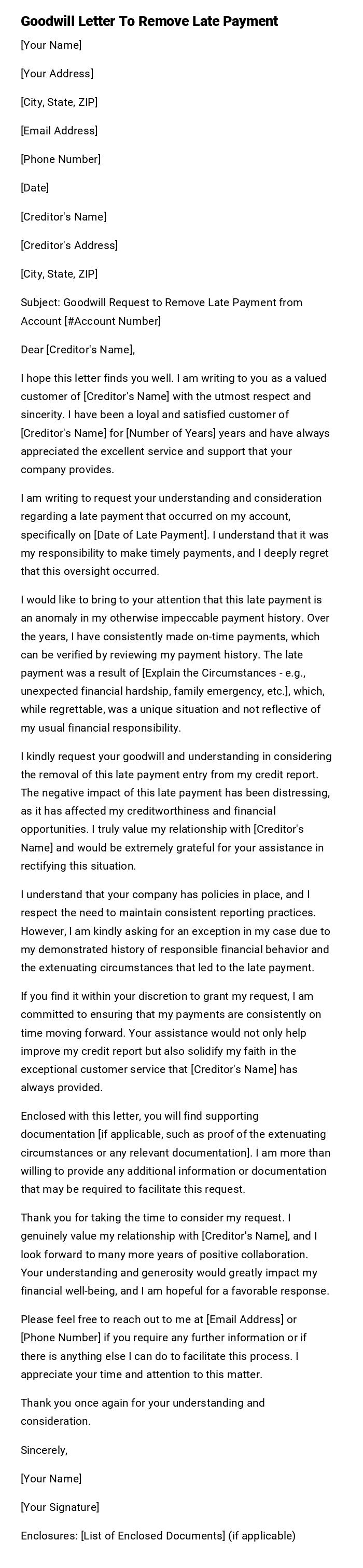

Goodwill Letter To Remove Late Payment

[Your Name]

[Your Address]

[City, State, ZIP]

[Email Address]

[Phone Number]

[Date]

[Creditor's Name]

[Creditor's Address]

[City, State, ZIP]

Subject: Goodwill Request to Remove Late Payment from Account [#Account Number]

Dear [Creditor's Name],

I hope this letter finds you well. I am writing to you as a valued customer of [Creditor's Name] with the utmost respect and sincerity. I have been a loyal and satisfied customer of [Creditor's Name] for [Number of Years] years and have always appreciated the excellent service and support that your company provides.

I am writing to request your understanding and consideration regarding a late payment that occurred on my account, specifically on [Date of Late Payment]. I understand that it was my responsibility to make timely payments, and I deeply regret that this oversight occurred.

I would like to bring to your attention that this late payment is an anomaly in my otherwise impeccable payment history. Over the years, I have consistently made on-time payments, which can be verified by reviewing my payment history. The late payment was a result of [Explain the Circumstances - e.g., unexpected financial hardship, family emergency, etc.], which, while regrettable, was a unique situation and not reflective of my usual financial responsibility.

I kindly request your goodwill and understanding in considering the removal of this late payment entry from my credit report. The negative impact of this late payment has been distressing, as it has affected my creditworthiness and financial opportunities. I truly value my relationship with [Creditor's Name] and would be extremely grateful for your assistance in rectifying this situation.

I understand that your company has policies in place, and I respect the need to maintain consistent reporting practices. However, I am kindly asking for an exception in my case due to my demonstrated history of responsible financial behavior and the extenuating circumstances that led to the late payment.

If you find it within your discretion to grant my request, I am committed to ensuring that my payments are consistently on time moving forward. Your assistance would not only help improve my credit report but also solidify my faith in the exceptional customer service that [Creditor's Name] has always provided.

Enclosed with this letter, you will find supporting documentation [if applicable, such as proof of the extenuating circumstances or any relevant documentation]. I am more than willing to provide any additional information or documentation that may be required to facilitate this request.

Thank you for taking the time to consider my request. I genuinely value my relationship with [Creditor's Name], and I look forward to many more years of positive collaboration. Your understanding and generosity would greatly impact my financial well-being, and I am hopeful for a favorable response.

Please feel free to reach out to me at [Email Address] or [Phone Number] if you require any further information or if there is anything else I can do to facilitate this process. I appreciate your time and attention to this matter.

Thank you once again for your understanding and consideration.

