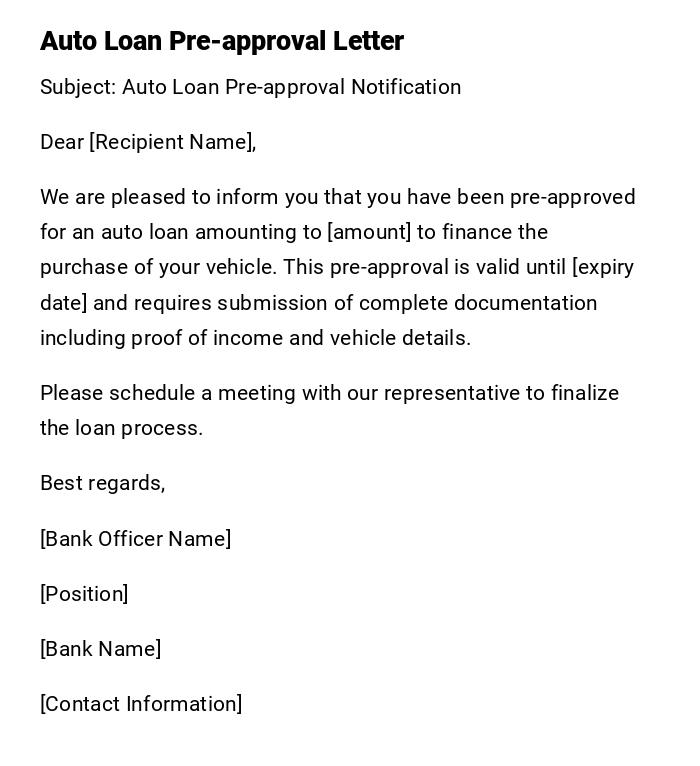

Bank Pre-approval Letter for Auto Loan

Subject: Auto Loan Pre-approval Notification

Dear [Recipient Name],

We are pleased to inform you that you have been pre-approved for an auto loan amounting to [amount] to finance the purchase of your vehicle. This pre-approval is valid until [expiry date] and requires submission of complete documentation including proof of income and vehicle details.

Please schedule a meeting with our representative to finalize the loan process.

Best regards,

[Bank Officer Name]

[Position]

[Bank Name]

[Contact Information]

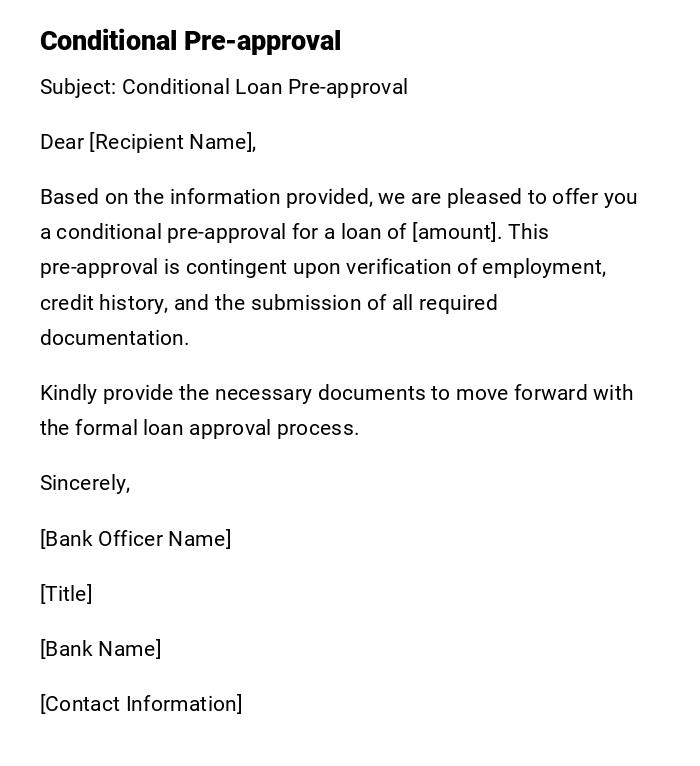

Conditional Bank Pre-approval Letter

Subject: Conditional Loan Pre-approval

Dear [Recipient Name],

Based on the information provided, we are pleased to offer you a conditional pre-approval for a loan of [amount]. This pre-approval is contingent upon verification of employment, credit history, and the submission of all required documentation.

Kindly provide the necessary documents to move forward with the formal loan approval process.

Sincerely,

[Bank Officer Name]

[Title]

[Bank Name]

[Contact Information]

Quick Pre-approval Letter for Mortgage

Subject: Mortgage Pre-approval Confirmation

Dear [Recipient Name],

We are happy to confirm your pre-approval for a mortgage of [amount] with [bank name]. This pre-approval is valid until [date] and subject to submission of property documentation and verification of income.

Please contact your mortgage advisor to complete the full approval process.

