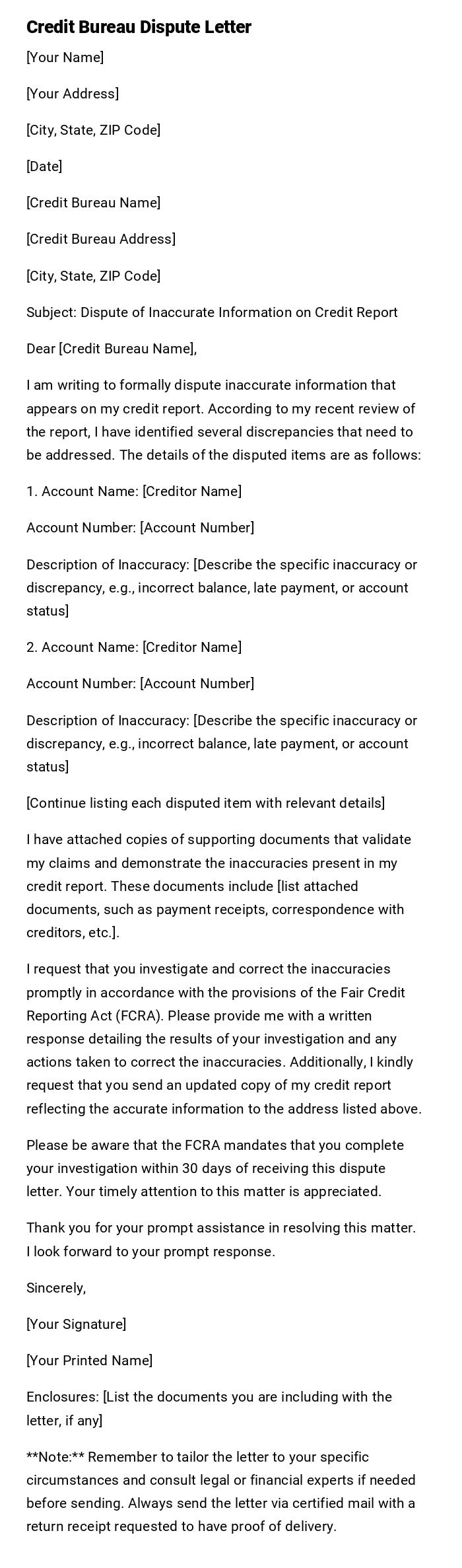

Credit Bureau Dispute Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, ZIP Code]

Subject: Dispute of Inaccurate Information on Credit Report

Dear [Credit Bureau Name],

I am writing to formally dispute inaccurate information that appears on my credit report. According to my recent review of the report, I have identified several discrepancies that need to be addressed. The details of the disputed items are as follows:

1. Account Name: [Creditor Name]

Account Number: [Account Number]

Description of Inaccuracy: [Describe the specific inaccuracy or discrepancy, e.g., incorrect balance, late payment, or account status]

2. Account Name: [Creditor Name]

Account Number: [Account Number]

Description of Inaccuracy: [Describe the specific inaccuracy or discrepancy, e.g., incorrect balance, late payment, or account status]

[Continue listing each disputed item with relevant details]

I have attached copies of supporting documents that validate my claims and demonstrate the inaccuracies present in my credit report. These documents include [list attached documents, such as payment receipts, correspondence with creditors, etc.].

I request that you investigate and correct the inaccuracies promptly in accordance with the provisions of the Fair Credit Reporting Act (FCRA). Please provide me with a written response detailing the results of your investigation and any actions taken to correct the inaccuracies. Additionally, I kindly request that you send an updated copy of my credit report reflecting the accurate information to the address listed above.

Please be aware that the FCRA mandates that you complete your investigation within 30 days of receiving this dispute letter. Your timely attention to this matter is appreciated.

Thank you for your prompt assistance in resolving this matter. I look forward to your prompt response.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosures: [List the documents you are including with the letter, if any]

**Note:** Remember to tailor the letter to your specific circumstances and consult legal or financial experts if needed before sending. Always send the letter via certified mail with a return receipt requested to have proof of delivery.

