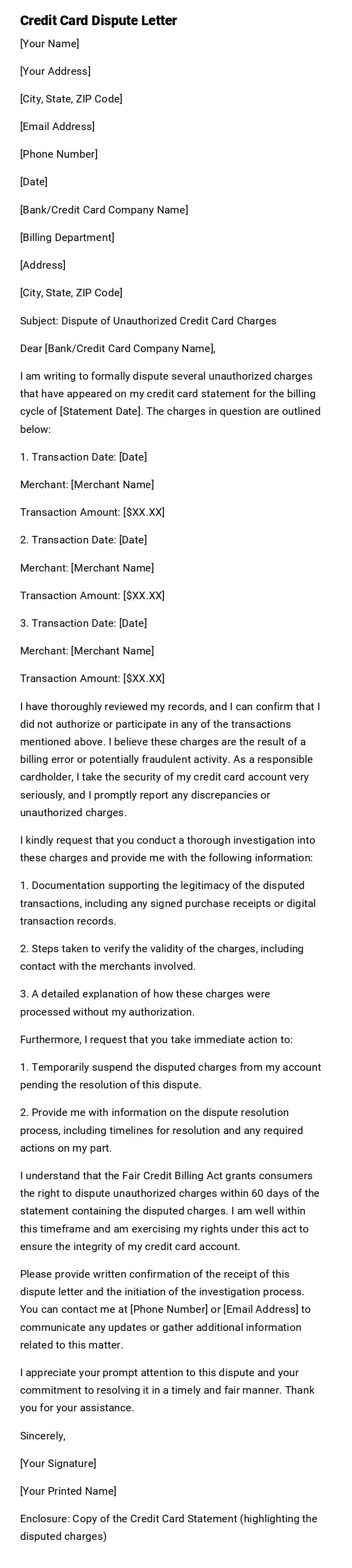

Credit Card Dispute Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank/Credit Card Company Name]

[Billing Department]

[Address]

[City, State, ZIP Code]

Subject: Dispute of Unauthorized Credit Card Charges

Dear [Bank/Credit Card Company Name],

I am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [Statement Date]. The charges in question are outlined below:

1. Transaction Date: [Date]

Merchant: [Merchant Name]

Transaction Amount: [$XX.XX]

2. Transaction Date: [Date]

Merchant: [Merchant Name]

Transaction Amount: [$XX.XX]

3. Transaction Date: [Date]

Merchant: [Merchant Name]

Transaction Amount: [$XX.XX]

I have thoroughly reviewed my records, and I can confirm that I did not authorize or participate in any of the transactions mentioned above. I believe these charges are the result of a billing error or potentially fraudulent activity. As a responsible cardholder, I take the security of my credit card account very seriously, and I promptly report any discrepancies or unauthorized charges.

I kindly request that you conduct a thorough investigation into these charges and provide me with the following information:

1. Documentation supporting the legitimacy of the disputed transactions, including any signed purchase receipts or digital transaction records.

2. Steps taken to verify the validity of the charges, including contact with the merchants involved.

3. A detailed explanation of how these charges were processed without my authorization.

Furthermore, I request that you take immediate action to:

1. Temporarily suspend the disputed charges from my account pending the resolution of this dispute.

2. Provide me with information on the dispute resolution process, including timelines for resolution and any required actions on my part.

I understand that the Fair Credit Billing Act grants consumers the right to dispute unauthorized charges within 60 days of the statement containing the disputed charges. I am well within this timeframe and am exercising my rights under this act to ensure the integrity of my credit card account.

Please provide written confirmation of the receipt of this dispute letter and the initiation of the investigation process. You can contact me at [Phone Number] or [Email Address] to communicate any updates or gather additional information related to this matter.

I appreciate your prompt attention to this dispute and your commitment to resolving it in a timely and fair manner. Thank you for your assistance.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosure: Copy of the Credit Card Statement (highlighting the disputed charges)

