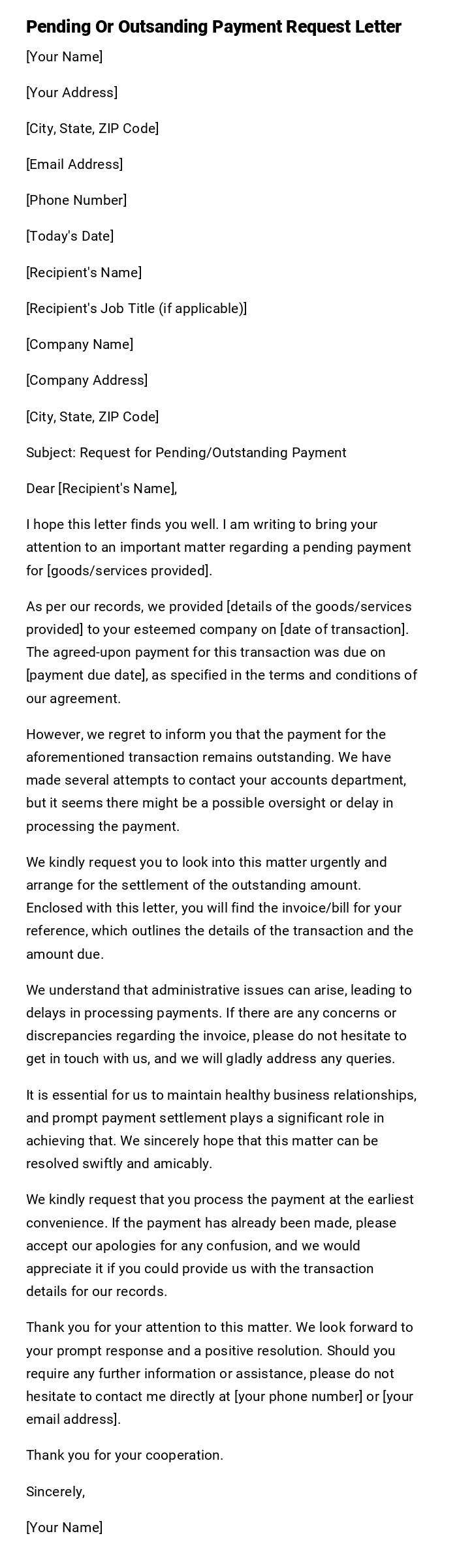

Pending Or Outsanding Payment Request Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Today's Date]

[Recipient's Name]

[Recipient's Job Title (if applicable)]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Subject: Request for Pending/Outstanding Payment

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to bring your attention to an important matter regarding a pending payment for [goods/services provided].

As per our records, we provided [details of the goods/services provided] to your esteemed company on [date of transaction]. The agreed-upon payment for this transaction was due on [payment due date], as specified in the terms and conditions of our agreement.

However, we regret to inform you that the payment for the aforementioned transaction remains outstanding. We have made several attempts to contact your accounts department, but it seems there might be a possible oversight or delay in processing the payment.

We kindly request you to look into this matter urgently and arrange for the settlement of the outstanding amount. Enclosed with this letter, you will find the invoice/bill for your reference, which outlines the details of the transaction and the amount due.

We understand that administrative issues can arise, leading to delays in processing payments. If there are any concerns or discrepancies regarding the invoice, please do not hesitate to get in touch with us, and we will gladly address any queries.

It is essential for us to maintain healthy business relationships, and prompt payment settlement plays a significant role in achieving that. We sincerely hope that this matter can be resolved swiftly and amicably.

We kindly request that you process the payment at the earliest convenience. If the payment has already been made, please accept our apologies for any confusion, and we would appreciate it if you could provide us with the transaction details for our records.

Thank you for your attention to this matter. We look forward to your prompt response and a positive resolution. Should you require any further information or assistance, please do not hesitate to contact me directly at [your phone number] or [your email address].

Thank you for your cooperation.

