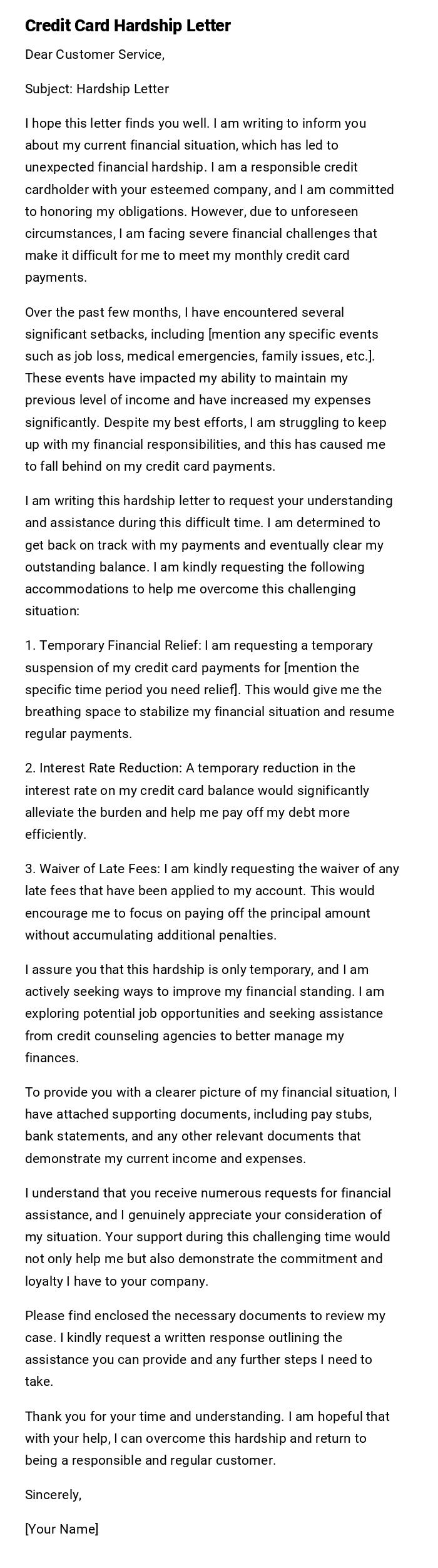

Credit Card Hardship Letter

Dear Customer Service,

Subject: Hardship Letter

I hope this letter finds you well. I am writing to inform you about my current financial situation, which has led to unexpected financial hardship. I am a responsible credit cardholder with your esteemed company, and I am committed to honoring my obligations. However, due to unforeseen circumstances, I am facing severe financial challenges that make it difficult for me to meet my monthly credit card payments.

Over the past few months, I have encountered several significant setbacks, including [mention any specific events such as job loss, medical emergencies, family issues, etc.]. These events have impacted my ability to maintain my previous level of income and have increased my expenses significantly. Despite my best efforts, I am struggling to keep up with my financial responsibilities, and this has caused me to fall behind on my credit card payments.

I am writing this hardship letter to request your understanding and assistance during this difficult time. I am determined to get back on track with my payments and eventually clear my outstanding balance. I am kindly requesting the following accommodations to help me overcome this challenging situation:

1. Temporary Financial Relief: I am requesting a temporary suspension of my credit card payments for [mention the specific time period you need relief]. This would give me the breathing space to stabilize my financial situation and resume regular payments.

2. Interest Rate Reduction: A temporary reduction in the interest rate on my credit card balance would significantly alleviate the burden and help me pay off my debt more efficiently.

3. Waiver of Late Fees: I am kindly requesting the waiver of any late fees that have been applied to my account. This would encourage me to focus on paying off the principal amount without accumulating additional penalties.

I assure you that this hardship is only temporary, and I am actively seeking ways to improve my financial standing. I am exploring potential job opportunities and seeking assistance from credit counseling agencies to better manage my finances.

To provide you with a clearer picture of my financial situation, I have attached supporting documents, including pay stubs, bank statements, and any other relevant documents that demonstrate my current income and expenses.

