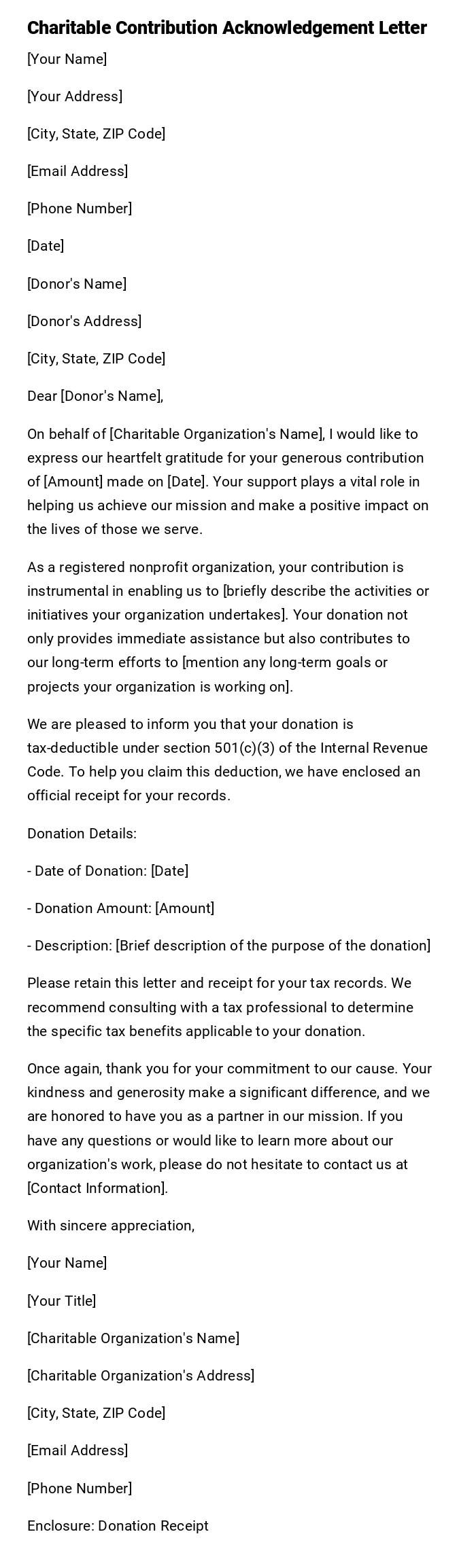

Charitable Contribution Acknowledgement Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Donor's Name]

[Donor's Address]

[City, State, ZIP Code]

Dear [Donor's Name],

On behalf of [Charitable Organization's Name], I would like to express our heartfelt gratitude for your generous contribution of [Amount] made on [Date]. Your support plays a vital role in helping us achieve our mission and make a positive impact on the lives of those we serve.

As a registered nonprofit organization, your contribution is instrumental in enabling us to [briefly describe the activities or initiatives your organization undertakes]. Your donation not only provides immediate assistance but also contributes to our long-term efforts to [mention any long-term goals or projects your organization is working on].

We are pleased to inform you that your donation is tax-deductible under section 501(c)(3) of the Internal Revenue Code. To help you claim this deduction, we have enclosed an official receipt for your records.

Donation Details:

- Date of Donation: [Date]

- Donation Amount: [Amount]

- Description: [Brief description of the purpose of the donation]

Please retain this letter and receipt for your tax records. We recommend consulting with a tax professional to determine the specific tax benefits applicable to your donation.

Once again, thank you for your commitment to our cause. Your kindness and generosity make a significant difference, and we are honored to have you as a partner in our mission. If you have any questions or would like to learn more about our organization's work, please do not hesitate to contact us at [Contact Information].

With sincere appreciation,

[Your Name]

[Your Title]

[Charitable Organization's Name]

