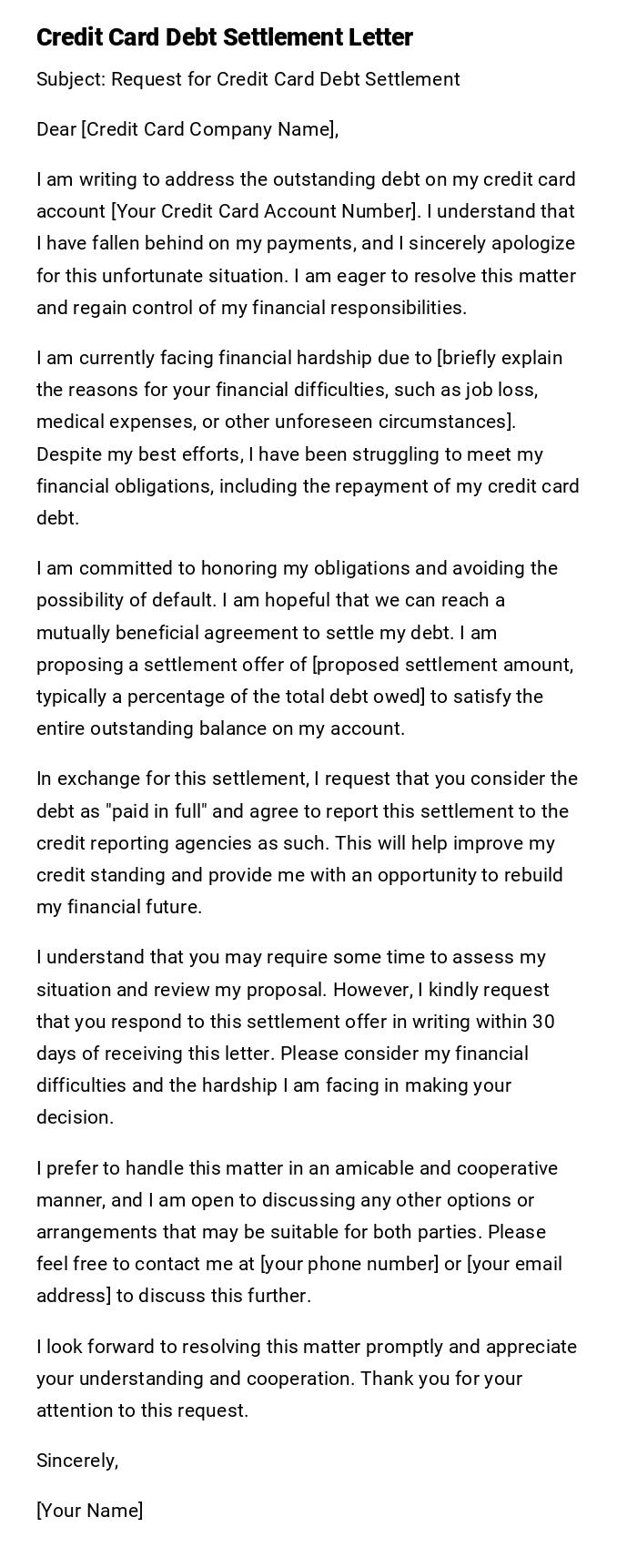

Credit Card Debt Settlement Letter

Subject: Request for Credit Card Debt Settlement

Dear [Credit Card Company Name],

I am writing to address the outstanding debt on my credit card account [Your Credit Card Account Number]. I understand that I have fallen behind on my payments, and I sincerely apologize for this unfortunate situation. I am eager to resolve this matter and regain control of my financial responsibilities.

I am currently facing financial hardship due to [briefly explain the reasons for your financial difficulties, such as job loss, medical expenses, or other unforeseen circumstances]. Despite my best efforts, I have been struggling to meet my financial obligations, including the repayment of my credit card debt.

I am committed to honoring my obligations and avoiding the possibility of default. I am hopeful that we can reach a mutually beneficial agreement to settle my debt. I am proposing a settlement offer of [proposed settlement amount, typically a percentage of the total debt owed] to satisfy the entire outstanding balance on my account.

In exchange for this settlement, I request that you consider the debt as "paid in full" and agree to report this settlement to the credit reporting agencies as such. This will help improve my credit standing and provide me with an opportunity to rebuild my financial future.

I understand that you may require some time to assess my situation and review my proposal. However, I kindly request that you respond to this settlement offer in writing within 30 days of receiving this letter. Please consider my financial difficulties and the hardship I am facing in making your decision.

I prefer to handle this matter in an amicable and cooperative manner, and I am open to discussing any other options or arrangements that may be suitable for both parties. Please feel free to contact me at [your phone number] or [your email address] to discuss this further.

I look forward to resolving this matter promptly and appreciate your understanding and cooperation. Thank you for your attention to this request.

