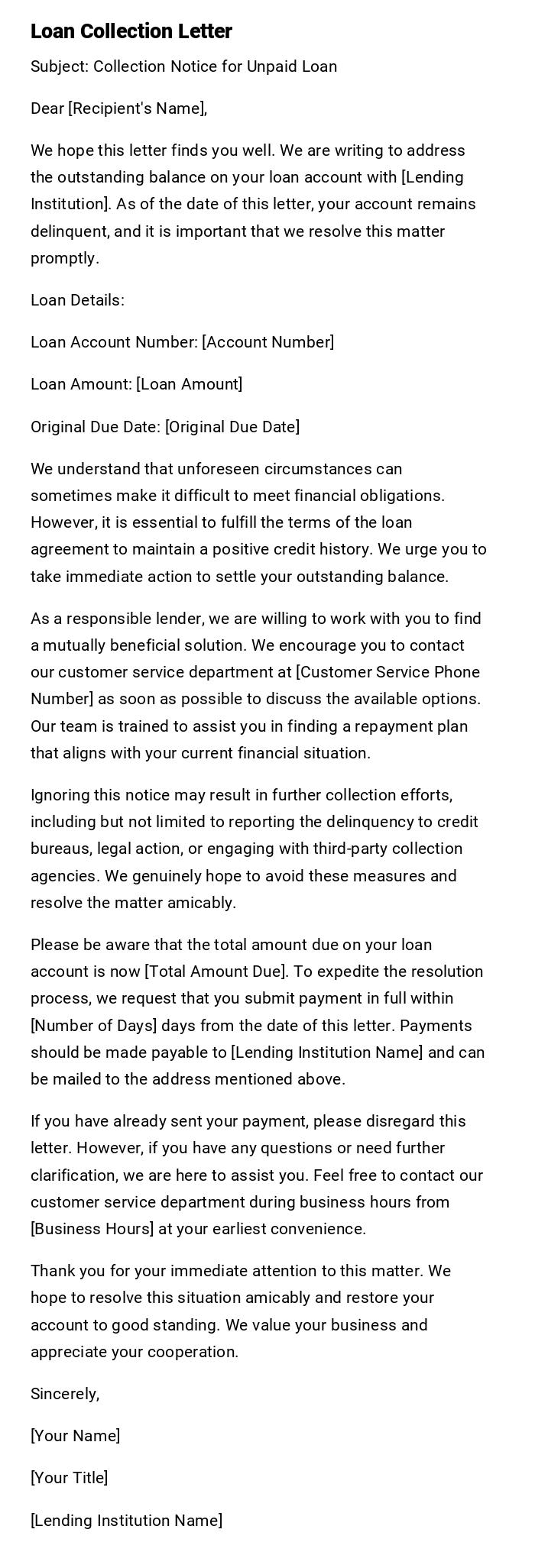

Loan Collection Letter

Subject: Collection Notice for Unpaid Loan

Dear [Recipient's Name],

We hope this letter finds you well. We are writing to address the outstanding balance on your loan account with [Lending Institution]. As of the date of this letter, your account remains delinquent, and it is important that we resolve this matter promptly.

Loan Details:

Loan Account Number: [Account Number]

Loan Amount: [Loan Amount]

Original Due Date: [Original Due Date]

We understand that unforeseen circumstances can sometimes make it difficult to meet financial obligations. However, it is essential to fulfill the terms of the loan agreement to maintain a positive credit history. We urge you to take immediate action to settle your outstanding balance.

As a responsible lender, we are willing to work with you to find a mutually beneficial solution. We encourage you to contact our customer service department at [Customer Service Phone Number] as soon as possible to discuss the available options. Our team is trained to assist you in finding a repayment plan that aligns with your current financial situation.

Ignoring this notice may result in further collection efforts, including but not limited to reporting the delinquency to credit bureaus, legal action, or engaging with third-party collection agencies. We genuinely hope to avoid these measures and resolve the matter amicably.

Please be aware that the total amount due on your loan account is now [Total Amount Due]. To expedite the resolution process, we request that you submit payment in full within [Number of Days] days from the date of this letter. Payments should be made payable to [Lending Institution Name] and can be mailed to the address mentioned above.

If you have already sent your payment, please disregard this letter. However, if you have any questions or need further clarification, we are here to assist you. Feel free to contact our customer service department during business hours from [Business Hours] at your earliest convenience.

Thank you for your immediate attention to this matter. We hope to resolve this situation amicably and restore your account to good standing. We value your business and appreciate your cooperation.