[Charitable Organization's Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

Enclosure: Donation Receipt

Formal Charitable Contribution Acknowledgement Letter

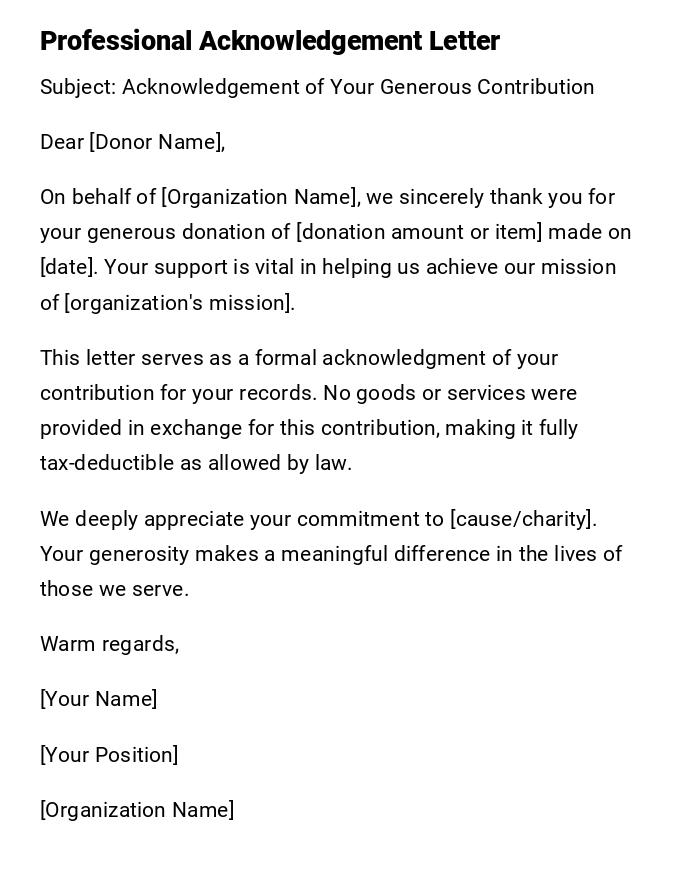

Subject: Acknowledgement of Your Generous Contribution

Dear [Donor Name],

On behalf of [Organization Name], we sincerely thank you for your generous donation of [donation amount or item] made on [date]. Your support is vital in helping us achieve our mission of [organization's mission].

This letter serves as a formal acknowledgment of your contribution for your records. No goods or services were provided in exchange for this contribution, making it fully tax-deductible as allowed by law.

We deeply appreciate your commitment to [cause/charity]. Your generosity makes a meaningful difference in the lives of those we serve.

Warm regards,

[Your Name]

[Your Position]

[Organization Name]

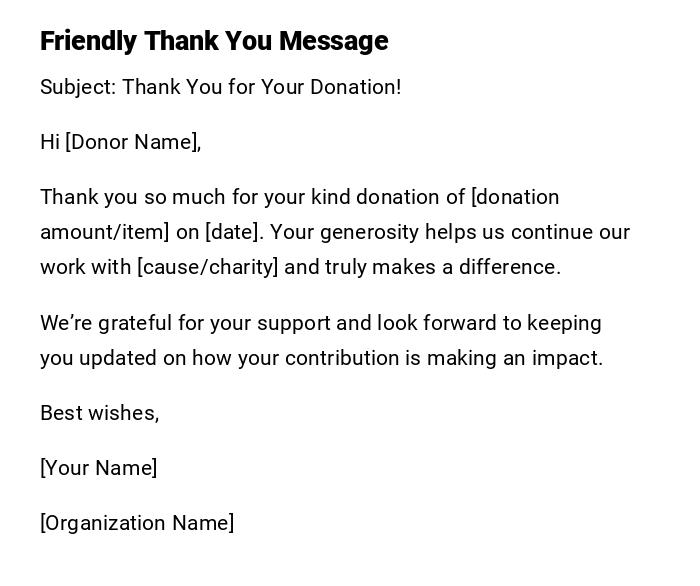

Casual Charitable Contribution Thank You Email

Subject: Thank You for Your Donation!

Hi [Donor Name],

Thank you so much for your kind donation of [donation amount/item] on [date]. Your generosity helps us continue our work with [cause/charity] and truly makes a difference.

We’re grateful for your support and look forward to keeping you updated on how your contribution is making an impact.

Best wishes,

[Your Name]

[Organization Name]

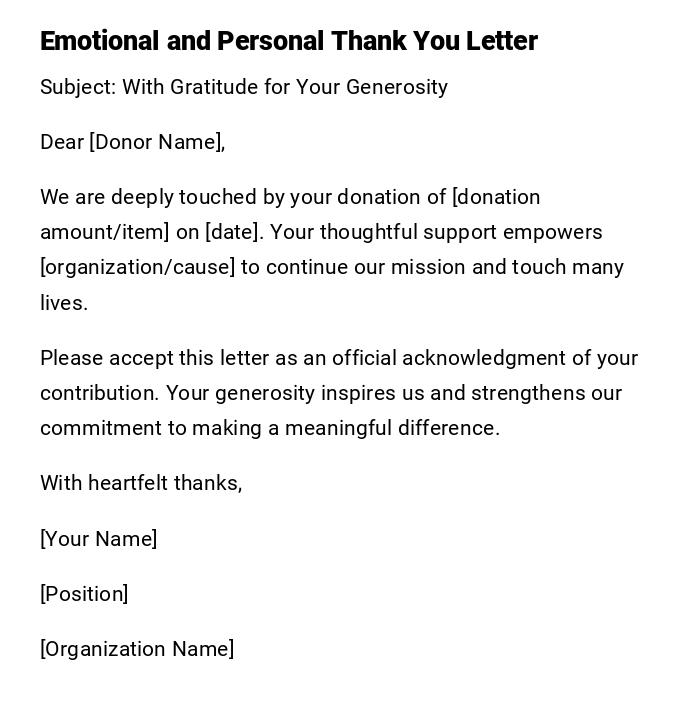

Heartfelt Charitable Contribution Acknowledgement Letter

Subject: With Gratitude for Your Generosity

Dear [Donor Name],

We are deeply touched by your donation of [donation amount/item] on [date]. Your thoughtful support empowers [organization/cause] to continue our mission and touch many lives.