Sincerely,

[Your Name]

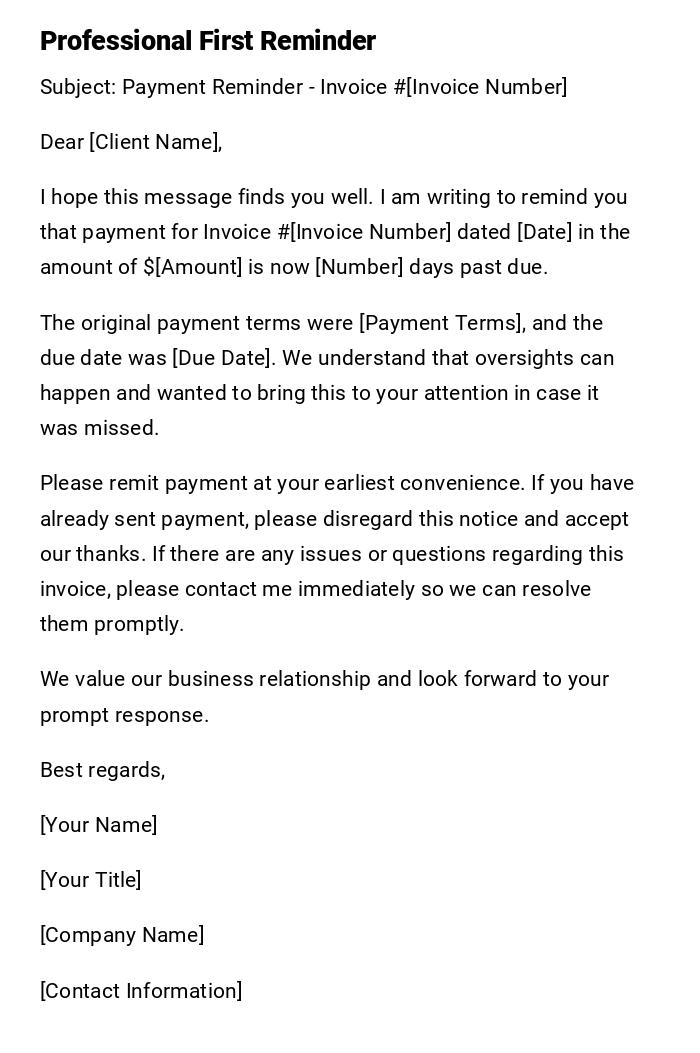

Initial Payment Reminder Letter

Subject: Payment Reminder - Invoice #[Invoice Number]

Dear [Client Name],

I hope this message finds you well. I am writing to remind you that payment for Invoice #[Invoice Number] dated [Date] in the amount of $[Amount] is now [Number] days past due.

The original payment terms were [Payment Terms], and the due date was [Due Date]. We understand that oversights can happen and wanted to bring this to your attention in case it was missed.

Please remit payment at your earliest convenience. If you have already sent payment, please disregard this notice and accept our thanks. If there are any issues or questions regarding this invoice, please contact me immediately so we can resolve them promptly.

We value our business relationship and look forward to your prompt response.

