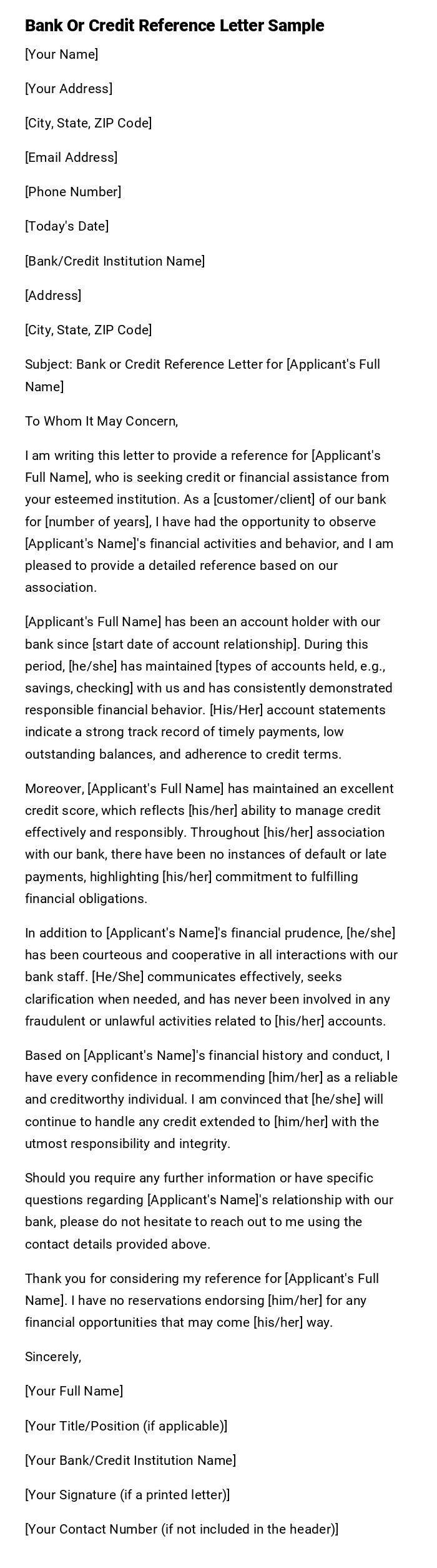

Bank Or Credit Reference Letter Sample

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Today's Date]

[Bank/Credit Institution Name]

[Address]

[City, State, ZIP Code]

Subject: Bank or Credit Reference Letter for [Applicant's Full Name]

To Whom It May Concern,

I am writing this letter to provide a reference for [Applicant's Full Name], who is seeking credit or financial assistance from your esteemed institution. As a [customer/client] of our bank for [number of years], I have had the opportunity to observe [Applicant's Name]'s financial activities and behavior, and I am pleased to provide a detailed reference based on our association.

[Applicant's Full Name] has been an account holder with our bank since [start date of account relationship]. During this period, [he/she] has maintained [types of accounts held, e.g., savings, checking] with us and has consistently demonstrated responsible financial behavior. [His/Her] account statements indicate a strong track record of timely payments, low outstanding balances, and adherence to credit terms.

Moreover, [Applicant's Full Name] has maintained an excellent credit score, which reflects [his/her] ability to manage credit effectively and responsibly. Throughout [his/her] association with our bank, there have been no instances of default or late payments, highlighting [his/her] commitment to fulfilling financial obligations.

In addition to [Applicant's Name]'s financial prudence, [he/she] has been courteous and cooperative in all interactions with our bank staff. [He/She] communicates effectively, seeks clarification when needed, and has never been involved in any fraudulent or unlawful activities related to [his/her] accounts.

Based on [Applicant's Name]'s financial history and conduct, I have every confidence in recommending [him/her] as a reliable and creditworthy individual. I am convinced that [he/she] will continue to handle any credit extended to [him/her] with the utmost responsibility and integrity.

Should you require any further information or have specific questions regarding [Applicant's Name]'s relationship with our bank, please do not hesitate to reach out to me using the contact details provided above.

Thank you for considering my reference for [Applicant's Full Name]. I have no reservations endorsing [him/her] for any financial opportunities that may come [his/her] way.

