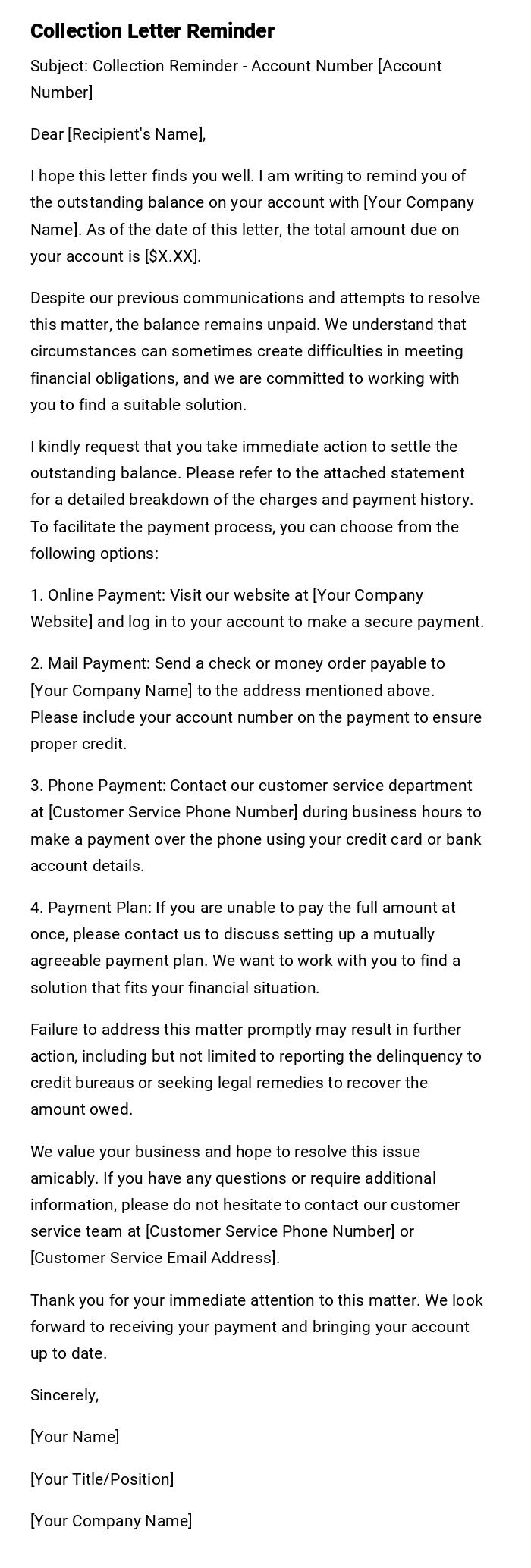

Collection Letter Reminder

Subject: Collection Reminder - Account Number [Account Number]

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to remind you of the outstanding balance on your account with [Your Company Name]. As of the date of this letter, the total amount due on your account is [$X.XX].

Despite our previous communications and attempts to resolve this matter, the balance remains unpaid. We understand that circumstances can sometimes create difficulties in meeting financial obligations, and we are committed to working with you to find a suitable solution.

I kindly request that you take immediate action to settle the outstanding balance. Please refer to the attached statement for a detailed breakdown of the charges and payment history. To facilitate the payment process, you can choose from the following options:

1. Online Payment: Visit our website at [Your Company Website] and log in to your account to make a secure payment.

2. Mail Payment: Send a check or money order payable to [Your Company Name] to the address mentioned above. Please include your account number on the payment to ensure proper credit.

3. Phone Payment: Contact our customer service department at [Customer Service Phone Number] during business hours to make a payment over the phone using your credit card or bank account details.

4. Payment Plan: If you are unable to pay the full amount at once, please contact us to discuss setting up a mutually agreeable payment plan. We want to work with you to find a solution that fits your financial situation.

Failure to address this matter promptly may result in further action, including but not limited to reporting the delinquency to credit bureaus or seeking legal remedies to recover the amount owed.

We value your business and hope to resolve this issue amicably. If you have any questions or require additional information, please do not hesitate to contact our customer service team at [Customer Service Phone Number] or [Customer Service Email Address].

