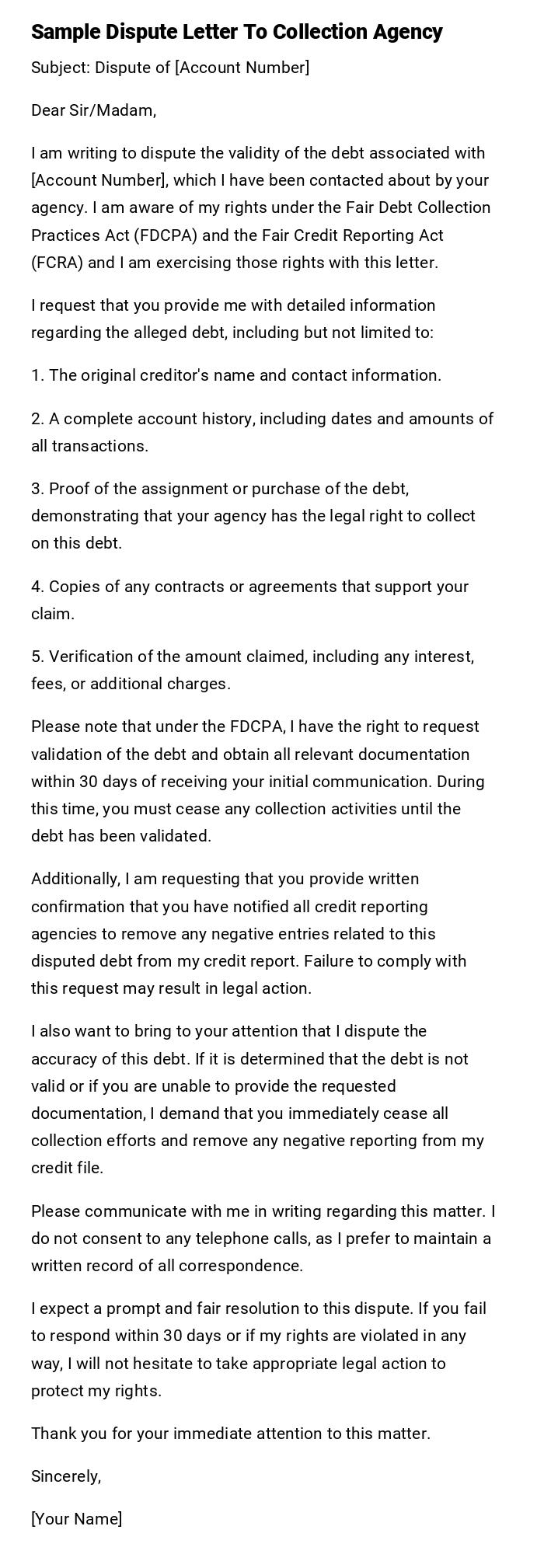

Sample Dispute Letter To Collection Agency

Subject: Dispute of [Account Number]

Dear Sir/Madam,

I am writing to dispute the validity of the debt associated with [Account Number], which I have been contacted about by your agency. I am aware of my rights under the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA) and I am exercising those rights with this letter.

I request that you provide me with detailed information regarding the alleged debt, including but not limited to:

1. The original creditor's name and contact information.

2. A complete account history, including dates and amounts of all transactions.

3. Proof of the assignment or purchase of the debt, demonstrating that your agency has the legal right to collect on this debt.

4. Copies of any contracts or agreements that support your claim.

5. Verification of the amount claimed, including any interest, fees, or additional charges.

Please note that under the FDCPA, I have the right to request validation of the debt and obtain all relevant documentation within 30 days of receiving your initial communication. During this time, you must cease any collection activities until the debt has been validated.

Additionally, I am requesting that you provide written confirmation that you have notified all credit reporting agencies to remove any negative entries related to this disputed debt from my credit report. Failure to comply with this request may result in legal action.