Sincerely,

[Your Full Name]

[Your Title/Position (if applicable)]

[Your Bank/Credit Institution Name]

[Your Signature (if a printed letter)]

[Your Contact Number (if not included in the header)]

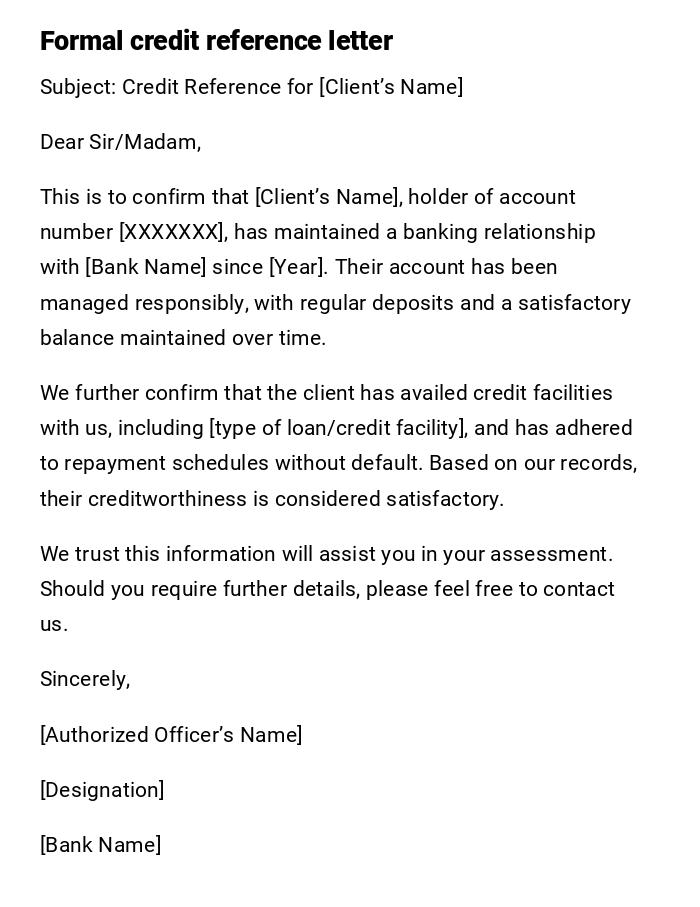

Formal Bank Credit Reference Letter

Subject: Credit Reference for [Client’s Name]

Dear Sir/Madam,

This is to confirm that [Client’s Name], holder of account number [XXXXXXX], has maintained a banking relationship with [Bank Name] since [Year]. Their account has been managed responsibly, with regular deposits and a satisfactory balance maintained over time.

We further confirm that the client has availed credit facilities with us, including [type of loan/credit facility], and has adhered to repayment schedules without default. Based on our records, their creditworthiness is considered satisfactory.

We trust this information will assist you in your assessment. Should you require further details, please feel free to contact us.

Sincerely,

[Authorized Officer’s Name]

[Designation]

[Bank Name]

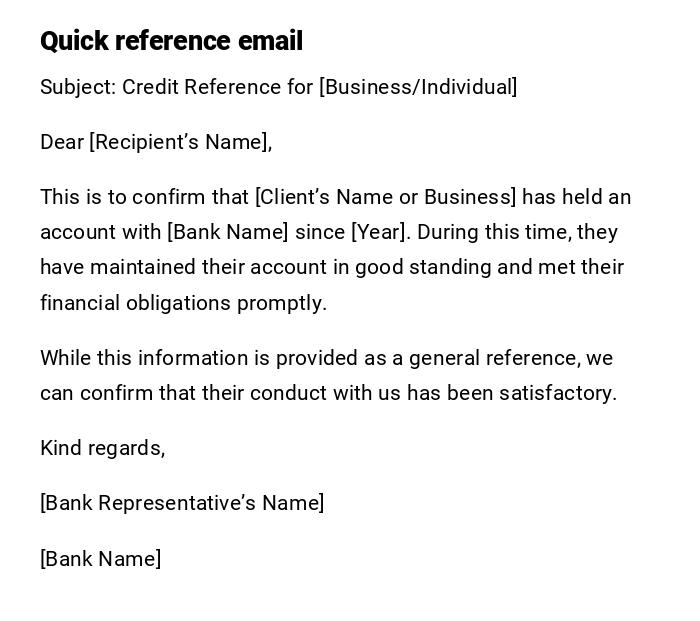

Simple Credit Reference Email for Small Businesses

Subject: Credit Reference for [Business/Individual]

Dear [Recipient’s Name],

This is to confirm that [Client’s Name or Business] has held an account with [Bank Name] since [Year]. During this time, they have maintained their account in good standing and met their financial obligations promptly.

