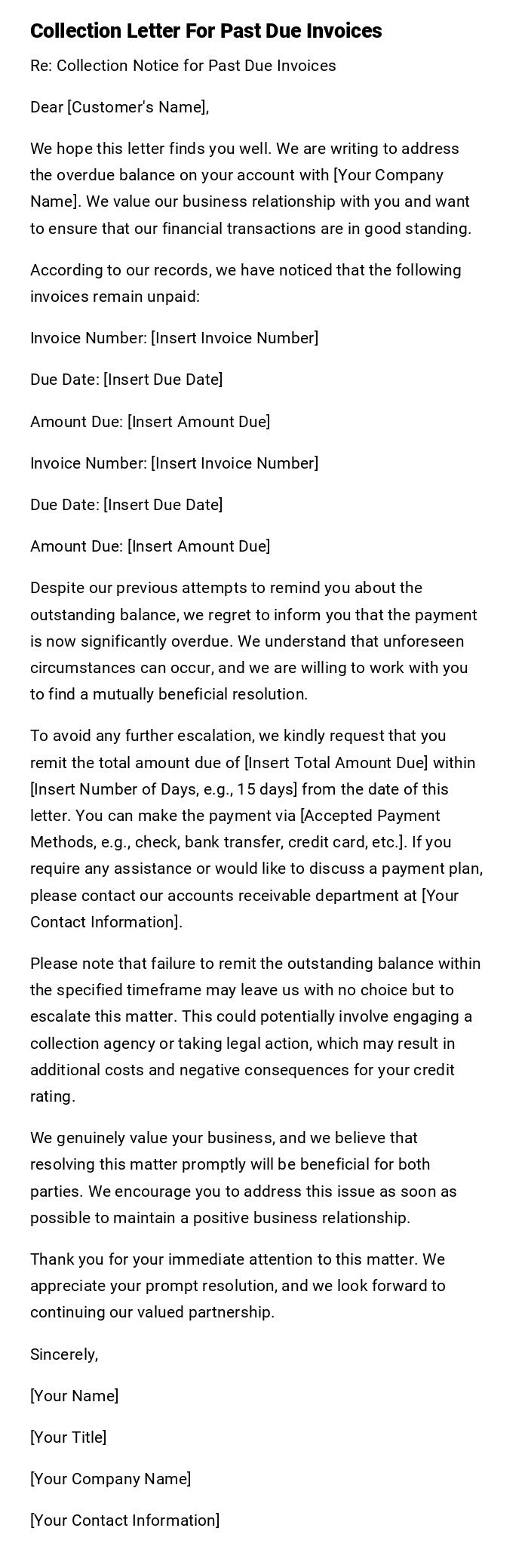

Collection Letter For Past Due Invoices

Re: Collection Notice for Past Due Invoices

Dear [Customer's Name],

We hope this letter finds you well. We are writing to address the overdue balance on your account with [Your Company Name]. We value our business relationship with you and want to ensure that our financial transactions are in good standing.

According to our records, we have noticed that the following invoices remain unpaid:

Invoice Number: [Insert Invoice Number]

Due Date: [Insert Due Date]

Amount Due: [Insert Amount Due]

Invoice Number: [Insert Invoice Number]

Due Date: [Insert Due Date]

Amount Due: [Insert Amount Due]

Despite our previous attempts to remind you about the outstanding balance, we regret to inform you that the payment is now significantly overdue. We understand that unforeseen circumstances can occur, and we are willing to work with you to find a mutually beneficial resolution.

To avoid any further escalation, we kindly request that you remit the total amount due of [Insert Total Amount Due] within [Insert Number of Days, e.g., 15 days] from the date of this letter. You can make the payment via [Accepted Payment Methods, e.g., check, bank transfer, credit card, etc.]. If you require any assistance or would like to discuss a payment plan, please contact our accounts receivable department at [Your Contact Information].

Please note that failure to remit the outstanding balance within the specified timeframe may leave us with no choice but to escalate this matter. This could potentially involve engaging a collection agency or taking legal action, which may result in additional costs and negative consequences for your credit rating.

We genuinely value your business, and we believe that resolving this matter promptly will be beneficial for both parties. We encourage you to address this issue as soon as possible to maintain a positive business relationship.

