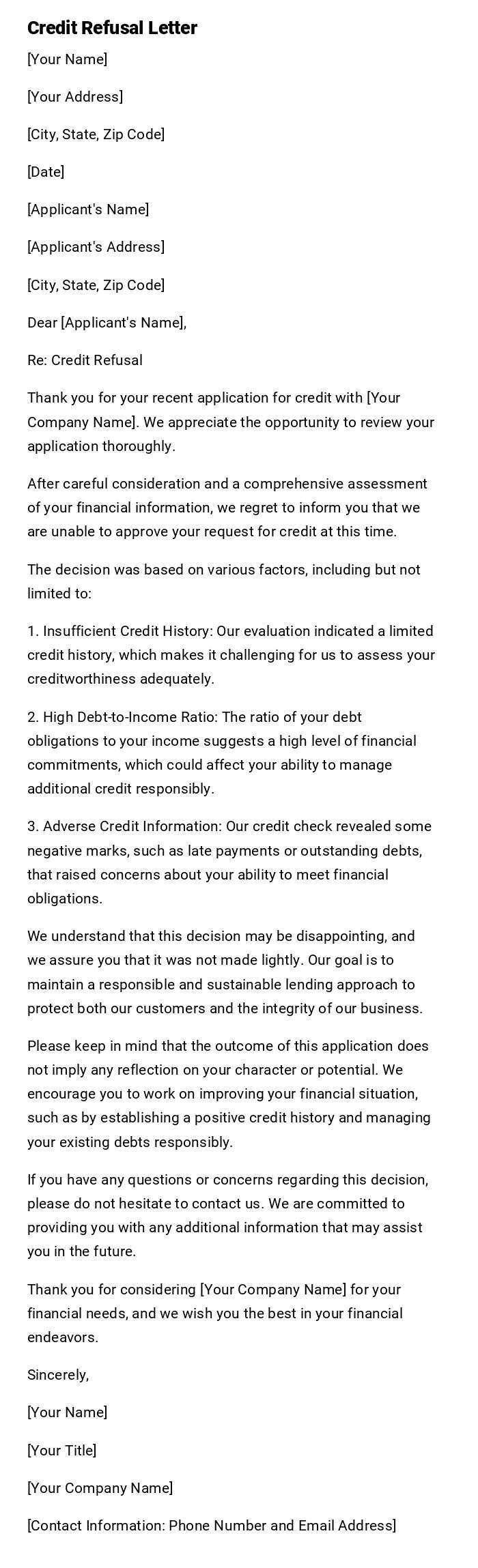

Credit Refusal Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Applicant's Name]

[Applicant's Address]

[City, State, Zip Code]

Dear [Applicant's Name],

Re: Credit Refusal

Thank you for your recent application for credit with [Your Company Name]. We appreciate the opportunity to review your application thoroughly.

After careful consideration and a comprehensive assessment of your financial information, we regret to inform you that we are unable to approve your request for credit at this time.

The decision was based on various factors, including but not limited to:

1. Insufficient Credit History: Our evaluation indicated a limited credit history, which makes it challenging for us to assess your creditworthiness adequately.

2. High Debt-to-Income Ratio: The ratio of your debt obligations to your income suggests a high level of financial commitments, which could affect your ability to manage additional credit responsibly.

3. Adverse Credit Information: Our credit check revealed some negative marks, such as late payments or outstanding debts, that raised concerns about your ability to meet financial obligations.

We understand that this decision may be disappointing, and we assure you that it was not made lightly. Our goal is to maintain a responsible and sustainable lending approach to protect both our customers and the integrity of our business.

Please keep in mind that the outcome of this application does not imply any reflection on your character or potential. We encourage you to work on improving your financial situation, such as by establishing a positive credit history and managing your existing debts responsibly.

If you have any questions or concerns regarding this decision, please do not hesitate to contact us. We are committed to providing you with any additional information that may assist you in the future.

Thank you for considering [Your Company Name] for your financial needs, and we wish you the best in your financial endeavors.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Contact Information: Phone Number and Email Address]

