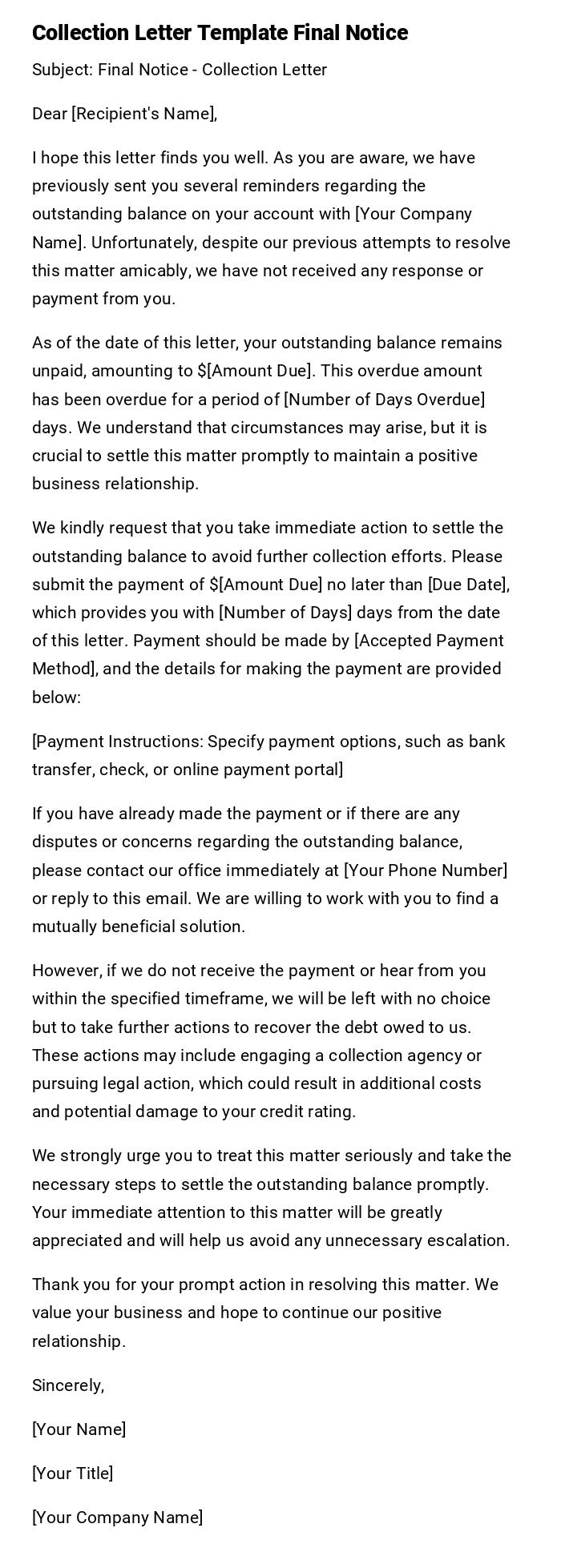

Collection Letter Template Final Notice

Subject: Final Notice - Collection Letter

Dear [Recipient's Name],

I hope this letter finds you well. As you are aware, we have previously sent you several reminders regarding the outstanding balance on your account with [Your Company Name]. Unfortunately, despite our previous attempts to resolve this matter amicably, we have not received any response or payment from you.

As of the date of this letter, your outstanding balance remains unpaid, amounting to $[Amount Due]. This overdue amount has been overdue for a period of [Number of Days Overdue] days. We understand that circumstances may arise, but it is crucial to settle this matter promptly to maintain a positive business relationship.

We kindly request that you take immediate action to settle the outstanding balance to avoid further collection efforts. Please submit the payment of $[Amount Due] no later than [Due Date], which provides you with [Number of Days] days from the date of this letter. Payment should be made by [Accepted Payment Method], and the details for making the payment are provided below:

[Payment Instructions: Specify payment options, such as bank transfer, check, or online payment portal]

If you have already made the payment or if there are any disputes or concerns regarding the outstanding balance, please contact our office immediately at [Your Phone Number] or reply to this email. We are willing to work with you to find a mutually beneficial solution.

However, if we do not receive the payment or hear from you within the specified timeframe, we will be left with no choice but to take further actions to recover the debt owed to us. These actions may include engaging a collection agency or pursuing legal action, which could result in additional costs and potential damage to your credit rating.

We strongly urge you to treat this matter seriously and take the necessary steps to settle the outstanding balance promptly. Your immediate attention to this matter will be greatly appreciated and will help us avoid any unnecessary escalation.

