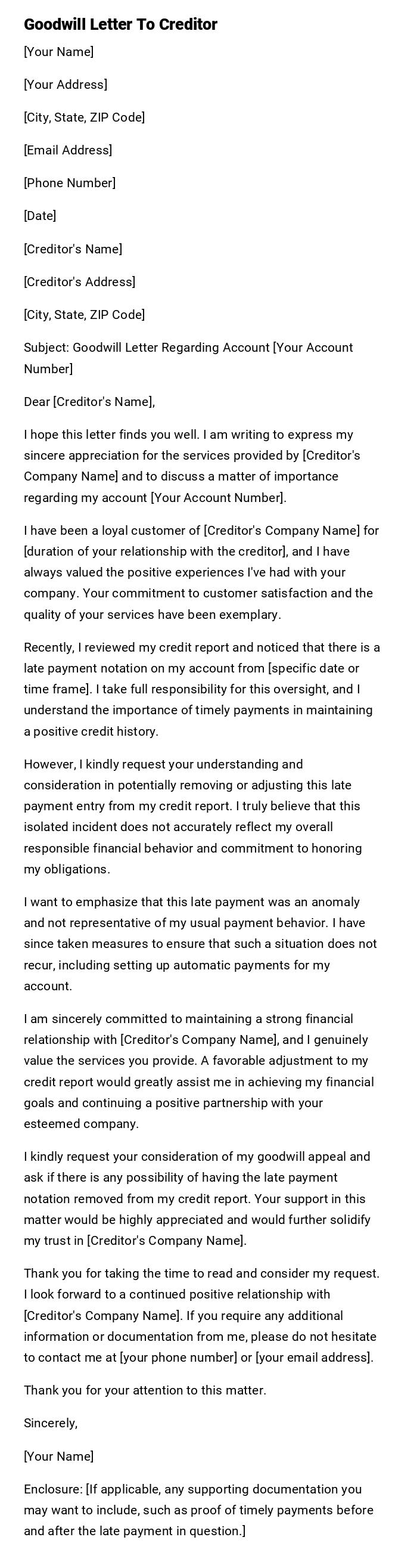

Goodwill Letter To Creditor

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Creditor's Name]

[Creditor's Address]

[City, State, ZIP Code]

Subject: Goodwill Letter Regarding Account [Your Account Number]

Dear [Creditor's Name],

I hope this letter finds you well. I am writing to express my sincere appreciation for the services provided by [Creditor's Company Name] and to discuss a matter of importance regarding my account [Your Account Number].

I have been a loyal customer of [Creditor's Company Name] for [duration of your relationship with the creditor], and I have always valued the positive experiences I've had with your company. Your commitment to customer satisfaction and the quality of your services have been exemplary.

Recently, I reviewed my credit report and noticed that there is a late payment notation on my account from [specific date or time frame]. I take full responsibility for this oversight, and I understand the importance of timely payments in maintaining a positive credit history.

However, I kindly request your understanding and consideration in potentially removing or adjusting this late payment entry from my credit report. I truly believe that this isolated incident does not accurately reflect my overall responsible financial behavior and commitment to honoring my obligations.

I want to emphasize that this late payment was an anomaly and not representative of my usual payment behavior. I have since taken measures to ensure that such a situation does not recur, including setting up automatic payments for my account.

I am sincerely committed to maintaining a strong financial relationship with [Creditor's Company Name], and I genuinely value the services you provide. A favorable adjustment to my credit report would greatly assist me in achieving my financial goals and continuing a positive partnership with your esteemed company.

I kindly request your consideration of my goodwill appeal and ask if there is any possibility of having the late payment notation removed from my credit report. Your support in this matter would be highly appreciated and would further solidify my trust in [Creditor's Company Name].

Thank you for taking the time to read and consider my request. I look forward to a continued positive relationship with [Creditor's Company Name]. If you require any additional information or documentation from me, please do not hesitate to contact me at [your phone number] or [your email address].

Thank you for your attention to this matter.

