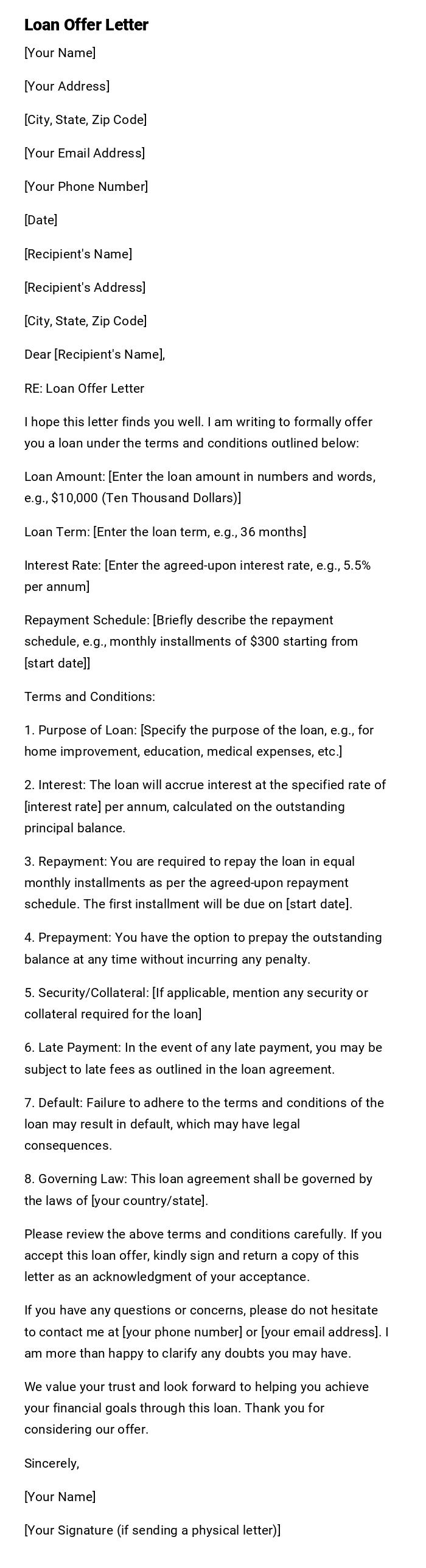

Loan Offer Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Dear [Recipient's Name],

RE: Loan Offer Letter

I hope this letter finds you well. I am writing to formally offer you a loan under the terms and conditions outlined below:

Loan Amount: [Enter the loan amount in numbers and words, e.g., $10,000 (Ten Thousand Dollars)]

Loan Term: [Enter the loan term, e.g., 36 months]

Interest Rate: [Enter the agreed-upon interest rate, e.g., 5.5% per annum]

Repayment Schedule: [Briefly describe the repayment schedule, e.g., monthly installments of $300 starting from [start date]]

Terms and Conditions:

1. Purpose of Loan: [Specify the purpose of the loan, e.g., for home improvement, education, medical expenses, etc.]

2. Interest: The loan will accrue interest at the specified rate of [interest rate] per annum, calculated on the outstanding principal balance.

3. Repayment: You are required to repay the loan in equal monthly installments as per the agreed-upon repayment schedule. The first installment will be due on [start date].

4. Prepayment: You have the option to prepay the outstanding balance at any time without incurring any penalty.

5. Security/Collateral: [If applicable, mention any security or collateral required for the loan]

6. Late Payment: In the event of any late payment, you may be subject to late fees as outlined in the loan agreement.

7. Default: Failure to adhere to the terms and conditions of the loan may result in default, which may have legal consequences.

8. Governing Law: This loan agreement shall be governed by the laws of [your country/state].

Please review the above terms and conditions carefully. If you accept this loan offer, kindly sign and return a copy of this letter as an acknowledgment of your acceptance.

If you have any questions or concerns, please do not hesitate to contact me at [your phone number] or [your email address]. I am more than happy to clarify any doubts you may have.

We value your trust and look forward to helping you achieve your financial goals through this loan. Thank you for considering our offer.

Sincerely,

[Your Name]

[Your Signature (if sending a physical letter)]

