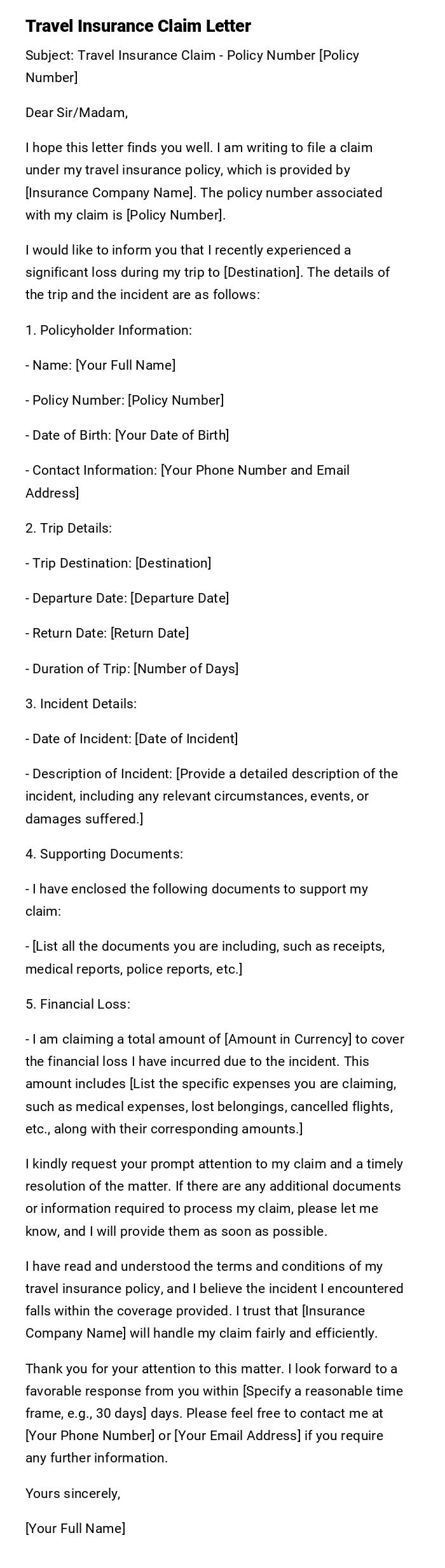

Travel Insurance Claim Letter

Subject: Travel Insurance Claim - Policy Number [Policy Number]

Dear Sir/Madam,

I hope this letter finds you well. I am writing to file a claim under my travel insurance policy, which is provided by [Insurance Company Name]. The policy number associated with my claim is [Policy Number].

I would like to inform you that I recently experienced a significant loss during my trip to [Destination]. The details of the trip and the incident are as follows:

1. Policyholder Information:

- Name: [Your Full Name]

- Policy Number: [Policy Number]

- Date of Birth: [Your Date of Birth]

- Contact Information: [Your Phone Number and Email Address]

2. Trip Details:

- Trip Destination: [Destination]

- Departure Date: [Departure Date]

- Return Date: [Return Date]

- Duration of Trip: [Number of Days]

3. Incident Details:

- Date of Incident: [Date of Incident]

- Description of Incident: [Provide a detailed description of the incident, including any relevant circumstances, events, or damages suffered.]

4. Supporting Documents:

- I have enclosed the following documents to support my claim:

- [List all the documents you are including, such as receipts, medical reports, police reports, etc.]

5. Financial Loss:

- I am claiming a total amount of [Amount in Currency] to cover the financial loss I have incurred due to the incident. This amount includes [List the specific expenses you are claiming, such as medical expenses, lost belongings, cancelled flights, etc., along with their corresponding amounts.]

I kindly request your prompt attention to my claim and a timely resolution of the matter. If there are any additional documents or information required to process my claim, please let me know, and I will provide them as soon as possible.

I have read and understood the terms and conditions of my travel insurance policy, and I believe the incident I encountered falls within the coverage provided. I trust that [Insurance Company Name] will handle my claim fairly and efficiently.

