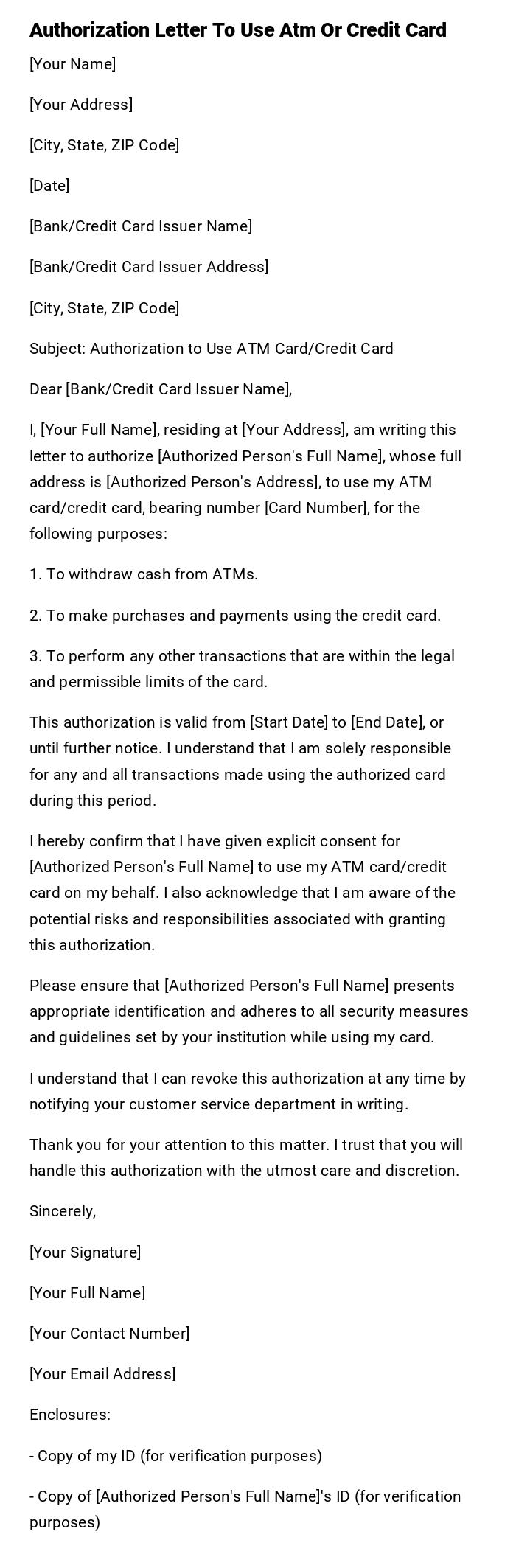

Authorization Letter To Use Atm Or Credit Card

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Bank/Credit Card Issuer Name]

[Bank/Credit Card Issuer Address]

[City, State, ZIP Code]

Subject: Authorization to Use ATM Card/Credit Card

Dear [Bank/Credit Card Issuer Name],

I, [Your Full Name], residing at [Your Address], am writing this letter to authorize [Authorized Person's Full Name], whose full address is [Authorized Person's Address], to use my ATM card/credit card, bearing number [Card Number], for the following purposes:

1. To withdraw cash from ATMs.

2. To make purchases and payments using the credit card.

3. To perform any other transactions that are within the legal and permissible limits of the card.

This authorization is valid from [Start Date] to [End Date], or until further notice. I understand that I am solely responsible for any and all transactions made using the authorized card during this period.

I hereby confirm that I have given explicit consent for [Authorized Person's Full Name] to use my ATM card/credit card on my behalf. I also acknowledge that I am aware of the potential risks and responsibilities associated with granting this authorization.

Please ensure that [Authorized Person's Full Name] presents appropriate identification and adheres to all security measures and guidelines set by your institution while using my card.

I understand that I can revoke this authorization at any time by notifying your customer service department in writing.

Thank you for your attention to this matter. I trust that you will handle this authorization with the utmost care and discretion.

Sincerely,

[Your Signature]

[Your Full Name]

[Your Contact Number]

[Your Email Address]

Enclosures:

- Copy of my ID (for verification purposes)

- Copy of [Authorized Person's Full Name]'s ID (for verification purposes)

