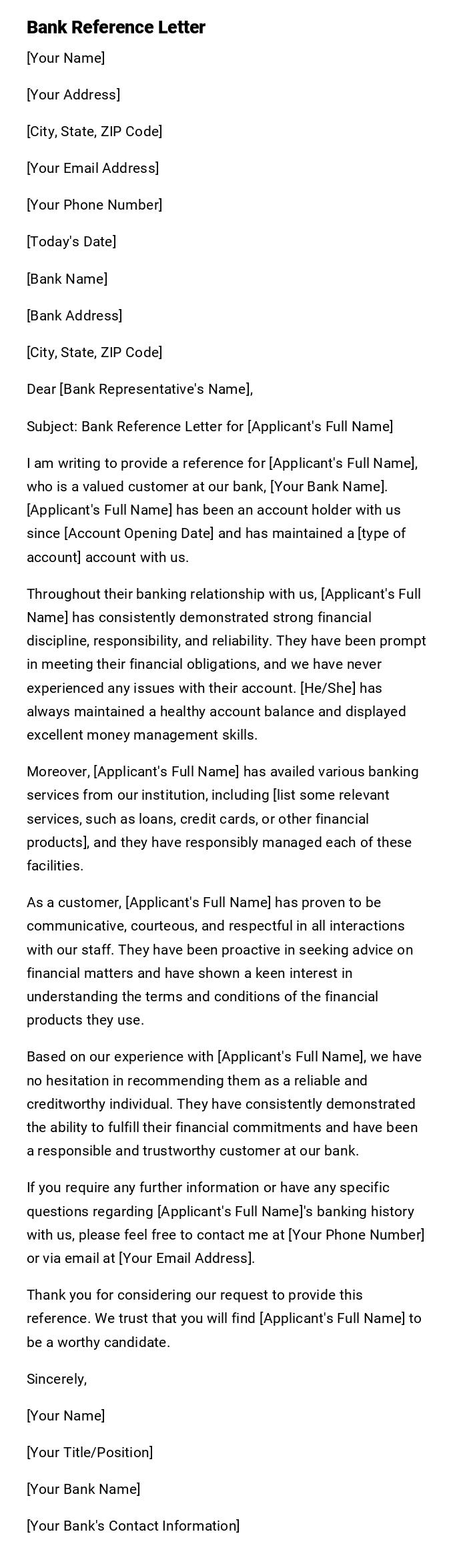

Bank Reference Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Today's Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Dear [Bank Representative's Name],

Subject: Bank Reference Letter for [Applicant's Full Name]

I am writing to provide a reference for [Applicant's Full Name], who is a valued customer at our bank, [Your Bank Name]. [Applicant's Full Name] has been an account holder with us since [Account Opening Date] and has maintained a [type of account] account with us.

Throughout their banking relationship with us, [Applicant's Full Name] has consistently demonstrated strong financial discipline, responsibility, and reliability. They have been prompt in meeting their financial obligations, and we have never experienced any issues with their account. [He/She] has always maintained a healthy account balance and displayed excellent money management skills.

Moreover, [Applicant's Full Name] has availed various banking services from our institution, including [list some relevant services, such as loans, credit cards, or other financial products], and they have responsibly managed each of these facilities.

As a customer, [Applicant's Full Name] has proven to be communicative, courteous, and respectful in all interactions with our staff. They have been proactive in seeking advice on financial matters and have shown a keen interest in understanding the terms and conditions of the financial products they use.

Based on our experience with [Applicant's Full Name], we have no hesitation in recommending them as a reliable and creditworthy individual. They have consistently demonstrated the ability to fulfill their financial commitments and have been a responsible and trustworthy customer at our bank.

If you require any further information or have any specific questions regarding [Applicant's Full Name]'s banking history with us, please feel free to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for considering our request to provide this reference. We trust that you will find [Applicant's Full Name] to be a worthy candidate.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Bank Name]

[Your Bank's Contact Information]

