Cash Collateralized Letter Of Credit

[Your Company's Letterhead]

[Date]

[Beneficiary's Name]

[Beneficiary's Address]

City, State, ZIP

Dear [Beneficiary's Name],

LETTER OF CREDIT - CASH COLLATERALIZED

We, [Your Company's Name], hereby issue this Cash Collateralized Letter of Credit in favor of [Beneficiary's Name], in accordance with the terms and conditions stated below:

1. Issuing Bank: [Your Bank's Name]

Address: [Bank's Address]

City, State, ZIP

SWIFT/BIC Code: [SWIFT/BIC Code]

Account Number: [Account Number]

2. Applicant (Buyer): [Your Company's Name]

Address: [Your Company's Address]

City, State, ZIP

Contact Person: [Your Contact Person]

Email: [Your Contact Email]

Phone: [Your Contact Phone]

3. Beneficiary (Seller/Service Provider): [Beneficiary's Name]

Address: [Beneficiary's Address]

City, State, ZIP

Contact Person: [Beneficiary's Contact Person]

Email: [Beneficiary's Contact Email]

Phone: [Beneficiary's Contact Phone]

4. Amount: [Specify the amount in the currency of the LC]

5. Expiry Date: [Specify the expiry date of the LC]

6. Terms and Conditions:

[Include specific terms and conditions related to the transaction, shipment, documents required, etc. Be as detailed as necessary.]

7. Validity:

This Letter of Credit is valid until [Expiry Date]. Any claims or demands made by the Beneficiary must be presented to the Issuing Bank on or before the expiry date. Any claims received after this date shall be considered null and void.

8. Presentation of Documents:

The Beneficiary shall present all required documents in conformity with the terms and conditions set forth herein at [Your Bank's Name] for examination and negotiation.

9. Charges:

All bank charges outside the Issuing Bank shall be borne by the Applicant. The Issuing Bank's charges related to the issuance and confirmation of this Letter of Credit shall be borne by the Applicant.

10. Governing Law:

This Cash Collateralized Letter of Credit shall be governed by and construed in accordance with the laws of [Your Country/State].

Please find attached herewith a cashier's check for the full amount specified in this Letter of Credit, which serves as collateral and shall be released to [Your Company's Name] upon receipt of the documents specified herein and confirmation of payment to the Beneficiary.

This Letter of Credit is irrevocable and transferable, subject to the terms and conditions stated herein.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company's Name]

[Your Email]

[Your Phone]

What is a Cash Collateralized Letter of Credit and Why is it Used?

A Cash Collateralized Letter of Credit (CCLC) is a financial instrument issued by a bank on behalf of an applicant (buyer/importer) guaranteeing payment to a beneficiary (seller/exporter), with the unique feature that the letter of credit is fully backed by cash deposits held by the issuing bank. This collateral eliminates credit risk for the bank and makes it easier for parties with limited credit history to obtain LCs. CCLCs are commonly used in international trade, real estate transactions, contract performance guarantees, and situations where the applicant needs to demonstrate strong financial commitment without relying on traditional creditworthiness.

Who Should Request a Cash Collateralized Letter of Credit?

- Importers or buyers with limited credit history or poor credit ratings

- New businesses without established banking relationships

- Companies expanding into international markets for the first time

- Entities involved in high-value transactions requiring enhanced security

- Contractors bidding on projects requiring performance guarantees

- Businesses in industries with high default rates

- Subsidiaries of larger corporations operating independently

- Individual entrepreneurs engaging in significant commercial transactions

When Should You Use a Cash Collateralized Letter of Credit?

- When entering into international trade agreements with new suppliers

- When a seller requires payment assurance before shipping goods

- When traditional credit facilities are unavailable or insufficient

- During tender processes requiring bid or performance bonds

- When establishing credibility with foreign business partners

- For large equipment purchases requiring staged payments

- When leasing commercial real estate or equipment

- During mergers and acquisitions as escrow alternatives

- When customs authorities require import guarantees

- For deferred payment arrangements in high-value transactions

Request for Cash Collateralized Letter of Credit Issuance - Formal Business Tone

Subject: Application for Cash Collateralized Letter of Credit

Dear [Bank Manager's Name],

I am writing to formally request the issuance of a Cash Collateralized Letter of Credit in favor of [Beneficiary Company Name], located at [Beneficiary Address], for the amount of [Currency] [Amount].

