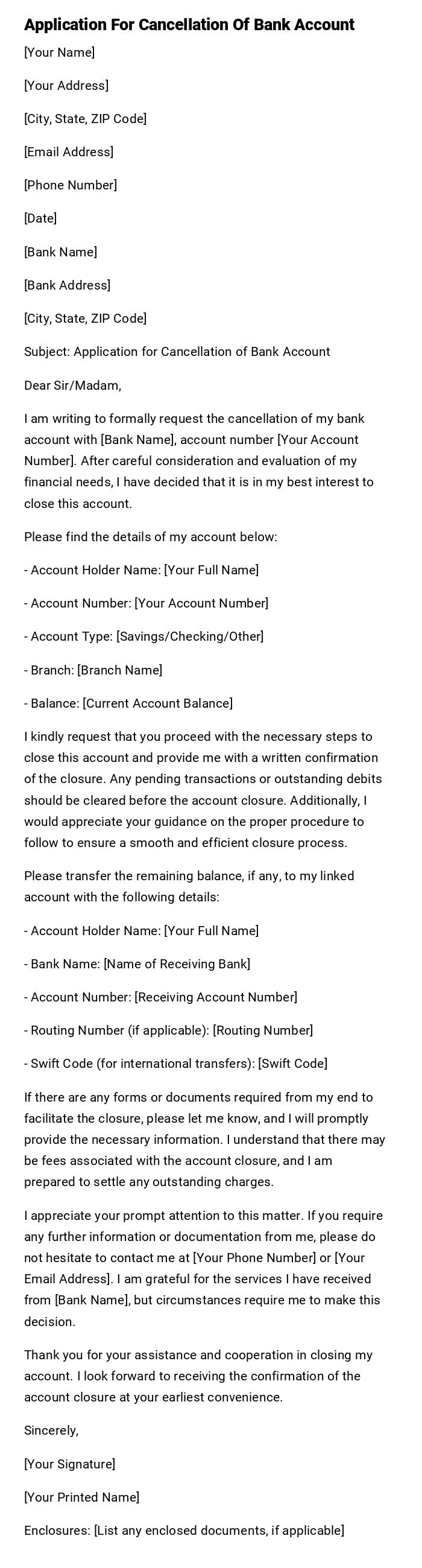

Application For Cancellation Of Bank Account

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Application for Cancellation of Bank Account

Dear Sir/Madam,

I am writing to formally request the cancellation of my bank account with [Bank Name], account number [Your Account Number]. After careful consideration and evaluation of my financial needs, I have decided that it is in my best interest to close this account.

Please find the details of my account below:

- Account Holder Name: [Your Full Name]

- Account Number: [Your Account Number]

- Account Type: [Savings/Checking/Other]

- Branch: [Branch Name]

- Balance: [Current Account Balance]

I kindly request that you proceed with the necessary steps to close this account and provide me with a written confirmation of the closure. Any pending transactions or outstanding debits should be cleared before the account closure. Additionally, I would appreciate your guidance on the proper procedure to follow to ensure a smooth and efficient closure process.

Please transfer the remaining balance, if any, to my linked account with the following details:

- Account Holder Name: [Your Full Name]

- Bank Name: [Name of Receiving Bank]

- Account Number: [Receiving Account Number]

- Routing Number (if applicable): [Routing Number]

- Swift Code (for international transfers): [Swift Code]

If there are any forms or documents required from my end to facilitate the closure, please let me know, and I will promptly provide the necessary information. I understand that there may be fees associated with the account closure, and I am prepared to settle any outstanding charges.

I appreciate your prompt attention to this matter. If you require any further information or documentation from me, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. I am grateful for the services I have received from [Bank Name], but circumstances require me to make this decision.

