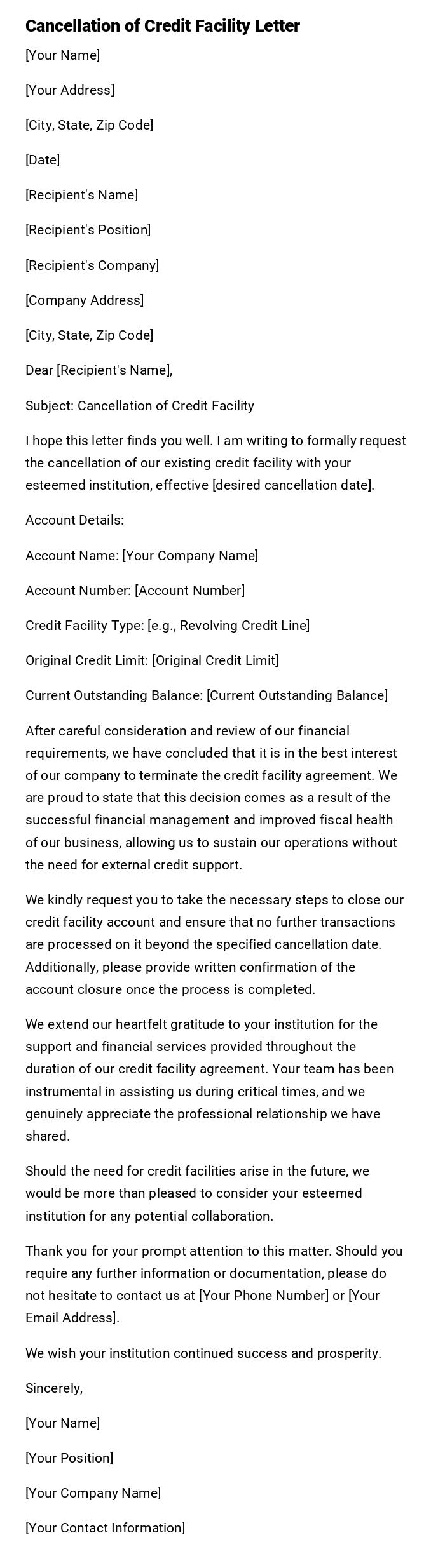

Cancellation of Credit Facility Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Recipient's Name]

[Recipient's Position]

[Recipient's Company]

[Company Address]

[City, State, Zip Code]

Dear [Recipient's Name],

Subject: Cancellation of Credit Facility

I hope this letter finds you well. I am writing to formally request the cancellation of our existing credit facility with your esteemed institution, effective [desired cancellation date].

Account Details:

Account Name: [Your Company Name]

Account Number: [Account Number]

Credit Facility Type: [e.g., Revolving Credit Line]

Original Credit Limit: [Original Credit Limit]

Current Outstanding Balance: [Current Outstanding Balance]

After careful consideration and review of our financial requirements, we have concluded that it is in the best interest of our company to terminate the credit facility agreement. We are proud to state that this decision comes as a result of the successful financial management and improved fiscal health of our business, allowing us to sustain our operations without the need for external credit support.

We kindly request you to take the necessary steps to close our credit facility account and ensure that no further transactions are processed on it beyond the specified cancellation date. Additionally, please provide written confirmation of the account closure once the process is completed.

We extend our heartfelt gratitude to your institution for the support and financial services provided throughout the duration of our credit facility agreement. Your team has been instrumental in assisting us during critical times, and we genuinely appreciate the professional relationship we have shared.

Should the need for credit facilities arise in the future, we would be more than pleased to consider your esteemed institution for any potential collaboration.

Thank you for your prompt attention to this matter. Should you require any further information or documentation, please do not hesitate to contact us at [Your Phone Number] or [Your Email Address].

We wish your institution continued success and prosperity.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

[Your Contact Information]