Our company, [Your Company Name], has entered into a purchase agreement with the above-mentioned beneficiary for the procurement of [Description of Goods/Services]. The transaction requires a letter of credit as the primary payment mechanism, and we are prepared to provide full cash collateral to secure this instrument.

Transaction Details:

Amount: [Currency] [Amount]

Beneficiary: [Company Name and Address]

Expiry Date: [Date]

Latest Shipment Date: [Date]

Partial Shipments: [Allowed/Not Allowed]

Transshipment: [Allowed/Not Allowed]

We hereby authorize you to debit our account number [Account Number] for the full collateral amount of [Currency] [Amount], plus any applicable issuance fees and charges. We understand that these funds will be held as security until the letter of credit expires or is fully utilized.

Please find enclosed the following documents:

- Signed LC application form

- Pro forma invoice from beneficiary

- Purchase agreement

- Company resolution authorizing this transaction

- Proof of cash deposit

We request that this letter of credit be issued by [Desired Date] to meet our contractual obligations. Please confirm receipt of this application and advise on the expected issuance timeline.

Should you require any additional information or documentation, please contact me at [Phone Number] or [Email Address].

Thank you for your prompt attention to this matter.

Respectfully,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

Amendment Request for Existing Cash Collateralized LC - Professional Tone

Subject: Request to Amend Letter of Credit No. [LC Number]

Dear [Bank Officer's Name],

Reference is made to our Cash Collateralized Letter of Credit No. [LC Number] dated [Issue Date] in favor of [Beneficiary Name] for [Original Amount].

Due to [reason for amendment - e.g., changes in shipping schedule, increased order quantity, extended delivery timeline], we hereby request the following amendments to the above-referenced letter of credit:

Requested Changes:

[Specify each amendment clearly, such as:]

- Increase credit amount from [Original Amount] to [New Amount]

- Extend expiry date from [Original Date] to [New Date]

- Modify latest shipment date to [New Date]

- Change description of goods to include [Additional Items]

- [Any other specific changes]

We understand that:

1. Amendment fees will apply as per the bank's standard charges

2. Additional cash collateral of [Amount] will be required (if applicable)

3. The beneficiary must accept these amendments for them to become effective

4. All other terms and conditions remain unchanged

We authorize you to debit our account [Account Number] for the amendment fees and any additional collateral required. Please process this amendment request urgently as our commercial commitments are time-sensitive.

Kindly confirm receipt and provide an estimated timeline for processing this amendment.

Best regards,

[Your Name]

[Your Title]

[Company Name]

[Date]

Beneficiary's Request for Payment Under CCLC - Formal Official Tone

Subject: Presentation of Documents for Payment Under LC No. [LC Number]

To: [Issuing Bank Name]

[Bank Address]

Attention: Trade Finance Department / Letter of Credit Division

Dear Sir/Madam,

We, [Beneficiary Company Name], hereby present the following documents for payment under Letter of Credit No. [LC Number] dated [Issue Date], issued by your institution in favor of our company for the amount of [Currency] [Amount].

This letter of credit was established by [Applicant Name] to cover [Description of Transaction]. We have fulfilled all contractual obligations and now claim payment in accordance with the LC terms.

Documents Presented:

1. Signed commercial invoice No. [Number] for [Amount]

2. Full set of clean on-board bills of lading dated [Date]

3. Packing list showing [Details]

4. Certificate of origin issued by [Authority]

5. Insurance certificate/policy for [Coverage Amount]

6. Inspection certificate issued by [Inspector Name]

7. [Any other documents specified in the LC]

We certify that:

- All documents are genuine and comply with LC requirements

- Goods have been shipped as per the LC terms

- All information provided is accurate and complete

- The shipment was made within the stipulated timeframe

Drawing Amount: [Currency] [Amount]

Payment Instructions:

Beneficiary Bank: [Bank Name]

Account Number: [Account Number]

SWIFT Code: [Code]

Account Name: [Beneficiary Company Name]

We request payment within the standard processing period as stipulated in UCP 600 guidelines. All documents are available for your examination at our bank, [Advising/Negotiating Bank Name].

Please acknowledge receipt of these documents and confirm the examination timeline.

Yours faithfully,

[Authorized Signatory Name]

[Title]

[Beneficiary Company Name]

[Date]

Request for Release of Cash Collateral - Professional Business Tone

Subject: Request for Release of Cash Collateral - LC No. [LC Number]

Dear [Bank Manager's Name],

I am writing to request the release of cash collateral held against Letter of Credit No. [LC Number], which has now [expired/been fully utilized/been cancelled].