Sincerely,

[Your Name]

[Your Signature]

Enclosures: [List of Enclosed Documents] (if applicable)

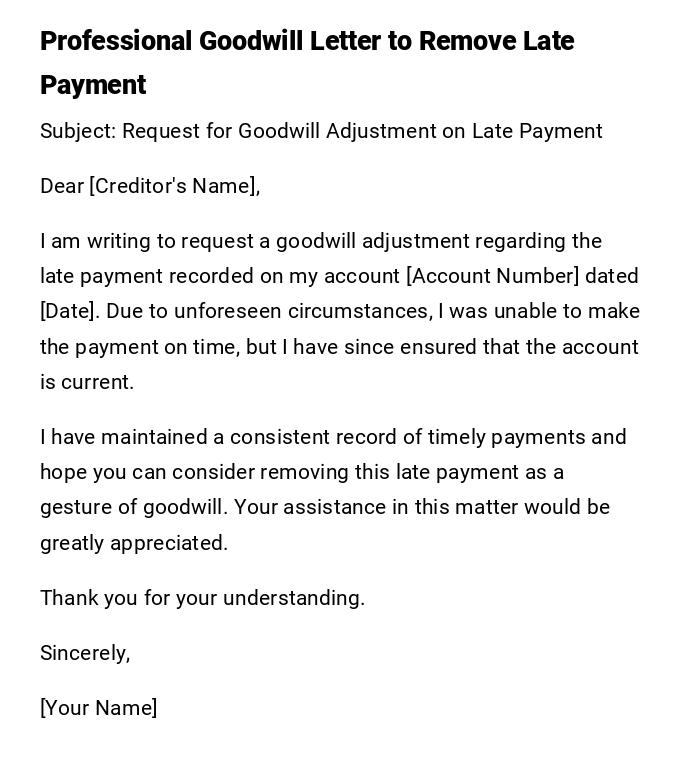

Professional Goodwill Letter to Remove Late Payment

Subject: Request for Goodwill Adjustment on Late Payment

Dear [Creditor's Name],

I am writing to request a goodwill adjustment regarding the late payment recorded on my account [Account Number] dated [Date]. Due to unforeseen circumstances, I was unable to make the payment on time, but I have since ensured that the account is current.

I have maintained a consistent record of timely payments and hope you can consider removing this late payment as a gesture of goodwill. Your assistance in this matter would be greatly appreciated.

Thank you for your understanding.

Sincerely,

[Your Name]

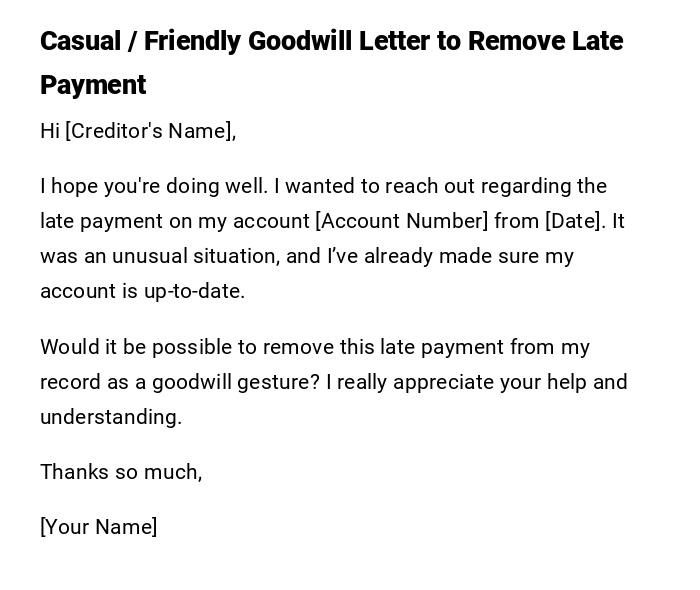

Casual / Friendly Goodwill Letter to Remove Late Payment

Hi [Creditor's Name],

I hope you're doing well. I wanted to reach out regarding the late payment on my account [Account Number] from [Date]. It was an unusual situation, and I’ve already made sure my account is up-to-date.

Would it be possible to remove this late payment from my record as a goodwill gesture? I really appreciate your help and understanding.

Thanks so much,

[Your Name]

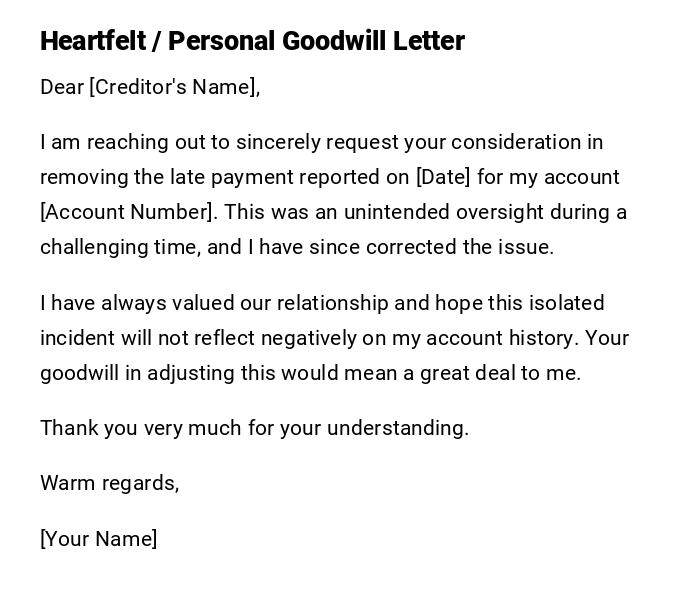

Heartfelt / Personal Goodwill Letter

Dear [Creditor's Name],

I am reaching out to sincerely request your consideration in removing the late payment reported on [Date] for my account [Account Number]. This was an unintended oversight during a challenging time, and I have since corrected the issue.

