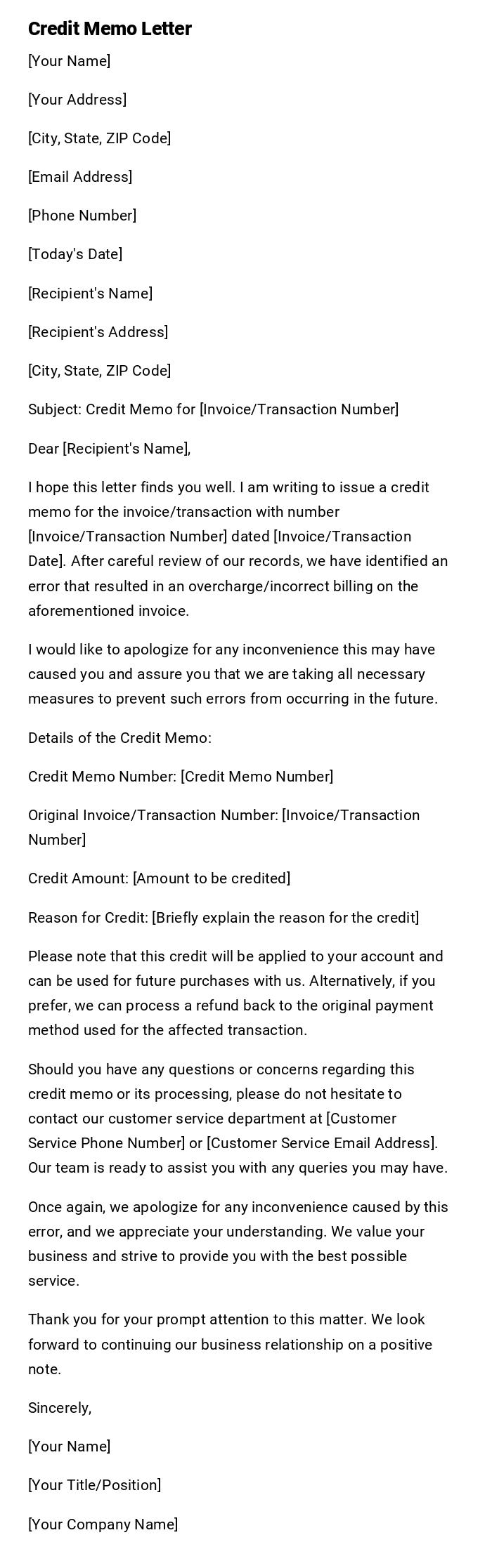

Credit Memo Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Today's Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Credit Memo for [Invoice/Transaction Number]

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to issue a credit memo for the invoice/transaction with number [Invoice/Transaction Number] dated [Invoice/Transaction Date]. After careful review of our records, we have identified an error that resulted in an overcharge/incorrect billing on the aforementioned invoice.

I would like to apologize for any inconvenience this may have caused you and assure you that we are taking all necessary measures to prevent such errors from occurring in the future.

Details of the Credit Memo:

Credit Memo Number: [Credit Memo Number]

Original Invoice/Transaction Number: [Invoice/Transaction Number]

Credit Amount: [Amount to be credited]

Reason for Credit: [Briefly explain the reason for the credit]

Please note that this credit will be applied to your account and can be used for future purchases with us. Alternatively, if you prefer, we can process a refund back to the original payment method used for the affected transaction.

Should you have any questions or concerns regarding this credit memo or its processing, please do not hesitate to contact our customer service department at [Customer Service Phone Number] or [Customer Service Email Address]. Our team is ready to assist you with any queries you may have.

Once again, we apologize for any inconvenience caused by this error, and we appreciate your understanding. We value your business and strive to provide you with the best possible service.

Thank you for your prompt attention to this matter. We look forward to continuing our business relationship on a positive note.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company Name]

