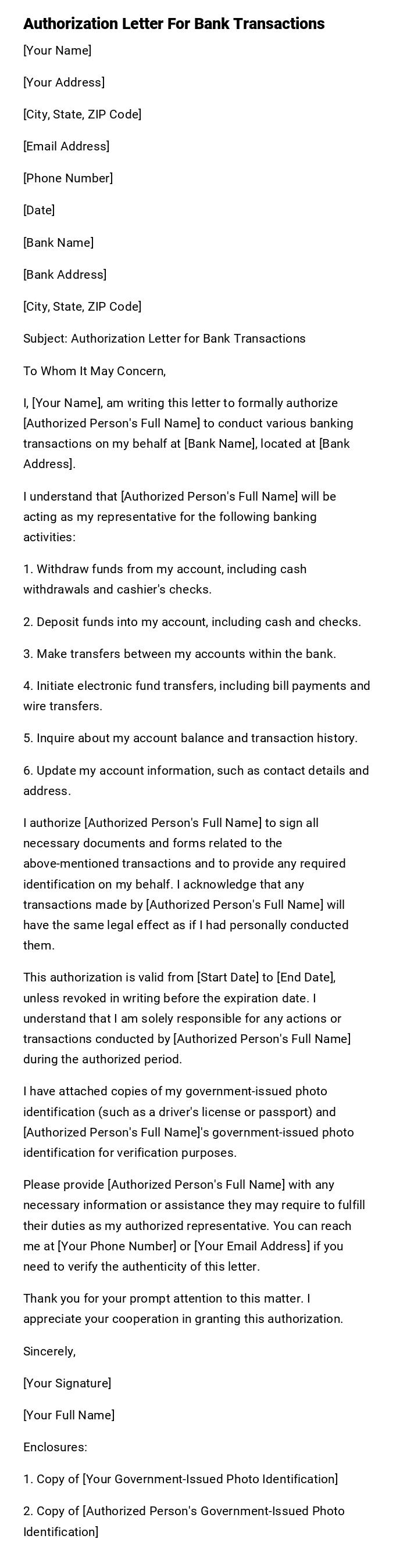

Authorization Letter For Bank Transactions

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Authorization Letter for Bank Transactions

To Whom It May Concern,

I, [Your Name], am writing this letter to formally authorize [Authorized Person's Full Name] to conduct various banking transactions on my behalf at [Bank Name], located at [Bank Address].

I understand that [Authorized Person's Full Name] will be acting as my representative for the following banking activities:

1. Withdraw funds from my account, including cash withdrawals and cashier's checks.

2. Deposit funds into my account, including cash and checks.

3. Make transfers between my accounts within the bank.

4. Initiate electronic fund transfers, including bill payments and wire transfers.

5. Inquire about my account balance and transaction history.

6. Update my account information, such as contact details and address.

I authorize [Authorized Person's Full Name] to sign all necessary documents and forms related to the above-mentioned transactions and to provide any required identification on my behalf. I acknowledge that any transactions made by [Authorized Person's Full Name] will have the same legal effect as if I had personally conducted them.

This authorization is valid from [Start Date] to [End Date], unless revoked in writing before the expiration date. I understand that I am solely responsible for any actions or transactions conducted by [Authorized Person's Full Name] during the authorized period.

I have attached copies of my government-issued photo identification (such as a driver's license or passport) and [Authorized Person's Full Name]'s government-issued photo identification for verification purposes.

Please provide [Authorized Person's Full Name] with any necessary information or assistance they may require to fulfill their duties as my authorized representative. You can reach me at [Your Phone Number] or [Your Email Address] if you need to verify the authenticity of this letter.

Thank you for your prompt attention to this matter. I appreciate your cooperation in granting this authorization.