Best regards,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

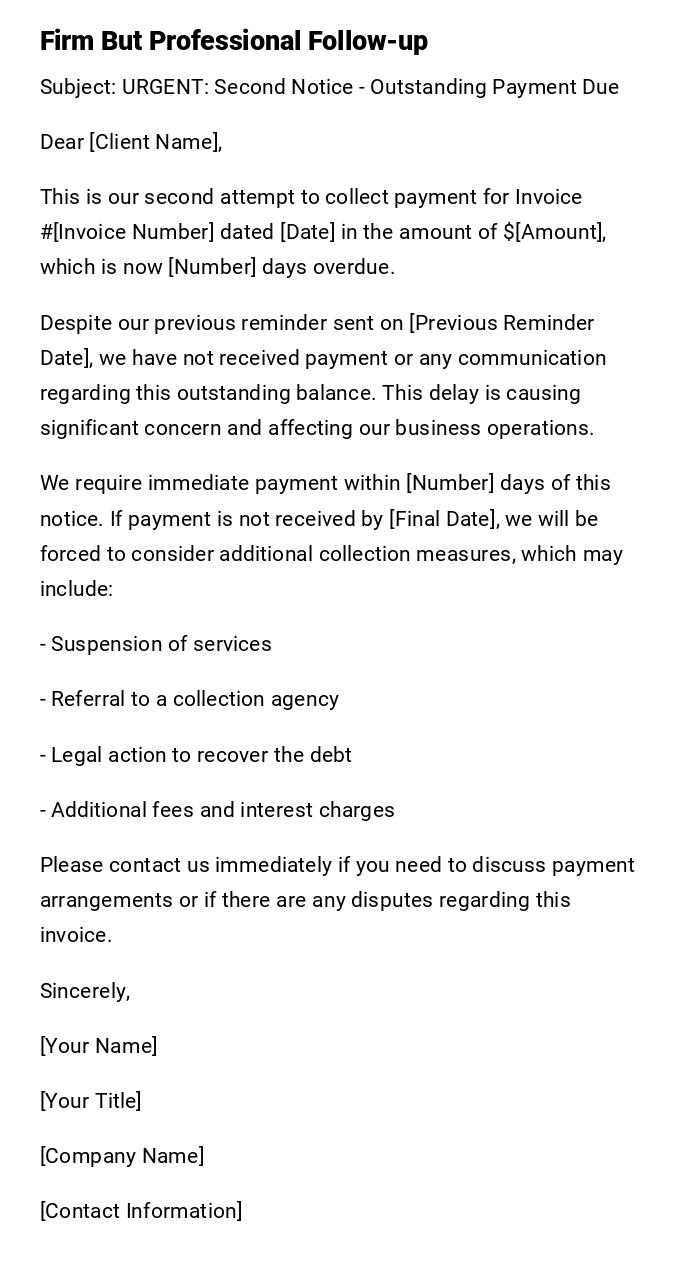

Second Payment Demand Letter

Subject: URGENT: Second Notice - Outstanding Payment Due

Dear [Client Name],

This is our second attempt to collect payment for Invoice #[Invoice Number] dated [Date] in the amount of $[Amount], which is now [Number] days overdue.

Despite our previous reminder sent on [Previous Reminder Date], we have not received payment or any communication regarding this outstanding balance. This delay is causing significant concern and affecting our business operations.

We require immediate payment within [Number] days of this notice. If payment is not received by [Final Date], we will be forced to consider additional collection measures, which may include:

- Suspension of services

- Referral to a collection agency

- Legal action to recover the debt

- Additional fees and interest charges

Please contact us immediately if you need to discuss payment arrangements or if there are any disputes regarding this invoice.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

