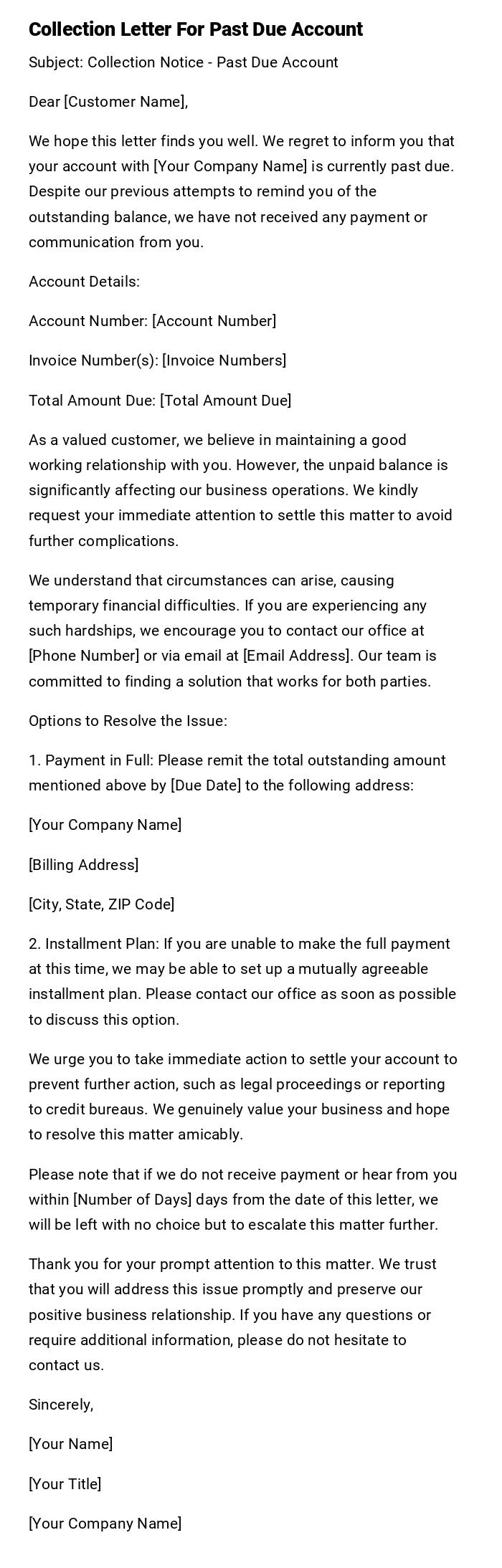

Collection Letter For Past Due Account

Subject: Collection Notice - Past Due Account

Dear [Customer Name],

We hope this letter finds you well. We regret to inform you that your account with [Your Company Name] is currently past due. Despite our previous attempts to remind you of the outstanding balance, we have not received any payment or communication from you.

Account Details:

Account Number: [Account Number]

Invoice Number(s): [Invoice Numbers]

Total Amount Due: [Total Amount Due]

As a valued customer, we believe in maintaining a good working relationship with you. However, the unpaid balance is significantly affecting our business operations. We kindly request your immediate attention to settle this matter to avoid further complications.

We understand that circumstances can arise, causing temporary financial difficulties. If you are experiencing any such hardships, we encourage you to contact our office at [Phone Number] or via email at [Email Address]. Our team is committed to finding a solution that works for both parties.

Options to Resolve the Issue:

1. Payment in Full: Please remit the total outstanding amount mentioned above by [Due Date] to the following address:

[Your Company Name]

[Billing Address]

[City, State, ZIP Code]

2. Installment Plan: If you are unable to make the full payment at this time, we may be able to set up a mutually agreeable installment plan. Please contact our office as soon as possible to discuss this option.

We urge you to take immediate action to settle your account to prevent further action, such as legal proceedings or reporting to credit bureaus. We genuinely value your business and hope to resolve this matter amicably.

Please note that if we do not receive payment or hear from you within [Number of Days] days from the date of this letter, we will be left with no choice but to escalate this matter further.

Thank you for your prompt attention to this matter. We trust that you will address this issue promptly and preserve our positive business relationship. If you have any questions or require additional information, please do not hesitate to contact us.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