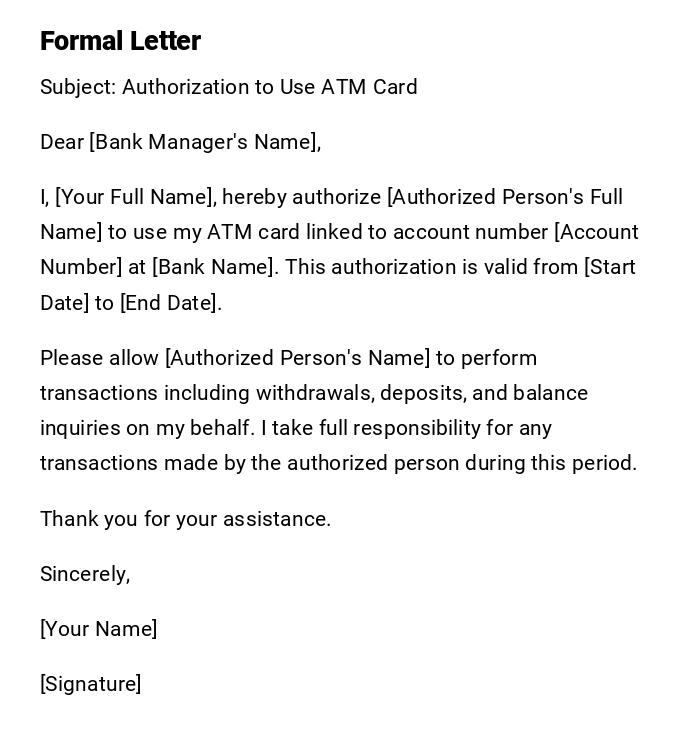

Formal Authorization Letter to Use ATM Card

Subject: Authorization to Use ATM Card

Dear [Bank Manager's Name],

I, [Your Full Name], hereby authorize [Authorized Person's Full Name] to use my ATM card linked to account number [Account Number] at [Bank Name]. This authorization is valid from [Start Date] to [End Date].

Please allow [Authorized Person's Name] to perform transactions including withdrawals, deposits, and balance inquiries on my behalf. I take full responsibility for any transactions made by the authorized person during this period.

Thank you for your assistance.

Sincerely,

[Your Name]

[Signature]

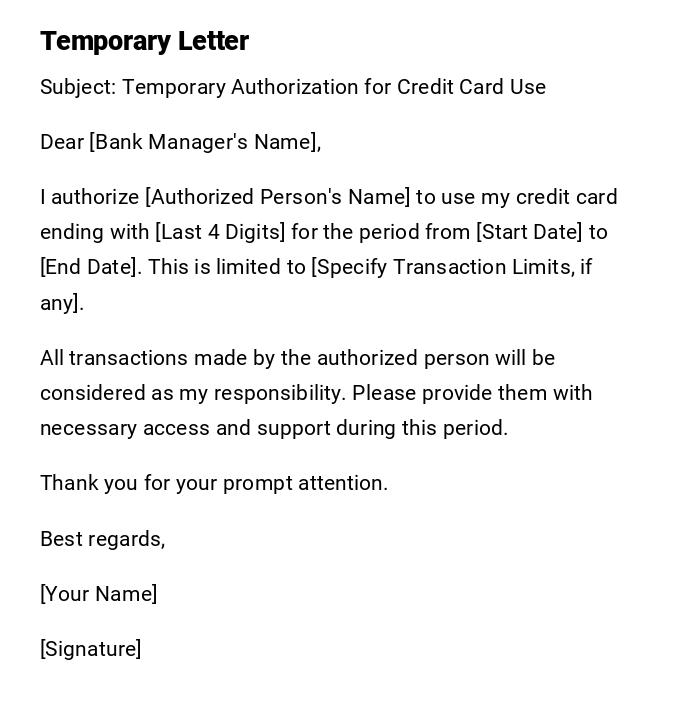

Temporary Authorization Letter for Credit Card Use

Subject: Temporary Authorization for Credit Card Use

Dear [Bank Manager's Name],

I authorize [Authorized Person's Name] to use my credit card ending with [Last 4 Digits] for the period from [Start Date] to [End Date]. This is limited to [Specify Transaction Limits, if any].

All transactions made by the authorized person will be considered as my responsibility. Please provide them with necessary access and support during this period.

Thank you for your prompt attention.

Best regards,

[Your Name]

[Signature]

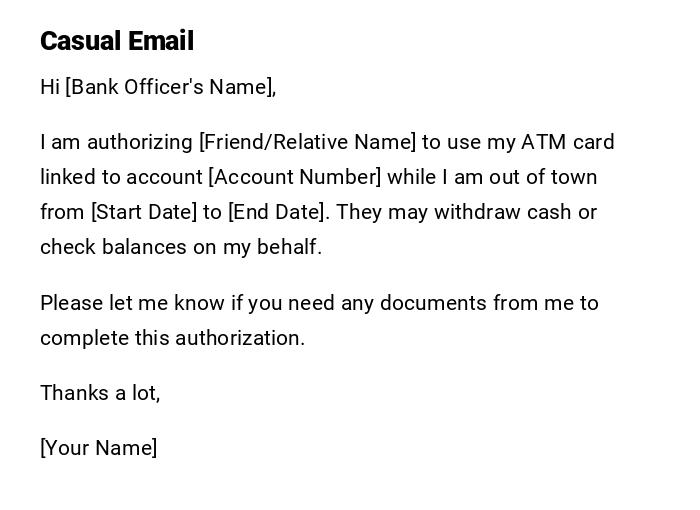

Casual Authorization Message for ATM Usage

Hi [Bank Officer's Name],

I am authorizing [Friend/Relative Name] to use my ATM card linked to account [Account Number] while I am out of town from [Start Date] to [End Date]. They may withdraw cash or check balances on my behalf.

Please let me know if you need any documents from me to complete this authorization.