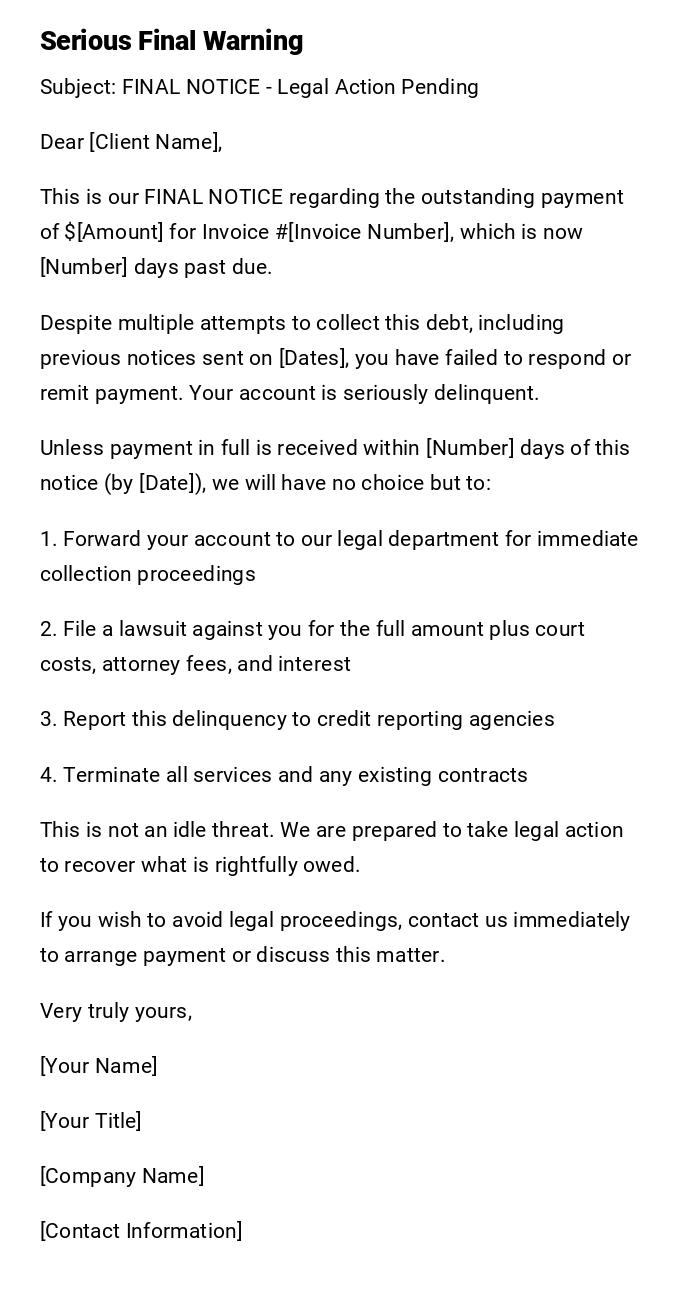

Final Demand Before Legal Action

Subject: FINAL NOTICE - Legal Action Pending

Dear [Client Name],

This is our FINAL NOTICE regarding the outstanding payment of $[Amount] for Invoice #[Invoice Number], which is now [Number] days past due.

Despite multiple attempts to collect this debt, including previous notices sent on [Dates], you have failed to respond or remit payment. Your account is seriously delinquent.

Unless payment in full is received within [Number] days of this notice (by [Date]), we will have no choice but to:

1. Forward your account to our legal department for immediate collection proceedings

2. File a lawsuit against you for the full amount plus court costs, attorney fees, and interest

3. Report this delinquency to credit reporting agencies

4. Terminate all services and any existing contracts

This is not an idle threat. We are prepared to take legal action to recover what is rightfully owed.

If you wish to avoid legal proceedings, contact us immediately to arrange payment or discuss this matter.

Very truly yours,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

Friendly Payment Request to Longtime Client

Subject: Friendly Reminder About Outstanding Invoice

Dear [Client Name],

I hope you and your team are doing well! It's always a pleasure working with [Company Name], and we truly value our long-standing partnership.

I wanted to reach out personally regarding Invoice #[Invoice Number] for $[Amount], which appears to have been overlooked. The invoice was due on [Due Date], and it's now been [Number] days.

I know how busy things can get, and sometimes these things slip through the cracks. Could you please check on this for me when you have a moment?

If there's anything unusual about this invoice or if you need any clarification, please don't hesitate to give me a call. We're always happy to work with our valued clients to resolve any concerns.

Thanks so much for your attention to this matter. Looking forward to continuing our great working relationship!

Warmest regards,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

Payment Request for Services Rendered

Subject: Payment Request for Completed Services

Dear [Client Name],

I am writing to request payment for the services completed on [Date] as outlined in our agreement dated [Agreement Date].

The services provided include:

- [Service 1]

- [Service 2]

- [Service 3]

The total amount due is $[Amount], which was payable upon completion of services as per our contract. The work was completed to your satisfaction on [Completion Date], and payment is now [Number] days overdue.

I have attached copies of the original agreement and any relevant documentation for your review. Please process payment within [Number] days to avoid any disruption to our ongoing business relationship.

If you have any questions about the charges or need additional documentation, please contact me immediately.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Title]

[Contact Information]

Payment Plan Request Letter

Subject: Payment Arrangement Proposal

Dear [Client Name],

I understand that you may be experiencing temporary financial difficulties, and I want to work with you to resolve the outstanding balance of $[Amount] on Invoice #[Invoice Number].

Rather than pursuing immediate collection action, I would like to propose a payment plan that could work for both of us:

Option 1: Monthly payments of $[Amount] for [Number] months

Option 2: Bi-weekly payments of $[Amount] for [Number] payments

Option 3: [Custom arrangement based on client needs]

This arrangement would allow you to satisfy your obligation while managing your cash flow. In return, I would need your commitment to make payments on time according to the agreed schedule.

Please let me know if any of these options work for you, or if you would like to propose an alternative arrangement. Once we agree on terms, I will prepare a formal payment agreement for both parties to sign.

I look forward to resolving this matter amicably and continuing our business relationship.

Best regards,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

Payment Request with Late Fees Notice

Subject: Payment Due with Accrued Late Fees

Dear [Client Name],

This letter serves as formal notice that Invoice #[Invoice Number] in the amount of $[Original Amount] remains unpaid [Number] days after the due date of [Due Date].

