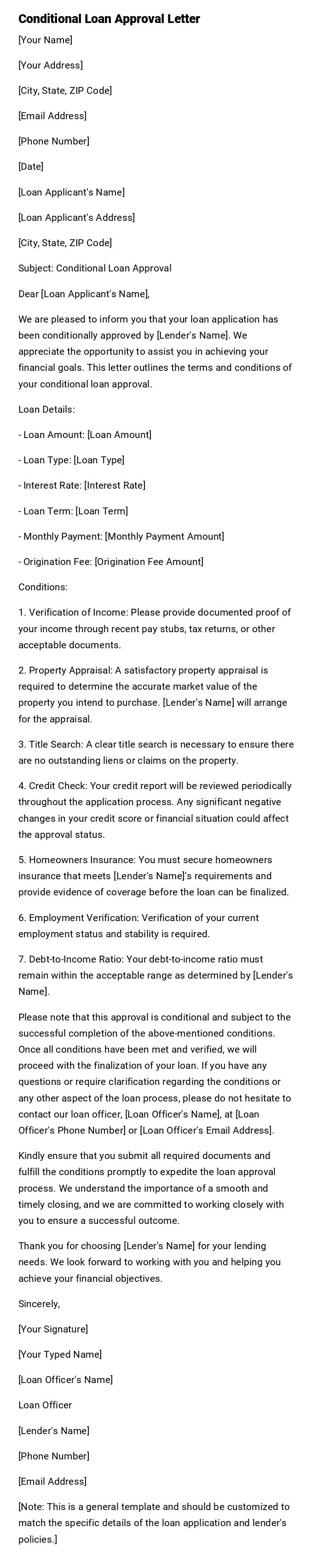

Conditional Loan Approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Loan Applicant's Name]

[Loan Applicant's Address]

[City, State, ZIP Code]

Subject: Conditional Loan Approval

Dear [Loan Applicant's Name],

We are pleased to inform you that your loan application has been conditionally approved by [Lender's Name]. We appreciate the opportunity to assist you in achieving your financial goals. This letter outlines the terms and conditions of your conditional loan approval.

Loan Details:

- Loan Amount: [Loan Amount]

- Loan Type: [Loan Type]

- Interest Rate: [Interest Rate]

- Loan Term: [Loan Term]

- Monthly Payment: [Monthly Payment Amount]

- Origination Fee: [Origination Fee Amount]

Conditions:

1. Verification of Income: Please provide documented proof of your income through recent pay stubs, tax returns, or other acceptable documents.

2. Property Appraisal: A satisfactory property appraisal is required to determine the accurate market value of the property you intend to purchase. [Lender's Name] will arrange for the appraisal.

3. Title Search: A clear title search is necessary to ensure there are no outstanding liens or claims on the property.

4. Credit Check: Your credit report will be reviewed periodically throughout the application process. Any significant negative changes in your credit score or financial situation could affect the approval status.

5. Homeowners Insurance: You must secure homeowners insurance that meets [Lender's Name]'s requirements and provide evidence of coverage before the loan can be finalized.

6. Employment Verification: Verification of your current employment status and stability is required.

7. Debt-to-Income Ratio: Your debt-to-income ratio must remain within the acceptable range as determined by [Lender's Name].

Please note that this approval is conditional and subject to the successful completion of the above-mentioned conditions. Once all conditions have been met and verified, we will proceed with the finalization of your loan. If you have any questions or require clarification regarding the conditions or any other aspect of the loan process, please do not hesitate to contact our loan officer, [Loan Officer's Name], at [Loan Officer's Phone Number] or [Loan Officer's Email Address].

Kindly ensure that you submit all required documents and fulfill the conditions promptly to expedite the loan approval process. We understand the importance of a smooth and timely closing, and we are committed to working closely with you to ensure a successful outcome.

Thank you for choosing [Lender's Name] for your lending needs. We look forward to working with you and helping you achieve your financial objectives.

Sincerely,

[Your Signature]

[Your Typed Name]

[Loan Officer's Name]

Loan Officer

[Lender's Name]

[Phone Number]

[Email Address]

[Note: This is a general template and should be customized to match the specific details of the loan application and lender's policies.]

