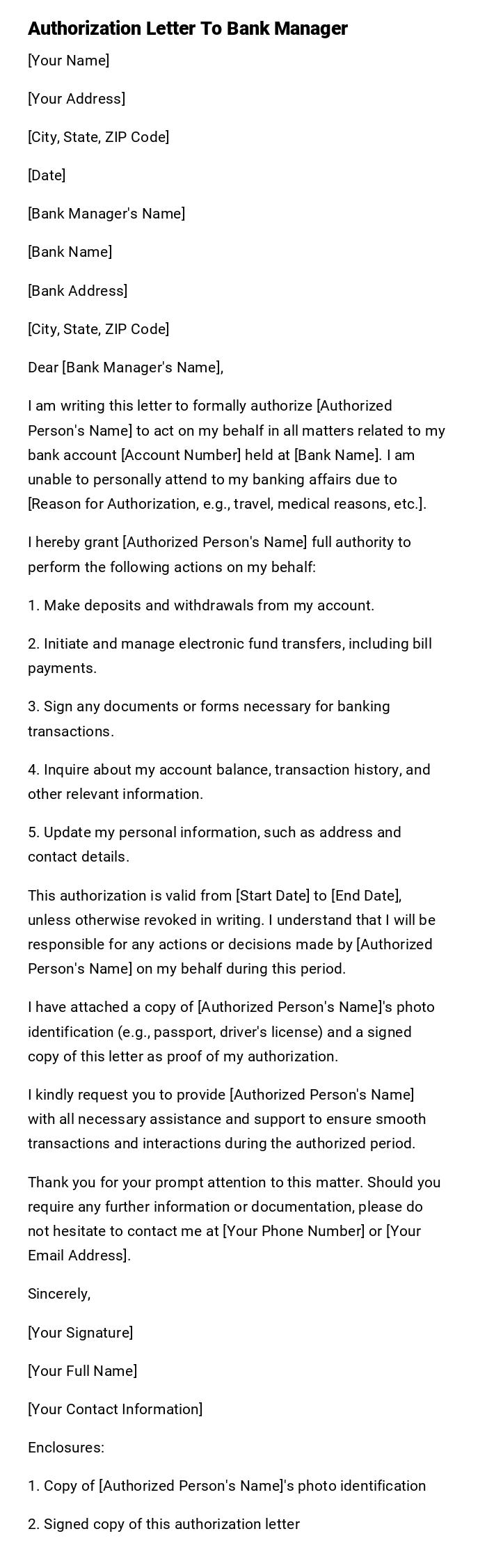

Authorization Letter To Bank Manager

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Bank Manager's Name]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Dear [Bank Manager's Name],

I am writing this letter to formally authorize [Authorized Person's Name] to act on my behalf in all matters related to my bank account [Account Number] held at [Bank Name]. I am unable to personally attend to my banking affairs due to [Reason for Authorization, e.g., travel, medical reasons, etc.].

I hereby grant [Authorized Person's Name] full authority to perform the following actions on my behalf:

1. Make deposits and withdrawals from my account.

2. Initiate and manage electronic fund transfers, including bill payments.

3. Sign any documents or forms necessary for banking transactions.

4. Inquire about my account balance, transaction history, and other relevant information.

5. Update my personal information, such as address and contact details.

This authorization is valid from [Start Date] to [End Date], unless otherwise revoked in writing. I understand that I will be responsible for any actions or decisions made by [Authorized Person's Name] on my behalf during this period.

I have attached a copy of [Authorized Person's Name]'s photo identification (e.g., passport, driver's license) and a signed copy of this letter as proof of my authorization.

I kindly request you to provide [Authorized Person's Name] with all necessary assistance and support to ensure smooth transactions and interactions during the authorized period.