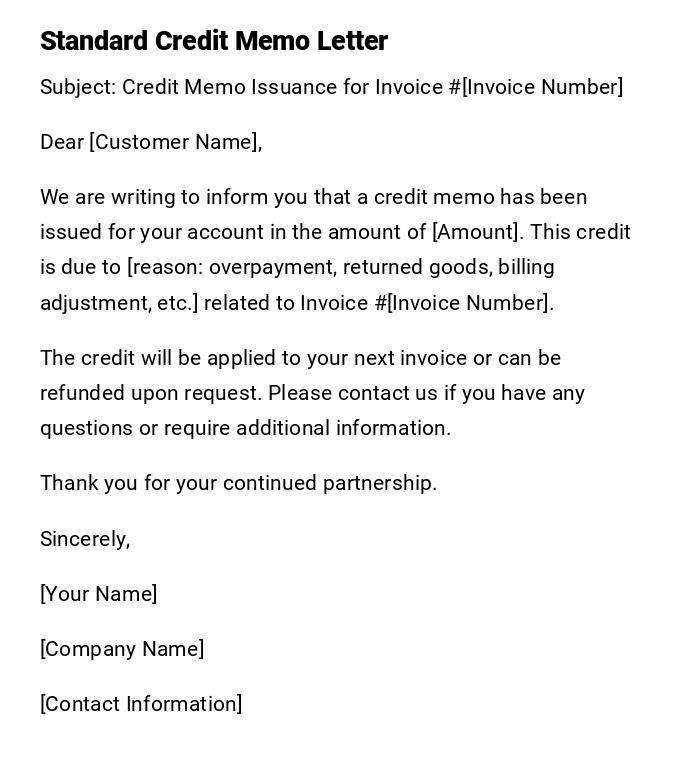

Standard Credit Memo Letter

Subject: Credit Memo Issuance for Invoice #[Invoice Number]

Dear [Customer Name],

We are writing to inform you that a credit memo has been issued for your account in the amount of [Amount]. This credit is due to [reason: overpayment, returned goods, billing adjustment, etc.] related to Invoice #[Invoice Number].

The credit will be applied to your next invoice or can be refunded upon request. Please contact us if you have any questions or require additional information.

Thank you for your continued partnership.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

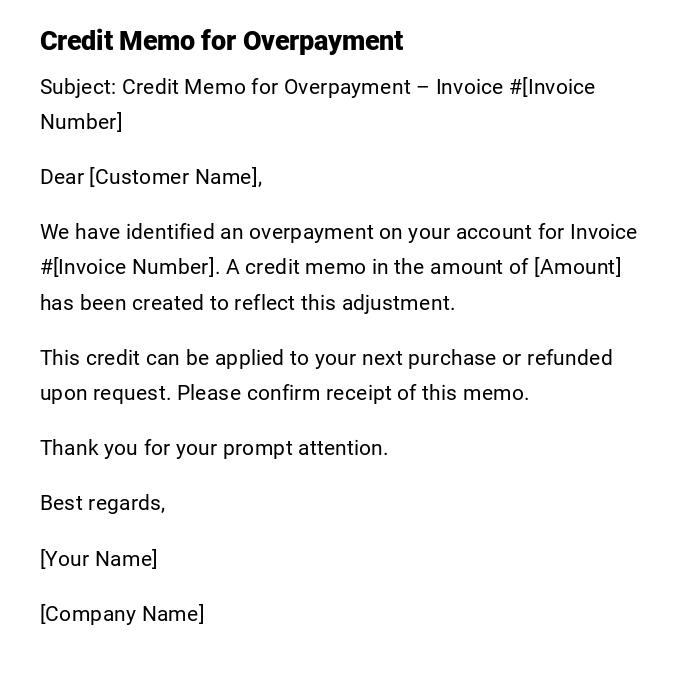

Credit Memo for Overpayment

Subject: Credit Memo for Overpayment – Invoice #[Invoice Number]

Dear [Customer Name],

We have identified an overpayment on your account for Invoice #[Invoice Number]. A credit memo in the amount of [Amount] has been created to reflect this adjustment.

This credit can be applied to your next purchase or refunded upon request. Please confirm receipt of this memo.

Thank you for your prompt attention.

Best regards,

[Your Name]

[Company Name]

