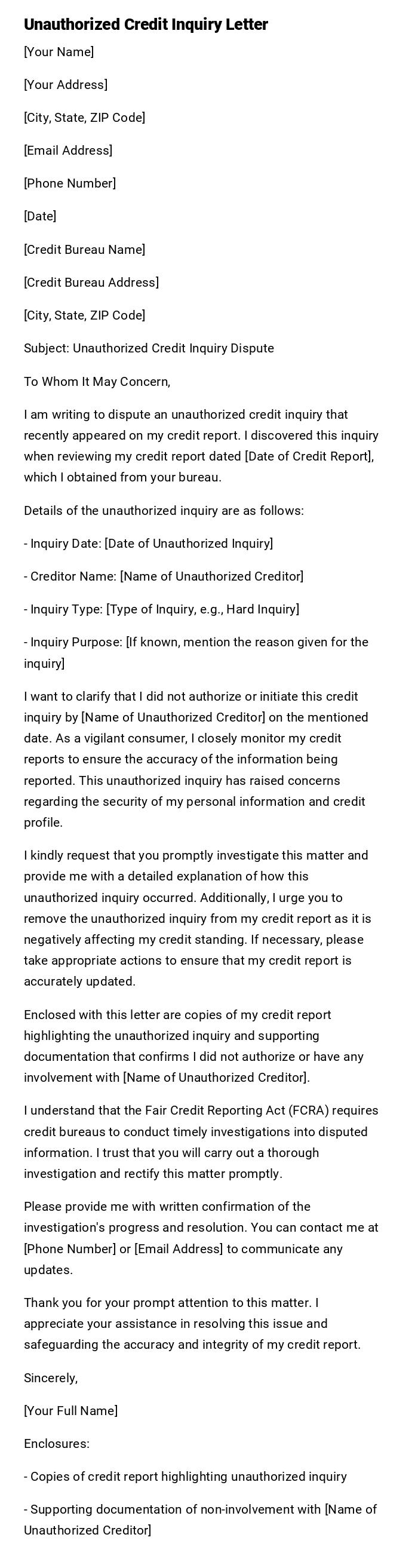

Unauthorized Credit Inquiry Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, ZIP Code]

Subject: Unauthorized Credit Inquiry Dispute

To Whom It May Concern,

I am writing to dispute an unauthorized credit inquiry that recently appeared on my credit report. I discovered this inquiry when reviewing my credit report dated [Date of Credit Report], which I obtained from your bureau.

Details of the unauthorized inquiry are as follows:

- Inquiry Date: [Date of Unauthorized Inquiry]

- Creditor Name: [Name of Unauthorized Creditor]

- Inquiry Type: [Type of Inquiry, e.g., Hard Inquiry]

- Inquiry Purpose: [If known, mention the reason given for the inquiry]

I want to clarify that I did not authorize or initiate this credit inquiry by [Name of Unauthorized Creditor] on the mentioned date. As a vigilant consumer, I closely monitor my credit reports to ensure the accuracy of the information being reported. This unauthorized inquiry has raised concerns regarding the security of my personal information and credit profile.

I kindly request that you promptly investigate this matter and provide me with a detailed explanation of how this unauthorized inquiry occurred. Additionally, I urge you to remove the unauthorized inquiry from my credit report as it is negatively affecting my credit standing. If necessary, please take appropriate actions to ensure that my credit report is accurately updated.

Enclosed with this letter are copies of my credit report highlighting the unauthorized inquiry and supporting documentation that confirms I did not authorize or have any involvement with [Name of Unauthorized Creditor].

I understand that the Fair Credit Reporting Act (FCRA) requires credit bureaus to conduct timely investigations into disputed information. I trust that you will carry out a thorough investigation and rectify this matter promptly.

Please provide me with written confirmation of the investigation's progress and resolution. You can contact me at [Phone Number] or [Email Address] to communicate any updates.

Thank you for your prompt attention to this matter. I appreciate your assistance in resolving this issue and safeguarding the accuracy and integrity of my credit report.

