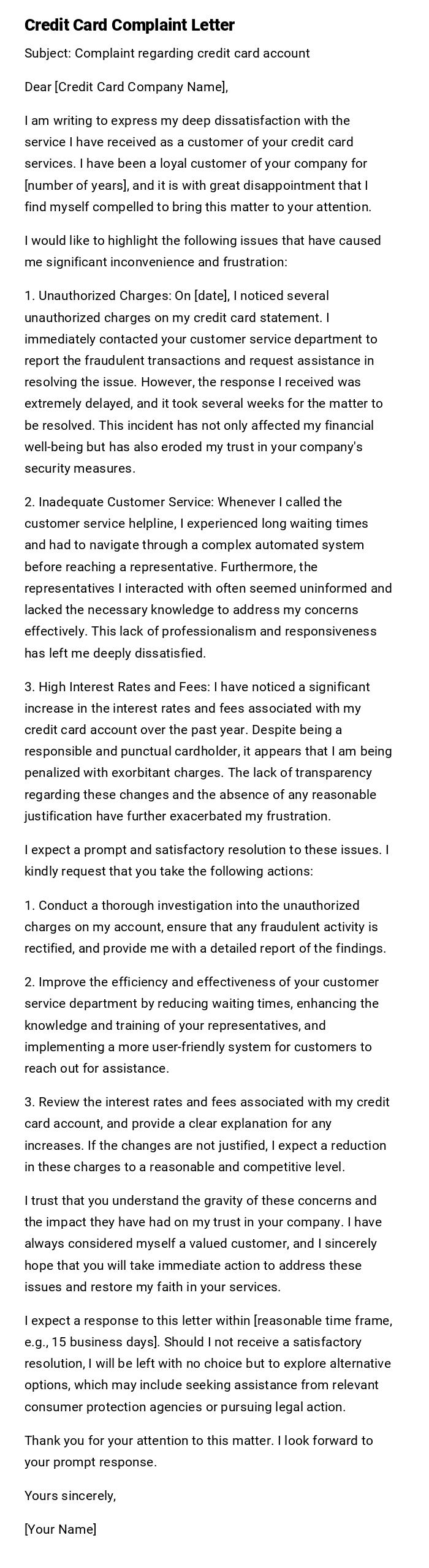

Credit Card Complaint Letter

Subject: Complaint regarding credit card account

Dear [Credit Card Company Name],

I am writing to express my deep dissatisfaction with the service I have received as a customer of your credit card services. I have been a loyal customer of your company for [number of years], and it is with great disappointment that I find myself compelled to bring this matter to your attention.

I would like to highlight the following issues that have caused me significant inconvenience and frustration:

1. Unauthorized Charges: On [date], I noticed several unauthorized charges on my credit card statement. I immediately contacted your customer service department to report the fraudulent transactions and request assistance in resolving the issue. However, the response I received was extremely delayed, and it took several weeks for the matter to be resolved. This incident has not only affected my financial well-being but has also eroded my trust in your company's security measures.

2. Inadequate Customer Service: Whenever I called the customer service helpline, I experienced long waiting times and had to navigate through a complex automated system before reaching a representative. Furthermore, the representatives I interacted with often seemed uninformed and lacked the necessary knowledge to address my concerns effectively. This lack of professionalism and responsiveness has left me deeply dissatisfied.

3. High Interest Rates and Fees: I have noticed a significant increase in the interest rates and fees associated with my credit card account over the past year. Despite being a responsible and punctual cardholder, it appears that I am being penalized with exorbitant charges. The lack of transparency regarding these changes and the absence of any reasonable justification have further exacerbated my frustration.

I expect a prompt and satisfactory resolution to these issues. I kindly request that you take the following actions:

1. Conduct a thorough investigation into the unauthorized charges on my account, ensure that any fraudulent activity is rectified, and provide me with a detailed report of the findings.

2. Improve the efficiency and effectiveness of your customer service department by reducing waiting times, enhancing the knowledge and training of your representatives, and implementing a more user-friendly system for customers to reach out for assistance.

3. Review the interest rates and fees associated with my credit card account, and provide a clear explanation for any increases. If the changes are not justified, I expect a reduction in these charges to a reasonable and competitive level.

