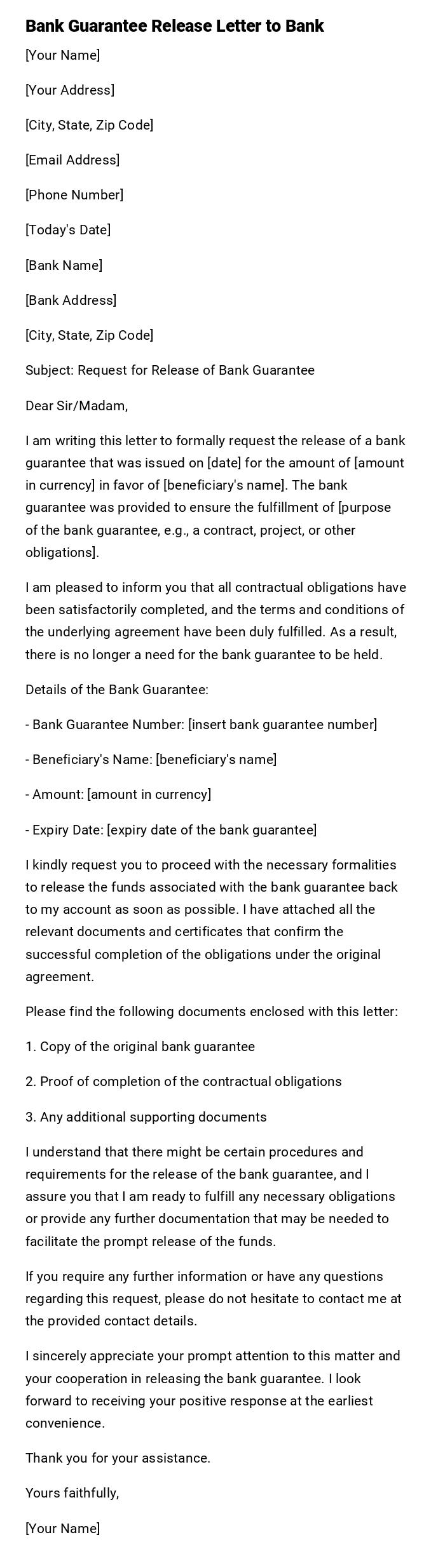

Bank Guarantee Release Letter to Bank

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Today's Date]

[Bank Name]

[Bank Address]

[City, State, Zip Code]

Subject: Request for Release of Bank Guarantee

Dear Sir/Madam,

I am writing this letter to formally request the release of a bank guarantee that was issued on [date] for the amount of [amount in currency] in favor of [beneficiary's name]. The bank guarantee was provided to ensure the fulfillment of [purpose of the bank guarantee, e.g., a contract, project, or other obligations].

I am pleased to inform you that all contractual obligations have been satisfactorily completed, and the terms and conditions of the underlying agreement have been duly fulfilled. As a result, there is no longer a need for the bank guarantee to be held.

Details of the Bank Guarantee:

- Bank Guarantee Number: [insert bank guarantee number]

- Beneficiary's Name: [beneficiary's name]

- Amount: [amount in currency]

- Expiry Date: [expiry date of the bank guarantee]

I kindly request you to proceed with the necessary formalities to release the funds associated with the bank guarantee back to my account as soon as possible. I have attached all the relevant documents and certificates that confirm the successful completion of the obligations under the original agreement.

Please find the following documents enclosed with this letter:

1. Copy of the original bank guarantee

2. Proof of completion of the contractual obligations

3. Any additional supporting documents

I understand that there might be certain procedures and requirements for the release of the bank guarantee, and I assure you that I am ready to fulfill any necessary obligations or provide any further documentation that may be needed to facilitate the prompt release of the funds.

If you require any further information or have any questions regarding this request, please do not hesitate to contact me at the provided contact details.

I sincerely appreciate your prompt attention to this matter and your cooperation in releasing the bank guarantee. I look forward to receiving your positive response at the earliest convenience.