Thank you for your assistance and cooperation in closing my account. I look forward to receiving the confirmation of the account closure at your earliest convenience.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosures: [List any enclosed documents, if applicable]

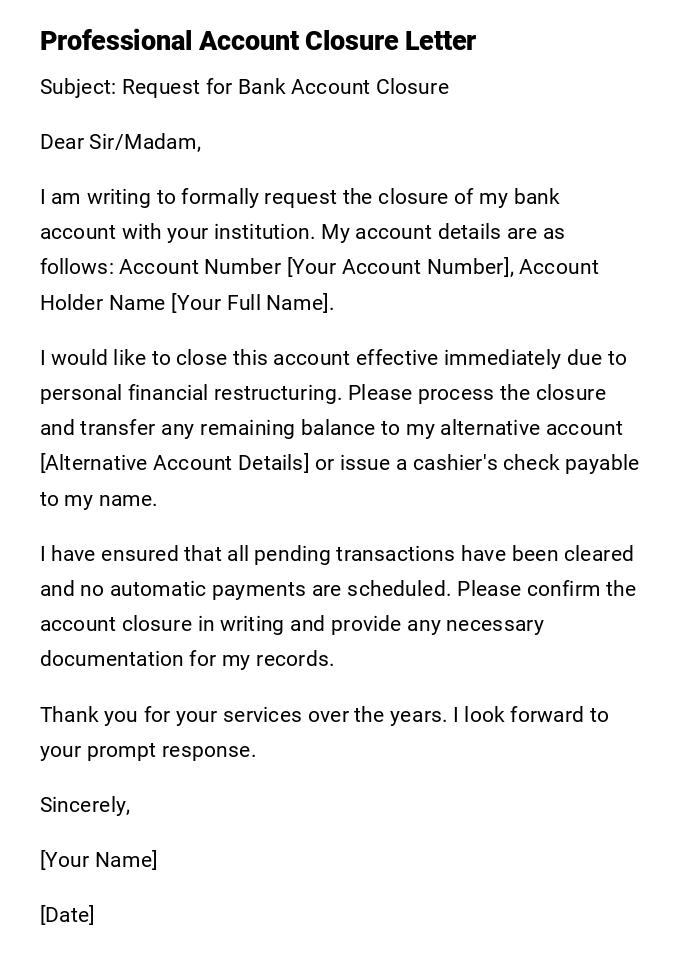

Standard Bank Account Closure Request

Subject: Request for Bank Account Closure

Dear Sir/Madam,

I am writing to formally request the closure of my bank account with your institution. My account details are as follows: Account Number [Your Account Number], Account Holder Name [Your Full Name].

I would like to close this account effective immediately due to personal financial restructuring. Please process the closure and transfer any remaining balance to my alternative account [Alternative Account Details] or issue a cashier's check payable to my name.

I have ensured that all pending transactions have been cleared and no automatic payments are scheduled. Please confirm the account closure in writing and provide any necessary documentation for my records.

Thank you for your services over the years. I look forward to your prompt response.

Sincerely,

[Your Name]

[Date]

Account Closure Due to Relocation

Subject: Bank Account Closure Due to Permanent Relocation

Dear Banking Team,

I hope this message finds you well. I am writing to inform you of my permanent relocation to [City, State/Country] and request the immediate closure of my account [Account Number] with your branch.

Due to the distance and lack of local branches in my new location, maintaining this account is no longer practical. I have already established banking relationships in my new city and need to consolidate my financial accounts.

Please process the account closure and mail the final balance via certified check to my new address: [New Address]. I have attached a copy of my new address proof for verification purposes.

I appreciate the excellent service your team has provided during my time as your customer. Please send confirmation of the closure to my new address.

Best regards,

[Your Name]

[Contact Information]