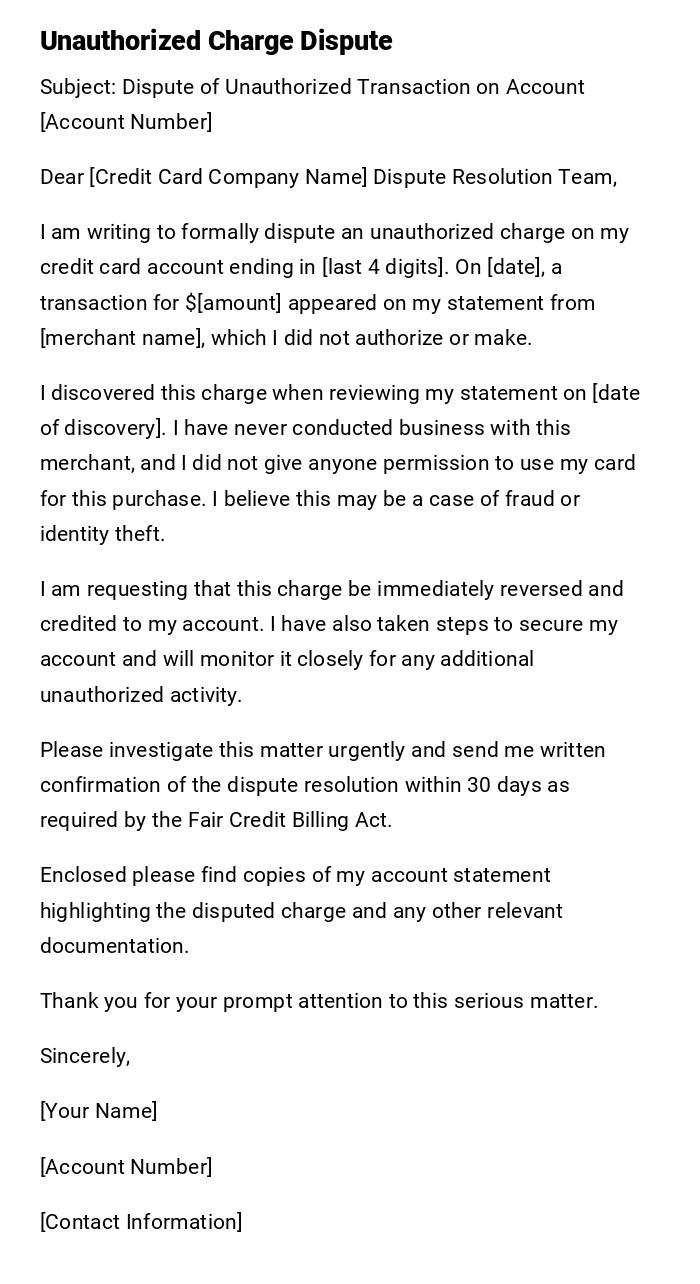

Unauthorized Charge Dispute

Subject: Dispute of Unauthorized Transaction on Account [Account Number]

Dear [Credit Card Company Name] Dispute Resolution Team,

I am writing to formally dispute an unauthorized charge on my credit card account ending in [last 4 digits]. On [date], a transaction for $[amount] appeared on my statement from [merchant name], which I did not authorize or make.

I discovered this charge when reviewing my statement on [date of discovery]. I have never conducted business with this merchant, and I did not give anyone permission to use my card for this purchase. I believe this may be a case of fraud or identity theft.

I am requesting that this charge be immediately reversed and credited to my account. I have also taken steps to secure my account and will monitor it closely for any additional unauthorized activity.

Please investigate this matter urgently and send me written confirmation of the dispute resolution within 30 days as required by the Fair Credit Billing Act.

Enclosed please find copies of my account statement highlighting the disputed charge and any other relevant documentation.

Thank you for your prompt attention to this serious matter.

Sincerely,

[Your Name]

[Account Number]

[Contact Information]