Thank you for your assistance.

Yours faithfully,

[Your Name]

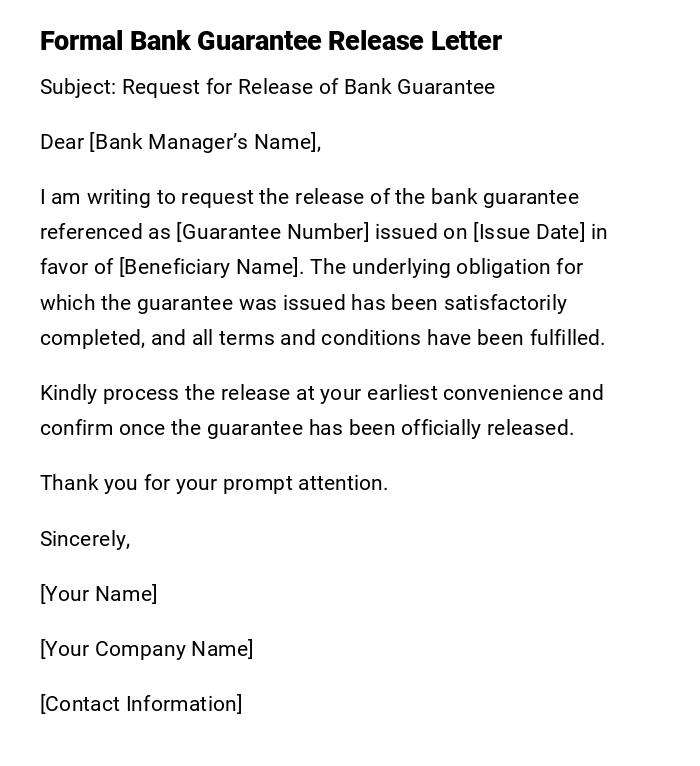

Formal Bank Guarantee Release Letter

Subject: Request for Release of Bank Guarantee

Dear [Bank Manager’s Name],

I am writing to request the release of the bank guarantee referenced as [Guarantee Number] issued on [Issue Date] in favor of [Beneficiary Name]. The underlying obligation for which the guarantee was issued has been satisfactorily completed, and all terms and conditions have been fulfilled.

Kindly process the release at your earliest convenience and confirm once the guarantee has been officially released.

Thank you for your prompt attention.

Sincerely,

[Your Name]

[Your Company Name]

[Contact Information]

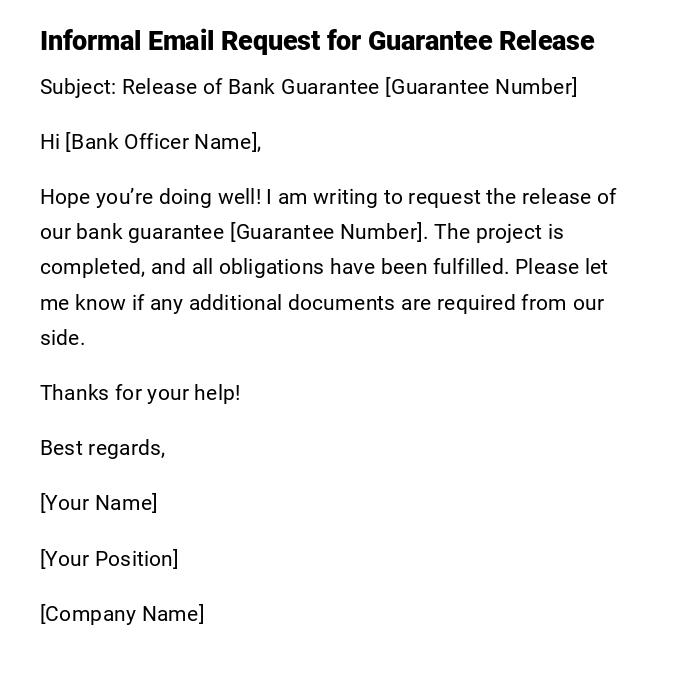

Informal Email Request for Guarantee Release

Subject: Release of Bank Guarantee [Guarantee Number]

Hi [Bank Officer Name],

Hope you’re doing well! I am writing to request the release of our bank guarantee [Guarantee Number]. The project is completed, and all obligations have been fulfilled. Please let me know if any additional documents are required from our side.

