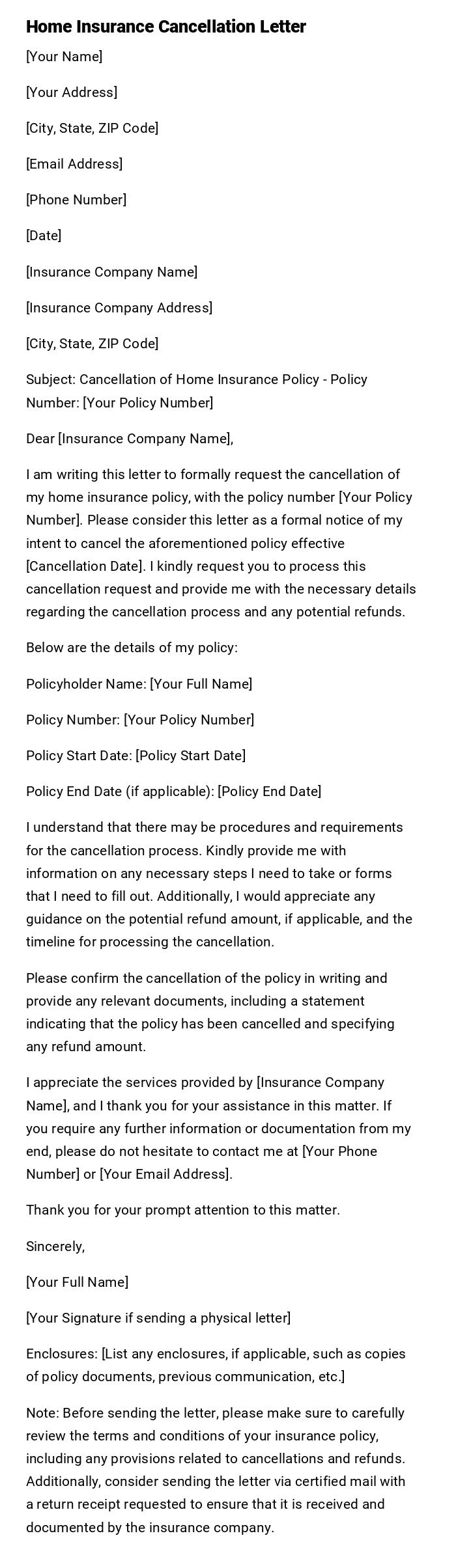

Home Insurance Cancellation Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Insurance Company Name]

[Insurance Company Address]

[City, State, ZIP Code]

Subject: Cancellation of Home Insurance Policy - Policy Number: [Your Policy Number]

Dear [Insurance Company Name],

I am writing this letter to formally request the cancellation of my home insurance policy, with the policy number [Your Policy Number]. Please consider this letter as a formal notice of my intent to cancel the aforementioned policy effective [Cancellation Date]. I kindly request you to process this cancellation request and provide me with the necessary details regarding the cancellation process and any potential refunds.

Below are the details of my policy:

Policyholder Name: [Your Full Name]

Policy Number: [Your Policy Number]

Policy Start Date: [Policy Start Date]

Policy End Date (if applicable): [Policy End Date]

I understand that there may be procedures and requirements for the cancellation process. Kindly provide me with information on any necessary steps I need to take or forms that I need to fill out. Additionally, I would appreciate any guidance on the potential refund amount, if applicable, and the timeline for processing the cancellation.

Please confirm the cancellation of the policy in writing and provide any relevant documents, including a statement indicating that the policy has been cancelled and specifying any refund amount.

I appreciate the services provided by [Insurance Company Name], and I thank you for your assistance in this matter. If you require any further information or documentation from my end, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Signature if sending a physical letter]

Enclosures: [List any enclosures, if applicable, such as copies of policy documents, previous communication, etc.]

Note: Before sending the letter, please make sure to carefully review the terms and conditions of your insurance policy, including any provisions related to cancellations and refunds. Additionally, consider sending the letter via certified mail with a return receipt requested to ensure that it is received and documented by the insurance company.