I understand that you receive numerous requests for financial assistance, and I genuinely appreciate your consideration of my situation. Your support during this challenging time would not only help me but also demonstrate the commitment and loyalty I have to your company.

Please find enclosed the necessary documents to review my case. I kindly request a written response outlining the assistance you can provide and any further steps I need to take.

Thank you for your time and understanding. I am hopeful that with your help, I can overcome this hardship and return to being a responsible and regular customer.

Sincerely,

[Your Name]

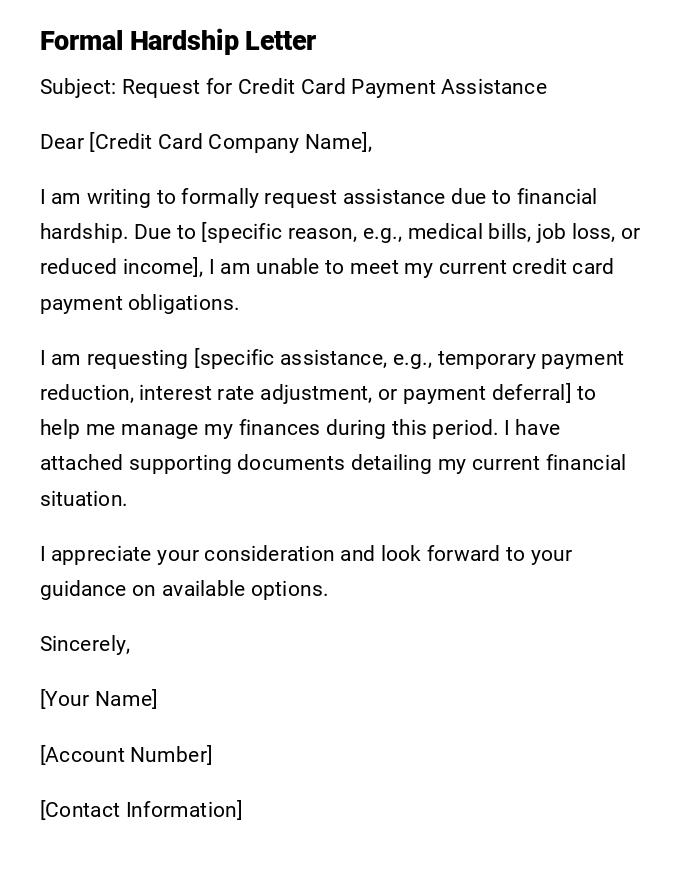

Formal Credit Card Hardship Letter

Subject: Request for Credit Card Payment Assistance

Dear [Credit Card Company Name],

I am writing to formally request assistance due to financial hardship. Due to [specific reason, e.g., medical bills, job loss, or reduced income], I am unable to meet my current credit card payment obligations.

I am requesting [specific assistance, e.g., temporary payment reduction, interest rate adjustment, or payment deferral] to help me manage my finances during this period. I have attached supporting documents detailing my current financial situation.

I appreciate your consideration and look forward to your guidance on available options.

Sincerely,

[Your Name]

[Account Number]

[Contact Information]

