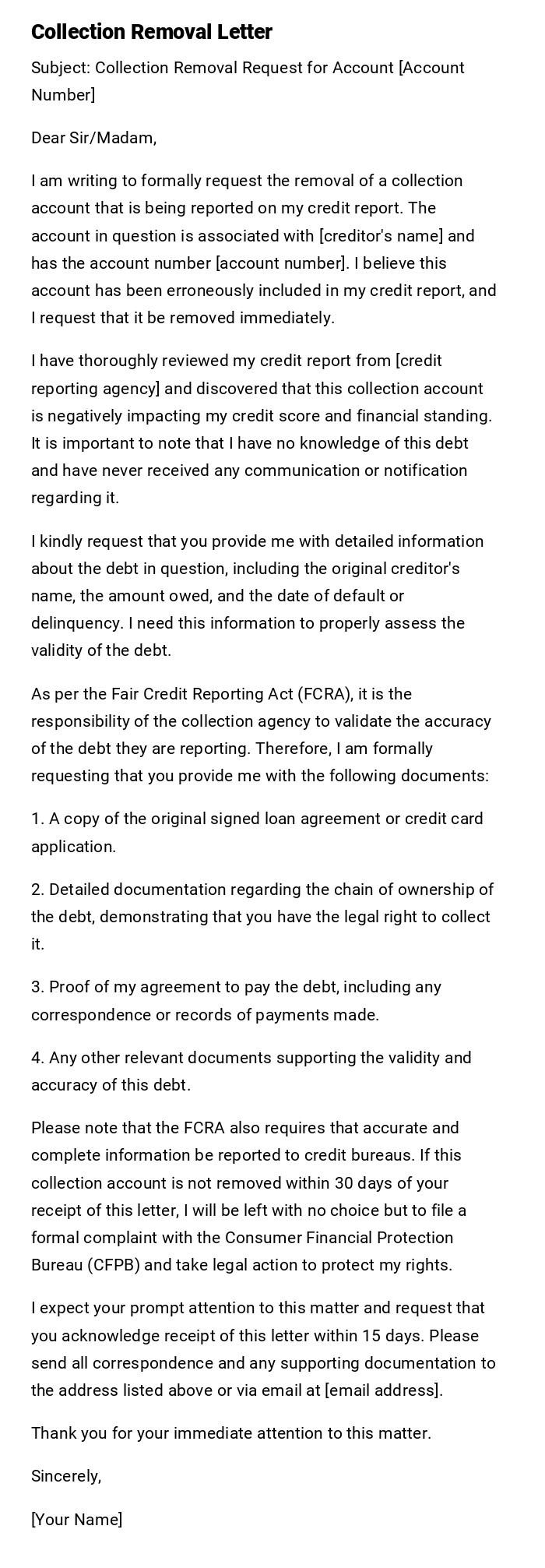

Collection Removal Letter

Subject: Collection Removal Request for Account [Account Number]

Dear Sir/Madam,

I am writing to formally request the removal of a collection account that is being reported on my credit report. The account in question is associated with [creditor's name] and has the account number [account number]. I believe this account has been erroneously included in my credit report, and I request that it be removed immediately.

I have thoroughly reviewed my credit report from [credit reporting agency] and discovered that this collection account is negatively impacting my credit score and financial standing. It is important to note that I have no knowledge of this debt and have never received any communication or notification regarding it.

I kindly request that you provide me with detailed information about the debt in question, including the original creditor's name, the amount owed, and the date of default or delinquency. I need this information to properly assess the validity of the debt.

As per the Fair Credit Reporting Act (FCRA), it is the responsibility of the collection agency to validate the accuracy of the debt they are reporting. Therefore, I am formally requesting that you provide me with the following documents:

1. A copy of the original signed loan agreement or credit card application.

2. Detailed documentation regarding the chain of ownership of the debt, demonstrating that you have the legal right to collect it.

3. Proof of my agreement to pay the debt, including any correspondence or records of payments made.

4. Any other relevant documents supporting the validity and accuracy of this debt.

Please note that the FCRA also requires that accurate and complete information be reported to credit bureaus. If this collection account is not removed within 30 days of your receipt of this letter, I will be left with no choice but to file a formal complaint with the Consumer Financial Protection Bureau (CFPB) and take legal action to protect my rights.

I expect your prompt attention to this matter and request that you acknowledge receipt of this letter within 15 days. Please send all correspondence and any supporting documentation to the address listed above or via email at [email address].