While this information is provided as a general reference, we can confirm that their conduct with us has been satisfactory.

Kind regards,

[Bank Representative’s Name]

[Bank Name]

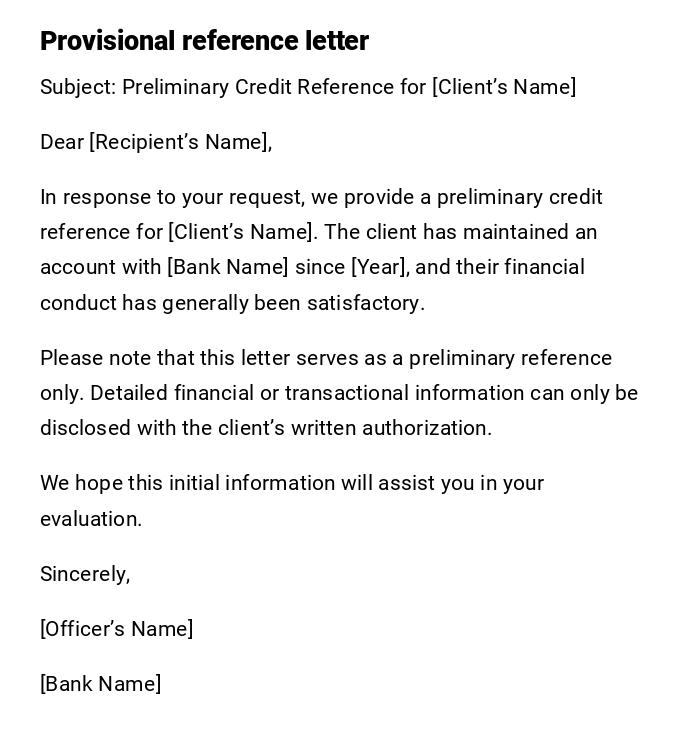

Preliminary Credit Reference Letter

Subject: Preliminary Credit Reference for [Client’s Name]

Dear [Recipient’s Name],

In response to your request, we provide a preliminary credit reference for [Client’s Name]. The client has maintained an account with [Bank Name] since [Year], and their financial conduct has generally been satisfactory.

Please note that this letter serves as a preliminary reference only. Detailed financial or transactional information can only be disclosed with the client’s written authorization.

We hope this initial information will assist you in your evaluation.

Sincerely,

[Officer’s Name]

[Bank Name]

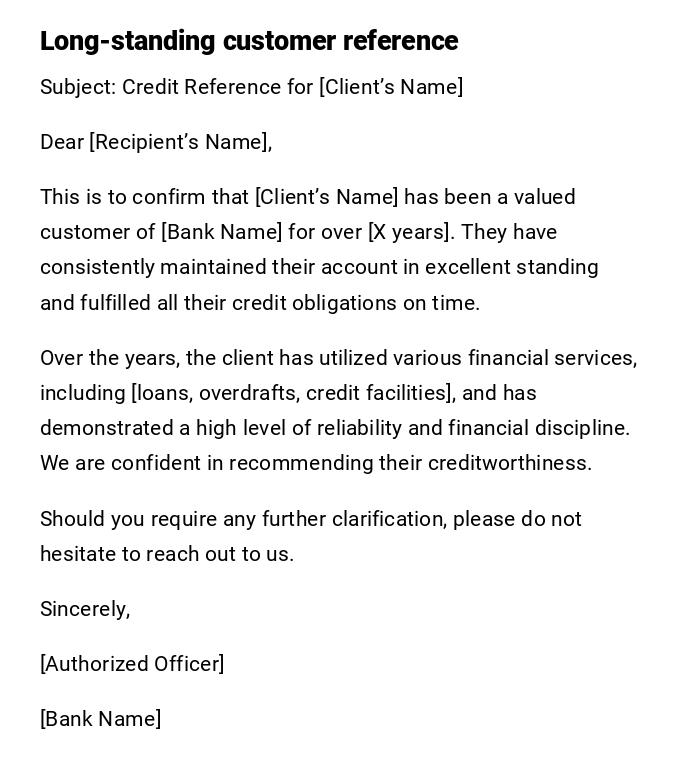

Credit Reference Letter for a Long-Term Customer

Subject: Credit Reference for [Client’s Name]

Dear [Recipient’s Name],

This is to confirm that [Client’s Name] has been a valued customer of [Bank Name] for over [X years]. They have consistently maintained their account in excellent standing and fulfilled all their credit obligations on time.