Thank you for your prompt attention to this matter. Should you require any further information or documentation, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Signature]

[Your Full Name]

[Your Contact Information]

Enclosures:

1. Copy of [Authorized Person's Name]'s photo identification

2. Signed copy of this authorization letter

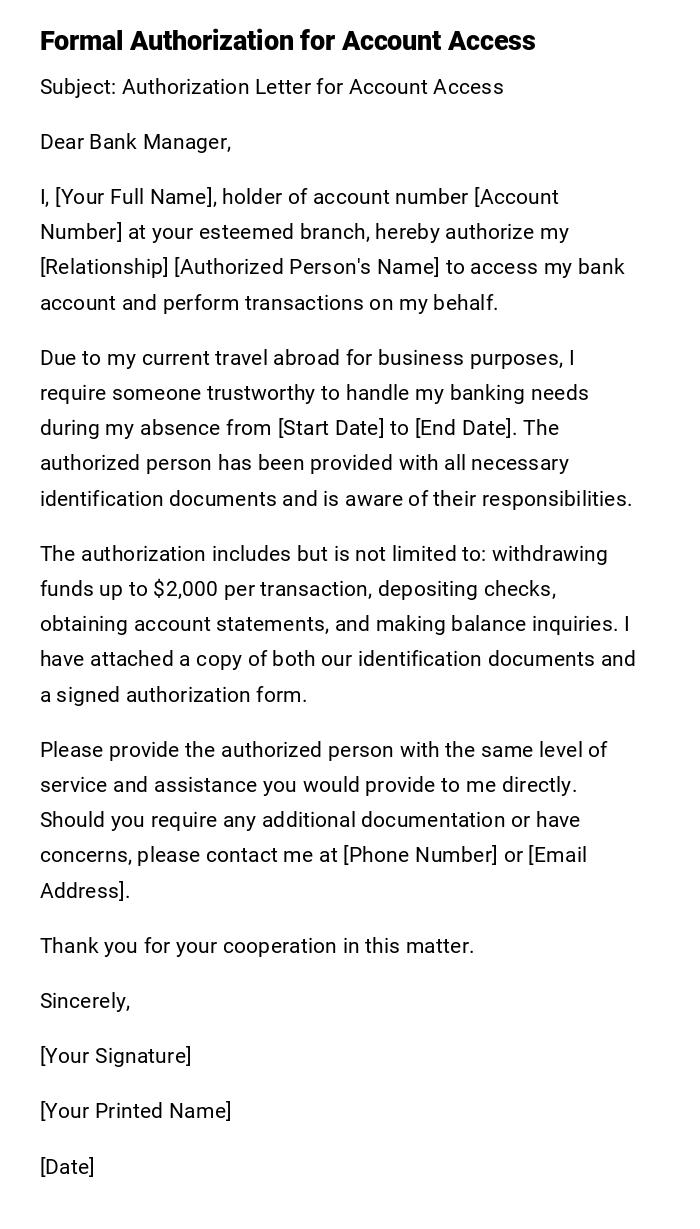

Account Access Authorization for Family Member

Subject: Authorization Letter for Account Access

Dear Bank Manager,

I, [Your Full Name], holder of account number [Account Number] at your esteemed branch, hereby authorize my [Relationship] [Authorized Person's Name] to access my bank account and perform transactions on my behalf.

Due to my current travel abroad for business purposes, I require someone trustworthy to handle my banking needs during my absence from [Start Date] to [End Date]. The authorized person has been provided with all necessary identification documents and is aware of their responsibilities.

The authorization includes but is not limited to: withdrawing funds up to $2,000 per transaction, depositing checks, obtaining account statements, and making balance inquiries. I have attached a copy of both our identification documents and a signed authorization form.

Please provide the authorized person with the same level of service and assistance you would provide to me directly. Should you require any additional documentation or have concerns, please contact me at [Phone Number] or [Email Address].

Thank you for your cooperation in this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

[Date]