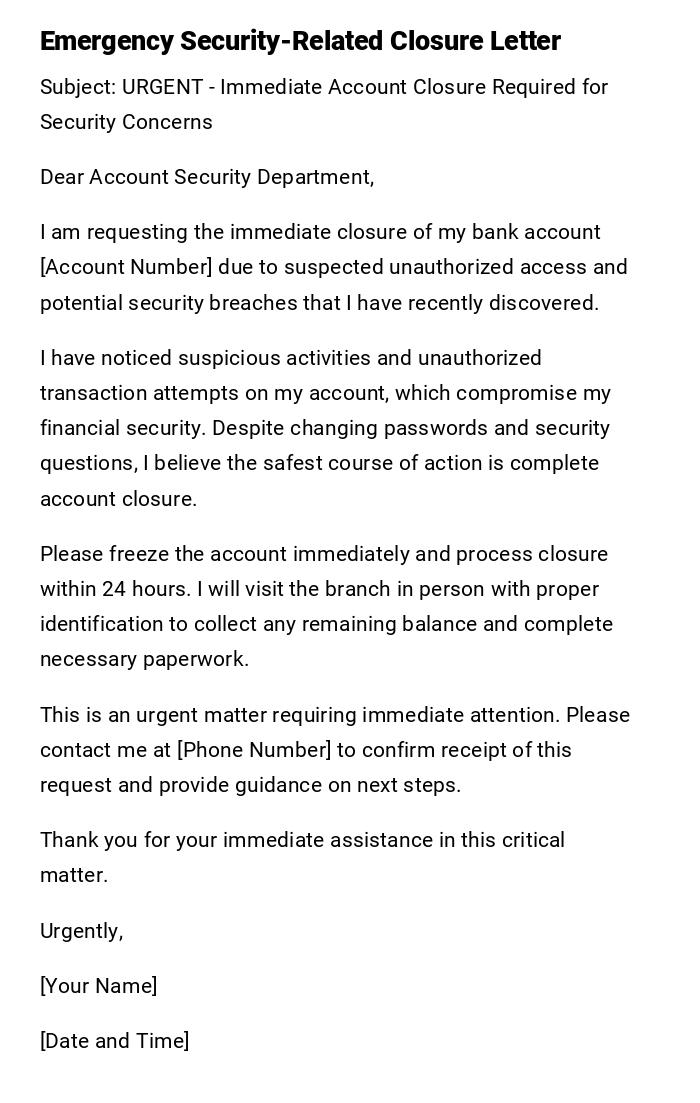

Urgent Account Closure for Security Reasons

Subject: URGENT - Immediate Account Closure Required for Security Concerns

Dear Account Security Department,

I am requesting the immediate closure of my bank account [Account Number] due to suspected unauthorized access and potential security breaches that I have recently discovered.

I have noticed suspicious activities and unauthorized transaction attempts on my account, which compromise my financial security. Despite changing passwords and security questions, I believe the safest course of action is complete account closure.

Please freeze the account immediately and process closure within 24 hours. I will visit the branch in person with proper identification to collect any remaining balance and complete necessary paperwork.

This is an urgent matter requiring immediate attention. Please contact me at [Phone Number] to confirm receipt of this request and provide guidance on next steps.

Thank you for your immediate assistance in this critical matter.

Urgently,

[Your Name]

[Date and Time]

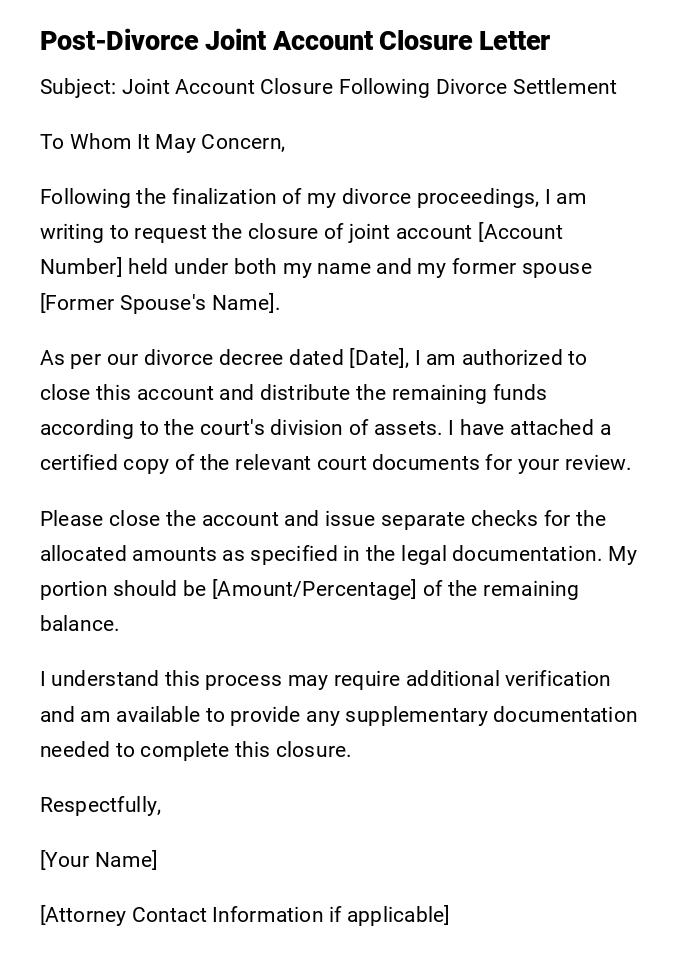

Joint Account Closure After Divorce

Subject: Joint Account Closure Following Divorce Settlement

To Whom It May Concern,

Following the finalization of my divorce proceedings, I am writing to request the closure of joint account [Account Number] held under both my name and my former spouse [Former Spouse's Name].