Over the years, the client has utilized various financial services, including [loans, overdrafts, credit facilities], and has demonstrated a high level of reliability and financial discipline. We are confident in recommending their creditworthiness.

Should you require any further clarification, please do not hesitate to reach out to us.

Sincerely,

[Authorized Officer]

[Bank Name]

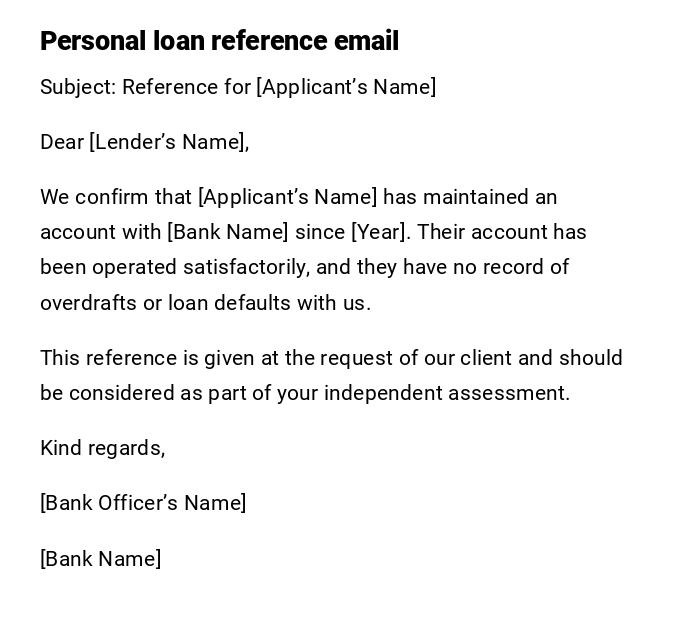

Credit Reference Email for Individual Loan Application

Subject: Reference for [Applicant’s Name]

Dear [Lender’s Name],

We confirm that [Applicant’s Name] has maintained an account with [Bank Name] since [Year]. Their account has been operated satisfactorily, and they have no record of overdrafts or loan defaults with us.

This reference is given at the request of our client and should be considered as part of your independent assessment.

Kind regards,

[Bank Officer’s Name]

[Bank Name]

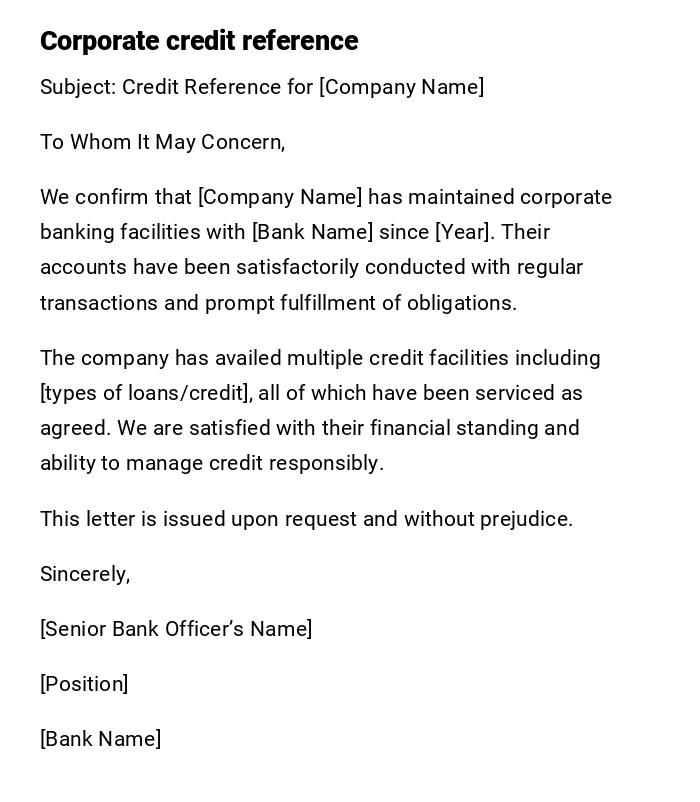

Official Credit Reference Letter for Corporate Clients

Subject: Credit Reference for [Company Name]

To Whom It May Concern,

We confirm that [Company Name] has maintained corporate banking facilities with [Bank Name] since [Year]. Their accounts have been satisfactorily conducted with regular transactions and prompt fulfillment of obligations.

The company has availed multiple credit facilities including [types of loans/credit], all of which have been serviced as agreed. We are satisfied with their financial standing and ability to manage credit responsibly.