LC Details:

LC Number: [Number]

Original Amount: [Amount]

Issue Date: [Date]

Expiry Date: [Date]

Beneficiary: [Name]

Collateral Deposited: [Amount]

The letter of credit has concluded as follows:

[Choose applicable:]

- Expired on [Date] without any drawings

- All obligations have been satisfied and payment completed on [Date]

- Cancelled by mutual agreement with beneficiary's consent received on [Date]

We request that the collateral amount of [Currency] [Amount], plus any accrued interest (if applicable), be released and credited to our operating account [Account Number]. Please deduct any outstanding fees or charges before releasing the balance.

Enclosed please find:

- Copy of expired/completed letter of credit

- [Beneficiary's consent to cancellation, if applicable]

- [Final payment receipt, if applicable]

We would appreciate if this release could be processed within [Number] business days. Please confirm the exact amount to be released after deducting all applicable charges.

Thank you for your cooperation throughout this transaction.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

[Date]

Discrepancy Notice Response - Professional Serious Tone

Subject: Response to Discrepancy Notice - LC No. [LC Number]

Dear [Bank Officer's Name],

We acknowledge receipt of your discrepancy notice dated [Date] regarding documents presented under Letter of Credit No. [LC Number]. We have carefully reviewed each discrepancy identified and respond as follows:

Discrepancy 1: [State the discrepancy as noted by the bank]

Our Response: [Provide detailed explanation, correction, or justification]

Discrepancy 2: [State the discrepancy]

Our Response: [Explanation/Resolution]

[Continue for each discrepancy identified]

Based on the above clarifications, we respectfully request that:

Option 1: [If discrepancies are minor] You reconsider your position and process payment, as the discrepancies do not materially affect the transaction and are consistent with international standard banking practice.

Option 2: [If corrections needed] We will provide corrected/additional documents within [Number] days to cure the discrepancies.

Option 3: [If seeking applicant's waiver] You contact the applicant to seek waiver of the noted discrepancies, as the commercial intent has been fulfilled.

We understand that:

- Payment is held pending resolution of these discrepancies

- Additional bank charges may apply for processing corrections

- Time is of the essence for commercial reasons

Please confirm receipt of this response and advise on the next steps. We are committed to resolving this matter promptly and remain available for any clarifications you may require.

We request a response by [Date] to avoid further delays that could impact our business operations.

Respectfully submitted,

[Your Name]

[Your Title]

[Company Name]

[Date]

Increase in Cash Collateral Notification - Formal Official Tone

Subject: Additional Cash Collateral Deposit for LC No. [LC Number]

Dear [Bank Manager's Name],

Further to our recent amendment request for Letter of Credit No. [LC Number], we hereby confirm our deposit of additional cash collateral as required.

Original LC Amount: [Currency] [Original Amount]

Amended LC Amount: [Currency] [New Amount]

Additional Collateral Required: [Currency] [Difference Amount]

We have today deposited [Currency] [Amount] into your designated collateral account. Please find attached the deposit receipt for your records.

Transaction Details:

Deposit Date: [Date]

Deposit Receipt No.: [Number]

Payment Method: [Wire Transfer/Check/Cash]

Reference Number: [Number]

We request that you:

1. Confirm receipt of the additional collateral

2. Update the LC collateral records accordingly

3. Proceed with issuing the LC amendment as previously requested

4. Provide written confirmation once the amendment is active

This additional collateral is subject to the same terms and conditions as the original collateral deposit, including:

- Hold period until LC expiry or completion

- Bank's security interest and lien rights

- Interest accrual provisions (if any)

- Release conditions

Please confirm that the total collateral now held is [Total Amount] and that this fully satisfies the collateral requirements for the amended letter of credit.

Should you require any additional documentation, please advise immediately.

Yours truly,

[Your Name]

[Your Title]

[Company Name]

[Date]

Pre-Application Inquiry for CCLC Facility - Professional Casual Tone

Subject: Inquiry About Cash Collateralized Letter of Credit Services

Dear [Bank Relationship Manager's Name],

I hope this message finds you well. I'm reaching out to explore the possibility of establishing a Cash Collateralized Letter of Credit facility with your bank for our upcoming international trade activities.