Sincerely,

[Your Full Name]

Enclosures:

- Copies of credit report highlighting unauthorized inquiry

- Supporting documentation of non-involvement with [Name of Unauthorized Creditor]

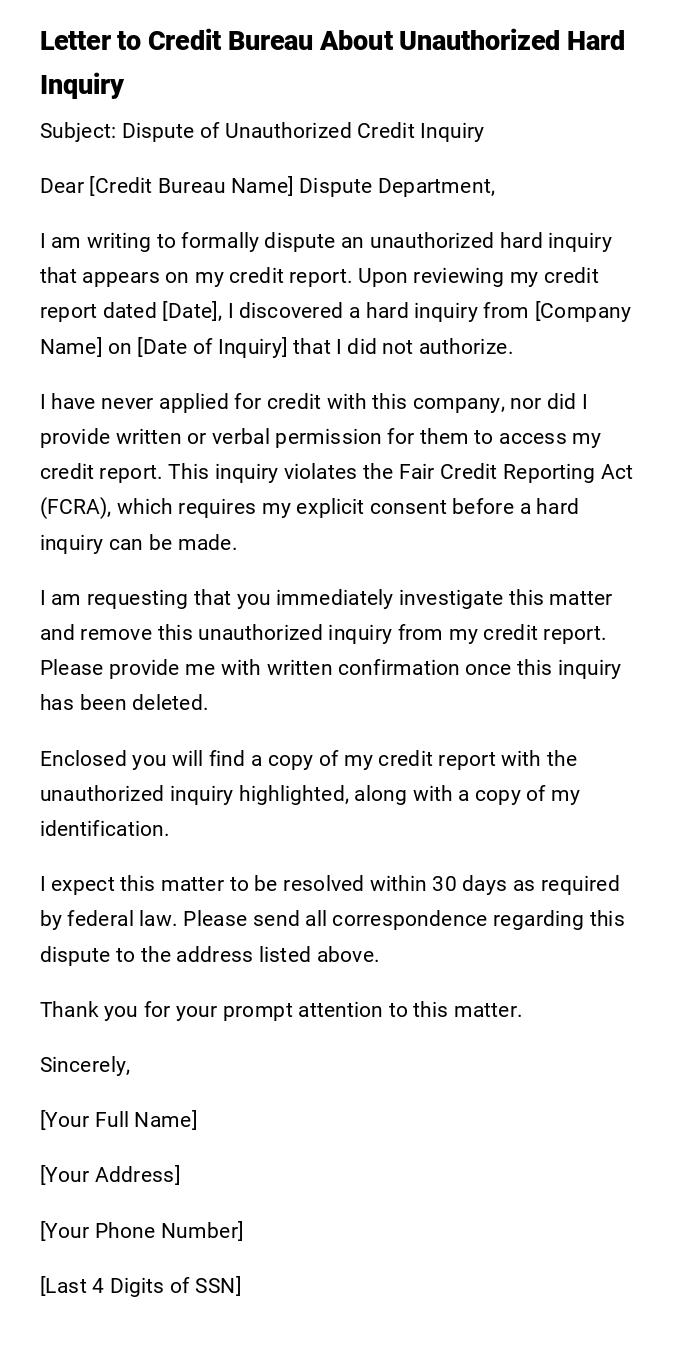

Letter to Credit Bureau About Unauthorized Hard Inquiry

Subject: Dispute of Unauthorized Credit Inquiry

Dear [Credit Bureau Name] Dispute Department,

I am writing to formally dispute an unauthorized hard inquiry that appears on my credit report. Upon reviewing my credit report dated [Date], I discovered a hard inquiry from [Company Name] on [Date of Inquiry] that I did not authorize.

I have never applied for credit with this company, nor did I provide written or verbal permission for them to access my credit report. This inquiry violates the Fair Credit Reporting Act (FCRA), which requires my explicit consent before a hard inquiry can be made.

I am requesting that you immediately investigate this matter and remove this unauthorized inquiry from my credit report. Please provide me with written confirmation once this inquiry has been deleted.

Enclosed you will find a copy of my credit report with the unauthorized inquiry highlighted, along with a copy of my identification.

I expect this matter to be resolved within 30 days as required by federal law. Please send all correspondence regarding this dispute to the address listed above.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Address]

[Your Phone Number]

[Last 4 Digits of SSN]

