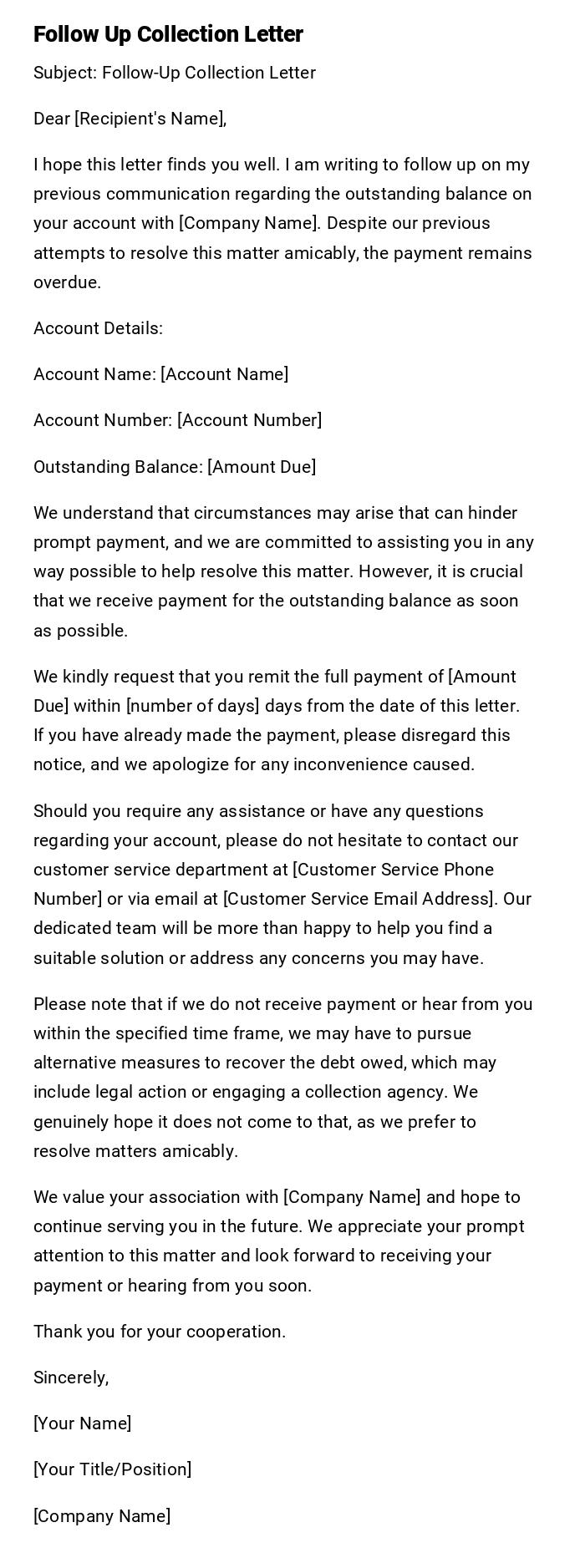

Follow Up Collection Letter

Subject: Follow-Up Collection Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to follow up on my previous communication regarding the outstanding balance on your account with [Company Name]. Despite our previous attempts to resolve this matter amicably, the payment remains overdue.

Account Details:

Account Name: [Account Name]

Account Number: [Account Number]

Outstanding Balance: [Amount Due]

We understand that circumstances may arise that can hinder prompt payment, and we are committed to assisting you in any way possible to help resolve this matter. However, it is crucial that we receive payment for the outstanding balance as soon as possible.

We kindly request that you remit the full payment of [Amount Due] within [number of days] days from the date of this letter. If you have already made the payment, please disregard this notice, and we apologize for any inconvenience caused.

Should you require any assistance or have any questions regarding your account, please do not hesitate to contact our customer service department at [Customer Service Phone Number] or via email at [Customer Service Email Address]. Our dedicated team will be more than happy to help you find a suitable solution or address any concerns you may have.

Please note that if we do not receive payment or hear from you within the specified time frame, we may have to pursue alternative measures to recover the debt owed, which may include legal action or engaging a collection agency. We genuinely hope it does not come to that, as we prefer to resolve matters amicably.

