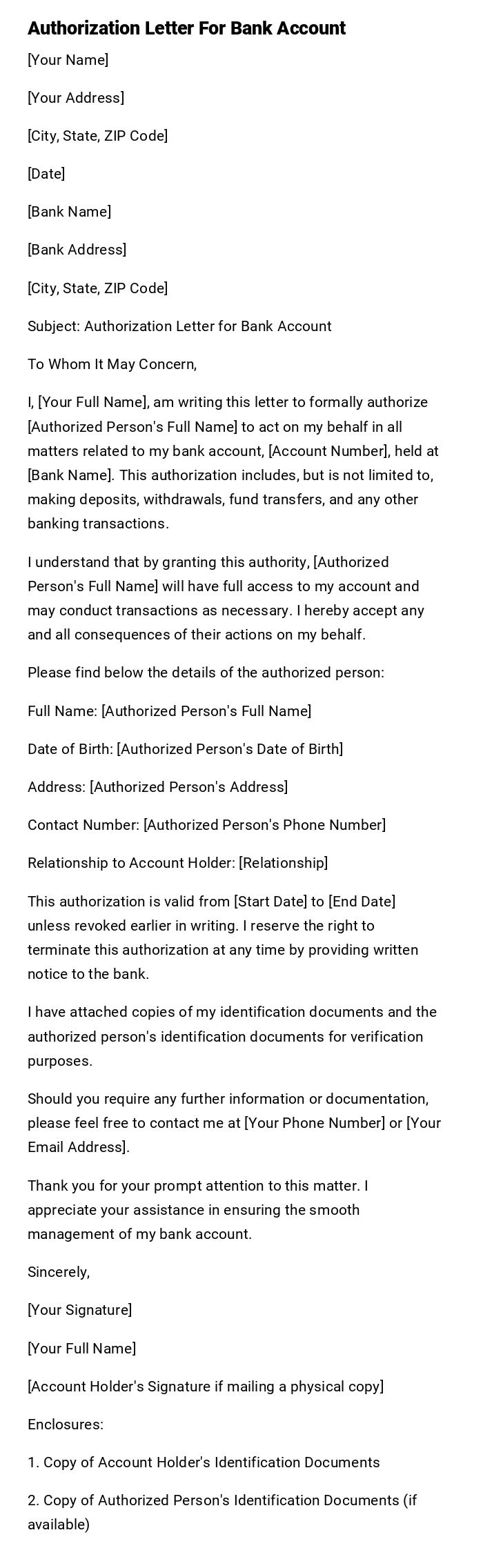

Authorization Letter For Bank Account

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Authorization Letter for Bank Account

To Whom It May Concern,

I, [Your Full Name], am writing this letter to formally authorize [Authorized Person's Full Name] to act on my behalf in all matters related to my bank account, [Account Number], held at [Bank Name]. This authorization includes, but is not limited to, making deposits, withdrawals, fund transfers, and any other banking transactions.

I understand that by granting this authority, [Authorized Person's Full Name] will have full access to my account and may conduct transactions as necessary. I hereby accept any and all consequences of their actions on my behalf.

Please find below the details of the authorized person:

Full Name: [Authorized Person's Full Name]

Date of Birth: [Authorized Person's Date of Birth]

Address: [Authorized Person's Address]

Contact Number: [Authorized Person's Phone Number]

Relationship to Account Holder: [Relationship]

This authorization is valid from [Start Date] to [End Date] unless revoked earlier in writing. I reserve the right to terminate this authorization at any time by providing written notice to the bank.

I have attached copies of my identification documents and the authorized person's identification documents for verification purposes.

Should you require any further information or documentation, please feel free to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your prompt attention to this matter. I appreciate your assistance in ensuring the smooth management of my bank account.

