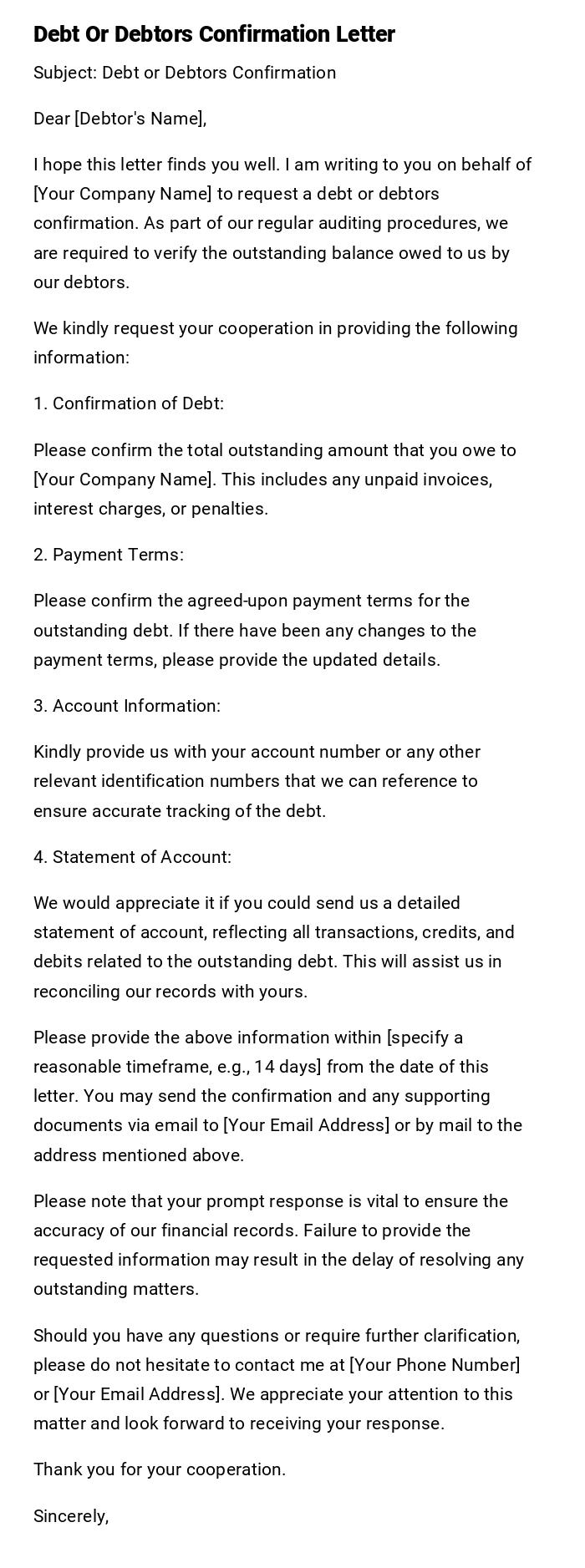

Debt Or Debtors Confirmation Letter

Subject: Debt or Debtors Confirmation

Dear [Debtor's Name],

I hope this letter finds you well. I am writing to you on behalf of [Your Company Name] to request a debt or debtors confirmation. As part of our regular auditing procedures, we are required to verify the outstanding balance owed to us by our debtors.

We kindly request your cooperation in providing the following information:

1. Confirmation of Debt:

Please confirm the total outstanding amount that you owe to [Your Company Name]. This includes any unpaid invoices, interest charges, or penalties.

2. Payment Terms:

Please confirm the agreed-upon payment terms for the outstanding debt. If there have been any changes to the payment terms, please provide the updated details.

3. Account Information:

Kindly provide us with your account number or any other relevant identification numbers that we can reference to ensure accurate tracking of the debt.

4. Statement of Account:

We would appreciate it if you could send us a detailed statement of account, reflecting all transactions, credits, and debits related to the outstanding debt. This will assist us in reconciling our records with yours.

Please provide the above information within [specify a reasonable timeframe, e.g., 14 days] from the date of this letter. You may send the confirmation and any supporting documents via email to [Your Email Address] or by mail to the address mentioned above.

Please note that your prompt response is vital to ensure the accuracy of our financial records. Failure to provide the requested information may result in the delay of resolving any outstanding matters.

Should you have any questions or require further clarification, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. We appreciate your attention to this matter and look forward to receiving your response.

Thank you for your cooperation.