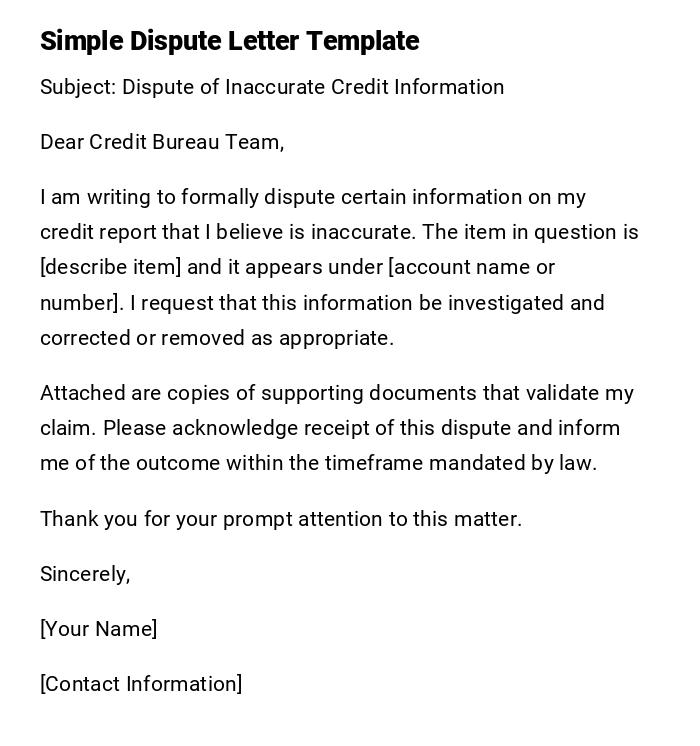

Simple Credit Bureau Dispute Letter

Subject: Dispute of Inaccurate Credit Information

Dear Credit Bureau Team,

I am writing to formally dispute certain information on my credit report that I believe is inaccurate. The item in question is [describe item] and it appears under [account name or number]. I request that this information be investigated and corrected or removed as appropriate.

Attached are copies of supporting documents that validate my claim. Please acknowledge receipt of this dispute and inform me of the outcome within the timeframe mandated by law.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Contact Information]

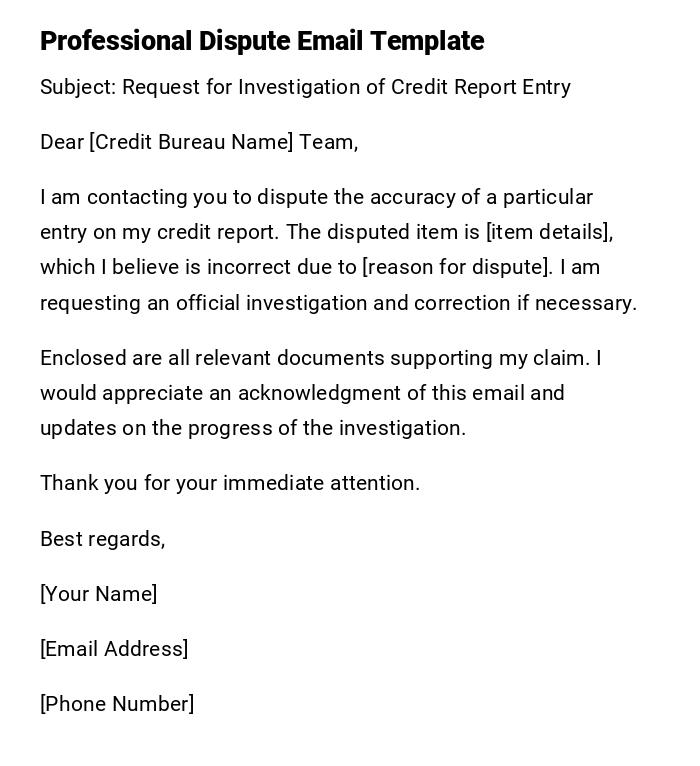

Professional Credit Dispute Email

Subject: Request for Investigation of Credit Report Entry

Dear [Credit Bureau Name] Team,

I am contacting you to dispute the accuracy of a particular entry on my credit report. The disputed item is [item details], which I believe is incorrect due to [reason for dispute]. I am requesting an official investigation and correction if necessary.