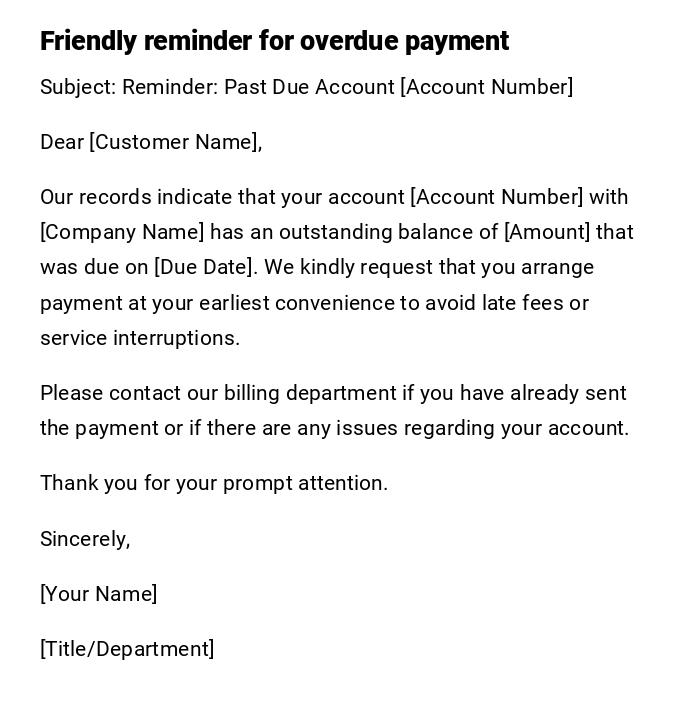

Polite Reminder for Past Due Account

Subject: Reminder: Past Due Account [Account Number]

Dear [Customer Name],

Our records indicate that your account [Account Number] with [Company Name] has an outstanding balance of [Amount] that was due on [Due Date]. We kindly request that you arrange payment at your earliest convenience to avoid late fees or service interruptions.

Please contact our billing department if you have already sent the payment or if there are any issues regarding your account.

Thank you for your prompt attention.

Sincerely,

[Your Name]

[Title/Department]

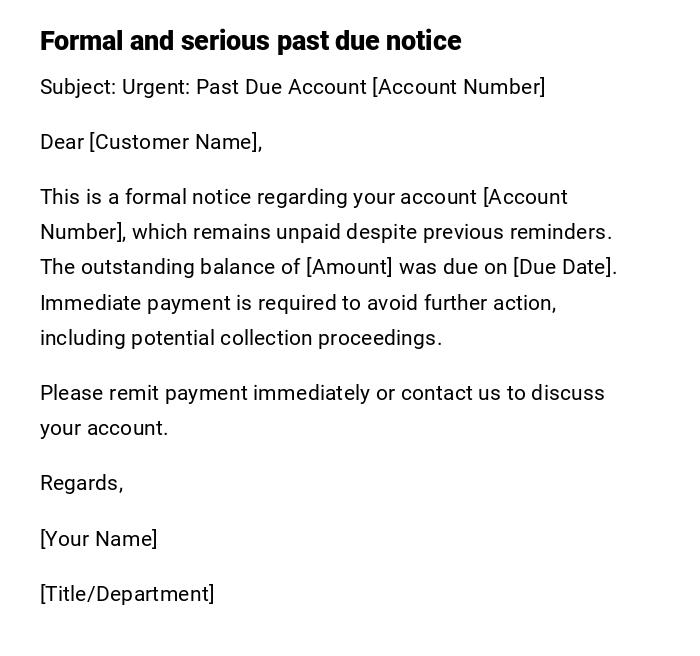

Serious Notice for Overdue Account

Subject: Urgent: Past Due Account [Account Number]

Dear [Customer Name],

This is a formal notice regarding your account [Account Number], which remains unpaid despite previous reminders. The outstanding balance of [Amount] was due on [Due Date]. Immediate payment is required to avoid further action, including potential collection proceedings.

Please remit payment immediately or contact us to discuss your account.

Regards,

[Your Name]

[Title/Department]

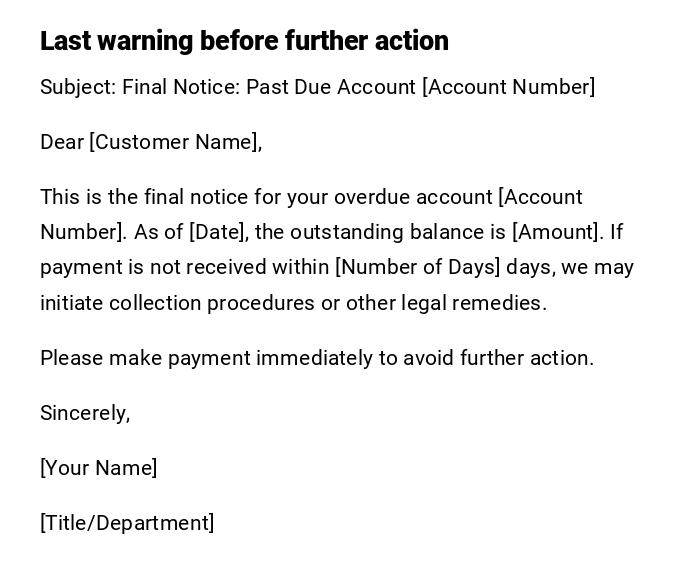

Final Collection Notice

Subject: Final Notice: Past Due Account [Account Number]

Dear [Customer Name],

This is the final notice for your overdue account [Account Number]. As of [Date], the outstanding balance is [Amount]. If payment is not received within [Number of Days] days, we may initiate collection procedures or other legal remedies.

