Irrevocable Letter of Credit for Import/Export

[Date]

[Issuer's Name and Address]

[City, State, ZIP]

[Beneficiary's Name and Address]

[City, State, ZIP]

Dear [Issuer's Name],

We hereby establish an irrevocable letter of credit in favor of [Beneficiary's Name] for an amount not exceeding [Amount] USD (United States Dollars).

This letter of credit is subject to the Uniform Customs and Practice for Documentary Credits (UCP) [Current UCP Version], and shall expire on [Expiry Date].

Please arrange for the required documents to be presented at [Issuing Bank's Name and Address] for payment.

Sincerely,

[Your Name]

Standby Letter of Credit (Performance Guarantee)

[Date]

[Issuer's Name and Address]

[City, State, ZIP]

[Beneficiary's Name and Address]

[City, State, ZIP]

Dear [Issuer's Name],

This is to confirm that [Issuer's Name] has established a standby letter of credit in favor of [Beneficiary's Name] for an amount not exceeding [Amount] USD (United States Dollars).

This standby letter of credit is intended to serve as a performance guarantee and will be payable upon presentation of a written demand for payment indicating the failure to perform under the terms of the underlying agreement between the parties.

Sincerely,

[Your Name]

Revolving Letter of Credit

[Date]

[Issuer's Name and Address]

[City, State, ZIP]

[Beneficiary's Name and Address]

[City, State, ZIP]

Dear [Issuer's Name],

We hereby establish a revolving letter of credit in favor of [Beneficiary's Name] for an aggregate amount not exceeding [Total Amount] USD (United States Dollars).

This letter of credit allows for multiple draws and reimbursements up to the specified aggregate amount, subject to the terms and conditions outlined in the underlying agreement.

Sincerely,

[Your Name]

Transferable Letter of Credit

[Date]

[First Issuing Bank's Name and Address]

[City, State, ZIP]

[Second Issuing Bank's Name and Address]

[City, State, ZIP]

[Beneficiary's Name and Address]

[City, State, ZIP]

Dear [First Issuing Bank's Name],

We request the issuance of a transferable letter of credit in favor of [Second Issuing Bank's Name], based on the terms of the original letter of credit issued by [First Issuing Bank's Name].

This transferable letter of credit will enable [Second Issuing Bank's Name] to further transfer portions of the credit to one or more secondary beneficiaries.

Sincerely,

[Your Name]

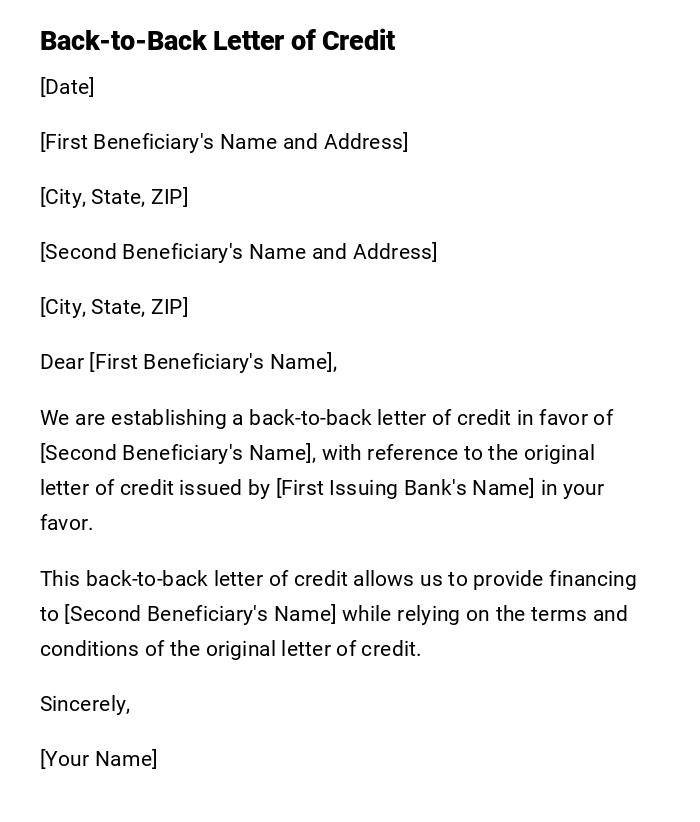

Back-to-Back Letter of Credit

[Date]

[First Beneficiary's Name and Address]

[City, State, ZIP]

[Second Beneficiary's Name and Address]

[City, State, ZIP]

Dear [First Beneficiary's Name],

We are establishing a back-to-back letter of credit in favor of [Second Beneficiary's Name], with reference to the original letter of credit issued by [First Issuing Bank's Name] in your favor.