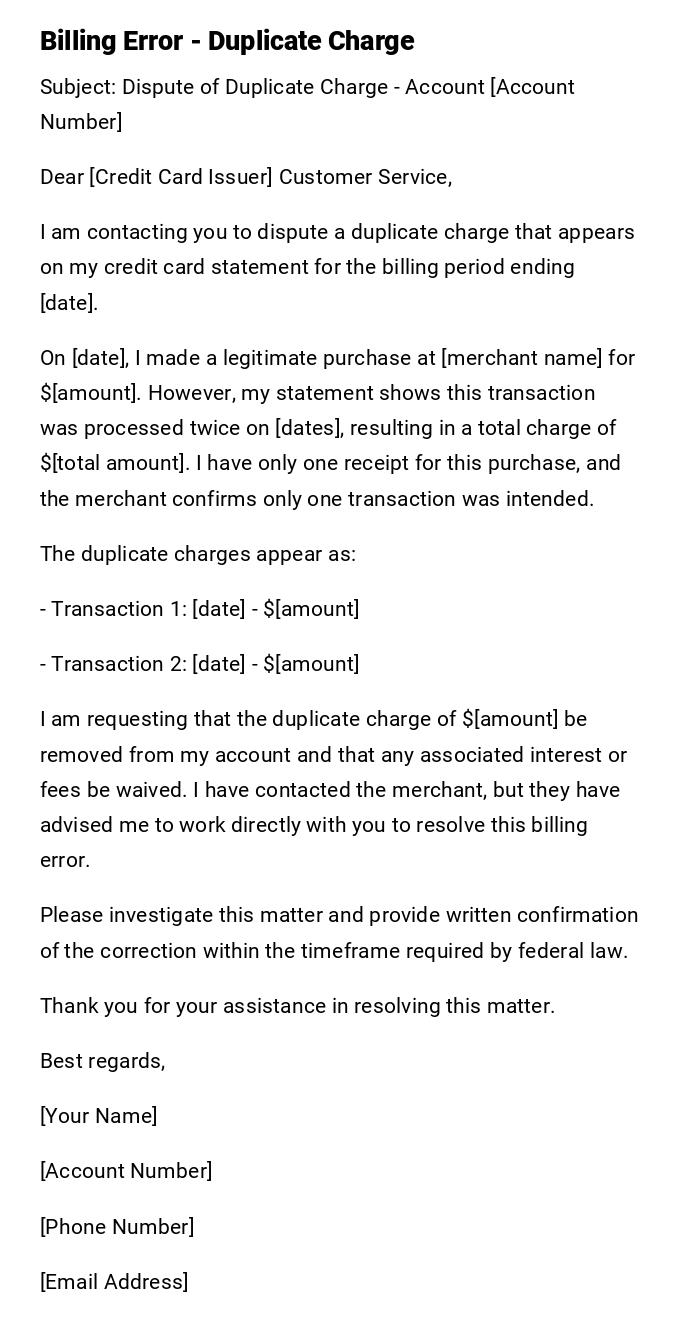

Billing Error - Duplicate Charge

Subject: Dispute of Duplicate Charge - Account [Account Number]

Dear [Credit Card Issuer] Customer Service,

I am contacting you to dispute a duplicate charge that appears on my credit card statement for the billing period ending [date].

On [date], I made a legitimate purchase at [merchant name] for $[amount]. However, my statement shows this transaction was processed twice on [dates], resulting in a total charge of $[total amount]. I have only one receipt for this purchase, and the merchant confirms only one transaction was intended.

The duplicate charges appear as:

- Transaction 1: [date] - $[amount]

- Transaction 2: [date] - $[amount]

I am requesting that the duplicate charge of $[amount] be removed from my account and that any associated interest or fees be waived. I have contacted the merchant, but they have advised me to work directly with you to resolve this billing error.

Please investigate this matter and provide written confirmation of the correction within the timeframe required by federal law.

Thank you for your assistance in resolving this matter.

Best regards,

[Your Name]

[Account Number]

[Phone Number]

[Email Address]

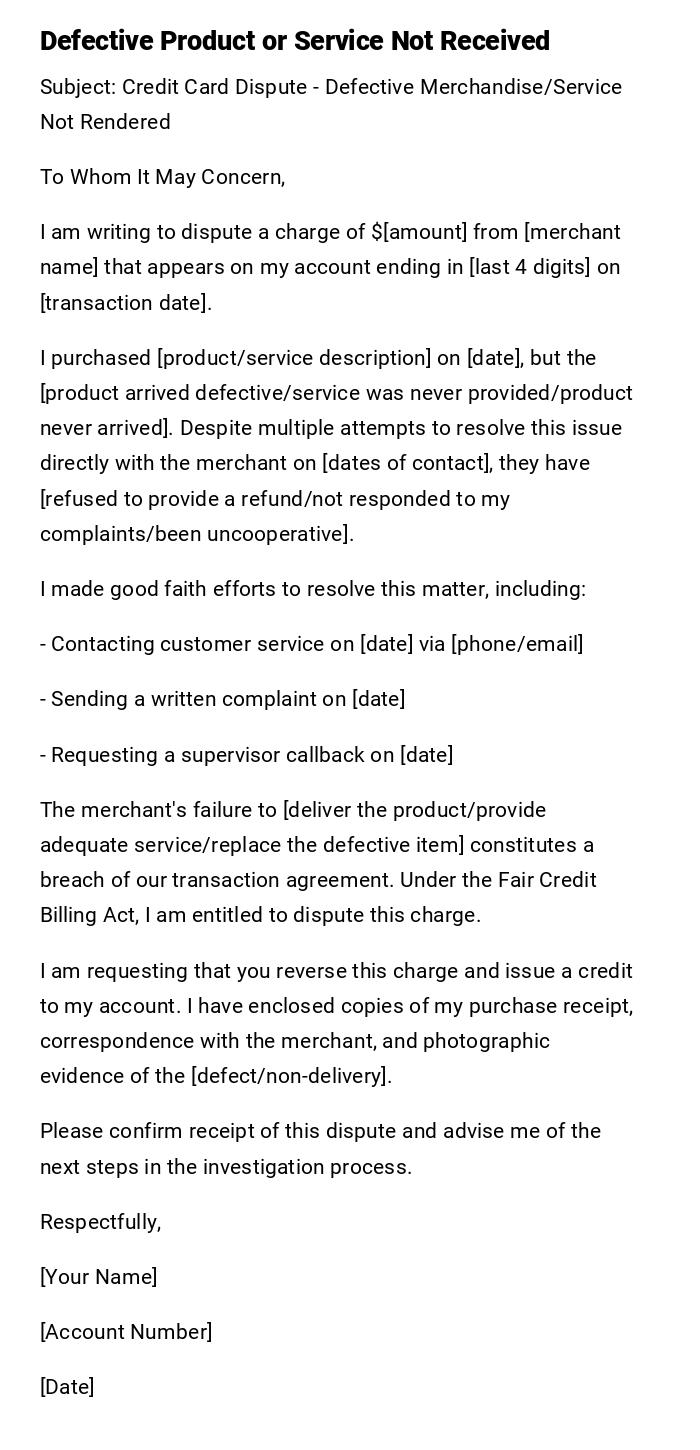

Defective Product or Service Not Received

Subject: Credit Card Dispute - Defective Merchandise/Service Not Rendered

To Whom It May Concern,

I am writing to dispute a charge of $[amount] from [merchant name] that appears on my account ending in [last 4 digits] on [transaction date].