Thank you for your immediate attention to this matter. We appreciate your prompt resolution, and we look forward to continuing our valued partnership.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Contact Information]

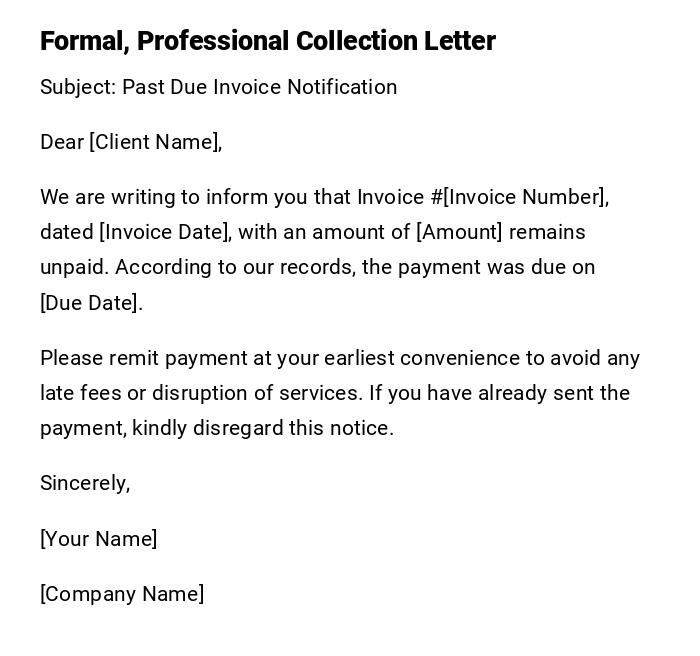

Professional Collection Letter for Past Due Invoice

Subject: Past Due Invoice Notification

Dear [Client Name],

We are writing to inform you that Invoice #[Invoice Number], dated [Invoice Date], with an amount of [Amount] remains unpaid. According to our records, the payment was due on [Due Date].

Please remit payment at your earliest convenience to avoid any late fees or disruption of services. If you have already sent the payment, kindly disregard this notice.

Sincerely,

[Your Name]

[Company Name]

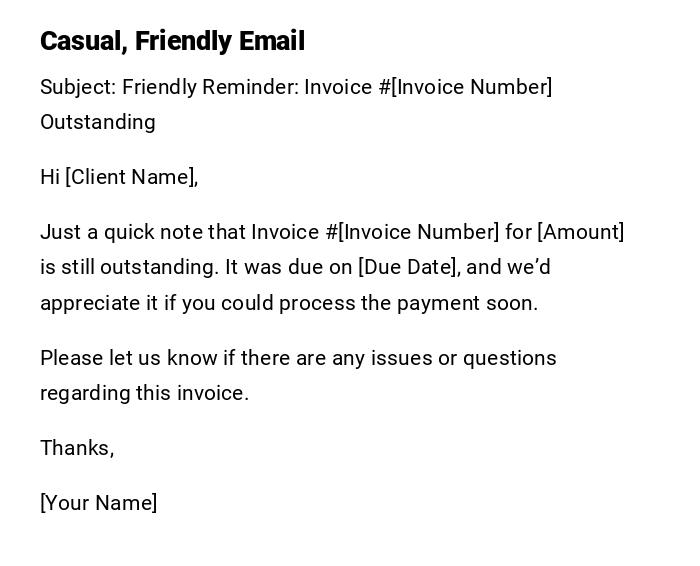

Casual Reminder Email for Overdue Payment

Subject: Friendly Reminder: Invoice #[Invoice Number] Outstanding

Hi [Client Name],

Just a quick note that Invoice #[Invoice Number] for [Amount] is still outstanding. It was due on [Due Date], and we’d appreciate it if you could process the payment soon.

Please let us know if there are any issues or questions regarding this invoice.

Thanks,

[Your Name]

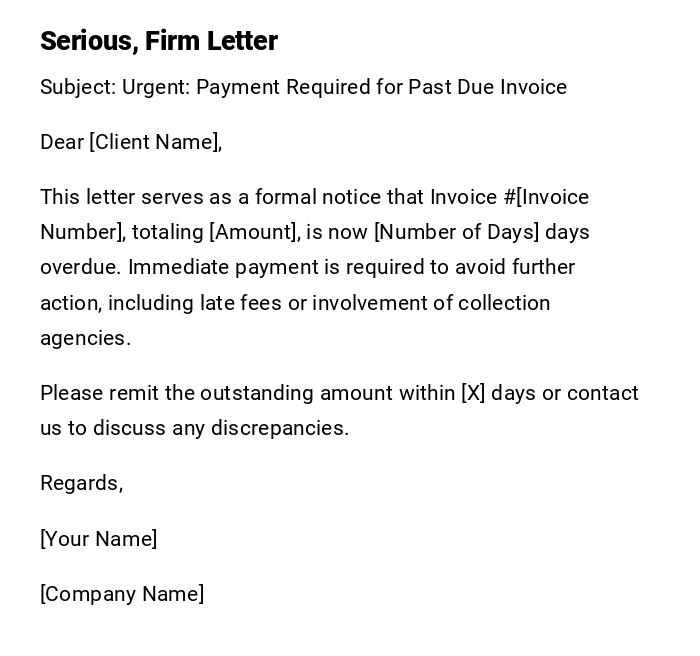

Serious Collection Letter for Long-Overdue Invoice

Subject: Urgent: Payment Required for Past Due Invoice

Dear [Client Name],

This letter serves as a formal notice that Invoice #[Invoice Number], totaling [Amount], is now [Number of Days] days overdue. Immediate payment is required to avoid further action, including late fees or involvement of collection agencies.

