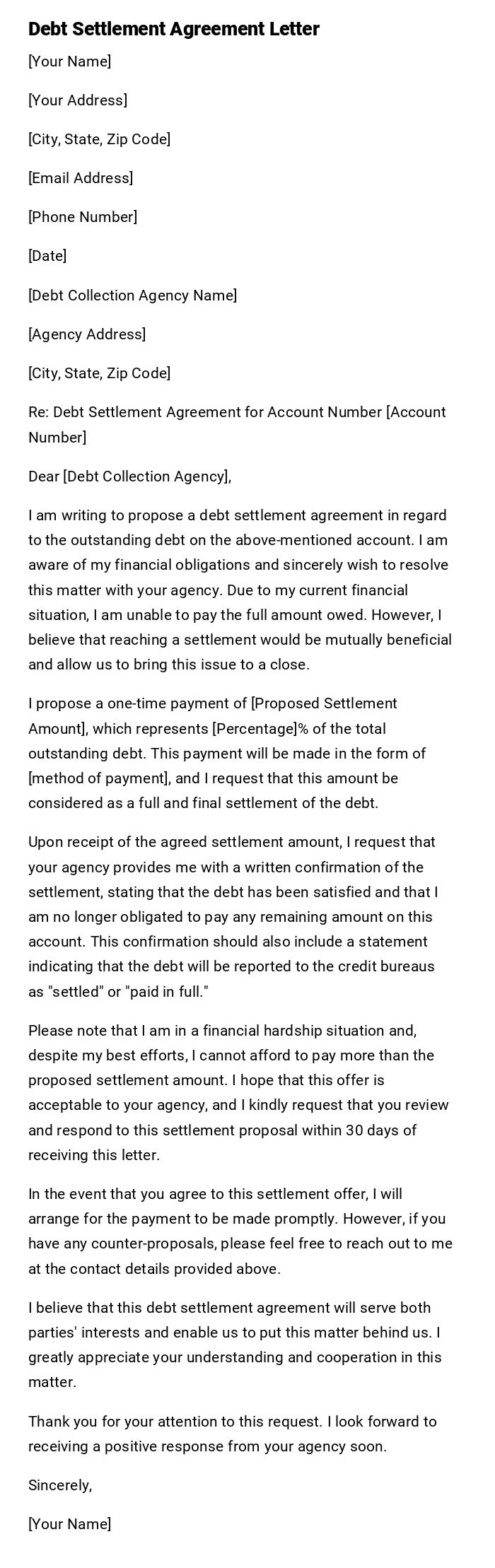

Debt Settlement Agreement Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Debt Collection Agency Name]

[Agency Address]

[City, State, Zip Code]

Re: Debt Settlement Agreement for Account Number [Account Number]

Dear [Debt Collection Agency],

I am writing to propose a debt settlement agreement in regard to the outstanding debt on the above-mentioned account. I am aware of my financial obligations and sincerely wish to resolve this matter with your agency. Due to my current financial situation, I am unable to pay the full amount owed. However, I believe that reaching a settlement would be mutually beneficial and allow us to bring this issue to a close.

I propose a one-time payment of [Proposed Settlement Amount], which represents [Percentage]% of the total outstanding debt. This payment will be made in the form of [method of payment], and I request that this amount be considered as a full and final settlement of the debt.

Upon receipt of the agreed settlement amount, I request that your agency provides me with a written confirmation of the settlement, stating that the debt has been satisfied and that I am no longer obligated to pay any remaining amount on this account. This confirmation should also include a statement indicating that the debt will be reported to the credit bureaus as "settled" or "paid in full."

Please note that I am in a financial hardship situation and, despite my best efforts, I cannot afford to pay more than the proposed settlement amount. I hope that this offer is acceptable to your agency, and I kindly request that you review and respond to this settlement proposal within 30 days of receiving this letter.

In the event that you agree to this settlement offer, I will arrange for the payment to be made promptly. However, if you have any counter-proposals, please feel free to reach out to me at the contact details provided above.

I believe that this debt settlement agreement will serve both parties' interests and enable us to put this matter behind us. I greatly appreciate your understanding and cooperation in this matter.

Thank you for your attention to this request. I look forward to receiving a positive response from your agency soon.

