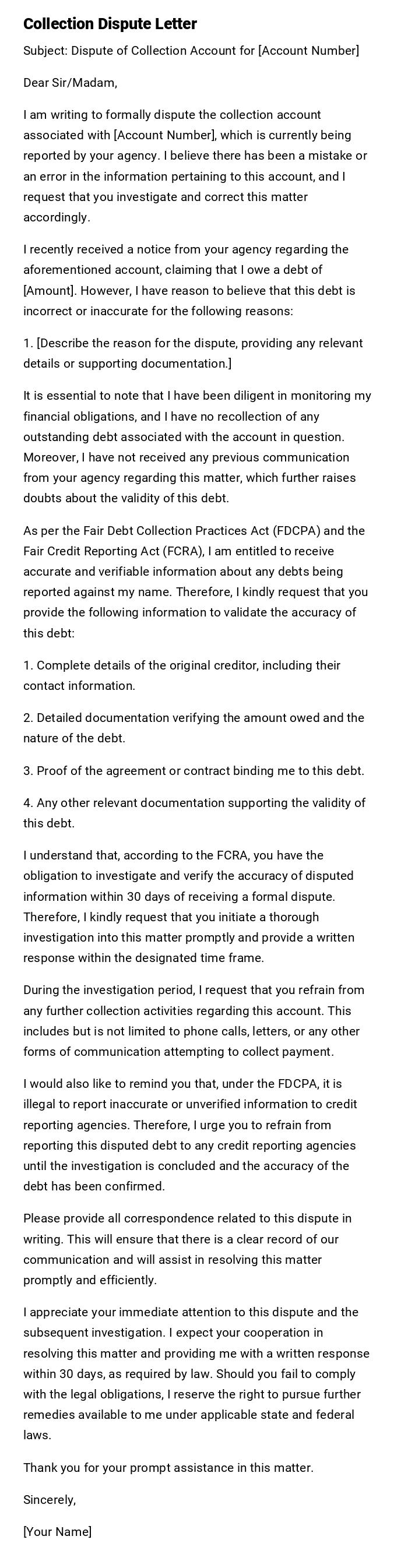

Collection Dispute Letter

Subject: Dispute of Collection Account for [Account Number]

Dear Sir/Madam,

I am writing to formally dispute the collection account associated with [Account Number], which is currently being reported by your agency. I believe there has been a mistake or an error in the information pertaining to this account, and I request that you investigate and correct this matter accordingly.

I recently received a notice from your agency regarding the aforementioned account, claiming that I owe a debt of [Amount]. However, I have reason to believe that this debt is incorrect or inaccurate for the following reasons:

1. [Describe the reason for the dispute, providing any relevant details or supporting documentation.]

It is essential to note that I have been diligent in monitoring my financial obligations, and I have no recollection of any outstanding debt associated with the account in question. Moreover, I have not received any previous communication from your agency regarding this matter, which further raises doubts about the validity of this debt.

As per the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA), I am entitled to receive accurate and verifiable information about any debts being reported against my name. Therefore, I kindly request that you provide the following information to validate the accuracy of this debt:

1. Complete details of the original creditor, including their contact information.

2. Detailed documentation verifying the amount owed and the nature of the debt.

3. Proof of the agreement or contract binding me to this debt.

4. Any other relevant documentation supporting the validity of this debt.

I understand that, according to the FCRA, you have the obligation to investigate and verify the accuracy of disputed information within 30 days of receiving a formal dispute. Therefore, I kindly request that you initiate a thorough investigation into this matter promptly and provide a written response within the designated time frame.

During the investigation period, I request that you refrain from any further collection activities regarding this account. This includes but is not limited to phone calls, letters, or any other forms of communication attempting to collect payment.

I would also like to remind you that, under the FDCPA, it is illegal to report inaccurate or unverified information to credit reporting agencies. Therefore, I urge you to refrain from reporting this disputed debt to any credit reporting agencies until the investigation is concluded and the accuracy of the debt has been confirmed.

Please provide all correspondence related to this dispute in writing. This will ensure that there is a clear record of our communication and will assist in resolving this matter promptly and efficiently.

I appreciate your immediate attention to this dispute and the subsequent investigation. I expect your cooperation in resolving this matter and providing me with a written response within 30 days, as required by law. Should you fail to comply with the legal obligations, I reserve the right to pursue further remedies available to me under applicable state and federal laws.