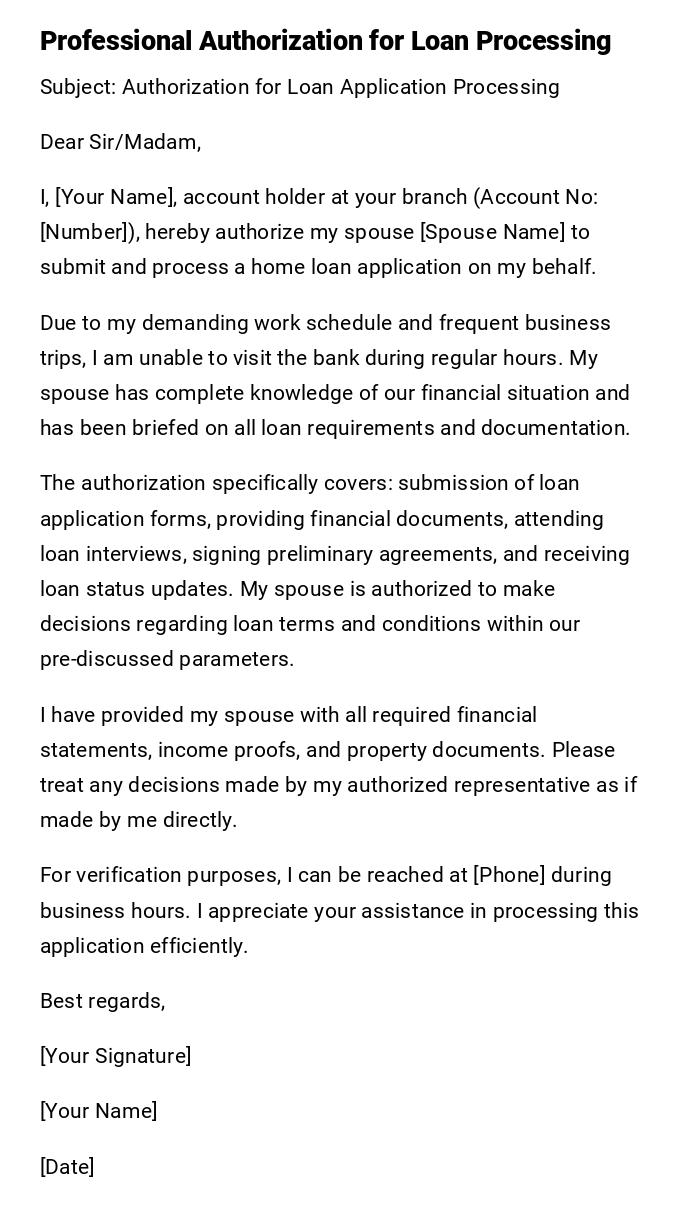

Loan Application Authorization for Spouse

Subject: Authorization for Loan Application Processing

Dear Sir/Madam,

I, [Your Name], account holder at your branch (Account No: [Number]), hereby authorize my spouse [Spouse Name] to submit and process a home loan application on my behalf.

Due to my demanding work schedule and frequent business trips, I am unable to visit the bank during regular hours. My spouse has complete knowledge of our financial situation and has been briefed on all loan requirements and documentation.

The authorization specifically covers: submission of loan application forms, providing financial documents, attending loan interviews, signing preliminary agreements, and receiving loan status updates. My spouse is authorized to make decisions regarding loan terms and conditions within our pre-discussed parameters.

I have provided my spouse with all required financial statements, income proofs, and property documents. Please treat any decisions made by my authorized representative as if made by me directly.

For verification purposes, I can be reached at [Phone] during business hours. I appreciate your assistance in processing this application efficiently.

Best regards,

[Your Signature]

[Your Name]

[Date]