I purchased [product/service description] on [date], but the [product arrived defective/service was never provided/product never arrived]. Despite multiple attempts to resolve this issue directly with the merchant on [dates of contact], they have [refused to provide a refund/not responded to my complaints/been uncooperative].

I made good faith efforts to resolve this matter, including:

- Contacting customer service on [date] via [phone/email]

- Sending a written complaint on [date]

- Requesting a supervisor callback on [date]

The merchant's failure to [deliver the product/provide adequate service/replace the defective item] constitutes a breach of our transaction agreement. Under the Fair Credit Billing Act, I am entitled to dispute this charge.

I am requesting that you reverse this charge and issue a credit to my account. I have enclosed copies of my purchase receipt, correspondence with the merchant, and photographic evidence of the [defect/non-delivery].

Please confirm receipt of this dispute and advise me of the next steps in the investigation process.

Respectfully,

[Your Name]

[Account Number]

[Date]

Incorrect Amount Charged

Subject: Billing Dispute - Incorrect Transaction Amount

Dear [Card Issuer] Billing Department,

I am writing to dispute an incorrect charge on my credit card statement dated [statement date]. The transaction in question occurred on [date] at [merchant name].

The issue is as follows: I was charged $[amount charged] for a purchase that should have been $[correct amount]. I have attached a copy of my receipt showing the agreed-upon price of $[correct amount], but my credit card statement reflects an overcharge of $[difference].

This discrepancy appears to be either a merchant error or a processing mistake. The correct amount should be $[correct amount] as evidenced by:

- Original receipt dated [date]

- Advertised price of $[amount]

- Written estimate provided before purchase

I am requesting that you adjust my account by crediting the difference of $[amount] and investigate why this billing error occurred. I would also appreciate any interest charges related to this erroneous amount being waived.

Please process this correction promptly and send written confirmation once the adjustment has been made.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Account Number]

[Contact Information]

Subscription Cancellation Not Honored

Subject: Dispute of Charges After Subscription Cancellation

Dear [Credit Card Company] Disputes Team,

I am disputing recurring charges from [company name] that have continued to appear on my account despite my cancellation of the subscription service.

I originally subscribed to [service name] on [date] but cancelled my subscription on [cancellation date] by [method of cancellation]. Despite this cancellation, I have been charged on the following dates after my cancellation:

- [Date 1]: $[amount]

- [Date 2]: $[amount]

- [Date 3]: $[amount]

Total disputed amount: $[total]

I have confirmation of my cancellation in the form of [cancellation email/confirmation number/customer service reference number], which is enclosed with this letter. I contacted the merchant on [date] to request these charges be refunded, but they have [not responded/refused/claimed no record of cancellation].

These charges are unauthorized as they occurred after the termination of my subscription agreement. I am requesting that all charges made after [cancellation date] be reversed and credited back to my account.

Please investigate this matter and provide written notification of your findings and the resolution.

Thank you for your prompt assistance.

Best regards,

[Your Name]

[Account Number]

[Date]

Identity Theft - Multiple Fraudulent Charges

Subject: URGENT - Identity Theft Dispute for Multiple Fraudulent Transactions

Dear [Credit Card Issuer] Fraud Department,

I am writing to report identity theft and dispute multiple fraudulent charges on my credit card account [account number]. I discovered these unauthorized transactions on [date] and immediately took steps to secure my account.

The following charges are fraudulent and were not made by me or anyone authorized to use my card:

[Date] - [Merchant] - $[amount]

[Date] - [Merchant] - $[amount]

[Date] - [Merchant] - $[amount]

[Date] - [Merchant] - $[amount]

Total fraudulent charges: $[total amount]

I have never done business with these merchants, and many of these charges occurred in locations where I have never been or at times when my card was in my possession. I believe my card information was compromised through [if known: data breach/skimming/online fraud].

I have taken the following actions:

- Frozen my credit card account on [date]

- Filed a police report (Report #[number]) on [date]

- Contacted the Federal Trade Commission

- Changed all online passwords and security questions

I request that you immediately reverse all fraudulent charges, issue me a new card with a different account number, and provide written confirmation that I am not liable for these charges. Please also investigate how this breach occurred to prevent future incidents.

This is an urgent matter affecting my financial security. I request expedited processing of this dispute.

Sincerely,

[Your Name]

[Account Number]

[Contact Information]

Enclosures: Police report, FTC Identity Theft Report

Promotional Rate Not Applied

Subject: Dispute - Promotional Interest Rate Not Applied to Account

Dear [Credit Card Company] Customer Service,

I am writing to dispute interest charges on my account ending in [last 4 digits] because the promotional rate I was promised has not been properly applied.