Sincerely,

[Your Signature]

[Your Full Name]

[Account Holder's Signature if mailing a physical copy]

Enclosures:

1. Copy of Account Holder's Identification Documents

2. Copy of Authorized Person's Identification Documents (if available)

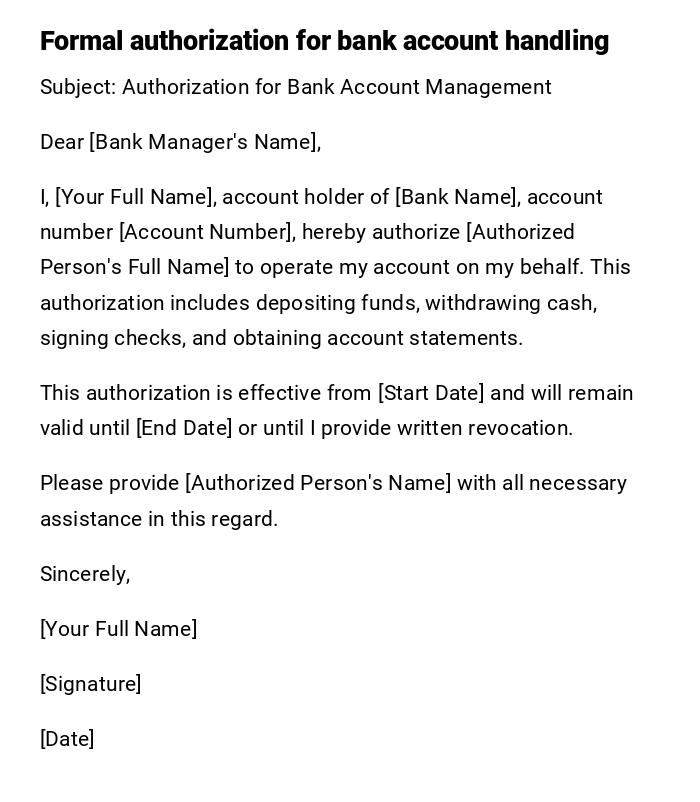

Formal Authorization Letter for Bank Account Management

Subject: Authorization for Bank Account Management

Dear [Bank Manager's Name],

I, [Your Full Name], account holder of [Bank Name], account number [Account Number], hereby authorize [Authorized Person's Full Name] to operate my account on my behalf. This authorization includes depositing funds, withdrawing cash, signing checks, and obtaining account statements.

This authorization is effective from [Start Date] and will remain valid until [End Date] or until I provide written revocation.

Please provide [Authorized Person's Name] with all necessary assistance in this regard.

Sincerely,

[Your Full Name]

[Signature]

[Date]

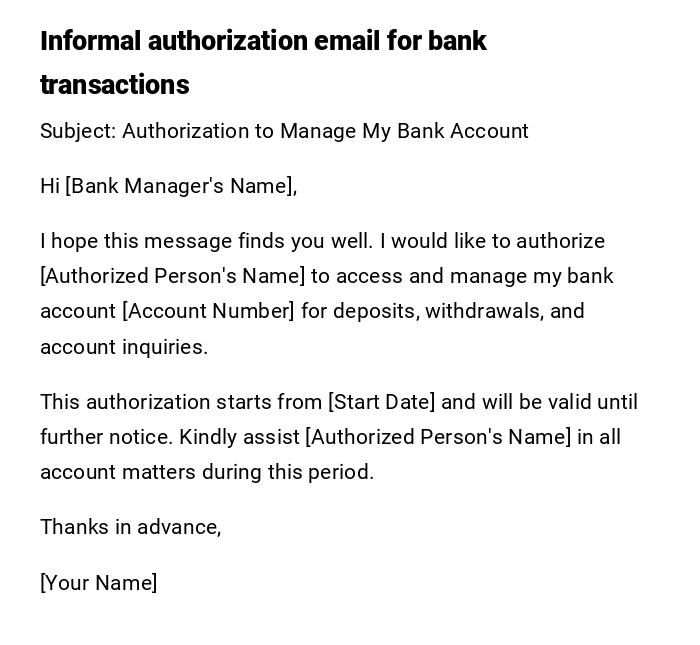

Casual Email Authorization for Bank Transactions

Subject: Authorization to Manage My Bank Account

Hi [Bank Manager's Name],

I hope this message finds you well. I would like to authorize [Authorized Person's Name] to access and manage my bank account [Account Number] for deposits, withdrawals, and account inquiries.