Please make payment immediately to avoid further action.

Sincerely,

[Your Name]

[Title/Department]

Informal Reminder for Overdue Payment

Subject: Friendly Reminder About Your Past Due Account

Hi [Customer Name],

We noticed that your account [Account Number] has an outstanding balance of [Amount] since [Due Date]. We’d appreciate it if you could take care of this at your earliest convenience.

Let us know if you need any assistance or if there’s been a misunderstanding.

Thanks,

[Your Name]

Provisional Payment Request Email

Subject: Provisional Notice: Past Due Account [Account Number]

Dear [Customer Name],

This is a provisional notice regarding your account [Account Number] with an unpaid balance of [Amount]. We request that you review your records and arrange for payment promptly. Confirmation of payment is appreciated.

Regards,

[Your Name]

[Title/Department]

What is a Collection Letter for a Past Due Account and Why Do You Need It?

A collection letter for a past due account is a formal communication sent to customers or clients who have not paid their bills on time.

It serves to remind them of their obligations, request immediate payment, and maintain a documented record of correspondence for accounting and legal purposes.

Who Should Send a Collection Letter for Past Due Accounts?

- Accounts receivable or billing departments in companies.

- Business owners managing client payments.

- Collection agencies acting on behalf of businesses.

- Any individual or entity responsible for tracking and collecting outstanding payments.

Whom Should a Past Due Collection Letter Be Addressed To?

- The customer or client responsible for the outstanding balance.

- Authorized contacts for corporate accounts.

- Individuals listed as responsible for payment on joint or corporate accounts.

When Should You Send a Collection Letter?

- Shortly after the payment due date has passed.

- After one or more friendly reminders have not resulted in payment.

- Prior to initiating legal action or external collections.

- Whenever a documented trail of communication is necessary for recordkeeping.

How to Write and Send a Collection Letter

- Include account number, balance, and due date.

- Use clear and polite language initially, escalating in seriousness for repeated notices.

- Specify actions the recipient must take and consequences of non-payment.

- Attach or reference any supporting documents such as invoices.

- Send via mail or email, keeping copies for records.

- Follow up promptly if no response is received.

Requirements and Prerequisites for Collection Letters

- Accurate customer account information.

- Record of previous communications and reminders.

- Outstanding balance and due dates confirmed.

- Company policy on late fees or collection procedures.

- Authorized personnel to send letters and follow up.

Formatting Guidelines for Past Due Collection Letters

- Length: Concise, typically one page or less.

- Tone: Escalates from polite to firm depending on the situation.

- Include clear subject lines, account numbers, and due amounts.

- Structure: Salutation, purpose of letter, payment instructions, closing.

- Mode: Email, postal mail, or certified mail depending on urgency.

After Sending a Past Due Collection Letter

- Monitor response and payment.

- Follow up with reminders or calls if necessary.

- Keep all correspondence for accounting and potential legal proceedings.

- Escalate to formal collection or legal action if payment is not received within the set timeframe.

Common Mistakes to Avoid

- Using overly aggressive or rude language initially.

- Omitting account numbers, due amounts, or due dates.

- Failing to provide a clear method for payment.

- Sending letters without confirming previous balances or communication history.

- Not documenting all correspondence for records.

Elements and Structure of a Collection Letter for Past Due Accounts

- Subject line indicating account and overdue status.

- Salutation to the customer or responsible party.

- Body outlining the overdue amount, due date, and payment instructions.

- Statement of consequences if payment is not received.

- Closing statement requesting acknowledgment or confirmation.

- Signature of authorized personnel.

Tricks and Tips for Effective Collection Letters

- Start with polite reminders and escalate if necessary.

- Clearly specify deadlines and consequences.

- Attach invoices or payment instructions for clarity.

- Use registered mail for high-value accounts or legal documentation.

- Maintain a consistent and documented communication trail.

FAQ About Collection Letters for Past Due Accounts

Q: Can I send the letter via email instead of mail?

A: Yes, email is accepted, but certified mail is preferred for legal records.

Q: How soon should I send the first collection letter?

A: Typically within a few days after the payment due date passes.

Q: What if the customer disputes the charge?

A: Include a contact number or department for dispute resolution and investigate promptly.

Q: Can repeated letters damage customer relations?

A: Yes, balance firmness with professionalism to maintain a business relationship.

Download Word Doc

Download Word Doc

Download PDF

Download PDF