We value your association with [Company Name] and hope to continue serving you in the future. We appreciate your prompt attention to this matter and look forward to receiving your payment or hearing from you soon.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Your Title/Position]

[Company Name]

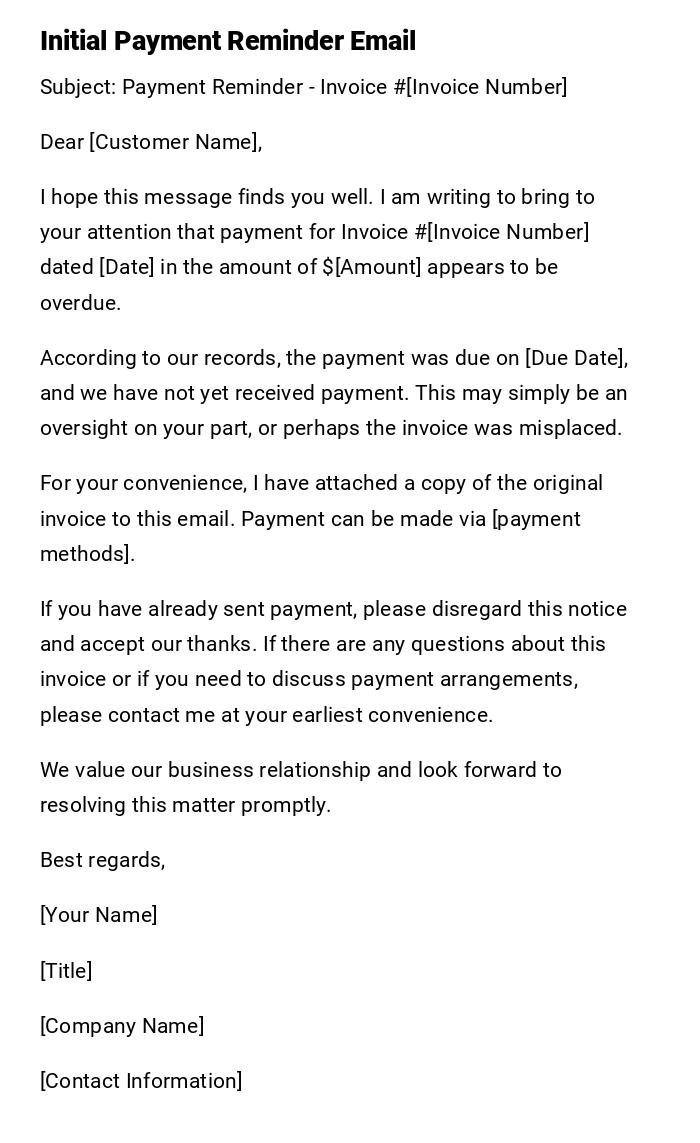

First Payment Reminder - Professional

Subject: Payment Reminder - Invoice #[Invoice Number]

Dear [Customer Name],

I hope this message finds you well. I am writing to bring to your attention that payment for Invoice #[Invoice Number] dated [Date] in the amount of $[Amount] appears to be overdue.

According to our records, the payment was due on [Due Date], and we have not yet received payment. This may simply be an oversight on your part, or perhaps the invoice was misplaced.

For your convenience, I have attached a copy of the original invoice to this email. Payment can be made via [payment methods].

If you have already sent payment, please disregard this notice and accept our thanks. If there are any questions about this invoice or if you need to discuss payment arrangements, please contact me at your earliest convenience.

We value our business relationship and look forward to resolving this matter promptly.

Best regards,

[Your Name]

[Title]

[Company Name]

[Contact Information]