I also want to bring to your attention that I dispute the accuracy of this debt. If it is determined that the debt is not valid or if you are unable to provide the requested documentation, I demand that you immediately cease all collection efforts and remove any negative reporting from my credit file.

Please communicate with me in writing regarding this matter. I do not consent to any telephone calls, as I prefer to maintain a written record of all correspondence.

I expect a prompt and fair resolution to this dispute. If you fail to respond within 30 days or if my rights are violated in any way, I will not hesitate to take appropriate legal action to protect my rights.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

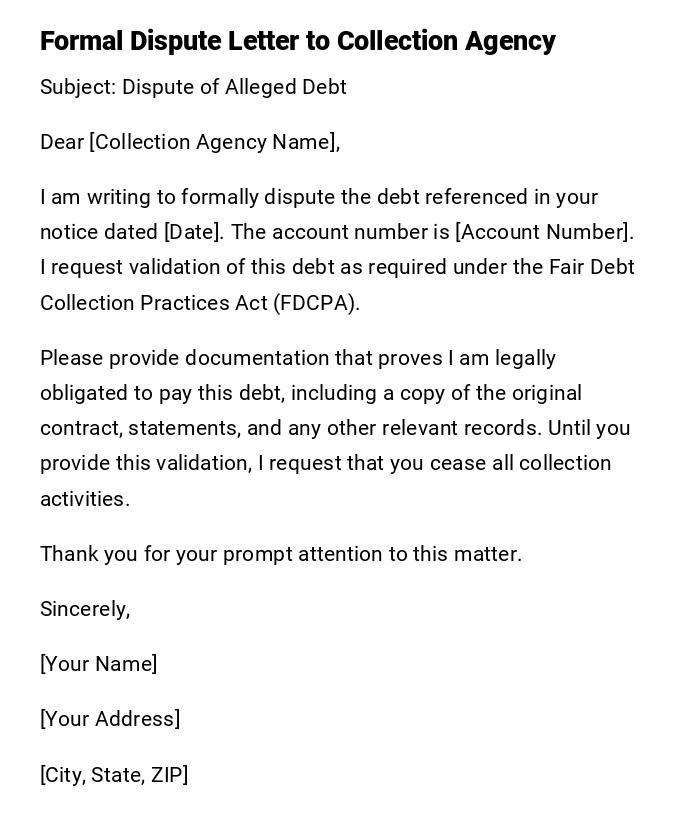

Formal Dispute Letter to Collection Agency

Subject: Dispute of Alleged Debt

Dear [Collection Agency Name],

I am writing to formally dispute the debt referenced in your notice dated [Date]. The account number is [Account Number]. I request validation of this debt as required under the Fair Debt Collection Practices Act (FDCPA).

Please provide documentation that proves I am legally obligated to pay this debt, including a copy of the original contract, statements, and any other relevant records. Until you provide this validation, I request that you cease all collection activities.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Address]

[City, State, ZIP]

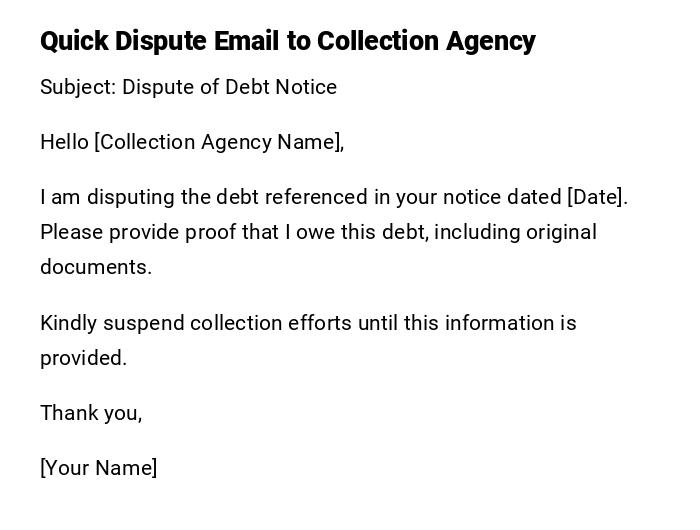

Quick Dispute Email to Collection Agency

Subject: Dispute of Debt Notice

Hello [Collection Agency Name],

I am disputing the debt referenced in your notice dated [Date]. Please provide proof that I owe this debt, including original documents.