Sincerely,

[Your Name]

[Your Title]

[Lending Institution Name]

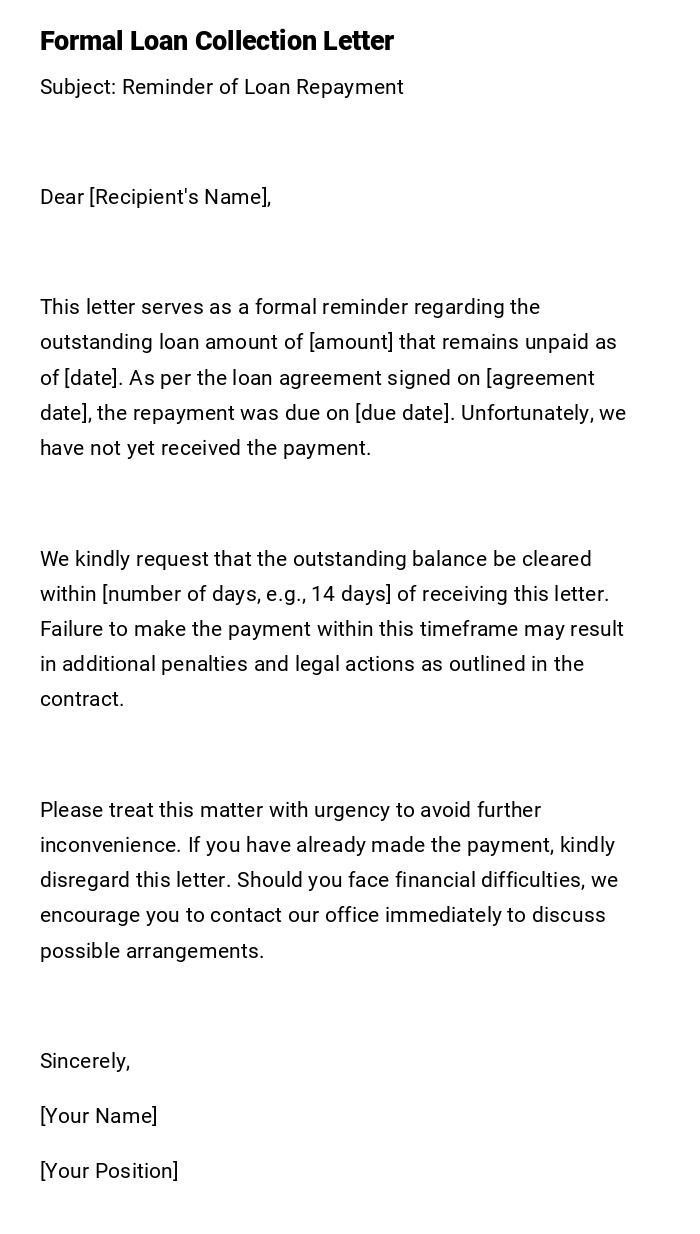

Formal Loan Collection Letter

Subject: Reminder of Loan Repayment

Dear [Recipient's Name],

This letter serves as a formal reminder regarding the outstanding loan amount of [amount] that remains unpaid as of [date]. As per the loan agreement signed on [agreement date], the repayment was due on [due date]. Unfortunately, we have not yet received the payment.

We kindly request that the outstanding balance be cleared within [number of days, e.g., 14 days] of receiving this letter. Failure to make the payment within this timeframe may result in additional penalties and legal actions as outlined in the contract.

Please treat this matter with urgency to avoid further inconvenience. If you have already made the payment, kindly disregard this letter. Should you face financial difficulties, we encourage you to contact our office immediately to discuss possible arrangements.

Sincerely,

[Your Name]

[Your Position]