Thanks a lot,

[Your Name]

Official Authorization Letter for Corporate Credit Card

Subject: Authorization to Use Corporate Credit Card

To Whom It May Concern,

This is to authorize [Employee Name] to use the corporate credit card ending with [Last 4 Digits] issued to [Company Name] for official business expenses from [Start Date] to [End Date].

All expenditures will be reimbursed and accounted for according to company policy. Kindly extend full cooperation to the authorized person.

Sincerely,

[Authorized Signatory Name]

[Designation]

[Company Seal]

Heartfelt Authorization Letter for Family Use

Dear [Bank Manager's Name],

I am writing to authorize my [Relation, e.g., sister] [Authorized Person's Name] to use my ATM card for essential expenses while I am away from [Start Date] to [End Date].

I trust [Authorized Person's Name] completely and request your kind support in facilitating this authorization smoothly.

Thank you for understanding.

Warm regards,

[Your Name]

[Signature]

Provisional Authorization Letter for Emergency Credit Card Use

Subject: Provisional Authorization for Credit Card Use

Dear [Bank Officer's Name],

Due to an urgent situation, I authorize [Authorized Person's Name] to use my credit card ending [Last 4 Digits] for immediate essential transactions. This authorization is effective from [Start Date] until [End Date].

Please consider this authorization provisional and provide necessary assistance for the duration mentioned.

Thank you,

[Your Name]

[Signature]

What / Why: Purpose of an Authorization Letter to Use ATM or Credit Card

An Authorization Letter to Use ATM or Credit Card allows a designated person to perform financial transactions on behalf of the account holder.

Purpose:

- Enable trusted individuals to access funds when the account holder is unavailable.

- Clearly outline transaction limits and validity period.

- Provide legal acknowledgment of delegated authority.

- Ensure bank compliance and record-keeping.

Who Should Send This Authorization Letter

- Account holders of ATM or credit cards.

- Business owners authorizing employees for corporate cards.

- Parents or guardians authorizing minors or family members.

- Individuals who are temporarily unavailable to manage their accounts.

Whom Should Receive the Authorization Letter

- Bank managers or officers of the issuing bank.

- Corporate finance departments for company-issued credit cards.

- Any authorized personnel required to verify and facilitate transactions.

- Relevant legal departments if requested by the bank.

When to Send an Authorization Letter for ATM or Credit Card

- When the account holder will be absent for an extended period.

- During travel or emergency situations requiring delegated access.

- For temporary corporate card usage by employees.

- For family members to handle essential payments.

How to Write and Send the Letter

- Include a clear subject line specifying authorization purpose.

- Identify account holder and authorized person with full names and relation.

- Specify account/card number and validity period.

- Mention transaction limits or restrictions if any.

- Include signature and date of the account holder.

- Submit in person at the bank or send via registered email/fax depending on bank policy.

Requirements and Prerequisites Before Writing

- Correct details of the account and authorized person.

- Identification documents for both account holder and authorized person.

- Understanding of bank policies regarding delegation of card usage.

- Awareness of transaction limits and potential liabilities.

- Bank forms, if the bank requires a specific template.

Formatting and Style Considerations

- Length: Typically 150–250 words.

- Tone: Formal, professional, or heartfelt depending on context.

- Wording: Clear, precise, and unambiguous.

- Style: Letter format preferred for print, email acceptable for quick authorization.

- Etiquette: Include courteous requests and legal acknowledgment of responsibility.

After Sending / Follow-up Actions

- Confirm bank has received and accepted the authorization.

- Verify the authorized person can access the account without issues.

- Keep copies for personal records.

- Revoke authorization immediately if circumstances change.

Tricks and Tips for Effective Authorization Letters

- Always include both full names and identification details.

- Specify exact dates and transaction limits to avoid confusion.

- Use registered communication methods for official records.

- Keep the language simple and legally clear.

- Maintain polite and professional tone to ensure smooth processing.

Common Mistakes to Avoid

- Leaving out card or account numbers.

- Not specifying validity period or transaction limits.

- Using informal language for official requests.

- Failing to include signatures or identification verification.

- Sending without bank confirmation or approval.

Elements and Structure of an Authorization Letter

- Subject Line: Purpose of the letter.

- Salutation: Addressing the bank or officer.

- Introduction: Identify account holder and intention.

- Authorization Details: Name of authorized person, account/card info, validity period, transaction limits.

- Responsibility Clause: Statement accepting responsibility for transactions.

- Closing: Sign-off and signature of account holder.

- Optional Attachments: Copies of ID documents, forms, or supporting letters.

FAQ About Authorization Letters for ATM or Credit Card Use

-

Q: Can an authorization letter be emailed or must it be printed?

A: Banks may accept both, but some require signed print copies. -

Q: Can the authorized person withdraw unlimited funds?

A: Only if explicitly stated; otherwise, limits should be set. -

Q: Is a bank witness required?

A: Some banks require verification of identity in person. -

Q: Can this authorization be revoked?

A: Yes, the account holder can revoke it anytime in writing. -

Q: How long is an authorization valid?

A: As specified in the letter, typically for a temporary or defined period.

Download Word Doc

Download Word Doc

Download PDF

Download PDF