Enclosed are all relevant documents supporting my claim. I would appreciate an acknowledgment of this email and updates on the progress of the investigation.

Thank you for your immediate attention.

Best regards,

[Your Name]

[Email Address]

[Phone Number]

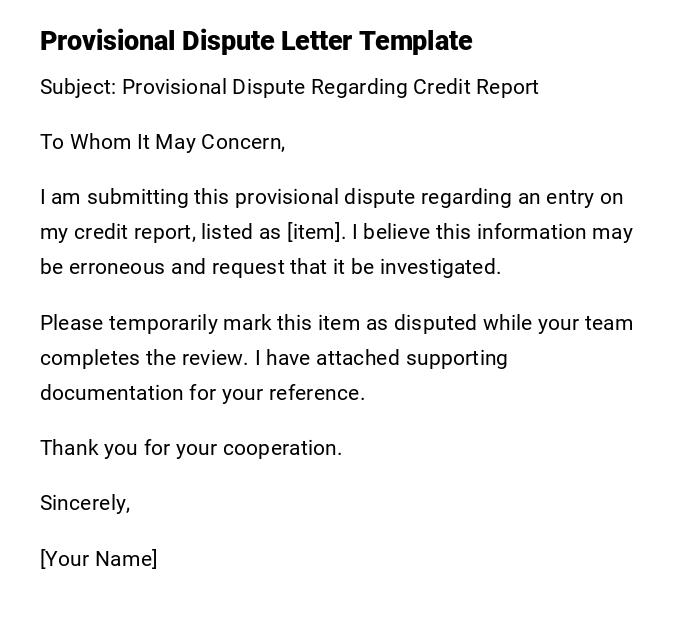

Provisional Dispute Letter

Subject: Provisional Dispute Regarding Credit Report

To Whom It May Concern,

I am submitting this provisional dispute regarding an entry on my credit report, listed as [item]. I believe this information may be erroneous and request that it be investigated.

Please temporarily mark this item as disputed while your team completes the review. I have attached supporting documentation for your reference.

Thank you for your cooperation.

Sincerely,

[Your Name]

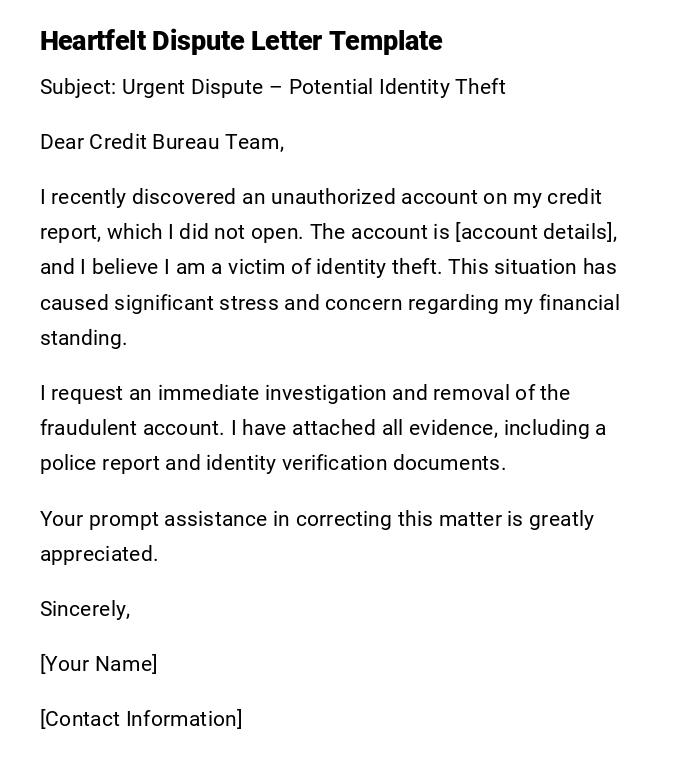

Heartfelt Dispute Letter for Identity Theft

Subject: Urgent Dispute – Potential Identity Theft

Dear Credit Bureau Team,

I recently discovered an unauthorized account on my credit report, which I did not open. The account is [account details], and I believe I am a victim of identity theft. This situation has caused significant stress and concern regarding my financial standing.