Sincerely,

[Your Name]

Enclosure: [If applicable, any supporting documentation you may want to include, such as proof of timely payments before and after the late payment in question.]

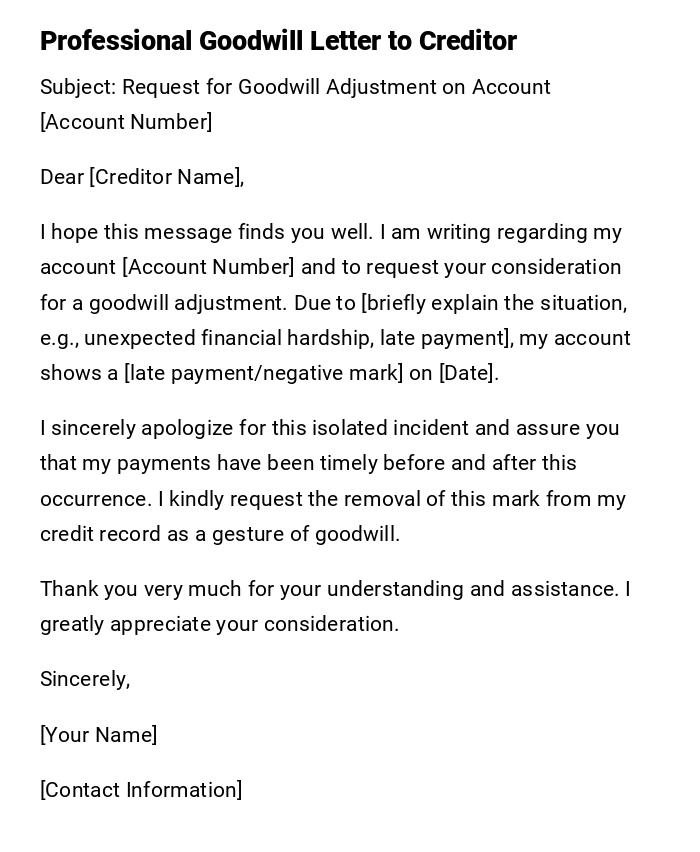

Professional Goodwill Letter to Creditor

Subject: Request for Goodwill Adjustment on Account [Account Number]

Dear [Creditor Name],

I hope this message finds you well. I am writing regarding my account [Account Number] and to request your consideration for a goodwill adjustment. Due to [briefly explain the situation, e.g., unexpected financial hardship, late payment], my account shows a [late payment/negative mark] on [Date].

I sincerely apologize for this isolated incident and assure you that my payments have been timely before and after this occurrence. I kindly request the removal of this mark from my credit record as a gesture of goodwill.

Thank you very much for your understanding and assistance. I greatly appreciate your consideration.

Sincerely,

[Your Name]

[Contact Information]

