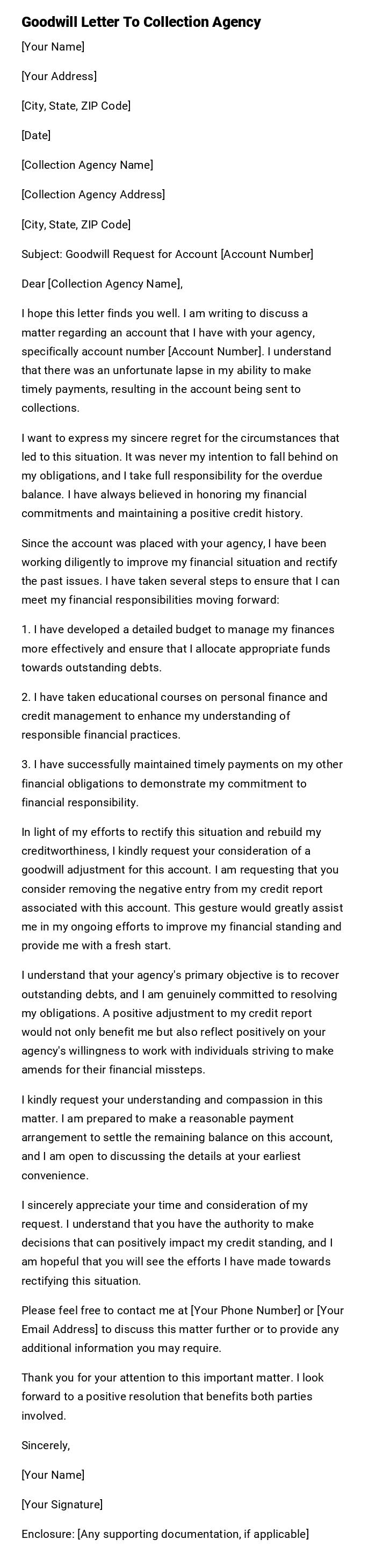

Goodwill Letter To Collection Agency

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Collection Agency Name]

[Collection Agency Address]

[City, State, ZIP Code]

Subject: Goodwill Request for Account [Account Number]

Dear [Collection Agency Name],

I hope this letter finds you well. I am writing to discuss a matter regarding an account that I have with your agency, specifically account number [Account Number]. I understand that there was an unfortunate lapse in my ability to make timely payments, resulting in the account being sent to collections.

I want to express my sincere regret for the circumstances that led to this situation. It was never my intention to fall behind on my obligations, and I take full responsibility for the overdue balance. I have always believed in honoring my financial commitments and maintaining a positive credit history.

Since the account was placed with your agency, I have been working diligently to improve my financial situation and rectify the past issues. I have taken several steps to ensure that I can meet my financial responsibilities moving forward:

1. I have developed a detailed budget to manage my finances more effectively and ensure that I allocate appropriate funds towards outstanding debts.

2. I have taken educational courses on personal finance and credit management to enhance my understanding of responsible financial practices.

3. I have successfully maintained timely payments on my other financial obligations to demonstrate my commitment to financial responsibility.

In light of my efforts to rectify this situation and rebuild my creditworthiness, I kindly request your consideration of a goodwill adjustment for this account. I am requesting that you consider removing the negative entry from my credit report associated with this account. This gesture would greatly assist me in my ongoing efforts to improve my financial standing and provide me with a fresh start.

I understand that your agency's primary objective is to recover outstanding debts, and I am genuinely committed to resolving my obligations. A positive adjustment to my credit report would not only benefit me but also reflect positively on your agency's willingness to work with individuals striving to make amends for their financial missteps.

I kindly request your understanding and compassion in this matter. I am prepared to make a reasonable payment arrangement to settle the remaining balance on this account, and I am open to discussing the details at your earliest convenience.

