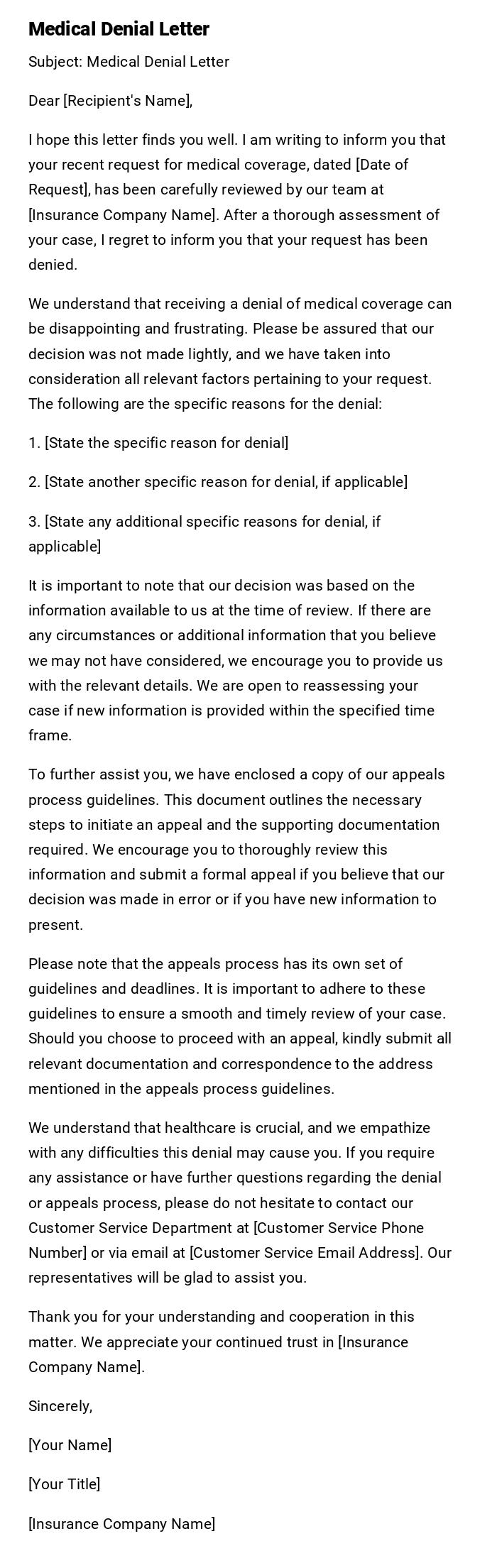

Medical Denial Letter

Subject: Medical Denial Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to inform you that your recent request for medical coverage, dated [Date of Request], has been carefully reviewed by our team at [Insurance Company Name]. After a thorough assessment of your case, I regret to inform you that your request has been denied.

We understand that receiving a denial of medical coverage can be disappointing and frustrating. Please be assured that our decision was not made lightly, and we have taken into consideration all relevant factors pertaining to your request. The following are the specific reasons for the denial:

1. [State the specific reason for denial]

2. [State another specific reason for denial, if applicable]

3. [State any additional specific reasons for denial, if applicable]

It is important to note that our decision was based on the information available to us at the time of review. If there are any circumstances or additional information that you believe we may not have considered, we encourage you to provide us with the relevant details. We are open to reassessing your case if new information is provided within the specified time frame.

To further assist you, we have enclosed a copy of our appeals process guidelines. This document outlines the necessary steps to initiate an appeal and the supporting documentation required. We encourage you to thoroughly review this information and submit a formal appeal if you believe that our decision was made in error or if you have new information to present.

Please note that the appeals process has its own set of guidelines and deadlines. It is important to adhere to these guidelines to ensure a smooth and timely review of your case. Should you choose to proceed with an appeal, kindly submit all relevant documentation and correspondence to the address mentioned in the appeals process guidelines.

We understand that healthcare is crucial, and we empathize with any difficulties this denial may cause you. If you require any assistance or have further questions regarding the denial or appeals process, please do not hesitate to contact our Customer Service Department at [Customer Service Phone Number] or via email at [Customer Service Email Address]. Our representatives will be glad to assist you.

Thank you for your understanding and cooperation in this matter. We appreciate your continued trust in [Insurance Company Name].