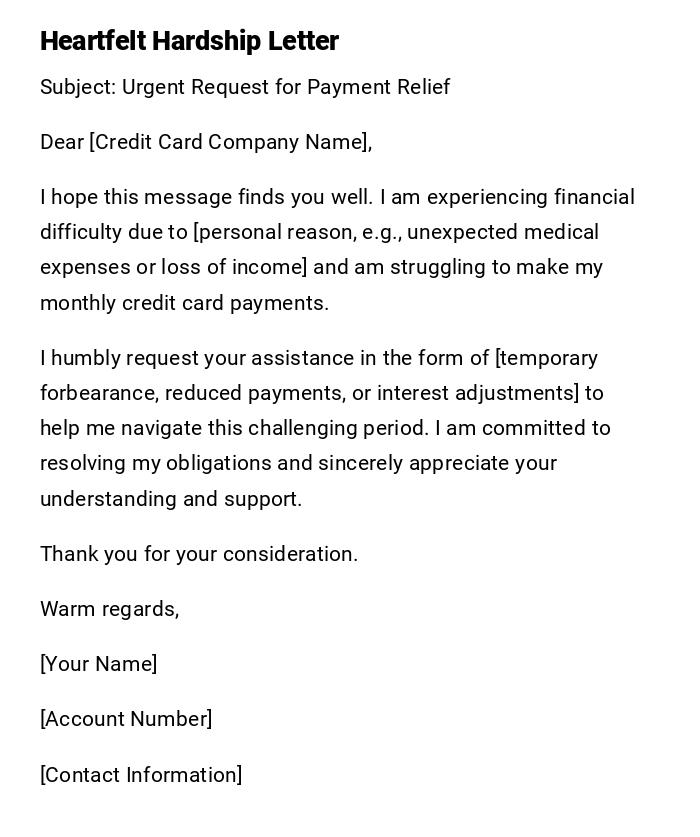

Heartfelt Credit Card Hardship Letter

Subject: Urgent Request for Payment Relief

Dear [Credit Card Company Name],

I hope this message finds you well. I am experiencing financial difficulty due to [personal reason, e.g., unexpected medical expenses or loss of income] and am struggling to make my monthly credit card payments.

I humbly request your assistance in the form of [temporary forbearance, reduced payments, or interest adjustments] to help me navigate this challenging period. I am committed to resolving my obligations and sincerely appreciate your understanding and support.

Thank you for your consideration.

Warm regards,

[Your Name]

[Account Number]

[Contact Information]

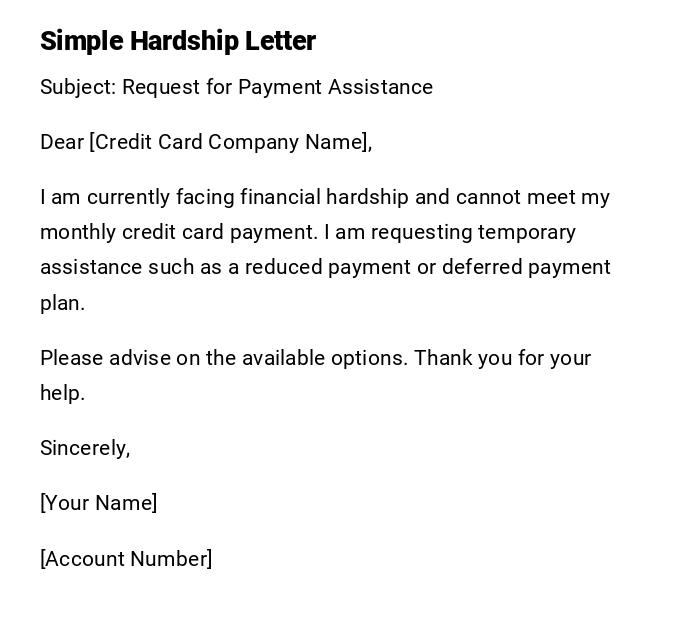

Simple / Quick Credit Card Hardship Letter

Subject: Request for Payment Assistance

Dear [Credit Card Company Name],

I am currently facing financial hardship and cannot meet my monthly credit card payment. I am requesting temporary assistance such as a reduced payment or deferred payment plan.

Please advise on the available options. Thank you for your help.

Sincerely,

[Your Name]

[Account Number]