Thank you for your attention to this matter. I look forward to a favorable response from you within [Specify a reasonable time frame, e.g., 30 days] days. Please feel free to contact me at [Your Phone Number] or [Your Email Address] if you require any further information.

Yours sincerely,

[Your Full Name]

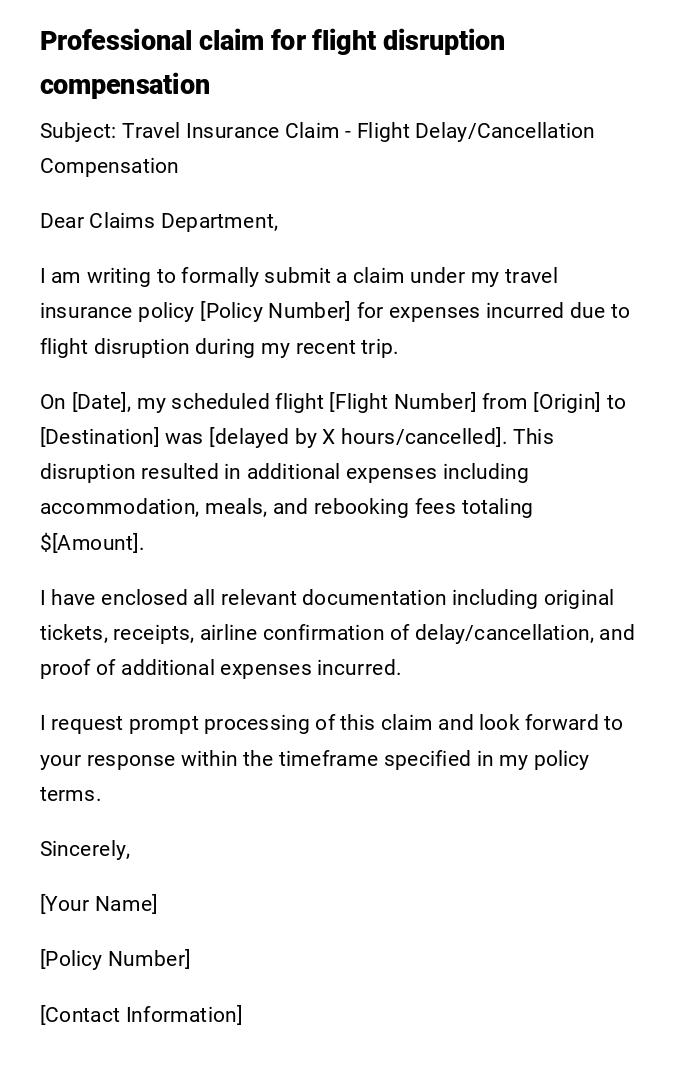

Flight Delay/Cancellation Compensation Claim

Subject: Travel Insurance Claim - Flight Delay/Cancellation Compensation

Dear Claims Department,

I am writing to formally submit a claim under my travel insurance policy [Policy Number] for expenses incurred due to flight disruption during my recent trip.

On [Date], my scheduled flight [Flight Number] from [Origin] to [Destination] was [delayed by X hours/cancelled]. This disruption resulted in additional expenses including accommodation, meals, and rebooking fees totaling $[Amount].

I have enclosed all relevant documentation including original tickets, receipts, airline confirmation of delay/cancellation, and proof of additional expenses incurred.

I request prompt processing of this claim and look forward to your response within the timeframe specified in my policy terms.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