Sincerely,

[Your Name]

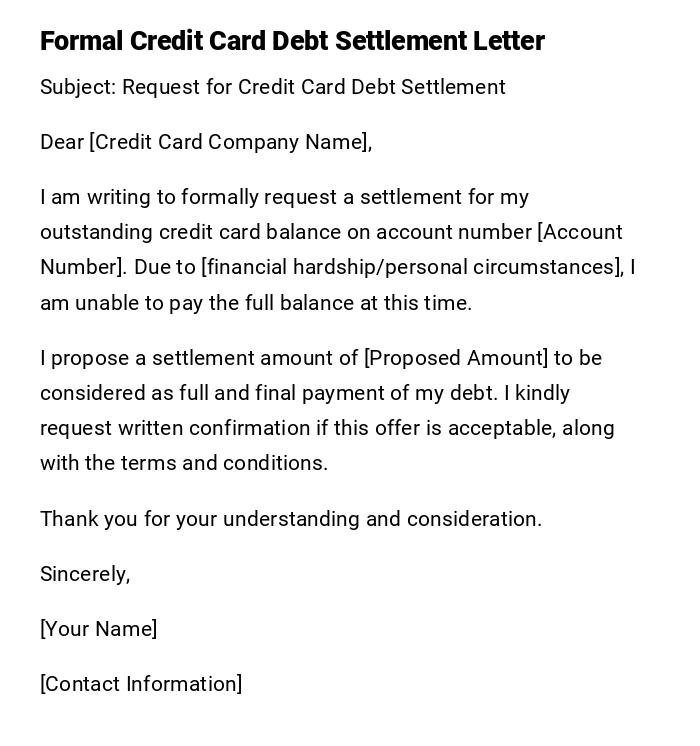

Formal Credit Card Debt Settlement Letter

Subject: Request for Credit Card Debt Settlement

Dear [Credit Card Company Name],

I am writing to formally request a settlement for my outstanding credit card balance on account number [Account Number]. Due to [financial hardship/personal circumstances], I am unable to pay the full balance at this time.

I propose a settlement amount of [Proposed Amount] to be considered as full and final payment of my debt. I kindly request written confirmation if this offer is acceptable, along with the terms and conditions.

Thank you for your understanding and consideration.

Sincerely,

[Your Name]

[Contact Information]

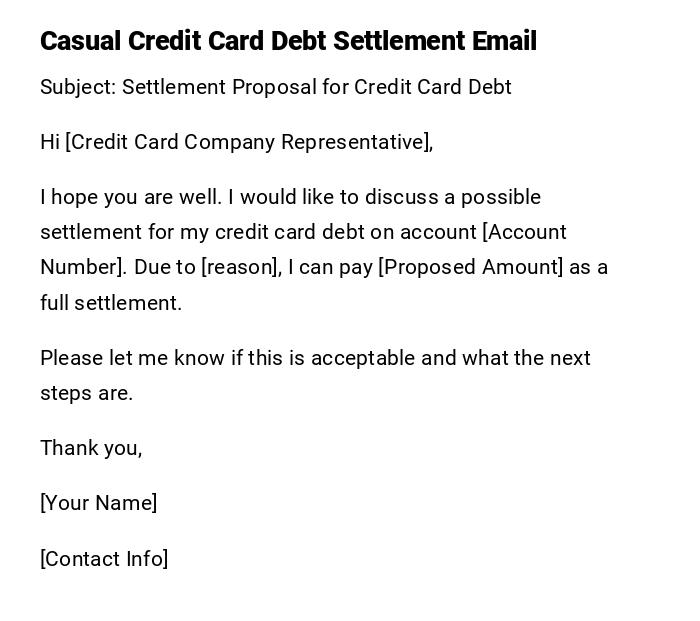

Casual Credit Card Debt Settlement Email

Subject: Settlement Proposal for Credit Card Debt

Hi [Credit Card Company Representative],

I hope you are well. I would like to discuss a possible settlement for my credit card debt on account [Account Number]. Due to [reason], I can pay [Proposed Amount] as a full settlement.

Please let me know if this is acceptable and what the next steps are.

Thank you,

[Your Name]

[Contact Info]

Provisional Debt Settlement Request Letter

Subject: Request for Provisional Debt Settlement

Dear [Credit Card Company],

I am seeking a provisional arrangement to settle my outstanding credit card debt, account number [Account Number]. I am currently facing temporary financial difficulties and propose a payment plan or reduced settlement amount.

Kindly advise on the possibility of a provisional settlement and any documentation required.