Thank you for your prompt assistance in this matter.

Sincerely,

[Your Name]

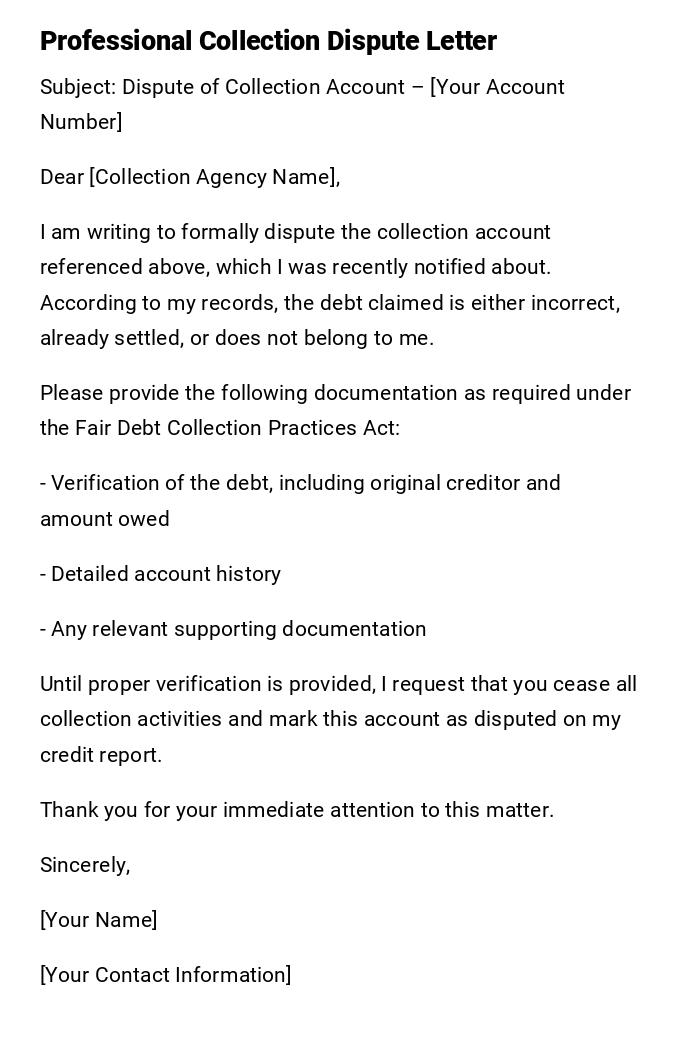

Professional Collection Dispute Letter

Subject: Dispute of Collection Account – [Your Account Number]

Dear [Collection Agency Name],

I am writing to formally dispute the collection account referenced above, which I was recently notified about. According to my records, the debt claimed is either incorrect, already settled, or does not belong to me.

Please provide the following documentation as required under the Fair Debt Collection Practices Act:

- Verification of the debt, including original creditor and amount owed

- Detailed account history

- Any relevant supporting documentation

Until proper verification is provided, I request that you cease all collection activities and mark this account as disputed on my credit report.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

[Your Contact Information]