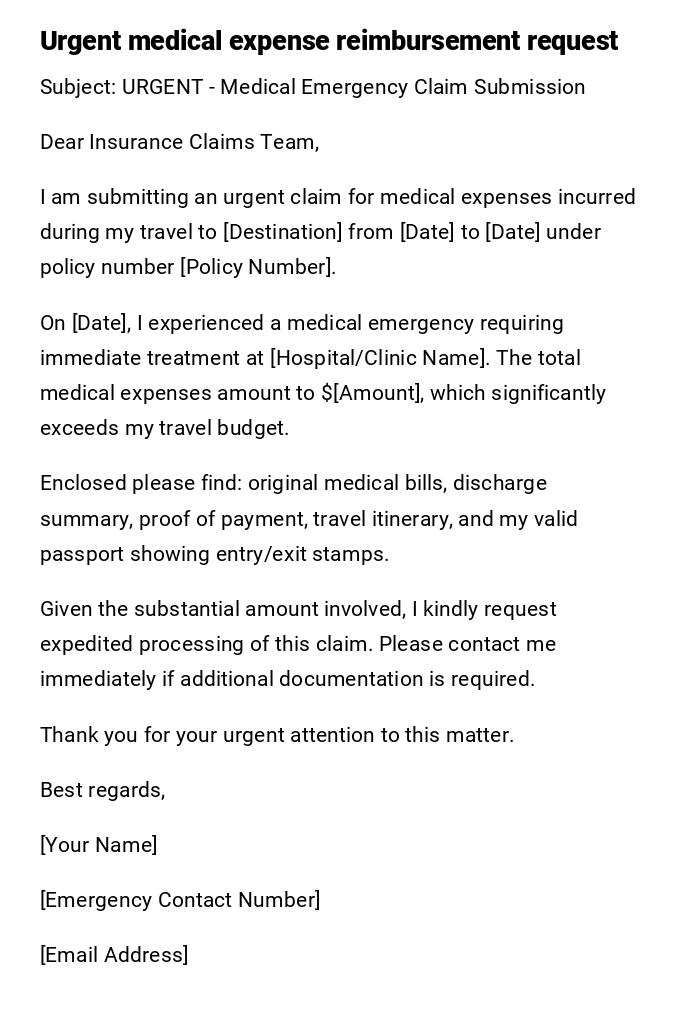

Medical Emergency Claim

Subject: URGENT - Medical Emergency Claim Submission

Dear Insurance Claims Team,

I am submitting an urgent claim for medical expenses incurred during my travel to [Destination] from [Date] to [Date] under policy number [Policy Number].

On [Date], I experienced a medical emergency requiring immediate treatment at [Hospital/Clinic Name]. The total medical expenses amount to $[Amount], which significantly exceeds my travel budget.

Enclosed please find: original medical bills, discharge summary, proof of payment, travel itinerary, and my valid passport showing entry/exit stamps.

Given the substantial amount involved, I kindly request expedited processing of this claim. Please contact me immediately if additional documentation is required.

Thank you for your urgent attention to this matter.

Best regards,

[Your Name]

[Emergency Contact Number]

[Email Address]