Sincerely,

[Your Name]

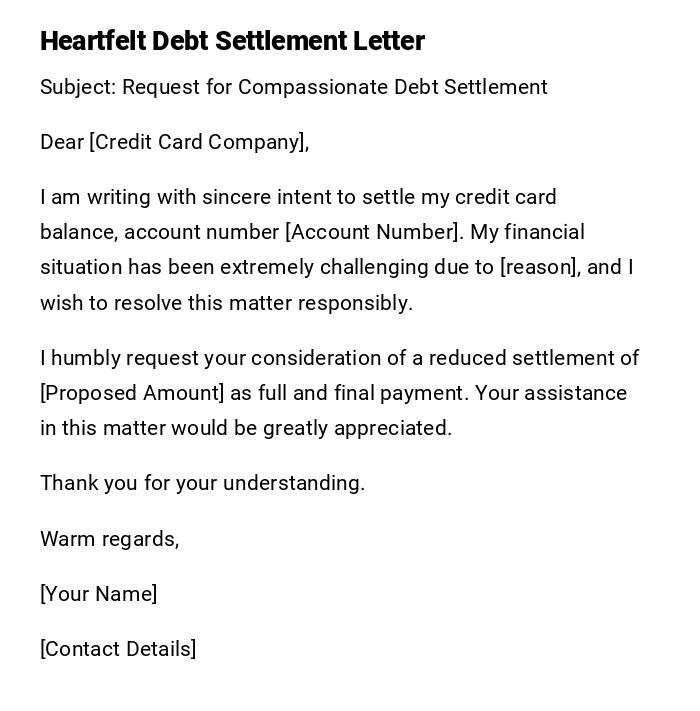

Heartfelt Debt Settlement Letter

Subject: Request for Compassionate Debt Settlement

Dear [Credit Card Company],

I am writing with sincere intent to settle my credit card balance, account number [Account Number]. My financial situation has been extremely challenging due to [reason], and I wish to resolve this matter responsibly.

I humbly request your consideration of a reduced settlement of [Proposed Amount] as full and final payment. Your assistance in this matter would be greatly appreciated.

Thank you for your understanding.

Warm regards,

[Your Name]

[Contact Details]

Immediate Debt Settlement Letter

Subject: Immediate Settlement Request for Credit Card Account

Dear [Credit Card Company Name],

Due to urgent financial constraints, I am requesting immediate settlement of my credit card debt, account number [Account Number]. I can provide a payment of [Proposed Amount] immediately and request written confirmation that this will be accepted as full settlement.

Please advise on any required documentation or formalities to process this request.

Sincerely,

[Your Name]

[Contact Information]

What is a Credit Card Debt Settlement Letter and Why It Is Needed

A credit card debt settlement letter is a formal request to a credit card company proposing a reduced payment amount to settle an outstanding debt.

Purposes include:

- Avoiding default and legal actions

- Resolving debt in a manageable way

- Rebuilding credit by settling accounts

- Providing a documented proposal for negotiation

Who Should Send a Credit Card Debt Settlement Letter

- The cardholder responsible for the debt

- Authorized financial representatives or legal advisors on behalf of the cardholder

- Individuals facing financial hardship seeking alternative repayment arrangements

Whom the Letter Should Be Addressed To

- Credit card company’s collections or customer service department

- Assigned account manager or representative

- Legal or debt settlement department if applicable

When to Send a Credit Card Debt Settlement Letter

- When unable to pay the full balance due to financial hardship

- Before default notices or legal actions are initiated

- When proposing a one-time settlement or payment plan

- To negotiate reduced interest rates or fees

How to Write and Send a Credit Card Debt Settlement Letter

- Include account details (number, holder name)

- Clearly state the purpose: request for debt settlement

- Mention reason for settlement request (financial hardship, loss of income, etc.)

- Propose a specific settlement amount or plan

- Request written confirmation of acceptance

- Send via certified mail, email, or portal to ensure receipt

Formatting Guidelines for a Credit Card Debt Settlement Letter

- Length: 1 page maximum

- Tone: Professional, respectful, and polite

- Language: Clear and concise

- Mode: Email or printed letter depending on company policy

- Include: Account number, proposed settlement, and contact info

Requirements and Prerequisites Before Sending

- Review your financial situation and determine a realistic settlement amount

- Check credit card company policies on settlements

- Gather account statements, past correspondence, and proof of financial hardship

- Keep a copy of the letter for records

Tricks and Tips for Successful Credit Card Debt Settlement

- Send the letter before the account becomes delinquent

- Offer a lump-sum payment if possible for faster approval

- Keep communication professional and courteous

- Follow up politely if no response is received within 2 weeks

- Get written confirmation before making any payment

Common Mistakes to Avoid

- Failing to include account details or contact information

- Offering an unrealistic or unaffordable settlement amount

- Using informal or aggressive language

- Making payment before receiving written agreement

- Neglecting to keep a copy of all correspondence

Elements and Structure of a Credit Card Debt Settlement Letter

- Subject line indicating settlement request

- Salutation to the relevant department or person

- Introduction including account details

- Explanation of financial situation or hardship

- Proposed settlement amount or plan

- Request for confirmation in writing

- Polite closing with signature and contact information

FAQ About Credit Card Debt Settlement Letters

Q: Can I negotiate the settlement amount?

A: Yes, the proposed amount is a starting point for negotiation.

Q: Should I send proof of financial hardship?

A: Providing documentation can strengthen your request.

Q: Is the settlement taxable?

A: Sometimes forgiven debt is considered taxable income; consult a tax professional.

Q: Can the letter prevent legal action immediately?

A: Not always, but timely communication can help prevent escalation.

Download Word Doc

Download Word Doc

Download PDF

Download PDF