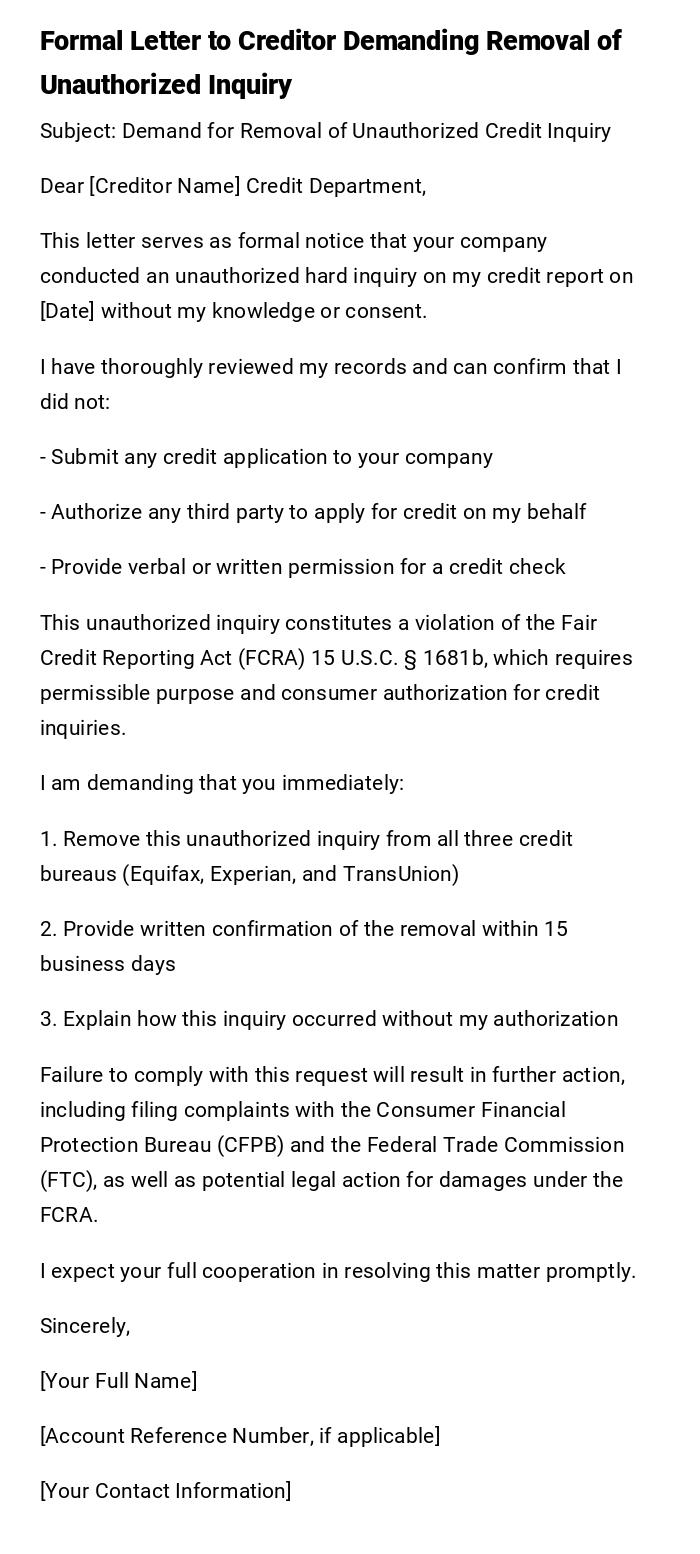

Formal Letter to Creditor Demanding Removal of Unauthorized Inquiry

Subject: Demand for Removal of Unauthorized Credit Inquiry

Dear [Creditor Name] Credit Department,

This letter serves as formal notice that your company conducted an unauthorized hard inquiry on my credit report on [Date] without my knowledge or consent.

I have thoroughly reviewed my records and can confirm that I did not:

- Submit any credit application to your company

- Authorize any third party to apply for credit on my behalf

- Provide verbal or written permission for a credit check

This unauthorized inquiry constitutes a violation of the Fair Credit Reporting Act (FCRA) 15 U.S.C. § 1681b, which requires permissible purpose and consumer authorization for credit inquiries.

I am demanding that you immediately:

1. Remove this unauthorized inquiry from all three credit bureaus (Equifax, Experian, and TransUnion)

2. Provide written confirmation of the removal within 15 business days

3. Explain how this inquiry occurred without my authorization

Failure to comply with this request will result in further action, including filing complaints with the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC), as well as potential legal action for damages under the FCRA.

I expect your full cooperation in resolving this matter promptly.