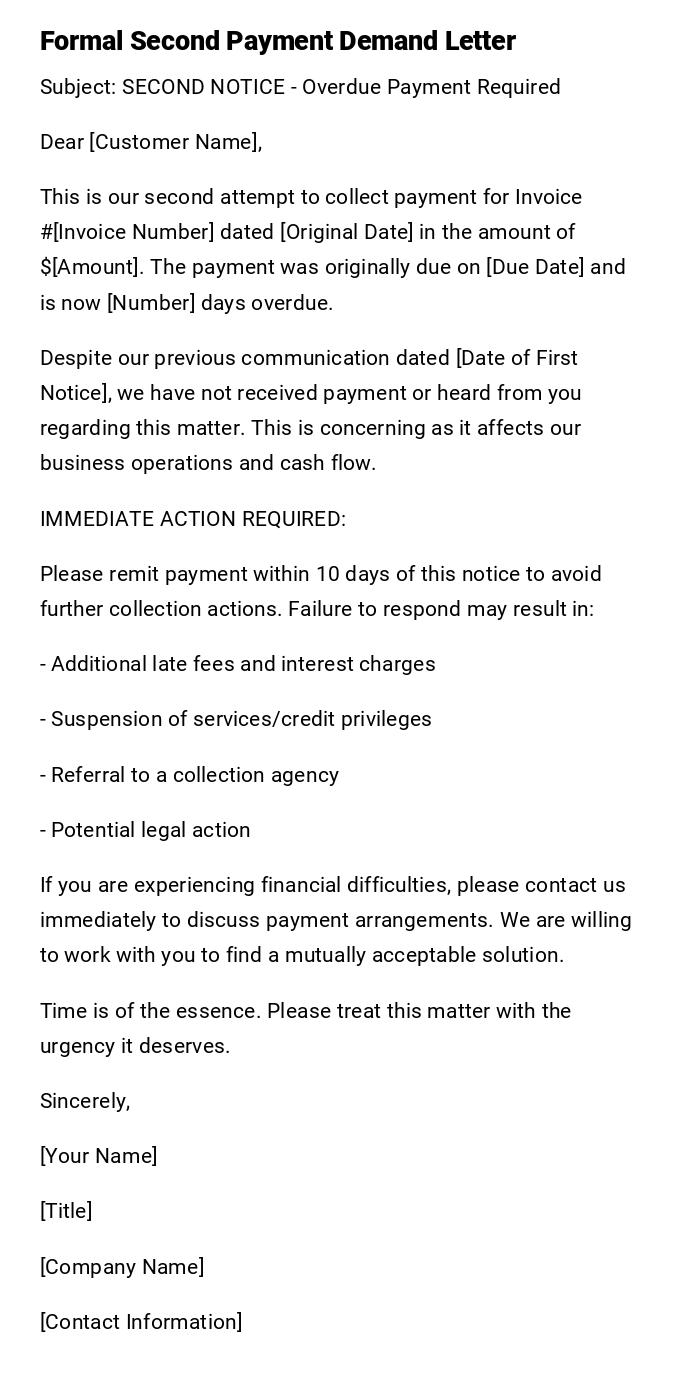

Second Notice - Formal Warning

Subject: SECOND NOTICE - Overdue Payment Required

Dear [Customer Name],

This is our second attempt to collect payment for Invoice #[Invoice Number] dated [Original Date] in the amount of $[Amount]. The payment was originally due on [Due Date] and is now [Number] days overdue.

Despite our previous communication dated [Date of First Notice], we have not received payment or heard from you regarding this matter. This is concerning as it affects our business operations and cash flow.

IMMEDIATE ACTION REQUIRED:

Please remit payment within 10 days of this notice to avoid further collection actions. Failure to respond may result in:

- Additional late fees and interest charges

- Suspension of services/credit privileges

- Referral to a collection agency

- Potential legal action

If you are experiencing financial difficulties, please contact us immediately to discuss payment arrangements. We are willing to work with you to find a mutually acceptable solution.

Time is of the essence. Please treat this matter with the urgency it deserves.

Sincerely,

[Your Name]

[Title]

[Company Name]

[Contact Information]