Sincerely,

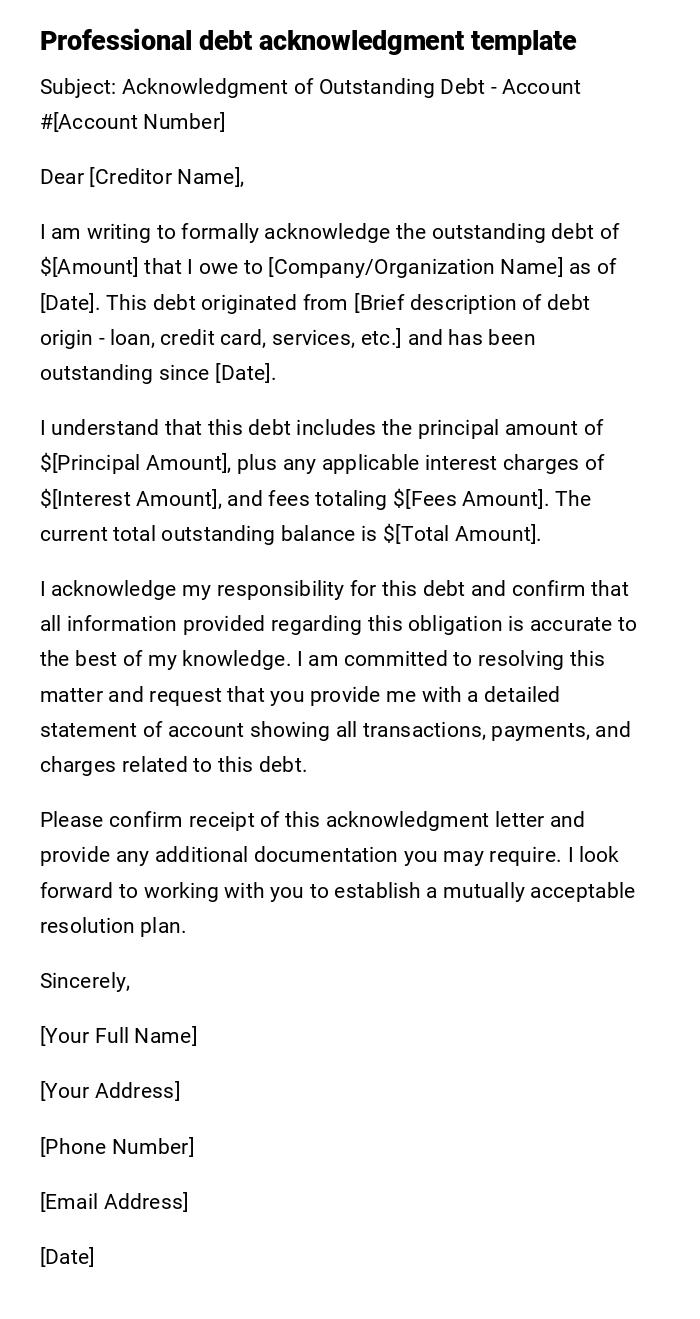

Formal Debt Acknowledgment Letter

Subject: Acknowledgment of Outstanding Debt - Account #[Account Number]

Dear [Creditor Name],

I am writing to formally acknowledge the outstanding debt of $[Amount] that I owe to [Company/Organization Name] as of [Date]. This debt originated from [Brief description of debt origin - loan, credit card, services, etc.] and has been outstanding since [Date].

I understand that this debt includes the principal amount of $[Principal Amount], plus any applicable interest charges of $[Interest Amount], and fees totaling $[Fees Amount]. The current total outstanding balance is $[Total Amount].

I acknowledge my responsibility for this debt and confirm that all information provided regarding this obligation is accurate to the best of my knowledge. I am committed to resolving this matter and request that you provide me with a detailed statement of account showing all transactions, payments, and charges related to this debt.

Please confirm receipt of this acknowledgment letter and provide any additional documentation you may require. I look forward to working with you to establish a mutually acceptable resolution plan.