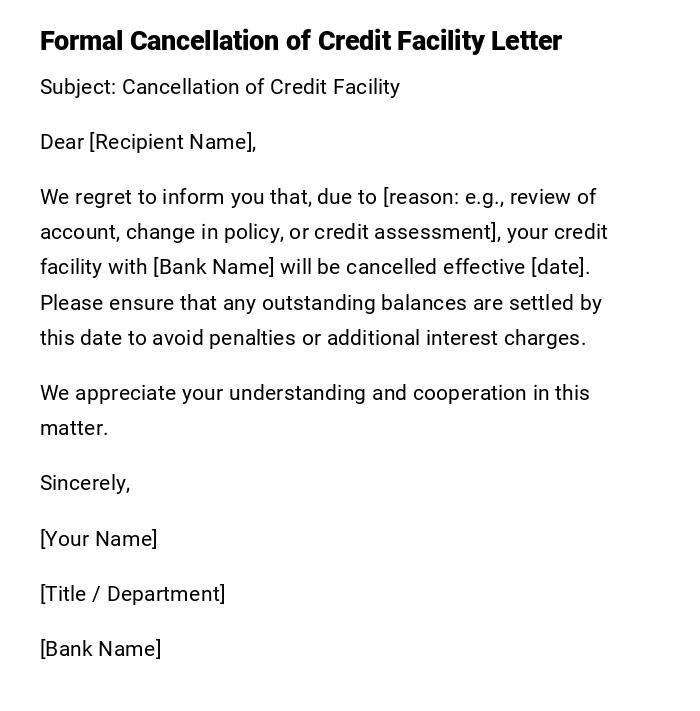

Cancellation of Credit Facility Letter – Formal Bank Letter

Subject: Cancellation of Credit Facility

Dear [Recipient Name],

We regret to inform you that, due to [reason: e.g., review of account, change in policy, or credit assessment], your credit facility with [Bank Name] will be cancelled effective [date]. Please ensure that any outstanding balances are settled by this date to avoid penalties or additional interest charges.

We appreciate your understanding and cooperation in this matter.

Sincerely,

[Your Name]

[Title / Department]

[Bank Name]

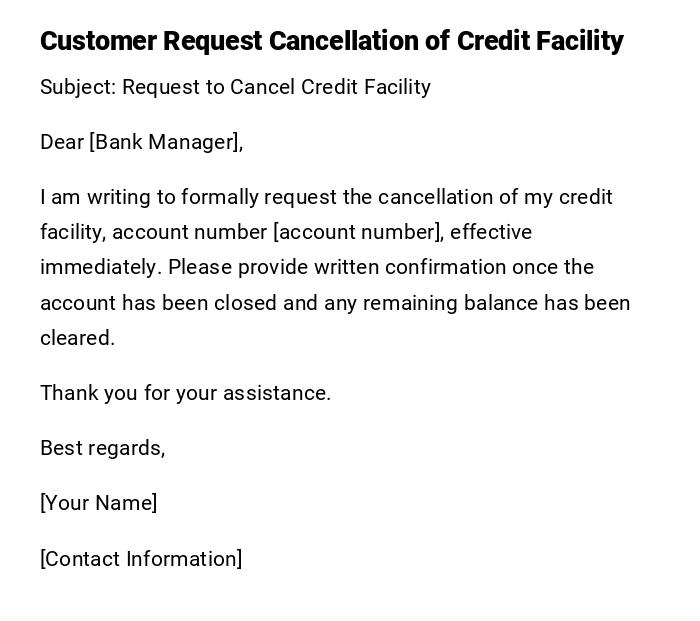

Cancellation of Credit Facility Letter – Customer-Initiated

Subject: Request to Cancel Credit Facility

Dear [Bank Manager],

I am writing to formally request the cancellation of my credit facility, account number [account number], effective immediately. Please provide written confirmation once the account has been closed and any remaining balance has been cleared.

Thank you for your assistance.

Best regards,

[Your Name]

[Contact Information]

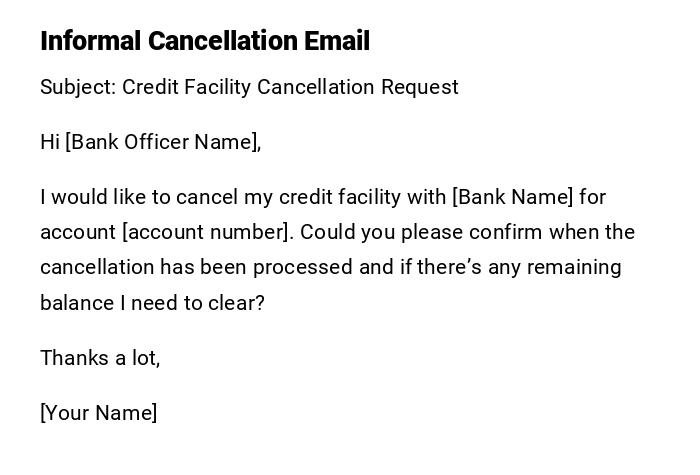

Cancellation of Credit Facility Letter – Friendly Informal Email

Subject: Credit Facility Cancellation Request

Hi [Bank Officer Name],

I would like to cancel my credit facility with [Bank Name] for account [account number]. Could you please confirm when the cancellation has been processed and if there’s any remaining balance I need to clear?