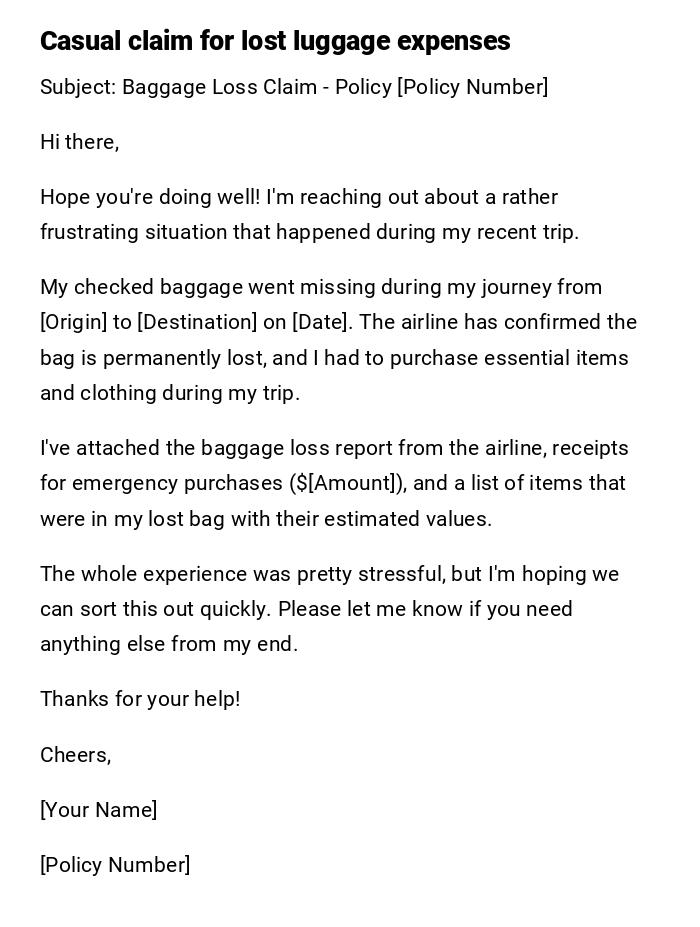

Lost Baggage Compensation

Subject: Baggage Loss Claim - Policy [Policy Number]

Hi there,

Hope you're doing well! I'm reaching out about a rather frustrating situation that happened during my recent trip.

My checked baggage went missing during my journey from [Origin] to [Destination] on [Date]. The airline has confirmed the bag is permanently lost, and I had to purchase essential items and clothing during my trip.

I've attached the baggage loss report from the airline, receipts for emergency purchases ($[Amount]), and a list of items that were in my lost bag with their estimated values.

The whole experience was pretty stressful, but I'm hoping we can sort this out quickly. Please let me know if you need anything else from my end.

Thanks for your help!

Cheers,

[Your Name]

[Policy Number]

Trip Cancellation Due to Family Emergency

Subject: Trip Cancellation Claim - Family Emergency

Dear Claims Advisor,

With a heavy heart, I am writing to file a claim for trip cancellation due to an unexpected family emergency under my travel insurance policy [Policy Number].

Just days before my planned departure on [Date], my [relationship] was hospitalized with a serious medical condition requiring immediate family support. This unforeseen circumstance forced me to cancel my entire trip to [Destination], scheduled from [Date] to [Date].

The non-refundable expenses I'm claiming include: airfare ($[Amount]), hotel reservations ($[Amount]), and tour bookings ($[Amount]), totaling $[Total Amount].

I have provided medical documentation from the attending physician, proof of relationship, and all original booking confirmations showing the non-refundable nature of these expenses.

I understand this is a difficult situation to verify, and I appreciate your understanding during this challenging time for my family.

Respectfully,

[Your Name]

[Policy Number]

Travel Delay Expense Reimbursement

Subject: Travel Delay Expense Claim

Dear Team,

Quick message regarding unexpected expenses from my recent travel delays.

My connecting flight on [Date] was delayed 8 hours, causing me to miss my final connection. Had to book overnight accommodation and meals while stranded at [Airport].

Expenses: Hotel $[Amount], Meals $[Amount], Transportation $[Amount]. Total: $[Amount].

Receipts attached. Policy number: [Policy Number].

Thanks!

[Your Name]

Adventure Activity Injury Claim

Subject: Medical Claim - Adventure Activity Injury

Dear Claims Department,

I am filing a formal claim for medical expenses related to an injury sustained during a covered adventure activity under my travel insurance policy [Policy Number].

While participating in [Activity] on [Date] in [Location], I suffered [Type of Injury] requiring immediate medical attention. The activity was conducted through a licensed operator and I followed all safety protocols.

Medical treatment costs totaled $[Amount], including emergency room treatment, X-rays, and ongoing physiotherapy as prescribed by the treating physician.

Enclosed documentation includes: medical reports, proof of activity booking with licensed operator, receipts for all medical expenses, and the incident report filed with local authorities.

This injury has significantly impacted my trip and recovery period. I trust you will process this claim with the seriousness it deserves.

Sincerely,

[Your Name]

[Policy Number]

Theft and Personal Property Loss

Subject: Theft Claim Submission - Policy [Policy Number]

To Whom It May Concern,

I hereby submit a formal claim for personal property theft that occurred during my travels to [Destination] under insurance policy [Policy Number].