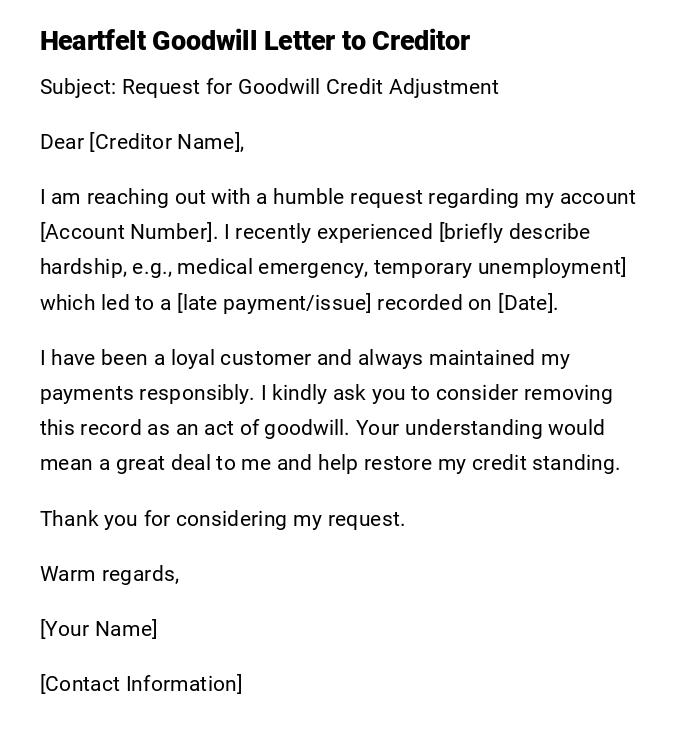

Heartfelt Goodwill Letter to Creditor

Subject: Request for Goodwill Credit Adjustment

Dear [Creditor Name],

I am reaching out with a humble request regarding my account [Account Number]. I recently experienced [briefly describe hardship, e.g., medical emergency, temporary unemployment] which led to a [late payment/issue] recorded on [Date].

I have been a loyal customer and always maintained my payments responsibly. I kindly ask you to consider removing this record as an act of goodwill. Your understanding would mean a great deal to me and help restore my credit standing.

Thank you for considering my request.

Warm regards,

[Your Name]

[Contact Information]

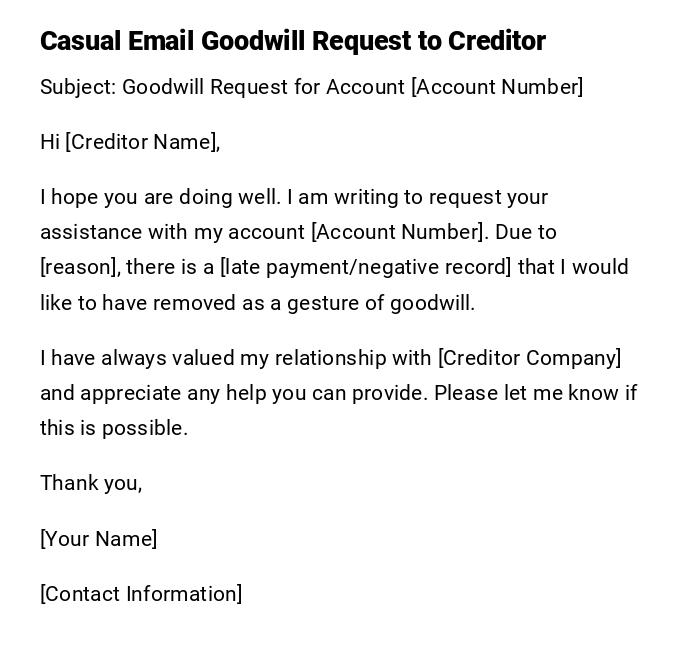

Casual Email Goodwill Request to Creditor

Subject: Goodwill Request for Account [Account Number]

Hi [Creditor Name],

I hope you are doing well. I am writing to request your assistance with my account [Account Number]. Due to [reason], there is a [late payment/negative record] that I would like to have removed as a gesture of goodwill.

I have always valued my relationship with [Creditor Company] and appreciate any help you can provide. Please let me know if this is possible.

Thank you,

[Your Name]

[Contact Information]