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

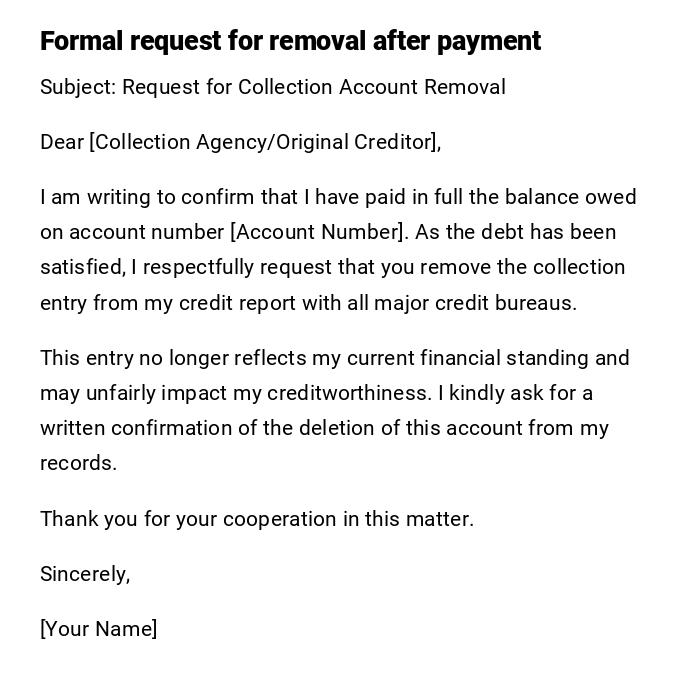

Formal Collection Removal Letter (Paid in Full)

Subject: Request for Collection Account Removal

Dear [Collection Agency/Original Creditor],

I am writing to confirm that I have paid in full the balance owed on account number [Account Number]. As the debt has been satisfied, I respectfully request that you remove the collection entry from my credit report with all major credit bureaus.

This entry no longer reflects my current financial standing and may unfairly impact my creditworthiness. I kindly ask for a written confirmation of the deletion of this account from my records.

Thank you for your cooperation in this matter.

Sincerely,

[Your Name]

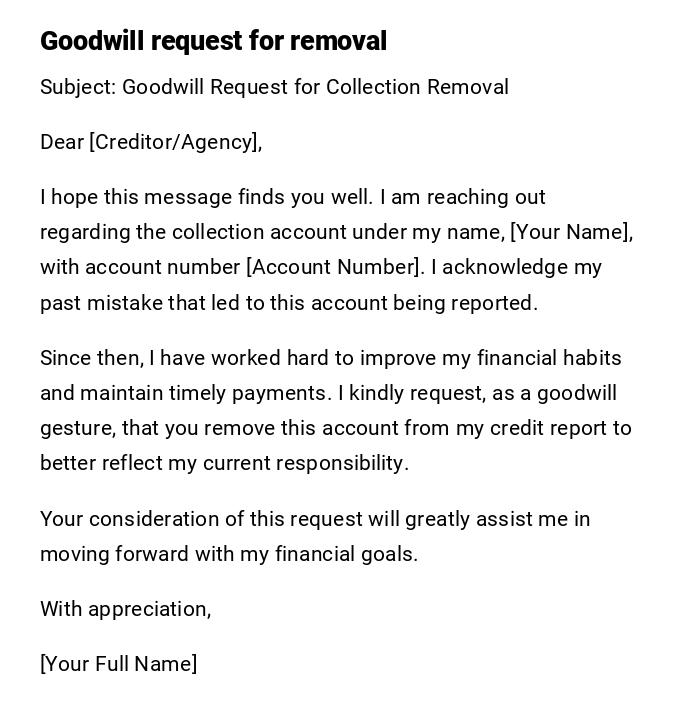

Goodwill Collection Removal Letter

Subject: Goodwill Request for Collection Removal

Dear [Creditor/Agency],

I hope this message finds you well. I am reaching out regarding the collection account under my name, [Your Name], with account number [Account Number]. I acknowledge my past mistake that led to this account being reported.

Since then, I have worked hard to improve my financial habits and maintain timely payments. I kindly request, as a goodwill gesture, that you remove this account from my credit report to better reflect my current responsibility.

Your consideration of this request will greatly assist me in moving forward with my financial goals.