Sincerely,

[Your Signature]

[Your Full Name]

Enclosures:

1. Copy of [Your Government-Issued Photo Identification]

2. Copy of [Authorized Person's Government-Issued Photo Identification]

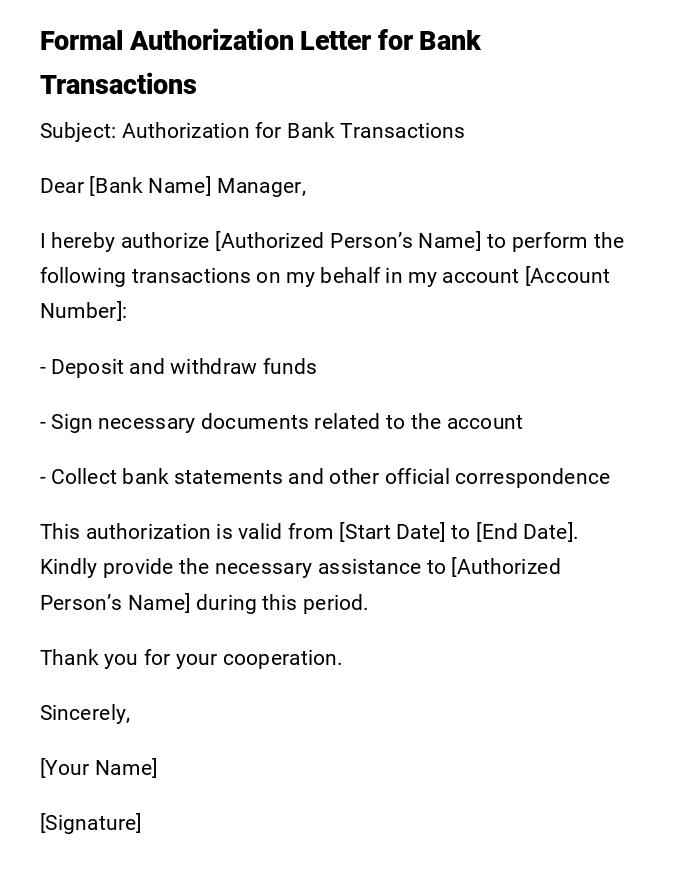

Formal Authorization Letter for Bank Transactions

Subject: Authorization for Bank Transactions

Dear [Bank Name] Manager,

I hereby authorize [Authorized Person’s Name] to perform the following transactions on my behalf in my account [Account Number]:

- Deposit and withdraw funds

- Sign necessary documents related to the account

- Collect bank statements and other official correspondence

This authorization is valid from [Start Date] to [End Date]. Kindly provide the necessary assistance to [Authorized Person’s Name] during this period.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Signature]

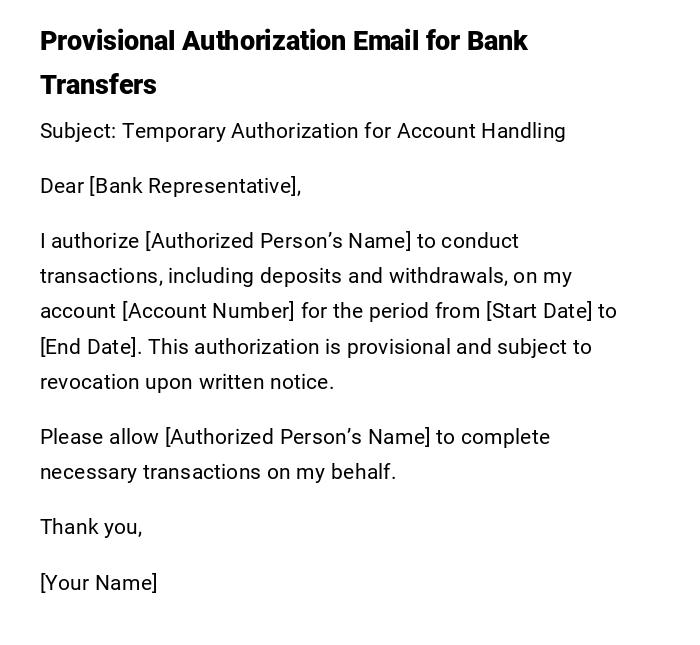

Provisional Authorization Email for Bank Transfers

Subject: Temporary Authorization for Account Handling

Dear [Bank Representative],

I authorize [Authorized Person’s Name] to conduct transactions, including deposits and withdrawals, on my account [Account Number] for the period from [Start Date] to [End Date]. This authorization is provisional and subject to revocation upon written notice.

Please allow [Authorized Person’s Name] to complete necessary transactions on my behalf.