I request an immediate investigation and removal of the fraudulent account. I have attached all evidence, including a police report and identity verification documents.

Your prompt assistance in correcting this matter is greatly appreciated.

Sincerely,

[Your Name]

[Contact Information]

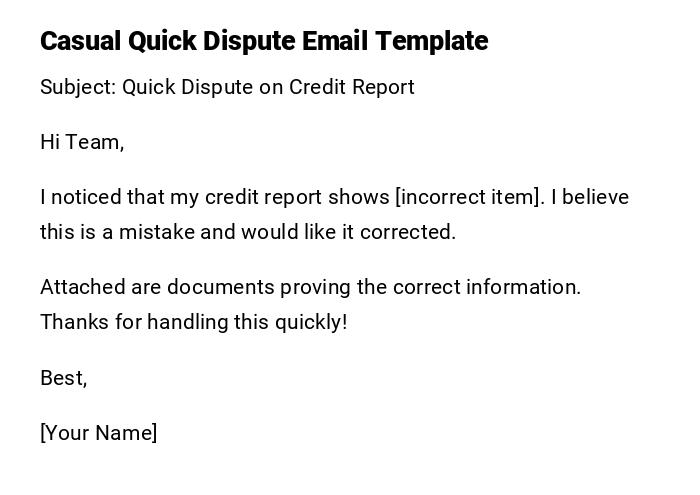

Casual Quick Dispute Email

Subject: Quick Dispute on Credit Report

Hi Team,

I noticed that my credit report shows [incorrect item]. I believe this is a mistake and would like it corrected.

Attached are documents proving the correct information. Thanks for handling this quickly!

Best,

[Your Name]

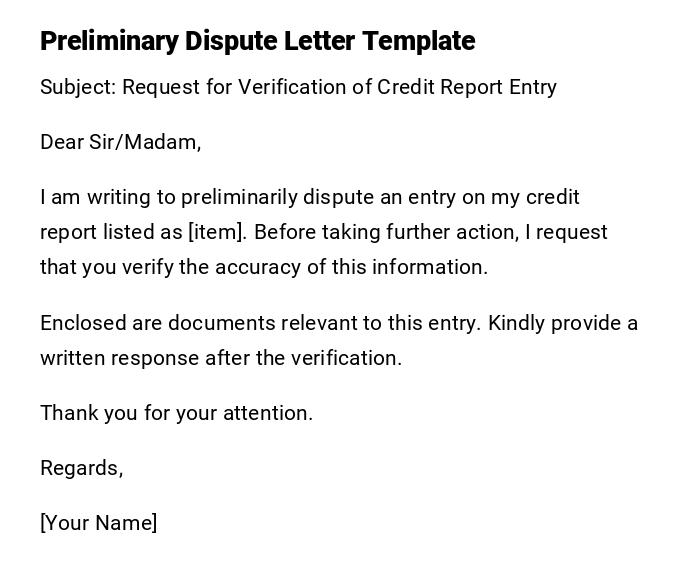

Preliminary Dispute Letter for Verification

Subject: Request for Verification of Credit Report Entry

Dear Sir/Madam,

I am writing to preliminarily dispute an entry on my credit report listed as [item]. Before taking further action, I request that you verify the accuracy of this information.

Enclosed are documents relevant to this entry. Kindly provide a written response after the verification.

Thank you for your attention.

Regards,

[Your Name]

What is a Credit Bureau Dispute Letter and Why You Need It

A credit bureau dispute letter is a formal communication sent to a credit reporting agency to challenge inaccurate or incomplete information on your credit report.

Reasons for sending this letter include:

- Correcting errors that negatively impact your credit score

- Removing outdated or unverifiable accounts

- Resolving fraudulent entries or identity theft issues

- Ensuring your financial record accurately reflects your creditworthiness

It is a legal right under the Fair Credit Reporting Act (FCRA) for consumers to dispute inaccurate information.