I sincerely appreciate your time and consideration of my request. I understand that you have the authority to make decisions that can positively impact my credit standing, and I am hopeful that you will see the efforts I have made towards rectifying this situation.

Please feel free to contact me at [Your Phone Number] or [Your Email Address] to discuss this matter further or to provide any additional information you may require.

Thank you for your attention to this important matter. I look forward to a positive resolution that benefits both parties involved.

Sincerely,

[Your Name]

[Your Signature]

Enclosure: [Any supporting documentation, if applicable]

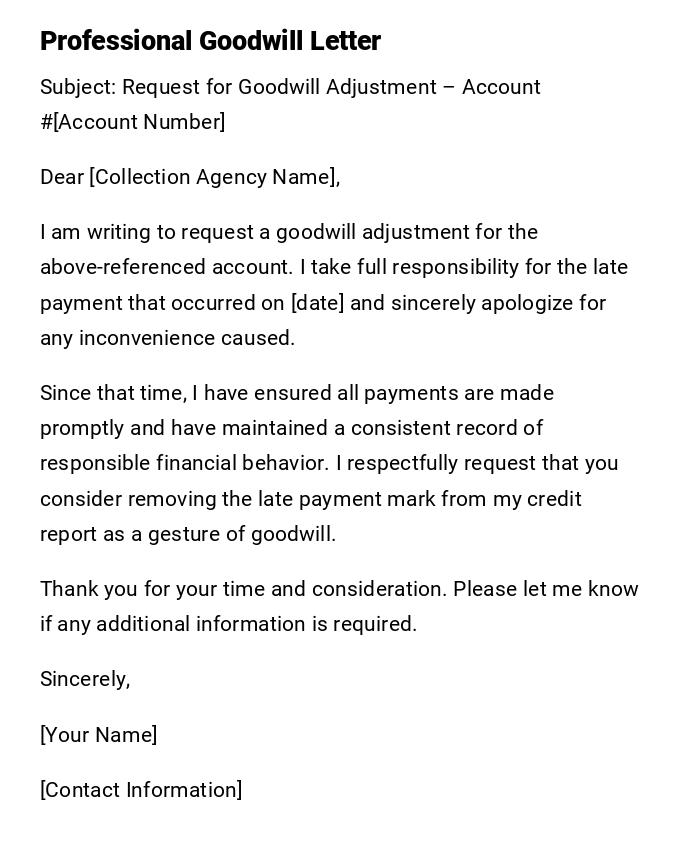

Formal Goodwill Letter to Collection Agency

Subject: Request for Goodwill Adjustment – Account #[Account Number]

Dear [Collection Agency Name],

I am writing to request a goodwill adjustment for the above-referenced account. I take full responsibility for the late payment that occurred on [date] and sincerely apologize for any inconvenience caused.

Since that time, I have ensured all payments are made promptly and have maintained a consistent record of responsible financial behavior. I respectfully request that you consider removing the late payment mark from my credit report as a gesture of goodwill.

Thank you for your time and consideration. Please let me know if any additional information is required.

Sincerely,

[Your Name]

[Contact Information]