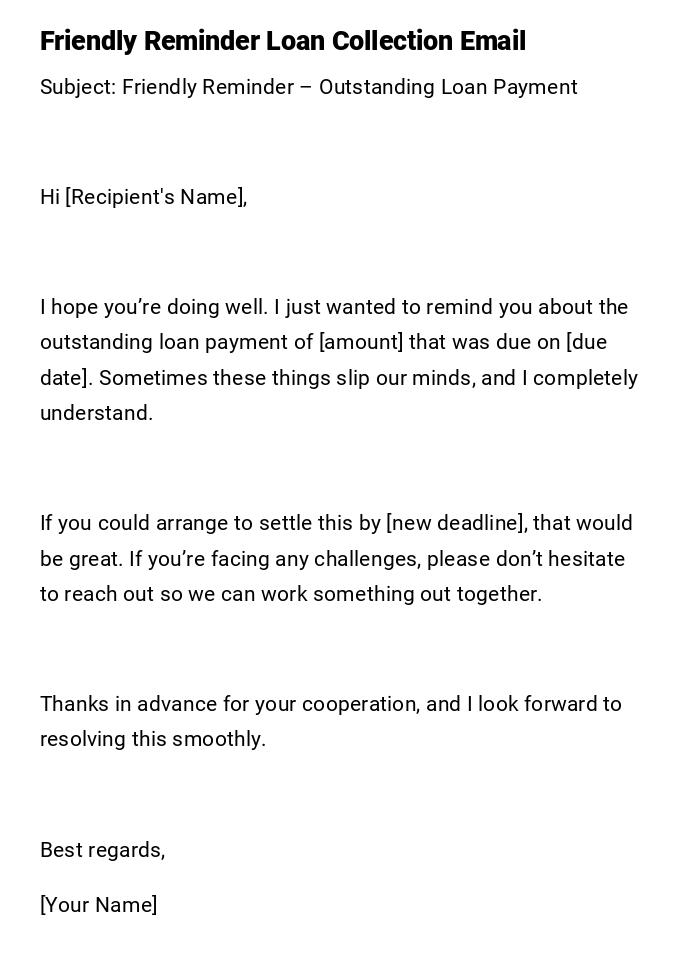

Friendly Reminder Loan Collection Email

Subject: Friendly Reminder – Outstanding Loan Payment

Hi [Recipient's Name],

I hope you’re doing well. I just wanted to remind you about the outstanding loan payment of [amount] that was due on [due date]. Sometimes these things slip our minds, and I completely understand.

If you could arrange to settle this by [new deadline], that would be great. If you’re facing any challenges, please don’t hesitate to reach out so we can work something out together.

Thanks in advance for your cooperation, and I look forward to resolving this smoothly.

Best regards,

[Your Name]

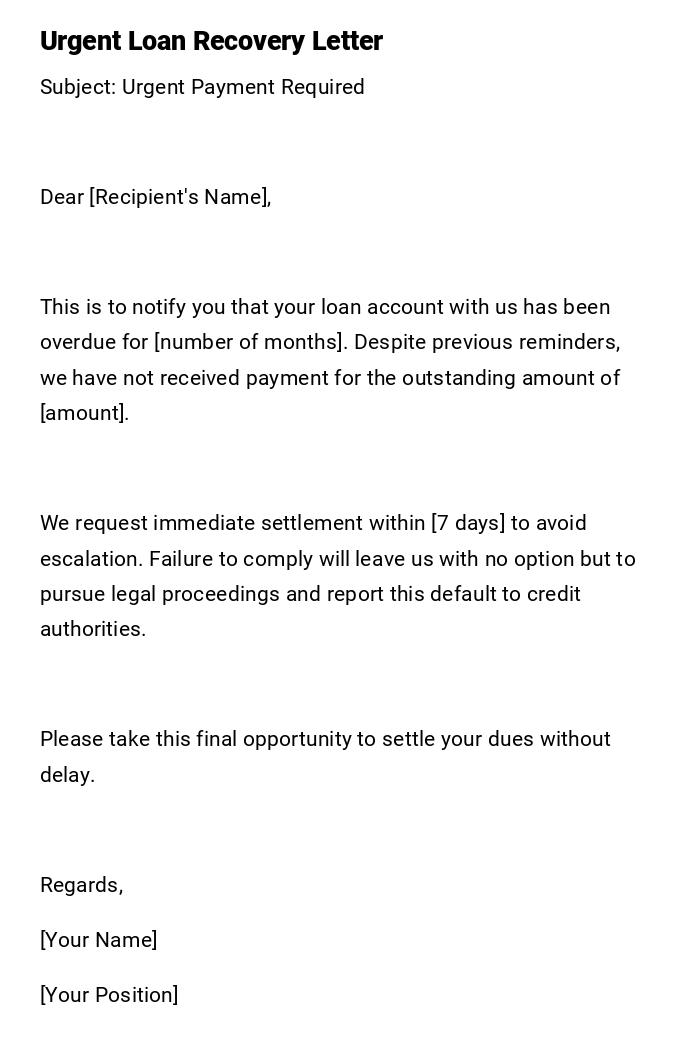

Urgent Loan Recovery Letter

Subject: Urgent Payment Required

Dear [Recipient's Name],

This is to notify you that your loan account with us has been overdue for [number of months]. Despite previous reminders, we have not received payment for the outstanding amount of [amount].

We request immediate settlement within [7 days] to avoid escalation. Failure to comply will leave us with no option but to pursue legal proceedings and report this default to credit authorities.

Please take this final opportunity to settle your dues without delay.

Regards,

[Your Name]

[Your Position]

Payment Plan Proposal Message

Subject: Payment Plan for Your Outstanding Loan

Dear [Recipient's Name],

We noticed that you are experiencing difficulties in repaying your loan of [amount]. Instead of allowing the debt to accumulate further, we would like to propose a structured payment plan that can make the repayment process easier for you.

The proposed plan would allow you to pay [amount] monthly over [duration], starting from [date]. This will help avoid late fees and protect your credit history.