Who Should Send a Credit Bureau Dispute Letter

- Individuals who notice errors in their personal credit report

- Victims of identity theft or fraud

- Borrowers disputing account status or balances

- People applying for loans or mortgages and needing accurate reports

It must come from the person whose credit report is being disputed or an authorized representative with proper consent.

Whom to Address Your Dispute Letter To

- Primary recipient: The credit bureau reporting the inaccurate information (e.g., Experian, Equifax, TransUnion)

- Secondary recipient (optional): The creditor or financial institution that reported the disputed item

- Use the designated dispute department contact details for faster processing

- Emails should be sent to verified addresses; letters should be mailed via certified post.

When to Send a Credit Bureau Dispute Letter

- Upon receiving your credit report and noticing errors

- After identifying fraudulent or unauthorized accounts

- Following notices from lenders about incorrect balances or late payments

- After identity theft incidents or suspected data breaches

- If a creditor fails to update corrected information on your report

How to Write and Send a Credit Bureau Dispute Letter

- Gather your credit report and identify incorrect entries

- Clearly describe the item being disputed and why it is inaccurate

- Include supporting documents (receipts, statements, police reports, identity proof)

- Use a professional or formal tone depending on the situation

- Send via certified mail or secure email to ensure confirmation of receipt

- Keep copies of everything for your records

Requirements and Prerequisites Before Sending

- A recent copy of your credit report

- Identification documents to verify your identity

- Supporting documents for the disputed items

- Clear, concise explanation of the dispute

- Knowledge of the correct contact information for the credit bureau

- Understanding of your legal rights under the FCRA

Formatting Your Credit Bureau Dispute Letter

- Start with a clear subject line mentioning "Dispute"

- Keep the letter concise, ideally one page

- Maintain a professional tone unless informal email is appropriate

- Number disputed items if multiple

- Include your name, contact information, and relevant account details

- Attach copies of supporting documents, not originals

After Sending / Follow-up Actions

- Request acknowledgment of receipt from the credit bureau

- Monitor your credit report for updates or changes

- Follow up within 30–45 days if no response is received

- Keep all correspondence documented for future reference

- Notify creditors if necessary about ongoing dispute outcomes

Common Mistakes to Avoid in Credit Bureau Dispute Letters

- Sending vague or incomplete information

- Failing to include supporting documents

- Not specifying the exact item or account being disputed

- Using an unprofessional or overly casual tone when formal communication is required

- Not keeping copies of the letter and attachments

- Ignoring deadlines and legal timeframes for dispute responses

Elements and Structure of a Strong Credit Bureau Dispute Letter

- Subject line indicating dispute

- Clear greeting and opening

- Detailed description of the disputed item

- Explanation of why the information is incorrect

- List of supporting documents attached

- Polite closing requesting investigation and correction

- Sender’s full name and contact information

Tips and Best Practices for Effective Credit Dispute Letters

- Always send letters via traceable methods like certified mail

- Keep communication concise and factual

- Number and organize disputes if multiple issues exist

- Include all necessary documentation in a single package

- Follow up systematically until resolution is confirmed

- Use templates to maintain consistency, but personalize details for each dispute

Pros and Cons of Sending a Credit Bureau Dispute Letter

Pros:

- Correct inaccurate information and improve credit score

- Legal right to challenge errors

- Provides official documentation of disputes

Cons: - May take time for investigation and correction

- No guarantee that all disputes will be resolved in your favor

- Requires careful documentation and organization

Compare and Contrast: Credit Bureau Dispute Letter vs. Direct Creditor Contact

- Credit Bureau Letter: Official legal route, formally challenges inaccurate reporting, triggers investigation under FCRA

- Direct Creditor Contact: Can resolve issues faster if error originated with the creditor, but may not update the credit bureau immediately

- Often, combining both methods yields the fastest correction

- Dispute letters provide documented proof that may be used for legal or financial purposes

Download Word Doc

Download Word Doc

Download PDF

Download PDF