Sincerely,

[Your Name]

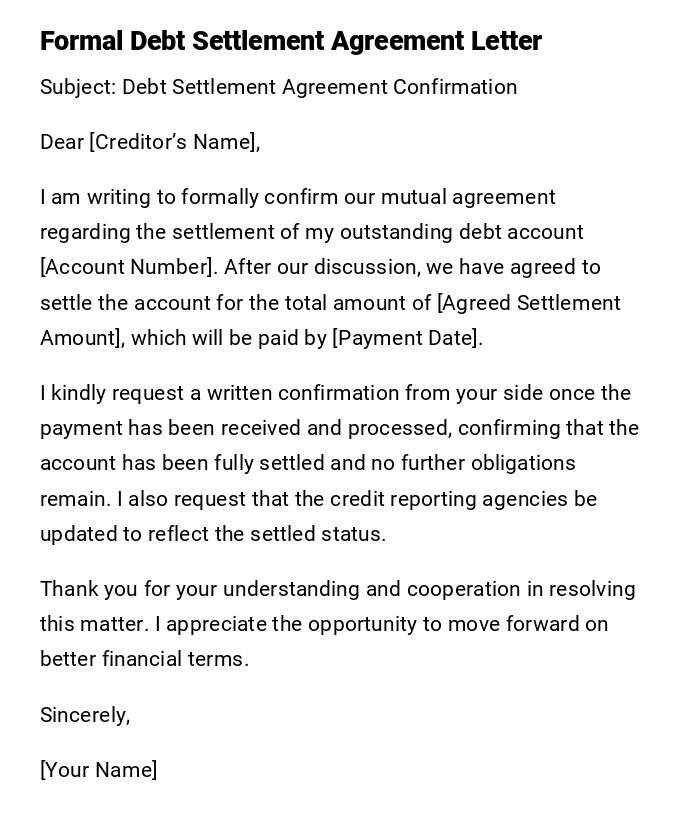

Formal Debt Settlement Agreement Letter

Subject: Debt Settlement Agreement Confirmation

Dear [Creditor’s Name],

I am writing to formally confirm our mutual agreement regarding the settlement of my outstanding debt account [Account Number]. After our discussion, we have agreed to settle the account for the total amount of [Agreed Settlement Amount], which will be paid by [Payment Date].

I kindly request a written confirmation from your side once the payment has been received and processed, confirming that the account has been fully settled and no further obligations remain. I also request that the credit reporting agencies be updated to reflect the settled status.

Thank you for your understanding and cooperation in resolving this matter. I appreciate the opportunity to move forward on better financial terms.

Sincerely,

[Your Name]

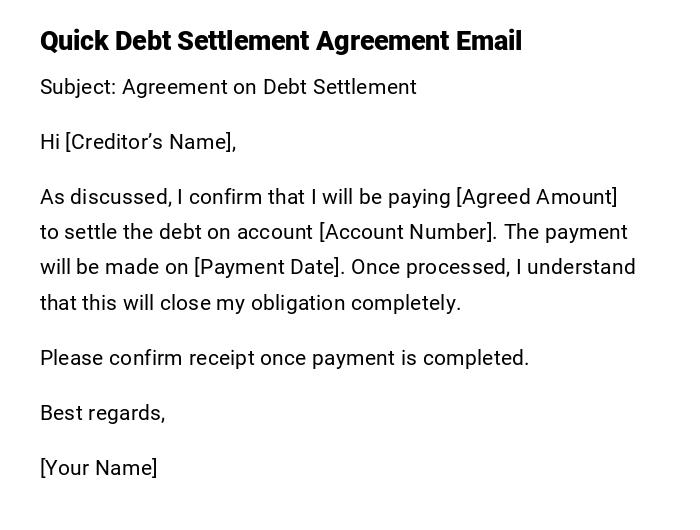

Quick Debt Settlement Agreement Email

Subject: Agreement on Debt Settlement

Hi [Creditor’s Name],

As discussed, I confirm that I will be paying [Agreed Amount] to settle the debt on account [Account Number]. The payment will be made on [Payment Date]. Once processed, I understand that this will close my obligation completely.

Please confirm receipt once payment is completed.