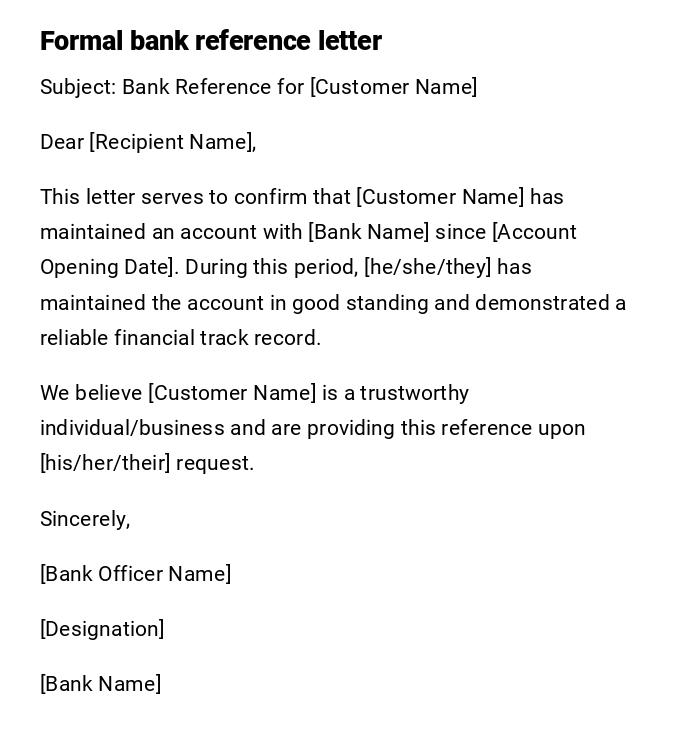

Standard Bank Reference Letter

Subject: Bank Reference for [Customer Name]

Dear [Recipient Name],

This letter serves to confirm that [Customer Name] has maintained an account with [Bank Name] since [Account Opening Date]. During this period, [he/she/they] has maintained the account in good standing and demonstrated a reliable financial track record.

We believe [Customer Name] is a trustworthy individual/business and are providing this reference upon [his/her/their] request.

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

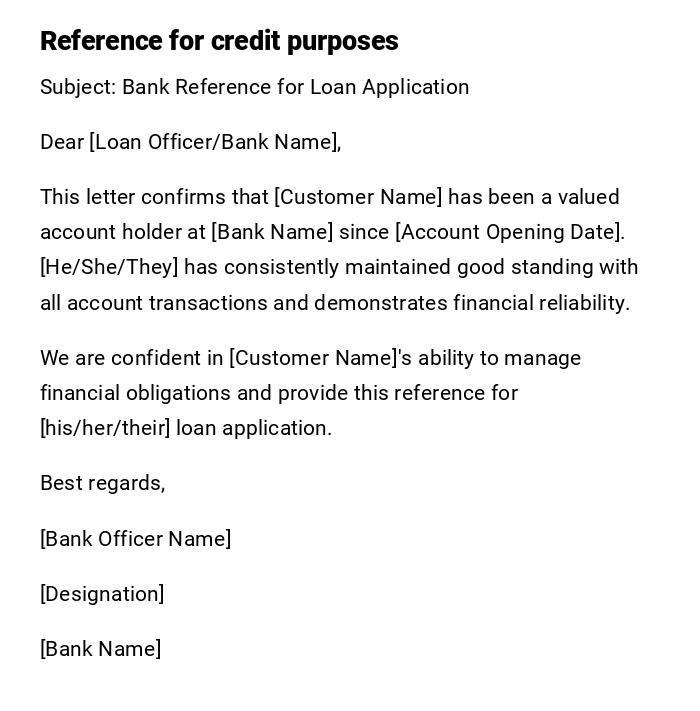

Bank Reference Letter for Loan Application

Subject: Bank Reference for Loan Application

Dear [Loan Officer/Bank Name],

This letter confirms that [Customer Name] has been a valued account holder at [Bank Name] since [Account Opening Date]. [He/She/They] has consistently maintained good standing with all account transactions and demonstrates financial reliability.

We are confident in [Customer Name]'s ability to manage financial obligations and provide this reference for [his/her/their] loan application.

Best regards,

[Bank Officer Name]

[Designation]

[Bank Name]