Sincerely,

[Your Name]

[Your Title]

[Insurance Company Name]

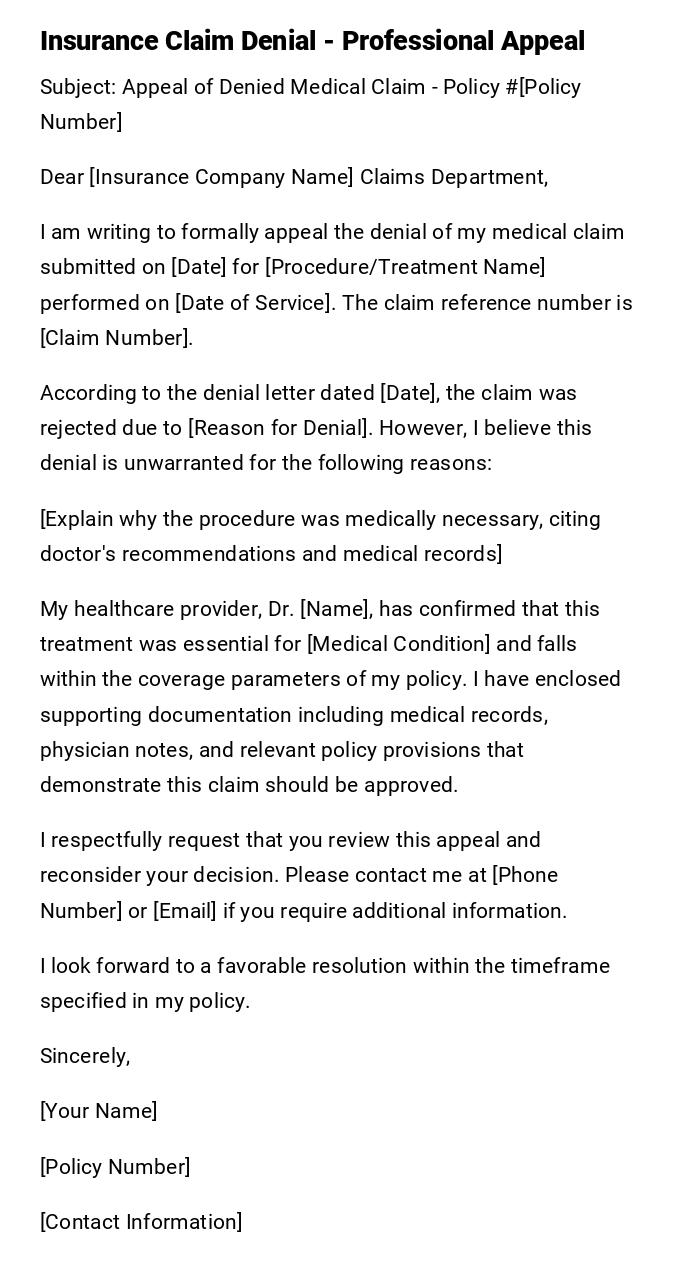

Insurance Claim Denial - Professional Appeal

Subject: Appeal of Denied Medical Claim - Policy #[Policy Number]

Dear [Insurance Company Name] Claims Department,

I am writing to formally appeal the denial of my medical claim submitted on [Date] for [Procedure/Treatment Name] performed on [Date of Service]. The claim reference number is [Claim Number].

According to the denial letter dated [Date], the claim was rejected due to [Reason for Denial]. However, I believe this denial is unwarranted for the following reasons:

[Explain why the procedure was medically necessary, citing doctor's recommendations and medical records]

My healthcare provider, Dr. [Name], has confirmed that this treatment was essential for [Medical Condition] and falls within the coverage parameters of my policy. I have enclosed supporting documentation including medical records, physician notes, and relevant policy provisions that demonstrate this claim should be approved.

I respectfully request that you review this appeal and reconsider your decision. Please contact me at [Phone Number] or [Email] if you require additional information.

I look forward to a favorable resolution within the timeframe specified in my policy.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