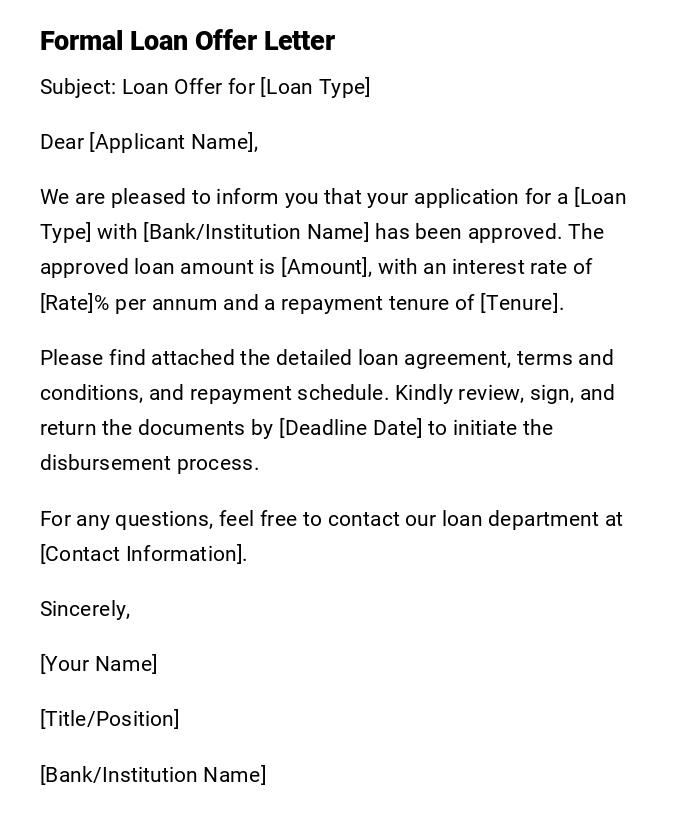

Formal Loan Offer Letter

Subject: Loan Offer for [Loan Type]

Dear [Applicant Name],

We are pleased to inform you that your application for a [Loan Type] with [Bank/Institution Name] has been approved. The approved loan amount is [Amount], with an interest rate of [Rate]% per annum and a repayment tenure of [Tenure].

Please find attached the detailed loan agreement, terms and conditions, and repayment schedule. Kindly review, sign, and return the documents by [Deadline Date] to initiate the disbursement process.

For any questions, feel free to contact our loan department at [Contact Information].

Sincerely,

[Your Name]

[Title/Position]

[Bank/Institution Name]

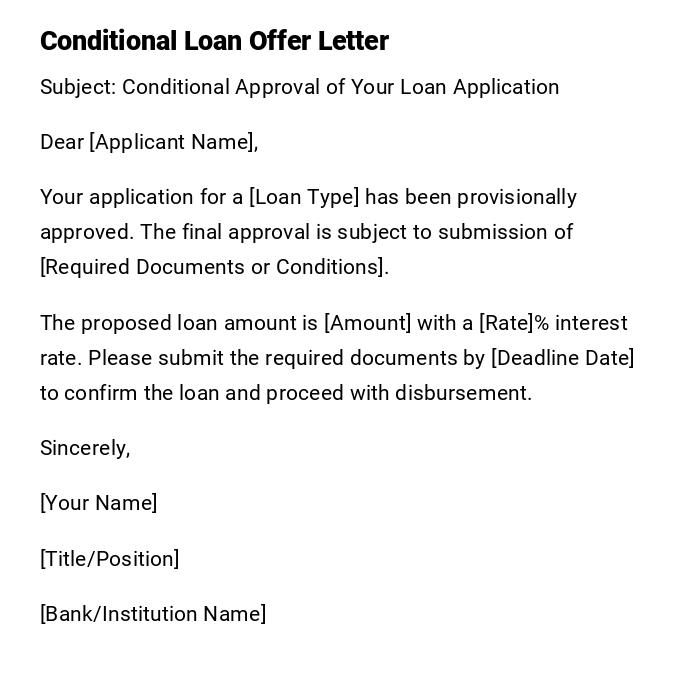

Conditional Loan Offer Letter

Subject: Conditional Approval of Your Loan Application

Dear [Applicant Name],

Your application for a [Loan Type] has been provisionally approved. The final approval is subject to submission of [Required Documents or Conditions].

The proposed loan amount is [Amount] with a [Rate]% interest rate. Please submit the required documents by [Deadline Date] to confirm the loan and proceed with disbursement.

Sincerely,

[Your Name]

[Title/Position]

[Bank/Institution Name]