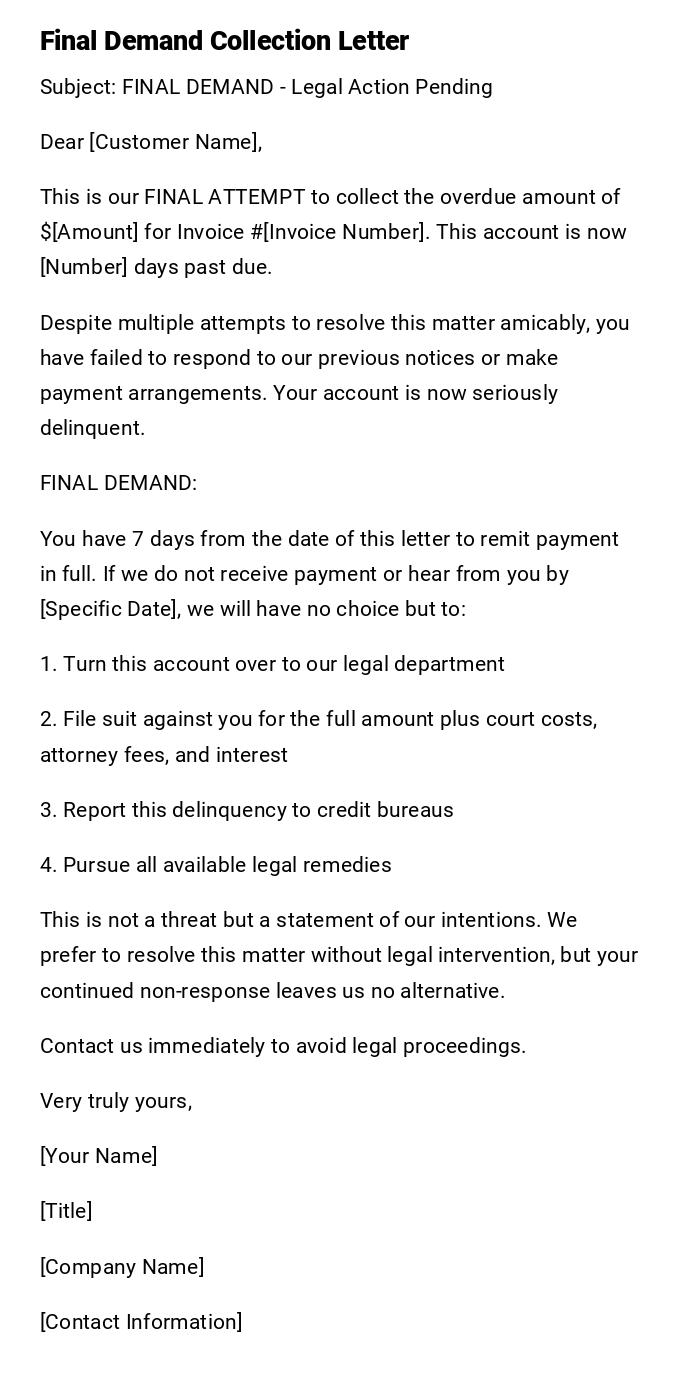

Final Demand Before Legal Action - Serious

Subject: FINAL DEMAND - Legal Action Pending

Dear [Customer Name],

This is our FINAL ATTEMPT to collect the overdue amount of $[Amount] for Invoice #[Invoice Number]. This account is now [Number] days past due.

Despite multiple attempts to resolve this matter amicably, you have failed to respond to our previous notices or make payment arrangements. Your account is now seriously delinquent.

FINAL DEMAND:

You have 7 days from the date of this letter to remit payment in full. If we do not receive payment or hear from you by [Specific Date], we will have no choice but to:

1. Turn this account over to our legal department

2. File suit against you for the full amount plus court costs, attorney fees, and interest

3. Report this delinquency to credit bureaus

4. Pursue all available legal remedies

This is not a threat but a statement of our intentions. We prefer to resolve this matter without legal intervention, but your continued non-response leaves us no alternative.

Contact us immediately to avoid legal proceedings.

Very truly yours,

[Your Name]

[Title]

[Company Name]

[Contact Information]

Medical/Healthcare Collection - Professional

Subject: Patient Account Balance - Payment Required

Dear [Patient Name],

We hope you are feeling better following your recent treatment at our facility. We are writing regarding your patient account balance of $[Amount] for services rendered on [Date of Service].

Our records show that insurance has processed their portion of the claim, leaving a patient responsibility balance. This amount has been outstanding for [Number] days.

We understand that medical expenses can be unexpected and sometimes difficult to manage. If you need to discuss payment options or have questions about your bill, please contact our billing department at [Phone Number].

Payment options available:

- Online payment at [Website]

- Phone payment at [Phone Number]

- Mail payment to [Address]

- Payment plan arrangements

If you believe this billing is in error or if you have insurance information we may not have on file, please contact us immediately so we can review your account.

We appreciate your prompt attention to this matter and thank you for choosing our healthcare services.

Sincerely,

[Billing Department]

[Healthcare Facility Name]

[Contact Information]

Utility/Service Collection - Official

Subject: IMPORTANT: Service Disconnection Notice - Account #[Account Number]

Dear [Customer Name],

Your utility account #[Account Number] for service at [Service Address] has an outstanding balance of $[Amount] that is now [Number] days past due.

DISCONNECTION NOTICE:

If payment is not received within 10 days of this notice, your service will be disconnected on [Disconnection Date]. Reconnection will require:

- Payment of the full outstanding balance

- Reconnection fee of $[Fee Amount]

- Possible security deposit

To avoid service interruption:

- Pay online at [Website]

- Pay by phone at [Phone Number]

- Pay in person at [Address]

- Mail payment to [Mailing Address]

If you are experiencing financial hardship, contact our customer service department immediately at [Phone Number] to discuss payment arrangements or assistance programs that may be available.

This notice is required by law. Service disconnection will proceed as scheduled unless payment is received or satisfactory payment arrangements are made.