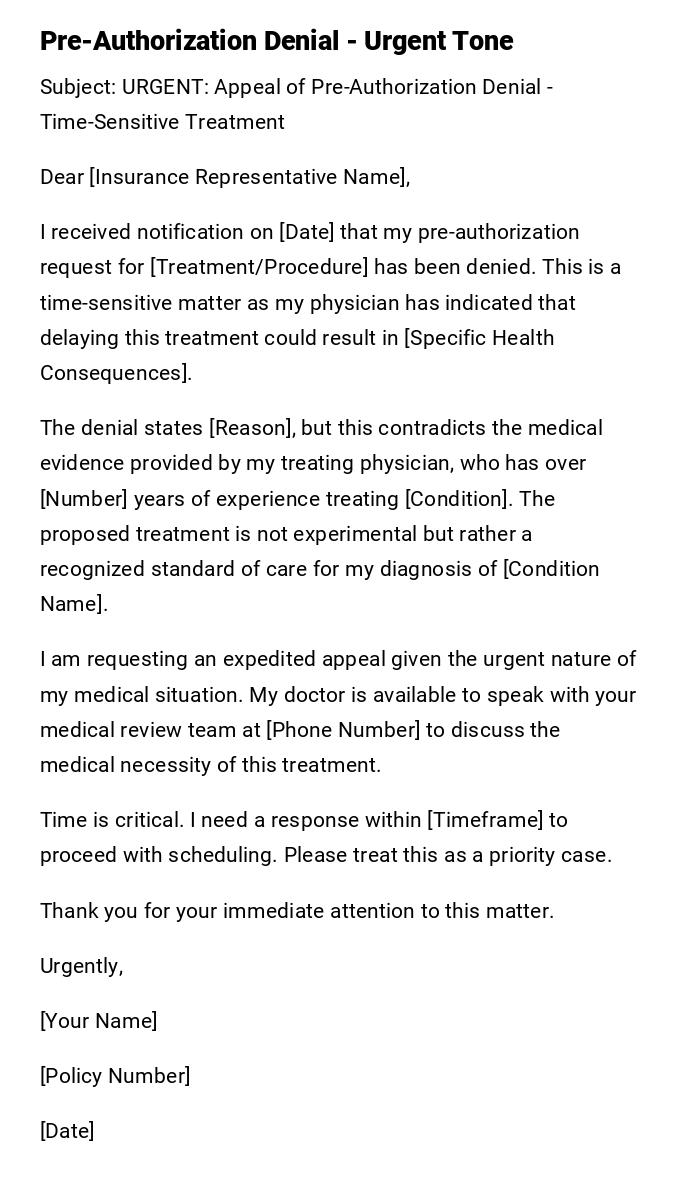

Pre-Authorization Denial - Urgent Tone

Subject: URGENT: Appeal of Pre-Authorization Denial - Time-Sensitive Treatment

Dear [Insurance Representative Name],

I received notification on [Date] that my pre-authorization request for [Treatment/Procedure] has been denied. This is a time-sensitive matter as my physician has indicated that delaying this treatment could result in [Specific Health Consequences].

The denial states [Reason], but this contradicts the medical evidence provided by my treating physician, who has over [Number] years of experience treating [Condition]. The proposed treatment is not experimental but rather a recognized standard of care for my diagnosis of [Condition Name].

I am requesting an expedited appeal given the urgent nature of my medical situation. My doctor is available to speak with your medical review team at [Phone Number] to discuss the medical necessity of this treatment.

Time is critical. I need a response within [Timeframe] to proceed with scheduling. Please treat this as a priority case.

Thank you for your immediate attention to this matter.

Urgently,

[Your Name]

[Policy Number]

[Date]

