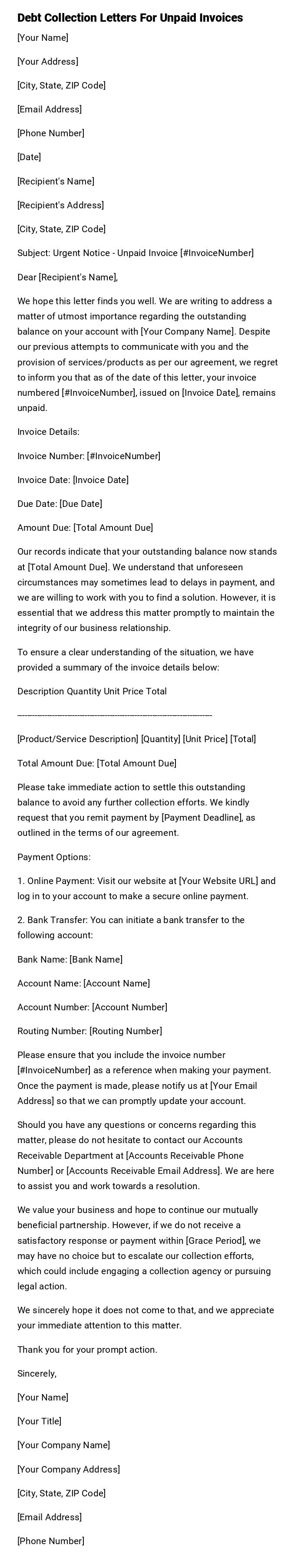

Debt Collection Letters For Unpaid Invoices

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Urgent Notice - Unpaid Invoice [#InvoiceNumber]

Dear [Recipient's Name],

We hope this letter finds you well. We are writing to address a matter of utmost importance regarding the outstanding balance on your account with [Your Company Name]. Despite our previous attempts to communicate with you and the provision of services/products as per our agreement, we regret to inform you that as of the date of this letter, your invoice numbered [#InvoiceNumber], issued on [Invoice Date], remains unpaid.

Invoice Details:

Invoice Number: [#InvoiceNumber]

Invoice Date: [Invoice Date]

Due Date: [Due Date]

Amount Due: [Total Amount Due]

Our records indicate that your outstanding balance now stands at [Total Amount Due]. We understand that unforeseen circumstances may sometimes lead to delays in payment, and we are willing to work with you to find a solution. However, it is essential that we address this matter promptly to maintain the integrity of our business relationship.

To ensure a clear understanding of the situation, we have provided a summary of the invoice details below:

Description Quantity Unit Price Total

------------------------------------------------------------------------------

[Product/Service Description] [Quantity] [Unit Price] [Total]

Total Amount Due: [Total Amount Due]

Please take immediate action to settle this outstanding balance to avoid any further collection efforts. We kindly request that you remit payment by [Payment Deadline], as outlined in the terms of our agreement.

Payment Options:

1. Online Payment: Visit our website at [Your Website URL] and log in to your account to make a secure online payment.

2. Bank Transfer: You can initiate a bank transfer to the following account:

Bank Name: [Bank Name]

Account Name: [Account Name]

Account Number: [Account Number]

Routing Number: [Routing Number]

Please ensure that you include the invoice number [#InvoiceNumber] as a reference when making your payment. Once the payment is made, please notify us at [Your Email Address] so that we can promptly update your account.

Should you have any questions or concerns regarding this matter, please do not hesitate to contact our Accounts Receivable Department at [Accounts Receivable Phone Number] or [Accounts Receivable Email Address]. We are here to assist you and work towards a resolution.

We value your business and hope to continue our mutually beneficial partnership. However, if we do not receive a satisfactory response or payment within [Grace Period], we may have no choice but to escalate our collection efforts, which could include engaging a collection agency or pursuing legal action.

We sincerely hope it does not come to that, and we appreciate your immediate attention to this matter.

Thank you for your prompt action.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

