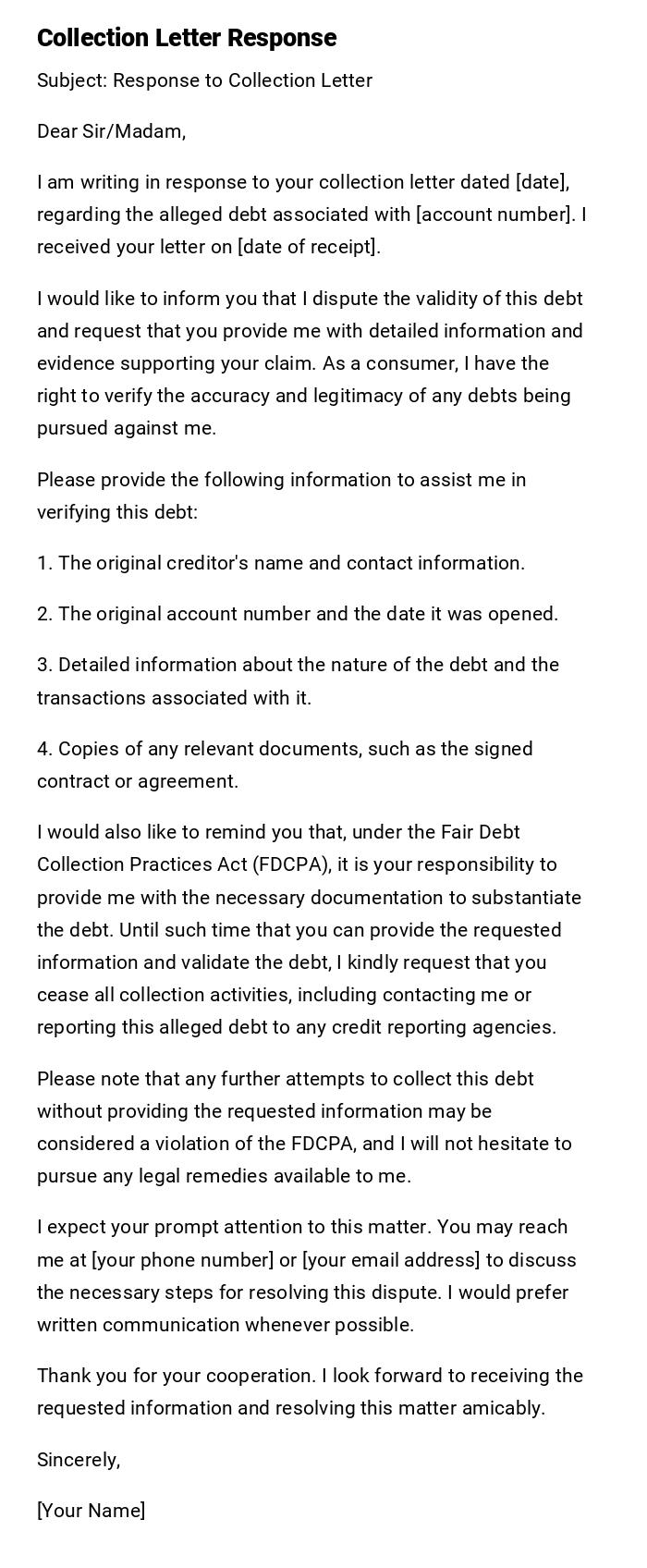

Collection Letter Response

Subject: Response to Collection Letter

Dear Sir/Madam,

I am writing in response to your collection letter dated [date], regarding the alleged debt associated with [account number]. I received your letter on [date of receipt].

I would like to inform you that I dispute the validity of this debt and request that you provide me with detailed information and evidence supporting your claim. As a consumer, I have the right to verify the accuracy and legitimacy of any debts being pursued against me.

Please provide the following information to assist me in verifying this debt:

1. The original creditor's name and contact information.

2. The original account number and the date it was opened.

3. Detailed information about the nature of the debt and the transactions associated with it.

4. Copies of any relevant documents, such as the signed contract or agreement.

I would also like to remind you that, under the Fair Debt Collection Practices Act (FDCPA), it is your responsibility to provide me with the necessary documentation to substantiate the debt. Until such time that you can provide the requested information and validate the debt, I kindly request that you cease all collection activities, including contacting me or reporting this alleged debt to any credit reporting agencies.

Please note that any further attempts to collect this debt without providing the requested information may be considered a violation of the FDCPA, and I will not hesitate to pursue any legal remedies available to me.

I expect your prompt attention to this matter. You may reach me at [your phone number] or [your email address] to discuss the necessary steps for resolving this dispute. I would prefer written communication whenever possible.

Thank you for your cooperation. I look forward to receiving the requested information and resolving this matter amicably.