Thank you for your immediate attention to this matter. We look forward to receiving your payment and bringing your account up to date.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company Name]

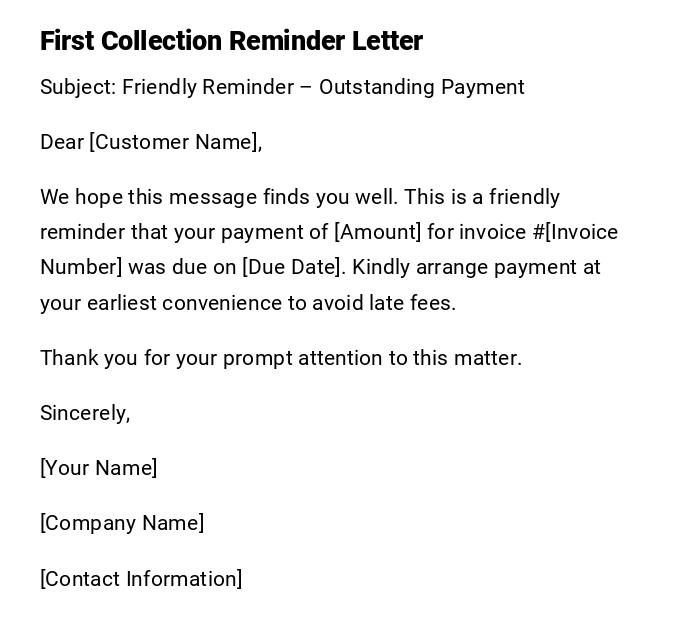

Collection Letter Reminder – First Reminder

Subject: Friendly Reminder – Outstanding Payment

Dear [Customer Name],

We hope this message finds you well. This is a friendly reminder that your payment of [Amount] for invoice #[Invoice Number] was due on [Due Date]. Kindly arrange payment at your earliest convenience to avoid late fees.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

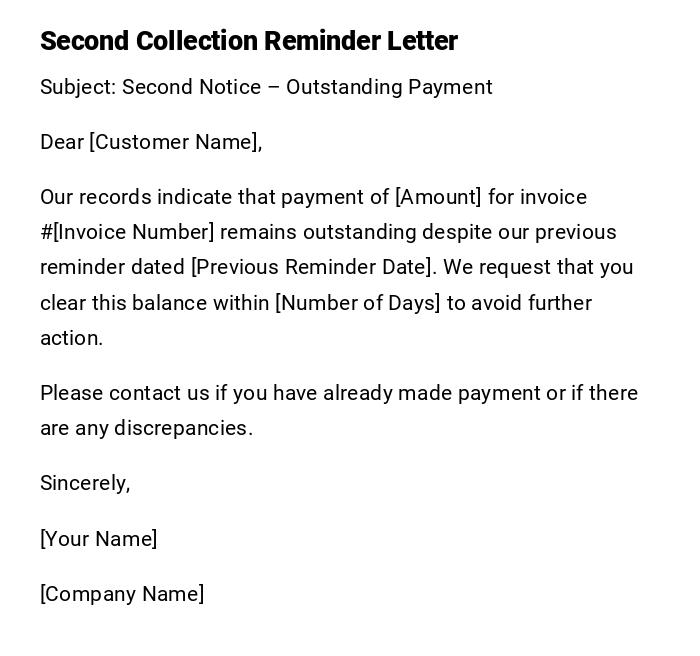

Collection Letter Reminder – Second Reminder

Subject: Second Notice – Outstanding Payment

Dear [Customer Name],

Our records indicate that payment of [Amount] for invoice #[Invoice Number] remains outstanding despite our previous reminder dated [Previous Reminder Date]. We request that you clear this balance within [Number of Days] to avoid further action.

Please contact us if you have already made payment or if there are any discrepancies.

Sincerely,

[Your Name]

[Company Name]

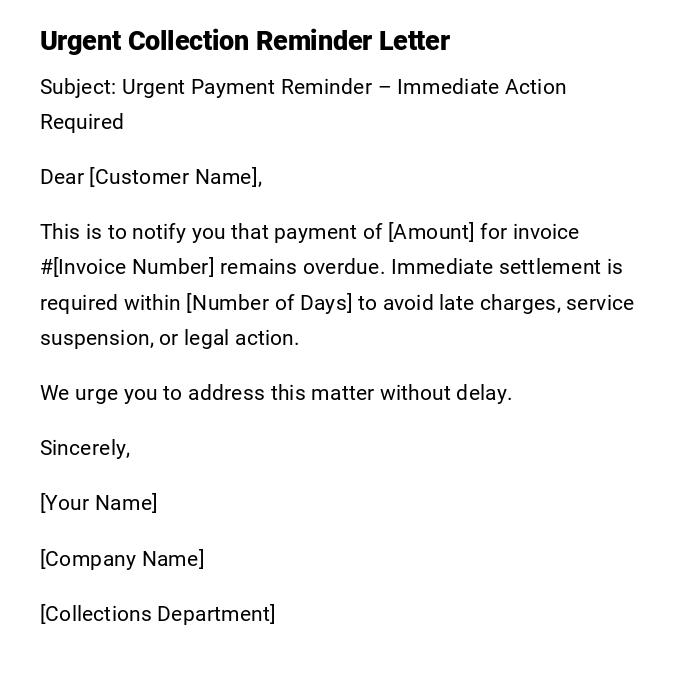

Collection Letter Reminder – Urgent / Serious Tone

Subject: Urgent Payment Reminder – Immediate Action Required

Dear [Customer Name],

This is to notify you that payment of [Amount] for invoice #[Invoice Number] remains overdue. Immediate settlement is required within [Number of Days] to avoid late charges, service suspension, or legal action.