Kindly suspend collection efforts until this information is provided.

Thank you,

[Your Name]

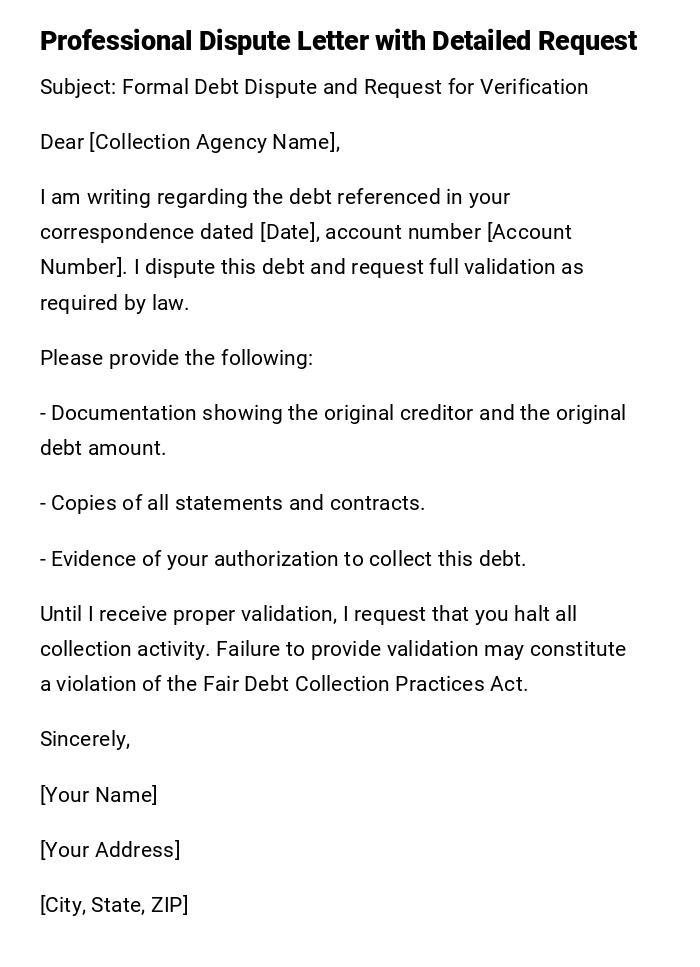

Professional Dispute Letter with Detailed Request

Subject: Formal Debt Dispute and Request for Verification

Dear [Collection Agency Name],

I am writing regarding the debt referenced in your correspondence dated [Date], account number [Account Number]. I dispute this debt and request full validation as required by law.

Please provide the following:

- Documentation showing the original creditor and the original debt amount.

- Copies of all statements and contracts.

- Evidence of your authorization to collect this debt.

Until I receive proper validation, I request that you halt all collection activity. Failure to provide validation may constitute a violation of the Fair Debt Collection Practices Act.

Sincerely,

[Your Name]

[Your Address]

[City, State, ZIP]