Thank you for your prompt action in resolving this matter. We value your business and hope to continue our positive relationship.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

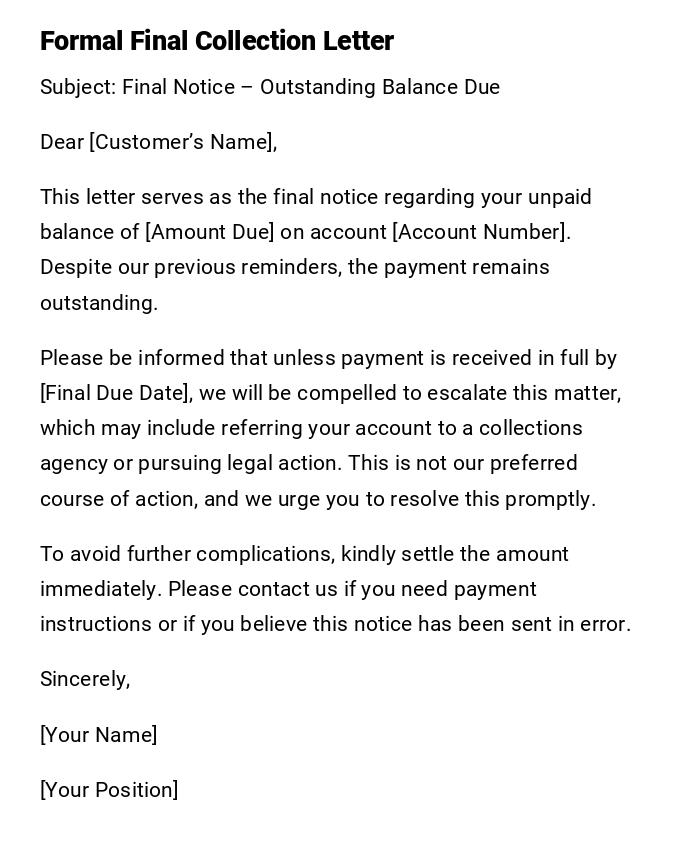

Formal Final Collection Letter

Subject: Final Notice – Outstanding Balance Due

Dear [Customer’s Name],

This letter serves as the final notice regarding your unpaid balance of [Amount Due] on account [Account Number]. Despite our previous reminders, the payment remains outstanding.

Please be informed that unless payment is received in full by [Final Due Date], we will be compelled to escalate this matter, which may include referring your account to a collections agency or pursuing legal action. This is not our preferred course of action, and we urge you to resolve this promptly.

To avoid further complications, kindly settle the amount immediately. Please contact us if you need payment instructions or if you believe this notice has been sent in error.

Sincerely,

[Your Name]

[Your Position]

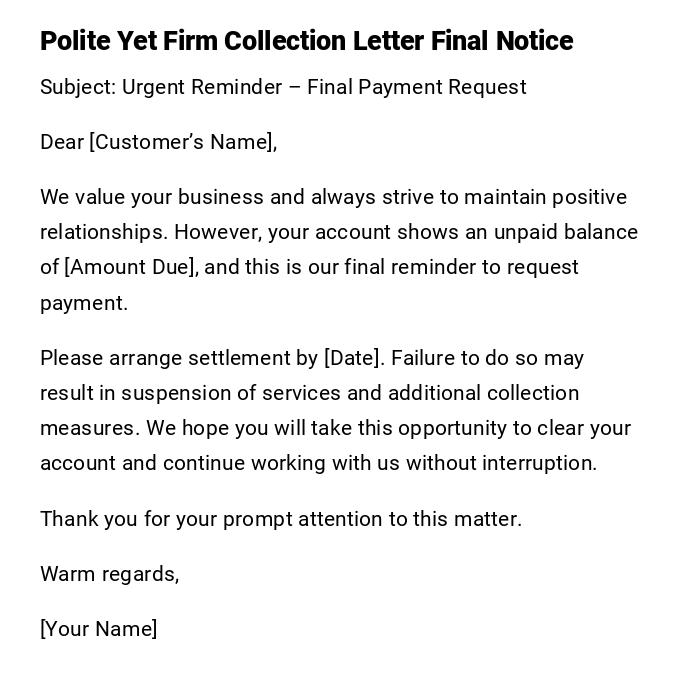

Polite Yet Firm Collection Letter Final Notice

Subject: Urgent Reminder – Final Payment Request

Dear [Customer’s Name],

We value your business and always strive to maintain positive relationships. However, your account shows an unpaid balance of [Amount Due], and this is our final reminder to request payment.

Please arrange settlement by [Date]. Failure to do so may result in suspension of services and additional collection measures. We hope you will take this opportunity to clear your account and continue working with us without interruption.

Thank you for your prompt attention to this matter.

Warm regards,

[Your Name]