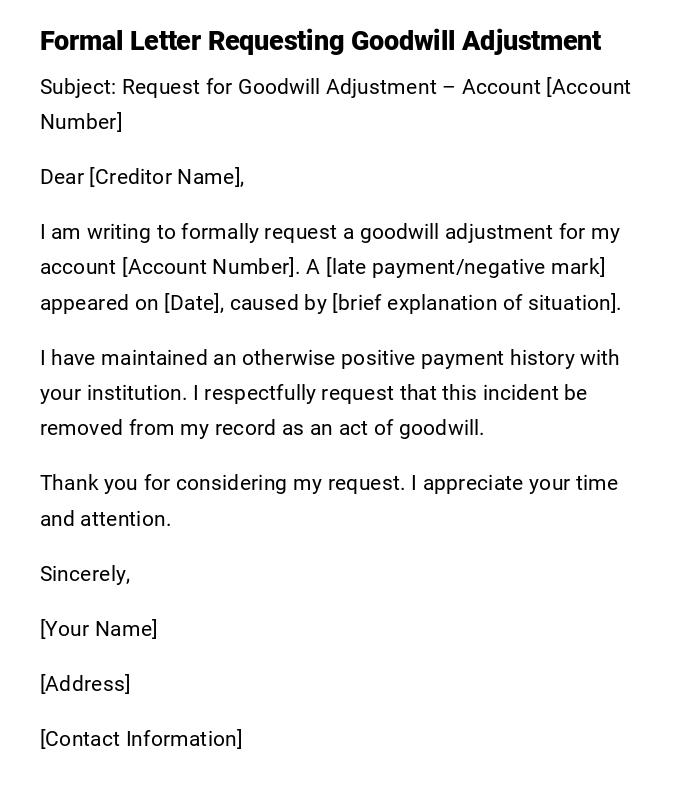

Formal Letter Requesting Goodwill Adjustment

Subject: Request for Goodwill Adjustment – Account [Account Number]

Dear [Creditor Name],

I am writing to formally request a goodwill adjustment for my account [Account Number]. A [late payment/negative mark] appeared on [Date], caused by [brief explanation of situation].

I have maintained an otherwise positive payment history with your institution. I respectfully request that this incident be removed from my record as an act of goodwill.

Thank you for considering my request. I appreciate your time and attention.

Sincerely,

[Your Name]

[Address]

[Contact Information]

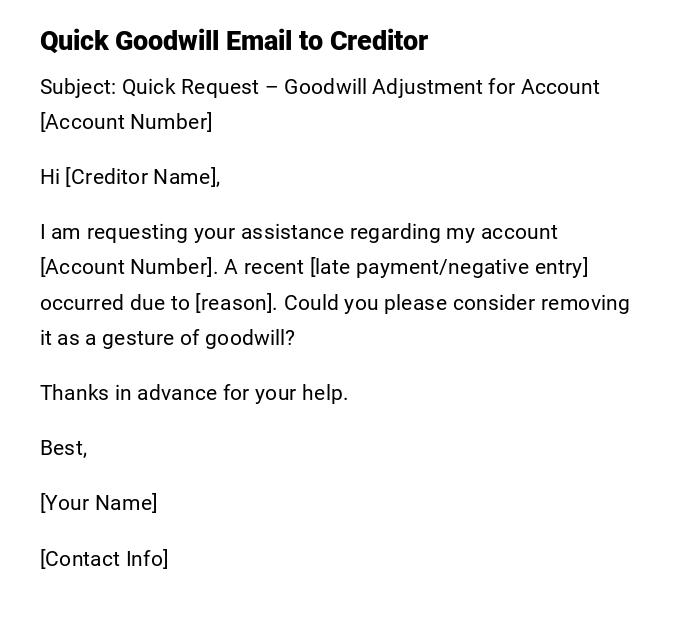

Quick Goodwill Email to Creditor

Subject: Quick Request – Goodwill Adjustment for Account [Account Number]

Hi [Creditor Name],

I am requesting your assistance regarding my account [Account Number]. A recent [late payment/negative entry] occurred due to [reason]. Could you please consider removing it as a gesture of goodwill?

Thanks in advance for your help.

Best,

[Your Name]

[Contact Info]