Our company, [Company Name], is planning to import [Description of Goods] from [Country] with an estimated transaction value of approximately [Currency] [Amount]. We understand that a letter of credit would be the preferred payment method for our supplier, and we're prepared to provide full cash collateral to secure this facility.

Before we proceed with a formal application, I'd appreciate information on the following:

- What is your current fee structure for cash collateralized LCs?

- What is the typical processing time from application to issuance?

- Are there any interest earnings on the collateral deposit?

- What percentage (if any) above the LC value do you require as collateral?

- Can the LC be issued in [Currency]?

- Do you have correspondent banking relationships in [Country]?

- What documentation would be required for the application?

- Are there any minimum relationship requirements with your bank?

We're looking to establish this facility within the next [Timeframe] and would value the opportunity to discuss this further. Would you be available for a meeting next week to explore how we can work together?

I can be reached at [Phone Number] or this email address. Looking forward to your response.

Best regards,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

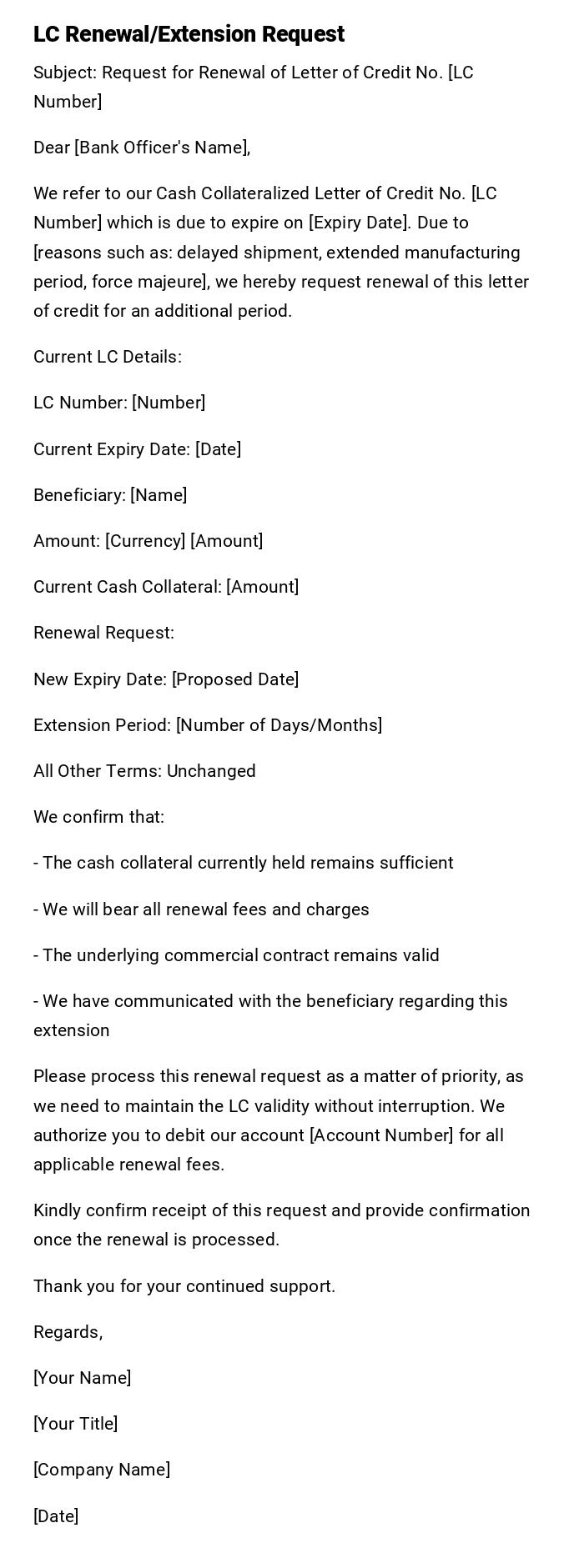

CCLC Renewal Request - Professional Standard Tone

Subject: Request for Renewal of Letter of Credit No. [LC Number]

Dear [Bank Officer's Name],

We refer to our Cash Collateralized Letter of Credit No. [LC Number] which is due to expire on [Expiry Date]. Due to [reasons such as: delayed shipment, extended manufacturing period, force majeure], we hereby request renewal of this letter of credit for an additional period.