This back-to-back letter of credit allows us to provide financing to [Second Beneficiary's Name] while relying on the terms and conditions of the original letter of credit.

Sincerely,

[Your Name]

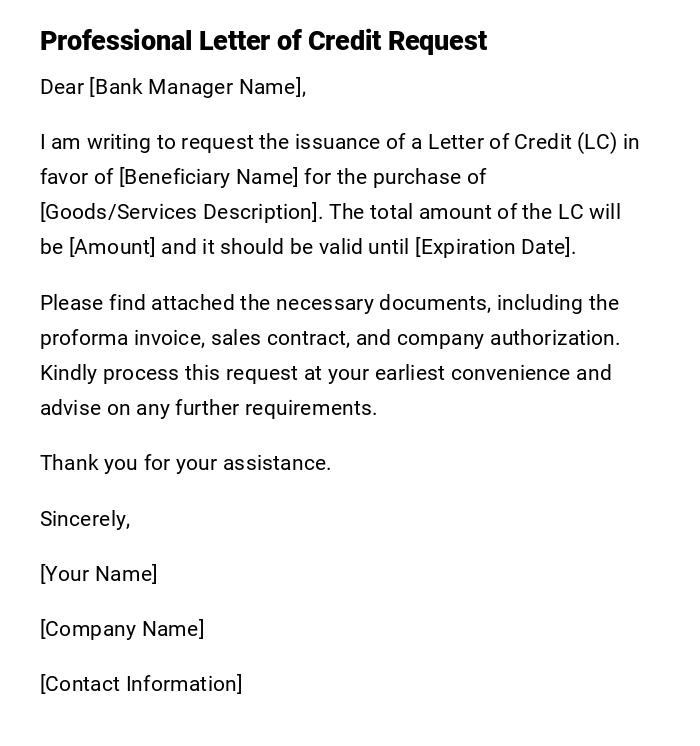

Standard Letter of Credit Request

Dear [Bank Manager Name],

I am writing to request the issuance of a Letter of Credit (LC) in favor of [Beneficiary Name] for the purchase of [Goods/Services Description]. The total amount of the LC will be [Amount] and it should be valid until [Expiration Date].

Please find attached the necessary documents, including the proforma invoice, sales contract, and company authorization. Kindly process this request at your earliest convenience and advise on any further requirements.

Thank you for your assistance.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

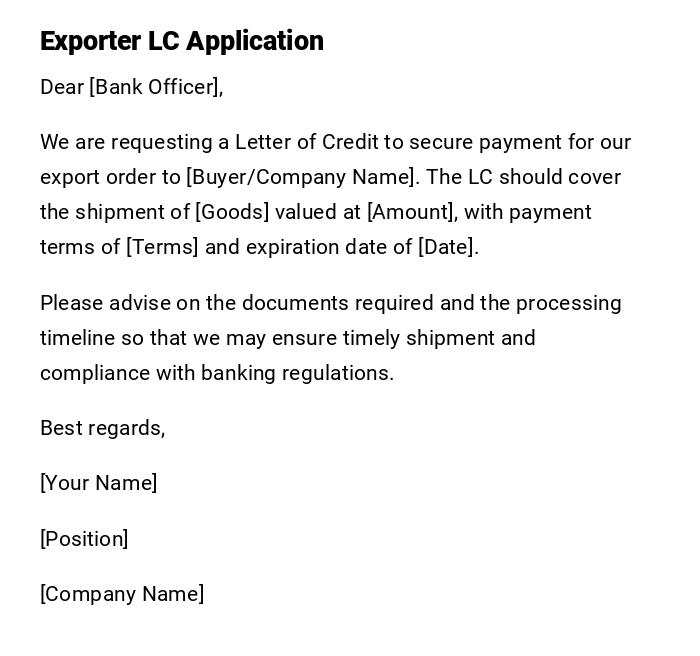

Export Letter of Credit Application

Dear [Bank Officer],

We are requesting a Letter of Credit to secure payment for our export order to [Buyer/Company Name]. The LC should cover the shipment of [Goods] valued at [Amount], with payment terms of [Terms] and expiration date of [Date].

