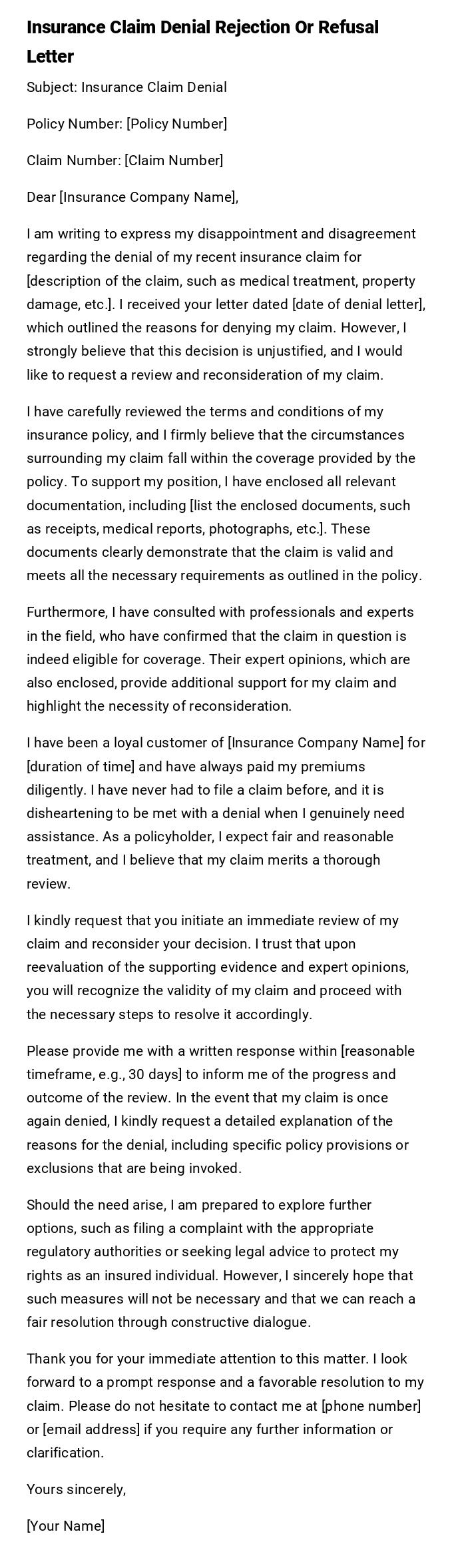

Insurance Claim Denial Rejection Or Refusal Letter

Subject: Insurance Claim Denial

Policy Number: [Policy Number]

Claim Number: [Claim Number]

Dear [Insurance Company Name],

I am writing to express my disappointment and disagreement regarding the denial of my recent insurance claim for [description of the claim, such as medical treatment, property damage, etc.]. I received your letter dated [date of denial letter], which outlined the reasons for denying my claim. However, I strongly believe that this decision is unjustified, and I would like to request a review and reconsideration of my claim.

I have carefully reviewed the terms and conditions of my insurance policy, and I firmly believe that the circumstances surrounding my claim fall within the coverage provided by the policy. To support my position, I have enclosed all relevant documentation, including [list the enclosed documents, such as receipts, medical reports, photographs, etc.]. These documents clearly demonstrate that the claim is valid and meets all the necessary requirements as outlined in the policy.

Furthermore, I have consulted with professionals and experts in the field, who have confirmed that the claim in question is indeed eligible for coverage. Their expert opinions, which are also enclosed, provide additional support for my claim and highlight the necessity of reconsideration.

I have been a loyal customer of [Insurance Company Name] for [duration of time] and have always paid my premiums diligently. I have never had to file a claim before, and it is disheartening to be met with a denial when I genuinely need assistance. As a policyholder, I expect fair and reasonable treatment, and I believe that my claim merits a thorough review.

I kindly request that you initiate an immediate review of my claim and reconsider your decision. I trust that upon reevaluation of the supporting evidence and expert opinions, you will recognize the validity of my claim and proceed with the necessary steps to resolve it accordingly.

Please provide me with a written response within [reasonable timeframe, e.g., 30 days] to inform me of the progress and outcome of the review. In the event that my claim is once again denied, I kindly request a detailed explanation of the reasons for the denial, including specific policy provisions or exclusions that are being invoked.