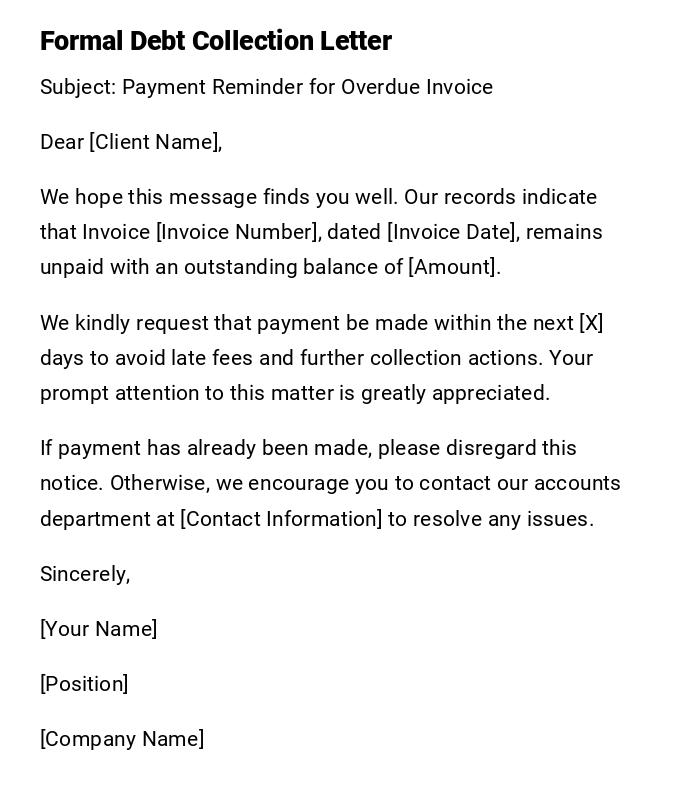

Professional Debt Collection Letter for Overdue Invoice

Subject: Payment Reminder for Overdue Invoice

Dear [Client Name],

We hope this message finds you well. Our records indicate that Invoice [Invoice Number], dated [Invoice Date], remains unpaid with an outstanding balance of [Amount].

We kindly request that payment be made within the next [X] days to avoid late fees and further collection actions. Your prompt attention to this matter is greatly appreciated.

If payment has already been made, please disregard this notice. Otherwise, we encourage you to contact our accounts department at [Contact Information] to resolve any issues.

Sincerely,

[Your Name]

[Position]

[Company Name]

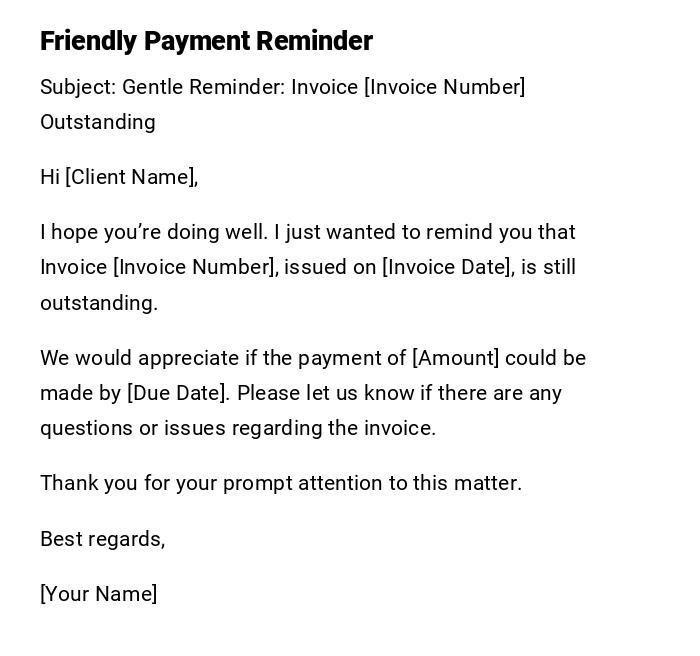

Friendly Reminder Email for Overdue Payment

Subject: Gentle Reminder: Invoice [Invoice Number] Outstanding

Hi [Client Name],

I hope you’re doing well. I just wanted to remind you that Invoice [Invoice Number], issued on [Invoice Date], is still outstanding.

We would appreciate if the payment of [Amount] could be made by [Due Date]. Please let us know if there are any questions or issues regarding the invoice.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