Best regards,

[Your Name]

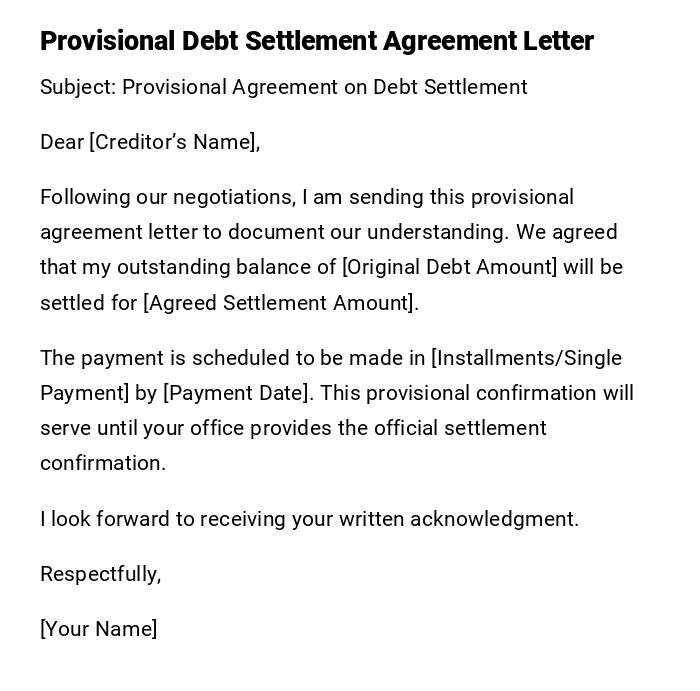

Provisional Debt Settlement Agreement Letter

Subject: Provisional Agreement on Debt Settlement

Dear [Creditor’s Name],

Following our negotiations, I am sending this provisional agreement letter to document our understanding. We agreed that my outstanding balance of [Original Debt Amount] will be settled for [Agreed Settlement Amount].

The payment is scheduled to be made in [Installments/Single Payment] by [Payment Date]. This provisional confirmation will serve until your office provides the official settlement confirmation.

I look forward to receiving your written acknowledgment.

Respectfully,

[Your Name]

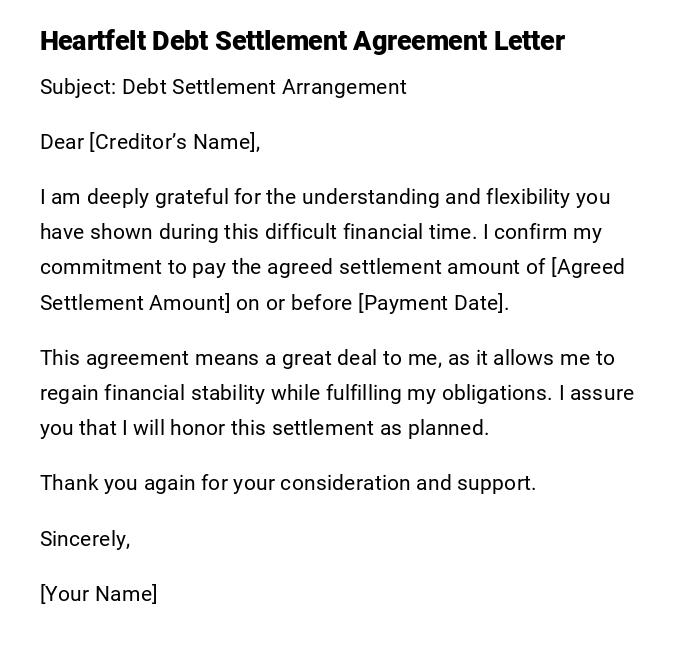

Heartfelt Debt Settlement Agreement Letter

Subject: Debt Settlement Arrangement

Dear [Creditor’s Name],

I am deeply grateful for the understanding and flexibility you have shown during this difficult financial time. I confirm my commitment to pay the agreed settlement amount of [Agreed Settlement Amount] on or before [Payment Date].

This agreement means a great deal to me, as it allows me to regain financial stability while fulfilling my obligations. I assure you that I will honor this settlement as planned.

Thank you again for your consideration and support.