Sincerely,

[Your Full Name]

[Account Reference Number, if applicable]

[Your Contact Information]

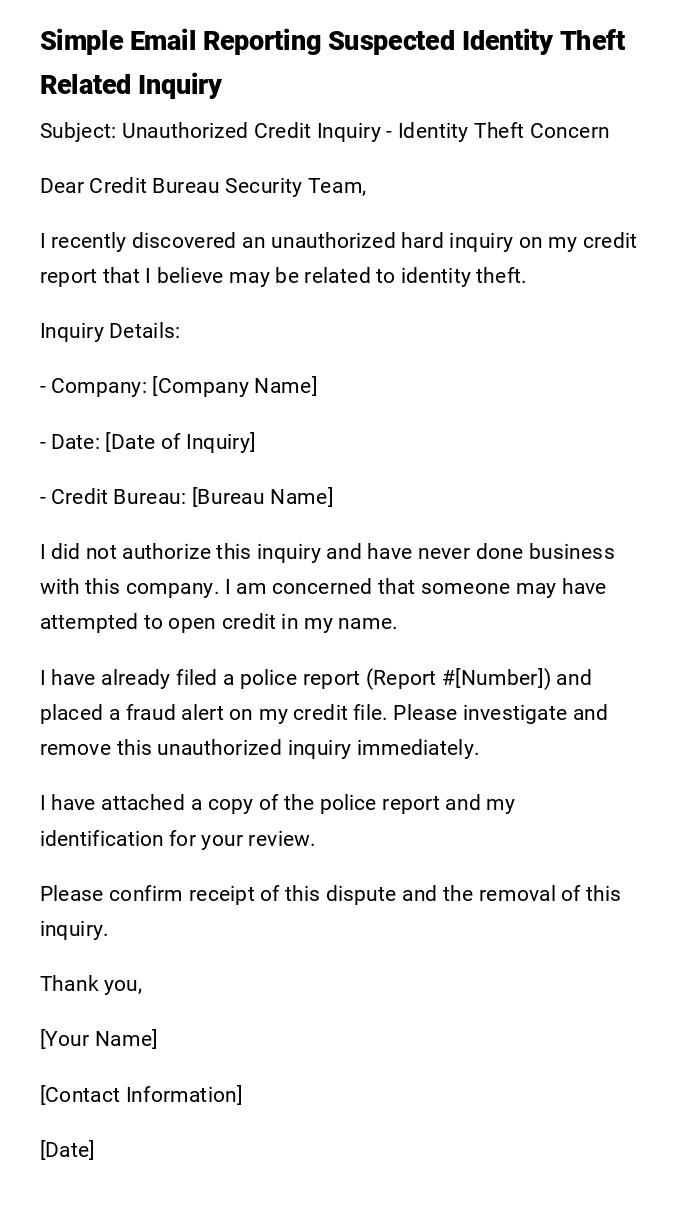

Simple Email Reporting Suspected Identity Theft Related Inquiry

Subject: Unauthorized Credit Inquiry - Identity Theft Concern

Dear Credit Bureau Security Team,

I recently discovered an unauthorized hard inquiry on my credit report that I believe may be related to identity theft.

Inquiry Details:

- Company: [Company Name]

- Date: [Date of Inquiry]

- Credit Bureau: [Bureau Name]

I did not authorize this inquiry and have never done business with this company. I am concerned that someone may have attempted to open credit in my name.

I have already filed a police report (Report #[Number]) and placed a fraud alert on my credit file. Please investigate and remove this unauthorized inquiry immediately.

I have attached a copy of the police report and my identification for your review.

Please confirm receipt of this dispute and the removal of this inquiry.

Thank you,

[Your Name]

[Contact Information]

[Date]

Professional Letter Following Up on Previous Dispute

Subject: Follow-Up: Unauthorized Credit Inquiry Dispute - Reference #[Number]

Dear [Credit Bureau] Dispute Resolution Team,

I am writing to follow up on my dispute regarding an unauthorized credit inquiry that I submitted on [Date of Original Dispute]. My original dispute reference number is [Reference Number].

To date, I have not received confirmation that this inquiry has been removed from my credit report, nor have I received any correspondence regarding the status of my investigation.

As a reminder, the disputed inquiry is:

- Creditor: [Company Name]

- Date of Inquiry: [Date]

- Reason for Dispute: No authorization provided

The Fair Credit Reporting Act requires that disputes be investigated within 30 days. It has now been [Number] days since my initial dispute was filed.

I am requesting immediate action on this matter, including:

- Complete investigation of this unauthorized inquiry

- Removal of the inquiry from my credit report

- Written confirmation of the removal

- Updated credit report showing the correction

Please treat this matter with urgency. If I do not receive a response within 10 business days, I will escalate this complaint to the Consumer Financial Protection Bureau.