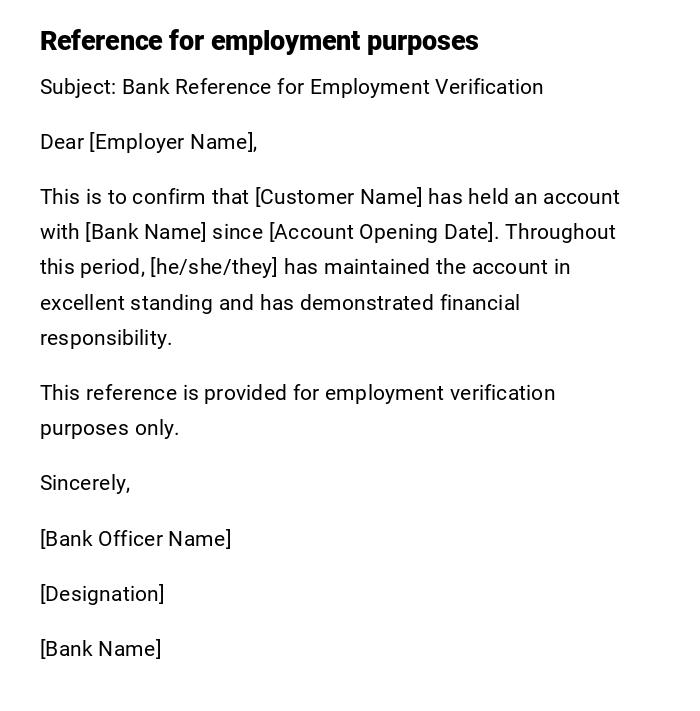

Bank Reference Letter for Employment Verification

Subject: Bank Reference for Employment Verification

Dear [Employer Name],

This is to confirm that [Customer Name] has held an account with [Bank Name] since [Account Opening Date]. Throughout this period, [he/she/they] has maintained the account in excellent standing and has demonstrated financial responsibility.

This reference is provided for employment verification purposes only.

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

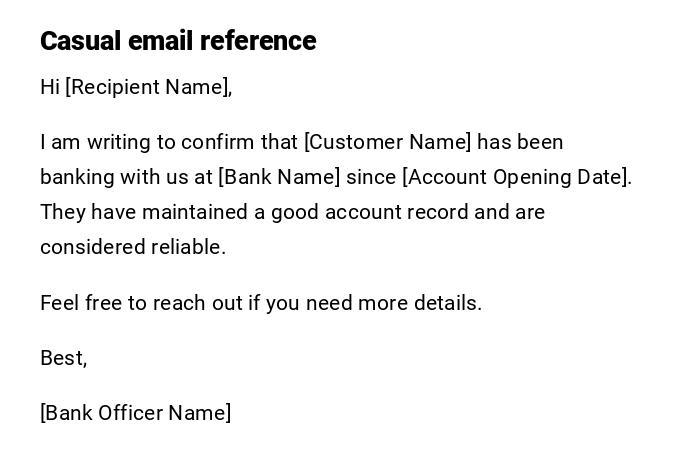

Informal Bank Reference Email

Hi [Recipient Name],

I am writing to confirm that [Customer Name] has been banking with us at [Bank Name] since [Account Opening Date]. They have maintained a good account record and are considered reliable.

Feel free to reach out if you need more details.

Best,

[Bank Officer Name]

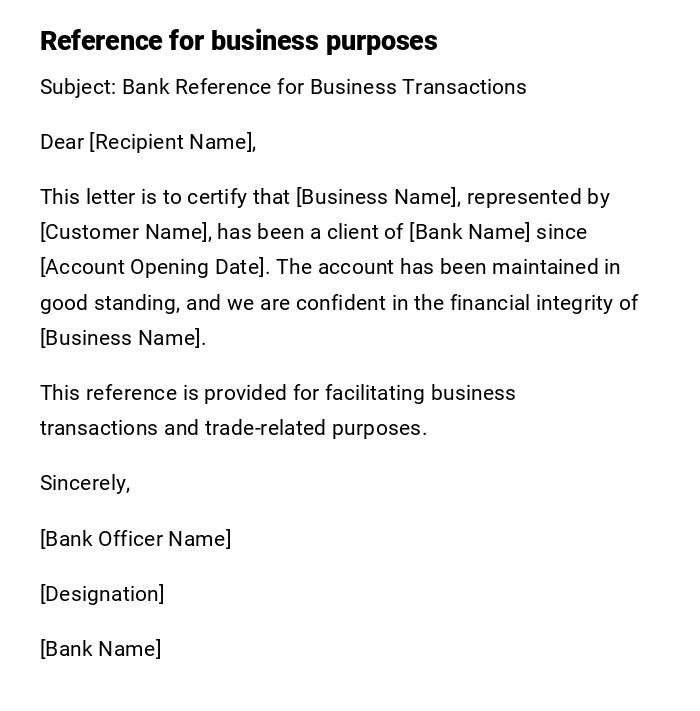

Bank Reference Letter for Business Transactions

Subject: Bank Reference for Business Transactions

Dear [Recipient Name],

This letter is to certify that [Business Name], represented by [Customer Name], has been a client of [Bank Name] since [Account Opening Date]. The account has been maintained in good standing, and we are confident in the financial integrity of [Business Name].

This reference is provided for facilitating business transactions and trade-related purposes.