Sincerely,

[Your Name]

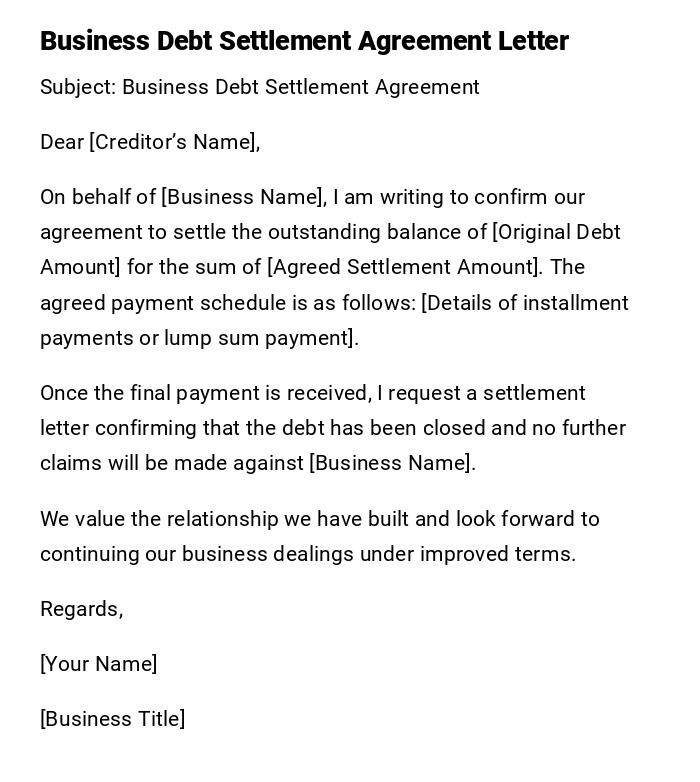

Business Debt Settlement Agreement Letter

Subject: Business Debt Settlement Agreement

Dear [Creditor’s Name],

On behalf of [Business Name], I am writing to confirm our agreement to settle the outstanding balance of [Original Debt Amount] for the sum of [Agreed Settlement Amount]. The agreed payment schedule is as follows: [Details of installment payments or lump sum payment].

Once the final payment is received, I request a settlement letter confirming that the debt has been closed and no further claims will be made against [Business Name].

We value the relationship we have built and look forward to continuing our business dealings under improved terms.

Regards,

[Your Name]

[Business Title]

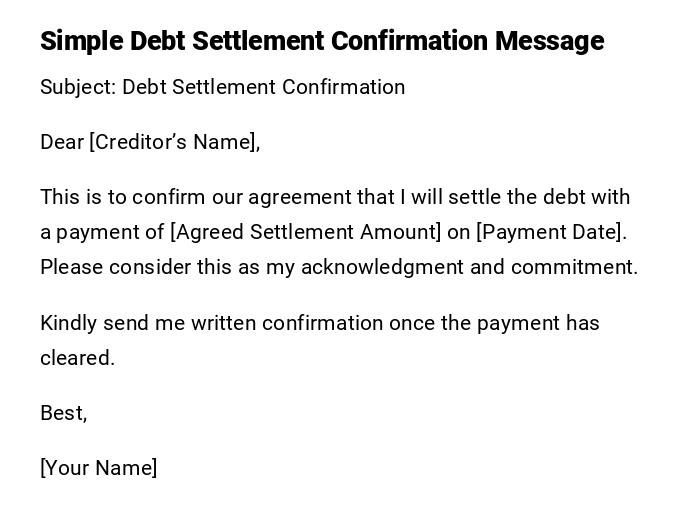

Simple Debt Settlement Confirmation Message

Subject: Debt Settlement Confirmation

Dear [Creditor’s Name],

This is to confirm our agreement that I will settle the debt with a payment of [Agreed Settlement Amount] on [Payment Date]. Please consider this as my acknowledgment and commitment.

Kindly send me written confirmation once the payment has cleared.