This authorization starts from [Start Date] and will be valid until further notice. Kindly assist [Authorized Person's Name] in all account matters during this period.

Thanks in advance,

[Your Name]

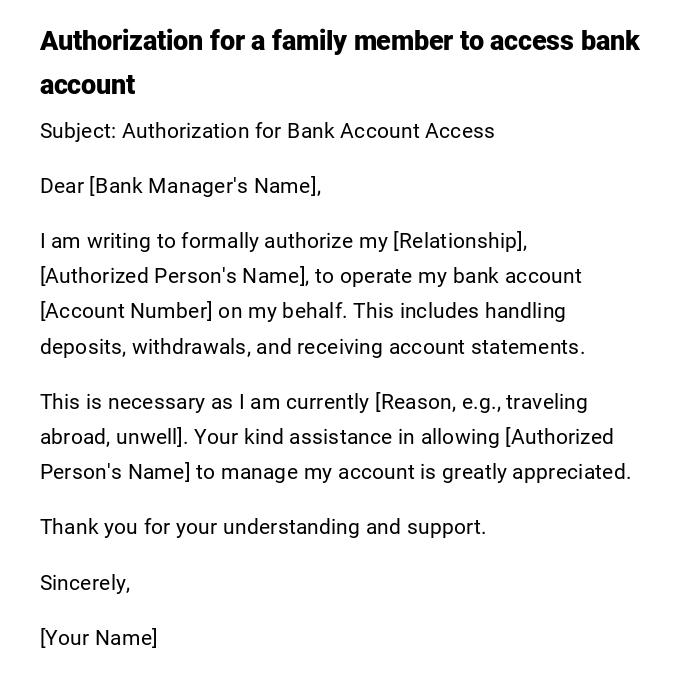

Heartfelt Authorization Letter for a Family Member

Subject: Authorization for Bank Account Access

Dear [Bank Manager's Name],

I am writing to formally authorize my [Relationship], [Authorized Person's Name], to operate my bank account [Account Number] on my behalf. This includes handling deposits, withdrawals, and receiving account statements.

This is necessary as I am currently [Reason, e.g., traveling abroad, unwell]. Your kind assistance in allowing [Authorized Person's Name] to manage my account is greatly appreciated.

Thank you for your understanding and support.

Sincerely,

[Your Name]