I have always valued our relationship and hope this isolated incident will not reflect negatively on my account history. Your goodwill in adjusting this would mean a great deal to me.

Thank you very much for your understanding.

Warm regards,

[Your Name]

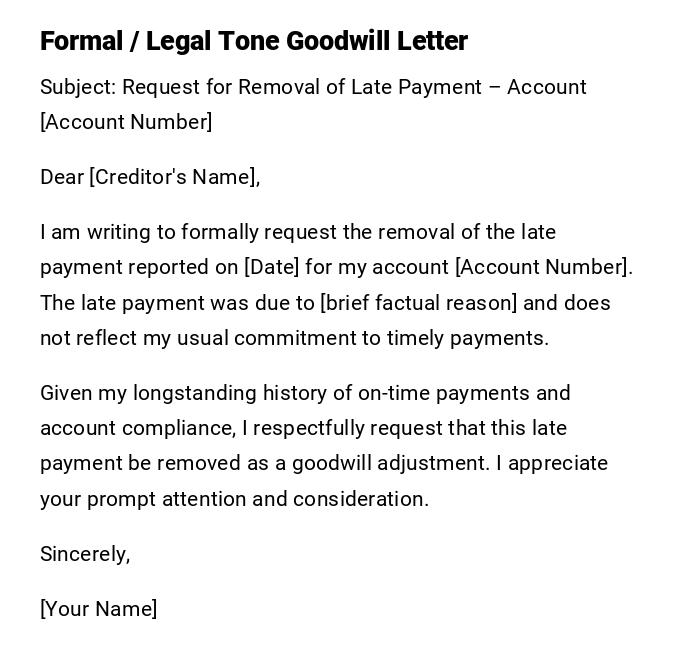

Formal / Legal Tone Goodwill Letter

Subject: Request for Removal of Late Payment – Account [Account Number]

Dear [Creditor's Name],

I am writing to formally request the removal of the late payment reported on [Date] for my account [Account Number]. The late payment was due to [brief factual reason] and does not reflect my usual commitment to timely payments.

Given my longstanding history of on-time payments and account compliance, I respectfully request that this late payment be removed as a goodwill adjustment. I appreciate your prompt attention and consideration.

Sincerely,

[Your Name]

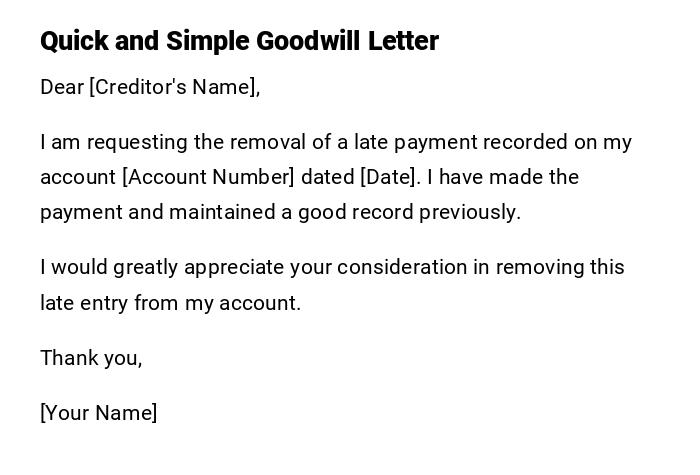

Quick and Simple Goodwill Letter

Dear [Creditor's Name],

I am requesting the removal of a late payment recorded on my account [Account Number] dated [Date]. I have made the payment and maintained a good record previously.

I would greatly appreciate your consideration in removing this late entry from my account.