Please advise on the documents required and the processing timeline so that we may ensure timely shipment and compliance with banking regulations.

Best regards,

[Your Name]

[Position]

[Company Name]

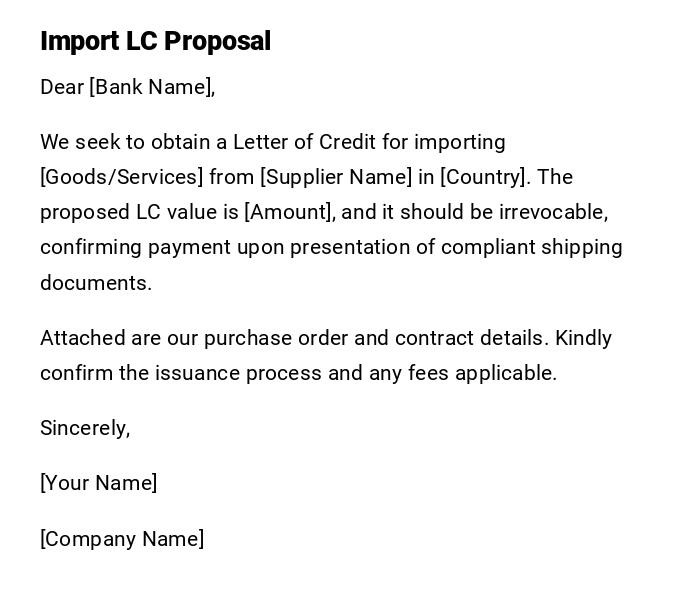

Import Letter of Credit Proposal

Dear [Bank Name],

We seek to obtain a Letter of Credit for importing [Goods/Services] from [Supplier Name] in [Country]. The proposed LC value is [Amount], and it should be irrevocable, confirming payment upon presentation of compliant shipping documents.

Attached are our purchase order and contract details. Kindly confirm the issuance process and any fees applicable.

Sincerely,

[Your Name]

[Company Name]

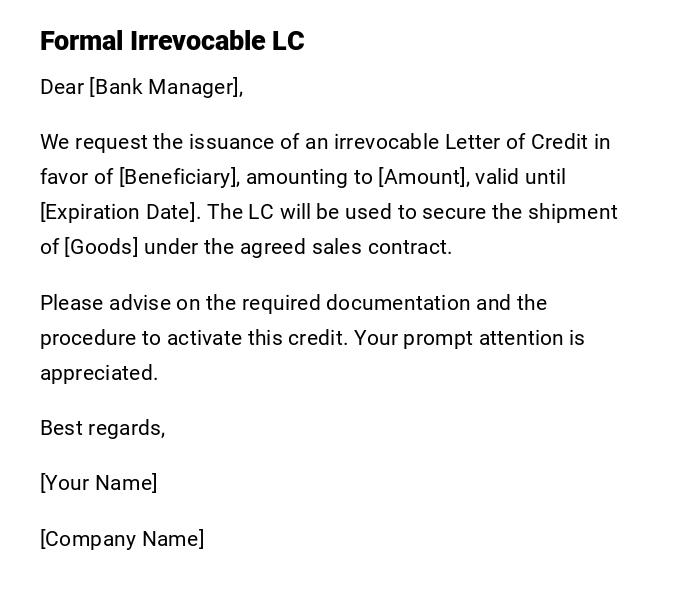

Irrevocable Letter of Credit Request

Dear [Bank Manager],

We request the issuance of an irrevocable Letter of Credit in favor of [Beneficiary], amounting to [Amount], valid until [Expiration Date]. The LC will be used to secure the shipment of [Goods] under the agreed sales contract.

Please advise on the required documentation and the procedure to activate this credit. Your prompt attention is appreciated.