This letter is issued upon request and without prejudice.

Sincerely,

[Senior Bank Officer’s Name]

[Position]

[Bank Name]

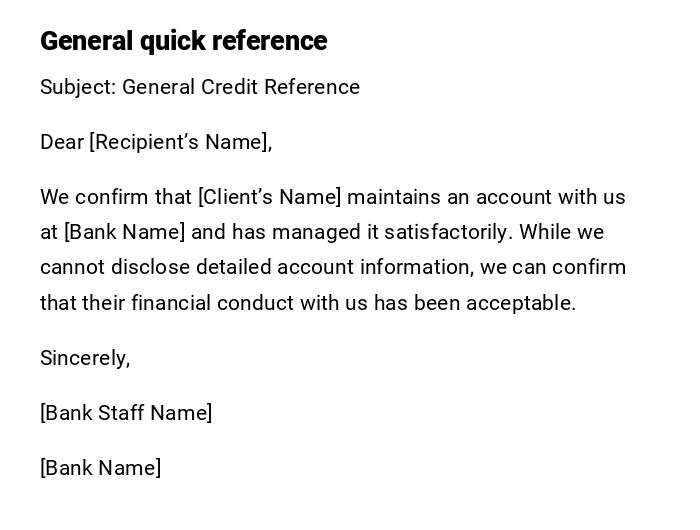

Quick and General Credit Reference Note

Subject: General Credit Reference

Dear [Recipient’s Name],

We confirm that [Client’s Name] maintains an account with us at [Bank Name] and has managed it satisfactorily. While we cannot disclose detailed account information, we can confirm that their financial conduct with us has been acceptable.

Sincerely,

[Bank Staff Name]

[Bank Name]

What is a Bank or Credit Reference Letter and Why Do You Need It

A bank or credit reference letter is an official document provided by a financial institution to verify the financial credibility of an individual or business.

It is typically requested when applying for loans, leases, credit accounts, or partnerships.

The purpose is to assure the recipient that the client is financially responsible and reliable.

Who Should Issue a Bank or Credit Reference Letter

- Banks and credit unions where the client maintains accounts.

- Authorized financial officers or relationship managers.

- Sometimes requested by credit rating agencies through banks.

Whom Should These Letters Be Addressed To

- Other banks assessing a loan or credit application.

- Landlords or leasing companies.

- Business partners verifying financial reliability.

- Credit agencies conducting background checks.

When Are Bank or Credit Reference Letters Required

- Applying for business or personal loans.

- Securing property rentals or leases.

- Requesting supplier credit terms.

- Expanding business relationships that require financial assurance.

How to Write and Send a Bank Credit Reference Letter

- Begin with client details and the banking relationship.

- Confirm account activity and general financial behavior.

- Mention credit facilities and repayment history if relevant.

- Use a professional, formal tone.

- Send via secure, official channels such as email from a bank domain or on printed letterhead.

Requirements Before Writing a Credit Reference Letter

- Written request from the client.

- Proper authorization to disclose financial details.

- Verification of client’s account records.

- Approval from senior bank staff if needed.

Formatting Guidelines for a Bank or Credit Reference Letter

- Use official bank letterhead for printed letters.

- Keep the letter concise (one page).

- Maintain a neutral, factual tone without personal opinions.

- Avoid disclosing sensitive details like balances unless authorized.

What to Do After Sending a Credit Reference Letter

- Keep a record of the letter issued.

- Notify the client that the reference has been sent.

- Respond to any follow-up queries from the requesting institution.

Common Mistakes to Avoid in Credit Reference Letters

- Disclosing unauthorized or sensitive financial details.

- Using vague language that creates confusion.

- Providing opinions instead of factual statements.

- Sending without proper authorization from the client.

Elements and Structure of a Bank Credit Reference Letter

- Subject line or heading.

- Introduction identifying the client.

- Duration and nature of the banking relationship.

- General assessment of financial conduct.

- Mention of credit facilities if relevant.

- Closing statement with disclaimer.

- Authorized officer’s signature and designation.

Compare and Contrast: Bank Reference Letters vs Credit Reports

- A bank reference letter provides a concise, official statement about financial credibility.

- A credit report provides detailed history, scores, and records from multiple institutions.

- Letters are personalized and often limited in detail, while reports are data-driven.

- Both are used for financial verification but serve different depth levels.

Download Word Doc

Download Word Doc

Download PDF

Download PDF