As per our divorce decree dated [Date], I am authorized to close this account and distribute the remaining funds according to the court's division of assets. I have attached a certified copy of the relevant court documents for your review.

Please close the account and issue separate checks for the allocated amounts as specified in the legal documentation. My portion should be [Amount/Percentage] of the remaining balance.

I understand this process may require additional verification and am available to provide any supplementary documentation needed to complete this closure.

Respectfully,

[Your Name]

[Attorney Contact Information if applicable]

Business Account Closure

Subject: Business Account Closure - [Company Name]

Dear Business Banking Manager,

I am writing on behalf of [Company Name] to formally request the closure of our business account [Account Number] effective [Date].

Our company has decided to consolidate banking services with another institution that better serves our expanded operational needs. This decision follows a comprehensive review of our banking requirements and cost-benefit analysis.

All outstanding checks have been accounted for, and we have redirected all automatic payments and deposits to our new banking partner. Please process the account closure and transfer the remaining balance of [Amount] to our new business account via wire transfer to [New Bank Details].

We appreciate the professional service your institution has provided during our business relationship. Please provide written confirmation of account closure and final statements for our accounting records.

Thank you for facilitating this transition smoothly.

Professionally yours,

[Your Name]

[Title]

[Company Name]

Student Account Closure After Graduation

Subject: Student Account Closure After Graduation

Hi there,

Hope you're doing well! I wanted to reach out about closing my student account now that I've graduated and started my career.

My account number is [Account Number], and I've been really happy with the student benefits over the past few years. However, now that I'm no longer eligible for student status, I'd like to close this account and move to a regular checking account with better features for working professionals.

I've already set up my new account elsewhere, so please go ahead and close this one. There should be about [Amount] left in there - could you please send me a check for the remaining balance?

Thanks for everything! The student account really helped me manage my finances during college.

Cheers,

[Your Name]

[Graduation Date]

Account Closure Due to Poor Service

Subject: Account Closure Due to Unsatisfactory Service Experience

Dear Customer Service Manager,

After careful consideration and multiple attempts to resolve ongoing service issues, I have decided to close my account [Account Number] with your bank.

Over the past [Time Period], I have experienced repeated problems including excessive fees, poor customer service response times, and system outages that have disrupted my banking activities. Despite raising these concerns through your official channels, the issues remain unresolved.

This decision was not made lightly, as I have been a customer for [Duration]. However, the consistent service problems have made it necessary for me to seek banking services elsewhere.

Please process the account closure immediately and provide a final statement. I will collect the remaining balance in person within the next week.

I hope you will take this feedback constructively to improve services for other customers.

Disappointedly,

[Your Name]

[Account Details]

What is a Bank Account Cancellation Letter and Why Do You Need It

A bank account cancellation letter is a formal document requesting the closure of your existing bank account. This letter serves as official notice to your financial institution of your intent to terminate the banking relationship and provides necessary instructions for handling remaining funds. The letter creates a paper trail for legal and financial record-keeping, protects you from future liability, and ensures proper closure procedures are followed according to banking regulations.

Who Should Send Bank Account Cancellation Letters

- Individual account holders who wish to close personal checking or savings accounts