As stated in our contract terms and conditions, late payments are subject to additional charges. Your current balance includes:

Original Invoice Amount: $[Original Amount]

Late Fee ([Rate]% per month): $[Late Fee Amount]

Interest Charges: $[Interest Amount]

Total Amount Due: $[Total Amount]

To avoid additional late fees and interest charges, please remit payment immediately. Late fees will continue to accrue until the balance is paid in full.

If you believe there is an error in these calculations or if you wish to discuss payment arrangements, please contact our accounting department at [Phone Number] within [Number] days.

Payment should be sent to:

[Payment Address]

Thank you for your immediate attention to this matter.

Respectfully,

[Your Name]

[Your Title]

[Company Name]

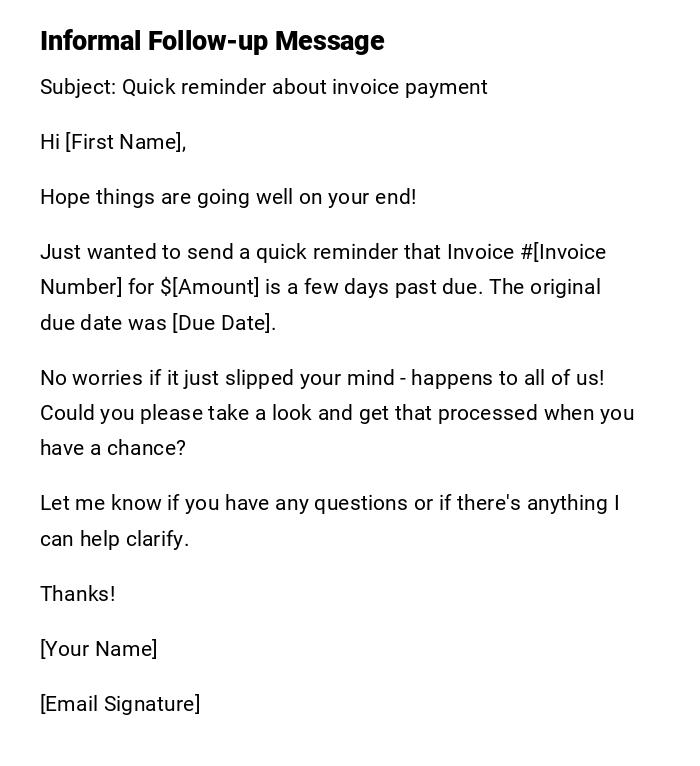

Casual Payment Reminder Email

Subject: Quick reminder about invoice payment

Hi [First Name],

Hope things are going well on your end!

Just wanted to send a quick reminder that Invoice #[Invoice Number] for $[Amount] is a few days past due. The original due date was [Due Date].

No worries if it just slipped your mind - happens to all of us! Could you please take a look and get that processed when you have a chance?

Let me know if you have any questions or if there's anything I can help clarify.

Thanks!

[Your Name]

[Email Signature]

What Are Pending or Outstanding Payment Request Letters and Why Do You Need Them

Pending or outstanding payment request letters are formal or informal communications sent to clients, customers, or debtors who have failed to pay their bills by the agreed-upon due date. These letters serve as official documentation of the debt and create a paper trail for potential legal action.

The primary purposes include:

- Reminding clients of overdue payments

- Maintaining professional relationships while addressing financial obligations

- Creating legal documentation for collection efforts

- Establishing clear communication about payment expectations

- Protecting your business's cash flow and financial stability

- Demonstrating good faith efforts before pursuing legal remedies

Who Should Send These Payment Request Letters

These letters should typically be sent by:

- Business owners owed money for products or services

- Freelancers and independent contractors

- Property managers collecting rent payments

- Loan officers or financial institutions

- Accounts receivable departments

- Collection agencies acting on behalf of creditors

- Service providers (lawyers, consultants, contractors)

- Suppliers owed money for delivered goods

- Healthcare providers with outstanding patient balances

When to Send Outstanding Payment Request Letters

Key triggers for sending these letters include:

- Payment is 1-7 days overdue (gentle reminder)

- Payment is 15-30 days overdue (formal notice)

- Payment is 30-60 days overdue (serious demand)

- Payment is 60+ days overdue (final notice before legal action)