Please remit the outstanding amount within [X] days or contact us to discuss any discrepancies.

Regards,

[Your Name]

[Company Name]

Preliminary Collection Email for Overdue Invoice

Subject: Payment Reminder for Invoice #[Invoice Number]

Dear [Client Name],

We noticed that Invoice #[Invoice Number] for [Amount] is past due as of [Due Date]. We would like to preliminarily remind you to settle this invoice or contact us to arrange payment.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

Heartfelt Collection Letter Requesting Payment

Subject: Gentle Reminder: Past Due Invoice

Dear [Client Name],

We value our business relationship and are reaching out regarding Invoice #[Invoice Number] amounting to [Amount], which remains unpaid since [Due Date]. We understand that oversights happen and kindly request your prompt attention to this payment.

We appreciate your cooperation and look forward to continuing our partnership.

Sincerely,

[Your Name]

[Company Name]

What is a Collection Letter for Past Due Invoices and Why It Is Needed

A collection letter for past due invoices is a formal communication sent to a client or customer requesting payment for outstanding amounts.

Purposes include:

- Reminding the client of overdue payments

- Maintaining business cash flow and financial stability

- Documenting communication for legal or accounting purposes

- Preserving professional relationships while enforcing payment obligations

Who Should Send a Collection Letter for Past Due Invoices

- Accounts receivable personnel

- Business owners or managers responsible for billing

- Finance or accounting departments

- Legal representatives in cases of long overdue amounts

Whom Should Receive the Collection Letter

- The client or customer responsible for payment

- Accounts payable contact at the client organization

- Secondary contacts if previous reminders were ignored

- Legal or financial departments if escalation is required

When to Send a Collection Letter

- Shortly after the invoice due date has passed

- When a payment reminder or initial notice has not been heeded

- Before taking further action such as involving a collection agency or legal steps

- As a preliminary, intermediate, or final notice depending on the overdue duration

How to Write and Send a Collection Letter for Past Due Invoices

- Begin with a clear subject line including invoice number and past due status

- Address the client professionally

- Specify the invoice amount, due date, and number of days overdue

- Request payment politely but firmly

- Offer payment options or request contact if there are issues

- Close respectfully and provide contact information

- Send via email for speed or print for formal documentation

Requirements and Prerequisites Before Sending

- Verify the invoice details (number, amount, due date)

- Confirm payment has not been received

- Keep records of previous reminders or communications

- Ensure the client contact information is correct

- Determine the tone appropriate for the overdue duration

Formatting Guidelines for Collection Letters

- Length: One page maximum

- Tone: Polite for initial reminders, firm or serious for long overdue amounts

- Style: Professional and factual, avoiding emotional language

- Mode: Email for quick reminders, printed letter for formal or legal documentation

- Wording: Clear, concise, and specific about payment and consequences

Common Mistakes to Avoid

- Sending letters with incorrect invoice details

- Using overly aggressive or accusatory language initially

- Neglecting to include contact details or payment instructions

- Failing to document communications for records

- Ignoring escalation procedures for long overdue invoices

Elements and Structure of a Collection Letter

- Subject line clearly identifying the overdue invoice

- Salutation addressing the client by name

- Reference to invoice number, date, and amount

- Reminder of due date and overdue status

- Request for payment and deadline for response

- Optional mention of consequences if payment is not received

- Polite closing with contact information

- Attachments such as invoice copy if necessary

Tips and Best Practices for Collection Letters

- Start with a polite reminder for initial overdue invoices

- Escalate tone progressively for long overdue payments

- Maintain professionalism to preserve business relationships

- Include clear payment instructions and contact information

- Keep records of all communications for accountability

- Customize messages to reflect client relationship and history

Frequently Asked Questions (FAQ)

Q: Can I send a collection letter via email?

A: Yes, email is widely accepted and allows for quicker response.

Q: How many reminders should I send before escalation?

A: Typically, send 2-3 reminders; escalation is recommended after continued non-payment.

Q: Should I attach the invoice?

A: Yes, attaching the invoice ensures clarity and reduces confusion.

Q: Is it appropriate to mention legal action?

A: Only in serious overdue situations or final notices, to maintain professionalism.

After Sending / Follow-up Actions

- Confirm receipt of the letter if possible

- Track whether payment has been made

- Send follow-up reminders based on escalation policy

- Contact client to resolve disputes or issues promptly

- Escalate to collection agency or legal steps if necessary

Compare and Contrast with Other Collection Methods

- Phone Calls: Immediate but less documented

- Email Reminders: Fast and trackable; professional for initial notices

- Printed Letters: Formal and legally recognizable; ideal for escalation

- Collection Agency or Legal Action: Final step; should follow documented communications

Download Word Doc

Download Word Doc

Download PDF

Download PDF