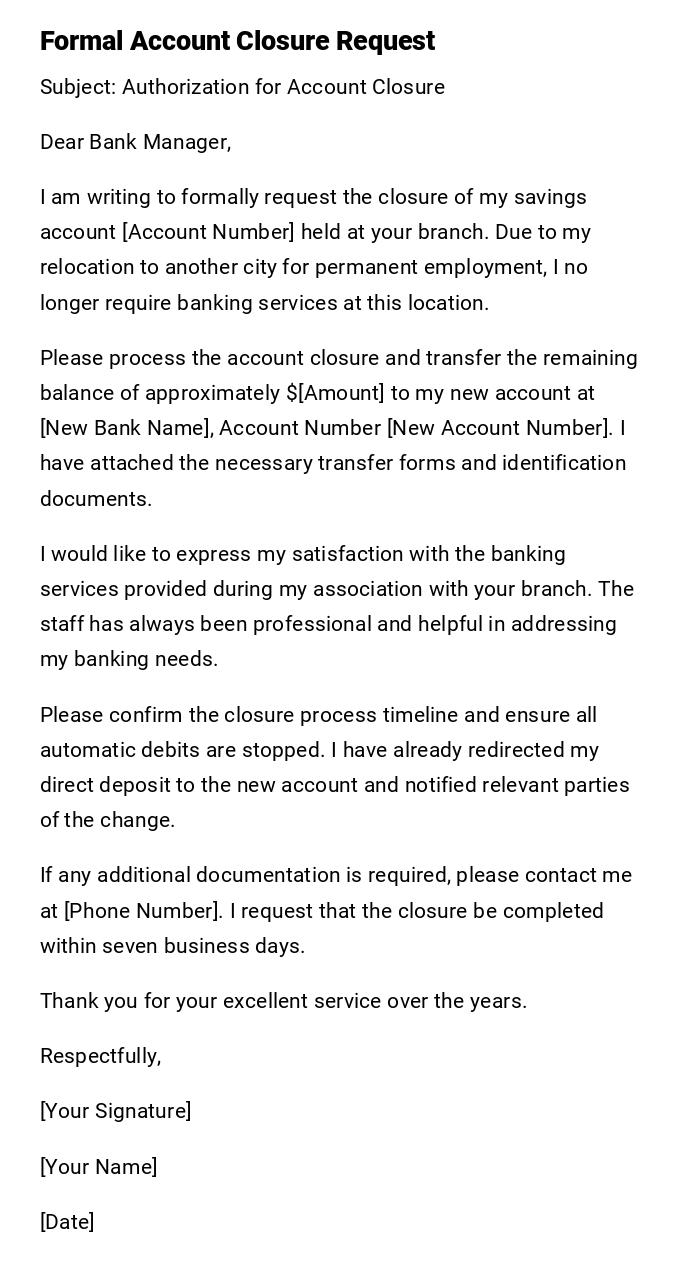

Account Closure Authorization

Subject: Authorization for Account Closure

Dear Bank Manager,

I am writing to formally request the closure of my savings account [Account Number] held at your branch. Due to my relocation to another city for permanent employment, I no longer require banking services at this location.

Please process the account closure and transfer the remaining balance of approximately $[Amount] to my new account at [New Bank Name], Account Number [New Account Number]. I have attached the necessary transfer forms and identification documents.

I would like to express my satisfaction with the banking services provided during my association with your branch. The staff has always been professional and helpful in addressing my banking needs.

Please confirm the closure process timeline and ensure all automatic debits are stopped. I have already redirected my direct deposit to the new account and notified relevant parties of the change.

If any additional documentation is required, please contact me at [Phone Number]. I request that the closure be completed within seven business days.

Thank you for your excellent service over the years.

Respectfully,

[Your Signature]

[Your Name]

[Date]

Credit Card Limit Increase Request

Subject: Request for Credit Card Limit Enhancement

Hi there,

Hope you're doing well! I'm reaching out regarding my credit card (Card Number: XXXX-XXXX-XXXX-[Last 4 digits]) and would love to discuss increasing my credit limit.

I've been a loyal customer for over three years now, and my financial situation has improved significantly since I first got the card. I recently received a promotion with a 40% salary increase, and I'm planning some major purchases for home renovation.

My current limit of $5,000 feels a bit restrictive now, and I was hoping we could bump it up to around $10,000. I've never missed a payment, always pay more than the minimum, and my credit score has improved to 750 according to my last report.

I'd be happy to provide updated income documents or any other paperwork you might need. I'm also available to come in for a quick chat if that would be easier than handling this through email.

Let me know what you think and what the next steps would be. I really appreciate all the great service you've provided over the years!

Thanks a bunch,

[Your Name]

[Phone Number]

[Date]

Power of Attorney Banking Authorization

Subject: Power of Attorney Authorization for Banking Matters

To Whom It May Concern,

This letter serves as formal notification that I, [Your Full Name], have executed a Power of Attorney document granting [Attorney-in-Fact Name] full authority to conduct banking transactions on my behalf.

Due to my declining health condition, I require assistance managing my financial affairs. The attached Power of Attorney document, duly notarized and witnessed, grants my attorney-in-fact comprehensive authority over all my accounts at your institution.

The authorized powers include but are not limited to: opening and closing accounts, making deposits and withdrawals, writing checks, applying for loans, accessing safe deposit boxes, and making investment decisions. This authorization shall remain in effect until formally revoked by me in writing.

Please update your records to reflect this arrangement and provide [Attorney-in-Fact Name] with all necessary banking access. I have included copies of the Power of Attorney document, my identification, and the attorney-in-fact's identification for your files.