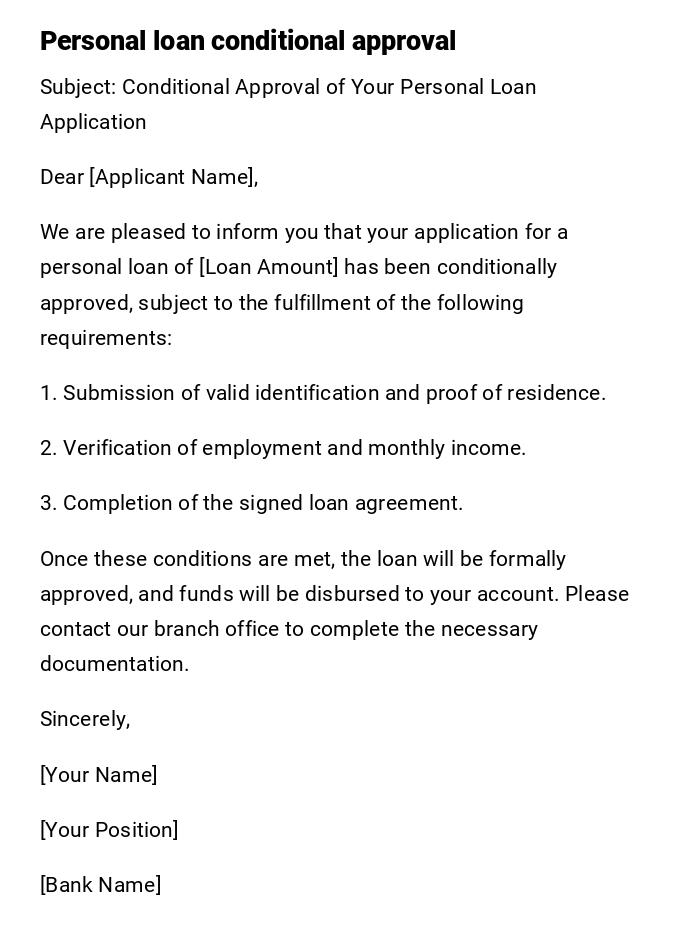

Conditional Loan Approval Letter for Personal Loan

Subject: Conditional Approval of Your Personal Loan Application

Dear [Applicant Name],

We are pleased to inform you that your application for a personal loan of [Loan Amount] has been conditionally approved, subject to the fulfillment of the following requirements:

1. Submission of valid identification and proof of residence.

2. Verification of employment and monthly income.

3. Completion of the signed loan agreement.

Once these conditions are met, the loan will be formally approved, and funds will be disbursed to your account. Please contact our branch office to complete the necessary documentation.

Sincerely,

[Your Name]

[Your Position]

[Bank Name]

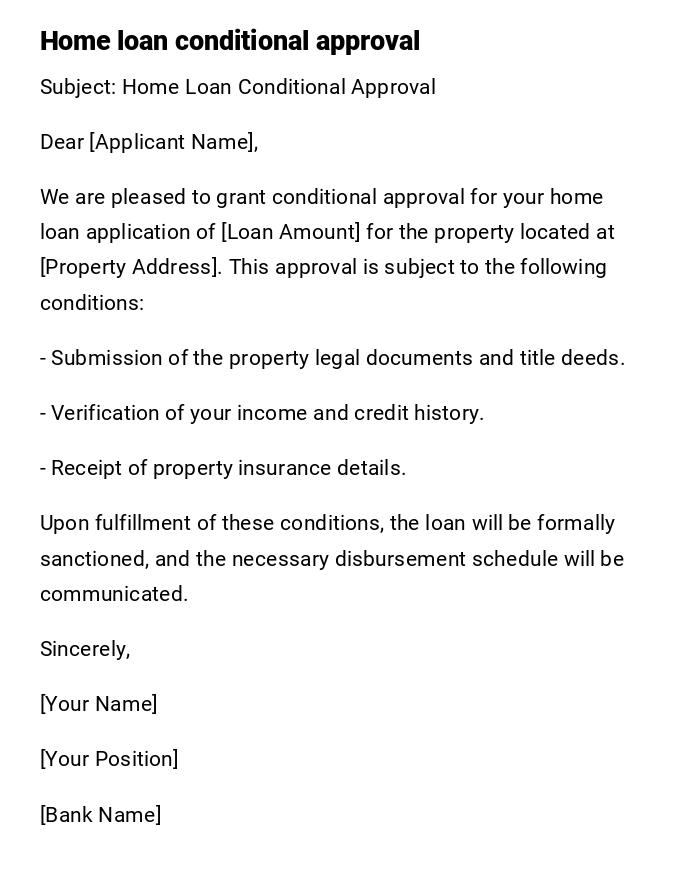

Conditional Loan Approval Letter for Home Loan

Subject: Home Loan Conditional Approval

Dear [Applicant Name],

We are pleased to grant conditional approval for your home loan application of [Loan Amount] for the property located at [Property Address]. This approval is subject to the following conditions:

- Submission of the property legal documents and title deeds.