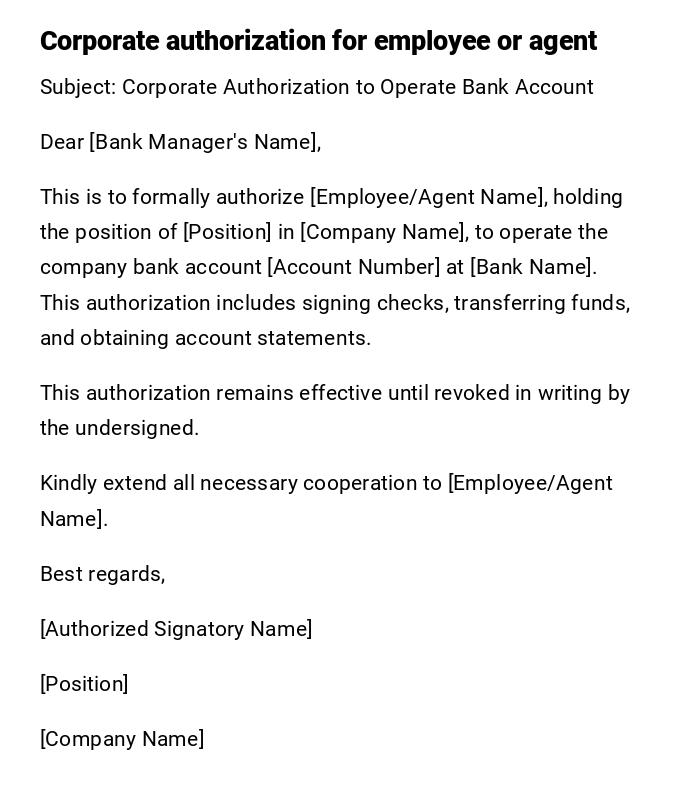

Professional Corporate Authorization Letter

Subject: Corporate Authorization to Operate Bank Account

Dear [Bank Manager's Name],

This is to formally authorize [Employee/Agent Name], holding the position of [Position] in [Company Name], to operate the company bank account [Account Number] at [Bank Name]. This authorization includes signing checks, transferring funds, and obtaining account statements.

This authorization remains effective until revoked in writing by the undersigned.

Kindly extend all necessary cooperation to [Employee/Agent Name].

Best regards,

[Authorized Signatory Name]

[Position]

[Company Name]

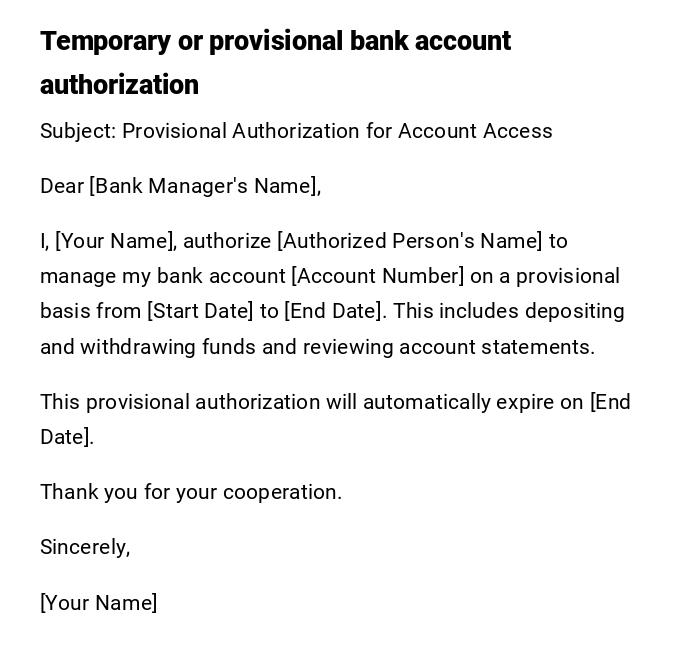

Provisional Authorization Letter

Subject: Provisional Authorization for Account Access

Dear [Bank Manager's Name],

I, [Your Name], authorize [Authorized Person's Name] to manage my bank account [Account Number] on a provisional basis from [Start Date] to [End Date]. This includes depositing and withdrawing funds and reviewing account statements.

This provisional authorization will automatically expire on [End Date].

Thank you for your cooperation.

Sincerely,

[Your Name]

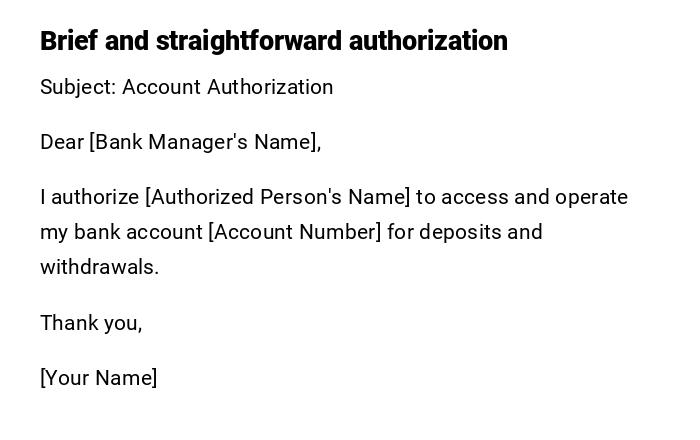

Simple and Quick Authorization Note

Subject: Account Authorization

Dear [Bank Manager's Name],

I authorize [Authorized Person's Name] to access and operate my bank account [Account Number] for deposits and withdrawals.