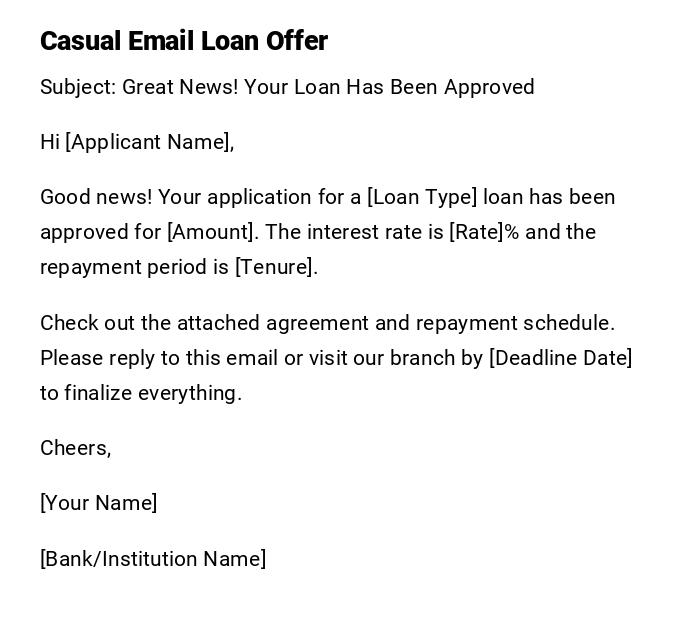

Casual Email Loan Offer

Subject: Great News! Your Loan Has Been Approved

Hi [Applicant Name],

Good news! Your application for a [Loan Type] loan has been approved for [Amount]. The interest rate is [Rate]% and the repayment period is [Tenure].

Check out the attached agreement and repayment schedule. Please reply to this email or visit our branch by [Deadline Date] to finalize everything.

Cheers,

[Your Name]

[Bank/Institution Name]

What / Why Section

What is a Loan Offer Letter and Why It Is Important

- A loan offer letter is an official notification from a bank or financial institution confirming that a loan has been approved for an applicant.

- Purpose:

- Communicates approval status formally.

- Details the loan amount, interest rate, repayment terms, and conditions.

- Serves as a reference document for the borrower.

- Initiates the next steps toward loan disbursement.

Who Should Send a Loan Offer Letter

Authorized Senders

- Loan officers or managers from the bank or lending institution.

- Branch managers responsible for loan approvals.

- Official representatives of the financial institution authorized to communicate loan offers.

Whom Should the Letter Be Addressed To

Recipients

- The individual or entity that applied for the loan.

- Co-applicants if applicable.

- In case of business loans, may also include company representatives or guarantors.

When to Send a Loan Offer Letter

Timing

- Immediately after loan approval has been confirmed.

- After any conditions for provisional approval have been met.

- With enough time for the borrower to review and respond before disbursement.

How to Write and Send a Loan Offer Letter

Process

- Begin with a clear subject line indicating loan approval.

- Address the recipient personally.

- Include loan type, amount, interest rate, and repayment tenure.

- Mention any conditions if applicable.

- Attach loan agreement and schedule.

- Provide a deadline for document submission or confirmation.

- Sign off with the sender’s name, title, and institution.

- Send via official email or printed letterhead.

Requirements and Prerequisites for Sending

Before Sending

- Verify that the loan application is fully approved.

- Confirm all documentation and eligibility checks are complete.

- Prepare the loan agreement, terms, and repayment schedule.

- Ensure the sender is authorized to issue the offer.

Formatting Guidelines for Loan Offer Letters

Letter Style and Tone

- Length: Typically one page.

- Tone: Professional, clear, and formal.

- Elements:

- Subject line

- Salutation

- Loan approval notification

- Loan details and conditions

- Attachments and instructions

- Deadline for response

- Closing and contact information

- Delivery mode: Email or printed letterhead.

After Sending / Follow-up Actions

Post-Sending

- Track recipient confirmation or queries.

- Update internal records and loan management systems.

- Follow up to ensure submission of signed agreements and documents.

- Schedule disbursement once conditions are fulfilled.

Common Mistakes to Avoid in Loan Offer Letters

Mistakes

- Omitting important loan details such as interest rate or repayment terms.

- Not specifying conditions for provisional approvals.

- Using vague or unclear language.

- Failing to include attachments or deadlines.

- Sending from unauthorized personnel or unofficial channels.

Tricks and Tips for Loan Offer Letters

Best Practices

- Use clear, concise, and professional language.

- Include all loan details to prevent misunderstandings.

- Attach all necessary documents for transparency.

- Specify deadlines for response to streamline processing.

- Personalize the letter with the applicant's name and loan specifics.

Elements and Structure of a Loan Offer Letter

Key Components

- Subject line indicating loan approval

- Salutation with recipient’s name

- Loan approval statement

- Loan type, amount, interest rate, repayment tenure

- Conditions or requirements (if any)

- Attachments (loan agreement, repayment schedule)

- Deadline for acceptance or response

- Contact information

- Closing statement

Compare and Contrast with Loan Approval or Sanction Letters

Differences

- Loan offer letter communicates the approved loan with terms, while approval or sanction letters may simply confirm eligibility.

- Offer letters include instructions and attachments for signing and disbursement.

- Alternatives: Conditional loan offer letters or pre-approved letters.

Does a Loan Offer Letter Require Authorization?

Authorization Requirements

- Must be issued by an authorized bank official or loan officer.

- Typically sent on official bank letterhead or email domain.

- Conditional offers may require additional approval from senior management.

Download Word Doc

Download Word Doc

Download PDF

Download PDF