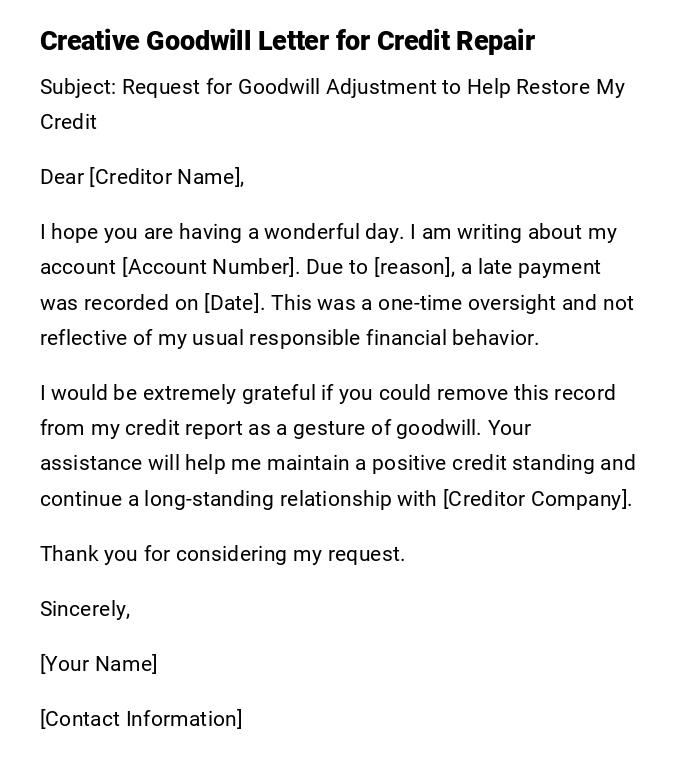

Creative Goodwill Letter for Credit Repair

Subject: Request for Goodwill Adjustment to Help Restore My Credit

Dear [Creditor Name],

I hope you are having a wonderful day. I am writing about my account [Account Number]. Due to [reason], a late payment was recorded on [Date]. This was a one-time oversight and not reflective of my usual responsible financial behavior.

I would be extremely grateful if you could remove this record from my credit report as a gesture of goodwill. Your assistance will help me maintain a positive credit standing and continue a long-standing relationship with [Creditor Company].

Thank you for considering my request.

Sincerely,

[Your Name]

[Contact Information]

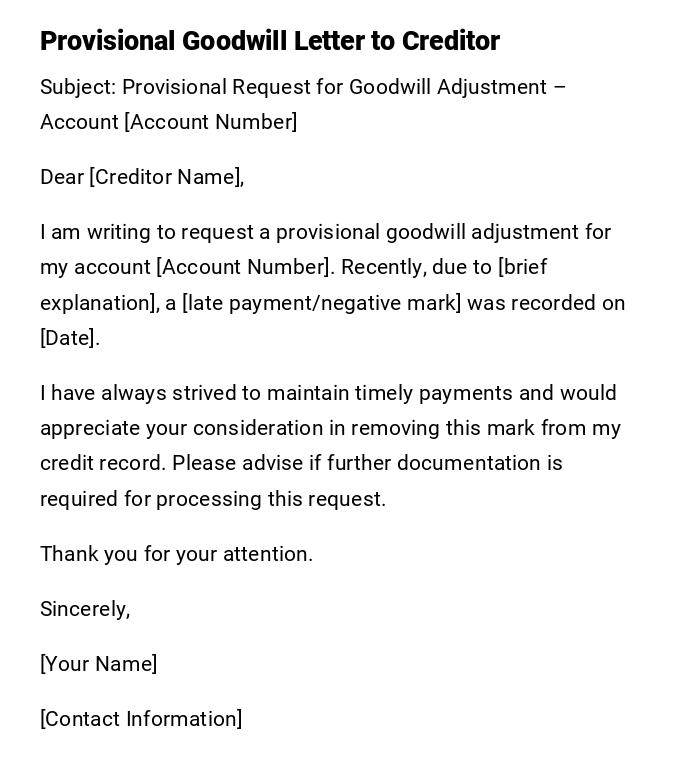

Provisional Goodwill Letter to Creditor

Subject: Provisional Request for Goodwill Adjustment – Account [Account Number]

Dear [Creditor Name],

I am writing to request a provisional goodwill adjustment for my account [Account Number]. Recently, due to [brief explanation], a [late payment/negative mark] was recorded on [Date].

I have always strived to maintain timely payments and would appreciate your consideration in removing this mark from my credit record. Please advise if further documentation is required for processing this request.

Thank you for your attention.

Sincerely,

[Your Name]

[Contact Information]

What a Goodwill Letter to Creditor Is and Why You Need It

- A goodwill letter is a written request to a creditor to remove a negative mark from a credit report.