Should the need arise, I am prepared to explore further options, such as filing a complaint with the appropriate regulatory authorities or seeking legal advice to protect my rights as an insured individual. However, I sincerely hope that such measures will not be necessary and that we can reach a fair resolution through constructive dialogue.

Thank you for your immediate attention to this matter. I look forward to a prompt response and a favorable resolution to my claim. Please do not hesitate to contact me at [phone number] or [email address] if you require any further information or clarification.

Yours sincerely,

[Your Name]

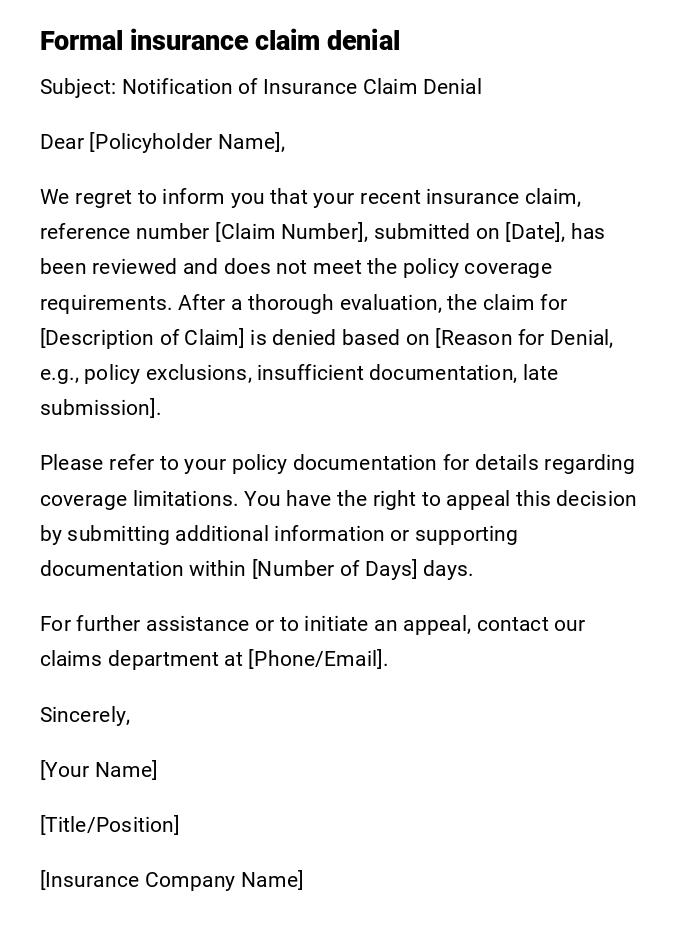

Formal Insurance Claim Denial Letter

Subject: Notification of Insurance Claim Denial

Dear [Policyholder Name],

We regret to inform you that your recent insurance claim, reference number [Claim Number], submitted on [Date], has been reviewed and does not meet the policy coverage requirements. After a thorough evaluation, the claim for [Description of Claim] is denied based on [Reason for Denial, e.g., policy exclusions, insufficient documentation, late submission].

Please refer to your policy documentation for details regarding coverage limitations. You have the right to appeal this decision by submitting additional information or supporting documentation within [Number of Days] days.

For further assistance or to initiate an appeal, contact our claims department at [Phone/Email].

Sincerely,

[Your Name]

[Title/Position]

[Insurance Company Name]