Please accept this letter as an official acknowledgment of your contribution. Your generosity inspires us and strengthens our commitment to making a meaningful difference.

With heartfelt thanks,

[Your Name]

[Position]

[Organization Name]

Quick Charitable Contribution Acknowledgement Email

Subject: Thank You for Your Support!

Hi [Donor Name],

Thank you for your donation of [donation amount/item]. Your contribution is greatly appreciated and helps us continue our work with [cause/charity].

Thanks again!

[Your Name]

[Organization Name]

Official Corporate Charitable Acknowledgement Letter

Subject: Corporate Acknowledgement of Your Contribution

Dear [Donor Name/Company Name],

On behalf of [Organization Name], we formally acknowledge your generous contribution of [donation amount/item] made on [date]. Your support is crucial in advancing our programs and mission.

No goods or services were provided in return for this contribution, and it may be tax-deductible according to applicable law. We appreciate your commitment to social responsibility and community support.

Sincerely,

[Your Name]

[Position]

[Organization Name]

Creative Charitable Contribution Thank You Letter

Subject: You Made a Difference – Thank You!

Dear [Donor Name],

Wow! Your contribution of [donation amount/item] on [date] is helping us create a real impact at [organization/cause]. We’re thrilled to have your support and can’t wait to share the results with you.

This letter is to acknowledge your gift officially. Your generosity fuels our mission and brightens the lives of those we serve.

Cheers and gratitude,

[Your Name]

[Organization Name]

What is a Charitable Contribution Acknowledgement Letter and Why You Need It

A Charitable Contribution Acknowledgement Letter is a formal or informal communication sent by an organization to a donor to:

- Express gratitude for their contribution.

- Officially acknowledge the donation for record-keeping and tax purposes.

- Strengthen relationships with supporters and encourage future giving.

- Provide transparency about the use and impact of the donation.

Who Should Send a Charitable Contribution Acknowledgement Letter

- Nonprofit organizations or charities that receive donations.

- Corporate giving departments acknowledging employee or corporate donations.

- Event organizers thanking attendees for fundraising contributions.

Whom Should Receive a Charitable Contribution Acknowledgement Letter

- Individual donors who have contributed money, goods, or services.

- Businesses or corporate sponsors providing financial or in-kind support.

- Volunteers or community partners who contributed time or resources in a charitable capacity.

When to Send a Charitable Contribution Acknowledgement Letter

- Immediately after receiving a donation.

- At the end of a fiscal or donation cycle to summarize support.

- After fundraising events or campaigns to acknowledge contributors.

- Prior to tax season to provide donors with necessary documentation.

How to Write and Send a Charitable Contribution Acknowledgement Letter

- Begin with a warm greeting and direct expression of gratitude.

- Specify the donation details: amount, item, date, and purpose.

- Include a statement regarding tax-deductibility if applicable.

- Add personal touches about the impact of their contribution.

- Choose the appropriate mode: printed letter for formal acknowledgment, email for quick acknowledgment.

- Proofread and ensure all names and amounts are correct before sending.

Requirements and Prerequisites Before Sending the Letter

- Accurate record of the donation (amount, type, date).

- Donor's name and contact information.

- Organization’s official letterhead or email signature.

- Knowledge of tax-deductibility rules applicable to the contribution.

Formatting Guidelines for Charitable Contribution Acknowledgement Letters

- Length: concise, typically one page or less.

- Tone: can range from formal and professional to casual and heartfelt.

- Include a subject line for emails or a heading for printed letters.

- Provide clear details of the donation and acknowledgment.

- Attach any necessary supporting documents, such as receipts or tax statements.

After Sending / Follow-up Actions

- Maintain a record of sent acknowledgements for internal and tax purposes.

- Respond promptly to any donor inquiries or additional requests.

- Update donor databases to reflect acknowledgement.

- Consider sending periodic updates or newsletters to maintain engagement.

Tricks and Tips for Effective Charitable Contribution Acknowledgement Letters

- Personalize each letter to show genuine appreciation.

- Include specific information about how the donation will be used.

- Use storytelling or impact statements to connect emotionally with donors.

- Send acknowledgements promptly to reinforce positive donor experience.

- Keep a template for efficiency but customize key details for each donor.

Common Mistakes to Avoid in Charitable Contribution Acknowledgement Letters

- Delaying the acknowledgment, which can appear unprofessional.

- Failing to include donation specifics or tax information.

- Using generic language without personalization.

- Forgetting to verify donor names, amounts, or dates.

- Neglecting to attach receipts or necessary documentation.

Elements and Structure of a Charitable Contribution Acknowledgement Letter

- Subject or Heading indicating gratitude and acknowledgment.

- Greeting addressed to the donor.

- Expression of sincere thanks.

- Details of the contribution: amount, item, date.

- Statement about tax-deductibility if applicable.

- Optional: description of the impact or use of the donation.

- Closing with appreciation and contact information.

- Optional attachments: receipts, certificates, or supporting documents.

Download Word Doc

Download Word Doc

Download PDF

Download PDF