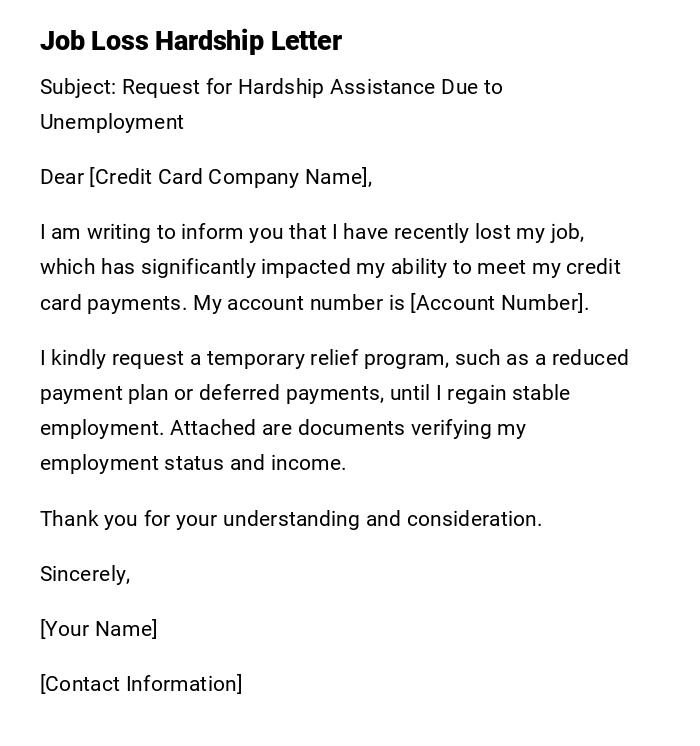

Formal Hardship Letter Due to Job Loss

Subject: Request for Hardship Assistance Due to Unemployment

Dear [Credit Card Company Name],

I am writing to inform you that I have recently lost my job, which has significantly impacted my ability to meet my credit card payments. My account number is [Account Number].

I kindly request a temporary relief program, such as a reduced payment plan or deferred payments, until I regain stable employment. Attached are documents verifying my employment status and income.

Thank you for your understanding and consideration.

Sincerely,

[Your Name]

[Contact Information]

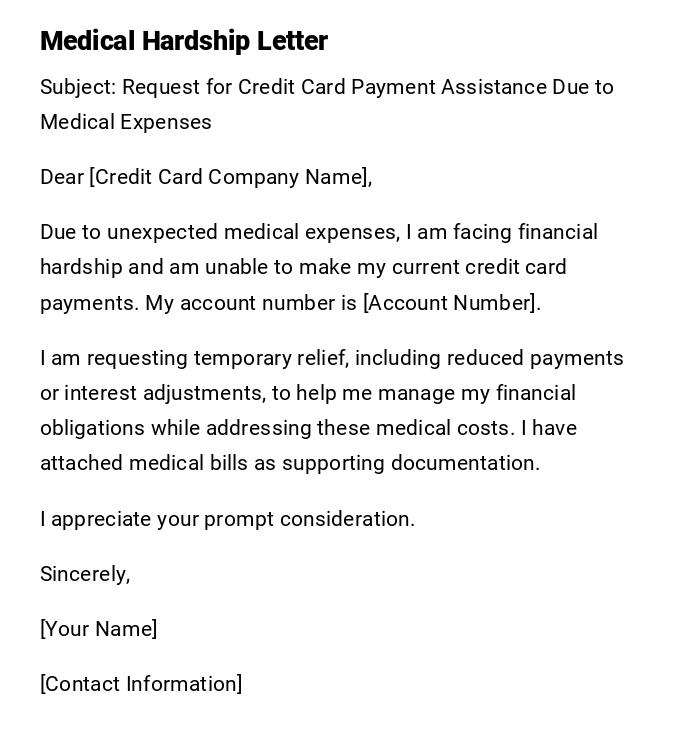

Medical Hardship Credit Card Letter

Subject: Request for Credit Card Payment Assistance Due to Medical Expenses

Dear [Credit Card Company Name],

Due to unexpected medical expenses, I am facing financial hardship and am unable to make my current credit card payments. My account number is [Account Number].

I am requesting temporary relief, including reduced payments or interest adjustments, to help me manage my financial obligations while addressing these medical costs. I have attached medical bills as supporting documentation.

I appreciate your prompt consideration.

Sincerely,

[Your Name]

[Contact Information]