Should you require any clarification or additional documentation, please contact my attorney at [Attorney Contact] or reach me directly at [Phone Number] during my available hours.

I trust this arrangement will facilitate smooth management of my banking affairs.

Sincerely,

[Your Signature]

[Your Printed Name]

[Date]

Witnessed by: [Witness Signature and Name]

Notarized: [Notary Signature and Seal]

Business Account Management Authorization

Subject: Authorization for Business Account Management

Dear Banking Officer,

As the CEO of [Company Name], I hereby authorize [Employee Name], our Chief Financial Officer, to manage all banking operations for our business accounts at your institution.

Our company is experiencing rapid growth, and I need to delegate banking responsibilities to ensure efficient financial operations. [Employee Name] has extensive experience in financial management and has been thoroughly briefed on our banking policies and procedures.

The authorization encompasses: making deposits and withdrawals up to $50,000 per transaction, signing checks, applying for business loans, managing payroll accounts, and conducting foreign exchange transactions. This individual is also authorized to add or remove signatories as business needs dictate.

Please note that this authorization supersedes any previous arrangements and should be implemented immediately. I have attached the board resolution approving this delegation of authority along with the authorized person's identification documents.

For verification purposes, you may contact me at [CEO Contact Information]. I expect all banking services to be provided with the same level of professionalism and attention to detail that our company has come to appreciate.

Thank you for your continued support of our business banking needs.

Professionally yours,

[CEO Signature]

[CEO Printed Name]

Chief Executive Officer

[Company Name]

[Date]

Student Account Access for Parent

Subject: Parental Authorization for Student Account Access

Dear Bank Manager,

As a parent sending my child off to college, I'm writing with a heavy heart but necessary purpose to authorize access to my son's student account during his studies abroad.

My son [Student Name] is pursuing his engineering degree overseas, and due to the time zone differences and his busy academic schedule, I need to help manage his financial needs. As his father and financial supporter, I want to ensure he never faces financial difficulties while focusing on his education.

I am requesting authorization to: monitor account balances, transfer funds for tuition and living expenses, pay bills on his behalf, and receive account statements. This will help me support him better while he's thousands of miles away from home.

I've included a signed letter from my son consenting to this arrangement, along with copies of both our identification documents. He will retain his own access to the account, but this will provide an additional layer of financial security for our family.

Please understand that this comes from a place of love and concern for my child's wellbeing. I want to ensure he has everything he needs to succeed in his studies without worrying about financial matters.

I would greatly appreciate your assistance in setting up this arrangement. If you need to speak with my son directly, he can be reached at [Son's International Phone Number].

With gratitude,

[Parent Signature]

[Parent Name]

Proud Parent

[Date]

Temporary Travel Authorization

Subject: Quick Authorization for Travel Banking

Hi,

Need to set up temporary banking access ASAP! I'm leaving for a 3-month work assignment in Japan next week, and my business partner needs to handle some transactions while I'm gone.

Here's the deal: [Partner Name] needs to access my business account [Account Number] to pay suppliers, collect payments, and handle day-to-day banking stuff. Nothing crazy - just keeping the business running smoothly while I'm dealing with the Tokyo project.

Max transaction limit should be $10,000 per day, which should cover most of our regular business expenses. I'll still have online access for monitoring, but having someone locally available is crucial for check deposits and urgent matters.

I've attached both our IDs and a simple authorization form. This should only be active from [Start Date] to [End Date] when I return.

Can we get this sorted by [Date]? Really appreciate the quick turnaround!

Cheers,

[Your Name]

[Phone Number]

[Date]

P.S. - I'll bring you some amazing Japanese snacks when I get back!

What is an Authorization Letter to Bank Manager and Why Do You Need It

An authorization letter to a bank manager is a formal document that grants another person the legal right to conduct banking transactions on your behalf. This letter serves as official permission for someone you trust to access your account, make transactions, or handle specific banking matters when you cannot personally attend to them.