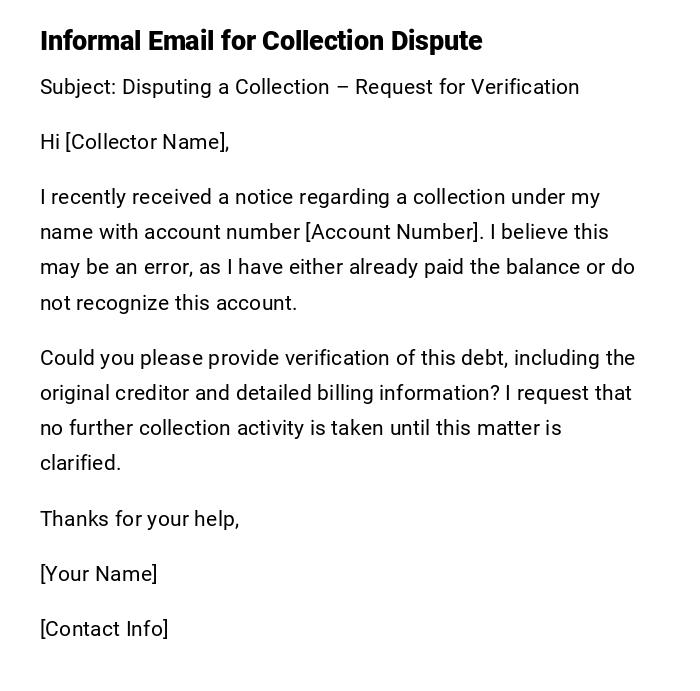

Informal Email for Collection Dispute

Subject: Disputing a Collection – Request for Verification

Hi [Collector Name],

I recently received a notice regarding a collection under my name with account number [Account Number]. I believe this may be an error, as I have either already paid the balance or do not recognize this account.

Could you please provide verification of this debt, including the original creditor and detailed billing information? I request that no further collection activity is taken until this matter is clarified.

Thanks for your help,

[Your Name]

[Contact Info]

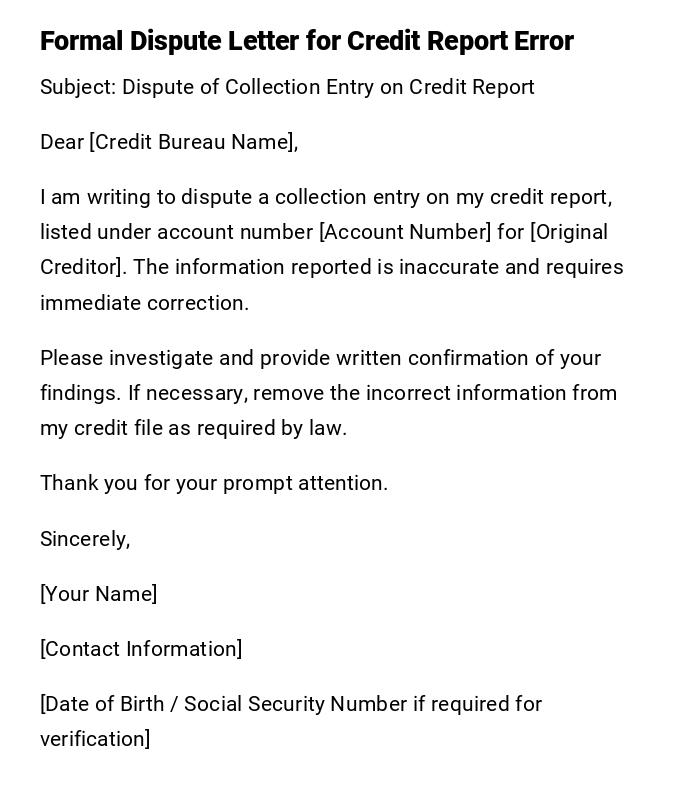

Formal Dispute Letter for Credit Report Error

Subject: Dispute of Collection Entry on Credit Report

Dear [Credit Bureau Name],

I am writing to dispute a collection entry on my credit report, listed under account number [Account Number] for [Original Creditor]. The information reported is inaccurate and requires immediate correction.

Please investigate and provide written confirmation of your findings. If necessary, remove the incorrect information from my credit file as required by law.

Thank you for your prompt attention.

Sincerely,

[Your Name]

[Contact Information]

[Date of Birth / Social Security Number if required for verification]

Heartfelt Collection Dispute Letter

Subject: Urgent Dispute Regarding Collection Notice

Dear [Collection Agency Name],

I am reaching out regarding the collection notice I received for account [Account Number]. This notice has caused me significant distress, as I believe it to be an error.

I kindly request your assistance in providing documentation to verify the debt. I am confident that once this is reviewed, the matter will be resolved amicably.

Thank you for understanding and your cooperation.

Sincerely,

[Your Name]

[Contact Information]

Provisional Collection Dispute Letter Pending Investigation

Subject: Provisional Dispute of Collection Account

Dear [Collection Agency Name],

I am writing to dispute the validity of the collection account with reference [Account Number]. I am currently gathering records and request that all collection actions be put on hold during this investigation.

Please provide the original creditor documentation, itemized statements, and proof of my liability for this debt.