With appreciation,

[Your Full Name]

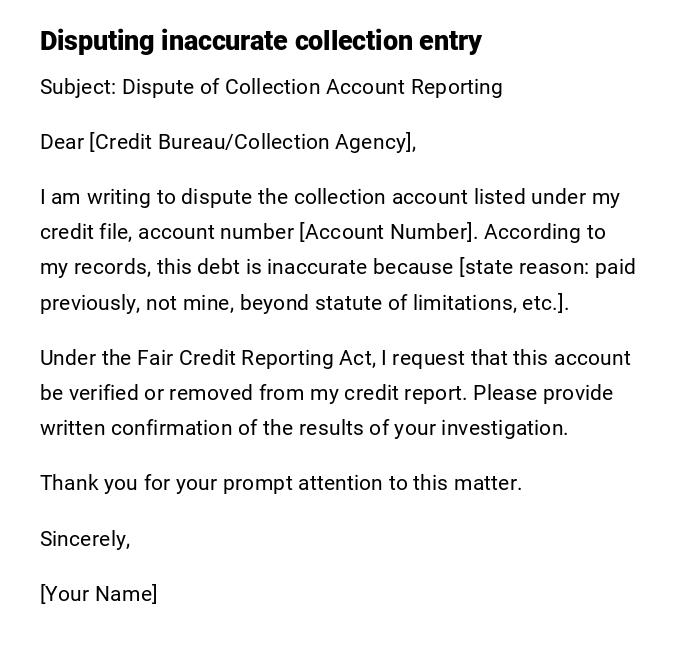

Dispute Collection Removal Letter

Subject: Dispute of Collection Account Reporting

Dear [Credit Bureau/Collection Agency],

I am writing to dispute the collection account listed under my credit file, account number [Account Number]. According to my records, this debt is inaccurate because [state reason: paid previously, not mine, beyond statute of limitations, etc.].

Under the Fair Credit Reporting Act, I request that this account be verified or removed from my credit report. Please provide written confirmation of the results of your investigation.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

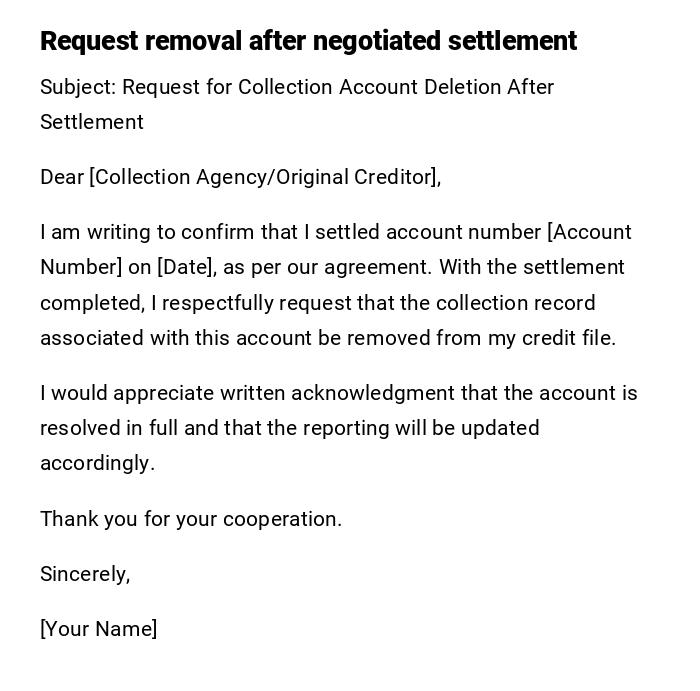

Collection Removal Letter After Settlement

Subject: Request for Collection Account Deletion After Settlement

Dear [Collection Agency/Original Creditor],

I am writing to confirm that I settled account number [Account Number] on [Date], as per our agreement. With the settlement completed, I respectfully request that the collection record associated with this account be removed from my credit file.

I would appreciate written acknowledgment that the account is resolved in full and that the reporting will be updated accordingly.

Thank you for your cooperation.