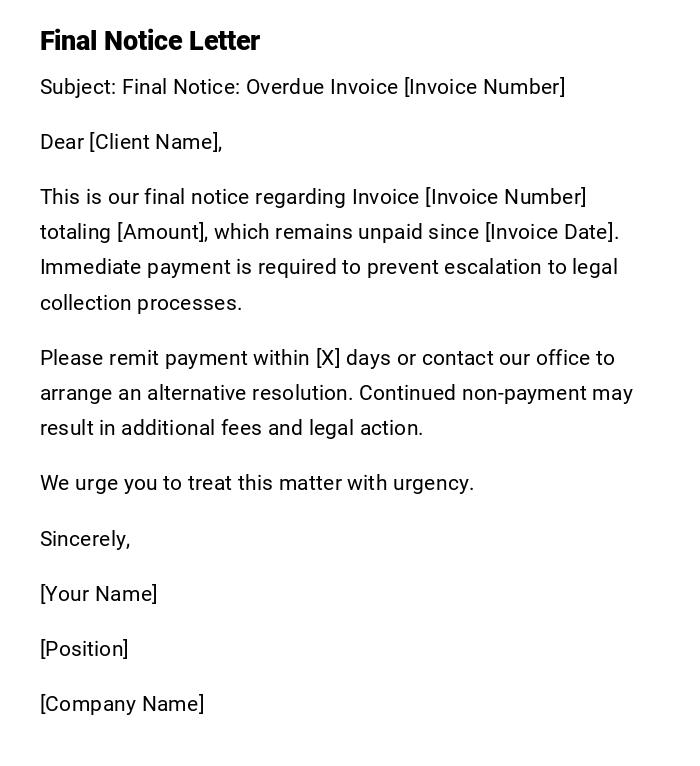

Serious Final Notice Debt Collection Letter

Subject: Final Notice: Overdue Invoice [Invoice Number]

Dear [Client Name],

This is our final notice regarding Invoice [Invoice Number] totaling [Amount], which remains unpaid since [Invoice Date]. Immediate payment is required to prevent escalation to legal collection processes.

Please remit payment within [X] days or contact our office to arrange an alternative resolution. Continued non-payment may result in additional fees and legal action.

We urge you to treat this matter with urgency.

Sincerely,

[Your Name]

[Position]

[Company Name]

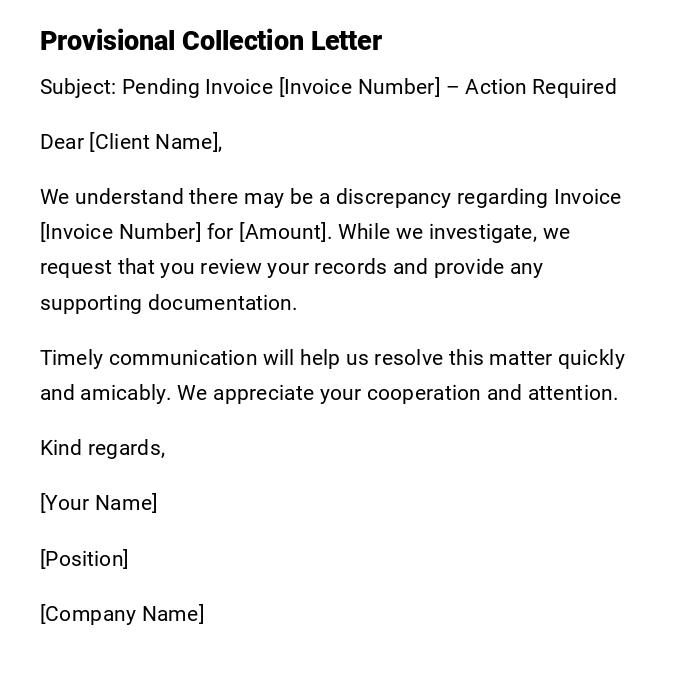

Provisional Debt Collection Letter for Pending Dispute

Subject: Pending Invoice [Invoice Number] – Action Required

Dear [Client Name],

We understand there may be a discrepancy regarding Invoice [Invoice Number] for [Amount]. While we investigate, we request that you review your records and provide any supporting documentation.

Timely communication will help us resolve this matter quickly and amicably. We appreciate your cooperation and attention.

Kind regards,

[Your Name]

[Position]

[Company Name]

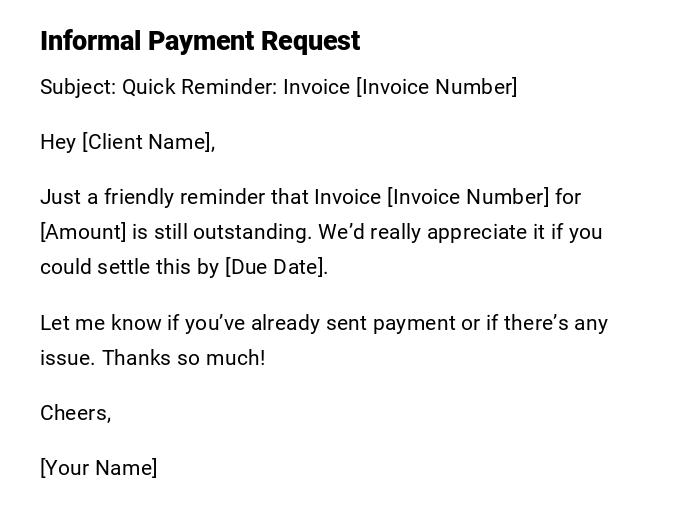

Informal Friendly Payment Request Email

Subject: Quick Reminder: Invoice [Invoice Number]

Hey [Client Name],

Just a friendly reminder that Invoice [Invoice Number] for [Amount] is still outstanding. We’d really appreciate it if you could settle this by [Due Date].