Best regards,

[Your Name]

[Company Name]

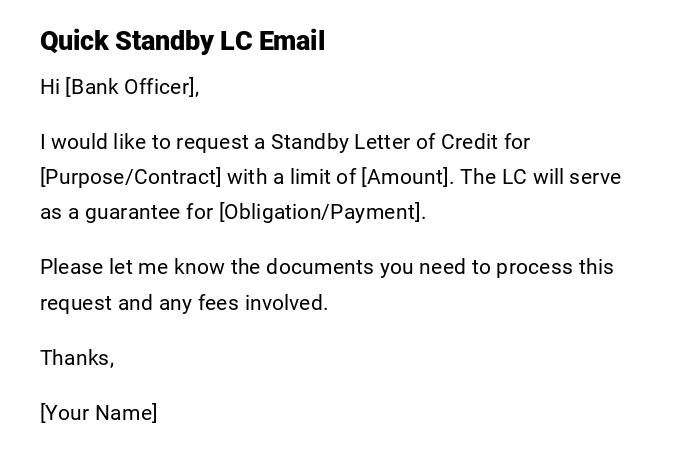

Standby Letter of Credit Email

Hi [Bank Officer],

I would like to request a Standby Letter of Credit for [Purpose/Contract] with a limit of [Amount]. The LC will serve as a guarantee for [Obligation/Payment].

Please let me know the documents you need to process this request and any fees involved.

Thanks,

[Your Name]

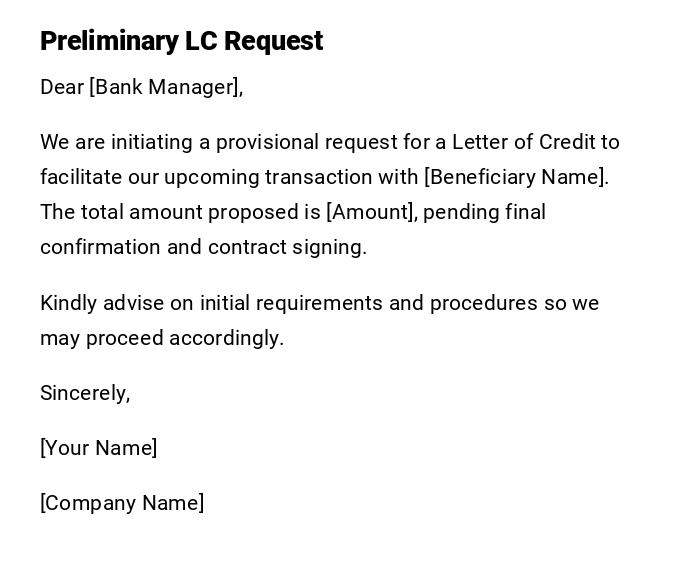

Provisional Letter of Credit Request

Dear [Bank Manager],

We are initiating a provisional request for a Letter of Credit to facilitate our upcoming transaction with [Beneficiary Name]. The total amount proposed is [Amount], pending final confirmation and contract signing.

Kindly advise on initial requirements and procedures so we may proceed accordingly.

Sincerely,

[Your Name]

[Company Name]

What / Why: Purpose of a Letter of Credit

- A Letter of Credit (LC) is a financial document issued by a bank guaranteeing a buyer's payment to a seller upon meeting specific conditions.

- Used to mitigate risks in international trade and ensure secure payment between parties.

- Provides assurance to exporters that they will receive payment if documents comply with LC terms.

Who Should Send a Letter of Credit Request

- Companies or individuals purchasing goods internationally.

- Importers requiring bank assurance for payment.

- Exporters may also request advising or confirmation from their bank to secure payment.

Whom the Letter of Credit Is Addressed To

- The issuing bank responsible for LC issuance.

- Advising bank for confirmation in some international trade scenarios.

- Beneficiary's bank if acting as confirming or negotiating bank.

When to Request a Letter of Credit

- Prior to shipment of goods in international trade.

- When a sales contract requires secure payment terms.

- For standby LCs, when financial guarantees or obligations must be secured.

- Before finalizing import/export agreements to ensure transaction security.

How to Write and Send a Letter of Credit Request

- Clearly identify buyer, seller, and bank details.

- Specify LC type (Irrevocable, Standby, Confirmed, etc.).

- Include total amount, currency, expiration date, and shipment details.

- Attach relevant documents such as invoices, contracts, and shipping instructions.

- Submit through bank channels, often via email or secure banking platform.

Formatting Guidelines for a Letter of Credit

- Keep the tone professional and formal.

- Include all critical transaction details: LC amount, beneficiary, expiry, shipping terms.

- Use standard banking terminology to avoid ambiguities.

- Attach supporting documents and reference previous agreements.

- Ensure clarity and conciseness to avoid delays in processing.

