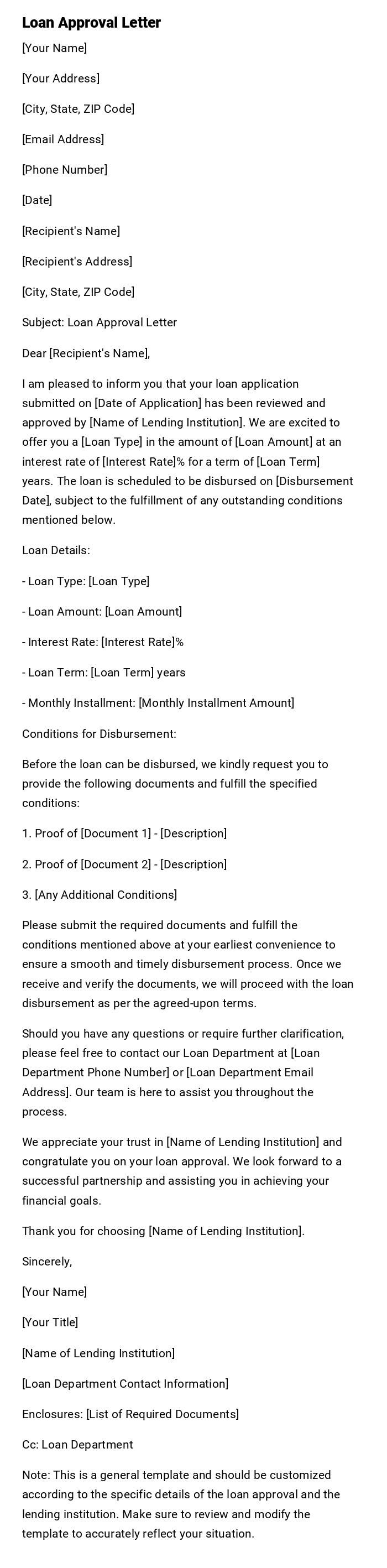

Loan Approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Loan Approval Letter

Dear [Recipient's Name],

I am pleased to inform you that your loan application submitted on [Date of Application] has been reviewed and approved by [Name of Lending Institution]. We are excited to offer you a [Loan Type] in the amount of [Loan Amount] at an interest rate of [Interest Rate]% for a term of [Loan Term] years. The loan is scheduled to be disbursed on [Disbursement Date], subject to the fulfillment of any outstanding conditions mentioned below.

Loan Details:

- Loan Type: [Loan Type]

- Loan Amount: [Loan Amount]

- Interest Rate: [Interest Rate]%

- Loan Term: [Loan Term] years

- Monthly Installment: [Monthly Installment Amount]

Conditions for Disbursement:

Before the loan can be disbursed, we kindly request you to provide the following documents and fulfill the specified conditions:

1. Proof of [Document 1] - [Description]

2. Proof of [Document 2] - [Description]

3. [Any Additional Conditions]

Please submit the required documents and fulfill the conditions mentioned above at your earliest convenience to ensure a smooth and timely disbursement process. Once we receive and verify the documents, we will proceed with the loan disbursement as per the agreed-upon terms.

Should you have any questions or require further clarification, please feel free to contact our Loan Department at [Loan Department Phone Number] or [Loan Department Email Address]. Our team is here to assist you throughout the process.

We appreciate your trust in [Name of Lending Institution] and congratulate you on your loan approval. We look forward to a successful partnership and assisting you in achieving your financial goals.

Thank you for choosing [Name of Lending Institution].

Sincerely,

[Your Name]

[Your Title]

[Name of Lending Institution]

[Loan Department Contact Information]

Enclosures: [List of Required Documents]

Cc: Loan Department

Note: This is a general template and should be customized according to the specific details of the loan approval and the lending institution. Make sure to review and modify the template to accurately reflect your situation.