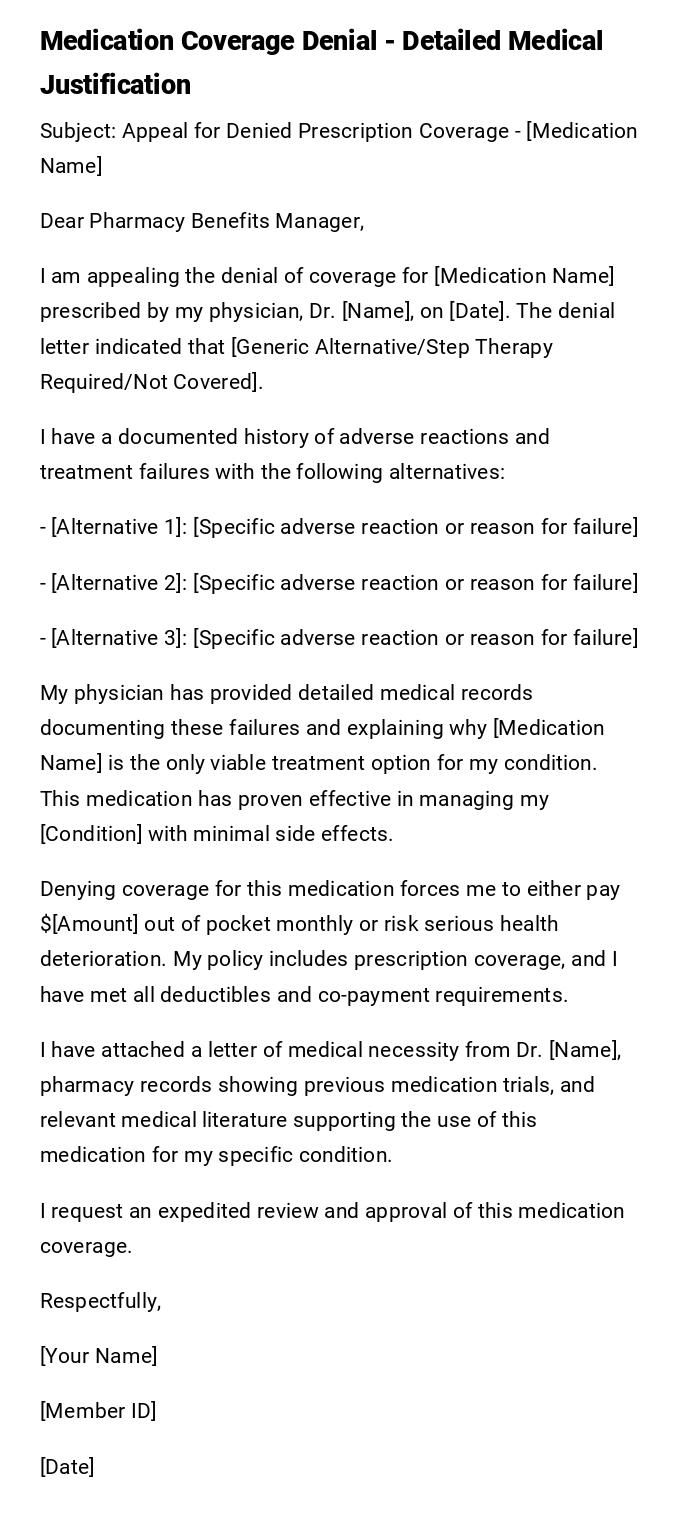

Medication Coverage Denial - Detailed Medical Justification

Subject: Appeal for Denied Prescription Coverage - [Medication Name]

Dear Pharmacy Benefits Manager,

I am appealing the denial of coverage for [Medication Name] prescribed by my physician, Dr. [Name], on [Date]. The denial letter indicated that [Generic Alternative/Step Therapy Required/Not Covered].

I have a documented history of adverse reactions and treatment failures with the following alternatives:

- [Alternative 1]: [Specific adverse reaction or reason for failure]

- [Alternative 2]: [Specific adverse reaction or reason for failure]

- [Alternative 3]: [Specific adverse reaction or reason for failure]

My physician has provided detailed medical records documenting these failures and explaining why [Medication Name] is the only viable treatment option for my condition. This medication has proven effective in managing my [Condition] with minimal side effects.

Denying coverage for this medication forces me to either pay $[Amount] out of pocket monthly or risk serious health deterioration. My policy includes prescription coverage, and I have met all deductibles and co-payment requirements.

I have attached a letter of medical necessity from Dr. [Name], pharmacy records showing previous medication trials, and relevant medical literature supporting the use of this medication for my specific condition.

I request an expedited review and approval of this medication coverage.

Respectfully,

[Your Name]

[Member ID]

[Date]

Out-of-Network Provider Denial - Circumstantial Appeal

Subject: Appeal for Out-of-Network Services - Emergency/Specialized Care

Dear Claims Review Department,

I am writing to appeal the denial of my claim for services provided by Dr. [Name], an out-of-network provider, on [Date]. The claim was denied because the provider is not in your network.

However, the circumstances of my case warrant an exception to standard network restrictions:

[Choose applicable reason: Emergency situation where no in-network providers were available / No in-network specialists with expertise in my rare condition / In-network provider referred me to this specialist due to complexity of case / Nearest in-network provider is [X] miles away and inaccessible due to my medical condition]

I made reasonable efforts to obtain in-network care, including [Describe efforts]. The out-of-network provider was the only viable option given [Circumstances].

According to my policy provisions regarding [Emergency Care/Continuity of Care/Rare Conditions], coverage should be extended to out-of-network providers under these circumstances. I am requesting that this claim be processed at in-network benefit levels.

Supporting documentation is enclosed, including medical records justifying the necessity of this specific provider.

Thank you for your fair consideration of this appeal.

Sincerely,

[Your Name]

[Policy Information]

Experimental Treatment Denial - Research-Based Appeal

Subject: Appeal of Denial for "Experimental" Treatment Designation

Dear Medical Review Board,

I am appealing the denial of coverage for [Treatment Name], which was classified as "experimental" or "investigational" in your denial dated [Date].