Sincerely,

[Your Name]

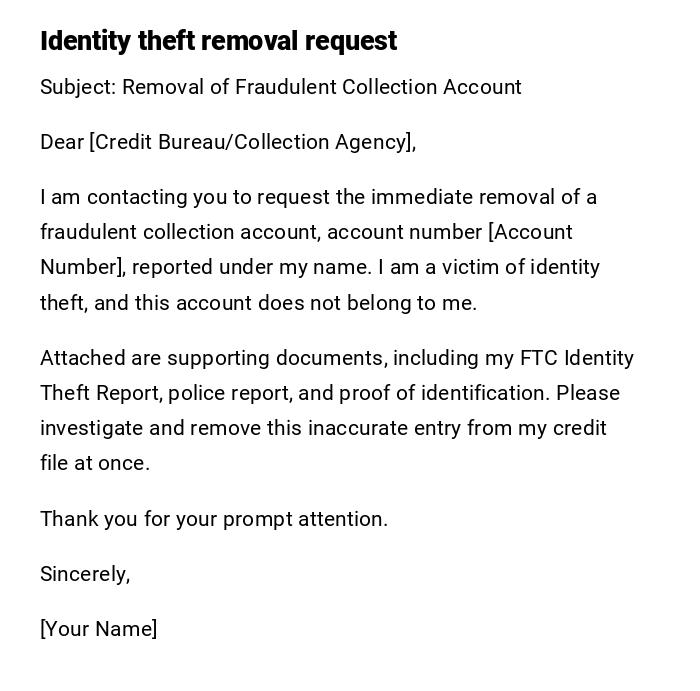

Collection Removal Letter for Identity Theft

Subject: Removal of Fraudulent Collection Account

Dear [Credit Bureau/Collection Agency],

I am contacting you to request the immediate removal of a fraudulent collection account, account number [Account Number], reported under my name. I am a victim of identity theft, and this account does not belong to me.

Attached are supporting documents, including my FTC Identity Theft Report, police report, and proof of identification. Please investigate and remove this inaccurate entry from my credit file at once.

Thank you for your prompt attention.

Sincerely,

[Your Name]

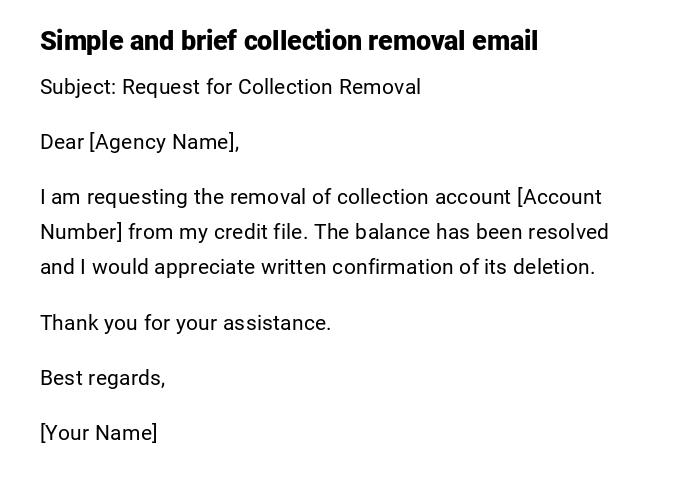

Quick Collection Removal Email

Subject: Request for Collection Removal

Dear [Agency Name],

I am requesting the removal of collection account [Account Number] from my credit file. The balance has been resolved and I would appreciate written confirmation of its deletion.

Thank you for your assistance.

Best regards,

[Your Name]

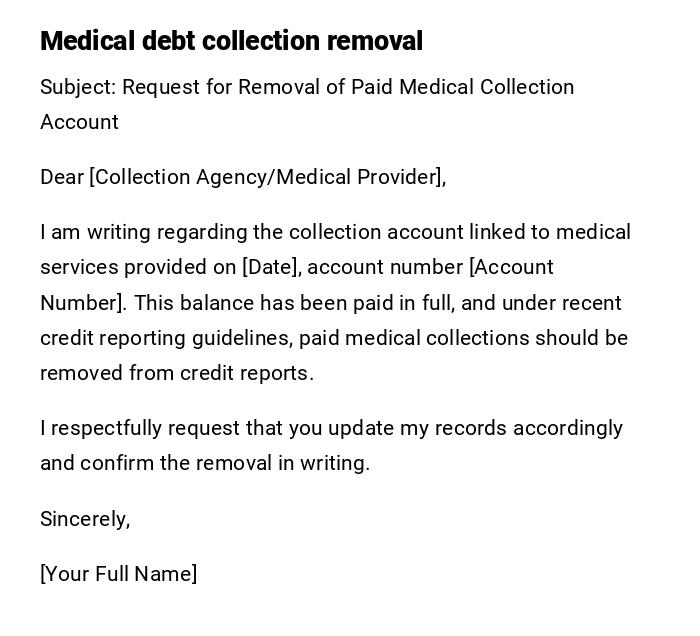

Collection Removal Letter (Medical Debt)

Subject: Request for Removal of Paid Medical Collection Account

Dear [Collection Agency/Medical Provider],

I am writing regarding the collection account linked to medical services provided on [Date], account number [Account Number]. This balance has been paid in full, and under recent credit reporting guidelines, paid medical collections should be removed from credit reports.