Let me know if you’ve already sent payment or if there’s any issue. Thanks so much!

Cheers,

[Your Name]

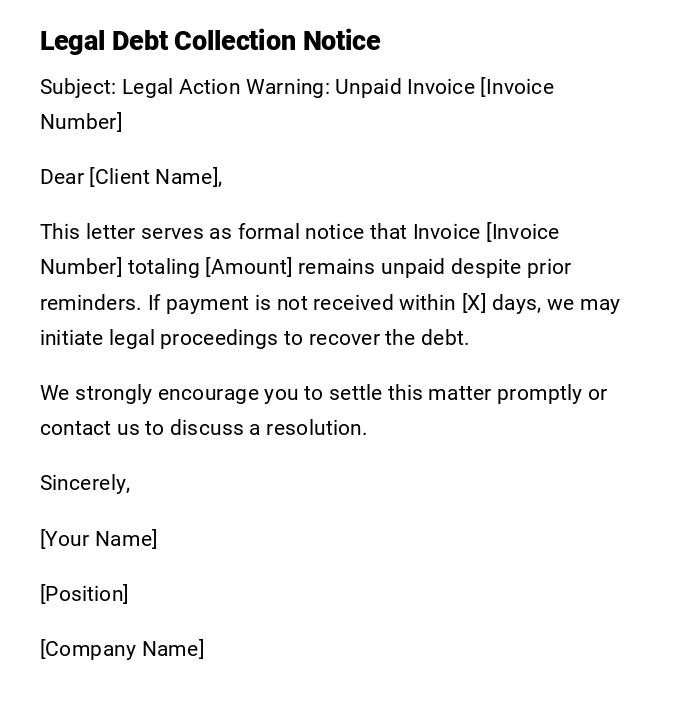

Legal Notice Debt Collection Letter

Subject: Legal Action Warning: Unpaid Invoice [Invoice Number]

Dear [Client Name],

This letter serves as formal notice that Invoice [Invoice Number] totaling [Amount] remains unpaid despite prior reminders. If payment is not received within [X] days, we may initiate legal proceedings to recover the debt.

We strongly encourage you to settle this matter promptly or contact us to discuss a resolution.

Sincerely,

[Your Name]

[Position]

[Company Name]

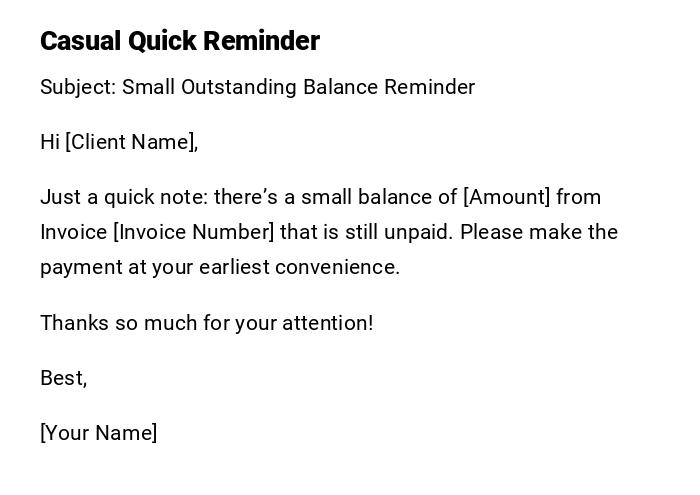

Casual Quick Reminder for Small Outstanding Amounts

Subject: Small Outstanding Balance Reminder

Hi [Client Name],

Just a quick note: there’s a small balance of [Amount] from Invoice [Invoice Number] that is still unpaid. Please make the payment at your earliest convenience.

Thanks so much for your attention!

Best,

[Your Name]

Creative and Persuasive Debt Collection Letter

Subject: Let’s Settle Invoice [Invoice Number] Easily

Dear [Client Name],

We value your business and want to keep our relationship strong. Invoice [Invoice Number] for [Amount] is still outstanding, and we’d like to resolve this quickly.

To make it easy, you can pay via [Payment Methods], or contact us if you need a payment plan. Settling this promptly helps avoid unnecessary fees and maintains a smooth partnership.

Thank you for your cooperation.