I trust that you understand the gravity of these concerns and the impact they have had on my trust in your company. I have always considered myself a valued customer, and I sincerely hope that you will take immediate action to address these issues and restore my faith in your services.

I expect a response to this letter within [reasonable time frame, e.g., 15 business days]. Should I not receive a satisfactory resolution, I will be left with no choice but to explore alternative options, which may include seeking assistance from relevant consumer protection agencies or pursuing legal action.

Thank you for your attention to this matter. I look forward to your prompt response.

Yours sincerely,

[Your Name]

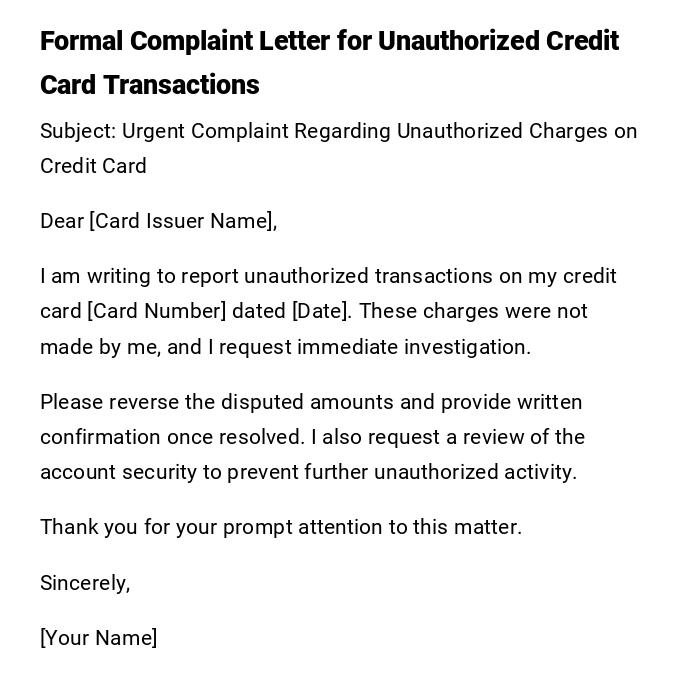

Formal Complaint Letter for Unauthorized Credit Card Transactions

Subject: Urgent Complaint Regarding Unauthorized Charges on Credit Card

Dear [Card Issuer Name],

I am writing to report unauthorized transactions on my credit card [Card Number] dated [Date]. These charges were not made by me, and I request immediate investigation.

Please reverse the disputed amounts and provide written confirmation once resolved. I also request a review of the account security to prevent further unauthorized activity.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Informal Credit Card Service Complaint Email

Hi [Credit Card Customer Service],

I am facing issues with my credit card [Card Number], including delayed billing and unresponsive customer support. This has caused inconvenience in managing my finances.

Kindly review my case and let me know how this can be resolved. Your prompt response will be appreciated.

Thanks,

[Your Name]

Serious Letter About Billing Discrepancies

Subject: Complaint Regarding Incorrect Billing on Credit Card

Dear [Card Issuer Name],

I have noticed discrepancies in my recent credit card statement for account [Card Number], dated [Date]. Some charges appear to be duplicated or incorrect.

I request a thorough review and correction of these errors and a written confirmation once resolved. Please respond promptly to avoid any negative impact on my credit record.

Sincerely,

[Your Name]

Heartfelt Complaint Letter About Poor Credit Card Support

Dear [Credit Card Department],

I am disappointed with the repeated issues and lack of proper response regarding my credit card [Card Number]. The ongoing problems have caused both stress and inconvenience.

I sincerely request immediate attention and resolution to prevent further difficulties. Your understanding and cooperation will be greatly appreciated.

Warm regards,

[Your Name]

Quick / Simple Complaint Message for Credit Card Issue

Hi [Bank Name],

There are errors on my credit card [Card Number] statement. Please correct them and confirm once done.

Thanks,

[Your Name]

Provisional Complaint Letter Regarding Credit Limit Dispute

Dear [Card Issuer Name],

I am writing to complain about an unexpected change in my credit limit on card [Card Number]. The adjustment was made without prior notice or explanation.

I request a review of this change and a provisional resolution until the issue is clarified. Please provide written confirmation once resolved.