- Verification of your income and credit history.

- Receipt of property insurance details.

Upon fulfillment of these conditions, the loan will be formally sanctioned, and the necessary disbursement schedule will be communicated.

Sincerely,

[Your Name]

[Your Position]

[Bank Name]

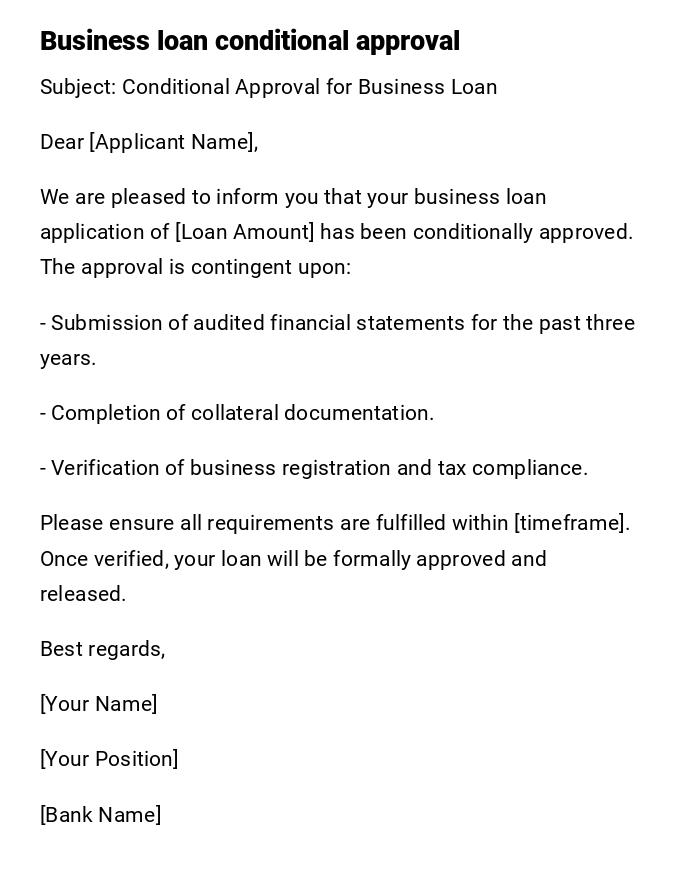

Conditional Loan Approval for Business Loan

Subject: Conditional Approval for Business Loan

Dear [Applicant Name],

We are pleased to inform you that your business loan application of [Loan Amount] has been conditionally approved. The approval is contingent upon:

- Submission of audited financial statements for the past three years.

- Completion of collateral documentation.

- Verification of business registration and tax compliance.

Please ensure all requirements are fulfilled within [timeframe]. Once verified, your loan will be formally approved and released.

Best regards,

[Your Name]

[Your Position]

[Bank Name]

Conditional Loan Approval for Car Loan

Subject: Conditional Approval of Your Car Loan

Dear [Applicant Name],

Congratulations! Your car loan application for [Car Model] has been conditionally approved for [Loan Amount]. Approval is subject to:

- Submission of the vehicle invoice and registration details.

- Verification of your employment and income.

- Completion of the loan agreement.

Upon meeting these conditions, your loan will be formally approved, and funds will be arranged for vehicle purchase.

Sincerely,

[Your Name]

[Your Position]

[Bank Name]

Quick Conditional Loan Approval Email

Subject: Conditional Approval of Your Loan Application

Hi [Applicant Name],

Good news! Your loan request for [Loan Amount] has been conditionally approved. Before we release funds, please provide:

1. Identity and address proof.

2. Income verification.

3. Signed loan agreement.

Once we receive these, your loan will be finalized. Feel free to reach out for any clarifications.