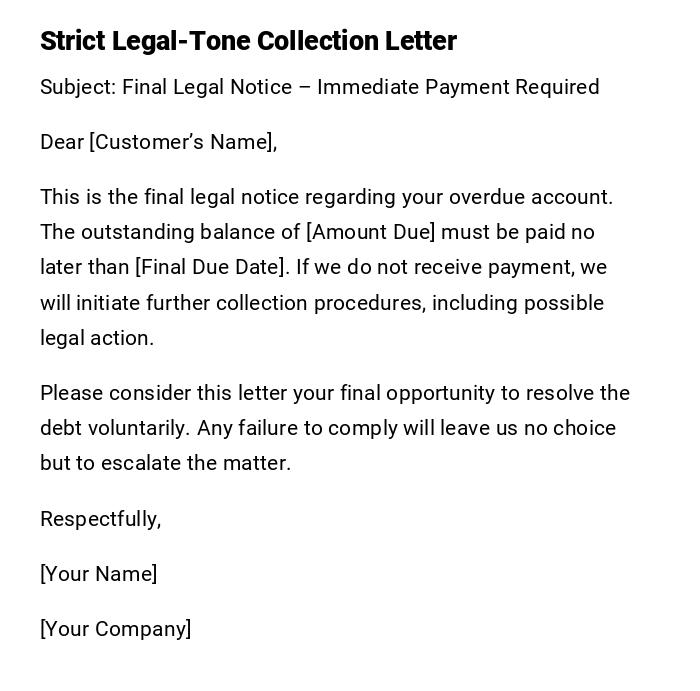

Strict Legal-Tone Collection Letter

Subject: Final Legal Notice – Immediate Payment Required

Dear [Customer’s Name],

This is the final legal notice regarding your overdue account. The outstanding balance of [Amount Due] must be paid no later than [Final Due Date]. If we do not receive payment, we will initiate further collection procedures, including possible legal action.

Please consider this letter your final opportunity to resolve the debt voluntarily. Any failure to comply will leave us no choice but to escalate the matter.

Respectfully,

[Your Name]

[Your Company]

Business-to-Business Final Collection Letter

Subject: Final Demand for Payment – Account [Number]

Dear [Business Partner’s Name],

Our records indicate that your company’s account is overdue in the amount of [Amount Due]. Previous reminders have gone unanswered. This is our final notice requesting full payment by [Final Due Date].

We greatly value our business relationship but cannot allow this matter to continue unresolved. Failure to remit payment will result in collection escalation and may impact future business transactions between us.

We urge you to act immediately to avoid further action.

Regards,

[Your Name]

[Your Position]

Casual Final Collection Email

Subject: Final Reminder – Outstanding Balance

Hi [Customer’s Name],

This is a final reminder about your overdue payment of [Amount Due]. Please make sure the payment is completed by [Final Due Date] to avoid any further action.

If you’ve already made the payment, just ignore this message. Otherwise, please take care of it today.

Thanks for your cooperation,

[Your Name]

Heartfelt Final Collection Letter

Subject: Last Chance to Resolve Your Account

Dear [Customer’s Name],

We understand that financial challenges can arise and make it difficult to meet obligations. Unfortunately, your account balance of [Amount Due] remains unpaid despite several attempts to reach you.

This is the final notice before additional measures are taken. We would prefer to resolve this directly with you, and we are open to discussing payment arrangements if needed. Please contact us by [Final Due Date] to avoid escalation.

With understanding,

[Your Name]

Quick SMS-Style Collection Message Final Notice

Final Notice: Your balance of [Amount Due] is overdue. Please pay by [Final Due Date] to avoid legal/collection action. Contact us at [Phone Number] if you’ve already paid.

Why do you need a final notice collection letter?

A final notice collection letter is the last communication sent to a debtor before legal or third-party collection action. It serves to:

- Provide a clear, documented demand for payment.

- Show seriousness and urgency.

- Offer one final chance to settle before escalation.

- Protect the creditor by demonstrating reasonable attempts at resolution.

Who should send a collection letter final notice?

- Businesses to customers with overdue invoices.

- Service providers to clients who have not paid.

- Landlords to tenants with unpaid rent.

- Credit departments or accounts receivable teams.

- Debt collection agencies authorized by the original creditor.

When should you send a final notice collection letter?

- After multiple reminders have gone unanswered.

- When the account is seriously overdue (commonly 60–90+ days).

- Before turning the account over to collections or legal departments.

- When you need to establish a clear record of last communication.

Elements and structure of a collection letter final notice

A proper final notice collection letter should include:

- Subject line or heading stating “Final Notice.”

- The debtor’s name and account reference.

- The amount due and original due date.

- A strict final payment deadline.

- Consequences of non-payment (legal action, collections, service suspension).

- A closing statement urging immediate payment.

Mistakes to avoid when sending a final notice collection letter

- Being vague about the amount due or deadline.

- Using threatening or aggressive language that may be illegal.

- Forgetting to include consequences of non-payment.

- Sending without prior reminders.

- Not keeping a copy for legal documentation.

After sending a final notice collection letter: what happens next?

- If payment is made, confirm receipt and close the account.

- If no response, escalate to a collection agency.

- If the debt is large, consider legal action.

- Update internal records to reflect the status.

- Avoid further informal communication once escalation has started.

Tricks and tips for writing effective final notice collection letters

- Keep the tone professional but firm.

- Use bold or capitalized “FINAL NOTICE” in the subject line.

- State consequences clearly without sounding hostile.

- Offer easy payment methods to encourage compliance.

- Send by both email and certified mail when possible.

Compare and contrast: final notice vs. earlier collection letters

- Earlier collection letters: Gentle reminders, polite tone, often flexible.

- Final notice letters: Serious, urgent, strict deadlines, consequences included.

- Earlier letters encourage cooperation; final notices signal escalation.

Download Word Doc

Download Word Doc

Download PDF

Download PDF