Sincerely,

[Your Full Name]

[Your Address]

[Phone Number]

[Email Address]

[Date]

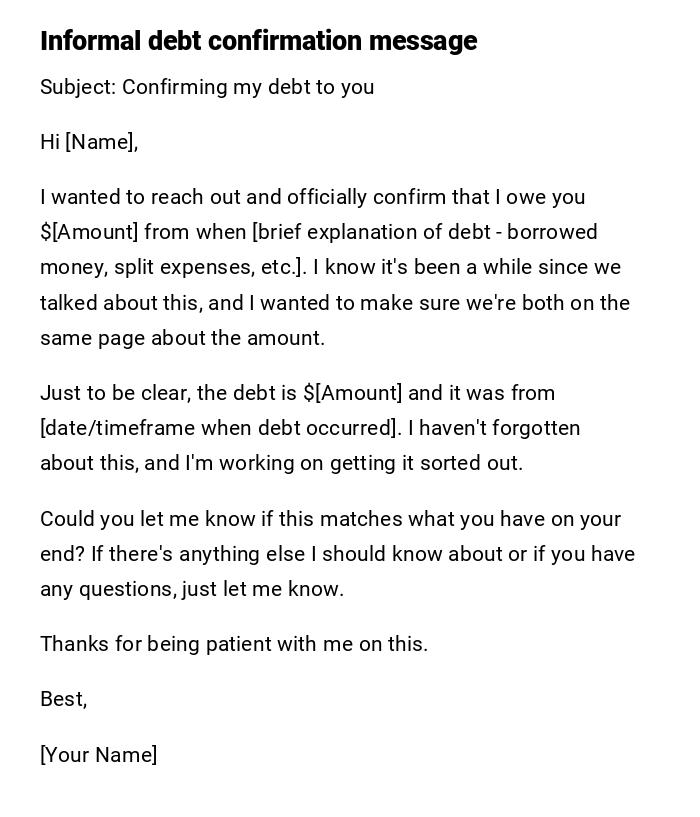

Casual Debt Confirmation Email

Subject: Confirming my debt to you

Hi [Name],

I wanted to reach out and officially confirm that I owe you $[Amount] from when [brief explanation of debt - borrowed money, split expenses, etc.]. I know it's been a while since we talked about this, and I wanted to make sure we're both on the same page about the amount.

Just to be clear, the debt is $[Amount] and it was from [date/timeframe when debt occurred]. I haven't forgotten about this, and I'm working on getting it sorted out.

Could you let me know if this matches what you have on your end? If there's anything else I should know about or if you have any questions, just let me know.

Thanks for being patient with me on this.

Best,

[Your Name]

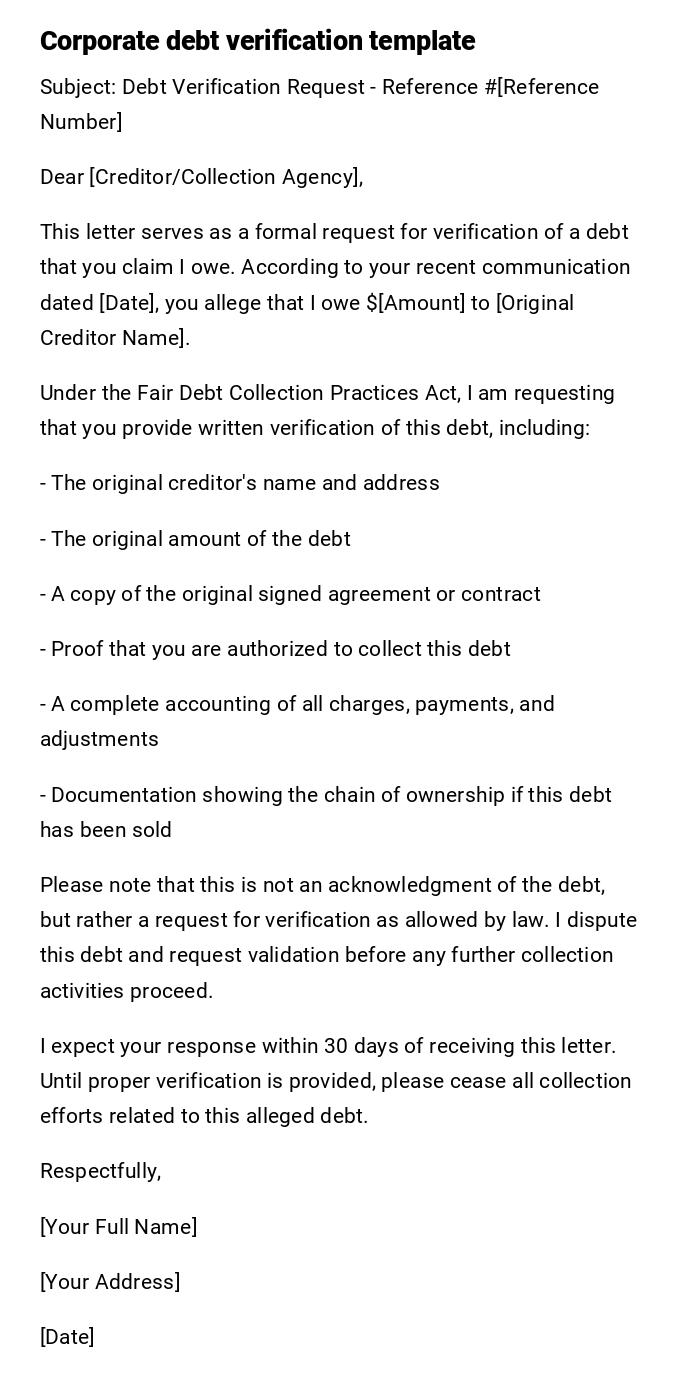

Business Debt Verification Letter

Subject: Debt Verification Request - Reference #[Reference Number]