We urge you to address this matter without delay.

Sincerely,

[Your Name]

[Company Name]

[Collections Department]

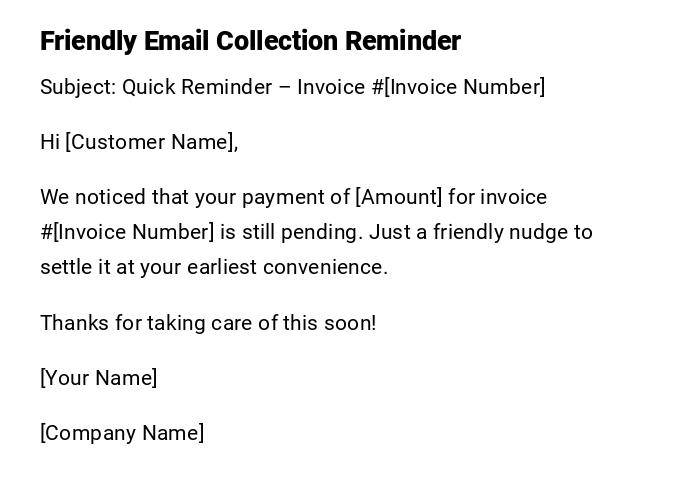

Collection Letter Reminder – Customer-Friendly Email

Subject: Quick Reminder – Invoice #[Invoice Number]

Hi [Customer Name],

We noticed that your payment of [Amount] for invoice #[Invoice Number] is still pending. Just a friendly nudge to settle it at your earliest convenience.

Thanks for taking care of this soon!

[Your Name]

[Company Name]

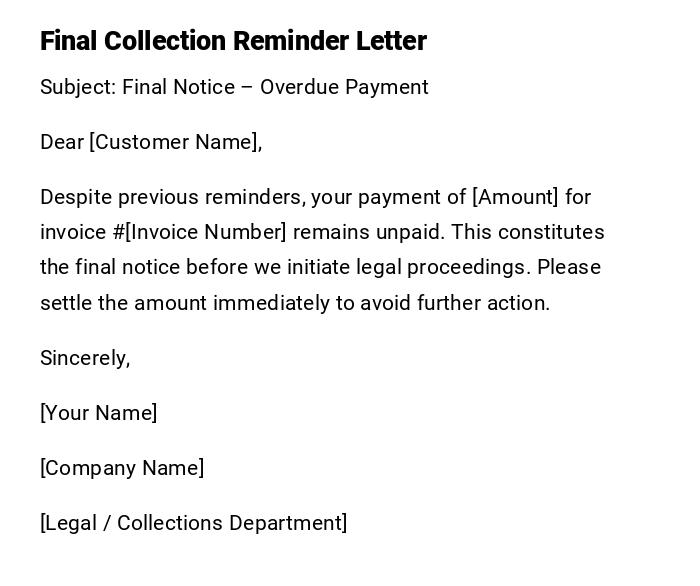

Collection Letter Reminder – Legal / Final Notice

Subject: Final Notice – Overdue Payment

Dear [Customer Name],

Despite previous reminders, your payment of [Amount] for invoice #[Invoice Number] remains unpaid. This constitutes the final notice before we initiate legal proceedings. Please settle the amount immediately to avoid further action.

Sincerely,

[Your Name]

[Company Name]

[Legal / Collections Department]