Thank you,

[Your Name]

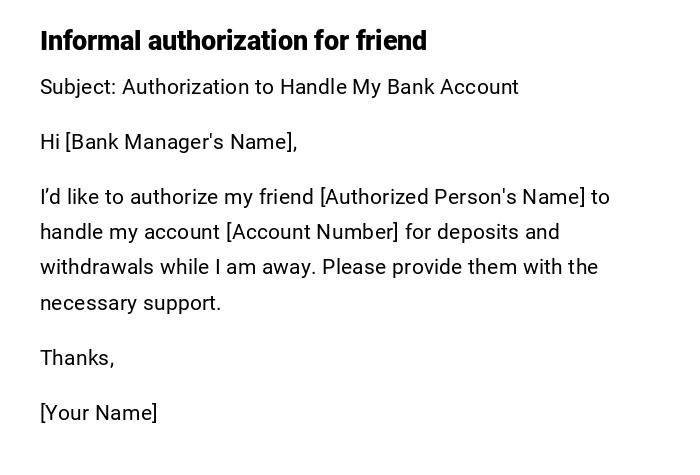

Informal Authorization Email for a Trusted Friend

Subject: Authorization to Handle My Bank Account

Hi [Bank Manager's Name],

I’d like to authorize my friend [Authorized Person's Name] to handle my account [Account Number] for deposits and withdrawals while I am away. Please provide them with the necessary support.

Thanks,

[Your Name]

Official Authorization Letter for Bank Account Transactions

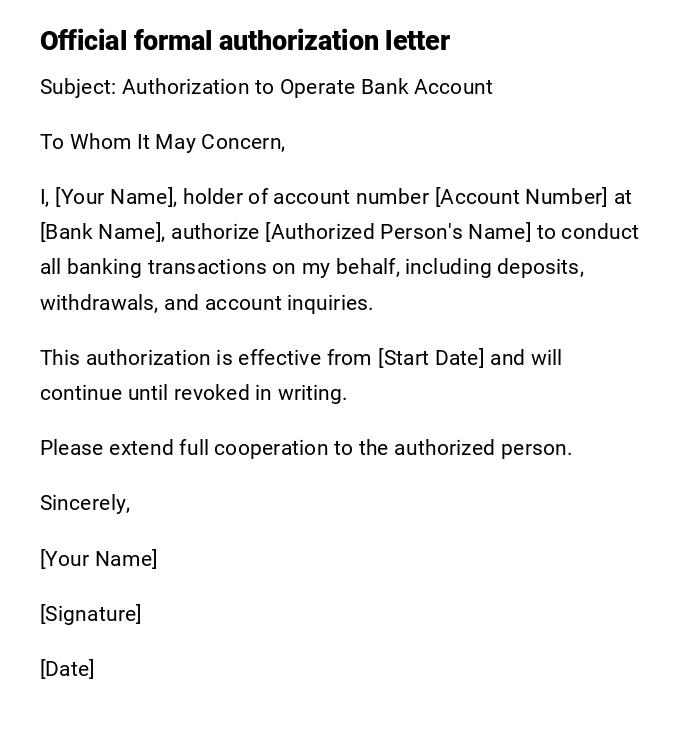

Subject: Authorization to Operate Bank Account

To Whom It May Concern,

I, [Your Name], holder of account number [Account Number] at [Bank Name], authorize [Authorized Person's Name] to conduct all banking transactions on my behalf, including deposits, withdrawals, and account inquiries.

This authorization is effective from [Start Date] and will continue until revoked in writing.

Please extend full cooperation to the authorized person.

Sincerely,

[Your Name]

[Signature]

[Date]

What is an Authorization Letter for Bank Account and Why Do You Need It?

An authorization letter for a bank account is a written document permitting another individual to perform banking transactions on behalf of the account holder.

Purpose:

- Enables others to access and manage the account legally.

- Ensures smooth operation during travel, illness, or unavailability.