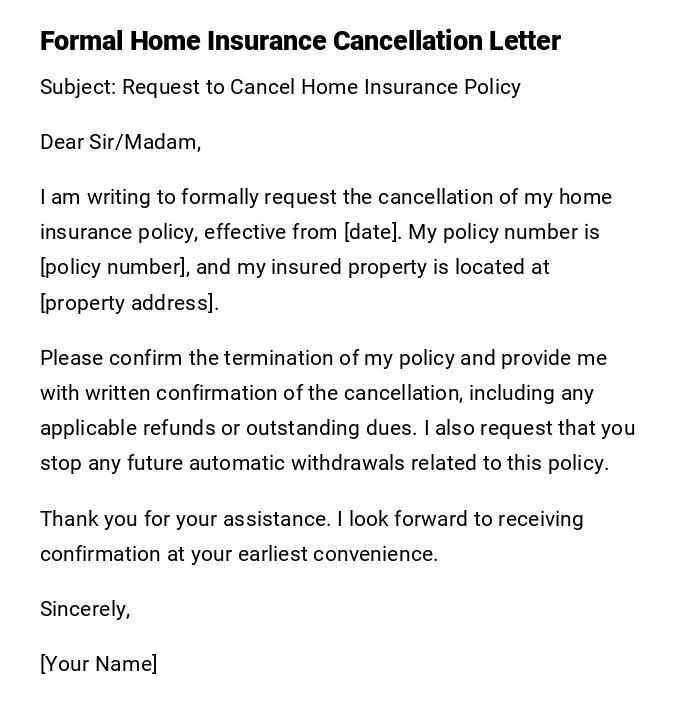

Formal Home Insurance Cancellation Letter

Subject: Request to Cancel Home Insurance Policy

Dear Sir/Madam,

I am writing to formally request the cancellation of my home insurance policy, effective from [date]. My policy number is [policy number], and my insured property is located at [property address].

Please confirm the termination of my policy and provide me with written confirmation of the cancellation, including any applicable refunds or outstanding dues. I also request that you stop any future automatic withdrawals related to this policy.

Thank you for your assistance. I look forward to receiving confirmation at your earliest convenience.

Sincerely,

[Your Name]

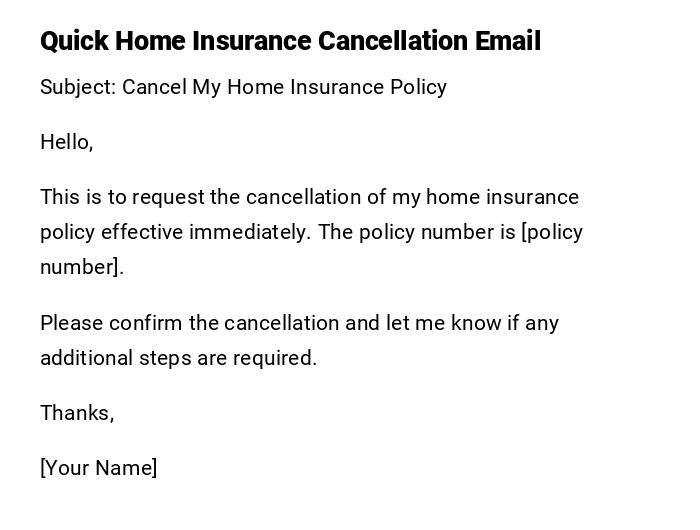

Quick Home Insurance Cancellation Email

Subject: Cancel My Home Insurance Policy

Hello,

This is to request the cancellation of my home insurance policy effective immediately. The policy number is [policy number].

Please confirm the cancellation and let me know if any additional steps are required.

Thanks,

[Your Name]

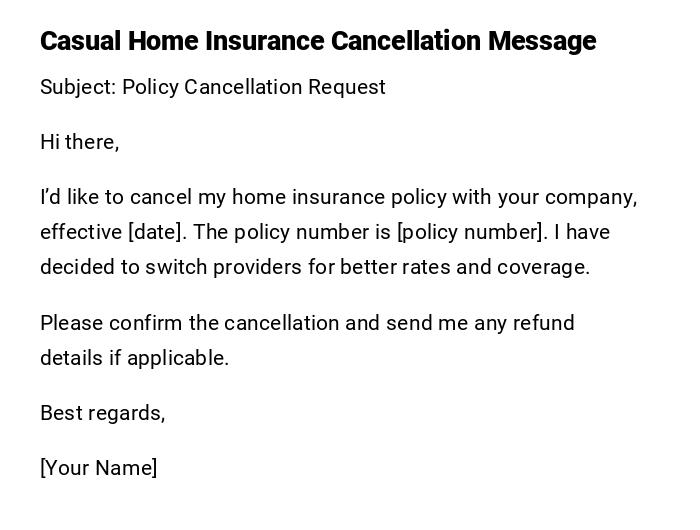

Casual Home Insurance Cancellation Message

Subject: Policy Cancellation Request

Hi there,

I’d like to cancel my home insurance policy with your company, effective [date]. The policy number is [policy number]. I have decided to switch providers for better rates and coverage.

Please confirm the cancellation and send me any refund details if applicable.

Best regards,

[Your Name]

Heartfelt Home Insurance Cancellation Letter Due to Property Sale

Subject: Request for Policy Cancellation Following Sale of Property

Dear Sir/Madam,

I am writing to request the cancellation of my home insurance policy [policy number] for the property located at [property address]. The property has recently been sold, and therefore, I no longer require insurance coverage for it.

I have appreciated the service your company has provided over the years and thank you for your professionalism. Please let me know about any refunds owed or final paperwork required.

Sincerely,

[Your Name]

Official Home Insurance Cancellation Letter for Policy Transfer

Subject: Request for Cancellation of Home Insurance Policy

Dear [Insurance Provider],

I am contacting you to request the cancellation of my home insurance policy [policy number]. The property associated with this policy has been refinanced, and a new insurance provider is covering the property effective [date].

Please issue confirmation of the cancellation and provide details of any refunds or prorated adjustments.

Thank you for your cooperation.