I respectfully request that you update my records accordingly and confirm the removal in writing.

Sincerely,

[Your Full Name]

Collection Removal Letter After Error Confirmation

Subject: Removal of Incorrect Collection Account

Dear [Collection Agency],

Thank you for confirming that the collection account under my name, account number [Account Number], was reported in error. I appreciate your acknowledgment and now kindly request that you update all major credit bureaus to delete this entry from my file.

Please provide a written confirmation once the correction has been made.

Sincerely,

[Your Name]

What is a collection removal letter and why do you need one

A collection removal letter is a written request to a creditor, collection agency, or credit bureau to delete a collection account from your credit report.

You need this type of letter because unpaid or resolved collections can significantly damage your credit score, making it harder to get loans, housing, or favorable interest rates.

The letter ensures there is a formal request and record of communication that can be used in follow-ups or disputes.

Who should write a collection removal letter

- Individuals who have paid or settled a collection account

- Victims of identity theft with fraudulent collections

- Borrowers disputing inaccurate credit report entries

- Consumers seeking goodwill removal after establishing good payment history

To whom should you address a collection removal letter

- The collection agency currently reporting the debt

- The original creditor if they still manage reporting

- The major credit bureaus (Experian, Equifax, TransUnion) for disputes

- Healthcare providers or medical collection services for medical debts

When should you send a collection removal letter

- After paying off a collection in full

- When a debt has been settled for less than the original balance

- If a collection was reported by mistake

- When requesting goodwill removal for a one-time lapse

- Immediately after confirming identity theft or fraud

How to write and send a collection removal letter

- Begin with a clear subject line requesting removal.

- Identify the account number and creditor/agency.

- State the reason for requesting removal (paid, settled, inaccurate, fraud, etc.).

- Attach supporting documents (receipts, reports, ID).

- Keep the tone polite but firm.

- Send via certified mail for proof of delivery, or secure email if accepted.

Requirements and prerequisites before sending a collection removal letter

- Verify account details and confirm balance status

- Obtain proof of payment, settlement, or fraud documentation

- Review Fair Credit Reporting Act (FCRA) rights

- Check whether recent credit reporting rules apply (e.g., medical debt policies)

- Prepare multiple copies of documents for bureaus, agencies, and personal records

Formatting guidelines for collection removal letters

- Keep the letter to one page when possible

- Use professional and respectful tone

- Clearly list account numbers and dates

- Attach documentation in an organized way

- Prefer printed letters with certified mail for disputes

- Use email only for goodwill or informal requests

After sending a collection removal letter – next steps

- Wait for acknowledgment from the agency or bureau

- Track the 30-day investigation window under FCRA rules

- Monitor credit reports for updates

- Follow up if no response is received

- Keep all written communication for future reference

Common mistakes to avoid in collection removal letters

- Not including account numbers or sufficient details

- Using an aggressive or hostile tone

- Sending without proof of payment or supporting documents

- Relying only on phone calls without written backup

- Forgetting to keep copies for personal records

Elements and structure of a collection removal letter

- Subject line clearly stating purpose

- Introduction identifying the account in question

- Explanation of payment, settlement, or dispute reason

- Request for removal or correction

- Supporting documents (receipts, ID, reports)

- Closing statement requesting confirmation in writing

Pros and cons of sending a collection removal letter

Pros

- May improve credit score significantly if successful

- Provides official written record of resolution

- Demonstrates proactive financial responsibility

Cons

- Not guaranteed to result in removal

- May take weeks for bureaus or agencies to respond

- Requires paperwork and follow-up efforts

Tips and tricks for successful collection removal letters

- Always be polite and professional, even if disputing errors

- Send via certified mail to track delivery

- Keep copies of every document and letter

- Be specific in your request, avoid vague language

- Follow up consistently until the record is corrected

Comparison with similar types of letters

- Collection removal vs. debt validation letter: Validation letters request proof of debt ownership, removal letters request deletion after resolution.

- Collection removal vs. pay-for-delete agreement: Pay-for-delete is negotiated before payment, while removal letters are typically after payment or dispute.

- Collection removal vs. credit dispute: Disputes challenge accuracy; removal letters may also appeal to goodwill or policy changes.

Download Word Doc

Download Word Doc

Download PDF

Download PDF