Requirements and Prerequisites

- Signed sales or purchase contract between buyer and seller.

- Bank account with sufficient funds or credit limit.

- Identification and company authorization for submitting LC.

- Knowledge of international trade terms (Incoterms) and shipping details.

After Sending / Follow-up

- Confirm receipt of the LC by the issuing or advising bank.

- Verify terms and conditions are correctly reflected in the LC.

- Notify beneficiary and ensure compliance with required documentation.

- Track LC until payment is executed or documents are settled.

Pros and Cons of Using a Letter of Credit

Pros:

- Reduces payment risk for exporters.

- Provides security for both buyer and seller.

- Facilitates international trade where trust is limited.

Cons:

- Requires strict compliance with documentation.

- Can involve additional bank fees and processing time.

- Errors in documents can delay payment.

Tricks and Tips for Efficient LC Management

- Double-check all LC terms against the contract before submission.

- Use clear and consistent banking terminology.

- Keep copies of all documents and correspondence for reference.

- Confirm deadlines for shipment and presentation of documents.

- Communicate proactively with beneficiary and banks to avoid discrepancies.

Common Mistakes to Avoid

- Incomplete or incorrect beneficiary information.

- Misalignment of LC terms with the underlying contract.

- Late submission of required documents.

- Ignoring the specific LC type and obligations it entails.

- Overlooking bank fees or charges associated with the LC.

Elements and Structure of a Letter of Credit Request

- Introduction: State purpose and context of the request.

- Buyer & Beneficiary Details: Full legal names and contact info.

- LC Type: Irrevocable, Standby, Confirmed, etc.

- Amount and Currency: Total credit value.

- Expiry Date: Validity period for the LC.

- Shipping/Delivery Terms: Include Incoterms and deadlines.

- Document Requirements: Invoices, bills of lading, inspection certificates.

- Bank Details: Issuing bank and any advising or confirming banks.

- Closing: Request for issuance and contact information for follow-up.

Does a Letter of Credit Require Authorization?

- Yes, LC requests require authorization from the company's signatories.

- Banks may require board resolutions, company stamps, or personal guarantees.

- Ensures the legal validity of the LC and protects all parties involved.

FAQ About Letters of Credit

-

Q: Can LC be amended after issuance?

A: Yes, but amendments require agreement from all parties and bank approval. -

Q: What is the difference between Irrevocable and Standby LC?

A: Irrevocable LC guarantees payment if conditions are met; Standby LC serves as a secondary guarantee in case of default. -

Q: Can an LC be used for domestic transactions?

A: Yes, although LC is more common in international trade, it can be applied domestically for secure payments.

Compare and Contrast Letter of Credit With Other Payment Methods

- LC vs Open Account: LC provides bank-guaranteed payment, whereas open account relies on buyer trust.

- LC vs Documentary Collection: LC offers stronger security; collection depends on buyer acceptance of documents.

- LC vs Cash in Advance: LC allows shipment before payment, while cash in advance requires full payment upfront.

Back To Back Letter Of Credit

Cash Collateralized Letter Of Credit

Commercial Letter Of Credit

Credit Approval Letter

Credit Authorization Letter

Credit Card Debt Settlement Letter

Credit Card Hardship Letter

Credit Clean Up Letters

Credit Correction Letter

Credit Denial Letter

Credit Dispute Letter

Credit Inquiry Letter

Credit Reference Letter

Credit Removal Deletion Or Cancellation Letter

Credit Repair Letters

Credit Validation Verification Or Check Letter

Declined Credit Card Letter

Deferred Payment Letter Of Credit

Discount Letter Of Credit

Divisible Letter Of Credit

Domestic Letter Of Credit

Increase Credit Limit Letter

International Letter Of Credit Import Export Or Trade

Irrevocable Letter Of Credit

Letter Of Credit Agreement

Letter Of Credit Guarantee

Letter Of Credit Payment Terms

Letter Of Credit Process

Letter Of Explanation For Credit Inquiries

Letter Of Explanation For Derogatory Or Bad Credit

Non Operative Letter Of Credit

Revocable Letter Of Credit

Revolving Letter Of Credit

Sight Draft Letter Of Credit

Standby Letter Of Credit

Transferable Letter Of Credit

Unconfirmed Letter Of Credit

Download Word Doc

Download Word Doc

Download PDF

Download PDF