Thanks for your help!

Best regards,

[Your Name]

[Your Position]

[Company Name]

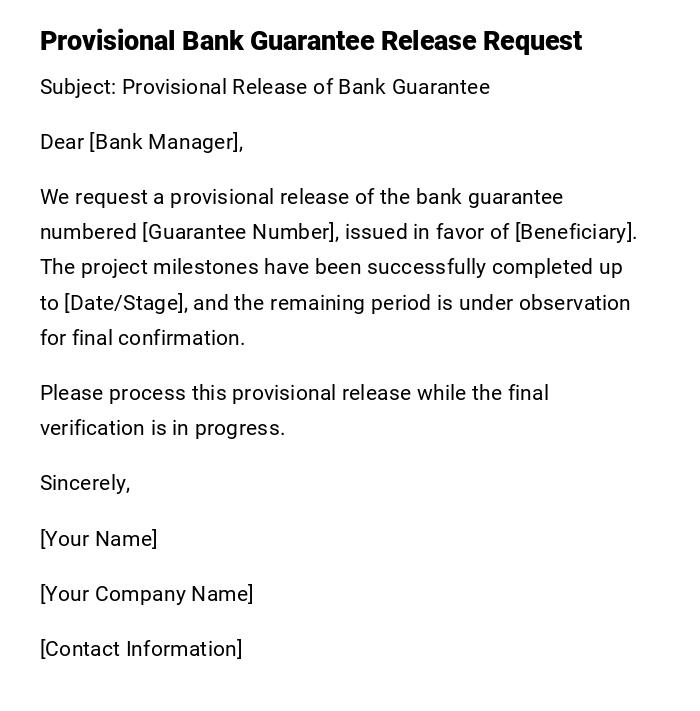

Provisional Bank Guarantee Release Request

Subject: Provisional Release of Bank Guarantee

Dear [Bank Manager],

We request a provisional release of the bank guarantee numbered [Guarantee Number], issued in favor of [Beneficiary]. The project milestones have been successfully completed up to [Date/Stage], and the remaining period is under observation for final confirmation.

Please process this provisional release while the final verification is in progress.

Sincerely,

[Your Name]

[Your Company Name]

[Contact Information]

Official Bank Letter Requesting Guarantee Release After Project Completion

Subject: Release of Bank Guarantee Post-Project Completion

Dear Sir/Madam,

We hereby request the release of the bank guarantee [Guarantee Number] issued for the [Project Name]. The project has been completed successfully, and all contractual obligations have been fulfilled by [Company Name]. Attached are the completion certificates and necessary documents for your reference.

Kindly confirm the release at the earliest convenience.

Thank you,

[Authorized Signatory Name]

[Designation]

[Company Name]

[Contact Information]

Quick Email Request for Bank Guarantee Release

Subject: Bank Guarantee Release Request

Hello [Bank Officer Name],

This is a request to release the bank guarantee [Guarantee Number]. All conditions have been met and the project is completed. Kindly confirm the release.

Thank you,

[Your Name]

[Company Name]

Heartfelt Letter Requesting Bank Guarantee Release

Subject: Request for Bank Guarantee Release

Dear [Bank Manager],

I hope this note finds you well. We sincerely appreciate your support during our project [Project Name]. As the project has been successfully concluded, we kindly request the release of the bank guarantee [Guarantee Number]. Your assistance in this matter will greatly help us in finalizing our accounts and fulfilling commitments to our partners.

Thank you for your continued cooperation.

Warm regards,

[Your Name]

[Your Position]

[Company Name]

What is a Bank Guarantee Release Letter and Why It’s Needed

A Bank Guarantee Release Letter is a formal request sent to a bank to release a previously issued bank guarantee.