Customer Service Department

[Utility Company Name]

[Contact Information]

Small Business Casual Reminder - Friendly

Subject: Quick reminder about Invoice #[Invoice Number]

Hi [Customer Name],

Hope you're doing well! I wanted to reach out with a friendly reminder that Invoice #[Invoice Number] for $[Amount] was due on [Due Date].

I know how busy things can get, and invoices sometimes slip through the cracks. No worries at all – it happens to the best of us!

If you could take a moment to process this payment, I'd really appreciate it. You can:

- Send a check to [Address]

- Use Venmo/PayPal at [Handle]

- Bank transfer to [Account Info]

If there are any issues with the invoice or if you need to chat about payment timing, just give me a call or shoot me an email. I'm always happy to work something out.

Thanks so much for being a great customer. Looking forward to continuing our work together!

Best,

[Your Name]

[Business Name]

[Phone/Email]

Rent Collection - Formal

Subject: NOTICE TO PAY RENT OR QUIT

TO: [Tenant Name(s)]

TENANT(S) IN POSSESSION OF: [Property Address]

YOU ARE HEREBY NOTIFIED that the rent on the above-described premises occupied by you, in the amount of $[Amount] for the period from [Start Date] to [End Date], is now due and payable.

YOU ARE FURTHER NOTIFIED that unless you pay said rent in full within [Number] days after service of this notice, or surrender up the possession of said premises to the undersigned, the undersigned will commence legal proceedings to:

1. Recover possession of said premises

2. Recover all unpaid rent and other charges

3. Obtain monetary damages

4. Obtain attorney fees and court costs

This notice is served upon you for the reason that you have failed to pay rent when due. The total amount now owed is $[Total Amount], which includes rent and any applicable late fees.

RENT MUST BE PAID TO:

[Landlord/Management Company Name]

[Address]

[Phone Number]

Only cashier's check, money order, or certified funds will be accepted. Personal checks will not be accepted for delinquent rent.

DATED: [Date]

[Landlord/Property Manager Signature]

[Printed Name and Title]

Credit Card Collection - Professional

Subject: Important Account Information - Payment Required

Dear [Cardholder Name],

Your credit card account ending in [Last 4 Digits] currently has a past due balance of $[Amount]. Your last payment was received on [Date], and you have missed [Number] consecutive payments.

Current Account Status:

- Past Due Amount: $[Past Due Amount]

- Total Balance: $[Total Balance]

- Days Past Due: [Number]

Immediate payment is required to bring your account current and avoid further collection actions. Please be aware that continued non-payment may result in:

- Account closure and acceleration of the full balance

- Negative reporting to credit bureaus

- Assignment to a collection agency

- Legal action for debt recovery

Payment Options:

- Online: [Website]

- Phone: [Phone Number]

- Mail: [Address]

If you are unable to pay the full amount, please contact us immediately at [Phone Number] to discuss payment arrangements. Our customer service representatives are available [Hours] to assist you.

We value your business relationship and want to help you resolve this matter. Please contact us as soon as possible.

Sincerely,

Customer Service Department

[Credit Card Company]

[Phone Number]

What is a Follow-Up Collection Letter and Why is it Needed

A follow-up collection letter is a formal written communication sent to individuals or businesses who have failed to pay outstanding debts, invoices, or financial obligations within the agreed timeframe. These letters serve as escalating reminders that become progressively more serious in tone and consequences as the debt remains unpaid.

The primary purposes include:

- Maintaining cash flow for businesses and service providers

- Documenting collection efforts for legal purposes

- Providing debtors with clear payment instructions and deadlines

- Establishing a paper trail before involving collection agencies or legal action

- Offering opportunities for payment arrangements before more drastic measures

- Protecting the creditor's legal rights and interests

Who Should Send Follow-Up Collection Letters

Collection letters should be sent by:

- Business owners and managers responsible for accounts receivable

- Billing departments and accounting personnel

- Property managers and landlords for overdue rent

- Healthcare facilities for unpaid medical bills

- Utility companies for service payments

- Credit card companies and financial institutions

- Collection departments within organizations

- Third-party collection agencies (when accounts are assigned)

- Legal representatives when authorized

- Small business owners handling their own collections

The sender should have proper authorization and legal standing to collect the debt.

To Whom Should Collection Letters be Addressed

Collection letters should be sent to:

- The original debtor or account holder

- Authorized representatives or agents

- Business partners in joint accounts

- Guarantors or co-signers when applicable

- Estate executors for deceased debtors

- Legal guardians for minors or incapacitated individuals

- Business owners or authorized personnel for corporate accounts

- Tenants and co-tenants for rental properties

- Insurance companies when they are responsible parties

Always verify the correct recipient and their legal authority to handle the debt before sending collection correspondence.