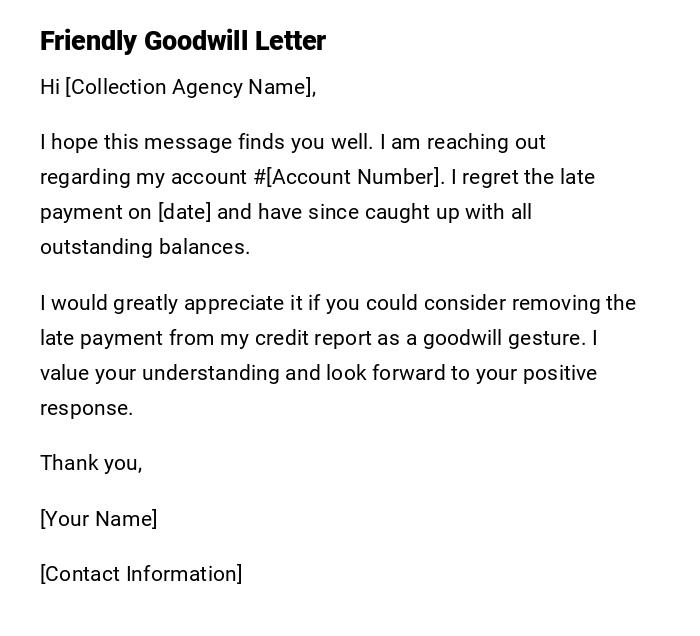

Casual Goodwill Letter to Collection Agency

Hi [Collection Agency Name],

I hope this message finds you well. I am reaching out regarding my account #[Account Number]. I regret the late payment on [date] and have since caught up with all outstanding balances.

I would greatly appreciate it if you could consider removing the late payment from my credit report as a goodwill gesture. I value your understanding and look forward to your positive response.

Thank you,

[Your Name]

[Contact Information]

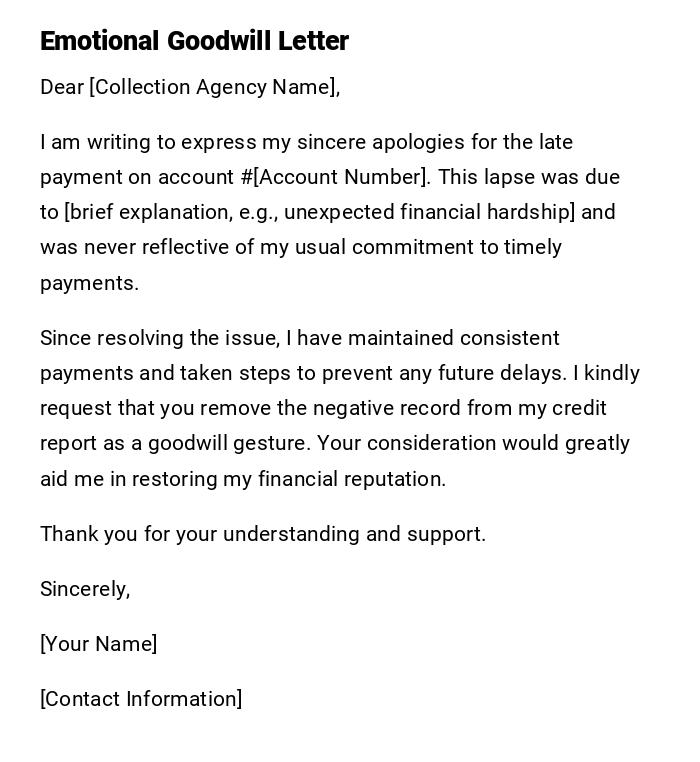

Heartfelt Goodwill Letter to Collection Agency

Dear [Collection Agency Name],

I am writing to express my sincere apologies for the late payment on account #[Account Number]. This lapse was due to [brief explanation, e.g., unexpected financial hardship] and was never reflective of my usual commitment to timely payments.

Since resolving the issue, I have maintained consistent payments and taken steps to prevent any future delays. I kindly request that you remove the negative record from my credit report as a goodwill gesture. Your consideration would greatly aid me in restoring my financial reputation.

Thank you for your understanding and support.

Sincerely,

[Your Name]

[Contact Information]