Contrary to this designation, [Treatment Name] is recognized as a standard treatment option by major medical organizations including [List Organizations]. The treatment has been FDA-approved since [Year] for [Indication], which directly applies to my diagnosis.

I have compiled extensive documentation demonstrating that this treatment is evidence-based and widely accepted in the medical community:

- FDA approval documentation

- Clinical practice guidelines from [Medical Societies]

- Peer-reviewed studies published in [Journals]

- Success rates and safety data

- Letters from specialists in the field

My condition, [Diagnosis], has not responded to conventional treatments, and my medical team believes this is the most appropriate next step. Several other insurance companies routinely cover this treatment for similar cases.

Denying coverage based on an outdated or inaccurate "experimental" designation contradicts current medical evidence and standard of care. I request that you consult with specialists in [Medical Field] during your review process.

I am prepared to provide additional documentation and facilitate a peer-to-peer review between my physician and your medical director.

Respectfully submitted,

[Your Name]

[Policy Number]

[Date]

Not Medically Necessary Denial - Patient Perspective Letter

Subject: Appeal of "Not Medically Necessary" Determination

Dear [Insurance Company],

I was devastated to receive your denial letter stating that my prescribed treatment for [Condition] is "not medically necessary." As someone living with this condition daily, I can assure you that this treatment is absolutely necessary for my quality of life and health.

My physician, who has treated me for [Time Period] and is intimately familiar with my medical history, has determined that this treatment is essential. The denial appears to be based on generic criteria that don't account for my specific circumstances:

[Describe personal impact: chronic pain, inability to work, daily limitations, previous treatment failures, progressive worsening of condition]

This is not an elective or cosmetic procedure. Without this treatment, I face [Specific consequences: hospitalization, disability, severe pain, inability to function].

I trust my doctor's professional judgment over administrative criteria applied by reviewers who have never examined me. My physician's letter of medical necessity provides detailed clinical justification that I hope you will review carefully and respectfully.

I am requesting a peer-to-peer review and reconsideration of this denial. My health and wellbeing depend on it.

Sincerely,

[Your Name]

Duplicate Claim Denial - Clarification Request

Subject: Appeal of Duplicate Claim Denial - Claim #[Number]

Dear Claims Department,

My claim submitted on [Date] was denied as a duplicate of claim #[Number]. However, these are separate services that should be processed independently.

The original claim dated [Date] was for [Service/Procedure], while the current claim dated [Date] is for [Different Service/Procedure]. These are distinct medical services provided on different dates for different purposes:

Claim #[Original]: [Date] - [Service] - [Provider]

Claim #[Current]: [Date] - [Service] - [Provider]

[Explain why these are different: different dates of service, different procedures, different diagnosis codes, follow-up vs. initial visit, different body parts/locations]

I have attached itemized bills and explanation of benefits for both dates of service showing that these are separate, non-duplicate claims that should both be honored under my policy coverage.

Please review the documentation and process this claim accordingly.

Thank you,

[Your Name]

[Policy Number]

Timing/Filing Deadline Denial - Extension Request

Subject: Appeal for Late Filing - Request for Exception

Dear Claims Administrator,

I am writing to appeal the denial of my claim filed on [Date] for services received on [Date of Service]. The claim was denied because it was filed after the [X]-day deadline specified in my policy.

I acknowledge the late filing but request an exception due to extenuating circumstances:

[Explain reason: serious illness prevented timely filing, never received original bills due to address change, was incapacitated during filing period, provider delayed submitting claim, administrative error, was traveling/deployed, family emergency]

I made every reasonable effort to submit this claim promptly once I became aware of the deadline and my circumstances permitted. The late filing was not due to negligence but rather circumstances beyond my control.

Many insurance companies grant exceptions for good cause, and I believe my situation warrants such consideration. I have been a policyholder in good standing for [Time Period] and have consistently paid my premiums.

I respectfully request that you waive the filing deadline in this instance and process my claim for the covered services.

Thank you for your understanding and consideration.

Sincerely,

[Your Name]

[Policy Information]

What is a Medical Denial Letter and Why Do You Need One

A medical denial letter is a formal written communication sent to an insurance company challenging their decision to deny coverage for medical services, procedures, medications, or treatments. When an insurance claim is rejected, patients have the legal right to appeal, and the denial letter serves as the foundation of that appeal process.