I look forward to your prompt response.

Respectfully,

[Your Full Name]

[Original Dispute Reference Number]

[Contact Information]

Serious Letter for Multiple Unauthorized Inquiries

Subject: Urgent: Multiple Unauthorized Credit Inquiries - Potential Fraud

Dear [Credit Bureau Name] Fraud Department,

I am writing to report multiple unauthorized hard inquiries on my credit report that suggest fraudulent activity. I recently obtained my credit report and discovered several inquiries that I did not authorize.

Unauthorized Inquiries:

1. [Company Name] - [Date]

2. [Company Name] - [Date]

3. [Company Name] - [Date]

4. [Company Name] - [Date]

I have never applied for credit with any of these companies, and I did not authorize anyone to apply on my behalf. The timing and number of these inquiries suggest that my personal information may have been compromised.

Actions I have taken:

- Filed a police report for identity theft (Report #[Number])

- Placed fraud alerts with all three credit bureaus

- Frozen my credit reports

- Notified the Federal Trade Commission through IdentityTheft.gov

I am requesting that you:

1. Immediately investigate all listed inquiries

2. Remove all unauthorized inquiries from my credit report

3. Flag my account for additional security monitoring

4. Provide documentation showing the removal of these inquiries

5. Contact me if you need additional information

This matter is extremely urgent as these inquiries are damaging my credit score and may indicate ongoing fraudulent activity. I am prepared to take all necessary legal action to protect my rights under the FCRA.

Please respond within 10 business days with an update on your investigation.

Sincerely,

[Your Full Name]

[SSN - Last 4 Digits]

[Date of Birth]

[Current Address]

[Phone Number]

[Email Address]

Enclosures: Copy of police report, government-issued ID, proof of address

Casual Email to Creditor About Promotional Inquiry Opt-Out

Subject: Request to Stop Pre-Approved Credit Inquiries

Hi [Company Name] Customer Service,

I noticed that your company has been making soft inquiries on my credit report for pre-approved credit offers. While I understand these don't affect my credit score, I'm not interested in receiving these offers and would like to opt out.

Could you please:

- Remove my information from your pre-screening lists

- Stop any future soft inquiries related to promotional offers

- Confirm once this has been completed

I've also registered with optoutprescreen.com, but wanted to reach out directly to make sure I'm removed from your specific marketing lists.

Thanks for taking care of this!

Best,

[Your Name]

[Account Number, if applicable]

[Email]

[Phone]

Official Letter Requesting Documentation of Authorization

Subject: Request for Proof of Authorization - Credit Inquiry

Dear [Creditor Name] Compliance Department,

On [Date], your company conducted a hard inquiry on my credit report. I do not recall authorizing this inquiry and am requesting documentation that proves I provided consent.

Under the Fair Credit Reporting Act, you must have permissible purpose to access my credit report. I am exercising my right to request proof of this authorization.

Please provide the following within 30 days:

1. A copy of any signed application or agreement bearing my signature

2. Records showing how and when I authorized the credit inquiry

3. The specific permissible purpose for accessing my credit report

4. Any recorded phone conversations where I provided verbal authorization

If you cannot provide this documentation, I expect you to:

- Immediately remove this inquiry from my credit reports with all three bureaus

- Send written confirmation of the removal to my address

- Provide a letter stating that the inquiry was made in error

Please note that failure to provide this documentation or remove the unauthorized inquiry may result in a formal complaint to regulatory agencies and potential legal action.

I expect a response within 30 days of receipt of this letter.

Sincerely,

[Your Full Name]

[Address]

[Phone Number]

[Date]

Direct Letter for Inquiry Made by Former Employer

Subject: Unauthorized Credit Check by Former Employer

Dear [Former Employer Name] Human Resources Department,

I recently discovered that your company conducted a credit inquiry on my credit report on [Date], which was after my employment with your company ended on [Date].

I did not authorize this post-employment credit check, and I am concerned about why this inquiry was made after I was no longer employed by your organization.

Under the Fair Credit Reporting Act, employers must obtain written authorization before accessing an employee's or former employee's credit report. Since my employment ended on [Date], any authorization I may have provided during my employment is no longer valid.