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

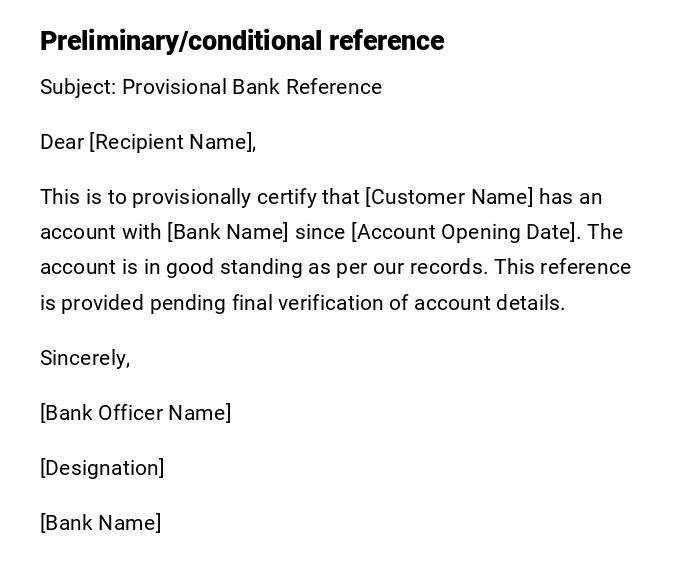

Provisional Bank Reference Letter

Subject: Provisional Bank Reference

Dear [Recipient Name],

This is to provisionally certify that [Customer Name] has an account with [Bank Name] since [Account Opening Date]. The account is in good standing as per our records. This reference is provided pending final verification of account details.

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

What is a Bank Reference Letter and Why It Is Needed

A Bank Reference Letter is an official document issued by a bank confirming a customer’s account history, financial standing, and reliability.

It is commonly needed for:

- Loan or credit applications

- Employment or rental verification

- Business transactions or partnerships

- Visa or immigration processes

Who Can Issue a Bank Reference Letter

- Account manager or relationship officer of the customer.

- Authorized banking officer with the authority to verify financial information.

- Head of the branch or bank department for official certification.

Whom Should a Bank Reference Letter Be Addressed To

- Loan officers or banks for credit approvals.

- Employers for verification of financial responsibility.

- Business partners for trade and transaction verification.

- Government or immigration authorities for official purposes.

When Should a Bank Reference Letter Be Requested

- When applying for personal or business loans.

- When verifying financial status for employment, rental, or visa purposes.

- Prior to entering new business agreements or partnerships.

- When requested by official authorities for documentation.

How to Write and Issue a Bank Reference Letter

- Include the subject and purpose of the letter clearly.

- Mention the customer’s name, account type, and account opening date.

- Confirm the account standing and any relevant financial reliability information.

- Avoid including sensitive information like account balances unless authorized.

- Close the letter with the bank officer’s signature, designation, and official seal.

- Deliver via email or printed format depending on the recipient’s requirements.

Formatting Guidelines for Bank Reference Letters

- Tone: Formal, professional, and precise.

- Length: Typically 100–200 words.

- Structure: Heading → Customer details → Account confirmation → Statement of reliability → Closing and signature.

- Attachments: Official letterhead and seal for authenticity.

- Mode: Printed or digital copy depending on the recipient's requirement.

Requirements and Prerequisites Before Issuing a Bank Reference Letter

- Verify account status and history for accuracy.

- Obtain written consent from the customer if sensitive details are to be included.

- Confirm the purpose of the letter with the recipient to ensure compliance with bank policies.

After Issuing a Bank Reference Letter

- Record the issued letter in the bank's official files.

- Provide the customer with a copy for their records.

- Respond to verification requests from third parties if needed.

Tricks and Tips for Effective Bank Reference Letters

- Keep the letter concise and factual.

- Avoid disclosing confidential account details unless necessary and authorized.

- Personalize the letter for the intended purpose (loan, employment, business).

- Use official bank letterhead and signature for credibility.

Common Mistakes to Avoid in Bank Reference Letters

- Providing incorrect account dates or customer information.

- Including unnecessary financial details.

- Failing to use official letterhead or proper authorization.

- Delaying issuance, which may affect the recipient’s process.

Elements and Structure of a Bank Reference Letter

- Heading/Subject (e.g., Bank Reference for [Customer Name])

- Customer’s full name and account information

- Account opening date and type

- Confirmation of account standing and reliability

- Purpose of the reference (loan, employment, business)

- Closing remarks

- Signature of authorized bank officer

- Date and official seal of the bank

Pros and Cons of Issuing a Bank Reference Letter

Pros:

- Provides formal verification of account status and financial reliability.

- Facilitates loans, employment, or business transactions.

- Strengthens customer-bank relationship.

Cons:

- Must ensure absolute accuracy to avoid legal or financial complications.

- Sensitive information must be carefully managed.

- Improper authorization can result in disputes or misuse.

Download Word Doc

Download Word Doc

Download PDF

Download PDF