Sincerely,

[Your Name]

What / Why You Might Need a Credit Card Complaint Letter

- To report unauthorized transactions or billing errors.

- To address delays, service issues, or unresponsive support.

- Provides a formal record to protect your rights and credit rating.

- Necessary when informal communication with the credit card issuer fails.

Who Should Send a Credit Card Complaint Letter

- Individual cardholders.

- Joint cardholders if the issue affects both parties.

- Business card account holders managing corporate expenses.

- Any cardholder encountering unresolved issues after initial support contact.

Whom the Letter Should Be Addressed To

- Credit card customer service department for general complaints.

- Branch manager for in-person disputes or escalations.

- Card dispute or fraud department for unauthorized charges.

- Regulatory or ombudsman authorities if issues remain unresolved.

When to Send a Credit Card Complaint Letter

- Immediately upon noticing unauthorized or incorrect charges.

- When statements are delayed, or billing errors persist.

- After repeated unsuccessful attempts to resolve the issue by phone or online.

- Prior to potential credit score impact due to unresolved issues.

How to Write and Send a Credit Card Complaint Letter

- Clearly state your credit card number, account details, and relevant dates.

- Describe the issue factually and chronologically.

- Specify the action you expect from the issuer (reversal, correction, clarification).

- Attach supporting documents such as statements or transaction proofs.

- Send via email for fast acknowledgment or via registered mail for official record.

- Keep copies for personal records and follow-up purposes.

Requirements and Prerequisites Before Writing

- Gather all relevant credit card statements and transaction details.

- Document previous interactions with customer service.

- Identify the expected resolution clearly.

- Ensure personal and account information is accurate.

- Keep copies of all supporting documentation.

Formatting Guidelines for Credit Card Complaint Letters

- Tone: Professional, firm, but polite.

- Length: One page is ideal; up to two pages if detailed evidence is included.

- Structure: Subject line, greeting, description of issue, request for action, closing.

- Attach evidence such as statements, receipts, and emails.

- Mode: Email for fast response, printed letter for formal complaints.

After Sending / Follow-up Actions

- Request acknowledgment of receipt from the credit card issuer.

- Track response times and deadlines given by the bank or issuer.

- Follow up if no response is received within the expected period.

- Escalate to higher authorities or regulatory bodies if resolution is delayed.

Pros and Cons of Sending a Credit Card Complaint Letter

Pros:

- Creates a formal record for dispute resolution.

- Increases chances of timely and accurate correction.

- Protects your credit score and rights.

Cons:

- May take time for resolution.

- Aggressive tone may affect cooperation.

- Some complaints may require escalation beyond the letter.

Tricks and Tips for Effective Credit Card Complaint Letters

- Be precise and include transaction details with dates.

- Reference previous communications or case numbers.

- Maintain a professional and factual tone.

- Specify the desired resolution clearly.

- Attach proof such as statements, emails, or receipts.

Common Mistakes to Avoid

- Being vague about the issue.

- Omitting important account or transaction details.

- Using emotional or aggressive language.

- Failing to specify the desired outcome.

- Not keeping a copy for personal records.

Elements and Structure of a Credit Card Complaint Letter

- Introduction: Clearly state the purpose of the complaint.

- Issue Description: Provide detailed explanation of the problem.

- Account Information: Include card number and relevant dates.

- Previous Communication: Mention prior attempts to resolve the issue.

- Requested Action: State the expected resolution clearly.

- Closing: Politely conclude with contact information.

- Attachments: Include statements, receipts, emails, or screenshots as evidence.

Compare and Contrast with Other Methods of Complaint

- Letter vs. Phone Call: Letter provides formal record; calls are quicker but less documented.

- Letter vs. Online Form: Online forms are convenient but limited in detail; letters allow comprehensive explanation.

- Letter vs. Social Media Complaint: Letters ensure privacy; social media may prompt quick attention but is public.

- Alternative: Use a combination of letter and follow-up call for maximum effectiveness.

Does It Require Attestation or Authorization

- Generally, a credit card complaint letter does not require notarization.

- Keep bank acknowledgment or reference numbers as proof of submission.

- Attach supporting documents to substantiate the complaint.

Download Word Doc

Download Word Doc

Download PDF

Download PDF