Dear [Creditor/Collection Agency],

This letter serves as a formal request for verification of a debt that you claim I owe. According to your recent communication dated [Date], you allege that I owe $[Amount] to [Original Creditor Name].

Under the Fair Debt Collection Practices Act, I am requesting that you provide written verification of this debt, including:

- The original creditor's name and address

- The original amount of the debt

- A copy of the original signed agreement or contract

- Proof that you are authorized to collect this debt

- A complete accounting of all charges, payments, and adjustments

- Documentation showing the chain of ownership if this debt has been sold

Please note that this is not an acknowledgment of the debt, but rather a request for verification as allowed by law. I dispute this debt and request validation before any further collection activities proceed.

I expect your response within 30 days of receiving this letter. Until proper verification is provided, please cease all collection efforts related to this alleged debt.

Respectfully,

[Your Full Name]

[Your Address]

[Date]

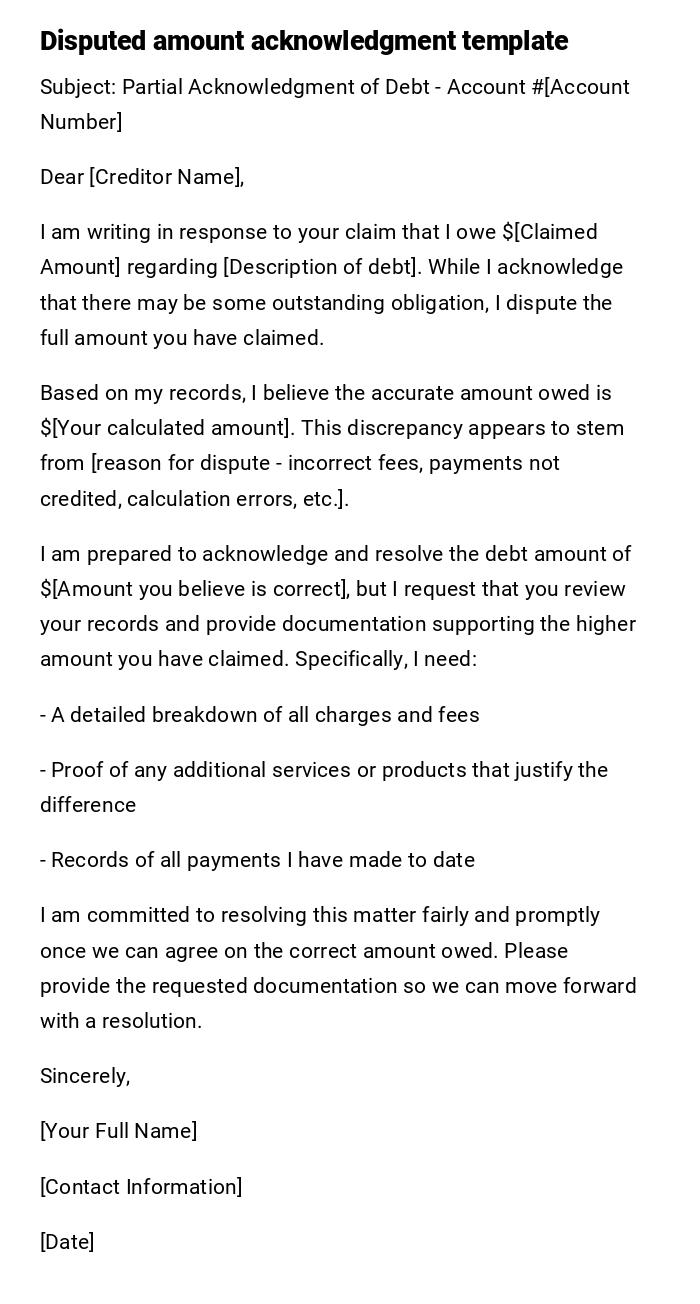

Partial Debt Acknowledgment Letter

Subject: Partial Acknowledgment of Debt - Account #[Account Number]

Dear [Creditor Name],

I am writing in response to your claim that I owe $[Claimed Amount] regarding [Description of debt]. While I acknowledge that there may be some outstanding obligation, I dispute the full amount you have claimed.