Current LC Details:

LC Number: [Number]

Current Expiry Date: [Date]

Beneficiary: [Name]

Amount: [Currency] [Amount]

Current Cash Collateral: [Amount]

Renewal Request:

New Expiry Date: [Proposed Date]

Extension Period: [Number of Days/Months]

All Other Terms: Unchanged

We confirm that:

- The cash collateral currently held remains sufficient

- We will bear all renewal fees and charges

- The underlying commercial contract remains valid

- We have communicated with the beneficiary regarding this extension

Please process this renewal request as a matter of priority, as we need to maintain the LC validity without interruption. We authorize you to debit our account [Account Number] for all applicable renewal fees.

Kindly confirm receipt of this request and provide confirmation once the renewal is processed.

Thank you for your continued support.

Regards,

[Your Name]

[Your Title]

[Company Name]

[Date]

How to Write and Send a Cash Collateralized LC Request

- Begin by establishing clear communication with your bank's trade finance or LC department

- Gather all commercial documents including purchase agreements, pro forma invoices, and supplier information

- Calculate the exact LC amount required, including shipping costs and insurance if applicable

- Prepare the cash collateral deposit - typically 100% to 110% of the LC value

- Complete the bank's LC application form with precise details about the transaction

- Specify all terms clearly: expiry date, shipment terms, required documents, partial shipment allowances

- Review UCP 600 guidelines to ensure your LC terms are internationally compliant

- Submit all supporting documentation including board resolutions if required

- Maintain clear communication channels with both the bank and beneficiary

- Keep copies of all correspondence and documentation for your records

- Follow up with the bank to confirm issuance and obtain the LC copy

Requirements and Prerequisites Before Applying for CCLC

- Active business bank account with the issuing institution

- Sufficient cash funds to cover 100% collateral plus fees (typically 2-5% of LC value)

- Valid commercial contract or purchase order with the beneficiary

- Complete beneficiary information including bank details

- Corporate documents (registration, tax ID, business licenses)

- Board resolution or authority letter authorizing LC issuance (for companies)

- Identification documents of authorized signatories

- Pro forma invoice or commercial invoice from supplier

- Understanding of Incoterms applicable to the transaction

- Knowledge of required shipping documents based on the transaction type

- Confirmation of correspondent banking relationships in beneficiary's country

- Compliance with any regulatory requirements for foreign exchange or imports

Elements and Structure of a Cash Collateralized LC Request

- Header Information: Your company name, address, date, and bank details

- Subject Line: Clear reference to LC application or amendment with LC number if applicable

- Opening Salutation: Formal greeting addressing specific bank officer when possible

- Introduction: Brief statement of purpose and LC request

- Transaction Details Section: Comprehensive information including amounts, dates, beneficiary details, and goods description

- Collateral Confirmation: Statement of willingness to provide cash security and authorization for account debit

- Document Checklist: List of all attachments being submitted with the request

- Timeline Requirements: Specific dates by which LC must be issued

- Contact Information: Multiple ways to reach you for clarifications

- Authorization Statement: Clear authority to proceed and incur charges

- Closing: Professional sign-off with full signature block

- Attachments: All supporting documents properly labeled and referenced

Formatting Guidelines for CCLC Correspondence

- Use formal business letter format for initial applications and official requests

- Professional email format is acceptable for routine inquiries and follow-ups

- Length should be concise yet comprehensive - typically 1-2 pages for applications

- Tone must be formal and professional for all bank correspondence

- Use clear paragraph breaks and bullet points for transaction details

- Include LC numbers prominently in subject lines for all follow-up correspondence

- Maintain consistent terminology aligned with UCP 600 standards

- Avoid ambiguous language - be specific about amounts, dates, and requirements

- Always include complete contact information in every communication

- Use standard business fonts and formatting - no decorative elements

- Proofread carefully as errors can delay processing or create discrepancies

- Keep sentences clear and direct - avoid complex legal jargon unless necessary

- Number pages if the letter exceeds one page

- Ensure all amounts are clearly stated with currency codes

Common Mistakes to Avoid with Cash Collateralized LCs

- Underestimating the total collateral needed by forgetting to include bank fees

- Providing vague or incomplete beneficiary information leading to payment delays

- Setting unrealistic expiry dates that don't account for shipping and document processing time

- Failing to align LC terms with the underlying commercial contract

- Not verifying the bank's correspondent relationships in the beneficiary's country

- Omitting critical documents from the required documents list

- Using inconsistent company names or addresses across different documents

- Not maintaining sufficient buffer time between latest shipment date and expiry date