On [Date] at approximately [Time], my personal belongings were stolen from [Location/Circumstances]. The incident was immediately reported to local police, and I have obtained an official police report [Report Number].

Stolen items and their values:

- [Item 1]: $[Value]

- [Item 2]: $[Value]

- [Item 3]: $[Value]

Total claimed amount: $[Total]

I have attached the police report, original receipts where available, and photographs of similar items to substantiate the claimed values.

I request your prompt attention to this matter and advise of any additional documentation required.

Yours truly,

[Your Name]

[Contact Information]

Natural Disaster Trip Interruption

Subject: PRELIMINARY - Natural Disaster Trip Interruption Claim

Dear Insurance Team,

This is a preliminary notification of my intent to file a claim for trip interruption due to natural disaster under policy [Policy Number].

During my stay in [Location] from [Date] to [Date], [Type of Natural Disaster] struck the area, forcing evacuation and early trip termination. Local authorities declared a state of emergency on [Date].

I incurred additional expenses for emergency accommodation, alternative transportation, and unused pre-paid tour arrangements. I estimate total damages at approximately $[Amount], though I am still compiling all receipts and documentation.

Please advise on your claims process for natural disaster situations and any specific documentation requirements. I will submit the complete claim package within [timeframe] once I have gathered all necessary materials.

This preliminary notice is submitted to ensure timely filing within policy requirements.

Best regards,

[Your Name]

[Policy Number]

[Temporary Contact Information]

What is a Travel Insurance Claim Letter and Why Do You Need One

A travel insurance claim letter is a formal document submitted to your insurance provider requesting compensation or reimbursement for covered losses, expenses, or damages incurred during travel. This letter serves as your official notification and request for benefits under your travel insurance policy.

The primary purposes include:

- Documenting your loss or expense with specific details

- Initiating the claims process with your insurance company

- Providing a written record of your request for legal purposes

- Demonstrating compliance with policy notification requirements

- Ensuring all relevant information is communicated clearly and professionally

Who Should Send Travel Insurance Claim Letters

- Primary Policyholder: The person who purchased the travel insurance policy

- Covered Family Members: Spouses, children, or relatives included under family coverage

- Authorized Representatives: Legal guardians, power of attorney holders, or designated beneficiaries

- Travel Group Leaders: When representing covered group members under group policies

- Employers: For business travel insurance claims on behalf of employees

- Third-Party Claims Managers: Professional services hired to handle insurance claims

When to Send Travel Insurance Claim Letters

Immediate situations requiring claim letters:

- Medical emergencies requiring treatment abroad

- Flight cancellations or significant delays

- Lost, stolen, or damaged baggage

- Trip cancellation due to covered reasons

- Trip interruption from natural disasters

- Personal property theft or damage

- Emergency evacuation situations

- Missed connections causing additional expenses

- Adventure activity injuries

- Accommodation issues or overbooking

- Travel document loss (passport, visa)

- Rental car damage or theft

Requirements and Prerequisites Before Filing

Essential preparations before submitting your claim:

- Review your policy thoroughly to understand coverage limits and exclusions

- Gather all original receipts and documentation

- Obtain official reports (police reports for theft, medical reports for injuries)

- Take photographs of damaged items or relevant scenes

- Keep detailed records of all expenses incurred

- Notify your insurance company within required timeframes (usually 24-48 hours for emergencies)

- Contact relevant service providers (airlines, hotels) to document issues

- Obtain written confirmations from third parties when applicable

- Ensure all documentation is in English or officially translated

- Make copies of all documents for your records

How to Write and Send Your Claim Letter

Planning Phase:

- Identify the specific type of claim and relevant policy coverage

- Organize all supporting documentation chronologically

- Calculate total expenses and losses accurately

- Determine the appropriate tone based on claim urgency and nature

Writing Process:

- Start with a clear, descriptive subject line

- Include your policy number in the opening paragraph

- Present facts chronologically and objectively

- Specify exact amounts being claimed

- Reference attached documentation

- Request specific action from the insurance company

- Provide multiple contact methods

Submission Methods:

- Email for urgent claims requiring immediate attention

- Certified mail for formal documentation and proof of delivery

- Online portals when available through your insurance provider

- Fax for time-sensitive claims when email isn't available

Formatting Guidelines and Best Practices

Professional Letters:

- Use business letter format with formal salutations

- Keep length between 1-2 pages maximum

- Use clear, concise language without emotional appeals

- Include specific dates, amounts, and policy numbers

Email Communications:

- Use descriptive subject lines including claim type and policy number

- Maintain professional tone even in urgent situations

- Attach documents as PDFs when possible

- Include signature with full contact information

Documentation Standards:

- Organize attachments logically and label clearly

- Provide summaries for extensive documentation

- Ensure all receipts are legible and complete

- Include translation certificates for foreign documents

Follow-up Actions After Sending Your Claim

Immediate Actions:

- Confirm receipt of your claim submission

- Save confirmation numbers or reference codes

- Continue documenting any ongoing expenses related to your claim

- Maintain communication with all relevant parties

Ongoing Monitoring:

- Track claim status through insurance company portals

- Respond promptly to requests for additional information

- Keep records of all communications with your insurance company

- Follow up if you don't receive acknowledgment within stated timeframes

Additional Steps:

- Notify other involved parties of claim submission when relevant

- Continue medical treatment as prescribed and document all expenses

- Avoid settling with third parties without insurance company approval

- Consider legal consultation for complex or disputed claims

Common Mistakes to Avoid

Documentation Errors:

- Submitting incomplete or unclear receipts

- Failing to obtain official reports when required

- Missing policy notification deadlines

- Providing inconsistent information across documents

Communication Mistakes:

- Using overly emotional or accusatory language

- Failing to include essential policy information

- Submitting claims for non-covered expenses

- Not keeping copies of all submitted materials

Process Errors:

- Accepting settlements from third parties before notifying insurance

- Failing to continue necessary medical treatment

- Not reporting incidents to local authorities when required

- Mixing multiple claim types in single submissions

Essential Elements Your Letter Must Include

Header Information:

- Your full name and contact information

- Policy number and coverage dates

- Date of letter submission

- Clear subject line describing claim type

Body Structure:

- Detailed description of incident or circumstances

- Specific dates, times, and locations

- Exact amounts being claimed with supporting calculations

- Reference to attached supporting documentation

- Clear request for specific action

Supporting Documentation:

- Original receipts and invoices

- Medical reports and discharge summaries

- Police reports for theft or criminal incidents

- Airline or hotel confirmations and correspondence

- Photographs of damage or relevant scenes

- Proof of relationship for family emergency claims

Advantages and Disadvantages of Different Claim Letter Approaches

Formal Professional Letters:

- Advantages: Creates official record, demonstrates seriousness, legally comprehensive

- Disadvantages: May delay urgent claims, can seem impersonal, requires more time to prepare

Quick Email Communications:

- Advantages: Immediate delivery, allows rapid back-and-forth communication, suitable for urgent claims

- Disadvantages: May lack formality for significant claims, easier to overlook important details

Preliminary Notifications:

- Advantages: Meets policy deadlines, allows time to gather complete documentation, demonstrates good faith

- Disadvantages: Requires follow-up submission, may create confusion about claim status

Tips and Best Practices for Successful Claims

Preparation Strategies:

- Photograph all important documents before traveling

- Keep digital and physical copies of receipts

- Understand your policy coverage before incidents occur

- Maintain detailed travel itineraries and contact information

Writing Techniques:

- Use bullet points for complex expense breakdowns

- Include timeline summaries for complicated incidents

- Reference specific policy clauses when applicable

- Maintain factual tone even in frustrating situations

Submission Timing:

- Submit preliminary notifications immediately for urgent situations

- Follow up with complete documentation within policy timeframes

- Don't wait for all documentation if policy deadlines are approaching

- Consider time zone differences when calculating notification deadlines

Download Word Doc

Download Word Doc

Download PDF

Download PDF