Based on my records, I believe the accurate amount owed is $[Your calculated amount]. This discrepancy appears to stem from [reason for dispute - incorrect fees, payments not credited, calculation errors, etc.].

I am prepared to acknowledge and resolve the debt amount of $[Amount you believe is correct], but I request that you review your records and provide documentation supporting the higher amount you have claimed. Specifically, I need:

- A detailed breakdown of all charges and fees

- Proof of any additional services or products that justify the difference

- Records of all payments I have made to date

I am committed to resolving this matter fairly and promptly once we can agree on the correct amount owed. Please provide the requested documentation so we can move forward with a resolution.

Sincerely,

[Your Full Name]

[Contact Information]

[Date]

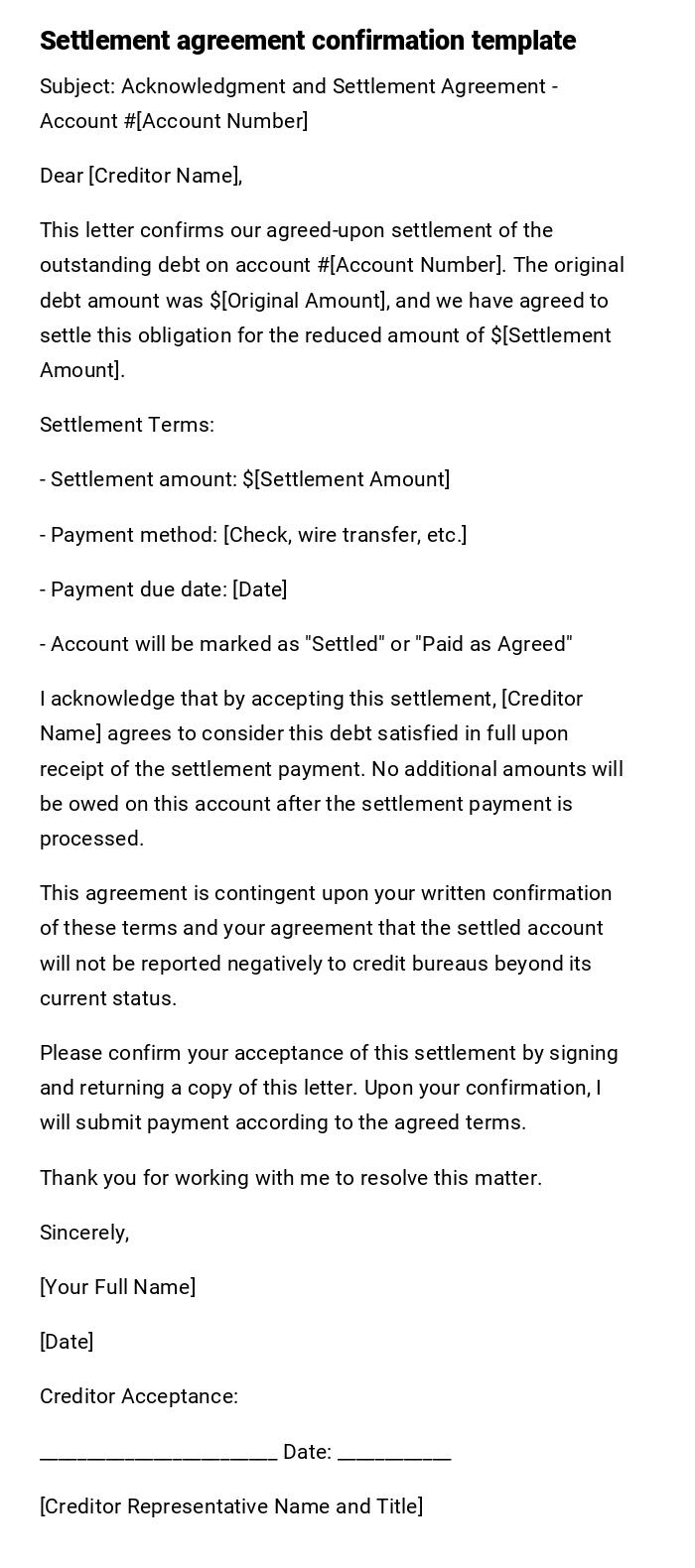

Debt Settlement Acknowledgment Letter

Subject: Acknowledgment and Settlement Agreement - Account #[Account Number]

Dear [Creditor Name],

This letter confirms our agreed-upon settlement of the outstanding debt on account #[Account Number]. The original debt amount was $[Original Amount], and we have agreed to settle this obligation for the reduced amount of $[Settlement Amount].