Thank you,

[Your Name]

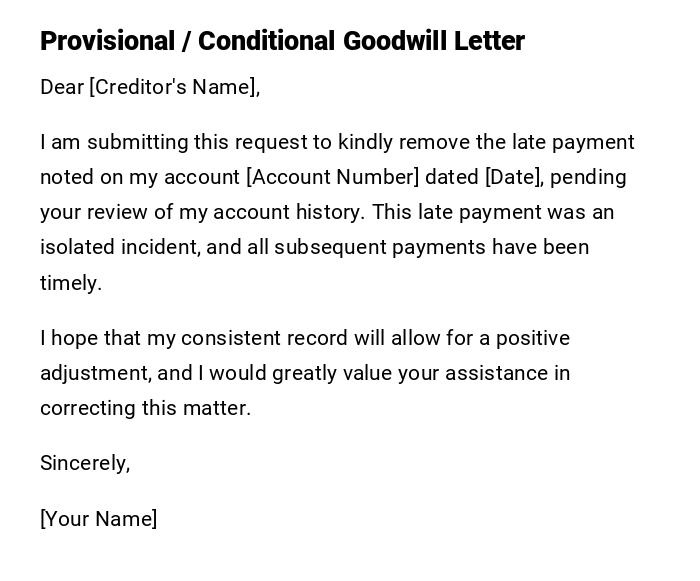

Provisional / Conditional Goodwill Letter

Dear [Creditor's Name],

I am submitting this request to kindly remove the late payment noted on my account [Account Number] dated [Date], pending your review of my account history. This late payment was an isolated incident, and all subsequent payments have been timely.

I hope that my consistent record will allow for a positive adjustment, and I would greatly value your assistance in correcting this matter.

Sincerely,

[Your Name]

What / Why You Might Need a Goodwill Letter to Remove Late Payment

- Corrects an accidental or rare late payment on a credit report.

- Maintains or improves credit score and financial credibility.

- Demonstrates responsibility and communication with creditors.

- Can be used for accounts like credit cards, loans, utilities, or mortgages.

Who Should Send a Goodwill Letter

- Account holders with a previously good payment history.

- Individuals who have experienced an unusual delay due to unforeseen circumstances.

- People seeking to maintain or improve their credit rating.

Whom the Goodwill Letter Should Be Addressed To

- Customer service or account manager of the creditor.

- Collections department if applicable.

- Credit bureau contact, if requesting a correction directly on the report.

When to Send a Goodwill Letter

- Immediately after a late payment has been reported.

- After resolving the overdue balance.

- When requesting removal of an isolated or first-time late payment.

- Before disputing the entry formally through a credit bureau, to maximize goodwill consideration.

How to Write and Send a Goodwill Letter

- Include account information and exact date of late payment.

- Explain the reason briefly without excessive detail.

- Highlight your history of timely payments.

- Be polite, professional, and positive.

- Send via email or physical mail, ideally with confirmation of receipt.

Requirements and Prerequisites Before Writing

- Verify account status and confirm the late payment is accurate.

- Gather evidence of on-time payments and communication records.

- Prepare a clear, concise explanation of circumstances that caused the delay.

Formatting Guidelines

- Tone: Polite, professional, and courteous.

- Length: One page or less, concise but complete.

- Structure: Subject, greeting, explanation, request for goodwill adjustment, closing.

- Mode: Email for speed, letter for official documentation.

- Include all relevant account identifiers for accurate processing.

After Sending / Follow-up Actions

- Request acknowledgment or confirmation of letter receipt.

- Monitor credit reports for changes or corrections.

- Follow up politely if no response is received within a reasonable timeframe (2–4 weeks).

Pros and Cons of Sending a Goodwill Letter

Pros:

- May improve credit score by removing negative entries.

- Strengthens relationship with creditor.

- Demonstrates proactive communication and responsibility.

Cons:

- No guarantee of success.

- May require persistence and follow-up.

- Overuse may appear insincere if frequent late payments occur.

Tricks and Tips for Maximizing Success

- Reference your long history of timely payments.

- Keep the letter concise and fact-based.

- Express gratitude and maintain a positive tone.

- Use proper account identifiers and include contact information.

- Send during periods of account stability for a better chance of approval.

Common Mistakes to Avoid

- Overexplaining or giving excessive personal details.

- Using a demanding or accusatory tone.

- Forgetting to include account information or payment dates.

- Sending letters after multiple late payments without improvement.

Elements and Structure of a Goodwill Letter to Remove Late Payment

- Introduction: State the purpose of the letter.

- Explanation: Briefly explain reason for late payment.

- Account History: Highlight previous on-time payments.

- Request: Politely ask for removal as a goodwill gesture.

- Closing: Express appreciation and provide contact information.

- Attachments (Optional): Proof of payment, documentation of circumstances.

Compare and Contrast with Other Credit Correction Methods

- Goodwill Letter vs. Formal Dispute: Goodwill is voluntary on creditor’s part, dispute is a formal correction process.

- Goodwill Letter vs. Payment Plans: Payment plans prevent further negative reporting but do not remove existing late payments.

- Key Advantage: Shows responsibility and preserves relationship without legal action.

- Alternative: Combine goodwill request with future on-time payments to strengthen credibility.

Does It Require Attestation or Authorization

- Generally does not require notarization.

- Creditor may need internal approval before adjustment is made.

- Written acknowledgment of change is recommended for personal records.

Download Word Doc

Download Word Doc

Download PDF

Download PDF