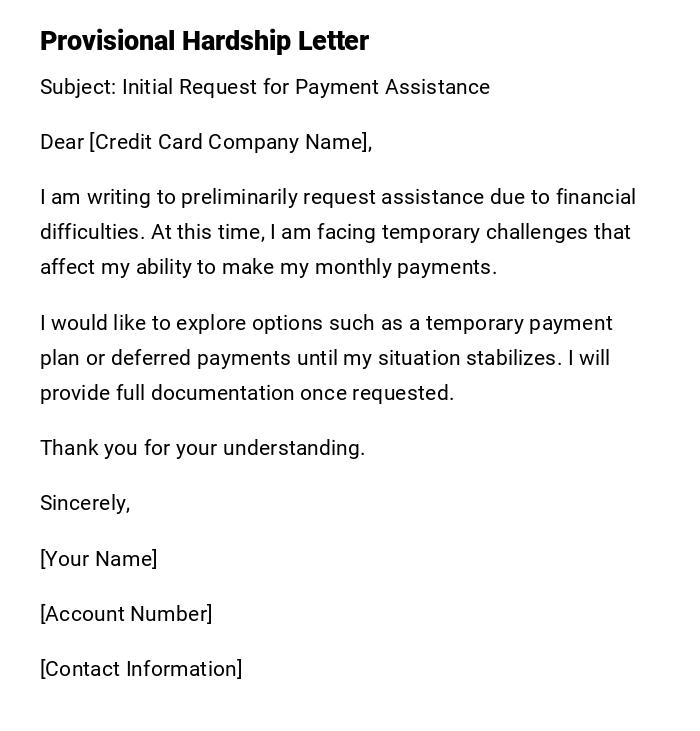

Provisional / Preliminary Hardship Letter

Subject: Initial Request for Payment Assistance

Dear [Credit Card Company Name],

I am writing to preliminarily request assistance due to financial difficulties. At this time, I am facing temporary challenges that affect my ability to make my monthly payments.

I would like to explore options such as a temporary payment plan or deferred payments until my situation stabilizes. I will provide full documentation once requested.

Thank you for your understanding.

Sincerely,

[Your Name]

[Account Number]

[Contact Information]

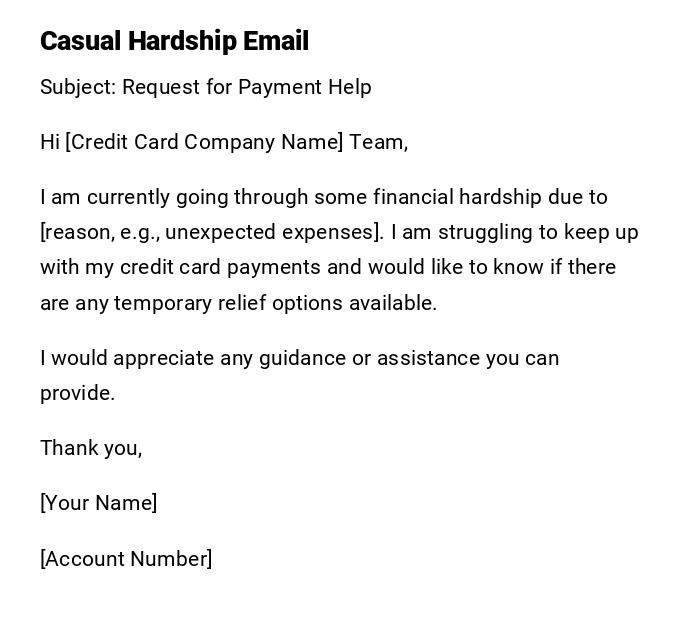

Casual / Friendly Hardship Email

Subject: Request for Payment Help

Hi [Credit Card Company Name] Team,

I am currently going through some financial hardship due to [reason, e.g., unexpected expenses]. I am struggling to keep up with my credit card payments and would like to know if there are any temporary relief options available.

I would appreciate any guidance or assistance you can provide.

Thank you,

[Your Name]

[Account Number]

What is a Credit Card Hardship Letter and Why It Is Needed

- A Credit Card Hardship Letter is a formal request to a credit card issuer for assistance due to financial difficulty.

- The purpose is to explain the financial situation and request options like payment deferral, reduced payments, or lower interest rates.

- It helps avoid late fees, damage to credit score, or default by negotiating temporary relief.

Who Should Write a Credit Card Hardship Letter

- The cardholder experiencing financial difficulty.

- A legal representative if the cardholder requires professional assistance.

- Authorized family members or financial advisors with permission in certain circumstances.

Whom Should the Hardship Letter Be Addressed To

- The credit card company’s customer service department or hardship program office.