Sincerely,

[Your Name]

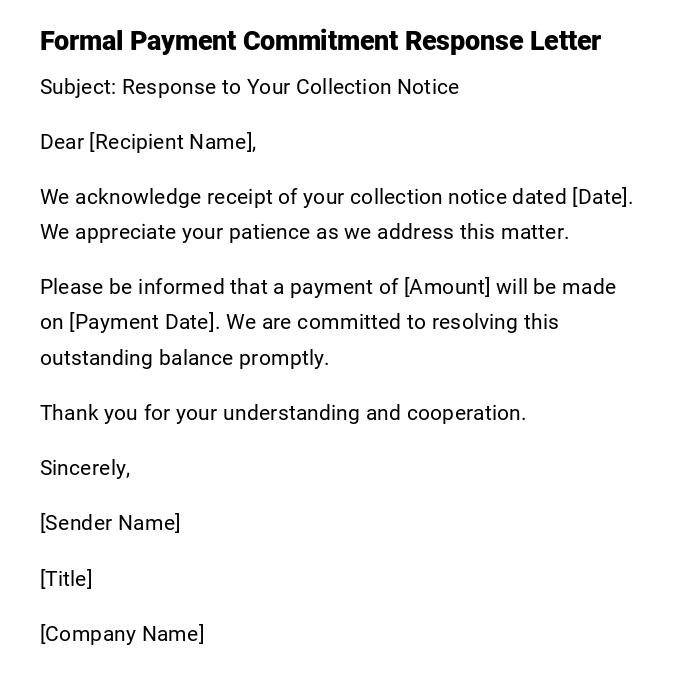

Formal Payment Commitment Response Letter

Subject: Response to Your Collection Notice

Dear [Recipient Name],

We acknowledge receipt of your collection notice dated [Date]. We appreciate your patience as we address this matter.

Please be informed that a payment of [Amount] will be made on [Payment Date]. We are committed to resolving this outstanding balance promptly.

Thank you for your understanding and cooperation.

Sincerely,

[Sender Name]

[Title]

[Company Name]

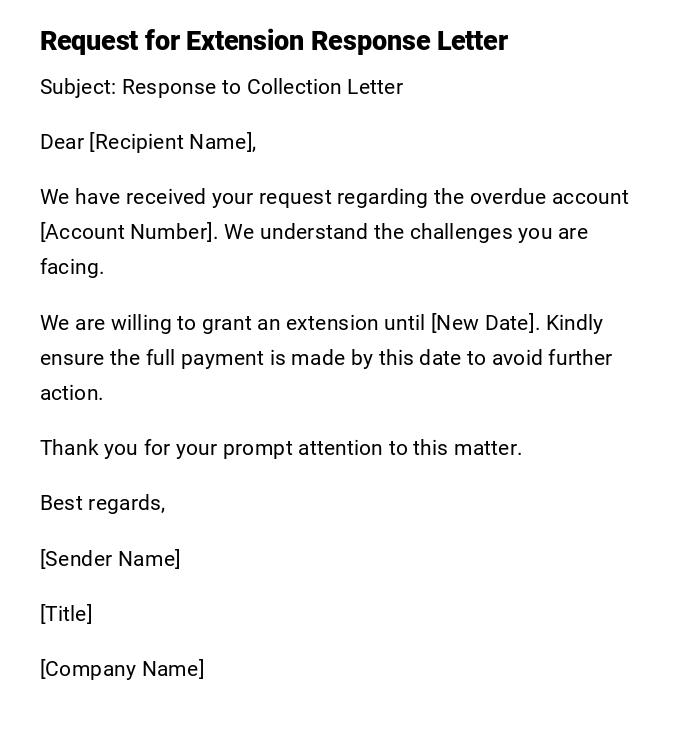

Request for Extension Response Letter

Subject: Response to Collection Letter

Dear [Recipient Name],

We have received your request regarding the overdue account [Account Number]. We understand the challenges you are facing.

We are willing to grant an extension until [New Date]. Kindly ensure the full payment is made by this date to avoid further action.

Thank you for your prompt attention to this matter.

Best regards,

[Sender Name]

[Title]

[Company Name]