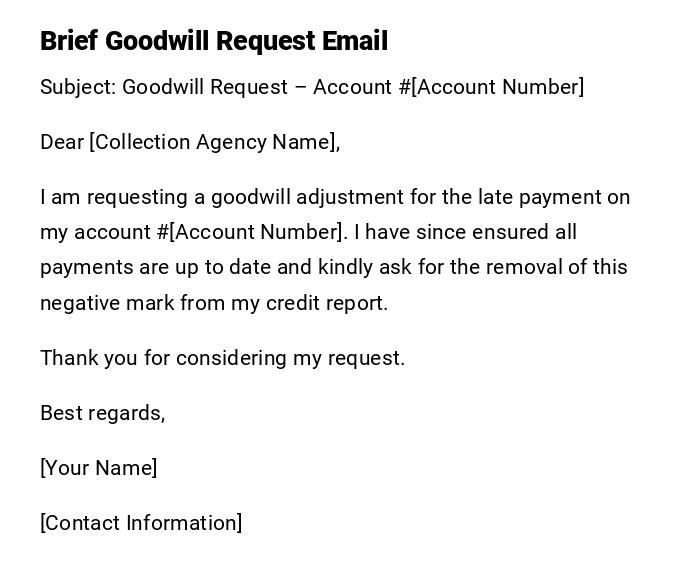

Quick Goodwill Email to Collection Agency

Subject: Goodwill Request – Account #[Account Number]

Dear [Collection Agency Name],

I am requesting a goodwill adjustment for the late payment on my account #[Account Number]. I have since ensured all payments are up to date and kindly ask for the removal of this negative mark from my credit report.

Thank you for considering my request.

Best regards,

[Your Name]

[Contact Information]

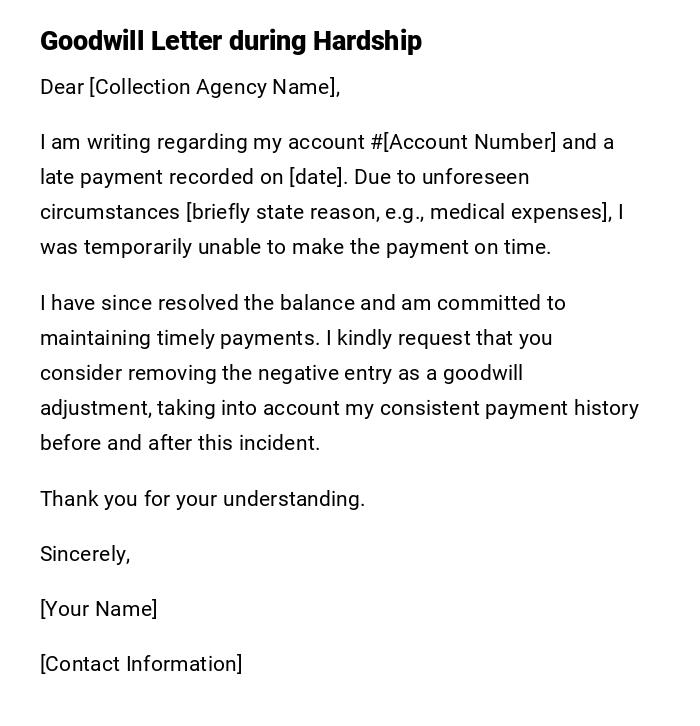

Provisional Goodwill Letter for Temporary Financial Hardship

Dear [Collection Agency Name],

I am writing regarding my account #[Account Number] and a late payment recorded on [date]. Due to unforeseen circumstances [briefly state reason, e.g., medical expenses], I was temporarily unable to make the payment on time.

I have since resolved the balance and am committed to maintaining timely payments. I kindly request that you consider removing the negative entry as a goodwill adjustment, taking into account my consistent payment history before and after this incident.

Thank you for your understanding.

Sincerely,

[Your Name]

[Contact Information]

Formal but Friendly Goodwill Letter

Dear [Collection Agency Name],

I hope you are doing well. I am contacting you regarding my account #[Account Number]. I take full responsibility for the late payment on [date] and have taken steps to ensure it does not happen again.

I would sincerely appreciate it if you could remove this negative mark from my credit report as a gesture of goodwill. Your cooperation would help me maintain a strong financial standing.

Thank you for your consideration.