- Specific account managers or representatives if previously assigned.

- Written attention to the collections or finance department may be necessary for formal requests.

When Should You Send a Credit Card Hardship Letter

- Immediately after experiencing financial hardship such as job loss, medical emergencies, or reduced income.

- Before missing payments to proactively manage account status.

- When the cardholder anticipates difficulty in meeting minimum monthly payments.

How to Write and Send a Hardship Letter

- Clearly explain the reason for financial hardship with factual details.

- Include your account number and relevant personal information.

- Specify the type of relief requested (deferred payments, interest reduction, etc.).

- Attach supporting documentation such as medical bills, termination letters, or income statements.

- Send via certified mail, email, or through the credit card issuer’s hardship portal.

- Keep a copy for your records and follow up as needed.

Formatting Guidelines for a Hardship Letter

- Length: 1–2 pages; concise yet detailed.

- Tone: Professional, polite, and sincere.

- Structure: Subject, greeting, body explaining hardship, requested assistance, closing, signature.

- Mode: Printed letter or email depending on issuer requirements.

- Attachments: Include evidence to substantiate the hardship claim.

Requirements and Prerequisites Before Sending

- Confirm current account balance and outstanding payments.

- Collect documentation supporting your hardship (medical bills, termination notices, pay stubs).

- Review the credit card company’s hardship policy or program.

- Have a clear plan for proposed payments or repayment options.

Tricks and Tips for Effective Hardship Letters

- Be honest and transparent about your situation.

- Specify the relief option that would best assist you.

- Include exact financial details to strengthen your case.

- Maintain a respectful and professional tone.

- Follow up if no response is received within a reasonable time frame.

Common Mistakes to Avoid

- Omitting account numbers or critical personal information.

- Using emotional language instead of factual explanation.

- Failing to provide documentation to support claims.

- Sending the letter to the wrong department.

- Requesting unrealistic or unspecified relief without justification.

Elements and Structure of a Credit Card Hardship Letter

- Subject Line: Clearly state it is a hardship request.

- Greeting: Address the correct department or representative.

- Introduction: State your account and reason for writing.

- Body: Explain the hardship, financial impact, and supporting facts.

- Request: Specify the type of assistance needed.

- Attachments: Include any relevant supporting documentation.

- Closing: Express appreciation and willingness to cooperate.

- Signature: Full name, account number, and contact information.

After Sending the Hardship Letter: Follow-Up Actions

- Confirm receipt of the letter via phone or email.

- Track deadlines or timelines provided by the issuer for a response.

- Keep a record of all communications with the credit card company.

- Prepare to negotiate or provide additional documentation if requested.

- Adjust personal budget to accommodate agreed-upon payment arrangements.

Pros and Cons of Sending a Credit Card Hardship Letter

Pros:

- Provides potential relief from payments, fees, or interest.

- Protects credit score from negative reporting.

- Establishes a clear, documented communication with the issuer.

Cons:

- May temporarily impact credit reporting if not approved promptly.

- Requires disclosure of sensitive personal and financial information.

- Response time may vary, potentially causing stress if urgent relief is needed.

FAQ About Credit Card Hardship Letters

Q: Can a hardship letter prevent a credit card from being closed?

A: Yes, if the issuer approves the hardship request, your account can remain active with adjusted terms.

Q: What documentation should I include?

A: Proof of income loss, medical bills, termination letters, or other financial hardship evidence.

Q: How long does it take to receive a response?

A: Usually within 30–45 days, depending on the issuer.

Q: Can I request multiple types of relief in one letter?

A: Yes, clearly state all requested options and prioritize them if needed.

Compare and Contrast With Similar Financial Requests

- Hardship Letter vs. Payment Deferral Request: Hardship letters explain the reason for financial difficulty; a deferral request may be shorter and less detailed.

- Hardship Letter vs. Debt Settlement Offer: Debt settlement focuses on reducing the total debt owed; hardship letters request temporary relief or adjusted payments.

- Email vs. Printed Letter: Emails are faster; printed letters provide formal documentation and can be mailed with supporting attachments.

Download Word Doc

Download Word Doc

Download PDF

Download PDF