Purpose:

- Confirms completion of the obligations for which the guarantee was issued.

- Frees up the funds or credit limit blocked under the guarantee.

- Provides official documentation that the guarantee is no longer in effect.

- Ensures financial clarity and supports smooth closure of projects or contracts.

Who Should Send a Bank Guarantee Release Letter

- Authorized representatives of the company or organization that availed the bank guarantee.

- Project managers responsible for contractual obligations.

- Financial officers handling bank interactions.

- Individuals or entities listed as the guarantee holder in bank records.

Whom Should the Letter Be Addressed To

- Bank managers of the branch where the guarantee was issued.

- Bank officers responsible for handling guarantees and financial instruments.

- Any authorized personnel designated by the bank for guarantee releases.

When to Send a Bank Guarantee Release Letter

- After successful completion of a project or contractual obligation.

- Upon receipt of confirmation or certificates from the beneficiary.

- At the end of the guarantee period if the guarantee was time-bound.

- When a provisional or partial release of the guarantee is applicable.

Requirements and Prerequisites Before Sending

- Original bank guarantee document reference and number.

- Proof of completion of obligations (certificates, completion reports).

- Internal authorization or board approval, if required.

- List of documents requested by the bank for processing the release.

- Clear identification of the sender and recipient details.

How to Write and Send the Letter

- Start with a clear subject line specifying the guarantee number.

- Use formal language and polite tone for official correspondence.

- Mention the reason for release and include any supporting documents.

- Indicate urgency or provisional requests if applicable.

- Send via official channels (bank email, registered post, or in-person delivery).

- Keep a copy for internal records and follow-up.

Formatting Guidelines for Bank Guarantee Release Letters

- Length: 1 page is sufficient; concise yet detailed.

- Tone: Formal, professional, or official; optional casual tone for internal communication.

- Wording: Clear, specific, and unambiguous.

- Style: Structured with subject line, greeting, body, closing, and signature.

- Attachments: Include all supporting documents as references.

After Sending / Follow-Up Actions

- Confirm receipt with the bank either by email or phone.

- Allow time for processing as per bank procedures.

- Follow up politely if no response is received within expected timelines.

- Collect official confirmation of release for internal records.

Common Mistakes to Avoid in Bank Guarantee Release Letters

- Failing to mention the correct guarantee number or project details.

- Sending incomplete or missing supporting documents.

- Using informal or vague language in formal requests.

- Not following up or confirming receipt with the bank.

- Overlooking required internal approvals before submission.

Elements and Structure of a Bank Guarantee Release Letter

- Subject Line: Clearly mentions the guarantee number.

- Greeting/Salutation: Address bank officer or manager appropriately.

- Introduction: State the purpose of the letter.

- Details of Guarantee: Include number, issue date, and beneficiary.

- Reason for Release: Confirm completion of obligations.

- Supporting Documents: Reference certificates or proof of completion.

- Closing/Polite Ending: Thank the bank and request confirmation.

- Signature and Contact Information: Include authorized signatory details.

- Attachments: List all documents attached to the letter.

Tricks and Tips for Effective Bank Guarantee Release Letters

- Keep all references and guarantee numbers accurate.

- Attach supporting documents in the correct order to avoid delays.

- Use polite, professional, and concise language.

- Specify deadlines if necessary for urgent processing.

- Maintain a copy of the letter and attachments for internal tracking.

FAQ About Bank Guarantee Release Letters

- Q: How long does it take for the bank to release a guarantee?

A: It varies, typically 7–14 business days after receiving all documents. - Q: Can a bank refuse to release a guarantee?

A: Yes, if obligations are not fulfilled or documents are incomplete. - Q: Is it necessary to send a letter for every type of guarantee?

A: Usually yes, except in electronic or auto-expiring guarantees. - Q: Can the letter be emailed?

A: Yes, banks accept emails if official communication channels are used.

Download Word Doc

Download Word Doc

Download PDF

Download PDF