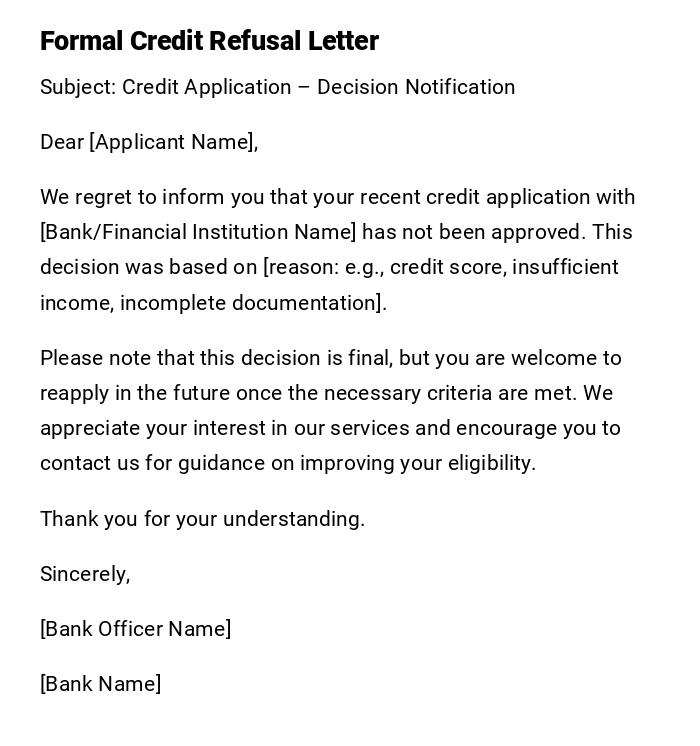

Formal Credit Refusal Letter for Bank Customers

Subject: Credit Application – Decision Notification

Dear [Applicant Name],

We regret to inform you that your recent credit application with [Bank/Financial Institution Name] has not been approved. This decision was based on [reason: e.g., credit score, insufficient income, incomplete documentation].

Please note that this decision is final, but you are welcome to reapply in the future once the necessary criteria are met. We appreciate your interest in our services and encourage you to contact us for guidance on improving your eligibility.

Thank you for your understanding.

Sincerely,

[Bank Officer Name]

[Bank Name]

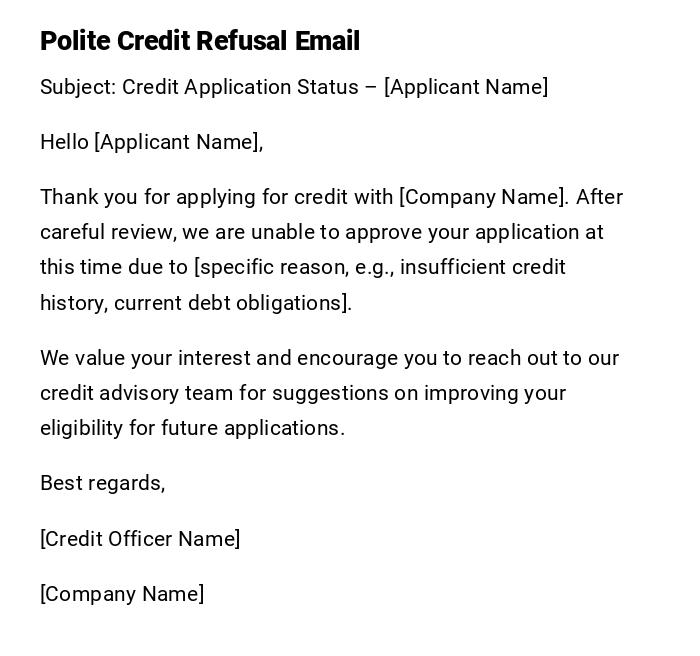

Polite Credit Refusal Email with Explanation

Subject: Credit Application Status – [Applicant Name]

Hello [Applicant Name],

Thank you for applying for credit with [Company Name]. After careful review, we are unable to approve your application at this time due to [specific reason, e.g., insufficient credit history, current debt obligations].

We value your interest and encourage you to reach out to our credit advisory team for suggestions on improving your eligibility for future applications.

Best regards,

[Credit Officer Name]

[Company Name]

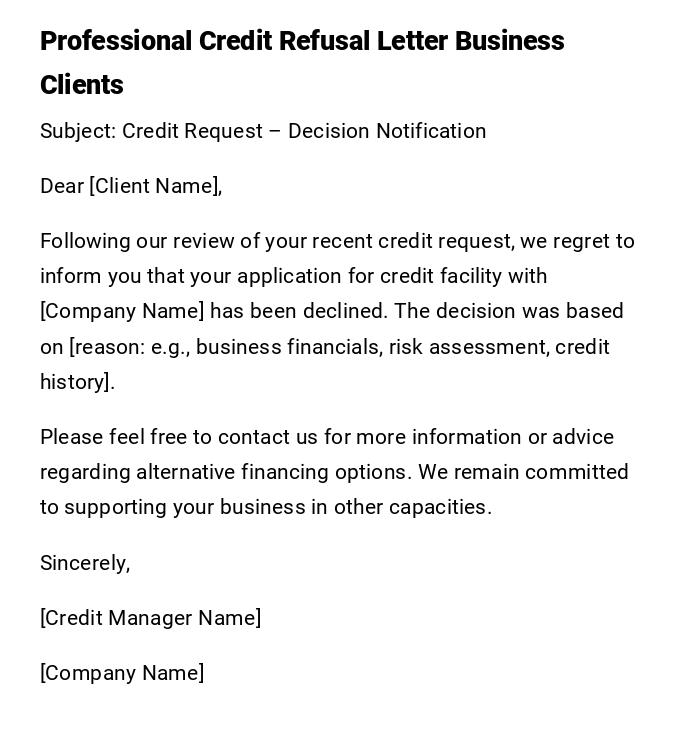

Professional Credit Refusal Letter for Business Clients

Subject: Credit Request – Decision Notification

Dear [Client Name],

Following our review of your recent credit request, we regret to inform you that your application for credit facility with [Company Name] has been declined. The decision was based on [reason: e.g., business financials, risk assessment, credit history].