Sincerely,

[Your Name]

Preliminary Cancellation Request Email

Subject: Preliminary Request to Cancel Home Insurance Policy

Dear [Insurance Agent],

I am considering cancelling my current home insurance policy [policy number]. Before proceeding, I would like to know what final balance or refunds would apply. If possible, please confirm the cancellation process and whether any penalties apply.

Once I receive your confirmation, I will finalize the cancellation request.

Kind regards,

[Your Name]

Serious Home Insurance Cancellation Letter Due to Relocation

Subject: Policy Cancellation Request Due to Relocation

Dear Sir/Madam,

I am relocating to another country and will no longer require coverage for my property located at [property address]. Therefore, I kindly request the cancellation of my home insurance policy [policy number], effective [date].

Please confirm the cancellation and provide any necessary documentation to complete the process. I appreciate your assistance in handling this matter promptly.

Respectfully,

[Your Name]

Simple Home Insurance Cancellation Email

Subject: Cancellation of Home Insurance Policy

Dear [Insurance Provider],

Please cancel my home insurance policy [policy number], effective [date]. I request confirmation of this cancellation.

Thank you,

[Your Name]

Funny Yet Polite Home Insurance Cancellation Email

Subject: Time to Break Up With My Insurance Policy

Dear [Insurance Team],

It’s not you, it’s me. After years of being covered, I’ve decided to move on to another provider who offered me a deal I couldn’t refuse. Please consider this my official notice to cancel my home insurance policy [policy number], effective [date].

Please confirm that our “breakup” is official and let me know about any final details. Thank you for keeping me safe all this time.

Sincerely (and with a little smile),

[Your Name]

What is a Home Insurance Cancellation Letter and Why is it Needed?

A home insurance cancellation letter is a formal request sent to an insurance provider asking them to terminate an existing home insurance policy.

It is necessary to prevent ongoing billing, stop automatic renewals, and confirm that coverage ends when it is no longer required.

This letter also ensures proper documentation for both the homeowner and the insurance company.

Who Should Write and Send the Cancellation Letter?

- The homeowner or policyholder should send the letter.

- In cases of joint ownership, both owners may need to sign.

- A legal representative may send it if the homeowner cannot.

- Sometimes, mortgage lenders request or confirm the cancellation.

Whom Should the Home Insurance Cancellation Letter Be Addressed To?

- The insurance company’s customer service department.

- A specific insurance agent or broker who manages your account.

- The company’s cancellation or policy services department.

- If in doubt, address it to "Customer Service" with your policy number.

When Do You Need to Cancel a Home Insurance Policy?

- When you sell the insured property.

- When switching to a different provider.

- If refinancing and coverage is included in a new arrangement.

- When relocating permanently.

- When you find more affordable or comprehensive coverage.

- When you no longer own or live in the property.

How to Write and Send a Home Insurance Cancellation Letter

- Start with a subject line that mentions cancellation.

- Include your policy number and property address.

- State the effective date of cancellation.

- Request confirmation and mention refunds or outstanding balances.

- Use formal, polite language.

- Send the letter by certified mail, email, or via the insurer’s portal.

Requirements and Prerequisites Before Sending

- Review your policy to understand cancellation terms.

- Check for penalties or fees related to early cancellation.

- Ensure you have new coverage in place if required by your lender.

- Gather policy details, effective date, and personal identification.

- Confirm the correct contact information for your insurance provider.

Common Mistakes to Avoid in Insurance Cancellation Letters

- Forgetting to mention the policy number.

- Not specifying an effective date for cancellation.

- Using vague or overly casual wording.

- Assuming the policy ends automatically without written notice.

- Failing to request written confirmation.

Formatting and Style Guidelines for Cancellation Letters

- Keep the letter to one page.

- Use clear, professional, and polite wording.

- Avoid unnecessary details that confuse the request.

- Clearly separate introduction, request, and conclusion.

- For emails, keep the subject line concise and to the point.

After Sending: Follow-Up Steps

- Wait for written confirmation of cancellation.

- Double-check that no further payments are withdrawn.

- Keep a copy of the cancellation letter for your records.

- Notify your mortgage lender if they require proof of new coverage.

- Contact the insurer again if confirmation is not received within 1–2 weeks.

Tricks and Tips for Successful Insurance Cancellations

- Always send the letter with a trackable method.

- Cancel well in advance of policy renewal dates.

- Be polite and professional even if dissatisfied.

- Request prorated refunds where applicable.

- Confirm new coverage before canceling old coverage.

Pros and Cons of Sending a Cancellation Letter

Pros:

- Provides legal documentation of cancellation.

- Ensures no unexpected charges continue.

- Can secure refunds for unused premiums.

Cons:

- Some insurers may charge fees.

- Lack of coverage could affect mortgage obligations.

- Requires time and effort to complete.

Elements and Structure of a Home Insurance Cancellation Letter

- Subject line mentioning cancellation.

- Policy number and insured property address.

- Effective date of cancellation.

- Statement of request for confirmation.

- Contact details for follow-up.

- Polite closing with signature.

Download Word Doc

Download Word Doc

Download PDF

Download PDF