When I [opened this account/made a balance transfer/accepted the promotional offer] on [date], I was explicitly offered a promotional APR of [rate]% for [time period] on [purchases/balance transfers/both]. However, my recent statements show I have been charged interest at [higher rate]%, which is not consistent with the promotional terms.

The promotional offer was communicated to me through [pre-approved offer letter/online advertisement/phone conversation/email dated [date]]. I have enclosed a copy of this promotional material for your reference.

Based on the correct promotional rate, I should have been charged approximately $[amount] in interest, but I was actually charged $[higher amount], resulting in an overcharge of $[difference].

I am requesting that:

1. The correct promotional rate be applied to my account immediately

2. All excess interest charges be credited back to my account

3. Written confirmation of the correction and the terms of my promotional period

I have been a loyal customer and fulfilled all requirements to maintain this promotional rate, including [making payments on time/meeting minimum payment requirements/not exceeding credit limit].

Please investigate this billing error and respond within 30 days as required by law.

Thank you for your prompt attention.

Respectfully,

[Your Name]

[Account Number]

[Date]

Merchant Refund Not Processed

Subject: Dispute - Merchant Refund Not Credited to Account

Dear [Credit Card Issuer],

I am disputing a charge on my account because a merchant-authorized refund has not been credited to my card after a reasonable period of time.

On [original purchase date], I purchased [item/service] from [merchant name] for $[amount], which appeared on my [month] statement. I returned this [item/cancelled this service] on [return date] and received a refund authorization from the merchant (Return Authorization #[number]).

The merchant confirmed the refund would be processed within [timeframe], but as of today, [number] days later, the credit has not appeared on my account. My most recent statement dated [date] does not reflect this refund.

I have contacted the merchant on [dates], and they claim the refund was processed on [date]. However, it has not appeared on my credit card account. Either the merchant did not process the refund as claimed, or there was an error in the processing.

I am requesting that you:

- Investigate why this refund has not been credited

- Manually credit $[amount] to my account if the merchant cannot provide proof of processing

- Remove any interest charges associated with this amount since the return date

Enclosed are copies of my original receipt, the return receipt, and correspondence with the merchant confirming the refund authorization.

Please resolve this matter promptly and provide written confirmation.

Thank you,

[Your Name]

[Account Number]

[Contact Information]

What is a Credit Card Dispute Letter and Why You Need One

A credit card dispute letter is a formal written communication sent to your credit card issuer to challenge an incorrect, unauthorized, or fraudulent charge on your account. This letter serves as your official notice that you are exercising your rights under the Fair Credit Billing Act (FCBA), which protects consumers from billing errors and fraud.

The primary purposes include:

- Documenting your dispute in writing for legal protection

- Initiating a formal investigation by your card issuer

- Creating a paper trail of your complaint

- Protecting yourself from liability for unauthorized or incorrect charges

- Ensuring compliance with the 60-day dispute window required by federal law

- Resolving billing errors that merchants refuse to correct directly

When Should You Send a Credit Card Dispute Letter

You should send a dispute letter in the following situations:

- Unauthorized transactions: Charges you didn't make or authorize, indicating possible fraud or identity theft

- Billing errors: You were charged the wrong amount, whether higher or lower than the agreed price

- Duplicate charges: The same transaction appears multiple times on your statement

- Products not received: You paid for merchandise that was never delivered

- Defective products or services: The item received was significantly different from what was advertised or arrived damaged

- Subscription issues: Recurring charges continue after you've cancelled a subscription or service

- Returns not credited: You returned merchandise but the refund hasn't appeared on your account

- Mathematical errors: Incorrect totals, miscalculations, or wrong interest charges on your statement

- Promotional rate problems: Promised promotional interest rates or rewards were not applied

- Service quality disputes: Services paid for were not performed as agreed or were inadequate

The FCBA requires you to send your dispute within 60 days of the statement date showing the error, not the transaction date.

Requirements and Prerequisites Before Sending Your Dispute

Before writing and sending your dispute letter, ensure you have:

- Account documentation: Your complete credit card statement showing the disputed charge

- Transaction evidence: Original receipts, invoices, order confirmations, or purchase records

- Communication records: Emails, chat logs, or notes from phone calls with the merchant

- Proof of attempts to resolve: Documentation showing you tried to resolve the issue with the merchant first (when applicable)

- Return documentation: If disputing a return, include return receipts, tracking numbers, and refund authorization numbers

- Promotional materials: If disputing promotional rates, include the original offer letter or advertisement

- Police report: For identity theft or fraud cases, file a police report and obtain the report number

- FTC Identity Theft Report: For fraud cases, complete the FTC's identity theft affidavit

- Cancellation proof: For subscription disputes, include cancellation confirmations or reference numbers

- Photographs: For defective merchandise, take clear photos showing the defect or damage

Note: While attempting to resolve the issue with the merchant first is recommended, it's not legally required. If the merchant is unresponsive or the matter is urgent (like fraud), you can dispute directly with your card issuer.