- Failing to communicate LC terms clearly with the beneficiary before issuance

- Neglecting to check if the beneficiary can comply with all documentary requirements

- Not reviewing LC terms carefully before bank issuance

- Assuming collateral will earn interest when it typically doesn't

- Forgetting to account for amendment fees in budget planning

- Missing renewal deadlines for ongoing transactions

- Not keeping the bank informed of changes in transaction status

Tips and Best Practices for Managing CCLCs

- Build a relationship with a dedicated LC specialist at your bank for smoother processing

- Create a standard checklist of documents needed for your typical LC transactions

- Maintain a separate collateral account specifically for LC security deposits

- Request email confirmation for every LC transaction milestone

- Set calendar reminders for expiry dates with at least 30 days advance notice

- Negotiate multi-use CCLC facilities if you have regular import requirements

- Keep digital copies of all LC documentation in organized folders

- Communicate proactively with beneficiaries about document requirements before shipment

- Review each LC immediately upon receipt to catch errors early

- Consider using electronic LC platforms (eUCP) when available for faster processing

- Build buffer time into all dates - typically 15-30 days beyond expected needs

- Document all conversations with the bank regarding LC transactions

- Understand the difference between LC amendments and new LC issuances for cost efficiency

- Leverage your cash collateral position to negotiate lower fees

- Consider whether standby LCs might be more appropriate than commercial LCs for certain transactions

What to Do After Sending Your CCLC Request

- Follow up within 48 hours if you haven't received acknowledgment from the bank

- Confirm receipt of your collateral deposit with the bank's back office

- Request an estimated timeline for LC issuance and document it

- Prepare to respond quickly to any bank queries or requests for additional information

- Notify the beneficiary once the LC is issued and provide them with LC details

- Obtain a copy of the issued LC and verify all terms match your application

- Send a copy of the LC to the beneficiary through the banking channel and directly via courier

- Create a tracking file with all key dates: issuance, latest shipment, expiry

- Monitor shipment progress if you're the importer to ensure compliance with LC terms

- Stay in contact with the beneficiary to confirm their ability to comply with LC requirements

- Review bank statements to confirm collateral hold and fee deductions

- Set up alerts or reminders for critical dates requiring action

- Keep the bank informed of any changes in transaction status or commercial circumstances

- Prepare amendment requests well in advance if changes become necessary

- Maintain a file of all correspondence for potential dispute resolution or audit purposes

Advantages and Disadvantages of Cash Collateralized Letters of Credit

Advantages:

- Accessible to businesses with limited credit history or poor credit ratings

- Faster approval process since credit risk is eliminated for the bank

- Lower interest costs compared to traditional credit-based LCs

- Builds banking relationship and creditworthiness over time

- Provides strong payment assurance to beneficiaries

- May earn modest interest on collateral deposits at some banks

- Simplifies approval as minimal financial analysis is required

- Allows participation in international trade for new market entrants

- Can be established with relatively minimal banking relationship history

Disadvantages:

- Ties up significant working capital that could be used elsewhere in the business

- Opportunity cost of collateral not being invested or used operationally

- Does not improve credit profile as dramatically as traditional credit facilities

- Fees and charges still apply despite providing full security

- May signal financial weakness to some counterparties

- Collateral release can be delayed if discrepancies arise

- No leverage benefit - requires full cash upfront

- May not build the credit history needed for future unsecured facilities

- Interest earned on collateral (if any) is typically minimal

- Reduces financial flexibility during the LC period

Comparing Cash Collateralized LCs with Alternatives

CCLC vs. Traditional Credit-Based LC: Cash collateralized LCs require full cash deposit while traditional LCs use the company's credit line. CCLCs have faster approval but tie up capital. Traditional LCs preserve working capital but require strong creditworthiness and involve interest charges.

CCLC vs. Wire Transfer in Advance: Both require upfront cash commitment. CCLCs provide more security for the buyer as payment releases only upon document compliance. Wire transfers offer no recourse if goods aren't shipped. CCLCs are more expensive but offer significantly better protection.

CCLC vs. Documentary Collection: Documentary collections are cheaper but provide less security. CCLCs guarantee payment to the seller while collections rely on buyer honor. CCLCs are preferable for high-value transactions or new trading relationships.

CCLC vs. Open Account Terms: Open account requires no upfront payment or collateral but offers minimal security to sellers. CCLCs are more expensive but essential when seller demands payment security. Open account is only viable with established trust relationships.