Regards,

[Your Name]

[Bank Name]

What / Why: Purpose of a Conditional Loan Approval Letter

- Confirms preliminary approval of a loan while listing necessary conditions.

- Protects the lender by ensuring all required documents and verifications are completed.

- Guides the borrower on steps needed for full loan approval.

- Provides an official communication record for both parties.

Who Should Send a Conditional Loan Approval Letter

- Bank loan officers or branch managers.

- Credit department representatives authorized to approve loans.

- Financial institutions or lenders with authority to issue conditional approvals.

Whom the Letter Should Be Addressed To

- Individual borrowers for personal, home, or car loans.

- Business entities for commercial or business loans.

- Joint applicants if applicable.

When to Send a Conditional Loan Approval Letter

- After initial review of a loan application.

- Upon verification of basic eligibility criteria.

- Before the final disbursement of funds.

- When additional documentation or checks are required.

How to Write and Send the Letter

- Begin with a subject clearly stating conditional approval.

- Address the applicant by name.

- Outline loan amount and type.

- List all conditions explicitly (e.g., document submission, verification, collateral).

- Provide instructions for next steps and timeframe.

- End with formal closing and authorized signature.

- Send via email for quick communication or printed letter for official records.

Formatting Guidelines

- Length: 1 page or less, concise yet comprehensive.

- Tone: Professional, formal, and reassuring.

- Structure:

- Subject line

- Salutation

- Conditional approval statement

- List of conditions

- Instructions for fulfillment

- Closing and signature

- Attach relevant forms or checklists if needed.

Requirements and Prerequisites

- Completed loan application form.

- Preliminary credit assessment or score review.

- Basic verification of income, employment, or business credentials.

- Identification of collateral if applicable.

- Internal approvals for conditional sanction.

Tricks and Tips for Conditional Loan Letters

- Clearly separate conditions from general information for clarity.

- Use bullet points or numbered lists for conditions.

- Specify deadlines or timelines for fulfilling requirements.

- Maintain a courteous and encouraging tone to instill confidence in the borrower.

- Include contact information for assistance.

Common Mistakes to Avoid

- Ambiguous or incomplete list of conditions.

- Using informal tone in professional loan communications.

- Failing to specify deadlines or required documentation.

- Sending letter before initial approval checks are complete.

- Omitting signature of authorized personnel.

Elements and Structure of a Conditional Loan Approval Letter

- Subject line clearly indicating conditional approval.

- Applicant’s name and loan reference number.

- Loan amount, type, and purpose.

- Explicit list of conditions to be met.

- Instructions for next steps.

- Timeline or deadline for condition fulfillment.

- Authorized signature and designation.

- Contact details for inquiries.

After Sending / Follow-up Actions

- Confirm receipt of the letter by the applicant.

- Track submission of required documents or fulfillment of conditions.

- Perform final verification checks.

- Issue full loan approval letter once all conditions are met.

- Maintain records in the lending institution’s files.

Pros and Cons of Conditional Loan Approval Letters

Pros:

- Provides clarity and transparency for borrowers.

- Protects lender by outlining specific requirements.

- Encourages timely submission of necessary documents.

Cons:

- May create anxiety for borrowers if too many conditions are listed.

- Requires careful drafting to ensure no ambiguity.

Compare and Contrast: Conditional vs Full Loan Approval Letters

-

Conditional Approval:

- Lists conditions to be met.

- Funds not yet disbursed.

- Requires follow-up actions by borrower.

-

Full Approval:

- No conditions pending.

- Funds can be disbursed immediately.

- Official confirmation of loan sanction.

FAQ

Q: Can a conditional loan approval letter be sent digitally?

A: Yes, email is acceptable for speed, but official documents may require signatures.

Q: How long does a borrower have to meet the conditions?

A: Typically specified in the letter; usually ranges from 7–30 days depending on the institution.

Q: Are conditional approvals legally binding?

A: They indicate intent to lend subject to conditions but are not final until conditions are met and full approval is granted.

Q: Can multiple conditions be listed?

A: Yes, clearly enumerated for easy compliance.

Does it Require Attestation or Authorization

- Must be signed by an authorized bank officer or loan manager.

- Some institutions may require official stamp or letterhead for authenticity.

- No notarization is usually necessary unless requested by borrower or regulatory guidelines.

Download Word Doc

Download Word Doc

Download PDF

Download PDF