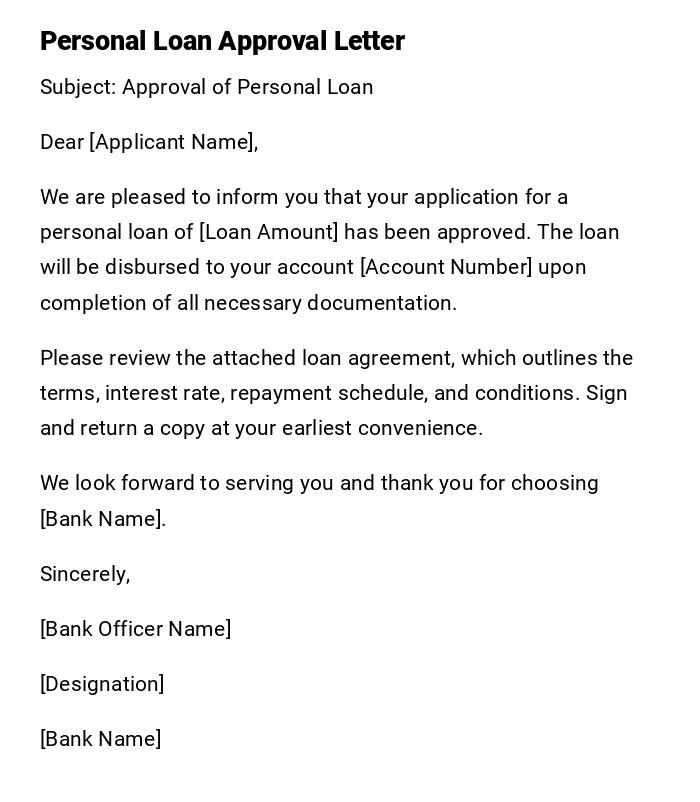

Personal Loan Approval Letter

Subject: Approval of Personal Loan

Dear [Applicant Name],

We are pleased to inform you that your application for a personal loan of [Loan Amount] has been approved. The loan will be disbursed to your account [Account Number] upon completion of all necessary documentation.

Please review the attached loan agreement, which outlines the terms, interest rate, repayment schedule, and conditions. Sign and return a copy at your earliest convenience.

We look forward to serving you and thank you for choosing [Bank Name].

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

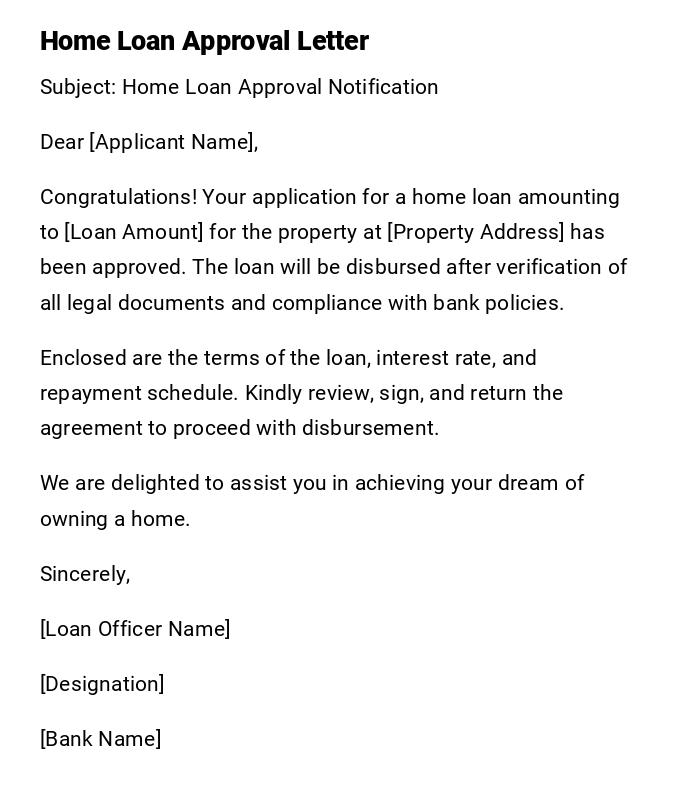

Home Loan Approval Letter

Subject: Home Loan Approval Notification

Dear [Applicant Name],

Congratulations! Your application for a home loan amounting to [Loan Amount] for the property at [Property Address] has been approved. The loan will be disbursed after verification of all legal documents and compliance with bank policies.