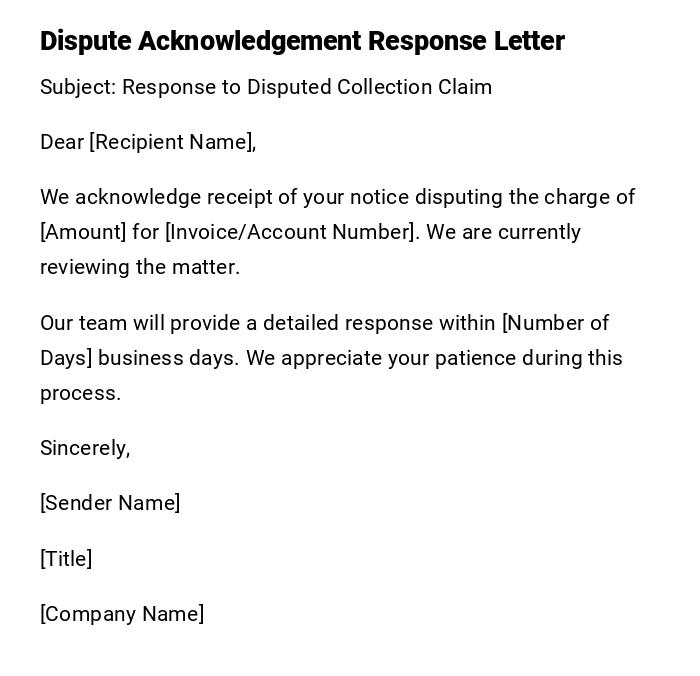

Dispute Acknowledgement Response Letter

Subject: Response to Disputed Collection Claim

Dear [Recipient Name],

We acknowledge receipt of your notice disputing the charge of [Amount] for [Invoice/Account Number]. We are currently reviewing the matter.

Our team will provide a detailed response within [Number of Days] business days. We appreciate your patience during this process.

Sincerely,

[Sender Name]

[Title]

[Company Name]

Partial Payment Confirmation Response Letter

Subject: Confirmation of Partial Payment

Dear [Recipient Name],

This letter confirms that we have received a partial payment of [Amount] towards the outstanding balance of [Total Amount] on [Date].

We appreciate your prompt action and request that the remaining balance of [Remaining Amount] be cleared by [Due Date] as agreed.

Thank you for your cooperation.

Best regards,

[Sender Name]

[Title]

[Company Name]

Payment Plan Acceptance Response Letter

Subject: Acceptance of Payment Plan

Dear [Recipient Name],

We acknowledge your proposal for a payment plan regarding your outstanding account [Account Number].

We are pleased to accept the proposed schedule and request adherence to the agreed installments as outlined.

Thank you for your commitment to resolving this matter.

Sincerely,

[Sender Name]

[Title]

[Company Name]

What / Why a Collection Letter Response is Necessary

- Definition: A formal reply to a collection notice addressing payment, dispute, or agreement.

- Purpose: To acknowledge the collection, provide clarity, and maintain professional relations.

- Impact: Helps prevent legal escalation and ensures transparent communication between parties.

Who Should Send a Collection Letter Response

- Accounts receivable managers.

- Financial officers or authorized personnel.

- Business owners or responsible representatives for the account.

Whom Should Receive the Collection Letter Response

- The creditor or collection agency issuing the original notice.

- Account managers or finance department of the requesting organization.

- Legal representatives if the matter has escalated.

When to Send a Collection Letter Response

- Immediately upon receipt of the collection notice.

- Before any deadlines mentioned in the original letter.

- Prior to escalation to legal or external collections agencies.

How to Write and Send a Collection Letter Response

- Begin by acknowledging receipt of the original collection notice.

- Clearly state your position: payment, dispute, or request for extension.

- Include specific details: amounts, account numbers, dates.

- Maintain a professional and courteous tone.

- Choose the appropriate delivery method: email for speed, postal letter for formality.

Formatting Guidelines for a Collection Letter Response

- Length: 1–2 pages maximum.

- Tone: Professional, neutral, and courteous.

- Style: Clear, concise, and factual.

- Mode: Email for routine communication; printed letter for formal/legal responses.

- Etiquette: Avoid emotional language or admissions not verified.

Requirements and Prerequisites Before Sending

- Review the original collection notice thoroughly.

- Verify all amounts, dates, and account details.

- Decide on your stance: full payment, partial payment, dispute, or request extension.

- Ensure authorized personnel approve the response if needed.

After Sending / Follow-Up Actions

- Confirm receipt by the creditor or collection agency.

- Maintain copies of the response for records.

- Monitor payment schedules or dispute resolutions.

- Respond promptly to any further correspondence to avoid escalation.

Tricks and Tips for Effective Collection Letter Responses

- Be concise and specific to reduce confusion.

- Include all necessary reference numbers.

- Maintain a polite and professional tone even in disputes.

- Use certified mail or read receipts when sending important responses.

Common Mistakes to Avoid in Collection Letter Responses

- Ignoring the notice or delaying response.

- Providing incorrect amounts or dates.

- Using overly emotional or accusatory language.

- Failing to keep records of correspondence.

- Not following up on promises made in the response.

Elements and Structure of a Collection Letter Response

- Subject Line: Clear reference to the collection notice.

- Greeting: Address the recipient formally.

- Acknowledgment: Confirm receipt of the original notice.

- Body: Explain your response: payment, dispute, or request.

- Closing: Express cooperation or next steps.

- Signature: Name, title, and company information.

Pros and Cons of Sending a Collection Letter Response

Pros:

- Maintains professional and legal communication.

- Avoids escalation to external collections or legal action.

- Clarifies payment arrangements or disputes.

Cons:

- Miscommunication may worsen the issue if details are incorrect.

- Delays can damage business reputation.

- Requires careful review to ensure accuracy and compliance.

Download Word Doc

Download Word Doc

Download PDF

Download PDF