How to Write and Send a Credit Card Dispute Letter

Follow these steps to create an effective dispute letter:

1. Use written communication: While you can initiate a dispute by phone, always follow up with a written letter for legal protection

2. Include essential information: Your name, account number, contact information, transaction date, merchant name, disputed amount, and a clear explanation of the problem

3. Be specific and concise: State exactly what's wrong, when you discovered it, and what resolution you're seeking

4. Attach supporting documents: Include copies (never originals) of receipts, statements, correspondence, and other relevant evidence

5. Send via certified mail: Mail your letter with return receipt requested to prove delivery and timing

6. Use the correct address: Send to your card issuer's billing inquiries address (found on your statement), not the payment address

7. Keep copies: Retain copies of your letter and all attachments for your records

8. Meet the deadline: Send within 60 days of the statement date showing the error

9. Continue minimum payments: Keep making at least minimum payments on undisputed amounts to avoid late fees and credit damage

10. Document everything: Keep a log of all communications, including dates, names of representatives, and reference numbers

Who Should Send a Credit Card Dispute Letter

Dispute letters should be sent by:

- Primary cardholders: The person whose name appears on the credit card account

- Authorized users: Individuals authorized to use the card who notice billing errors (though the primary cardholder should ideally send the letter)

- Legal representatives: Attorneys, power of attorney holders, or guardians acting on behalf of the cardholder

- Estate representatives: Executors or administrators handling a deceased cardholder's affairs

- Business owners: For business credit cards, the authorized business representative or account manager

- Identity theft victims: Anyone who discovers fraudulent charges on their account, even if they didn't make any legitimate charges

The letter should always include the cardholder's information and be signed by the person legally responsible for the account, unless you have documented authority to act on their behalf.

To Whom Should You Address Your Dispute Letter

Your dispute letter should be addressed to:

Primary recipient: Your credit card issuer's billing inquiries or disputes department (the specific address is typically printed on your monthly statement under "billing inquiries" or "disputes")

Not the payment address: Do not send dispute letters to the payment processing address, as they may not be forwarded to the correct department

Specific department names: Address it to "Billing Disputes Department," "Customer Disputes Team," or "Billing Inquiries Department"

Company name: Include the full legal name of your card issuing bank or financial institution

Additional considerations:

- For merchant disputes, you may also want to send a copy to the merchant's customer service department

- For fraud cases, you may need to file additional reports with law enforcement and the FTC

- Some issuers have online dispute portals, but always follow up with a written letter for legal protection

- Keep the merchant separate from the card issuer—your dispute is with the card company, not the merchant

Formatting Guidelines for Your Dispute Letter

Length: Keep your letter to one or two pages—be thorough but concise

Tone: Use a professional, factual, and courteous tone regardless of your frustration level

Structure: Use a business letter format with clear paragraphs and logical organization

Language: Be direct and specific; avoid emotional language, accusations, or threats

Details to include:

- Subject line clearly stating "Dispute" or "Billing Error"

- Your account number (not the full card number)

- Specific transaction details (date, merchant, amount)

- Clear statement of the problem

- Desired resolution

- Reference to Fair Credit Billing Act when appropriate

Formatting preferences:

- Use standard business letter format on plain paper

- Type rather than handwrite for clarity

- Use clear, readable font (11-12 point)

- Sign in ink if sending physical mail

- Number pages if more than one page

Mode of sending: Send via USPS certified mail with return receipt requested for legal documentation of delivery

Attachments: Clearly label all supporting documents and reference them in your letter

What to Do After Sending Your Dispute Letter

Immediate actions:

- Keep your certified mail receipt and tracking number

- Make a copy of everything you sent for your records

- Note the date you mailed the letter in your personal records

- Continue making minimum payments on your account to avoid late fees

Within 30 days of card issuer receipt:

- The issuer must acknowledge receipt of your dispute in writing (unless they resolve it within this time)

- Monitor your mail for their acknowledgment letter

Within 90 days:

- The card issuer must investigate and resolve your dispute

- They must either correct the error or explain why they believe the charge is correct

- If they find in your favor, they must remove the charge and related fees/interest

- If they deny your dispute, they must provide a written explanation

During the investigation:

- The disputed amount cannot be reported as delinquent to credit bureaus

- You don't have to pay the disputed amount during investigation

- However, you must pay all undisputed charges

- Interest may continue to accrue on the disputed amount

Follow-up actions:

- Respond promptly to any requests for additional information

- Check your next statement to verify corrections were made

- If denied, you have the right to request documentation supporting the merchant's claim

- Keep all correspondence from the card issuer

If resolution is unsatisfactory:

- Request a supervisor review

- File a complaint with the Consumer Financial Protection Bureau (CFPB)

- Contact your state Attorney General's office

- Consider consulting with a consumer rights attorney

Common Mistakes to Avoid When Disputing Charges

- Missing the 60-day deadline: Failing to dispute within 60 days of the statement date may forfeit your FCBA protections