Enclosed are the terms of the loan, interest rate, and repayment schedule. Kindly review, sign, and return the agreement to proceed with disbursement.

We are delighted to assist you in achieving your dream of owning a home.

Sincerely,

[Loan Officer Name]

[Designation]

[Bank Name]

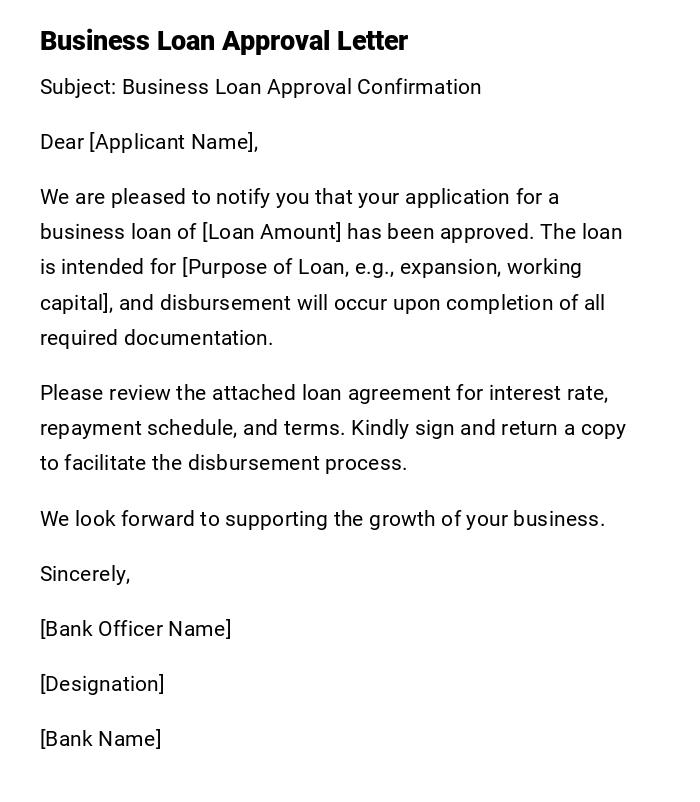

Business Loan Approval Letter

Subject: Business Loan Approval Confirmation

Dear [Applicant Name],

We are pleased to notify you that your application for a business loan of [Loan Amount] has been approved. The loan is intended for [Purpose of Loan, e.g., expansion, working capital], and disbursement will occur upon completion of all required documentation.

Please review the attached loan agreement for interest rate, repayment schedule, and terms. Kindly sign and return a copy to facilitate the disbursement process.

We look forward to supporting the growth of your business.

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

Educational Loan Approval Letter

Subject: Educational Loan Approval Notification

Dear [Applicant Name],

We are pleased to inform you that your educational loan application of [Loan Amount] for [Institution Name / Course] has been approved. The loan will be disbursed in accordance with the tuition fee schedule upon completion of all required formalities.

Enclosed are the loan terms, interest rate, and repayment plan. Kindly review, sign, and submit the agreement to initiate disbursement.

We wish you success in your academic pursuits.

Sincerely,

[Loan Officer Name]

[Designation]

[Bank Name]

Quick Loan Approval Email

Subject: Your Loan Has Been Approved

Hello [Applicant Name],

Good news! Your loan application for [Loan Amount] has been approved. The funds will be transferred to your account [Account Number] within [Timeframe] after completing the documentation.

Please check the attached agreement, sign it, and return it to confirm acceptance.

Thank you for choosing [Bank Name] for your financial needs.

Best regards,

[Bank Officer Name]

[Designation]

[Bank Name]

What / Why Section

What is a Loan Approval Letter and Why is it Important

- A loan approval letter is an official communication from a bank or financial institution indicating that a loan application has been accepted.

- Purpose:

- Confirms the approval of the requested loan amount.

- Provides formal terms and conditions of the loan.