Best regards,

[Your Name]

[Contact Information]

What / Why do you need a Goodwill Letter to a Collection Agency

A Goodwill Letter to a Collection Agency is a request for the removal of a negative mark or late payment from a credit report as a gesture of goodwill.

Reasons to write it include:

- To improve your credit score.

- To maintain a positive financial reputation.

- To explain circumstances and appeal for leniency.

Who should send a Goodwill Letter

- Individuals with a past late payment or collection account.

- Borrowers seeking to repair their credit history.

- Anyone with extenuating circumstances leading to a temporary lapse in payment.

Whom should the Goodwill Letter be addressed to

- The collection agency managing the account.

- Original creditor if applicable.

- Credit reporting agency only if requested by the creditor.

When to send a Goodwill Letter

- After resolving the outstanding balance.

- Following a temporary hardship that caused late payment.

- When seeking credit repair or mortgage/loan approval.

- After establishing a consistent record of timely payments.

How to write and send a Goodwill Letter

- Begin with a respectful greeting and clear subject line.

- Explain the circumstances that led to the late payment, briefly and honestly.

- Highlight a history of timely payments or recent corrective actions.

- Politely request removal of the negative mark as a gesture of goodwill.

- Include account information and contact details.

- Send via certified mail or email, depending on agency preference.

How many times can you send a Goodwill Letter

- Generally, one well-crafted letter is recommended.

- Follow-up may be acceptable after a reasonable period if no response is received.

- Multiple letters without new information may be counterproductive.

FAQ about Goodwill Letters

- Q: Will a collection agency always remove a late payment?

A: No, removal is at their discretion. - Q: Can this improve my credit score immediately?

A: If the negative mark is removed, your score may improve, but timing varies. - Q: Should I admit fault?

A: Yes, acknowledge the late payment while explaining circumstances.

Requirements and Prerequisites

- Account details and documentation of payments.

- Explanation of circumstances for late payment.

- Proof of current financial responsibility.

- Contact information and respectful tone prepared before sending.

Formatting and Style Tips

- Length: One page is sufficient.

- Tone: Polite, professional, and respectful.

- Style: Clear, concise, and sincere.

- Mode: Email or certified mail.

- Include account number, dates, and relevant explanations.

After Sending / Follow-up

- Wait at least 2–3 weeks for a response.

- Follow up politely if no reply is received.

- Keep copies of correspondence for your records.

- Confirm any adjustments to your credit report once acknowledged.

Pros and Cons of Sending a Goodwill Letter

Pros:

- Potential removal of negative marks from credit reports.

- Shows accountability and responsibility.

- May improve future loan or credit opportunities.

Cons: - Not guaranteed to succeed.

- Excessive or aggressive letters can be counterproductive.

- Takes time to prepare and follow up.

Compare and Contrast with Other Credit Repair Options

- Goodwill Letter: Requests voluntary removal from the creditor/agency.

- Dispute Letter: Used to correct factual errors on a credit report.

- Debt Settlement: Negotiates reduced payment; may not remove the negative mark.

- Goodwill letters are usually more personal and relationship-focused.

Tricks and Tips

- Keep the letter short, polite, and factual.

- Attach proof of payment or documentation if possible.

- Avoid blaming the agency; focus on responsibility and corrective actions.

- Personalize each letter for maximum impact.

Common Mistakes

- Sending generic or aggressive letters.

- Not including account information.

- Overexplaining or providing irrelevant personal details.

- Expecting guaranteed results.

Elements and Structure

- Greeting: Respectful and professional.

- Account Details: Include account number and relevant dates.

- Explanation: Briefly explain reason for late payment.

- Corrective Action: Highlight steps taken to prevent recurrence.

- Request: Politely ask for goodwill adjustment.

- Closing: Sincere thanks and contact information.

Does it require attestation or authorization

- Typically, no formal attestation is needed.

- Letters should be signed and include contact information.

- Certified mail can provide proof of sending and receipt.

Download Word Doc

Download Word Doc

Download PDF

Download PDF