The primary purposes include:

- Delegating banking responsibilities during travel or illness

- Enabling family members to help with financial management

- Allowing business associates to handle corporate banking

- Facilitating account management for elderly or disabled individuals

- Providing emergency access to funds during unexpected situations

- Streamlining banking processes for busy professionals

Who Should Send This Letter

Authorization letters should be sent by the primary account holder or an individual with legal authority over the account. This includes:

- Personal account holders authorizing family members or friends

- Business owners delegating authority to employees or partners

- Parents authorizing access for adult children's accounts

- Legal guardians acting on behalf of minors or incapacitated individuals

- Power of attorney holders representing the account owner

- Corporate officers authorizing banking access for company employees

- Elderly individuals preparing for potential future assistance needs

When You Need to Write This Letter

Several scenarios trigger the need for a bank authorization letter:

- Extended travel for business or personal reasons

- Medical emergencies or hospitalization

- Physical inability to visit the bank due to disability or age

- Busy work schedules preventing regular bank visits

- Military deployment or overseas assignments

- Managing accounts for elderly parents or relatives

- Business expansion requiring additional authorized signatories

- Temporary incapacitation due to surgery or treatment

- Moving to a different city while maintaining the account

- Preparing for potential future banking needs

Requirements and Prerequisites Before Writing

Before drafting your authorization letter, ensure you have:

- Valid identification documents for both parties

- Complete account information including numbers and branch details

- Clear understanding of the scope of authorization needed

- Signed consent from the person being authorized

- Notarization requirements check with your specific bank

- Witness signatures if required by bank policy

- Copies of relevant legal documents (Power of Attorney, etc.)

- Contact information for all parties involved

- Understanding of the bank's specific authorization procedures

- Time limits for the authorization period established

Formatting Guidelines and Best Practices

Proper formatting ensures your letter is professional and legally acceptable:

- Use formal business letter format for official requests

- Include complete contact information for all parties

- Clearly state the scope and limitations of authorization

- Specify exact time periods for temporary authorizations

- Use professional language avoiding ambiguous terms

- Include specific account numbers and identifying information

- Sign and date the letter with original signatures

- Attach required supporting documentation

- Keep the letter concise but comprehensive

- Use clear, straightforward language avoiding legal jargon

- Maintain consistent formatting throughout the document

After Sending - Follow-up Actions Required

Once you submit your authorization letter:

- Confirm receipt with the bank within 48 hours

- Verify that the authorization has been properly recorded

- Introduce the authorized person to relevant bank staff

- Monitor account activity regularly for the first few weeks

- Establish communication protocols with the authorized person

- Set up account alerts and notifications

- Review and adjust authorization limits as needed

- Plan for revocation procedures when authorization is no longer needed

- Maintain copies of all authorization documents

- Update emergency contacts and beneficiary information

- Schedule periodic reviews of the authorization arrangement

Common Mistakes to Avoid

Prevent authorization complications by avoiding these errors:

- Granting excessive authority without proper limitations

- Failing to specify exact time periods for authorization

- Not providing adequate identification documentation

- Using vague language regarding transaction limits

- Forgetting to notify the bank when circumstances change

- Not establishing clear communication with authorized persons

- Overlooking bank-specific requirements and procedures

- Failing to monitor account activity after granting authorization

- Not planning for emergency revocation procedures

- Assuming verbal agreements are sufficient

- Neglecting to update authorizations when people change roles

- Not keeping copies of all authorization documents

Pros and Cons of Banking Authorization

Advantages include:

- Convenient banking access when you're unavailable

- Emergency financial assistance during crises

- Efficient business banking operations with multiple authorized users

- Support for elderly or disabled family members

- Streamlined financial management for busy professionals

Disadvantages include:

- Potential for unauthorized or excessive transactions

- Risk of financial abuse by trusted individuals

- Complexity in monitoring multiple authorized users

- Legal complications if authorization terms are unclear

- Difficulty revoking authorization in emergency situations

- Bank fees for additional authorized signatories

- Potential for miscommunication regarding account management

Tips and Best Practices for Success

Maximize the effectiveness of your authorization:

- Start with limited authorization and expand gradually

- Establish regular communication schedules with authorized persons

- Use written instructions for complex transactions

- Set up account alerts for all transactions above certain amounts

- Review bank statements immediately upon receipt

- Create backup authorization plans for emergencies

- Document all authorization changes and updates

- Maintain professional relationships with bank staff

- Keep authorization periods as short as practically possible

- Establish clear boundaries regarding investment decisions

- Use joint accounts when appropriate instead of authorization

- Consider technology solutions for remote banking access

Download Word Doc

Download Word Doc

Download PDF

Download PDF