I am requesting:

1. An explanation for why this inquiry was conducted after my employment ended

2. Immediate removal of this unauthorized inquiry from my credit report

3. Written confirmation that no further inquiries will be made

4. Assurance that my personal information will be properly secured and not used for unauthorized purposes

Please respond within 15 business days. If I do not receive a satisfactory response, I will file complaints with the appropriate regulatory agencies and consider further legal action.

I trust this matter will be resolved quickly and professionally.

Regards,

[Your Full Name]

[Former Employee ID, if applicable]

[Contact Information]

[Date]

What is an Unauthorized Credit Inquiry Letter and Why Do You Need It

An unauthorized credit inquiry letter is a formal written dispute sent to credit bureaus or creditors to challenge and request removal of credit inquiries that appear on your credit report without your permission. These letters are essential tools for protecting your credit profile and exercising your rights under the Fair Credit Reporting Act (FCRA).

The primary purposes of this letter include:

- Disputing hard inquiries that negatively impact your credit score

- Documenting potential identity theft or fraud

- Holding creditors accountable for FCRA violations

- Initiating the investigation process required by law

- Creating a paper trail for potential legal action

- Restoring your credit score by removing unauthorized inquiries

- Preventing future unauthorized access to your credit report

When Should You Send an Unauthorized Credit Inquiry Letter

You should send this letter in the following scenarios:

- After discovering inquiries you don't recognize while reviewing your credit report from any of the three bureaus

- When companies check your credit without permission for applications you never submitted

- If you suspect identity theft and notice multiple unfamiliar inquiries within a short timeframe

- Following unauthorized dealer inquiries after visiting a car dealership without agreeing to a credit check

- When pre-employment credit checks are conducted without your written authorization

- After a data breach where your personal information may have been compromised

- When authorization has expired such as inquiries made by former employers or closed accounts

- If third parties access your credit without establishing permissible purpose

- Upon noticing inquiries from companies you've never heard of or done business with

- When promotional inquiries become excessive despite opt-out requests

- After divorce or separation if your former spouse applied for credit using your information

- When business partners or co-signers check your credit without current authorization

Who Should Send This Letter

The letter should be sent by:

- The credit report subject whose personal information was accessed without authorization

- Legal guardians on behalf of minors whose credit was accessed

- Power of attorney holders authorized to manage someone's financial affairs

- Estate executors dealing with unauthorized inquiries on a deceased person's report

- Identity theft victims who have filed police reports and fraud alerts

- Parents of dependents whose information was misused for credit applications

- Authorized representatives with proper legal documentation to act on someone's behalf

The letter must come from someone with legal standing to dispute the inquiry and protect the credit file in question.

To Whom Should This Letter Be Addressed

Depending on your specific situation, address the letter to:

- Credit Bureau Dispute Departments - Equifax, Experian, and TransUnion when the inquiry appears on their reports

- The creditor's compliance or legal department that made the unauthorized inquiry

- Fraud or security departments when identity theft is suspected

- Human resources departments for employer-related unauthorized inquiries

- Corporate headquarters for large companies that don't respond to initial requests

- Consumer protection divisions of financial institutions

- Dealership management for unauthorized automotive credit checks

- All three credit bureaus simultaneously when the same inquiry appears on multiple reports

- Third-party verification services that may have facilitated the unauthorized access

Include specific department names and reference numbers whenever possible to ensure proper routing and faster resolution.

Requirements and Prerequisites Before Sending the Letter

Before drafting and sending your letter, complete these essential steps:

- Obtain your credit reports from all three bureaus (free annually at AnnualCreditReport.com)

- Review reports thoroughly and identify all unauthorized inquiries with dates and creditor names

- Document your records showing you never applied for credit with the companies in question

- File a police report if you suspect identity theft or fraud

- Place fraud alerts on your credit files with all three bureaus

- Gather identification documents such as driver's license, passport, or government-issued ID

- Collect supporting evidence including correspondence, account statements, or lack thereof

- Check your authorization history to confirm you didn't inadvertently give permission

- Screenshot or print the disputed inquiry from your credit report

- Register with IdentityTheft.gov if fraud is involved

- Consider freezing your credit to prevent additional unauthorized inquiries

- Organize all documentation chronologically for easy reference

- Note reference numbers from any previous disputes or customer service interactions

How to Write and Send an Unauthorized Credit Inquiry Letter

Follow this systematic approach:

- Start with identifying information including your full name, address, SSN (last 4 digits), and date of birth

- Reference the specific inquiry with the creditor name, date of inquiry, and which credit bureau report it appears on