- Only disputing by phone: Phone disputes lack legal documentation; always follow up in writing

- Sending to the wrong address: Using the payment address instead of the billing inquiries address delays processing

- Not keeping copies: Failing to retain copies of your letter and supporting documents

- Including your full card number: Only include the last 4 digits or account number, never the full card number for security

- Being vague or emotional: Unclear descriptions or angry language weaken your case

- Forgetting to sign: Unsigned letters may not be processed

- Not sending certified mail: Regular mail provides no proof of delivery or timing

- Stopping all payments: You must continue paying undisputed amounts to avoid penalties

- Sending originals: Never send original documents; only send copies

- Waiting too long to follow up: Not checking on the status after 30-45 days

- Disputing legitimate charges: Frivolous disputes can harm your credibility and result in account closure

- Ignoring requests for information: Failing to respond to the issuer's requests during investigation

- Not documenting merchant contact attempts: When applicable, show you tried resolving directly first

- Assuming silence means acceptance: Always get written confirmation of the resolution

Pros and Cons of Filing a Credit Card Dispute

Advantages:

- Legal protection: FCBA provides strong consumer rights and limits your liability to $50 for unauthorized charges (often $0)

- No immediate payment: You don't have to pay disputed amounts during investigation

- Credit protection: Disputed amounts can't be reported as delinquent during investigation

- Professional investigation: Card issuers have resources and leverage to investigate merchants

- Time-efficient: Often faster than small claims court or other legal remedies

- No cost: Disputing charges is free, unlike hiring attorneys

- Stops recurring charges: Particularly useful for subscription fraud

- Written record: Creates documentation for potential legal action if needed

Disadvantages:

- Time-consuming: The process can take up to 90 days to resolve

- Documentation burden: Requires gathering evidence and supporting materials

- Potential denial: Not all disputes are resolved in the cardholder's favor

- Account freezing: Some issuers may restrict your account during fraud investigations

- Relationship strain: Frequent disputes may lead to account closure by the issuer

- Limited scope: Only covers billing errors and unauthorized charges, not quality disappointments (unless significant)

- Merchant relationship: May damage relationship with merchants you want to continue using

- Credit limit impact: Disputed amounts may still count against your credit limit during investigation

- Merchant rights: Merchants can provide evidence against your claim

- Abuse consequences: Frivolous disputes can result in loss of dispute privileges

Comparing Dispute Letters to Alternative Resolution Methods

Credit card dispute vs. merchant refund request:

- Merchant refunds are faster (instant to 5-7 days) but depend on merchant cooperation

- Disputes provide legal protection when merchants are uncooperative or unreachable

- Try merchant resolution first for minor issues; dispute for fraud or merchant refusal

Credit card dispute vs. chargeback:

- These terms are often used interchangeably, but technically a chargeback is the result of a successful dispute

- The dispute letter initiates the process; the chargeback is the reversal of funds

- Both follow the same FCBA procedures for credit cards

Credit card dispute vs. small claims court:

- Small claims requires filing fees ($30-$100) and court appearances

- Disputes are free and handled remotely

- Court may be necessary for amounts exceeding credit card limits or for additional damages

- Disputes are limited to the charge amount; courts can award additional compensation

Credit card dispute vs. Better Business Bureau complaints:

- BBB complaints address merchant practices but don't directly recover money

- Disputes focus solely on charge reversal

- BBB can be filed simultaneously for merchant accountability

- Disputes have legal force; BBB relies on merchant reputation concerns

Credit card dispute vs. doing nothing:

- Disputing protects your legal rights and limits liability

- Inaction means accepting responsibility for all charges

- Undisputed fraudulent charges can lead to continued fraud

- Time-sensitive: FCBA protections expire after 60 days

Debit card vs. credit card disputes:

- Credit cards offer stronger protections under FCBA

- Debit cards fall under different regulations (Regulation E) with potentially stricter timeframes

- Credit card disputes don't impact your cash immediately; debit card fraud removes money from your account

- Credit card disputes are generally easier to win

Essential Tips and Best Practices for Successful Disputes

- Act quickly: Don't wait until day 59; send disputes as soon as you notice the error

- Review statements immediately: Check your statements within days of receiving them to maximize your dispute window

- Keep a dispute file: Maintain a dedicated folder with all dispute-related documents

- Be specific about resolution: Clearly state you want the charge removed, not just investigated

- Use bullet points for multiple charges: When disputing several transactions, list them clearly

- Reference federal law: Mention the Fair Credit Billing Act to show you know your rights

- Remain professional: Even if frustrated, courteous letters get better responses

- Don't overshare: Include only relevant facts; unnecessary details can weaken your case

- Track deadlines: Calendar the 30-day acknowledgment and 90-day resolution deadlines

- Screenshot everything: For online purchases, capture screenshots of product descriptions, prices, and terms

- Save shipping confirmations: For returns, always get tracking numbers and signature confirmations