These letters are critical because:

- Insurance companies deny approximately 15-20% of claims initially, many of which are overturned on appeal

- Without a formal appeal, denied claims remain unpaid, leaving patients responsible for potentially thousands of dollars in medical bills

- A well-crafted denial letter creates an official record of your dispute and triggers the insurance company's formal review process

- Many denials are based on administrative errors, incomplete information, or misapplication of policy terms that can be corrected through appeal

- Federal and state laws provide patients with appeal rights that can only be exercised through written documentation

When Should You Send a Medical Denial Letter

Medical denial letters become necessary in the following situations:

- Claim Denial: When your insurance company rejects payment for services already received

- Pre-authorization Denial: When the insurer refuses to approve a recommended treatment before it occurs

- Medication Coverage Denial: When prescribed medications are not covered or require step therapy

- Out-of-Network Denials: When services from non-network providers are rejected despite medical necessity

- "Not Medically Necessary" Determinations: When the insurer claims a procedure isn't required despite physician recommendation

- Experimental Treatment Designations: When the insurer labels a standard treatment as investigational

- Duplicate Claim Denials: When legitimate separate claims are incorrectly flagged as duplicates

- Timing/Filing Deadline Issues: When claims are denied for late submission

- Coverage Limitation Disputes: When the insurer interprets policy limitations differently than you do

- Coding Errors: When incorrect billing codes lead to denial

- Prior Authorization Lapses: When administrative delays cause authorization expirations

Who Should Send a Medical Denial Letter

The denial letter can be sent by:

- The Patient/Policyholder: The insured individual has the primary right to appeal and should be the primary sender in most cases

- Patient's Legal Guardian: For minors or incapacitated adults, the legal guardian sends the appeal

- Patient's Authorized Representative: A family member or advocate with written authorization can appeal on behalf of the patient

- Healthcare Provider's Office: Some medical offices assist patients by submitting appeals, particularly for pre-authorization denials

- Patient Advocate or Case Manager: Professional advocates specializing in insurance appeals can draft and submit letters

- Attorney: In complex cases or when substantial amounts are at stake, legal representation may be appropriate

The letter should clearly identify who is sending it and their relationship to the patient, with appropriate authorization documentation if the sender is not the policyholder.

To Whom Should Medical Denial Letters Be Addressed

Medical denial letters should be directed to:

- Insurance Company's Appeals Department: The primary recipient, usually specified in the denial notice

- Claims Review Manager: For initial internal appeals

- Medical Director or Medical Review Board: For clinical necessity disputes requiring peer review

- Pharmacy Benefits Manager: For medication coverage denials

- Third-Party Administrator: If your employer self-funds insurance

- State Insurance Commissioner: For external appeals or complaints about the appeal process

- Independent Review Organization (IRO): For external reviews after internal appeals are exhausted

Always send copies to:

- Your treating physician's office

- Your own records

- Any patient advocate assisting you

- Your employer's HR benefits coordinator (for employer-sponsored plans)

How to Write and Send a Medical Denial Letter

Writing Process:

- Review the denial notice carefully to understand the exact reason for denial and appeal deadlines

- Gather supporting documentation: medical records, physician letters, policy provisions, medical literature

- Choose the appropriate template based on your specific denial reason

- Customize with specific details: dates, claim numbers, policy numbers, medical terminology

- State your case clearly: explain why the denial is incorrect with factual, logical arguments

- Reference policy language: quote specific sections of your insurance policy that support your position

- Include medical justification: incorporate physician explanations of medical necessity

- Maintain professional tone: even if frustrated, keep language respectful and factual

- Request specific action: clearly state you want the claim approved and processed

Sending Process:

- Use certified mail with return receipt for paper submissions to prove delivery

- Keep electronic confirmation if submitting through insurance portal

- Include all supporting documentation as attachments

- Send within the deadline specified in your denial notice (typically 180 days but varies)

- Follow up with a phone call to confirm receipt

- Document everything: dates sent, confirmation numbers, people spoken to

Requirements and Prerequisites Before Sending Your Appeal

Before drafting and sending your medical denial letter, ensure you have:

- Original Denial Letter: The official explanation of benefits (EOB) or denial notice with specific rejection reasons

- Insurance Policy Documents: Your complete policy or summary of benefits to reference coverage terms

- Medical Records: Relevant portions documenting your diagnosis, treatment history, and medical necessity

- Physician's Letter of Medical Necessity: A detailed statement from your doctor explaining why the treatment is required

- Billing Documentation: Itemized bills, procedure codes, diagnosis codes, and dates of service