Thank you,

[Your Name]

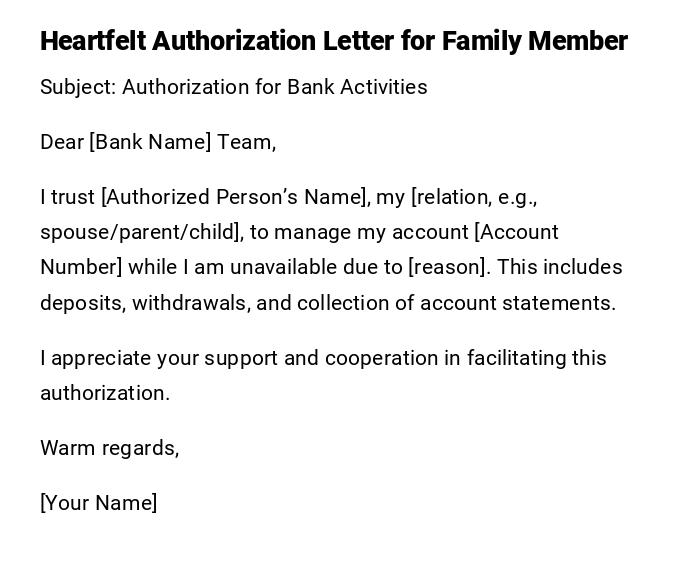

Heartfelt Authorization Letter for Family Member

Subject: Authorization for Bank Activities

Dear [Bank Name] Team,

I trust [Authorized Person’s Name], my [relation, e.g., spouse/parent/child], to manage my account [Account Number] while I am unavailable due to [reason]. This includes deposits, withdrawals, and collection of account statements.

I appreciate your support and cooperation in facilitating this authorization.

Warm regards,

[Your Name]

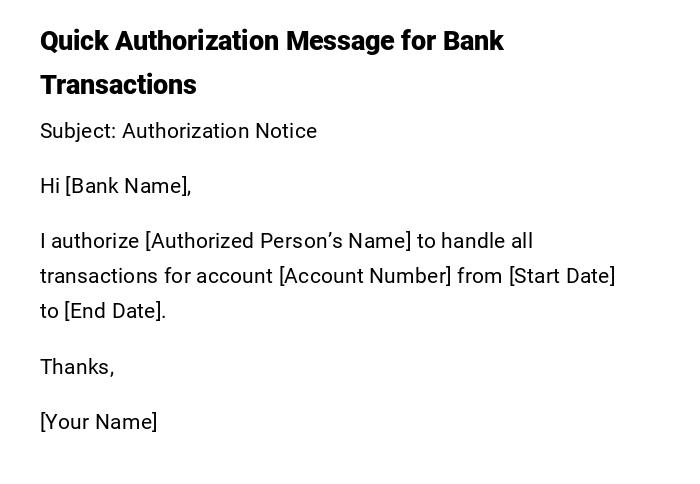

Quick Authorization Message for Bank Transactions

Subject: Authorization Notice

Hi [Bank Name],

I authorize [Authorized Person’s Name] to handle all transactions for account [Account Number] from [Start Date] to [End Date].

Thanks,

[Your Name]