- Serves as legal documentation for both the lender and borrower.

- Helps the borrower understand repayment schedule and obligations.

Who Should Send a Loan Approval Letter

Authorized Issuers

- Bank or financial institution officer responsible for loan approvals.

- Loan department head or manager.

- Authorized personnel with the legal capacity to confirm loan approval.

- Must ensure compliance with all banking and legal regulations.

Whom Should a Loan Approval Letter Be Addressed To

Recipients

- The individual applicant who applied for the loan.

- Co-applicants or guarantors (if applicable).

- Sometimes internal departments for record keeping (loan officer, finance department).

When to Issue a Loan Approval Letter

Situations Triggering Issuance

- After successful evaluation and verification of the loan application.

- Once all required documents have been submitted and validated.

- Upon meeting eligibility criteria set by the financial institution.

- Following final review by authorized personnel or committees.

How to Write and Send a Loan Approval Letter

Process and Considerations

- Verify the applicant’s identity and documentation.

- Specify the loan type, amount, and purpose.

- Include terms, interest rate, and repayment schedule.

- Address the applicant formally with a clear subject line.

- Attach the loan agreement for signing.

- Choose appropriate mode: printed letter or digital email.

- Ensure compliance with legal and regulatory requirements.

Formatting Guidelines for Loan Approval Letters

Preferred Style and Structure

- Length: One page is sufficient; concise yet detailed.

- Tone: Professional, formal, and clear.

- Structure:

- Subject line indicating approval

- Salutation to applicant

- Approval statement and loan details

- Terms, interest rate, and repayment plan

- Instructions for documentation or agreement signing

- Closing and authorized signature

- Attachments: Loan agreement or supporting documents

- Mode: Physical letter or email depending on institution policy

Requirements and Prerequisites Before Issuance

Checklist for Loan Approval Letter

- Completion of loan application verification.

- Submission of all required documents by the applicant.

- Creditworthiness and eligibility assessment.

- Approval by authorized personnel or committee.

- Prepared loan agreement with terms and repayment details.

After Sending / Follow-Up

Post-Issuance Actions

- Confirm receipt by the applicant.

- Ensure signed agreement is returned and processed.

- Coordinate disbursement of funds to applicant’s account.

- Maintain a copy in institutional records for auditing purposes.

- Answer any queries regarding repayment or terms.

Common Mistakes in Loan Approval Letters

Mistakes to Avoid

- Missing or unclear loan amount or type.

- Omitting repayment schedule or interest rate details.

- Using ambiguous or informal language.

- Failing to include instructions for signing the agreement.

- Sending without proper authorization or signature.

- Not keeping a copy for records.

Tricks and Tips for Effective Loan Approval Letters

Best Practices

- Clearly specify loan amount, purpose, and type.

- Include all critical terms, interest rates, and repayment schedules.

- Use professional and formal language.

- Attach loan agreement for immediate processing.

- Ensure timely communication to facilitate disbursement.

- Keep copies for internal auditing and legal compliance.

Elements and Structure of a Loan Approval Letter

Essential Components

- Subject line indicating approval

- Salutation

- Loan type, amount, and purpose

- Terms, interest rate, and repayment schedule

- Instructions for signing and submitting loan agreement

- Closing with authorized signature and designation

- Attachments: Loan agreement or supporting documentation

- Optional: Contact info for queries

Compare and Contrast with Other Financial Letters

Differences from Similar Letters

- Loan approval letters confirm acceptance, unlike loan application letters which request funding.

- Loan sanction letters may precede or accompany approval letters with detailed conditions.

- Loan rejection letters serve opposite purposes, explaining denial reasons.

- Other letters like credit verification letters focus on creditworthiness, not approval.

Does a Loan Approval Letter Require Attestation or Authorization?

Attestation Requirements

- Must be signed by authorized bank personnel or loan officer.

- Official stamp or letterhead often required for authenticity.

- Digital emails may include secure digital signatures.

- Some institutions require manager or departmental authorization for large amounts.

Download Word Doc

Download Word Doc

Download PDF

Download PDF