Sincerely,

[Your Name]

[Contact Information]

Quick Email to Stop Collection Calls

Subject: Dispute of Collection and Request to Cease Contact

Dear [Collection Agency Name],

I am disputing the collection account [Account Number]. Until this is resolved, please cease all phone calls and correspondence regarding this matter.

Please provide verification of the debt as required by law.

Thank you,

[Your Name]

[Contact Info]

What is a Collection Dispute Letter and Why It Is Necessary

A collection dispute letter is a formal written communication sent to a creditor or collection agency to contest a debt.

- Purpose: To protect consumer rights and correct errors

- Importance: Prevents inaccurate reporting on credit reports, stops unlawful collection practices

- Scenarios: Wrongly reported debt, identity theft, already paid balances, or billing errors

Who Should Send a Collection Dispute Letter

- Individuals who have received collection notices they believe are inaccurate

- Consumers who notice errors on their credit reports

- Representatives or attorneys acting on behalf of consumers

- Anyone disputing debt that is not theirs or has already been paid

Whom the Collection Dispute Letter Should Be Addressed To

- Collection agencies reporting the debt

- Original creditors requesting repayment

- Credit bureaus reporting incorrect information

- Financial institutions involved in billing errors

When to Send a Collection Dispute Letter

- Immediately after receiving a collection notice believed to be incorrect

- After noticing a negative entry on a credit report

- During the 30-day period allowed by law to dispute a debt

- Before paying any amount that may not be valid

How to Write and Send a Collection Dispute Letter

- Gather all relevant account information and records

- Start with a clear subject and account identification

- State your dispute clearly and request verification

- Provide copies of supporting documents (do not send originals)

- Request cessation of collection activity until the dispute is resolved

- Send via certified mail or secure email to ensure proof of delivery

Requirements and Prerequisites Before Sending a Collection Dispute Letter

- Verify your records to identify discrepancies

- Keep documentation: billing statements, receipts, emails, contracts

- Review relevant consumer protection laws (e.g., FDCPA in the U.S.)

- Ensure accurate account numbers and contact details

Formatting Recommendations for Collection Dispute Letters

- Length: One page is usually sufficient

- Tone: Professional, factual, and assertive

- Style: Concise, numbered points for clarity

- Include: Subject line, account number, dates, and specific dispute items

- Sending: Certified mail for formal letters, email for faster communication

After Sending a Collection Dispute Letter

- Confirm receipt with the recipient

- Track responses and any corrections made

- Retain copies for personal records and potential legal use

- Follow up if no response is received within 30 days

Pros and Cons of Sending a Collection Dispute Letter

Pros:

- Protects your credit report

- Forces validation of the debt

- Stops unlawful collection practices

Cons:

- May delay resolution if documentation is slow

- Collection agencies may respond aggressively

- Requires attention to detail and legal knowledge

Compare and Contrast Collection Dispute Letters with Other Consumer Letters

- Similar to complaint letters but specifically targets debt validation

- Different from payment plans: focuses on disputing rather than settling

- Alternatives: Phone disputes, online disputes with credit bureaus, but written letters provide formal proof

Tricks and Tips for Effective Collection Dispute Letters

- Keep a copy of every letter and delivery receipt

- Be factual and avoid emotional language

- Include all supporting documentation for quicker resolution

- Use certified mail to ensure legal proof of delivery

- Reference laws like the FDCPA to strengthen your position

Common Mistakes in Collection Dispute Letters

- Failing to clearly identify the disputed account

- Using vague language without evidence

- Sending the letter to the wrong recipient

- Not requesting debt verification explicitly

- Missing deadlines for disputing entries

Essential Elements and Structure of a Collection Dispute Letter

- Subject Line: Clear statement of purpose

- Greeting: Properly addressed to recipient

- Introduction: Identify yourself and account number

- Statement of Dispute: Clearly explain why the debt is disputed

- Request for Verification: Ask for documentation supporting the debt

- Cessation Request: Instruct to stop collection activities until verified

- Supporting Evidence: Attach copies of documents

- Closing: Professional signature and contact information

Does a Collection Dispute Letter Require Attestation or Authorization

- Typically does not require attestation for consumer disputes

- May require notarization or official signatures if submitted to court

- Attach copies of identity verification if requested by the creditor or credit bureau

Download Word Doc

Download Word Doc

Download PDF

Download PDF