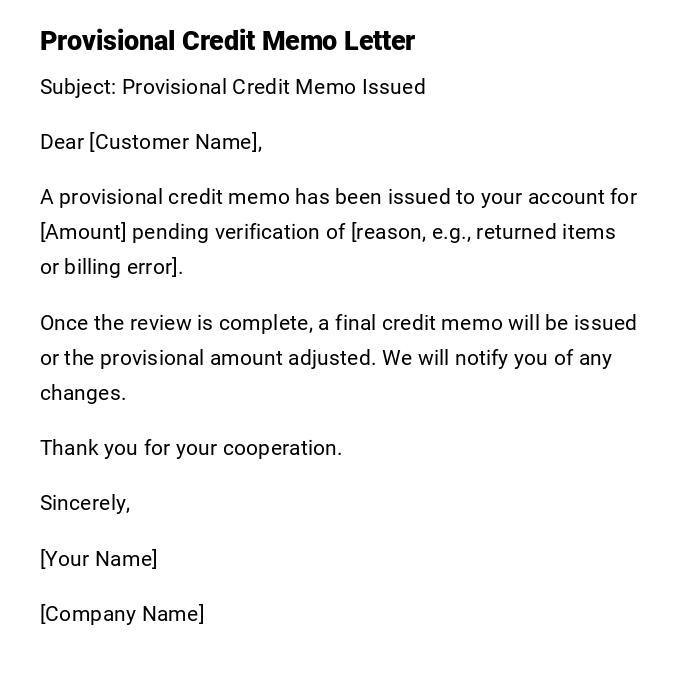

Provisional Credit Memo Letter

Subject: Provisional Credit Memo Issued

Dear [Customer Name],

A provisional credit memo has been issued to your account for [Amount] pending verification of [reason, e.g., returned items or billing error].

Once the review is complete, a final credit memo will be issued or the provisional amount adjusted. We will notify you of any changes.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Company Name]

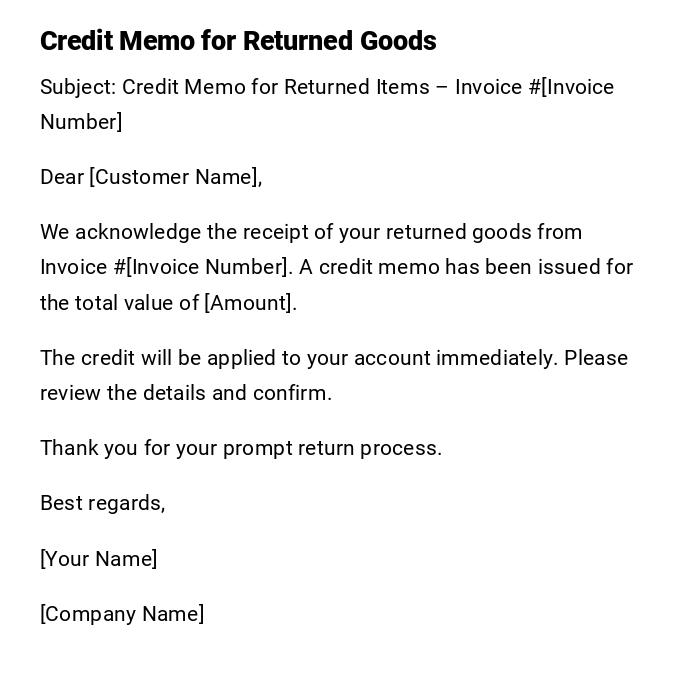

Credit Memo for Returned Goods

Subject: Credit Memo for Returned Items – Invoice #[Invoice Number]

Dear [Customer Name],

We acknowledge the receipt of your returned goods from Invoice #[Invoice Number]. A credit memo has been issued for the total value of [Amount].

The credit will be applied to your account immediately. Please review the details and confirm.

Thank you for your prompt return process.

Best regards,

[Your Name]

[Company Name]

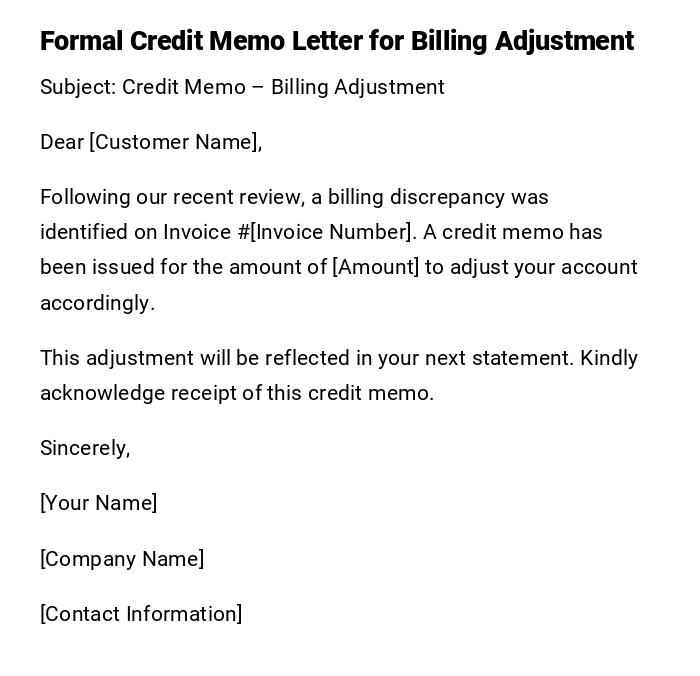

Formal Credit Memo Letter for Billing Adjustment

Subject: Credit Memo – Billing Adjustment

Dear [Customer Name],

Following our recent review, a billing discrepancy was identified on Invoice #[Invoice Number]. A credit memo has been issued for the amount of [Amount] to adjust your account accordingly.