Thanks a lot,

[Your Name]

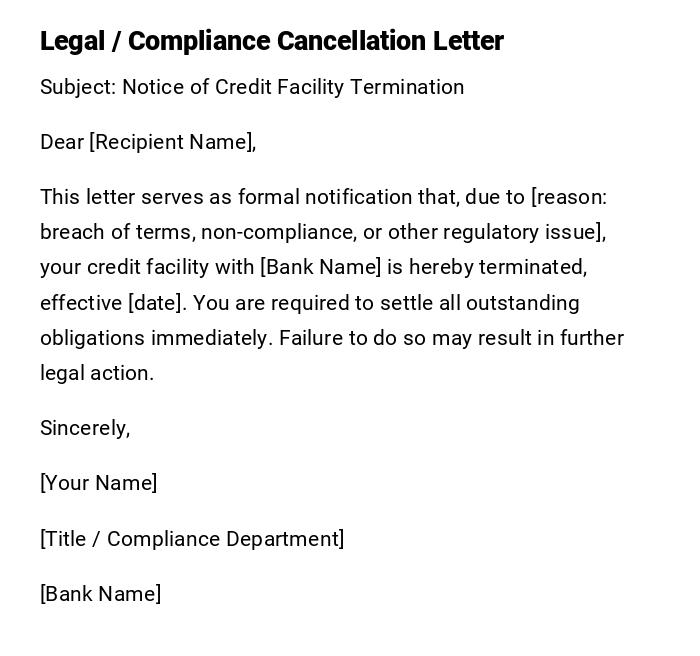

Cancellation of Credit Facility Letter – Legal / Compliance Scenario

Subject: Notice of Credit Facility Termination

Dear [Recipient Name],

This letter serves as formal notification that, due to [reason: breach of terms, non-compliance, or other regulatory issue], your credit facility with [Bank Name] is hereby terminated, effective [date]. You are required to settle all outstanding obligations immediately. Failure to do so may result in further legal action.

Sincerely,

[Your Name]

[Title / Compliance Department]

[Bank Name]

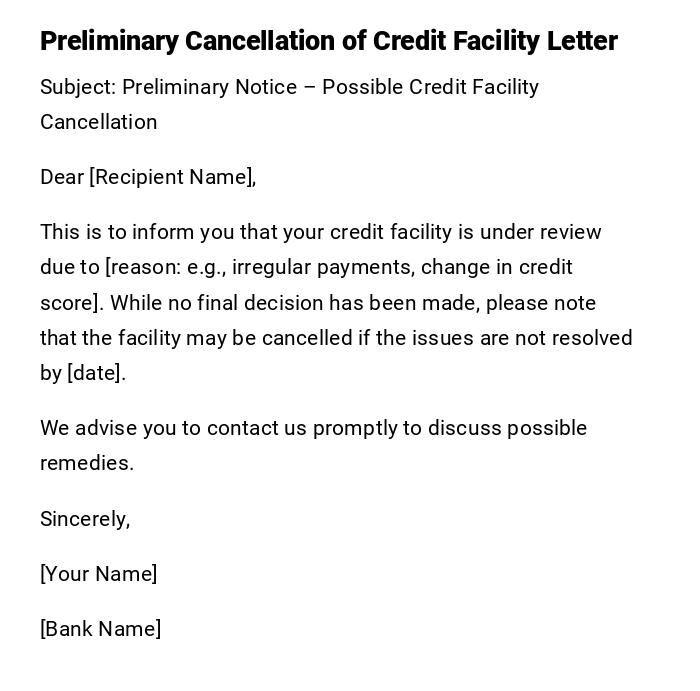

Provisional / Preliminary Cancellation Notice

Subject: Preliminary Notice – Possible Credit Facility Cancellation

Dear [Recipient Name],

This is to inform you that your credit facility is under review due to [reason: e.g., irregular payments, change in credit score]. While no final decision has been made, please note that the facility may be cancelled if the issues are not resolved by [date].

We advise you to contact us promptly to discuss possible remedies.

Sincerely,

[Your Name]

[Bank Name]