Warm regards,

[Your Name]

[Position]

[Company Name]

Preliminary Reminder for Newly Overdue Invoice

Subject: Reminder: Invoice [Invoice Number] Payment Due

Dear [Client Name],

Our records show that Invoice [Invoice Number] for [Amount] has passed its due date of [Due Date]. This is an early reminder in case the payment has been overlooked.

Please arrange payment at your earliest convenience. If you’ve already processed it, kindly disregard this message.

Thank you,

[Your Name]

What and why of Debt Collection Letters for Unpaid Invoices

Debt collection letters are formal communications sent to request payment for goods or services rendered that remain unpaid.

- Notify clients of outstanding invoices.

- Establish a record of collection attempts.

- Encourage timely payment while maintaining professional relationships.

- Serve as evidence if escalation to legal action becomes necessary.

Who should send Debt Collection Letters

- Accounts receivable departments of businesses.

- Business owners or managers responsible for billing.

- Collection agencies acting on behalf of clients.

- Legal representatives if formal legal notice is required.

Whom these letters should be addressed to

- Clients or customers with unpaid invoices.

- Business partners with delayed payments.

- Individuals with outstanding financial obligations.

- Debtors in both B2B and B2C contexts.

When to send Debt Collection Letters

- Shortly after the invoice due date has passed (preliminary reminder).

- After repeated attempts to contact the client have failed.

- Before initiating legal or formal collection procedures.

- At milestones such as 30, 60, or 90 days overdue.

How to write and send Debt Collection Letters

- Begin with a polite yet firm tone for early reminders; escalate tone for overdue and final notices.

- Include invoice number, date, amount, and payment due date.

- Specify payment methods and any late fees or consequences.

- Maintain professionalism and clarity.

- Choose the appropriate mode: email for quick reminders, printed letters for formal notices.

Requirements and Prerequisites

- Accurate invoice and client information.

- Payment history and records of prior communications.

- Company letterhead or email signature for credibility.

- Legal review if escalation to formal collection may be necessary.

Formatting and Style Guidelines

- Keep letters concise but detailed.

- Tone should match the stage: friendly for initial reminders, formal and firm for final notices.

- Include all essential details: invoice number, amount, due date, and payment options.

- Attach supporting documentation if necessary (copy of invoice, prior reminders).

- Maintain professional layout for print letters and clear formatting for emails.

After Sending / Follow-up

- Track responses and payment confirmation.

- Send subsequent reminders if payment is not received.

- Escalate to legal or collection agency if required.

- Document all communication for legal or accounting purposes.

Pros and Cons of Sending Debt Collection Letters

Pros:

- Encourages payment without immediate legal action.

- Provides clear documentation for accounting and legal purposes.

- Helps maintain business cash flow.

Cons:

- Risk of straining client relationships if too aggressive.

- Requires careful wording and monitoring of follow-up.

- Multiple letters may be time-consuming to manage.

Tricks and Tips for Effective Debt Collection Letters

- Start politely and escalate firmness gradually.

- Include clear payment instructions and due dates.

- Keep copies of all letters and emails.

- Consider including payment plan options for cooperation.

- Use templates for consistency across communications.

Common Mistakes to Avoid

- Using unclear or aggressive language early on.

- Failing to include invoice details and payment instructions.

- Ignoring follow-up procedures.

- Sending letters without proper authorization or company letterhead.

- Neglecting to track payments and responses.

Elements and Structure of Debt Collection Letters

- Subject line indicating invoice and payment request.

- Greeting addressing the client.

- Introduction referencing the unpaid invoice.

- Body detailing amount due, payment methods, and deadlines.

- Closing requesting payment and offering contact for queries.

- Signature and company information.

- Optional attachments: copy of invoice, prior reminders, legal notices.

Does it require attestation or authorization

- Typically sent by authorized staff in accounts or management.

- Final legal notice may require company director signature or notarization.

- Letters from collection agencies require proof of authorization to collect on behalf of the client.

How many letters to send for unpaid invoices

- Preliminary reminder: 1–2 letters shortly after due date.

- Follow-up reminder: 1–2 letters for ongoing overdue accounts.

- Final notice: 1 letter before escalation.

- Legal or collection letters as required depending on outstanding balance and response.

Compare and Contrast with Similar Letters

- Debt Collection Letter vs. Friendly Reminder: Friendly reminders are informal, early-stage; debt collection letters escalate in formality.

- Debt Collection Letter vs. Legal Notice: Legal notices involve formal legal language and may threaten litigation; collection letters aim to encourage voluntary payment first.

- Debt Collection Letter vs. Invoice: Invoice requests payment upfront; collection letter follows non-payment and serves as a reminder and warning.

Download Word Doc

Download Word Doc

Download PDF

Download PDF