This adjustment will be reflected in your next statement. Kindly acknowledge receipt of this credit memo.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

What is a Credit Memo Letter and Why It Is Important

- A credit memo letter documents a reduction in the amount owed by a customer.

- It serves as official communication confirming adjustments due to overpayment, returns, or billing errors.

- Provides transparency and maintains proper financial records for both the company and the customer.

Who Should Send a Credit Memo Letter

- Finance or accounting departments of a company.

- Customer service representatives in smaller businesses if authorized.

- Company management if the credit memo involves significant adjustments or sensitive accounts.

Whom Should Receive a Credit Memo Letter

- Customers whose accounts require adjustment.

- Internal accounting teams to reconcile accounts.

- Occasionally, external auditors for recordkeeping purposes.

When to Send a Credit Memo Letter

- After identifying billing errors or overpayments.

- Following the return of goods by a customer.

- When adjusting invoices for promotional discounts, allowances, or other contractual reasons.

How to Write and Send a Credit Memo Letter

- Identify the exact reason and amount of the credit.

- Reference the original invoice or transaction.

- Clearly state how the credit will be applied (next invoice, refund, or account adjustment).

- Maintain a professional and polite tone.

- Send via email for speed or as a printed letter for formal recordkeeping.

Requirements and Prerequisites Before Issuing a Credit Memo

- Verify the original invoice details.

- Confirm the reason for credit with appropriate department (sales, accounting, or customer service).

- Ensure approval from management if necessary.

- Keep documentation for internal records.

Formatting and Style Guidelines for Credit Memo Letters

- Length: Typically one concise page.

- Tone: Professional, polite, and factual.

- Style: Formal for corporate clients; slightly casual for small business customers.

- Structure: Include subject, reference to invoice, reason, amount, and next steps.

- Mode of Sending: Email for immediate notification; printed letter for formal records.

After Sending a Credit Memo Letter

- Confirm receipt with the customer.

- Apply the credit to the customer’s account or process refund as indicated.

- Update internal accounting records to reflect the adjustment.

- Retain copies for future reference and audits.

Common Mistakes to Avoid in Credit Memo Letters

- Failing to reference the original invoice or transaction.

- Sending incorrect credit amounts.

- Using ambiguous language that confuses the customer.

- Neglecting to update internal records after issuing the credit memo.

Elements and Structure of a Credit Memo Letter

- Subject Line: Clear and descriptive (e.g., "Credit Memo – Invoice #[Number]").

- Greeting: Address the customer personally.

- Reference Details: Include invoice number and date.

- Reason for Credit: Explain why the credit is issued.

- Amount: Clearly specify the credit amount.

- Application Instructions: How the credit will be applied or refunded.

- Closing: Polite sign-off with contact details for questions.

Tips for Effective Credit Memo Letters

- Double-check amounts and invoice references before sending.

- Keep the language concise and professional.

- Provide clear instructions on how the credit will be applied.

- Maintain a copy for internal records and future audits.

- Address the recipient personally to enhance customer relationship.

Pros and Cons of Sending Credit Memo Letters

Pros:

- Maintains transparency with customers.

- Strengthens trust and customer relations.

- Helps prevent disputes over billing errors.

Cons:

- Mistakes in the memo can create confusion or disputes.

- Requires careful recordkeeping and accounting follow-up.

- May delay cash flow if refunds are involved.

FAQ About Credit Memo Letters

- Q: Can a credit memo be applied to multiple invoices?

A: Yes, with clear explanation and customer agreement. - Q: Is a printed letter necessary?

A: Not always; email is sufficient unless a formal record is required. - Q: Does issuing a credit memo affect financial statements?

A: Yes, it reduces accounts receivable or adjusts revenue accordingly.

Download Word Doc

Download Word Doc

Download PDF

Download PDF