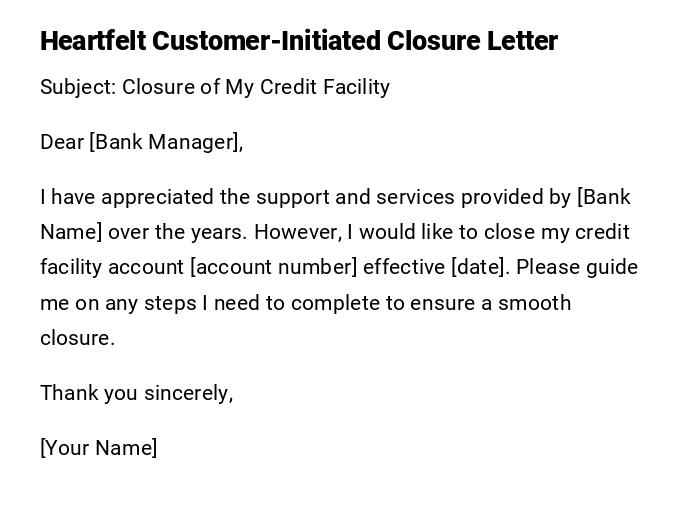

Cancellation of Credit Facility Letter – Heartfelt Customer Closure

Subject: Closure of My Credit Facility

Dear [Bank Manager],

I have appreciated the support and services provided by [Bank Name] over the years. However, I would like to close my credit facility account [account number] effective [date]. Please guide me on any steps I need to complete to ensure a smooth closure.

Thank you sincerely,

[Your Name]

What / Why a Cancellation of Credit Facility Letter is Needed

- This letter serves to formally notify the bank or customer of the termination of a credit facility.

- Purpose: Protect legal and financial interests, clarify obligations, and ensure a proper record of cancellation.

- Can be initiated by the bank or the customer, depending on circumstances.

Who Should Send the Cancellation Letter

- Banks or financial institutions notifying customers.

- Customers requesting closure of their credit facility.

- Legal or compliance officers in cases of regulatory or contractual breaches.

Whom Should the Letter Be Addressed To

- Bank branch managers or relevant banking department.

- Customers holding the credit facility account.

- Compliance or legal departments in formal cases.

When to Send a Cancellation of Credit Facility Letter

- Upon customer request for closure.

- After review of credit risk, breach of terms, or non-compliance.

- At the end of a contractual term or upon policy changes.

- Following regulatory or legal requirements.

How to Write and Send the Letter

- Clearly state whether the letter is bank-initiated or customer-initiated.

- Include account number and effective cancellation date.

- Mention reasons for cancellation when appropriate.

- Use professional tone; friendly or informal style can be used for customer-initiated emails.

- Deliver via email for speed or printed letter for formal/legal confirmation.

Requirements and Prerequisites Before Sending

- Confirm the account balance and outstanding obligations.

- Verify identity of the sender (customer or bank officer).

- Have documentation ready for regulatory or legal purposes.

- Ensure internal approval for bank-initiated cancellations.

Formatting Guidelines for Cancellation Letters

- Length: One page is generally sufficient.

- Tone: Professional, formal, or polite depending on context.

- Wording: Clear, concise, and unambiguous.

- Structure: Subject, greeting, body, closing, signature.

- Attachments: Include account statements or relevant documentation if needed.

After Sending / Follow-up Actions

- Confirm receipt with the recipient.

- Monitor closure of the account or repayment of outstanding balances.

- Keep a copy of the letter and any acknowledgment for records.

- Advise customers of next steps if applicable (e.g., final statement or refund).

Pros and Cons of Sending a Cancellation Letter

- Pros: Formal documentation, clear communication, legal protection, prevents misunderstandings.

- Cons: May cause customer dissatisfaction if bank-initiated, may require follow-up and administrative processing.

Tricks and Tips for Effective Cancellation Letters

- Use a clear subject line mentioning “Cancellation of Credit Facility.”

- Include relevant account details to avoid confusion.

- Set a clear effective date for closure.

- Keep tone professional even when conveying sensitive information.

- Provide contact details for follow-up questions.

Common Mistakes to Avoid

- Forgetting to include the account number or details.

- Using vague language that causes confusion.

- Sending without confirming outstanding balances.

- Being overly harsh or informal in bank-initiated cancellations.

Elements and Structure of the Letter

- Subject line specifying cancellation.

- Salutation addressing the recipient.

- Body: reason for cancellation, effective date, instructions for closing/settling account.

- Closing and signature.

- Optional: Attachments like account statement or supporting documents.

FAQ About Cancellation of Credit Facility Letters

-

Q: Can a credit facility be cancelled immediately?

A: Depends on the terms of agreement; some require notice periods. -

Q: Does the customer need to pay off outstanding balances?

A: Yes, all dues must be settled before closure. -

Q: Can the cancellation be requested via email?

A: Yes, customer-initiated emails are usually accepted if properly worded. -

Q: What happens if the bank cancels due to non-compliance?

A: The bank may request immediate settlement and could take further action per terms.

Compare and Contrast With Other Financial Letters

- Different from a loan default notice; the focus is closure, not debt recovery.

- Different from a credit limit adjustment letter; the facility is terminated, not modified.

- Similar to account closure letters, but specifically for credit facilities rather than general banking accounts.

Download Word Doc

Download Word Doc

Download PDF

Download PDF