- Read your card agreement: Understand your specific issuer's dispute procedures

- Monitor your credit: Check that disputed amounts aren't negatively affecting your credit score during investigation

- Be honest: Only dispute charges that are genuinely incorrect or unauthorized

- Consider timing: If you need a card for upcoming travel, be aware investigations may affect your credit limit

- Use templates wisely: Customize templates to your specific situation rather than sending generic letters

Key Elements and Structure of an Effective Dispute Letter

Every dispute letter should include these essential components:

Header section:

- Your name and complete mailing address

- Your phone number and email address

- Date of the letter

- Card issuer's billing inquiries address

Subject line:

- Clear indication this is a dispute (e.g., "Billing Dispute - Account #XXXX")

Opening/Greeting:

- Professional salutation addressing the disputes department

Account identification:

- Your account number (not full card number)

- Last four digits of your card

Transaction details:

- Date of the disputed transaction

- Merchant name

- Exact amount charged

- Description of the purchase

Problem statement:

- Clear, factual explanation of what's wrong

- When you discovered the error

- Why you believe it's incorrect or unauthorized

Supporting evidence reference:

- List of enclosed documents

- Brief description of what each document proves

Resolution request:

- Specific action you want taken (credit to account, charge removal, correction)

- Request for written confirmation

Legal reference (when appropriate):

- Mention of Fair Credit Billing Act rights

- Reference to 60-day dispute window

Closing:

- Professional sign-off

- Your signature (handwritten for mailed letters)

- Your typed name

Attachments:

- Copies of receipts, statements, correspondence

- Return receipts or tracking numbers

- Photos of defective merchandise

- Cancellation confirmations

- Police reports (for fraud)

Special additions for specific situations:

- Police report numbers for identity theft

- Return authorization numbers for product returns

- Promotional offer details for rate disputes

- Cancellation dates and methods for subscription disputes

How Many Times Can You Dispute and How Much Can You Dispute

Frequency of disputes:

- No legal limit on the number of disputes you can file

- However, excessive disputes may trigger account review or closure by the issuer

- Card issuers may flag accounts with frequent disputes as high-risk

- Legitimate disputes should always be filed regardless of frequency

Amount limitations:

- You can dispute any amount, from small charges to your entire credit limit

- Even charges under $1 can be disputed if unauthorized or incorrect

- For fraud cases, dispute all fraudulent charges regardless of total amount

- Some issuers may have internal thresholds for automatic approvals vs. investigations

Multiple disputes on one letter:

- You can dispute multiple charges in a single letter if they're related

- For unrelated errors, it's clearer to send separate letters

- List each disputed transaction separately with complete details

Time between disputes:

- No waiting period required between filing disputes

- You can dispute multiple charges from different statements simultaneously

- Each dispute is evaluated independently

Disputed amount during investigation:

- The disputed amount may still count against your credit limit during investigation

- You're not required to pay the disputed amount while it's under review

- Interest may continue to accrue on the disputed amount during investigation

- If resolved in your favor, interest on the disputed amount should be credited back

Limitations and considerations:

- Repeated disputes of the same charge after denial may not be accepted

- New evidence may warrant reopening a previously denied dispute

- Issuers may close accounts with patterns of suspected dispute abuse

- Legitimate cardholders should never hesitate to dispute valid errors due to frequency concerns

Frequently Asked Questions About Credit Card Disputes

Will disputing a charge hurt my credit score? No, legitimate disputes don't directly harm your credit. The disputed amount shouldn't be reported as delinquent during investigation.

Can I dispute a charge after 60 days? The FCBA's protections apply within 60 days of the statement date. After that, you may still dispute, but you'll have fewer legal protections and the issuer isn't obligated to investigate.

What happens if I lose the dispute? You'll be responsible for the charge plus any interest that accrued during the investigation period. You can request documentation showing why the dispute was denied.

Can merchants recharge my card after a dispute? If the dispute is resolved in the merchant's favor and they can prove the charge was valid, the charge will be reinstated. However, they cannot simply recharge your card without going through the dispute resolution process.

Do I need a lawyer for a credit card dispute? No, credit card disputes are designed for consumers to handle directly. However, for very large amounts or complex fraud cases, legal advice may be helpful.

What if the merchant goes out of business? You can still dispute charges with your card issuer. The merchant's closure may actually strengthen your case, especially for undelivered products or services.

Can I dispute a charge for buyer's remorse? No, simply changing your mind about a purchase isn't grounds for a credit card dispute. Disputes are for billing errors, fraud, or significantly misrepresented products.

Will the merchant know I disputed the charge? Yes, the card issuer will contact the merchant as part of their investigation. The merchant has the right to provide evidence supporting the charge.

Can I use my card during a dispute investigation? Yes, you can continue using your card for other purchases. Only the disputed amount is under investigation.

What if I already paid the disputed charge? You can still dispute it. If successful, you'll receive a credit back to your account.

Download Word Doc

Download Word Doc

Download PDF

Download PDF