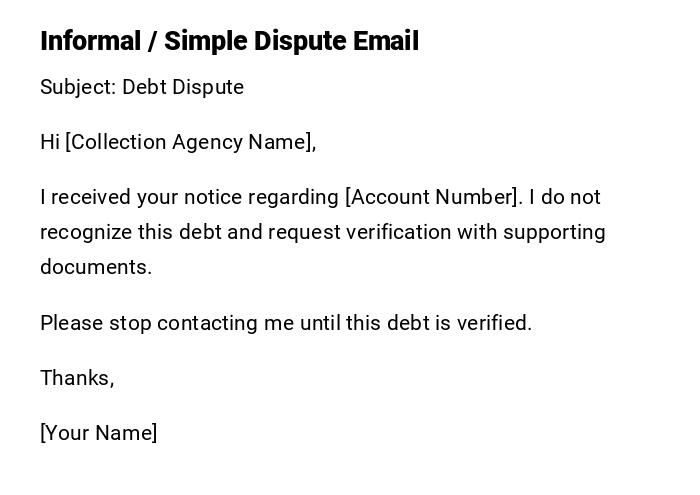

Informal / Simple Dispute Email

Subject: Debt Dispute

Hi [Collection Agency Name],

I received your notice regarding [Account Number]. I do not recognize this debt and request verification with supporting documents.

Please stop contacting me until this debt is verified.

Thanks,

[Your Name]

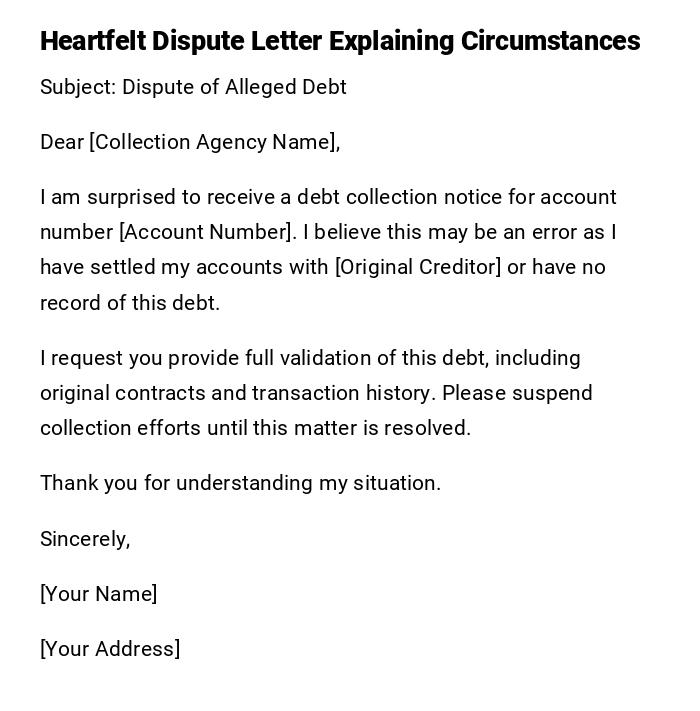

Heartfelt Dispute Letter Explaining Circumstances

Subject: Dispute of Alleged Debt

Dear [Collection Agency Name],

I am surprised to receive a debt collection notice for account number [Account Number]. I believe this may be an error as I have settled my accounts with [Original Creditor] or have no record of this debt.

I request you provide full validation of this debt, including original contracts and transaction history. Please suspend collection efforts until this matter is resolved.

Thank you for understanding my situation.

Sincerely,

[Your Name]

[Your Address]