Settlement Terms:

- Settlement amount: $[Settlement Amount]

- Payment method: [Check, wire transfer, etc.]

- Payment due date: [Date]

- Account will be marked as "Settled" or "Paid as Agreed"

I acknowledge that by accepting this settlement, [Creditor Name] agrees to consider this debt satisfied in full upon receipt of the settlement payment. No additional amounts will be owed on this account after the settlement payment is processed.

This agreement is contingent upon your written confirmation of these terms and your agreement that the settled account will not be reported negatively to credit bureaus beyond its current status.

Please confirm your acceptance of this settlement by signing and returning a copy of this letter. Upon your confirmation, I will submit payment according to the agreed terms.

Thank you for working with me to resolve this matter.

Sincerely,

[Your Full Name]

[Date]

Creditor Acceptance:

_________________________ Date: ____________

[Creditor Representative Name and Title]

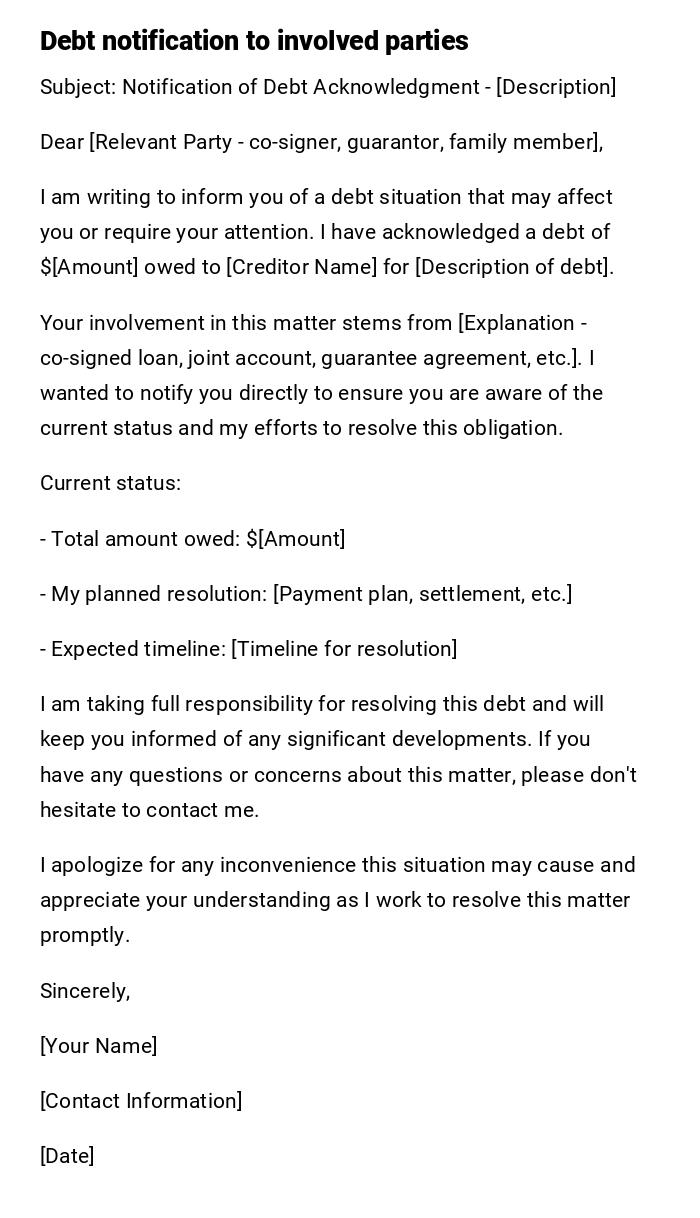

Third-Party Debt Notification Letter

Subject: Notification of Debt Acknowledgment - [Description]

Dear [Relevant Party - co-signer, guarantor, family member],

I am writing to inform you of a debt situation that may affect you or require your attention. I have acknowledged a debt of $[Amount] owed to [Creditor Name] for [Description of debt].

Your involvement in this matter stems from [Explanation - co-signed loan, joint account, guarantee agreement, etc.]. I wanted to notify you directly to ensure you are aware of the current status and my efforts to resolve this obligation.