CCLC vs. Standby Letter of Credit: Standby LCs are drawn upon default while commercial CCLCs are primary payment mechanisms. Standbys serve as backup guarantees while CCLCs are the main payment method. Both can be cash collateralized but serve different purposes.

CCLC vs. Bank Guarantee: Bank guarantees cover non-payment while LCs facilitate payment against documents. LCs are transaction-specific while guarantees cover performance obligations. Both can be cash collateralized depending on creditworthiness.

Frequently Asked Questions About Cash Collateralized Letters of Credit

Can I use assets other than cash as collateral? While called "cash collateralized," some banks may accept certificates of deposit, government bonds, or other liquid securities. However, true cash provides the fastest approval and simplest structure.

How long does the bank hold my collateral? Collateral is typically held until 15-30 days after LC expiry or until all drawings and claims are settled. The exact period depends on bank policy and LC terms.

What happens to my collateral if there are discrepancies? The collateral remains held until discrepancies are resolved, either through corrections, applicant waiver, or negotiated settlement. This can extend the hold period significantly.

Can I cancel a CCLC and get my collateral back immediately? Cancellation requires beneficiary consent. Even with consent, banks typically maintain the collateral hold for 30-90 days to cover any potential claims.

Are CCLC fees lower than regular LC fees? Fees are typically similar or slightly lower since the bank's credit risk is eliminated. However, you lose opportunity cost on the tied-up capital.

Can I use one collateral deposit for multiple LCs? Generally no - each LC requires its own collateral. However, some banks offer omnibus facilities where larger deposits can back multiple smaller LCs.

Will a CCLC help build my business credit? Somewhat, but less than traditional credit-based facilities. It demonstrates transaction capability but doesn't showcase debt management ability.

What if the LC amount needs to increase after issuance? You can request an amendment with additional collateral deposit. The bank will require the incremental amount plus amendment fees before processing.

Do I need an existing relationship with the bank? Not necessarily. CCLCs are accessible even to new customers since the cash collateral eliminates credit risk for the bank.

Can foreign currency collateral be used? Typically yes, but most banks prefer collateral in the same currency as the LC to avoid exchange rate complications.

Who Should Receive Cash Collateralized LC Communications

- Primary Recipient - Issuing Bank: The trade finance or LC department of your banking institution that will issue the LC

- Bank Relationship Manager: Your designated contact person for ongoing communication and relationship management

- Beneficiary's Bank (Advising Bank): The bank in the beneficiary's country that advises or confirms the LC

- The Beneficiary: The seller/exporter who is entitled to receive payment under the LC

- Internal Stakeholders: Finance team, procurement department, legal counsel, and management requiring approval authority

- Freight Forwarders: When their services are involved in the transaction and they need LC terms for documentation

- Insurance Providers: If cargo insurance is required as part of the LC terms

- Customs Brokers: Who may need LC documents for import clearance procedures

- External Auditors: For companies where significant LC commitments require disclosure or oversight

- Legal Advisors: When complex international transactions involve additional legal review

- Correspondent Banks: Intermediary banks involved in the payment chain for specific currencies or countries

How Much Does a Cash Collateralized Letter of Credit Cost?

- Issuance Fee: Typically 0.5% to 2% of the LC value, charged upfront when the LC is issued

- Quarterly/Monthly Management Fee: Usually 0.25% to 0.5% per quarter for the LC period

- Amendment Fee: Generally $50 to $200 per amendment depending on complexity

- Advising Bank Charges: $100 to $300 charged by the beneficiary's bank for advising the LC

- Confirmation Fee: Additional 0.5% to 2% if the advising bank confirms the LC (optional)

- Document Examination Fee: $75 to $150 per presentation of documents

- Discrepancy Handling Fee: $50 to $100 for processing discrepant documents

- SWIFT Charges: $15 to $50 per message for international communications

- Negotiation Fee: 0.1% to 0.5% if documents are negotiated by an intermediary bank

- Cancellation Fee: $50 to $150 if the LC is cancelled before expiry

- Collateral Amount: 100% to 110% of the LC value (the 10% buffer covers potential fees)

- Opportunity Cost: The lost returns from having capital tied up rather than invested elsewhere

- Total Estimated Cost: For a $100,000 LC held for 6 months: approximately $2,000-$4,000 in direct fees plus opportunity cost of collateral

Download Word Doc

Download Word Doc

Download PDF

Download PDF