When to Send Follow-Up Collection Letters

Collection letters should be sent in these situations:

- Initial payment deadline has passed (typically 10-15 days after due date)

- Previous verbal or informal reminders have been unsuccessful

- 30, 60, and 90 days past due milestones

- Before turning accounts over to collection agencies

- Prior to initiating legal proceedings

- When payment arrangements have been broken

- After returned or insufficient fund payments

- Following unsuccessful phone collection attempts

- Before reporting to credit bureaus

- When services need to be suspended or terminated

Timing depends on the type of debt, industry standards, and legal requirements.

How to Write and Send Effective Collection Letters

The collection letter process involves:

- Start with gentle, professional reminders assuming honest oversight

- Gradually escalate tone and consequences with each subsequent letter

- Include all relevant account information and payment details

- Clearly state the amount owed and payment deadline

- Provide multiple payment options for debtor convenience

- Document all correspondence with dates and delivery methods

- Follow legal guidelines and regulations (FDCPA, state laws)

- Maintain professional language even when being firm

- Offer payment plan alternatives when appropriate

- Keep copies of all correspondence for legal protection

Send via certified mail for important notices to ensure delivery confirmation.

Requirements and Prerequisites Before Sending Collection Letters

Before initiating collection correspondence:

- Verify the debt is legitimate and accurate

- Confirm you have legal authority to collect

- Check that all invoices or bills were properly delivered

- Review any existing payment agreements or contracts

- Ensure compliance with federal and state collection laws

- Obtain current contact information for the debtor

- Document all previous collection attempts

- Calculate total amount owed including fees and interest

- Prepare supporting documentation (invoices, contracts, statements)

- Understand any statute of limitations on the debt

- Review company collection policies and procedures

- Train staff on proper collection practices and legal requirements

Formatting Guidelines for Collection Letters

Effective collection letters should follow these formatting standards:

- Use business letter format with proper headers and dates

- Keep initial letters to one page, later notices can be longer

- Use clear, professional fonts (Times New Roman, Arial)

- Include subject lines that clearly identify the purpose

- Bold or highlight key information like amounts and deadlines

- Use bullet points for payment options and consequences

- Maintain consistent tone throughout the series

- Include all required legal disclosures and notices

- Provide complete contact information

- Use certified mail for final demands and legal notices

- Keep language simple and direct, avoid jargon

- Ensure proper spacing and professional appearance

- Include account numbers and reference information

Actions to Take After Sending Collection Letters

Follow-up actions include:

- Track delivery confirmation for certified mail

- Set calendar reminders for response deadlines

- Document all debtor responses or payments received

- Follow through on stated consequences if payment isn't received

- Escalate to the next letter in the series if appropriate

- Consider phone follow-up for better response rates

- Evaluate payment arrangement requests fairly

- Update account records with collection activity

- Prepare for potential legal action if necessary

- Consider third-party collection agency involvement

- Monitor for partial payments and adjust demands accordingly

- Maintain detailed records for potential court proceedings

- Review and improve collection letter effectiveness regularly

Common Mistakes to Avoid in Collection Letters

Avoid these critical errors:

- Using threatening, abusive, or unprofessional language

- Making false statements about legal consequences

- Contacting debtors at inappropriate times or places

- Failing to include required legal disclosures

- Not verifying debt accuracy before sending demands

- Sending letters to wrong addresses or parties

- Ignoring payment disputes without investigation

- Missing statutory notification requirements

- Using deceptive practices or misleading information

- Failing to honor payment arrangements once made

- Not documenting collection efforts properly

- Violating Fair Debt Collection Practices Act provisions

- Continuing collection on disputed debts without validation

- Using outdated or incorrect account information

Essential Elements and Structure of Collection Letters

Every collection letter must include:

- Clear identification of the creditor and debtor

- Accurate account information and reference numbers

- Specific amount owed with breakdown if applicable

- Original due date and current past-due status

- Payment instructions with multiple options

- Contact information for questions or arrangements

- Appropriate deadlines for response or payment

- Professional salutation and closing

- Date of the letter and sender identification

- Required legal notices and disclaimers

- Escalating consequences for continued non-payment

- Documentation of previous collection attempts

- Return address and proper business letterhead

- Signature of authorized collection personnel

Download Word Doc

Download Word Doc

Download PDF

Download PDF