Best,

[Your Name]

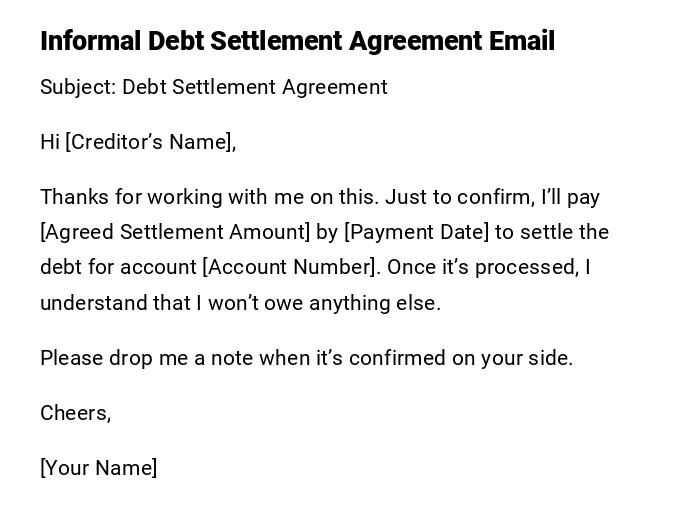

Informal Debt Settlement Agreement Email

Subject: Debt Settlement Agreement

Hi [Creditor’s Name],

Thanks for working with me on this. Just to confirm, I’ll pay [Agreed Settlement Amount] by [Payment Date] to settle the debt for account [Account Number]. Once it’s processed, I understand that I won’t owe anything else.

Please drop me a note when it’s confirmed on your side.

Cheers,

[Your Name]

What is a debt settlement agreement letter and why do you need it?

A debt settlement agreement letter is a formal or informal document confirming the terms under which a debt will be settled for less than the full balance owed.

You need it because:

- It provides written proof of the agreed settlement terms.

- It protects both the debtor and the creditor from future disputes.

- It ensures that once payment is made, no additional claims can be enforced.

- It is often required to update credit records accurately.

Who should send a debt settlement agreement letter?

- Individuals who owe personal debts to creditors or collection agencies.

- Businesses that need to settle outstanding vendor or supplier debts.

- Legal representatives acting on behalf of a debtor.

- Debt settlement companies managing the process on behalf of clients.

When should you write and send this letter?

Scenarios include:

- After negotiating a reduced payoff with a creditor.

- When a lump-sum settlement has been agreed upon.

- Before making the first payment under the settlement plan.

- After reaching a verbal agreement, to put the terms in writing.

- If a creditor requires documentation before closing an account.

How to write and send a debt settlement agreement letter

Steps:

- Start with a clear subject line referencing the settlement.

- State the account number and amount owed.

- Outline the agreed settlement amount and payment terms.

- Request written confirmation once the payment is received.

- Keep the tone professional, even if informal communication is acceptable.

- Send via email for speed or by certified mail for legal backup.

Requirements and prerequisites before writing the letter

- Finalize the settlement terms with the creditor.

- Confirm the payment amount and due dates.

- Ensure you have funds available for the agreed payment.

- Gather account numbers and correspondence references.

- Be prepared to keep a copy for your records.

Formatting guidelines for debt settlement agreement letters

- Keep it concise but thorough.

- Use a formal tone when addressing financial institutions.

- Use informal or quick wording only with trusted creditors.

- Mention account numbers, amounts, and dates.

- Prefer written letters for legal records, but emails are valid for informal confirmation.

After sending a debt settlement agreement letter: next steps

- Wait for written acknowledgment from the creditor.

- Ensure your payment is made exactly as agreed.

- Monitor your credit report to confirm updates.

- Keep a copy of the letter and payment receipt in your records.

- Follow up if you do not receive confirmation within a reasonable timeframe.

Common mistakes to avoid in debt settlement agreement letters

- Failing to specify the exact settlement amount.

- Not including the payment due date.

- Assuming a verbal agreement is enough.

- Forgetting to request written confirmation.

- Using an overly casual tone in formal financial matters.

Tricks and tips for writing a successful debt settlement agreement letter

- Always negotiate in writing for a stronger record.

- Be polite and professional; creditors respond better to respect.

- Keep the letter short to avoid confusion.

- Ask creditors to confirm that the debt will be marked as “Settled” on your credit report.

- Send letters by certified mail if the settlement is large.

Compare and contrast: debt settlement letters vs. debt forgiveness letters

- Debt settlement letters confirm that a reduced payment will close the account.

- Debt forgiveness letters indicate the creditor has waived the balance entirely.

- Settlement requires payment; forgiveness often does not.

- Both are important legal records but used in different financial contexts.

Download Word Doc

Download Word Doc

Download PDF

Download PDF