Current status:

- Total amount owed: $[Amount]

- My planned resolution: [Payment plan, settlement, etc.]

- Expected timeline: [Timeline for resolution]

I am taking full responsibility for resolving this debt and will keep you informed of any significant developments. If you have any questions or concerns about this matter, please don't hesitate to contact me.

I apologize for any inconvenience this situation may cause and appreciate your understanding as I work to resolve this matter promptly.

Sincerely,

[Your Name]

[Contact Information]

[Date]

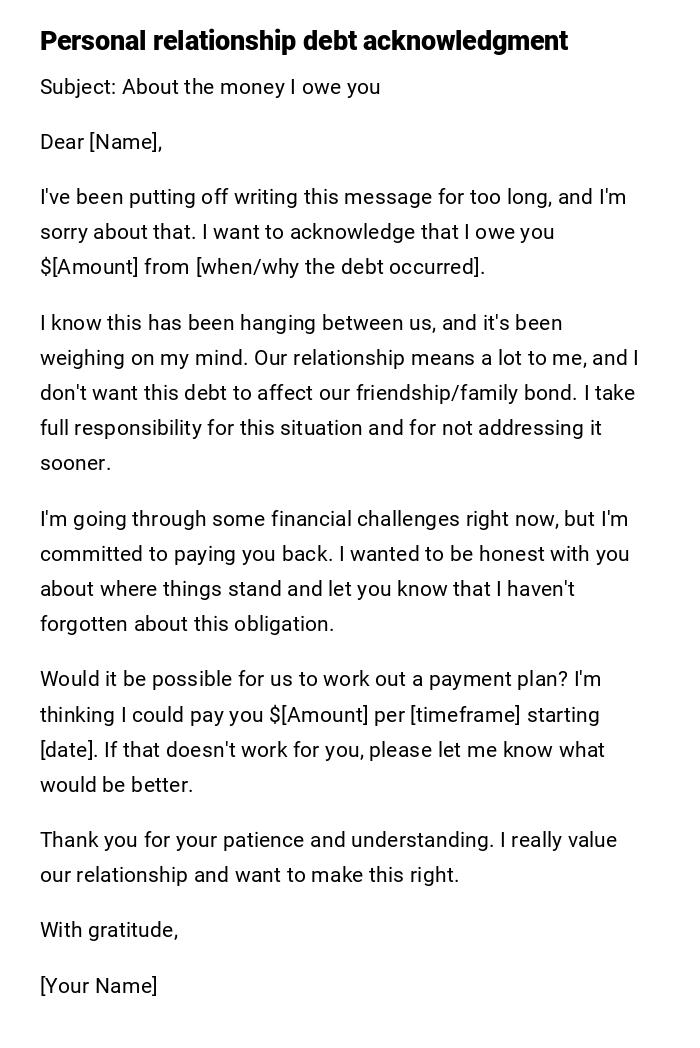

Heartfelt Personal Debt Acknowledgment Message

Subject: About the money I owe you

Dear [Name],

I've been putting off writing this message for too long, and I'm sorry about that. I want to acknowledge that I owe you $[Amount] from [when/why the debt occurred].

I know this has been hanging between us, and it's been weighing on my mind. Our relationship means a lot to me, and I don't want this debt to affect our friendship/family bond. I take full responsibility for this situation and for not addressing it sooner.

I'm going through some financial challenges right now, but I'm committed to paying you back. I wanted to be honest with you about where things stand and let you know that I haven't forgotten about this obligation.

Would it be possible for us to work out a payment plan? I'm thinking I could pay you $[Amount] per [timeframe] starting [date]. If that doesn't work for you, please let me know what would be better.

Thank you for your patience and understanding. I really value our relationship and want to make this right.

With gratitude,

[Your Name]

What is a Debt or Debtor Confirmation Letter and Why is it Needed

A debt or debtor confirmation letter is a formal written acknowledgment that establishes the existence, amount, and terms of a financial obligation between a debtor and creditor. These letters serve multiple critical purposes including legal documentation, dispute resolution, settlement negotiations, and relationship preservation. They provide clear written evidence of debt acknowledgment, help prevent misunderstandings about amounts owed, and can be essential for legal proceedings or credit reporting accuracy.