- State clearly that you did not authorize the inquiry and never applied for credit with that company

- Cite the Fair Credit Reporting Act to establish your legal grounds for the dispute

- Request specific actions including investigation, removal, and written confirmation

- Set a deadline typically 30 days as required by FCRA for investigation completion

- Maintain a professional tone even if you're frustrated or angry about the situation

- Include supporting documentation such as copies (never originals) of your ID and credit report

- Send via certified mail with return receipt to create proof of delivery and receipt

- Keep detailed records of all correspondence, dates sent, and responses received

- Send separate letters to each credit bureau and the creditor if addressing multiple parties

- Follow up consistently if you don't receive responses within the stated timeframe

Formatting Guidelines for Your Letter

Structure your letter with these formatting considerations:

- Length: Keep it concise, typically one to two pages maximum

- Tone: Professional and assertive but not aggressive or threatening

- Format: Business letter format with your address, date, recipient address, and formal greeting

- Font: Use standard readable fonts like Times New Roman or Arial in 11-12 point size

- Spacing: Single-spaced with double spacing between paragraphs

- Style: Direct and factual, avoiding emotional language or excessive detail

- Organization: Use clear paragraphs with each covering one main point

- Lists: Include bulleted or numbered lists for multiple inquiries or requested actions

- Legal references: Cite specific FCRA sections when applicable but don't overdo legal jargon

- Enclosures: Note at the bottom if you're including attachments

- Signature: Always include a handwritten signature on mailed letters

- Delivery method: Certified mail for important disputes, email for follow-ups or less urgent matters

- Subject line: Clear and specific for easy filing and routing by the recipient

What to Do After Sending the Letter

Once you've sent your dispute letter:

- Save all documentation including copies of the letter, certified mail receipts, and tracking information

- Monitor delivery confirmation through USPS tracking for certified mail

- Mark your calendar for the 30-day investigation deadline

- Check your mail regularly for responses from credit bureaus or creditors

- Follow up at 15 days if you haven't received acknowledgment of your dispute

- Review updated credit reports after receiving confirmation of removal

- Send a second letter if the inquiry isn't removed or you receive an inadequate response

- Document all responses including letters, emails, and phone calls with dates and representative names

- Escalate if necessary to supervisors or corporate offices for unresolved disputes

- File complaints with the Consumer Financial Protection Bureau (CFPB) if your dispute is mishandled

- Contact the FTC to report FCRA violations or identity theft issues

- Consider legal action if creditors refuse to remove clearly unauthorized inquiries

- Monitor your credit ongoing to ensure the inquiry doesn't reappear and to catch future unauthorized access

Advantages and Disadvantages of Sending This Letter

Advantages:

- Protects your legal rights under the FCRA

- Can improve your credit score by removing hard inquiries

- Creates documented evidence of unauthorized access

- Initiates mandatory investigations by credit bureaus

- Demonstrates proactive credit management

- May uncover identity theft early before more damage occurs

- Holds companies accountable for improper credit checks

- Establishes a paper trail for potential legal action

- Free to do yourself without hiring attorneys

Disadvantages:

- Time-consuming process requiring documentation and follow-up

- May take 30-60 days to see results

- No guaranteed removal if the creditor claims authorization exists

- Requires certified mail costs and administrative effort

- Can be stressful if dealing with multiple unauthorized inquiries

- May need to dispute with multiple entities separately

- Creditors sometimes respond with documentation you don't remember signing

- Could reveal larger identity theft issues requiring extensive remediation

Common Mistakes to Avoid

Don't make these frequent errors:

- Waiting too long to dispute - address unauthorized inquiries as soon as you discover them

- Sending to the wrong department - research the correct address for dispute resolution

- Being vague or unclear - always include specific dates, company names, and what you're requesting

- Forgetting to include identification - disputes often stall without proper verification documents

- Using threatening or hostile language - remain professional to be taken seriously

- Sending original documents - always send copies and retain originals for your records

- Not keeping records - save everything related to your dispute for future reference

- Disputing legitimate inquiries - only dispute inquiries you truly didn't authorize

- Ignoring the response - read carefully and respond if additional information is requested

- Giving up after one attempt - persistence is often necessary for successful removal

- Not following up - credit bureaus sometimes "verify" without proper investigation

- Mixing multiple issues in one letter - keep each dispute focused on specific inquiries