- Business owners closing company accounts due to restructuring or dissolution

- Joint account holders following life changes like divorce or separation

- Students transitioning from student accounts after graduation

- Estate executors closing accounts of deceased individuals

- Legal guardians managing accounts for minors or dependents

- Corporate representatives closing dormant or unused business accounts

- Account holders experiencing security breaches or identity theft

Who Should Receive Your Account Cancellation Request

- Branch manager or customer service manager at your local branch

- Business banking department for commercial accounts

- Account services department for online-only banks

- Relationship manager if you have premium banking status

- Estate services department for inheritance-related closures

- Joint account co-holders who must be notified of closure

- Legal department if there are disputes or complications

- Security department if closure is due to fraud concerns

When Should You Send an Account Cancellation Letter

- When relocating to areas without branch access

- After finding better banking options with lower fees or better services

- Following major life changes like marriage, divorce, or retirement

- When consolidating multiple accounts for simplified financial management

- After experiencing repeated poor customer service or service issues

- Due to security concerns or suspected account compromise

- Upon business closure, merger, or significant operational changes

- When switching to digital-only banking solutions

- After inheriting accounts that need to be settled

- Before extended travel or permanent relocation abroad

How to Write and Send Your Bank Account Cancellation Letter

Start by gathering all account information including account numbers, current balance, and recent statements. Draft your letter using a professional tone, clearly stating your request for account closure and providing specific account details. Include instructions for remaining balance disposal, whether by check, transfer, or cash pickup. Review the letter for accuracy and completeness before sending via certified mail or delivering in person. Keep copies of all correspondence for your records and follow up if you don't receive confirmation within a reasonable timeframe.

Requirements and Prerequisites Before Sending Your Letter

- Ensure all pending transactions have cleared and been processed

- Cancel all automatic payments, direct deposits, and scheduled transfers

- Update payment information with employers, utility companies, and service providers

- Withdraw or transfer funds leaving only minimum required balance

- Obtain recent account statements for final verification

- Gather identification documents and account-related paperwork

- Check for any outstanding fees, penalties, or account obligations

- Verify there are no liens, holds, or legal restrictions on the account

- Confirm account ownership and authorization for joint or business accounts

Formatting Guidelines for Bank Account Cancellation Letters

Letters should be between 200-400 words to ensure completeness without unnecessary length. Use formal business letter format for professional communications and slightly casual tone for student or simple closures. Include clear subject line, proper greeting, and professional closing signature. Specify exact account numbers, dates, and financial amounts without ambiguity. Maintain respectful tone even when expressing dissatisfaction with services. Use certified mail for important closures and keep delivery confirmations. Include contact information for follow-up communications and attach necessary supporting documentation.

What to Do After Sending Your Cancellation Letter

Follow up within 5-7 business days if you haven't received acknowledgment of your request. Visit the branch in person if you need to collect remaining balance or sign additional paperwork. Monitor the account for any unexpected activity or fees after closure confirmation. Update your financial records and notify relevant parties of account closure. Securely dispose of checks, debit cards, and account-related materials. Obtain written confirmation of account closure for tax and legal records. Review final statements for accuracy and address any discrepancies immediately. Keep closure documentation for at least seven years for potential future reference.

Advantages and Disadvantages of Closing Bank Accounts

Pros: Eliminates monthly fees and maintenance charges, reduces financial complexity and account management burden, prevents potential fraud on unused accounts, and allows switching to better banking options. Closure can improve financial organization and reduce paperwork.

Disadvantages: May affect credit history if account had overdraft protection, loss of established banking relationship and customer status, potential fees for early closure of certain account types, and inconvenience of updating all linked financial services and automatic payments.

Common Mistakes to Avoid When Closing Bank Accounts

- Failing to cancel automatic payments before closure, resulting in declined transactions and fees

- Not waiting for pending transactions to clear, causing complications and delays

- Forgetting to update employer direct deposit information, leading to payment issues

- Withdrawing funds too early, triggering account closure fees or penalties

- Not keeping copies of closure documentation for future reference

- Assuming verbal requests are sufficient without written confirmation

- Ignoring final statements or closure confirmations from the bank

- Failing to notify joint account holders or authorized users of closure plans

- Not researching early closure penalties or minimum balance requirements

Essential Elements Your Cancellation Letter Must Include

Your letter must contain clear identification including full name, account numbers, and contact information. Include specific closure request with effective date and instructions for remaining balance distribution. Provide reason for closure if required by bank policy or if seeking fee waivers. Request written confirmation of account closure and final statement. Include signature and date for authenticity. Attach supporting documentation like identification copies, legal documents for joint accounts, or business dissolution papers when applicable. Specify preferred method of final communication and balance distribution.

Download Word Doc

Download Word Doc

Download PDF

Download PDF