- Previous Treatment Records: Documentation of failed alternative treatments if applicable

- Research and Medical Literature: Peer-reviewed studies supporting your treatment, if challenging experimental designation

- Timeline Documentation: Records of any prior authorizations, provider communications, or administrative issues

- Policy Number and Claim Number: Essential identifying information for your case

- Deadline Information: Clear understanding of when the appeal must be submitted

- Contact Information: Current phone, email, and mailing address for response communications

Formatting Your Medical Denial Letter Properly

Length and Structure:

- Keep the letter concise but comprehensive, typically 1-3 pages

- Use single-spaced text with double spacing between paragraphs

- Include clear subject line with claim and policy numbers

- Organize information logically with distinct sections

Tone and Style:

- Professional and respectful, never hostile or emotional

- Factual and evidence-based rather than opinion-based

- Firm and assertive without being aggressive

- Clinical language when discussing medical issues

- Business formal for most situations; slightly less formal acceptable for patient perspective letters

Format Requirements:

- Use standard business letter format with date, addresses, and salutation

- Include policy number, claim number, and member ID in header or subject line

- Use clear headings or bullet points for easy readability

- Sign the letter (electronic signature acceptable for email submissions)

- Number pages if multiple pages

- Use standard fonts (Times New Roman, Arial, Calibri) in 11-12 point size

Submission Method:

- Certified mail for paper submissions (most reliable for important appeals)

- Secure insurance portal upload if available

- Fax with confirmation (less preferred but acceptable)

- Email only if specifically permitted by the insurance company

- Always retain proof of submission and copies of all documents

What to Do After Sending Your Medical Denial Letter

Immediate Follow-up (1-7 days):

- Confirm receipt of your appeal by calling the insurance company

- Obtain a confirmation or reference number for the appeal

- Ask about expected timeline for review and decision

- Verify that all submitted documents were received

During Review Period (30-60 days for standard appeals):

- Document all phone calls with insurance representatives (date, time, name, summary)

- Respond promptly to any requests for additional information

- Check claim status periodically through online portal or phone

- Keep your healthcare provider informed of appeal status

- Continue any ongoing treatment if possible (discuss payment arrangements with provider if needed)

If Additional Information Requested:

- Submit requested documents within specified timeframe

- Send via same method as original appeal with reference to appeal number

- Confirm receipt of supplemental materials

If Approved:

- Verify the approved amount matches expected coverage

- Confirm payment timeline with provider

- Keep approval letter for records

- Thank your healthcare provider for supporting documentation

If Denied Again:

- Request detailed written explanation of the denial

- Understand your next level of appeal options (typically external review)

- Consider consulting with a patient advocate or attorney

- File complaint with state insurance commissioner if appropriate

- Research independent review organization (IRO) options

Common Mistakes to Avoid in Medical Denial Letters

- Missing the deadline: Appeals have strict timeframes; late submissions may be automatically rejected

- Incomplete documentation: Failing to include all supporting medical records and physician statements

- Emotional rather than factual language: Anger and frustration undermine credibility

- Vague explanations: Not specifically addressing the stated reason for denial

- Failing to reference policy language: Not citing specific policy provisions that support your claim

- Submitting without physician support: Proceeding without a letter of medical necessity from your doctor

- Not keeping copies: Failing to retain documentation of submission and all materials sent

- Ignoring insurance company requests: Not responding to requests for additional information

- Writing too much: Lengthy, rambling letters that bury important facts

- Not following up: Assuming the appeal is being processed without confirmation

- Using wrong appeal address: Sending to general customer service instead of appeals department

- Omitting claim identifiers: Not including policy number, claim number, and member ID

- Accepting denial without appeal: Giving up after initial denial when success rates for appeals are significant

- Repeating the same appeal: Not adding new information or arguments in subsequent appeals

- Poor organization: Failing to structure the letter logically so reviewers can easily follow your argument

Essential Elements and Structure of Medical Denial Letters

Opening Section:

- Subject line with claim number, policy number, and brief description

- Formal salutation addressing appropriate department

- Clear statement that this is an appeal of a denied claim

- Date of denial and date of service

Identification Information:

- Your full name as it appears on policy

- Policy/member ID number

- Claim reference number

- Date of service

- Provider name and information

Explanation of Denial:

- Brief restatement of the insurance company's reason for denial

- Demonstration that you understand their position

Your Counter-Argument:

- Point-by-point refutation of denial reasons

- Specific facts and evidence supporting your position

- Medical necessity explanation in clinical terms

- Reference to policy provisions that support coverage

- Description of medical consequences of denial

Supporting Documentation:

- List of all attached documents

- Reference to physician letters, medical records, research

- Citations to policy language, medical guidelines, or regulations

Closing Section:

- Clear request for claim approval and processing

- Timeline for response

- Your contact information

- Professional closing and signature

Attachments:

- Letter of medical necessity from physician

- Relevant medical records and test results

- Copies of policy provisions

- Medical literature or clinical guidelines

- Prior authorization documentation if applicable

- Any other supporting evidence

Advantages and Disadvantages of Sending Medical Denial Letters

Advantages:

- Provides legal avenue to challenge incorrect denials and potentially recover thousands in medical costs

- Success rate for appeals is approximately 50% for internal appeals and higher for external reviews

- Creates official documentation of dispute that may be needed for future legal action

- Demonstrates to healthcare providers that you're actively working to resolve payment

- May uncover administrative errors that can be quickly corrected

- Exercises your rights under ERISA, ACA, or state insurance regulations

- Can prevent medical debt and collections actions

- Establishes record that may help with future claims for same condition

Disadvantages:

- Time-consuming process requiring research, documentation gathering, and writing

- No guarantee of success despite effort invested

- May require multiple levels of appeal, extending over months

- Can be emotionally draining, especially when dealing with serious health issues

- May require out-of-pocket payment for treatment while appeal is pending

- Complex medical and insurance terminology can be challenging

- Some patients may need to hire professional advocates or attorneys, adding costs

- Creates delay in final resolution of medical bills

- May strain relationship with healthcare providers awaiting payment

Tips and Best Practices for Successful Medical Denial Letters

- Act quickly: Start your appeal immediately upon receiving denial; don't wait until near the deadline

- Get your doctor on board early: Request a detailed letter of medical necessity as soon as you receive the denial

- Be specific and concrete: Use exact dates, claim numbers, medical codes, and policy section references

- Let evidence speak: Focus on factual medical information and policy language rather than emotional appeals

- Use medical terminology correctly: This demonstrates credibility and shows you understand the clinical aspects

- Quote policy language directly: Copy exact wording from your insurance policy to support your arguments

- Organize for easy review: Use headings, bullet points, and clear structure so reviewers can quickly find key information

- Include external authority: Reference medical society guidelines, FDA approvals, or peer-reviewed research when applicable

- Offer peer-to-peer review: Suggest your physician speak directly with the insurance company's medical director

- Keep detailed records: Document every interaction, save all correspondence, note names and dates

- Escalate strategically: Start with internal appeal but be prepared to request external review if necessary

- Use templates wisely: Customize templates to your situation; generic letters are less effective

- Consider professional help: For large claims or complex denials, patient advocates or attorneys may be worth the investment

- Stay persistent: Many successful appeals require multiple submissions and follow-ups

- Leverage your employer: For employer-sponsored plans, HR benefits coordinators can sometimes advocate effectively

Comparing Medical Denial Letters to Other Options

Medical Denial Letter vs. Phone Appeal:

- Letters provide written record; phone calls do not

- Letters allow you to organize complex arguments; phone conversations are limited

- Letters can include extensive documentation; phone calls cannot

- Letters meet legal requirements for formal appeal; phone calls typically do not

- However, phone calls are faster for simple administrative errors

Internal Appeal vs. External Review:

- Internal appeals are first-level reviews by your insurance company

- External reviews involve independent third-party organizations

- Internal appeals must be exhausted before external review (in most cases)

- External reviews have higher success rates but take longer

- External reviews are binding on insurance companies in most states

DIY Appeal vs. Professional Advocate:

- Self-written appeals save money but require significant time and research

- Professional advocates have experience and higher success rates

- Advocates typically cost $100-$200 per hour or percentage of recovered amount

- Most cases can be handled effectively without professional help

- Complex or high-value claims may warrant professional assistance

Formal Appeal vs. Insurance Commissioner Complaint:

- Formal appeals follow insurance company's process and are required first step

- Commissioner complaints address procedural violations or bad faith

- Appeals can result in claim approval; complaints address company conduct

- Both options can be pursued simultaneously in some situations

Settlement Negotiation vs. Full Appeal:

- Some patients negotiate partial payment rather than pursuing full appeal

- Settlements resolve the issue quickly but may leave money on the table

- Full appeals take longer but may result in complete coverage

- Consider settlement for borderline cases where appeal success is uncertain

Download Word Doc

Download Word Doc

Download PDF

Download PDF