- Purpose:

- Repair credit history after a minor or one-time issue.

- Maintain a positive relationship with the creditor.

- Demonstrate responsibility and accountability for past incidents.

Who Should Send a Goodwill Letter to a Creditor

- Individuals with a strong prior payment history who had an isolated late payment or issue.

- Consumers seeking to improve their credit score.

- Customers experiencing temporary financial hardship affecting their account.

Whom the Goodwill Letter Should Be Addressed To

- Primary recipient: Account manager, customer service representative, or collections department.

- Secondary recipient: Credit bureau may also be copied if necessary for credit reporting adjustments.

When to Send a Goodwill Letter to a Creditor

- After a minor late payment or negative entry appears on your account.

- When trying to repair or improve your credit report.

- Following a temporary hardship that caused missed or late payments.

How to Write and Send a Goodwill Letter

- Steps:

- Start with a polite greeting and identify the account number.

- Explain the circumstances that led to the negative mark briefly and honestly.

- Emphasize your positive payment history and reliability.

- Request the removal of the negative mark as an act of goodwill.

- Close with gratitude and provide contact information.

- Send via email for fast response or printed letter for formal requests.

Requirements and Prerequisites Before Sending

- Full account information and identification details.

- Evidence of any hardship or circumstances causing the late payment.

- History of timely payments or account reliability.

- Optional: supporting documentation demonstrating current good standing or improvement.

Formatting Guidelines for Goodwill Letters to Creditors

- Length: Keep concise, generally one page.

- Tone: Polite, respectful, and professional.

- Wording: Honest and factual; avoid excuses or blame.

- Mode: Email or physical letter depending on creditor preferences.

- Include subject line, salutation, body, closing, and contact information.

After Sending a Goodwill Letter to a Creditor

- Wait for acknowledgment or response, typically 2–4 weeks.

- Follow up politely if no response is received.

- Document any updates or credit adjustments.

- Maintain regular account activity to demonstrate ongoing responsibility.

Pros and Cons of Sending a Goodwill Letter

- Pros:

- Potential removal of negative credit entries.

- Demonstrates responsibility and communication with creditors.

- Can improve credit score and future borrowing opportunities.

- Cons:

- Not guaranteed; creditor may refuse.

- Requires careful, honest explanation.

- May take time for response and adjustment.

Common Mistakes to Avoid in Goodwill Letters

- Over-explaining or making excuses for the negative mark.

- Being rude, demanding, or unprofessional.

- Omitting account details or dates.

- Failing to highlight positive payment history.

Elements and Structure of a Goodwill Letter to Creditor

- Subject line: clearly stating the purpose.

- Salutation: addressing the creditor or account manager.

- Introduction: briefly identify account and reason for writing.

- Body: explanation of the situation, emphasis on prior reliability, request for goodwill.

- Closing: polite thank you and request for consideration.

- Signature: full name and contact information.

- Attachments: supporting documents, if any.

Tricks and Tips for Effective Goodwill Letters

- Keep the letter short and focused.

- Be honest about circumstances.

- Highlight a history of good behavior and timely payments.

- Send a polite follow-up if no response is received in a reasonable timeframe.

- Maintain records of all correspondence.

FAQ About Goodwill Letters to Creditors

-

Q: Will every creditor remove a negative mark?

A: No, it is at the creditor’s discretion, but it is more likely with a strong prior payment history. -

Q: Can I send multiple requests to different creditors?

A: Yes, but tailor each letter to the specific account and circumstances. -

Q: How long does it take to see changes in my credit report?

A: It can take 2–4 weeks for the creditor to respond and additional time for reporting agencies to update. -

Q: Should I attach supporting documents?

A: Yes, if they support your explanation and demonstrate good faith.

Does a Goodwill Letter Require Attestation or Authorization?

- Typically, no formal attestation is required.

- Signed letters with accurate account information are sufficient.

- Include identification if requested by the creditor to verify account ownership.

Download Word Doc

Download Word Doc

Download PDF

Download PDF