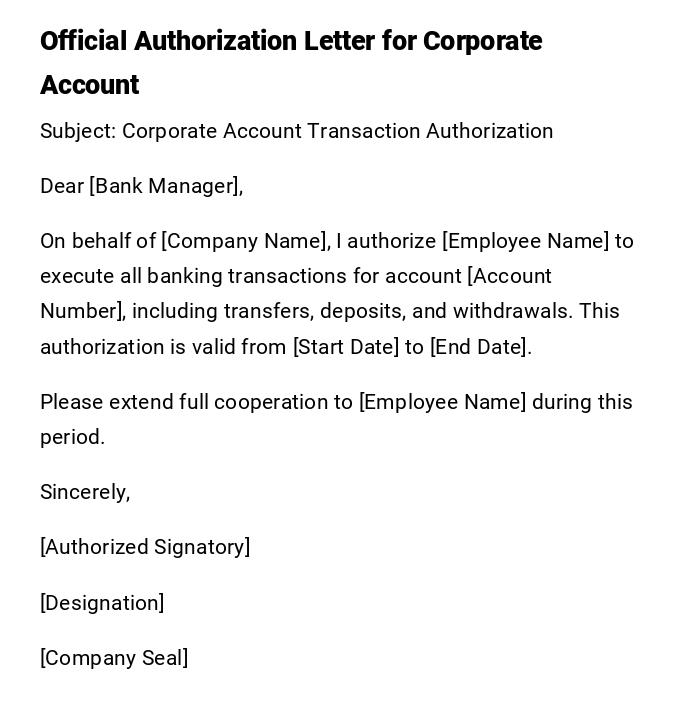

Official Authorization Letter for Corporate Account

Subject: Corporate Account Transaction Authorization

Dear [Bank Manager],

On behalf of [Company Name], I authorize [Employee Name] to execute all banking transactions for account [Account Number], including transfers, deposits, and withdrawals. This authorization is valid from [Start Date] to [End Date].

Please extend full cooperation to [Employee Name] during this period.

Sincerely,

[Authorized Signatory]

[Designation]

[Company Seal]

What is an Authorization Letter for Bank Transactions and Why It’s Important

An Authorization Letter for Bank Transactions is a formal document that allows a third party to perform banking activities on behalf of the account holder.

Its purposes include:

- Enabling transactions when the account holder is unavailable

- Providing legal clarity for the bank

- Ensuring smooth handling of funds and account management

- Reducing administrative delays for personal or corporate banking

Who Should Send an Authorization Letter for Bank Transactions

- Individual account holders granting temporary access to a trusted person

- Company executives or authorized personnel delegating authority to employees

- Guardians or legal representatives acting on behalf of minors or incapacitated clients

Whom Should the Letter Be Addressed To

- Bank managers or branch heads

- Bank customer service representatives handling account operations

- For corporate accounts, include the finance department for record-keeping

When to Use an Authorization Letter for Bank Transactions

- Temporary absence due to travel, illness, or personal commitments

- Corporate delegation to employees for account management

- Situations requiring urgent fund transfers or collection of statements

- Legal or estate matters where a representative is needed

How to Write and Send an Authorization Letter

- Choose a formal or casual tone depending on recipient and context.

- Clearly state the account number and the authorized person’s details.

- Specify the permitted transactions (withdrawals, deposits, statement collection, etc.).

- Mention the validity period of the authorization.

- Sign the letter and, if required, include identification or company seal.

- Send via email for quick processing or as a printed letter for formal verification.

Requirements and Prerequisites Before Sending

- Confirm the authorized person’s identity and credentials

- Have accurate account information ready

- Understand the bank’s policies regarding authorization

- Determine the duration and scope of the authorization

- Include any supporting documents required by the bank (e.g., ID copies, company seal)

Formatting Guidelines for the Letter

- Length: 150–250 words for detailed coverage

- Tone: Formal for corporate and official use, casual or heartfelt for family members

- Wording: Clear, concise, and legally unambiguous

- Mode: Printed letter with signature or email with scanned signature

- Attachments: Copies of IDs, corporate seal, or legal documentation if needed

After Sending the Authorization Letter

- Confirm receipt with the bank to ensure proper processing

- Verify that the authorized person can access the account without issues

- Maintain a copy of the letter and any attached documents for records

- Revoke or update authorization as required

Common Mistakes to Avoid

- Not specifying transaction limits or permissions

- Missing validity dates for authorization

- Omitting identification details of the authorized person

- Using ambiguous language that could cause disputes

- Failing to provide copies of necessary legal documents

Key Elements and Structure of an Authorization Letter

- Subject or Title

- Greeting

- Name and details of account holder

- Name and details of authorized person

- Scope of authorization (specific transactions)

- Validity period

- Signature of account holder

- Optional: Attachments (ID, company seal, legal documents)

Tricks and Tips for Effective Authorization Letters

- Use bullet points to clearly list authorized transactions

- Keep a consistent formal tone for banks to avoid confusion

- Send a scanned copy in advance to speed up bank approval

- Limit authorization duration to prevent misuse

- Always retain a copy for future reference

Does an Authorization Letter Require Attestation or Authorization?

- For corporate accounts, a company seal and authorized signatory validation may be required

- Some banks may ask for notarization to prevent fraud

- Individual letters usually require signature and ID proof

- Always check the bank’s policy to ensure compliance

Download Word Doc

Download Word Doc

Download PDF

Download PDF