Sincerely,

[Bank Officer Name]

[Title]

[Bank Name]

[Contact Information]

Preliminary Bank Pre-approval for Personal Loan

Subject: Personal Loan Pre-approval

Dear [Recipient Name],

We are pleased to offer a preliminary pre-approval for a personal loan of [amount]. This pre-approval is based on your initial application and credit assessment and is valid until [expiry date].

To proceed, please provide supporting documents including proof of income and identification.

Sincerely,

[Bank Officer Name]

[Position]

[Bank Name]

[Contact Information]

Bank Pre-approval Letter with Expiry

Subject: Loan Pre-approval Valid Until [Date]

Dear [Recipient Name],

Following a preliminary review of your financial application, we are pleased to provide pre-approval for a loan of [amount]. This pre-approval remains valid until [date], after which reassessment will be necessary.

Please submit all required documentation before the expiry date to ensure smooth processing.

Sincerely,

[Bank Officer Name]

[Title]

[Bank Name]

[Contact Information]

What / Why is a Bank Pre-approval Letter Important

A bank pre-approval letter is an official document indicating that a bank has preliminarily agreed to extend a certain loan amount to a borrower.

Purpose:

- Demonstrates financial readiness to sellers or agents.

- Speeds up loan processing by initiating verification early.

- Helps borrowers understand their borrowing limits.

- Builds credibility in negotiations for property, vehicles, or other financed purchases.

Who should issue a Bank Pre-approval Letter

- Authorized bank officers or loan officers.

- Financial institutions with lending authority.

- Certified representatives who can verify the creditworthiness of the applicant.

Whom should the Bank Pre-approval Letter be addressed to

- Individual borrowers applying for loans.

- Real estate agents or property sellers in home purchases.

- Vehicle dealers for auto loans.

- Employers or third-party verifiers if required by the bank.

When should a Bank Pre-approval Letter be used

- Before making offers on property or vehicles.

- When negotiating prices to demonstrate financial capability.

- During loan application processes to expedite formal approval.

- For budgeting purposes and loan eligibility checks.

How to request and write a Bank Pre-approval Letter

- Submit a loan application with preliminary financial documents.

- Request pre-approval explicitly from the bank or loan officer.

- Ensure all personal and financial information is accurate.

- Include details such as intended loan type, amount, and purpose.

- The bank reviews credit history, income, and liabilities to issue the letter.

How much information should be included

- Loan amount pre-approved.

- Validity or expiry date of the pre-approval.

- Any conditions or contingencies (employment verification, property appraisal).

- Contact details of the bank officer for verification.

Requirements and Prerequisites for Bank Pre-approval

- Completed loan application form.

- Proof of income or salary slips.

- Credit history or credit report.

- Identification documents (ID, passport, or social security).

- Details of the asset or property being financed if applicable.

Formatting and Tone Guidelines

- Professional and formal tone.

- Concise, one-page format.

- Include subject line clearly stating pre-approval.

- Mention the pre-approved amount, expiry date, and any conditions.

- Bank letterhead or digital signature should be used for authenticity.

After Sending / Using a Pre-approval Letter

- Present the letter to sellers or agents to strengthen negotiation.

- Follow up with the bank for formal loan approval.

- Ensure submission of additional required documents within validity period.

- Keep a copy for personal records and verification purposes.

Pros and Cons of Bank Pre-approval

Pros:

- Increases credibility in purchases.

- Helps understand budget and loan limits.

- Reduces time for formal loan processing.

Cons: - Conditional on document verification; not final approval.

- Expiry dates require timely action.

- Misrepresentation can lead to rejection.

Compare and Contrast with Final Loan Approval

- Pre-approval: preliminary, shows intent to lend.

- Final approval: complete verification, legally binding loan agreement.

- Pre-approval helps in planning and negotiations; final approval allows disbursement of funds.

- Pre-approval is faster; final approval is thorough and detailed.

Tricks and Tips for Effective Pre-approval

- Maintain a good credit score before applying.

- Submit accurate and complete documents.

- Request letters in digital format for quick sharing.

- Track validity dates to avoid expired pre-approval.

- Clarify all conditions before negotiating purchases.

Common Mistakes to Avoid

- Submitting incomplete or inaccurate information.

- Ignoring contingencies mentioned in the letter.

- Using expired pre-approval letters in negotiations.

- Assuming pre-approval guarantees final loan approval.

Elements and Structure of a Bank Pre-approval Letter

- Subject Line: Pre-approval for Loan.

- Greeting: Address recipient directly.

- Introduction: State purpose of letter and applicant details.

- Loan Details: Pre-approved amount, type of loan, validity date.

- Conditions: Any contingencies or required verifications.

- Closing: Bank officer signature, title, and contact details.

- Bank Information: Name, branch, and letterhead for authenticity.

Does a Bank Pre-approval Letter Require Attestation or Authorization

- Yes, must be issued by authorized bank personnel.

- Should carry official bank letterhead and signature.

- Digital letters should include verifiable authentication or e-signature.

Download Word Doc

Download Word Doc

Download PDF

Download PDF