Please confirm your acceptance of this proposal or suggest adjustments that may better suit your current financial situation. We are open to working with you toward a solution.

Sincerely,

[Your Name]

[Your Position]

Final Warning Loan Collection Letter

Subject: Final Notice Before Legal Action

Dear [Recipient's Name],

This is the final reminder concerning your overdue loan balance of [amount]. Despite multiple reminders, the payment has not been made, and your account remains in default.

If payment is not received by [final deadline], we will be compelled to initiate legal proceedings and transfer your case to our recovery agency. Please understand that this action will have significant consequences on your financial standing and credit history.

We urge you to make immediate arrangements to clear your dues to prevent these actions.

Regards,

[Your Name]

[Your Position]

Lighthearted Casual Reminder Email

Subject: Just a Quick Reminder About Your Loan

Hey [Recipient's Name],

Hope all’s good with you! I just wanted to nudge you about that loan payment of [amount] that’s still pending since [due date]. I know life gets busy and things slip through the cracks sometimes.

When you get a chance, could you settle it up by [date]? If there’s any hiccup on your side, let me know and we’ll figure it out.

Thanks a bunch!

Cheers,

[Your Name]

Debt Settlement Offer Letter

Subject: Settlement Offer for Your Loan

Dear [Recipient's Name],

We recognize that you have been unable to repay the full loan amount of [amount]. To resolve this matter amicably, we are willing to accept a one-time payment of [settlement amount] as full and final settlement, provided it is made by [settlement deadline].

This offer will relieve you of any further obligations on this account and will prevent legal escalation. Please confirm in writing if you agree to this settlement so we can provide the necessary payment instructions.

This is a limited-time opportunity, and we encourage you to act promptly.

Sincerely,

[Your Name]

[Your Position]

What is a loan collection letter and why do you need it?

A loan collection letter is a formal or informal communication sent to remind or demand repayment of an outstanding loan.

Its purpose is to:

- Remind borrowers of due dates and amounts.

- Encourage repayment without escalating the issue.

- Provide legal documentation of efforts made to collect debt.

- Offer repayment options or settlements.

Who should send a loan collection letter?

- Banks and financial institutions.

- Microfinance companies and cooperatives.

- Individual lenders in personal loan arrangements.

- Legal representatives acting on behalf of lenders.

- Debt recovery agencies contracted by the lender.

To whom should a loan collection letter be addressed?

- The primary borrower responsible for repayment.

- Co-signers or guarantors, if applicable.

- Authorized representatives of businesses in case of business loans.

- Executors or administrators if the borrower is deceased and the loan passes to the estate.

When should you send a loan collection letter?

- Immediately after a missed repayment due date.

- After repeated non-payment despite prior verbal reminders.

- At different stages: initial friendly reminder, second warning, and final notice.

- Before legal escalation or involving a debt collection agency.

- When offering settlements or payment plan options.

Common mistakes to avoid in loan collection letters

- Using aggressive or threatening language too early.

- Failing to specify the exact outstanding amount.

- Forgetting to include due dates or deadlines.

- Sending generic letters without personalizing the borrower’s details.

- Not keeping a copy of the communication for records.

Elements and structure of a loan collection letter

- Clear subject line (e.g., Reminder, Urgent Payment Required, Final Notice).

- Proper greeting addressing the borrower.

- Statement of outstanding balance and due date.

- Consequences of non-payment.

- Options for settlement, repayment plan, or further steps.

- Professional closing with contact details.

Tricks and tips for writing effective loan collection letters

- Start with polite language before moving to firmer tones.

- Always include the exact figures to avoid confusion.

- Offer flexibility like payment plans if feasible.

- Keep the letters short but precise.

- Use a mix of print letters and digital reminders for greater effectiveness.

After sending a loan collection letter – follow-up steps

- Track whether the borrower responds or makes payment.

- Send reminders at intervals if no action is taken.

- Keep all communications for legal evidence.

- Escalate to legal action or debt recovery agencies if letters fail.

- Inform the borrower of the consequences before taking final measures.

Pros and cons of sending loan collection letters

Pros:

- Creates a paper trail for legal protection.

- Encourages voluntary repayment before escalation.

- Can preserve lender-borrower relationship if written respectfully.

Cons:

- May be ignored if the borrower is unwilling or unable to pay.

- Risk of damaging the relationship if the tone is too harsh.

- Time-consuming if multiple reminders are required.

How many collection letters are usually sent?

- First reminder: Sent immediately after the due date is missed.

- Second reminder: Sent within 1–2 weeks after the first if no payment is received.

- Final notice: Sent before legal action, usually within 30–60 days.

- Typically, lenders send 2–3 collection letters before escalation.

Download Word Doc

Download Word Doc

Download PDF

Download PDF