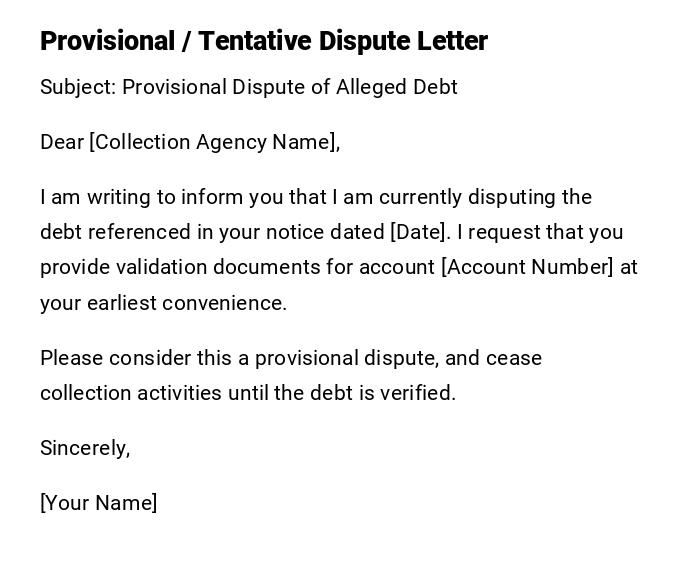

Provisional / Tentative Dispute Letter

Subject: Provisional Dispute of Alleged Debt

Dear [Collection Agency Name],

I am writing to inform you that I am currently disputing the debt referenced in your notice dated [Date]. I request that you provide validation documents for account [Account Number] at your earliest convenience.

Please consider this a provisional dispute, and cease collection activities until the debt is verified.

Sincerely,

[Your Name]

What a Dispute Letter to a Collection Agency Is and Why It Is Important

A Dispute Letter to a Collection Agency is a formal communication challenging the validity of a debt claim.

Purpose includes:

- Protecting your rights under the Fair Debt Collection Practices Act (FDCPA).

- Requesting verification of debt and supporting documents.

- Suspending collection activities until validation is provided.

- Maintaining a clear record of dispute communication.

Who Should Send a Dispute Letter to a Collection Agency

- Individuals who believe a debt claim is incorrect or fraudulent.

- Consumers who want formal proof before paying a debt.

- People seeking to exercise their legal rights regarding debt collection practices.

Whom the Dispute Letter Should Be Addressed To

- The collection agency listed on the debt notice.

- Any debt collection attorney or intermediary acting on behalf of the original creditor.

- Credit reporting agencies if disputing reported balances.

When to Send a Dispute Letter to a Collection Agency

- Immediately after receiving a debt collection notice that you dispute.

- Before making any payment on the alleged debt.

- Within 30 days of receiving the notice to ensure your rights are protected under the FDCPA.

How to Write and Send a Dispute Letter

- Include your full name, address, and account number.

- Clearly state that you dispute the debt and request validation.

- Specify what documents you expect to receive (contracts, statements, authorization to collect).

- Request that collection activities cease until validation is provided.

- Send via certified mail for tracking and proof of receipt.

Requirements and Prerequisites Before Writing the Letter

- A copy of the debt notice received.

- Personal records of payments and account history.

- Legal knowledge or reference to FDCPA rights.

- Certified mailing option to ensure receipt is documented.

Formatting Guidelines for a Dispute Letter

- Length: One page is usually sufficient.

- Tone: Professional, serious, and factual.

- Structure: Subject, greeting, dispute statement, documentation request, closing.

- Mode: Printed letter sent via certified mail or email if agency allows.

- Etiquette: Avoid emotional language; focus on facts and legal rights.

After Sending the Dispute Letter

- Wait for the collection agency to respond with validation.

- Keep copies of all correspondence.

- Follow up if the agency fails to provide documentation within the legal timeframe.

- Monitor credit reports for accuracy of reported debts.

Tricks and Tips for Effective Dispute Letters

- Always use certified mail to track delivery.

- Keep the letter concise but specific.

- Include account numbers and reference dates for clarity.

- Avoid admitting any liability in the letter.

- Retain copies of supporting documents for your records.

Common Mistakes to Avoid

- Failing to send the letter within the required timeframe.

- Using informal or emotional language.

- Not requesting specific documentation.

- Ignoring to track the delivery of the letter.

- Making payments before validating the debt.

Elements and Structure of a Dispute Letter to Collection Agency

- Subject: Clearly states “Dispute of Alleged Debt”.

- Greeting: Addressed to the collection agency or representative.

- Introduction: Identify yourself and reference the debt notice.

- Body: Explain the dispute and request validation documents.

- Closing: Request collection suspension until validation, sign-off politely.

- Attachments: Copies of any supporting documentation.

- Mailing: Certified mail recommended for proof of delivery.

Download Word Doc

Download Word Doc

Download PDF

Download PDF