- Forgetting to dispute with all three bureaus - inquiries may appear on multiple reports

- Not documenting phone conversations - always get representative names and reference numbers

Comparison with Similar Letters and Alternative Actions

Unauthorized Inquiry Letter vs. Credit Report Dispute Letter:

- Inquiry letters focus specifically on who accessed your credit, not the accuracy of account information

- General disputes address incorrect balances, accounts, or personal information

- Inquiry removal is based on authorization issues, not factual accuracy

Unauthorized Inquiry Letter vs. Identity Theft Affidavit:

- Inquiry letters address single or few unauthorized accesses

- Identity theft affidavits are comprehensive documents for confirmed fraud cases

- Affidavits trigger more extensive fraud investigations and protections

Unauthorized Inquiry Letter vs. Cease and Desist Letter:

- Inquiry letters seek removal of existing inquiries

- Cease and desist letters demand stopping ongoing unauthorized access or contact

Alternative Actions:

- Online disputes through credit bureau websites - faster but less documented

- Phone disputes - immediate but no paper trail unless followed by written confirmation

- Credit monitoring services - preventive but don't address existing inquiries

- Legal representation - more powerful but expensive for simple inquiry disputes

- Filing CFPB complaints - triggers regulatory oversight but doesn't directly remove inquiries

Essential Tips and Best Practices

- Act quickly - dispute unauthorized inquiries within 60 days of discovering them

- Dispute with everyone - send letters to both credit bureaus and the creditor who made the inquiry

- Use certified mail with return receipt for proof of delivery and to meet legal requirements

- Be specific - include exact dates, company names, and what action you want taken

- Keep emotions out - stick to facts and legal requirements rather than expressing anger

- Reference the law - mention FCRA section 1681b regarding permissible purpose

- Set clear deadlines - give 30 days for investigations and 15 days for creditor responses

- Document everything - maintain a dispute folder with copies of all correspondence

- Follow the money - if a credit line was opened, that's a bigger issue than just the inquiry

- Check all three bureaus - an inquiry on one report may not appear on others

- Use templates wisely - customize them to your specific situation rather than sending generic letters

- Request confirmation in writing - don't accept verbal promises that inquiries will be removed

- Monitor your credit regularly - sign up for free monitoring to catch future unauthorized access quickly

- Know when to escalate - if initial disputes fail, file complaints with CFPB and state attorney general

Required Elements and Structure of the Letter

Every unauthorized credit inquiry letter should include:

Opening Elements:

- Your complete contact information

- Date of the letter

- Recipient's complete address

- Clear subject line referencing the dispute

Body Elements:

- Statement that you're disputing a specific inquiry

- Detailed identification of the inquiry (company name, date, credit bureau)

- Clear statement that you did not authorize the inquiry

- Explanation of why you believe it's unauthorized

- Reference to relevant consumer protection laws (FCRA)

- Specific actions requested (investigation, removal, confirmation)

- Deadline for response (typically 30 days)

- Consequences of non-compliance if appropriate

Closing Elements:

- Professional closing statement

- Your handwritten signature

- Your printed name

- List of enclosures

Attachments:

- Copy of credit report highlighting the disputed inquiry

- Copy of government-issued photo ID

- Copy of police report if identity theft is suspected

- Any supporting documentation showing lack of authorization

How Many Inquiries Can You Dispute and Related Quantities

- Number of inquiries per letter: Dispute all unauthorized inquiries from the same creditor in one letter, but create separate letters for different creditors

- Investigation timeline: Credit bureaus must complete investigations within 30 days of receiving your dispute

- Credit score impact: Each hard inquiry typically reduces your score by 2-5 points and remains for 2 years

- Dispute frequency: No limit on legitimate disputes, but frivolous disputes can be ignored

- Follow-up timeline: Send follow-up letters after 15 days if no acknowledgment received, after 35 days if investigation incomplete

- Escalation waiting period: Wait at least 45 days before escalating to CFPB or legal action

- Statute of limitations: While inquiries stay on reports for 2 years, no time limit exists for disputing truly unauthorized inquiries

- Response rate: Approximately 70-80% of legitimate unauthorized inquiry disputes result in removal

- Cost considerations: Certified mail costs $8-10 per letter; online disputes are free but less documented

- Number of bureaus to contact: Always dispute with all three major bureaus (Equifax, Experian, TransUnion) as inquiries may appear on multiple reports

Download Word Doc

Download Word Doc

Download PDF

Download PDF