- Serves as proof for the bank to recognize authorized personnel.

Who Should Send an Authorization Letter for Bank Account?

- Account holders who cannot personally operate their bank account.

- Business owners authorizing employees or agents.

- Family members needing temporary assistance managing funds.

- Authorized representatives like lawyers or caretakers with the account holder’s consent.

Whom Should the Authorization Letter Be Addressed To?

- Bank manager or branch in charge.

- Customer service officer in case of larger banks.

- Account department for corporate accounts.

- Optionally, copy may be provided to authorized person for reference.

When Do You Need an Authorization Letter for Bank Account?

- When traveling or living abroad temporarily.

- During illness or incapacity preventing account access.

- For corporate accounts when employees need transaction authority.

- When delegating banking tasks to a family member or trusted individual.

- For temporary purposes, like one-time deposits or withdrawals.

How to Write and Send an Authorization Letter

- Begin with a clear subject stating purpose.

- Address the bank authority respectfully.

- Mention account holder’s details and account number.

- Name the authorized person and specify allowed transactions.

- Include duration of authorization (if temporary).

- Sign the letter and include date.

- Deliver via email, in-person, or postal service, depending on bank requirements.

Requirements and Prerequisites Before Sending

- Verify the authorized person’s identity.

- Have account details ready (number, type, branch).

- Confirm the bank’s specific authorization policies.

- Specify the scope of authority clearly (full access, limited transactions, etc.).

- Determine whether a notarized or attested letter is required.

Formatting, Tone, and Style Guidelines

- Length: 1–2 pages maximum.

- Tone: Formal and professional for banks.

- Wording: Clear, concise, and legally sound.

- Style: Structured with subject, introduction, body, closing.

- Mode of sending: In-person submission preferred; email acceptable if allowed.

- Etiquette: Polite, respectful, and precise.

After Sending the Authorization Letter: Next Steps

- Follow up with the bank to confirm acceptance.

- Provide the authorized person with a copy of the letter.

- Ensure the authorized person carries valid identification when conducting transactions.

- Keep a personal copy for records.

- Revoke the authorization in writing once it is no longer needed.

Pros and Cons of Sending a Bank Account Authorization Letter

Pros:

- Enables continuity of banking operations.

- Provides legal proof of delegated authority.

- Reduces inconvenience during absence or incapacity.

Cons:

- Risk if the authorized person is untrustworthy.

- Requires careful drafting to avoid ambiguity.

- Some banks may require notarization or additional verification.

Common Mistakes to Avoid

- Not specifying the account number or holder details.

- Ambiguous scope of authority.

- Omitting dates for temporary authorization.

- Failing to verify authorized person’s identity.

- Not keeping a copy for personal records.

Elements and Structure of an Authorization Letter for Bank Account

- Subject: Clear purpose of the letter.

- Introduction: Account holder details.

- Authorized Person Details: Name, ID, relationship (if applicable).

- Scope of Authority: Specific transactions permitted.

- Duration: Start and end date, if temporary.

- Closing: Request for assistance, thank the bank.

- Signature and Date: Mandatory for validity.

- Attachments: Copy of ID or authorization documents if required.

FAQ About Authorization Letters for Bank Accounts

Q: Can anyone operate my bank account without a letter?

A: No, banks require formal authorization to allow another person access.

Q: Is notarization required?

A: Some banks require notarized letters; check the specific bank policy.

Q: Can I authorize multiple people?

A: Yes, specify each individual and their scope of authority.

Q: Can the authorization be revoked?

A: Yes, it can be revoked anytime with a written notice to the bank.

Q: Can this letter be sent via email?

A: If the bank permits digital submissions, email is acceptable; otherwise, in-person submission is preferred.

Tricks and Tips for Effective Authorization Letters

- Always be specific about what the authorized person can do.

- Include start and end dates for clarity.

- Attach a copy of the authorized person’s identification.

- Use formal language and correct legal terminology.

- Keep copies of all correspondence for your records.

Download Word Doc

Download Word Doc

Download PDF

Download PDF