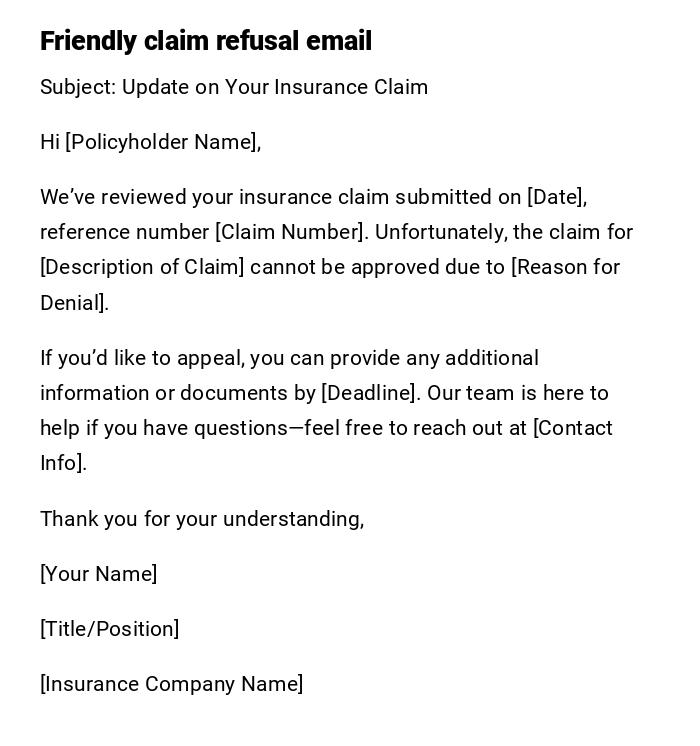

Casual / Friendly Insurance Claim Refusal Email

Subject: Update on Your Insurance Claim

Hi [Policyholder Name],

We’ve reviewed your insurance claim submitted on [Date], reference number [Claim Number]. Unfortunately, the claim for [Description of Claim] cannot be approved due to [Reason for Denial].

If you’d like to appeal, you can provide any additional information or documents by [Deadline]. Our team is here to help if you have questions—feel free to reach out at [Contact Info].

Thank you for your understanding,

[Your Name]

[Title/Position]

[Insurance Company Name]

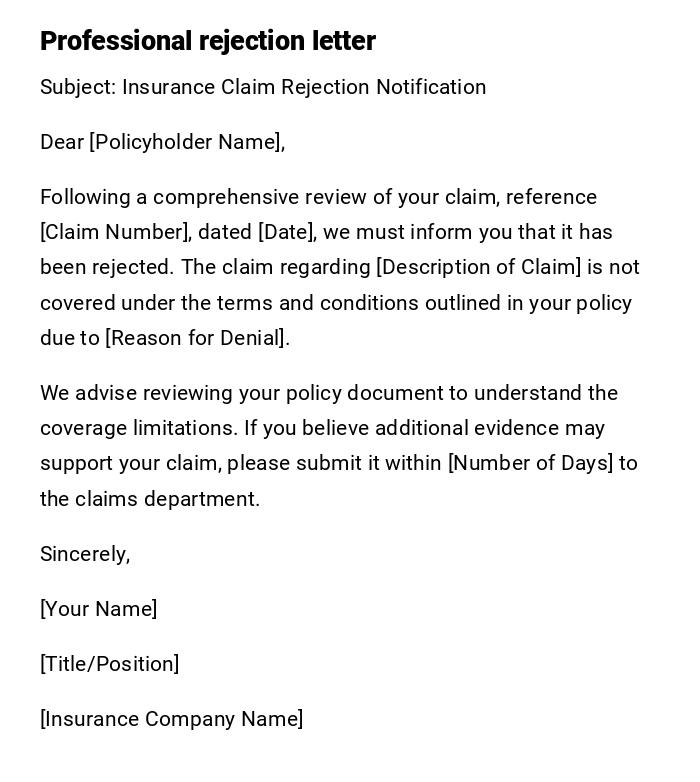

Professional and Serious Insurance Claim Rejection Letter

Subject: Insurance Claim Rejection Notification

Dear [Policyholder Name],

Following a comprehensive review of your claim, reference [Claim Number], dated [Date], we must inform you that it has been rejected. The claim regarding [Description of Claim] is not covered under the terms and conditions outlined in your policy due to [Reason for Denial].

We advise reviewing your policy document to understand the coverage limitations. If you believe additional evidence may support your claim, please submit it within [Number of Days] to the claims department.

Sincerely,

[Your Name]

[Title/Position]

[Insurance Company Name]

Heartfelt / Empathetic Insurance Claim Denial Letter

Subject: Important Update Regarding Your Insurance Claim

Dear [Policyholder Name],

We understand how disappointing it can be to receive news regarding your insurance claim, reference [Claim Number]. After careful review, your claim for [Description of Claim] has been denied due to [Reason for Denial].

We truly regret any inconvenience this may cause and encourage you to review your policy carefully. Should you wish to appeal or provide additional documentation, please contact us at [Contact Info].

Warm regards,

[Your Name]

[Title/Position]

[Insurance Company Name]

Quick / Simple Insurance Claim Refusal Email

Subject: Claim Status Update

Dear [Policyholder Name],

Your insurance claim [Claim Number] submitted on [Date] has been reviewed and cannot be approved due to [Reason for Denial].

For any questions or appeals, please contact our claims department at [Phone/Email].