- Client has missed agreed-upon payment plan installments

- Check has bounced or payment was returned

- Client has requested extensions multiple times

- Regular payment patterns have been broken

- End of grace period as specified in contract

- Before reporting to credit agencies

- Prior to engaging collection services

How to Write and Send Payment Request Letters

The process involves several key steps:

- Review the original contract or invoice terms

- Calculate exact amounts owed including any late fees

- Choose appropriate tone based on relationship and situation

- Start with gentle reminders and escalate if necessary

- Include all relevant invoice numbers and dates

- Specify exact payment amount and due date

- Provide clear payment instructions and methods

- Keep copies of all correspondence for records

- Send via traceable methods (certified mail, email with read receipt)

- Follow up consistently according to your timeline

- Document all attempts and responses

- Maintain professional demeanor throughout process

Requirements and Prerequisites Before Sending

Essential preparations include:

- Valid signed contract or agreement establishing payment terms

- Properly issued invoices with clear due dates

- Accurate record-keeping of all transactions

- Verification that goods were delivered or services completed

- Confirmation of correct client contact information

- Review of any previous payment arrangements or modifications

- Documentation of any partial payments received

- Understanding of applicable state laws regarding debt collection

- Compliance with Fair Debt Collection Practices Act if applicable

- Internal approval processes if working for larger organization

Formatting Guidelines for Payment Request Letters

Key formatting considerations:

- Length: Keep initial reminders brief (1-2 paragraphs), escalate detail in subsequent notices

- Tone: Start friendly and professional, become more formal with each notice

- Structure: Clear subject line, proper greeting, concise body, professional closing

- Delivery method: Email for quick reminders, certified mail for serious notices

- Documentation: Include invoice copies, contracts, and payment records as attachments

- Timing: Send during business hours on weekdays

- Language: Clear, direct, and free of emotional language

- Legal compliance: Avoid threatening language that violates collection laws

- Contact information: Always provide multiple ways to respond

Common Mistakes to Avoid When Requesting Payment

Frequent pitfalls include:

- Being too aggressive too quickly

- Failing to maintain proper documentation

- Using threatening or abusive language

- Not providing clear payment instructions

- Sending letters to wrong addresses or outdated contact information

- Failing to follow up consistently

- Not escalating appropriately through reminder sequence

- Ignoring partial payments or payment attempts

- Not understanding legal limitations on collection activities

- Mixing personal emotions with business communications

- Sending demands for incorrect amounts

- Violating debtor protection laws

- Not keeping copies of all correspondence

- Failing to verify debt accuracy before demanding payment

After Sending Payment Request Letters - Follow-up Actions

Essential post-sending activities:

- Track delivery confirmation and read receipts

- Set calendar reminders for follow-up dates

- Monitor for client responses and payment attempts

- Document all communications in client files

- Prepare escalation letters if no response received

- Consider phone calls for high-value accounts

- Evaluate effectiveness of collection efforts

- Decide on next steps (collection agency, legal action)

- Update internal credit policies if needed

- Review and adjust future payment terms

- Send thank you acknowledgments when payments are received

- Update account status in billing systems

- Prepare reports for management on collection success rates

Pros and Cons of Sending Payment Request Letters

Advantages:

- Creates official documentation trail

- Often resolves payment issues without legal action

- Maintains professional business relationships

- Cost-effective collection method

- Demonstrates good faith collection efforts

- Can strengthen legal position if litigation becomes necessary

Disadvantages:

- May strain client relationships

- Time-consuming process requiring consistent follow-up

- No guarantee of payment results

- May accelerate client's decision to file bankruptcy

- Could damage reputation if handled poorly

- Legal risks if collection laws are violated

Tips and Best Practices for Payment Collection Letters

Effective strategies include:

- Personalize letters with specific details about the business relationship

- Use graduated approach from friendly to firm

- Offer multiple payment options and methods

- Be willing to negotiate payment plans for good clients

- Always verify debt accuracy before sending demands

- Keep emotions out of business communications

- Use certified mail for important notices

- Maintain consistent follow-up schedule

- Consider timing of letters (avoid holidays, known busy periods)

- Review and update collection letter templates regularly

- Train staff on proper collection procedures

- Establish clear internal escalation policies

- Consider offering small discounts for immediate payment

- Use professional letterhead and proper business formatting

Download Word Doc

Download Word Doc

Download PDF

Download PDF