When to Send a Debt Confirmation Letter

- When disputing the amount of a claimed debt

- After reaching a settlement agreement with a creditor

- Upon request from a collection agency for debt verification

- When acknowledging a personal debt to preserve relationships

- Before entering into a payment plan arrangement

- After discovering errors in account statements or credit reports

- When notifying co-signers or guarantors of debt status

- As part of bankruptcy proceedings or financial restructuring

- When transferring debt responsibility between parties

- Following legal advice to document debt acknowledgment

Who Should Send These Letters

- Individual debtors acknowledging personal obligations

- Business owners confirming corporate debts

- Co-signers or guarantors clarifying their liability

- Estate executors handling deceased person's debts

- Divorce parties acknowledging debt division

- Students confirming educational loan obligations

- Family members formalizing informal loans

- Tenants acknowledging rental debt or damages

- Credit cardholders disputing charges or balances

- Borrowers working with debt consolidation services

Who Should Receive These Letters

- Original creditors or lenders

- Collection agencies and debt buyers

- Credit reporting bureaus

- Family members or friends who are owed money

- Co-signers, guarantors, or joint account holders

- Legal representatives or attorneys

- Court systems during legal proceedings

- Bankruptcy trustees or administrators

- Financial counselors or debt management companies

- Insurance companies for liability claims

Requirements and Prerequisites Before Sending

- Gather all relevant documentation including original agreements, statements, and payment records

- Verify the accuracy of debt amounts and creditor information

- Review applicable laws such as Fair Debt Collection Practices Act

- Consult with legal or financial advisors if substantial amounts are involved

- Ensure you have correct contact information for recipients

- Determine if the debt is within the statute of limitations

- Check if previous payments or settlements affect the current balance

- Understand potential credit reporting implications

- Consider tax consequences of debt settlement or forgiveness

- Prepare supporting documentation to attach to the letter

How to Write and Send These Letters

Start by clearly identifying the debt including account numbers, dates, and amounts. State your purpose explicitly whether acknowledging, disputing, or seeking verification. Provide specific details about what you're acknowledging or questioning. Request necessary documentation or confirmation from the recipient. Set clear expectations for next steps or timeline for resolution. Use professional language even in casual relationships. Keep copies of all correspondence for your records. Send via methods that provide delivery confirmation when dealing with significant amounts. Follow up appropriately based on the response received.

Formatting Guidelines and Best Practices

Keep letters concise but comprehensive, typically 1-2 pages maximum. Use professional business letter format for formal creditors and casual email format for personal relationships. Include all relevant account numbers, reference numbers, and dates. State facts clearly without unnecessary emotional language. Request specific actions or responses with reasonable timeframes. Always date your correspondence and keep copies. Use certified mail for important formal letters to creditors or collection agencies. Maintain respectful tone regardless of circumstances. Include your current contact information for responses.

After Sending - Follow-up Actions

Monitor for responses within reasonable timeframes (typically 30 days for formal debt verification requests). Keep detailed records of all communications and responses received. Follow through on any commitments made in your letter such as payment dates or additional documentation. If disputing debts, monitor credit reports for updates or corrections. Prepare for potential negotiation or legal proceedings based on responses. Update relevant parties such as co-signers about developments. Consider escalating to consumer protection agencies if creditors fail to respond appropriately. Maintain organized files of all debt-related correspondence for future reference.

Common Mistakes to Avoid

Never acknowledge debts you don't actually owe or amounts that are incorrect. Avoid admitting to more than what you actually know or remember. Don't ignore the statute of limitations which may affect your legal obligations. Avoid emotional language or blame that could complicate negotiations. Don't send letters without keeping copies or proof of delivery. Never provide more personal financial information than necessary. Avoid making payment commitments you cannot keep. Don't communicate with collection agencies verbally without written follow-up. Avoid signing anything without understanding full implications. Never ignore legitimate debt verification requests as this may restart collection activities.

Advantages and Disadvantages of Sending These Letters

Advantages: Provides clear written record of your position, can help resolve disputes before they escalate, demonstrates good faith effort to address obligations, may prevent negative credit reporting, can preserve personal relationships, establishes timeline for resolution, and protects your legal rights under consumer protection laws.

Disadvantages: May restart statute of limitations on old debts, could be used as evidence of debt acknowledgment in legal proceedings, might encourage more aggressive collection efforts, can be time-consuming to prepare properly, and may not result in desired outcomes from uncooperative creditors.

Essential Elements and Structure

Every debt confirmation letter should include: clear subject line identifying the debt, accurate creditor and debtor information, specific account or reference numbers, exact debt amounts with breakdowns if disputing, dates of original debt and current correspondence, specific purpose of the letter, requested actions from recipient, timeline for response or resolution, your current contact information, professional closing, and your signature with date. Attach relevant supporting documentation when appropriate and send via trackable delivery method for important formal communications.

Download Word Doc

Download Word Doc

Download PDF

Download PDF