Thank you,

[Your Name]

[Insurance Company Name]

What / Why: Purpose of an Insurance Claim Denial Letter

- Officially informs policyholders that their insurance claim has been rejected.

- Provides a clear explanation and justification for the denial.

- Offers guidance on appeal procedures or next steps.

- Helps maintain transparency and compliance with regulatory requirements.

Who Should Send an Insurance Claim Denial Letter

- Authorized personnel in the claims department.

- Insurance company representatives responsible for policy management.

- Supervisors or managers reviewing claims when required by policy procedures.

Whom the Insurance Claim Denial Letter Should Be Addressed To

- The policyholder who submitted the claim.

- In some cases, legal representatives or beneficiaries listed in the policy.

- Internal records for compliance documentation.

When to Send an Insurance Claim Denial Letter

- After thorough review of the claim against policy terms.

- Once all supporting documentation has been evaluated.

- Before the appeal deadline to ensure policyholder awareness and compliance.

How to Write and Send an Insurance Claim Denial Letter

- Begin with a clear subject indicating the denial or refusal of the claim.

- Include claim reference number and date submitted.

- Provide specific reasons for denial with reference to policy terms.

- Offer appeal instructions and deadlines.

- Use professional or empathetic tone based on audience and circumstances.

- Send via official mail or secure email depending on preference.

Formatting Guidelines for Insurance Claim Denial Letters

- Keep the letter concise, factual, and respectful.

- Use professional letterhead or official email format.

- Tone should reflect seriousness and clarity; empathy can be included where appropriate.

- Ensure all required details: claim number, date, reason, and appeal options are present.

Requirements and Prerequisites Before Sending

- Verify claim details and supporting documentation.

- Confirm policy coverage and exclusions.

- Document internal review process and decision rationale.

- Prepare appeal instructions if applicable.

After Sending / Follow-up Actions

- Monitor for receipt acknowledgment by policyholder.

- Respond to inquiries or appeals within stipulated timelines.

- Maintain records for regulatory compliance and internal auditing.

- Update claim status in internal systems accurately.

Pros and Cons of Sending an Insurance Claim Denial Letter

Pros:

- Provides clarity and transparency to the policyholder.

- Protects the insurer legally by documenting denial reasons.

- Helps manage expectations and prevent misunderstandings.

Cons:

- Can create dissatisfaction or complaints from policyholders.

- May trigger appeals or disputes requiring additional resources.

- Risk of negative reputation if not handled with clarity and empathy.

Tricks and Tips for Effective Insurance Claim Denial Letters

- Use clear and simple language avoiding jargon.

- Include direct references to policy terms supporting the denial.

- Maintain empathy while being firm in the decision.

- Provide clear instructions for appeal or next steps.

- Keep internal documentation to support the decision.

Common Mistakes to Avoid

- Vague explanations without referencing policy clauses.

- Missing claim numbers or submission dates.

- Delayed communication after decision is made.

- Using overly harsh or insensitive language.

Elements and Structure of an Insurance Claim Denial Letter

- Subject line clearly indicating claim denial or refusal

- Salutation addressing the policyholder

- Claim reference number and submission date

- Clear explanation of denial reason

- References to policy terms and conditions

- Instructions for appeal or submission of additional documentation

- Contact information for queries

- Closing statement with professional tone

Does it Require Attestation or Authorization

- Must be issued by authorized personnel in the claims department.

- Signature of manager or claims officer enhances authenticity.

- Use of official letterhead or secure company email ensures formal recognition.

Compare and Contrast: Claim Denial Letter vs Claim Acknowledgment Letter

-

Claim Denial Letter:

- Informs policyholder that claim is rejected.

- Provides detailed reasons for denial.

- Includes appeal instructions.

-

Claim Acknowledgment Letter:

- Confirms receipt of a claim.

- Does not indicate acceptance or denial.

- Provides claim tracking information and estimated review timelines.

FAQ

Q: Can I appeal a denied insurance claim?

A: Yes, most insurers provide a defined appeal process; instructions are usually included in the denial letter.

Q: How soon will I receive the denial letter?

A: Typically within the time frame stated in your policy after claim review.

Q: What if I disagree with the denial reason?

A: You can submit additional documentation or request a review following the appeal process.

Q: Can denial letters be sent via email?

A: Yes, if the policyholder has agreed to electronic communication, ensuring security and confidentiality.

Download Word Doc

Download Word Doc

Download PDF

Download PDF