Please feel free to contact us for more information or advice regarding alternative financing options. We remain committed to supporting your business in other capacities.

Sincerely,

[Credit Manager Name]

[Company Name]

Brief and Simple Credit Refusal Email

Subject: Credit Application – Not Approved

Hi [Applicant Name],

We regret to inform you that your credit application with [Company Name] cannot be approved at this time. We encourage you to review eligibility criteria and consider reapplying in the future.

Thank you for your understanding.

Regards,

[Credit Officer Name]

[Company Name]

Heartfelt Credit Refusal Letter with Encouragement

Subject: Credit Application Outcome – [Applicant Name]

Dear [Applicant Name],

We sincerely appreciate your interest in obtaining credit with [Bank/Company Name]. After careful consideration, we are unable to approve your application at this time due to [reason].

While this may be disappointing, we encourage you to explore steps to enhance your credit profile. Our team is available to provide guidance and support for future applications.

Thank you for considering us.

Warm regards,

[Credit Advisor Name]

[Company Name]

What is a Credit Refusal Letter and Why It Is Important

A credit refusal letter is an official communication informing an applicant that their credit application has been declined.

It serves to:

- Formally notify the applicant of the decision

- Provide reasons or guidance (if applicable)

- Maintain professional communication and customer relations

- Serve as a legal record of the decision

Who Should Issue a Credit Refusal Letter

- Credit managers or officers at banks and financial institutions

- Loan department personnel for companies offering credit

- Authorized staff responsible for evaluating credit applications

Whom Should the Credit Refusal Letter Be Addressed To

- Individual applicants requesting personal credit

- Business clients seeking loans or credit facilities

- Partners or organizations applying for credit terms

When to Send a Credit Refusal Letter

- After completing the credit evaluation process

- Following a loan or credit application review

- Immediately upon decision to decline to maintain transparency

Requirements and Prerequisites Before Sending

- Completed review of credit application

- Assessment of creditworthiness or risk analysis

- Documentation supporting the decision

- Authorized approval from management to communicate refusal

How to Write and Send a Credit Refusal Letter

- Start with a clear subject line indicating the decision

- Address the applicant directly

- State the decision politely and professionally

- Include reason(s) for refusal if appropriate

- Offer guidance for future applications or alternatives if applicable

- Use a professional and courteous tone

- Send via email for speed or as a printed letter for formal/legal purposes

Formatting Guidelines for Credit Refusal Letters

- Length: 1–2 paragraphs for brevity

- Tone: Professional, polite, and empathetic

- Wording: Clear and precise, avoid ambiguous phrases

- Mode: Email for rapid communication, printed letter for formal record

- Attachments: Include any required documentation supporting the decision if necessary

- Etiquette: Maintain respectful and considerate language

After Sending the Credit Refusal Letter

- Confirm the applicant received and acknowledged the letter

- Record the refusal decision in internal systems

- Respond to any follow-up queries politely

- Maintain documentation for legal or compliance purposes

Common Mistakes to Avoid in Credit Refusal Letters

- Using overly harsh or insensitive language

- Omitting a reason for refusal where required by law or policy

- Being too vague, leading to confusion or disputes

- Failing to maintain a professional tone

- Not sending the letter promptly after decision

Elements and Structure of a Credit Refusal Letter

- Subject line indicating the purpose

- Salutation addressing the applicant

- Opening sentence stating the decision

- Explanation or reason for refusal (if appropriate)

- Guidance or encouragement for future applications (optional)

- Closing statement with courtesy

- Signature and designation of issuing officer

Tips and Best Practices for Credit Refusal Letters

- Be empathetic yet professional

- Keep language concise and respectful

- Provide actionable advice when possible

- Avoid technical jargon unless necessary

- Ensure accuracy in referencing applicant details and application

- Maintain records for internal compliance

Pros and Cons of Sending a Credit Refusal Letter

Pros:

- Formalizes communication of the decision

- Maintains professionalism and transparency

- Provides legal documentation for the refusal

- Helps manage customer expectations

Cons:

- May disappoint or upset the applicant

- Risk of disputes if reasons are not clearly stated

- Requires careful drafting to avoid misinterpretation

Compare and Contrast Credit Refusal Letters with Similar Communications

- Approval Letter: Opposite in purpose; communicates acceptance and credit terms

- Informal Decline Email: Less formal, may lack documentation and compliance tracking

- Reminder Letter: Serves a different purpose (e.g., overdue payments), not an application decision

- Credit Refusal Letter: Formal, professional, and documents the refusal decision

Download Word Doc

Download Word Doc

Download PDF

Download PDF