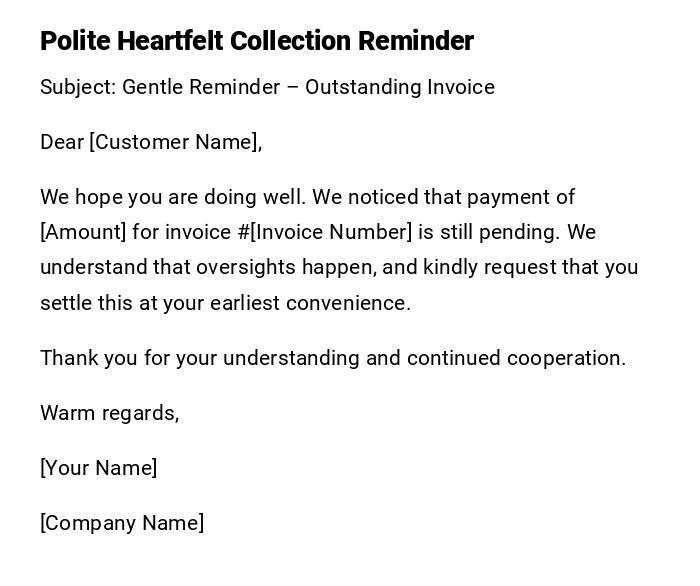

Collection Letter Reminder – Heartfelt / Polite Approach

Subject: Gentle Reminder – Outstanding Invoice

Dear [Customer Name],

We hope you are doing well. We noticed that payment of [Amount] for invoice #[Invoice Number] is still pending. We understand that oversights happen, and kindly request that you settle this at your earliest convenience.

Thank you for your understanding and continued cooperation.

Warm regards,

[Your Name]

[Company Name]

What / Why a Collection Letter Reminder is Needed

- Notifies a customer or client of unpaid invoices or outstanding debts.

- Serves to maintain cash flow and financial health of the business.

- Helps establish a record of communication for legal or administrative purposes.

- Encourages timely payments without confrontation.

Who Should Send a Collection Letter Reminder

- Accounts receivable or collections department of a company.

- Business owners or managers responsible for invoicing.

- Legal department if escalation is required.

Whom Should the Letter Be Addressed To

- Customers, clients, or partners who have outstanding invoices.

- Authorized representatives of companies in case of B2B transactions.

- Individual guarantors if relevant in contractual agreements.

When to Send a Collection Letter Reminder

- Immediately after the payment due date passes.

- As a second or follow-up notice if previous reminders were ignored.

- Before initiating late fees, service suspension, or legal proceedings.

- As a final notice to escalate the matter.

How to Write and Send a Collection Letter Reminder

- Begin with a polite or neutral greeting.

- Clearly specify invoice number, amount, and due date.

- Use tone appropriate to the stage: friendly, serious, or legal.

- Include payment instructions and contact information.

- Send via email for quick reminders or printed letter for formal/legal purposes.

Requirements and Prerequisites Before Sending

- Verify the payment status and confirm the overdue amount.

- Ensure accurate customer contact details.

- Keep records of prior reminders or communications.

- Obtain necessary internal approvals if escalating to serious or legal tone.

Formatting Guidelines for Collection Letter Reminders

- Length: Concise, usually one page.

- Tone: Varies from friendly to serious depending on overdue period.

- Wording: Clear, polite, and professional; avoid aggressive language.

- Style: Structured with subject, greeting, body, closing, signature.

- Mode: Email for early reminders, printed letter for formal or final notices.

After Sending / Follow-up Actions

- Track customer response or payment confirmation.

- Send subsequent reminders with increased urgency if unpaid.

- Maintain record of all communications for accounting and legal purposes.

- Escalate to legal action or collections agency if final notice fails.

Tricks and Tips for Effective Collection Letter Reminders

- Personalize the letter to the recipient for better response.

- Include multiple payment options for convenience.

- Keep a clear timeline of reminders for escalation planning.

- Use polite language in initial notices; increase firmness gradually.

- Document all communication for accountability.

Common Mistakes to Avoid

- Sending reminders without verifying invoice details.

- Using overly aggressive or threatening language prematurely.

- Forgetting to include due date, invoice number, or payment instructions.

- Ignoring customer disputes or queries related to the invoice.

Elements and Structure of a Collection Letter Reminder

- Subject line specifying overdue payment or invoice number.

- Salutation addressing the customer or recipient.

- Body: Amount due, invoice details, due date, and request for payment.

- Closing: Professional sign-off with contact details.

- Optional attachments: Invoice copy, payment instructions, or prior reminders.

FAQ About Collection Letter Reminders

-

Q: How many reminders should I send?

A: Typically, 2-3 reminders before escalation is sufficient. -

Q: Can collection reminders be sent via email?

A: Yes, email is suitable for early-stage reminders; printed letters are preferred for serious or final notices. -

Q: What tone should be used for first reminders?

A: Friendly and polite, avoiding any threatening language. -

Q: Do I need proof of sending reminders?

A: Yes, especially for escalation or legal purposes.

Compare and Contrast With Other Financial Letters

- Different from a demand letter: reminder letters are usually polite and non-threatening.

- Different from an invoice: reminders reference existing invoices rather than creating new obligations.

- Similar to late fee notices but less formal; may precede late fees.

- Alternative: phone calls or text reminders, but letters provide formal record.

Download Word Doc

Download Word Doc

Download PDF

Download PDF